Key Insights

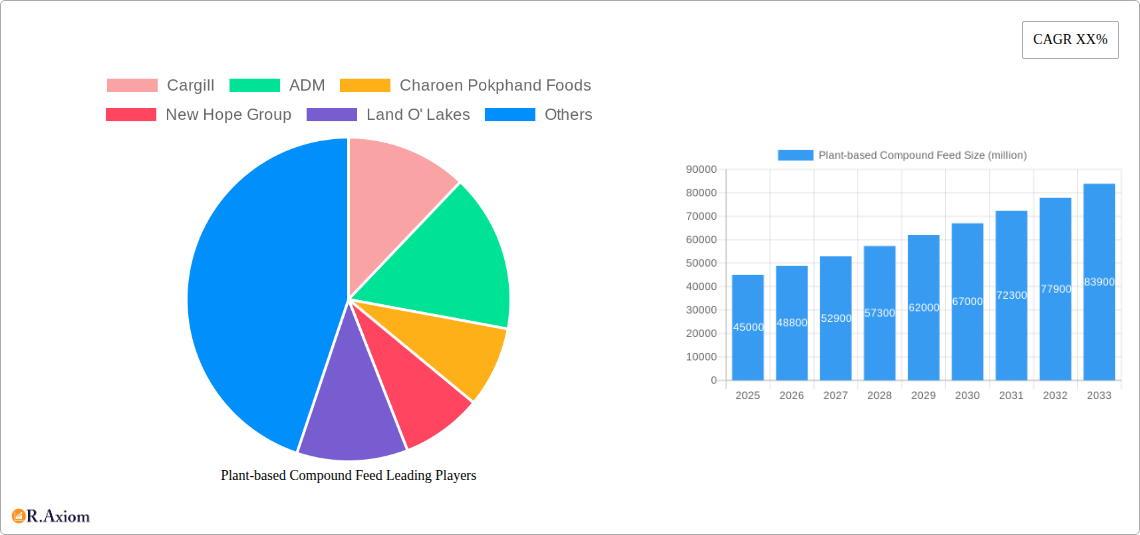

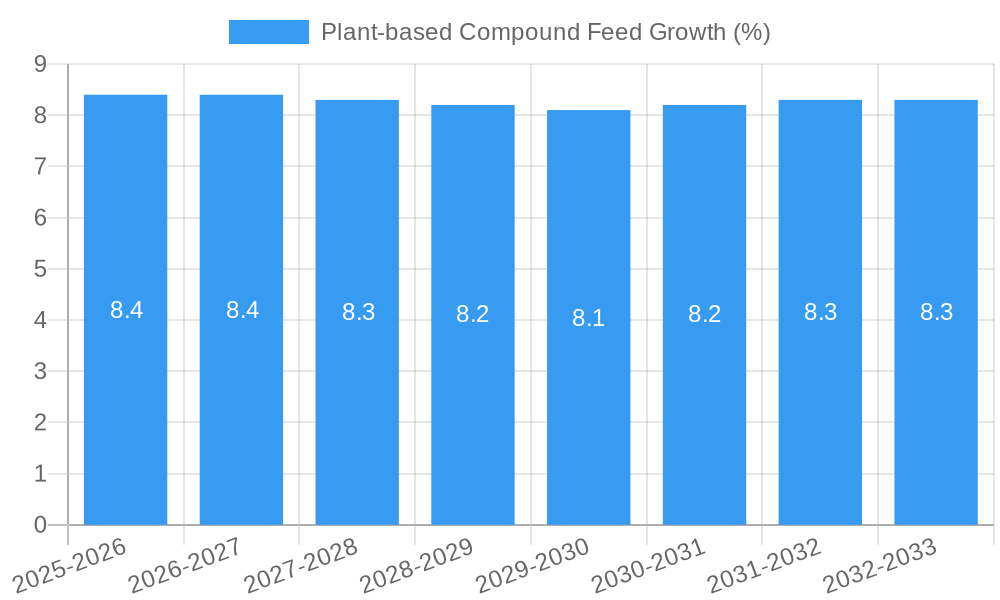

The global Plant-based Compound Feed market is poised for substantial expansion, projected to reach an estimated market size of $45,000 million in 2025. This growth is underpinned by a healthy Compound Annual Growth Rate (CAGR) of 8.5%, indicating a dynamic and rapidly evolving industry. The primary drivers fueling this upward trajectory are increasing consumer demand for sustainable and ethically sourced animal products, coupled with a growing awareness of the environmental impact of traditional feed ingredients. As regulatory bodies and consumers alike push for greener agricultural practices, plant-based alternatives are emerging as a crucial solution for reducing the carbon footprint of livestock farming. Furthermore, advancements in feed formulation technologies are enabling the development of more palatable and nutrient-dense plant-based feeds, addressing historical concerns about efficacy.

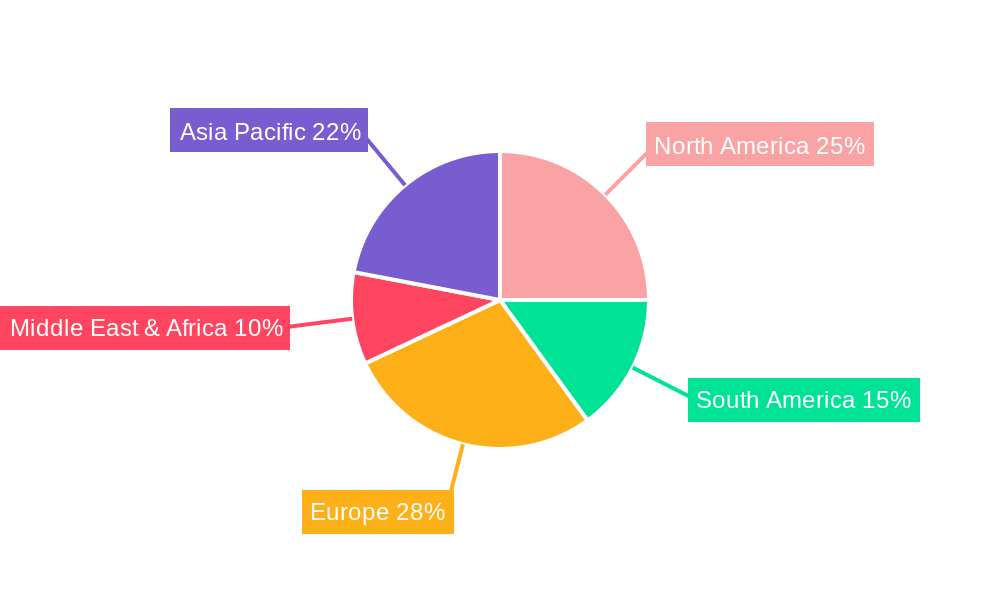

The market segmentation reveals a strong emphasis on Poultry, which is expected to be a dominant application segment due to the high volume consumption of feed in this sector. Pellet and Mash types are anticipated to lead in terms of adoption, offering convenient and efficient feeding solutions for various livestock. Geographically, Asia Pacific, particularly China and India, is expected to emerge as a significant growth engine, driven by their vast agricultural economies and burgeoning demand for animal protein. North America and Europe also represent mature yet steadily growing markets, characterized by innovation and a strong consumer preference for sustainable options. While the market enjoys robust growth, challenges such as the initial cost of some plant-based ingredients and the need for greater consumer education regarding their benefits will need to be strategically addressed by key players like Cargill, ADM, and Charoen Pokphand Foods to ensure sustained and widespread adoption. The market's trajectory suggests a transformative shift towards more eco-conscious animal nutrition.

This in-depth market research report provides a definitive analysis of the global Plant-based Compound Feed market, offering a detailed examination of its current state, historical trends, and future trajectory. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this report is an essential resource for industry stakeholders, including manufacturers, suppliers, investors, and end-users seeking to understand the dynamics of this rapidly evolving sector. With an estimated market size projected to reach hundreds of millions of dollars by 2025, the plant-based compound feed industry is experiencing robust growth driven by increasing demand for sustainable and efficient animal nutrition solutions. The report delves into critical aspects such as market concentration, innovation drivers, regulatory landscapes, competitive strategies, and emerging opportunities, providing actionable insights for strategic decision-making.

Plant-based Compound Feed Market Concentration & Innovation

The global Plant-based Compound Feed market exhibits a moderate concentration, with key players like Cargill, ADM, Charoen Pokphand Foods, New Hope Group, and Guangdong Haid Group holding significant market shares estimated in the millions. Innovation is a critical driver, fueled by advancements in feed formulation, ingredient sourcing, and processing technologies aiming to enhance nutritional efficacy and sustainability. Regulatory frameworks are progressively favoring plant-based ingredients due to their environmental benefits and reduced reliance on animal-derived components, impacting formulation standards and market access. Product substitutes, such as traditional feed formulations and novel protein sources, continue to be present, but the unique value proposition of plant-based feeds is gaining traction. End-user trends are strongly influenced by growing consumer awareness regarding animal welfare and the environmental footprint of food production, driving demand for ethically sourced animal products. Merger and acquisition (M&A) activities are expected to rise, with deal values potentially reaching hundreds of millions, as companies seek to consolidate market presence, acquire innovative technologies, and expand their product portfolios.

Plant-based Compound Feed Industry Trends & Insights

The Plant-based Compound Feed industry is poised for substantial growth, driven by a confluence of factors including escalating global protein demand, heightened environmental consciousness, and a paradigm shift towards sustainable agricultural practices. The compound annual growth rate (CAGR) is projected to be robust, exceeding xx percent over the forecast period, indicating a significant market penetration driven by innovative solutions. Technological disruptions, such as advanced extrusion techniques and the development of novel plant-based protein isolates, are enhancing the nutritional value and digestibility of these feeds. Consumer preferences are increasingly aligning with the demand for animal products raised on sustainable and transparent feed systems, directly influencing the purchasing decisions of livestock producers. Competitive dynamics are intensifying, with established feed manufacturers and agile startups vying for market share through product differentiation, strategic partnerships, and investment in research and development. The market penetration of plant-based compound feeds is expected to expand significantly across all major livestock segments, driven by economic benefits derived from optimized animal health and performance, alongside their positive environmental impact. The increasing awareness of antibiotic resistance and the desire for cleaner labels in the food supply chain further bolster the appeal of plant-based alternatives. Furthermore, governmental initiatives and subsidies aimed at promoting sustainable agriculture are creating a more favorable market environment for plant-based compound feed.

Dominant Markets & Segments in Plant-based Compound Feed

The Poultry segment stands out as the dominant market within the Plant-based Compound Feed industry, driven by its high volume consumption and the industry's proactive adoption of efficiency-enhancing technologies. This dominance is further amplified by favorable economic policies and well-established infrastructure for feed production and distribution across key regions. The application of plant-based compound feeds in poultry production offers significant advantages in terms of cost-effectiveness, improved growth rates, and enhanced meat quality, making it the preferred choice for many commercial operations.

- Poultry: This segment is a primary beneficiary of plant-based compound feeds due to the rapid growth cycles and high feed conversion ratios required in commercial poultry farming. Economic policies supporting sustainable agriculture and the growing consumer demand for poultry products produced with reduced environmental impact contribute significantly to its dominance.

- Swine: The swine sector also represents a substantial and growing market, with producers increasingly recognizing the benefits of plant-based diets for piglet health and overall herd performance. Advancements in formulation to meet the specific nutritional requirements of different swine life stages are driving market penetration.

- Ruminants: While historically reliant on forage, the ruminant segment is seeing increased adoption of plant-based compound feeds, particularly for dairy cows and beef cattle in intensive farming systems. These feeds contribute to improved milk production and meat quality, along with a reduced environmental footprint.

- Aquaculture: The aquaculture segment is a rapidly expanding area for plant-based compound feeds. With increasing pressure on wild fish stocks, aquaculture is growing, and the need for sustainable and cost-effective feed solutions is paramount. Plant-based options are emerging as viable alternatives to traditional fishmeal-based feeds.

- Other Livestock: This broad category encompasses a variety of animals, including sheep, goats, and horses, where plant-based compound feeds are finding niche applications. The specific nutritional needs of these animals are being addressed through tailored formulations.

The Pellet type of plant-based compound feed currently holds the largest market share due to its superior handling characteristics, reduced dust, and enhanced palatability for a wide range of livestock. The consistency and ease of automated feeding systems associated with pellets make them a preferred choice for large-scale operations.

- Pellet: The physical properties of pellets, such as durability and uniform particle size, are critical for efficient delivery and intake, contributing to their market leadership across various livestock applications.

- Mash: While less dominant than pellets, mash feed remains relevant, particularly for younger animals and in certain production systems where its finer texture is advantageous.

- Crumble: This feed form is specifically designed for young animals, such as broiler chicks and piglets, offering a transition between starter feeds and pelleted rations, ensuring optimal nutrient intake during crucial growth phases.

- Other forms: This category includes a variety of specialized feed formulations designed for specific dietary needs or delivery methods, catering to niche markets and advanced feeding strategies.

Plant-based Compound Feed Product Developments

Recent product developments in plant-based compound feeds are focusing on enhancing bioavailability of nutrients, improving palatability, and incorporating novel ingredients like insect proteins and algal extracts. Innovations are geared towards addressing specific nutritional deficiencies and disease prevention in livestock, offering a competitive advantage through improved animal health and performance. These advancements are critical for market acceptance and expanding the application scope of plant-based alternatives across diverse animal husbandry practices.

Report Scope & Segmentation Analysis

This report segmentations encompass the Application: Poultry, Ruminants, Swine, Aquaculture, and Other livestock, alongside Types: Mash, Pellet, Crumble, and Other forms. The Poultry segment, projected for substantial growth reaching hundreds of millions, is driven by its high consumption and technological adoption. The Pellet type is expected to maintain its lead, estimated at over xx percent market share, due to its practical advantages in automated feeding systems. Aquaculture shows promising growth potential, estimated at xx percent CAGR, driven by the expansion of sustainable fish farming.

Key Drivers of Plant-based Compound Feed Growth

The primary growth drivers for the Plant-based Compound Feed market are the escalating global demand for sustainable and ethically produced animal protein, coupled with increasing consumer awareness of the environmental impact of conventional feed sources. Technological advancements in feed formulation and processing, leading to improved nutritional efficiency and animal health, are significant catalysts. Furthermore, supportive governmental regulations and initiatives promoting sustainable agriculture and reducing reliance on animal-derived ingredients are creating a favorable market landscape, fostering innovation and market penetration estimated to reach hundreds of millions in value.

Challenges in the Plant-based Compound Feed Sector

Challenges in the Plant-based Compound Feed sector include navigating complex regulatory hurdles concerning ingredient approvals and labeling, ensuring consistent and high-quality supply chains for diverse plant-based raw materials, and overcoming ingrained traditional perceptions regarding feed efficacy. Competitive pressures from established conventional feed manufacturers and the need for significant investment in research and development to match the comprehensive nutritional profiles of animal-based feeds also pose considerable restraints, potentially impacting market growth projections from the hundreds of millions to even higher figures.

Emerging Opportunities in Plant-based Compound Feed

Emerging opportunities in the Plant-based Compound Feed market lie in the development of specialized formulations for niche livestock segments, capitalizing on the growing demand for antibiotic-free and traceable animal products. The integration of precision nutrition technologies and the exploration of novel, sustainable protein sources like microalgae and insect meal present significant avenues for market expansion. Furthermore, the increasing global focus on circular economy principles opens doors for utilizing co-products from other industries as feed ingredients, creating value and reducing waste, with market potential extending into the hundreds of millions.

Leading Players in the Plant-based Compound Feed Market

- Cargill

- ADM

- Charoen Pokphand Foods

- New Hope Group

- Land O' Lakes

- Nutreco N.V

- Alltech

- Guangdong Haid Group

- Weston Milling Animal

- Feed One

- Kent Nutrition

- Elanco Animal

- De Hues Animal

- ForFarmers

- Godrej Agrovet

- Hueber Feeds

- Nor Feed

Key Developments in Plant-based Compound Feed Industry

- 2024: Launch of new high-protein plant-based feed formulations for aquaculture, aiming to reduce reliance on fishmeal.

- 2023: Significant investment by a major player in R&D for next-generation plant-based feeds with enhanced digestibility.

- 2023: Strategic partnership formed to develop sustainable feed ingredients from agricultural by-products.

- 2022: Acquisition of a specialized plant-based feed technology company to bolster product portfolio.

- 2022: Introduction of novel feed additives derived from botanical extracts to improve animal immunity.

- 2021: Expansion of production capacity for plant-based compound feeds to meet rising global demand.

Strategic Outlook for Plant-based Compound Feed Market

- 2024: Launch of new high-protein plant-based feed formulations for aquaculture, aiming to reduce reliance on fishmeal.

- 2023: Significant investment by a major player in R&D for next-generation plant-based feeds with enhanced digestibility.

- 2023: Strategic partnership formed to develop sustainable feed ingredients from agricultural by-products.

- 2022: Acquisition of a specialized plant-based feed technology company to bolster product portfolio.

- 2022: Introduction of novel feed additives derived from botanical extracts to improve animal immunity.

- 2021: Expansion of production capacity for plant-based compound feeds to meet rising global demand.

Strategic Outlook for Plant-based Compound Feed Market

The strategic outlook for the Plant-based Compound Feed market is exceptionally positive, driven by its alignment with global sustainability goals and the increasing demand for efficient, ethical animal agriculture. Continued investment in research and development to enhance nutritional value, palatability, and cost-effectiveness will be crucial for sustained growth. Strategic collaborations with technology providers and ingredient suppliers, alongside market expansion into developing economies with burgeoning livestock sectors, will unlock further opportunities, with the market projected to reach multi-million dollar figures by the end of the forecast period.

Plant-based Compound Feed Segmentation

-

1. Application

- 1.1. Poultry

- 1.2. Ruminants

- 1.3. Swine

- 1.4. Aquaculture

- 1.5. Other livestock

-

2. Types

- 2.1. Mash

- 2.2. Pellet

- 2.3. Crumble

- 2.4. Other forms

Plant-based Compound Feed Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Plant-based Compound Feed REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Plant-based Compound Feed Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Poultry

- 5.1.2. Ruminants

- 5.1.3. Swine

- 5.1.4. Aquaculture

- 5.1.5. Other livestock

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Mash

- 5.2.2. Pellet

- 5.2.3. Crumble

- 5.2.4. Other forms

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Plant-based Compound Feed Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Poultry

- 6.1.2. Ruminants

- 6.1.3. Swine

- 6.1.4. Aquaculture

- 6.1.5. Other livestock

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Mash

- 6.2.2. Pellet

- 6.2.3. Crumble

- 6.2.4. Other forms

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Plant-based Compound Feed Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Poultry

- 7.1.2. Ruminants

- 7.1.3. Swine

- 7.1.4. Aquaculture

- 7.1.5. Other livestock

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Mash

- 7.2.2. Pellet

- 7.2.3. Crumble

- 7.2.4. Other forms

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Plant-based Compound Feed Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Poultry

- 8.1.2. Ruminants

- 8.1.3. Swine

- 8.1.4. Aquaculture

- 8.1.5. Other livestock

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Mash

- 8.2.2. Pellet

- 8.2.3. Crumble

- 8.2.4. Other forms

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Plant-based Compound Feed Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Poultry

- 9.1.2. Ruminants

- 9.1.3. Swine

- 9.1.4. Aquaculture

- 9.1.5. Other livestock

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Mash

- 9.2.2. Pellet

- 9.2.3. Crumble

- 9.2.4. Other forms

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Plant-based Compound Feed Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Poultry

- 10.1.2. Ruminants

- 10.1.3. Swine

- 10.1.4. Aquaculture

- 10.1.5. Other livestock

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Mash

- 10.2.2. Pellet

- 10.2.3. Crumble

- 10.2.4. Other forms

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Cargill

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ADM

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Charoen Pokphand Foods

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 New Hope Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Land O' Lakes

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nutreco N.V

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Alltech

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Guangdong Haid Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Weston Milling Animal

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Feed One

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Kent Nutrition

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Elanco Animal

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 De Hues Animal

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 ForFarmers

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Godrej Agrovet

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Hueber Feeds

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Nor Feed

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Cargill

List of Figures

- Figure 1: Global Plant-based Compound Feed Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Plant-based Compound Feed Revenue (million), by Application 2024 & 2032

- Figure 3: North America Plant-based Compound Feed Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Plant-based Compound Feed Revenue (million), by Types 2024 & 2032

- Figure 5: North America Plant-based Compound Feed Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Plant-based Compound Feed Revenue (million), by Country 2024 & 2032

- Figure 7: North America Plant-based Compound Feed Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Plant-based Compound Feed Revenue (million), by Application 2024 & 2032

- Figure 9: South America Plant-based Compound Feed Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Plant-based Compound Feed Revenue (million), by Types 2024 & 2032

- Figure 11: South America Plant-based Compound Feed Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Plant-based Compound Feed Revenue (million), by Country 2024 & 2032

- Figure 13: South America Plant-based Compound Feed Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Plant-based Compound Feed Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Plant-based Compound Feed Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Plant-based Compound Feed Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Plant-based Compound Feed Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Plant-based Compound Feed Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Plant-based Compound Feed Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Plant-based Compound Feed Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Plant-based Compound Feed Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Plant-based Compound Feed Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Plant-based Compound Feed Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Plant-based Compound Feed Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Plant-based Compound Feed Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Plant-based Compound Feed Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Plant-based Compound Feed Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Plant-based Compound Feed Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Plant-based Compound Feed Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Plant-based Compound Feed Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Plant-based Compound Feed Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Plant-based Compound Feed Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Plant-based Compound Feed Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Plant-based Compound Feed Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Plant-based Compound Feed Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Plant-based Compound Feed Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Plant-based Compound Feed Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Plant-based Compound Feed Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Plant-based Compound Feed Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Plant-based Compound Feed Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Plant-based Compound Feed Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Plant-based Compound Feed Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Plant-based Compound Feed Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Plant-based Compound Feed Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Plant-based Compound Feed Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Plant-based Compound Feed Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Plant-based Compound Feed Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Plant-based Compound Feed Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Plant-based Compound Feed Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Plant-based Compound Feed Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Plant-based Compound Feed Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Plant-based Compound Feed Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Plant-based Compound Feed Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Plant-based Compound Feed Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Plant-based Compound Feed Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Plant-based Compound Feed Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Plant-based Compound Feed Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Plant-based Compound Feed Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Plant-based Compound Feed Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Plant-based Compound Feed Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Plant-based Compound Feed Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Plant-based Compound Feed Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Plant-based Compound Feed Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Plant-based Compound Feed Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Plant-based Compound Feed Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Plant-based Compound Feed Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Plant-based Compound Feed Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Plant-based Compound Feed Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Plant-based Compound Feed Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Plant-based Compound Feed Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Plant-based Compound Feed Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Plant-based Compound Feed Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Plant-based Compound Feed Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Plant-based Compound Feed Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Plant-based Compound Feed Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Plant-based Compound Feed Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Plant-based Compound Feed Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Plant-based Compound Feed Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Plant-based Compound Feed?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Plant-based Compound Feed?

Key companies in the market include Cargill, ADM, Charoen Pokphand Foods, New Hope Group, Land O' Lakes, Nutreco N.V, Alltech, Guangdong Haid Group, Weston Milling Animal, Feed One, Kent Nutrition, Elanco Animal, De Hues Animal, ForFarmers, Godrej Agrovet, Hueber Feeds, Nor Feed.

3. What are the main segments of the Plant-based Compound Feed?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Plant-based Compound Feed," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Plant-based Compound Feed report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Plant-based Compound Feed?

To stay informed about further developments, trends, and reports in the Plant-based Compound Feed, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence