Key Insights

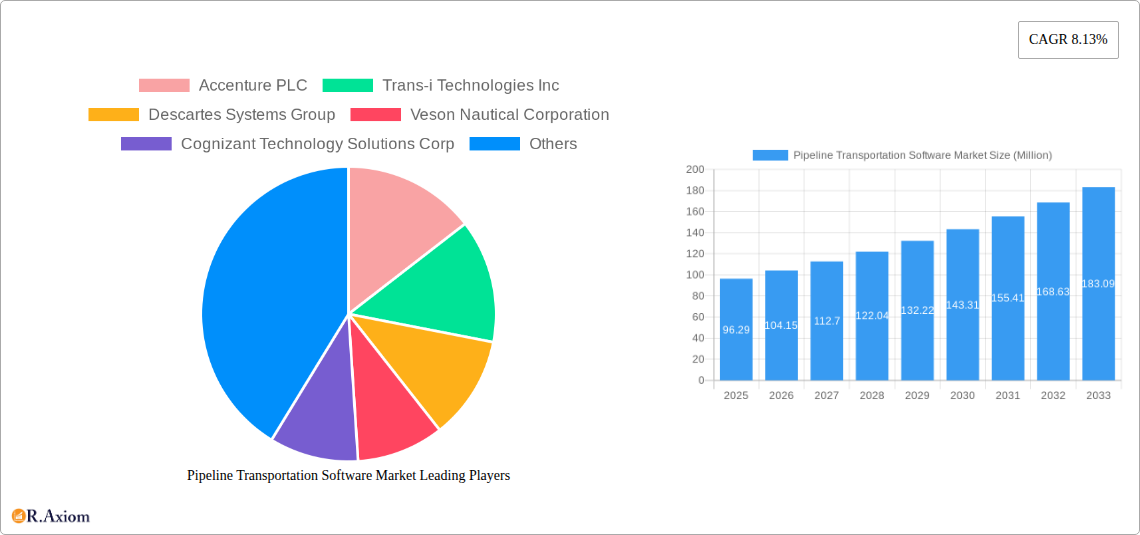

The Pipeline Transportation Software Market is experiencing robust growth, projected to reach a valuation of USD 96.29 million by 2025, with a Compound Annual Growth Rate (CAGR) of 8.13% expected from 2025 to 2033. This expansion is primarily driven by the increasing complexity of global supply chains, the critical need for efficient and secure transportation of oil, gas, and other essential commodities, and the growing adoption of digital technologies across the industry. Enhanced real-time monitoring capabilities, predictive maintenance features, and advanced analytics are becoming paramount for optimizing pipeline operations, ensuring safety, and minimizing downtime. The demand for cloud-based solutions is on the rise due to their scalability, flexibility, and cost-effectiveness, enabling companies to manage their pipeline networks more dynamically.

Pipeline Transportation Software Market Market Size (In Million)

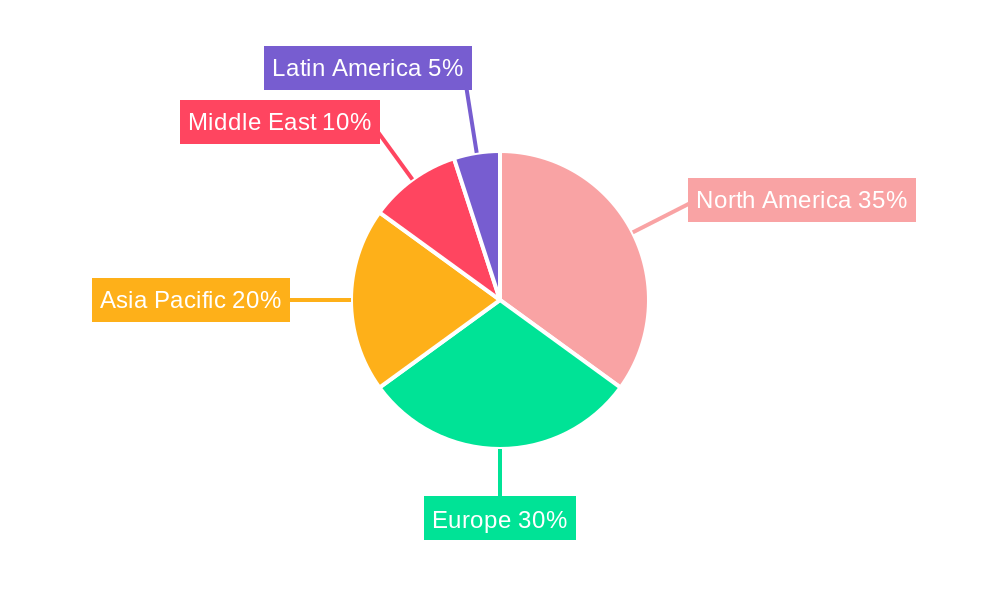

The market is segmented by deployment models, with cloud and hybrid solutions gaining significant traction over traditional on-premise systems. End-user verticals such as Oil and Gas, Manufacturing and Industrial, and Chemical industries represent the largest adopters, leveraging these software solutions to streamline operations, comply with stringent regulations, and improve overall productivity. While North America and Europe currently dominate the market, the Asia Pacific region is anticipated to witness the fastest growth due to significant investments in energy infrastructure and the increasing digitalization of its industrial sectors. Key players like SAP SE, Accenture PLC, and Descartes Systems Group are at the forefront, continuously innovating and offering comprehensive solutions to meet the evolving demands of the pipeline transportation sector, overcoming challenges related to cybersecurity and integration complexities.

Pipeline Transportation Software Market Company Market Share

This in-depth report provides a detailed analysis of the global Pipeline Transportation Software Market, offering critical insights for industry stakeholders. Spanning from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025-2033, this report delves into market dynamics, key trends, leading players, and emerging opportunities. We explore the technological advancements, regulatory landscapes, and evolving end-user demands that are shaping the future of pipeline transportation management. The report leverages high-traffic keywords such as "pipeline management software," "logistics optimization," "SCADA systems," "asset integrity management," and "supply chain visibility" to enhance searchability and reach. With an estimated market size projected to reach XX Million by 2033, this research is indispensable for businesses seeking to navigate and capitalize on this dynamic sector.

Pipeline Transportation Software Market Market Concentration & Innovation

The Pipeline Transportation Software Market exhibits a moderate level of concentration, with several key players vying for market share. Innovation is primarily driven by the increasing demand for real-time monitoring, predictive maintenance, and enhanced safety features. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is a significant innovation driver, enabling more sophisticated data analysis and operational efficiency. Regulatory frameworks play a crucial role, pushing for compliance with stringent safety and environmental standards, which in turn spurs the development of specialized software solutions. Product substitutes, such as manual tracking and basic spreadsheet management, are gradually being phased out as the benefits of advanced software become apparent. End-user trends are leaning towards cloud-based solutions for scalability and accessibility. Mergers and acquisitions (M&A) are active, with notable deals aimed at expanding product portfolios and geographical reach. For instance, a recent M&A deal in 2023 involved a software provider acquiring a specialized analytics firm for an undisclosed XX Million to enhance its predictive capabilities. The market share distribution sees leading companies holding significant portions, with the top 5 players estimated to control over XX% of the market by 2025.

- Market Share Metrics: Leading players are projected to hold substantial market share, with Accenture PLC and SAP SE among the top contenders, each estimated to command XX% by 2025.

- M&A Deal Values: The average M&A deal value in the last three years has been around XX Million, indicating strategic consolidation efforts.

- Innovation Drivers:

- AI/ML for predictive analytics and anomaly detection.

- IoT integration for real-time data acquisition.

- Blockchain for enhanced transparency and security.

- Cloud scalability and accessibility.

Pipeline Transportation Software Market Industry Trends & Insights

The Pipeline Transportation Software Market is experiencing robust growth, driven by the escalating need for efficient, safe, and compliant management of critical infrastructure. The projected Compound Annual Growth Rate (CAGR) for the market is estimated at XX% between 2025 and 2033. Several key trends are shaping this trajectory. Firstly, the increasing volume of global trade and the subsequent demand for reliable transportation of commodities like oil, gas, and chemicals are significant growth drivers. Secondly, a heightened focus on operational efficiency and cost reduction is compelling organizations to adopt sophisticated software solutions that can optimize routing, scheduling, and resource allocation. Technological advancements, including the Internet of Things (IoT) for real-time monitoring of pipeline integrity and SCADA (Supervisory Control and Data Acquisition) systems for remote control and data management, are revolutionizing how pipelines are operated. Consumer preferences are shifting towards integrated platforms that offer end-to-end visibility across the entire supply chain, from sourcing to delivery. The competitive dynamics are intensifying, with companies investing heavily in research and development to offer innovative features such as advanced leak detection, automated compliance reporting, and dynamic risk assessment. Market penetration is steadily increasing, particularly in emerging economies where infrastructure development is a priority. The adoption of cloud-based solutions is accelerating due to their flexibility, scalability, and reduced upfront costs, contributing significantly to market penetration. Furthermore, the growing emphasis on environmental sustainability and the need to mitigate potential hazards associated with pipeline operations are driving the demand for software that can enhance safety and environmental monitoring capabilities.

Dominant Markets & Segments in Pipeline Transportation Software Market

The Pipeline Transportation Software Market is characterized by regional dominance and distinct segment preferences.

- Dominant Region: North America currently holds a significant market share, driven by its extensive oil and gas infrastructure and early adoption of advanced technologies.

- Key Drivers:

- Mature oil and gas industry with substantial pipeline networks.

- Strict regulatory environment mandating advanced safety and monitoring systems.

- High investment in R&D for technological innovations in pipeline management.

- Presence of major pipeline operators and technology providers.

- Key Drivers:

- Dominant Country: Within North America, the United States leads due to its vast energy sector and proactive adoption of digital transformation initiatives in logistics and infrastructure management.

- Economic Policies: Government incentives and policies supporting energy infrastructure development and modernization.

- Infrastructure: Extensive network of oil, gas, and chemical pipelines requiring sophisticated management.

- Dominant Deployment Segment: Cloud deployment is emerging as the dominant model, offering scalability, flexibility, and cost-effectiveness.

- Market Penetration: Cloud-based solutions are expected to capture over XX% of the market by 2028, driven by their accessibility and reduced IT overhead.

- Advantages:

- Scalability to handle fluctuating data volumes.

- Remote accessibility for real-time monitoring and control.

- Faster deployment and updates.

- Reduced capital expenditure.

- Dominant End-user Vertical: The Oil and Gas sector is the largest consumer of pipeline transportation software.

- Market Size: This sector is estimated to contribute over XX% to the total market revenue by 2025.

- Specific Needs:

- Asset integrity management to prevent leaks and failures.

- Real-time flow monitoring and optimization.

- SCADA integration for operational control.

- Compliance with stringent safety and environmental regulations.

- Manufacturing and Industrial vertical is also a significant segment, driven by the need to transport raw materials and finished goods efficiently.

- Growth Potential: This segment is projected to grow at a CAGR of XX% during the forecast period.

- Applications: Bulk material transportation, chemical feedstock delivery, and finished product distribution.

- Chemical industry relies heavily on pipeline transportation for hazardous materials, necessitating advanced safety and tracking features.

- Market Drivers: Increasing production and global demand for chemicals.

- Software Features: Enhanced security protocols, real-time tracking of hazardous substances, and emergency response management.

- Retail and Food and Beverage sectors are increasingly adopting pipeline software for specialized products like liquid food ingredients and biofuels, showcasing a diversification of the market.

Pipeline Transportation Software Market Product Developments

Product development in the Pipeline Transportation Software Market is characterized by a strong focus on enhancing operational efficiency, safety, and regulatory compliance. Innovations include the integration of AI-powered predictive analytics for asset maintenance, real-time leak detection using advanced sensor technology, and sophisticated route optimization algorithms. Solutions are increasingly offering comprehensive dashboards for end-to-end visibility of the entire transportation process, from inventory management to delivery confirmation. Competitive advantages are being gained through the ability to offer modular and scalable software architectures, catering to the diverse needs of different industries and pipeline types. Emphasis is also placed on user-friendly interfaces and seamless integration with existing enterprise systems.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Pipeline Transportation Software Market, segmented across various dimensions.

- Deployment:

- On-premise: Traditional software installation on company servers, offering greater control but requiring significant IT infrastructure.

- Cloud: Subscription-based access to software hosted remotely, providing flexibility and scalability. Expected to see significant growth.

- Hybrid: A combination of on-premise and cloud solutions, catering to specific security and operational needs.

- End-user Vertical:

- Retail: Primarily for specialized liquid product distribution.

- Oil and Gas: The largest segment, focusing on crude oil, natural gas, and refined products.

- Manufacturing and Industrial: Transport of raw materials, intermediate products, and bulk chemicals.

- Aerospace and Defense: Niche applications for specialized fluid transportation.

- Chemical: Transport of a wide range of hazardous and non-hazardous chemicals.

- Construction: Logistics for bulk materials and fluids.

- Healthcare: Specialized applications for medical gases and fluids.

- Food and Beverage: Transport of liquid ingredients, beverages, and edible oils.

- Other End-user Verticals: Encompassing diverse industries with unique pipeline transportation needs.

Each segment is analyzed for its market size, growth projections, and competitive dynamics within the forecast period.

Key Drivers of Pipeline Transportation Software Market Growth

The Pipeline Transportation Software Market is propelled by several interconnected drivers:

- Increasing Demand for Efficiency and Cost Optimization: Companies are investing in software to streamline operations, reduce manual intervention, and minimize transit times, leading to significant cost savings.

- Stringent Safety and Environmental Regulations: Governments worldwide are imposing stricter regulations on pipeline operations to prevent environmental disasters and ensure public safety. This necessitates advanced monitoring, detection, and reporting software.

- Technological Advancements: The integration of AI, ML, IoT, and advanced analytics is enabling more sophisticated pipeline management, from predictive maintenance to real-time anomaly detection.

- Growth in Global Trade and Commodity Demand: The rising global demand for oil, gas, chemicals, and other commodities transported via pipelines directly fuels the need for robust transportation software solutions.

- Digital Transformation Initiatives: A broad push towards digitalization across industries is encouraging pipeline operators to adopt modern software for improved visibility, control, and decision-making.

Challenges in the Pipeline Transportation Software Market Sector

Despite its growth, the Pipeline Transportation Software Market faces several challenges:

- High Initial Investment Costs: Implementing comprehensive pipeline management software can require substantial upfront investment, which can be a barrier for smaller organizations.

- Integration Complexity: Integrating new software with existing legacy systems can be a complex and time-consuming process, requiring specialized expertise.

- Cybersecurity Threats: The increasing reliance on digital systems makes pipelines vulnerable to cyberattacks, necessitating robust security measures and constant vigilance.

- Skilled Workforce Shortage: A lack of skilled professionals capable of implementing, managing, and utilizing advanced pipeline transportation software can hinder adoption and efficient deployment.

- Regulatory Compliance Burden: While regulations drive adoption, keeping up with constantly evolving and diverse international compliance standards can be challenging for global operators.

Emerging Opportunities in Pipeline Transportation Software Market

The Pipeline Transportation Software Market is ripe with emerging opportunities:

- Expansion in Emerging Economies: Rapid infrastructure development in regions like Asia-Pacific and Latin America presents significant opportunities for market expansion.

- Focus on Predictive Maintenance: The growing emphasis on proactive rather than reactive maintenance offers substantial scope for AI and ML-driven predictive analytics software.

- IoT and Sensor Technology Integration: The proliferation of IoT devices and advanced sensors for real-time data collection opens avenues for more sophisticated monitoring and control solutions.

- Demand for Real-time Visibility and Transparency: Shippers and consumers are increasingly demanding end-to-end visibility, creating opportunities for software that provides granular tracking and tracing capabilities.

- Sustainability and ESG Initiatives: Software solutions that support environmental monitoring, leak prevention, and emissions reduction are gaining traction due to increasing ESG (Environmental, Social, and Governance) mandates.

Leading Players in the Pipeline Transportation Software Market Market

- Accenture PLC

- Trans-i Technologies Inc

- Descartes Systems Group

- Veson Nautical Corporation

- Cognizant Technology Solutions Corp

- HighJump Software Inc

- Bass Software Ltd

- SAP SE

- DNV GL (GL Maritime Software GmbH)

- Aljex Software Inc

Key Developments in Pipeline Transportation Software Market Industry

- April 2023: Serbia's government announced an investment of EUR 28 million (USD 30.6 million) in the overall development of river transport infrastructure across the country as part of the "Sail Through Serbia" government initiative. This initiative includes constructing new piers, marinas, and increasing river traffic volumes, thereby creating significant growth opportunities for related logistics and transportation software.

- January 2023: The Nhava Sheva Freeport Terminal Private Limited (NSFTPL) and the Asian Development Bank (ADB) signed a USD 131 million loan to upgrade the Jawaharlal Nehru Port Container Terminal in Navi Mumbai, Maharashtra, India. This development aims to augment international trade through transparent, efficient, and state-of-the-art logistics infrastructure, presenting ample opportunities for market growth and expansion in the region.

Strategic Outlook for Pipeline Transportation Software Market Market

The strategic outlook for the Pipeline Transportation Software Market is overwhelmingly positive, driven by ongoing global demand for efficient commodity transport and a relentless push towards operational excellence. Key growth catalysts include the continued adoption of cloud-based solutions for their agility and scalability, alongside the deep integration of AI and ML for predictive analytics and enhanced safety. The increasing regulatory landscape, while presenting challenges, also acts as a powerful driver for sophisticated software adoption. Opportunities lie in catering to the growing needs of emerging economies and in developing specialized solutions for sectors beyond oil and gas, such as chemical and food and beverage. Companies that focus on innovation in real-time monitoring, cybersecurity, and seamless integration will be well-positioned to capitalize on the substantial future potential of this market.

Pipeline Transportation Software Market Segmentation

-

1. Deployment

- 1.1. On-premise

- 1.2. Cloud

- 1.3. Hybrid

-

2. End-user Vertical

- 2.1. Retail

- 2.2. Oil and Gas

- 2.3. Manufacturing and Industrial

- 2.4. Aerospace and Defense

- 2.5. Chemical

- 2.6. Construction

- 2.7. Healthcare

- 2.8. Food and Beverage

- 2.9. Other End-user Verticals

Pipeline Transportation Software Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Pipeline Transportation Software Market Regional Market Share

Geographic Coverage of Pipeline Transportation Software Market

Pipeline Transportation Software Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Volume of Cargo; Establishment of New Ports in Developing Countries

- 3.3. Market Restrains

- 3.3.1. Stringent Emission Laws and Policies

- 3.4. Market Trends

- 3.4.1. Establishment of New Ports in Developing Countries is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pipeline Transportation Software Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On-premise

- 5.1.2. Cloud

- 5.1.3. Hybrid

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Retail

- 5.2.2. Oil and Gas

- 5.2.3. Manufacturing and Industrial

- 5.2.4. Aerospace and Defense

- 5.2.5. Chemical

- 5.2.6. Construction

- 5.2.7. Healthcare

- 5.2.8. Food and Beverage

- 5.2.9. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America Pipeline Transportation Software Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. On-premise

- 6.1.2. Cloud

- 6.1.3. Hybrid

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Retail

- 6.2.2. Oil and Gas

- 6.2.3. Manufacturing and Industrial

- 6.2.4. Aerospace and Defense

- 6.2.5. Chemical

- 6.2.6. Construction

- 6.2.7. Healthcare

- 6.2.8. Food and Beverage

- 6.2.9. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Europe Pipeline Transportation Software Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. On-premise

- 7.1.2. Cloud

- 7.1.3. Hybrid

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Retail

- 7.2.2. Oil and Gas

- 7.2.3. Manufacturing and Industrial

- 7.2.4. Aerospace and Defense

- 7.2.5. Chemical

- 7.2.6. Construction

- 7.2.7. Healthcare

- 7.2.8. Food and Beverage

- 7.2.9. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Asia Pacific Pipeline Transportation Software Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. On-premise

- 8.1.2. Cloud

- 8.1.3. Hybrid

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. Retail

- 8.2.2. Oil and Gas

- 8.2.3. Manufacturing and Industrial

- 8.2.4. Aerospace and Defense

- 8.2.5. Chemical

- 8.2.6. Construction

- 8.2.7. Healthcare

- 8.2.8. Food and Beverage

- 8.2.9. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Latin America Pipeline Transportation Software Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. On-premise

- 9.1.2. Cloud

- 9.1.3. Hybrid

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. Retail

- 9.2.2. Oil and Gas

- 9.2.3. Manufacturing and Industrial

- 9.2.4. Aerospace and Defense

- 9.2.5. Chemical

- 9.2.6. Construction

- 9.2.7. Healthcare

- 9.2.8. Food and Beverage

- 9.2.9. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Middle East Pipeline Transportation Software Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 10.1.1. On-premise

- 10.1.2. Cloud

- 10.1.3. Hybrid

- 10.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.2.1. Retail

- 10.2.2. Oil and Gas

- 10.2.3. Manufacturing and Industrial

- 10.2.4. Aerospace and Defense

- 10.2.5. Chemical

- 10.2.6. Construction

- 10.2.7. Healthcare

- 10.2.8. Food and Beverage

- 10.2.9. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Accenture PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Trans-i Technologies Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Descartes Systems Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Veson Nautical Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cognizant Technology Solutions Corp

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 HighJump Software Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bass Software Ltd *List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SAP SE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DNV GL (GL Maritime Software GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Aljex Software Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Accenture PLC

List of Figures

- Figure 1: Global Pipeline Transportation Software Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Pipeline Transportation Software Market Revenue (Million), by Deployment 2025 & 2033

- Figure 3: North America Pipeline Transportation Software Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 4: North America Pipeline Transportation Software Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 5: North America Pipeline Transportation Software Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 6: North America Pipeline Transportation Software Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Pipeline Transportation Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Pipeline Transportation Software Market Revenue (Million), by Deployment 2025 & 2033

- Figure 9: Europe Pipeline Transportation Software Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 10: Europe Pipeline Transportation Software Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 11: Europe Pipeline Transportation Software Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 12: Europe Pipeline Transportation Software Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Pipeline Transportation Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Pipeline Transportation Software Market Revenue (Million), by Deployment 2025 & 2033

- Figure 15: Asia Pacific Pipeline Transportation Software Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 16: Asia Pacific Pipeline Transportation Software Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 17: Asia Pacific Pipeline Transportation Software Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 18: Asia Pacific Pipeline Transportation Software Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Pipeline Transportation Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Pipeline Transportation Software Market Revenue (Million), by Deployment 2025 & 2033

- Figure 21: Latin America Pipeline Transportation Software Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 22: Latin America Pipeline Transportation Software Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 23: Latin America Pipeline Transportation Software Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 24: Latin America Pipeline Transportation Software Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Pipeline Transportation Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Pipeline Transportation Software Market Revenue (Million), by Deployment 2025 & 2033

- Figure 27: Middle East Pipeline Transportation Software Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 28: Middle East Pipeline Transportation Software Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 29: Middle East Pipeline Transportation Software Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 30: Middle East Pipeline Transportation Software Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East Pipeline Transportation Software Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pipeline Transportation Software Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 2: Global Pipeline Transportation Software Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 3: Global Pipeline Transportation Software Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Pipeline Transportation Software Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 5: Global Pipeline Transportation Software Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 6: Global Pipeline Transportation Software Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Pipeline Transportation Software Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 8: Global Pipeline Transportation Software Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 9: Global Pipeline Transportation Software Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Pipeline Transportation Software Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 11: Global Pipeline Transportation Software Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 12: Global Pipeline Transportation Software Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Pipeline Transportation Software Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 14: Global Pipeline Transportation Software Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 15: Global Pipeline Transportation Software Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Pipeline Transportation Software Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 17: Global Pipeline Transportation Software Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 18: Global Pipeline Transportation Software Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pipeline Transportation Software Market?

The projected CAGR is approximately 8.13%.

2. Which companies are prominent players in the Pipeline Transportation Software Market?

Key companies in the market include Accenture PLC, Trans-i Technologies Inc, Descartes Systems Group, Veson Nautical Corporation, Cognizant Technology Solutions Corp, HighJump Software Inc, Bass Software Ltd *List Not Exhaustive, SAP SE, DNV GL (GL Maritime Software GmbH, Aljex Software Inc.

3. What are the main segments of the Pipeline Transportation Software Market?

The market segments include Deployment, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 96.29 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Volume of Cargo; Establishment of New Ports in Developing Countries.

6. What are the notable trends driving market growth?

Establishment of New Ports in Developing Countries is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Stringent Emission Laws and Policies.

8. Can you provide examples of recent developments in the market?

April 2023: Serbia's government announced to invest EUR 28 million (USD 30.6 million) in the overall development of river transport infrastructure all over the country as a crucial part of the Sail Through Serbia government initiative. The Sail Through Serbia initiative envisages the construction of new piers, marinas, and the increasing volume of river traffic throughout the country, thereby facilitating the market's growth opportunities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pipeline Transportation Software Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pipeline Transportation Software Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pipeline Transportation Software Market?

To stay informed about further developments, trends, and reports in the Pipeline Transportation Software Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence