Key Insights

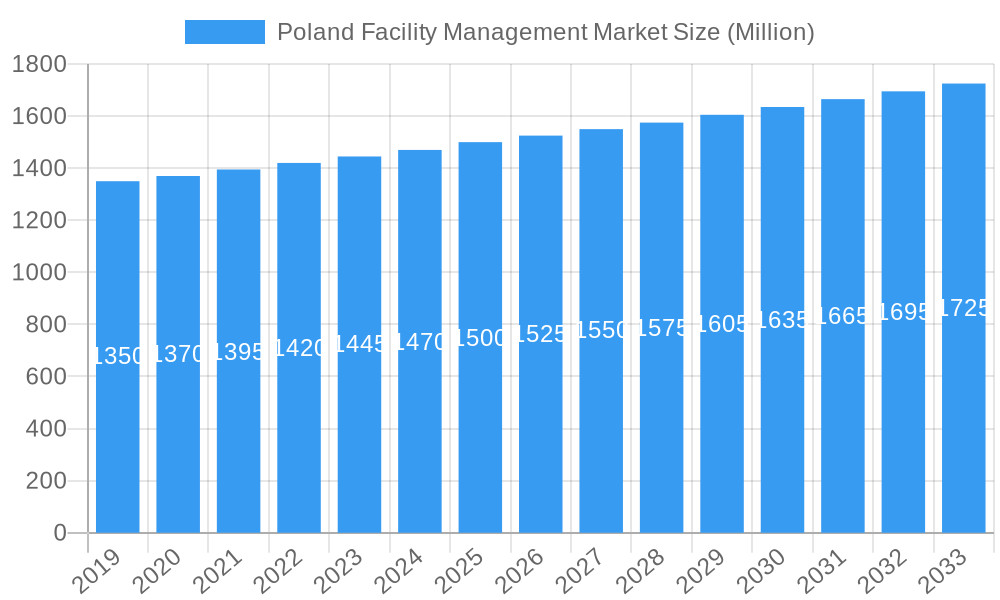

The Poland Facility Management market is forecast to experience robust growth, reaching an estimated market size of $15 billion by 2024, with a projected Compound Annual Growth Rate (CAGR) of 9.7% from 2024 to 2033. This expansion is fueled by increasing business demands for operational efficiency, the growing complexity of modern commercial and industrial infrastructure management, and a rising preference for integrated facility management solutions. The outsourcing of non-core functions to specialized providers and the adoption of smart building technologies and sustainable practices are significant growth drivers.

Poland Facility Management Market Market Size (In Billion)

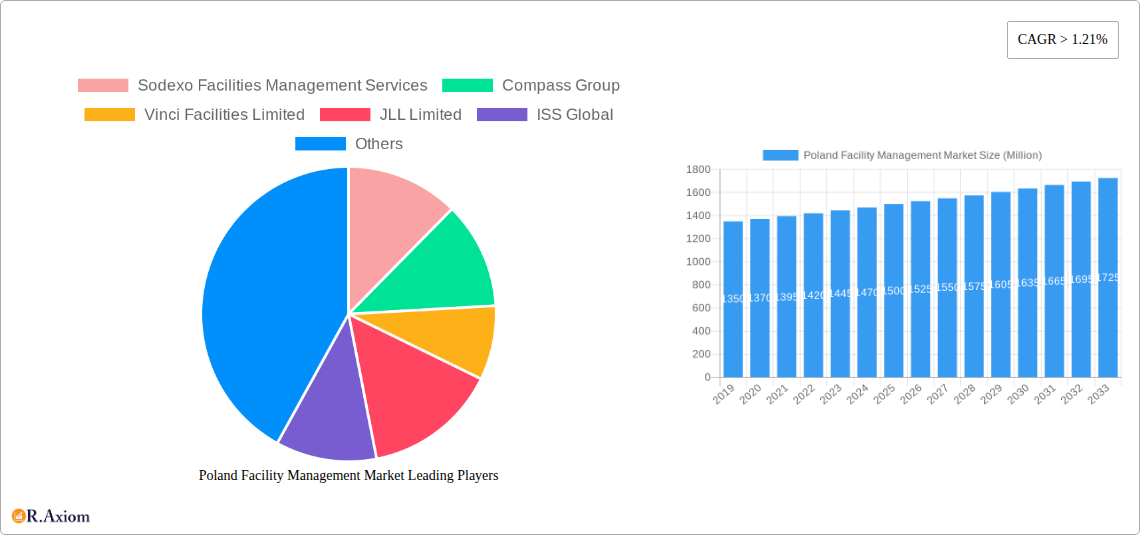

The market landscape highlights a strong trend towards outsourced facility management, encompassing single, bundled, and integrated service models. Hard FM services, focusing on building maintenance and engineering, are anticipated to lead, while Soft FM services, including cleaning, security, and catering, are gaining traction due to a heightened focus on employee well-being and workplace experience. Commercial and industrial sectors, particularly logistics, manufacturing, and corporate offices, represent the largest end-user segments. Institutional and public/infrastructure segments also contribute to growth through investments in facility upgrades and maintenance. Key market participants like Sodexo Facilities Management Services, Compass Group, and JLL Limited are actively influencing the competitive environment through strategic initiatives and service advancements.

Poland Facility Management Market Company Market Share

This comprehensive report offers an in-depth analysis of the Poland Facility Management market, a dynamic sector experiencing significant growth driven by increasing outsourcing trends, technological advancements, and evolving business needs. Covering the historical period of 2019-2024, the base year of 2024, and a detailed forecast period from 2024-2033, this report provides crucial insights for industry stakeholders, investors, and decision-makers. We explore market concentration, innovation, key trends, dominant segments, product developments, growth drivers, challenges, emerging opportunities, and leading players. The Poland FM market size is projected to reach $15 billion by 2033, with a projected CAGR of 9.7% during the forecast period.

Poland Facility Management Market Market Concentration & Innovation

The Poland Facility Management Market exhibits a moderate level of market concentration, with a mix of large global players and a growing number of local service providers. Innovation is a key differentiator, driven by the adoption of smart building technologies, IoT integration for predictive maintenance, and the demand for sustainable FM solutions. Regulatory frameworks, particularly concerning labor laws and environmental standards, are shaping service offerings and operational efficiency. Product substitutes, such as in-house service provision or specialized technology solutions, are present but often less comprehensive than integrated FM offerings. End-user trends point towards a rising demand for flexible and customizable FM services, particularly within the commercial and industrial sectors. Mergers and acquisitions (M&A) are a significant factor in market consolidation, with recent M&A deal values estimated to be in the range of XX Million USD to XX Million USD annually. Key players are actively pursuing strategic acquisitions to expand their service portfolios and geographical reach. Market share for leading players varies, with the top 5 companies estimated to hold approximately XX% to XX% of the total market.

Poland Facility Management Market Industry Trends & Insights

The Poland Facility Management Market is poised for robust expansion, fueled by a confluence of compelling industry trends and evolving business imperatives. A primary growth driver is the escalating adoption of outsourced facility management services across diverse sectors. As businesses increasingly focus on core competencies, they are delegating non-core functions such as building maintenance, security, and catering to specialized FM providers. This trend is particularly pronounced in the commercial sector, with the rise of modern office spaces, retail complexes, and hospitality establishments demanding professional FM support. Technological disruption is another pivotal force, with the integration of smart building technologies, including IoT sensors, AI-powered analytics, and building management systems (BMS), revolutionizing operational efficiency. These technologies enable predictive maintenance, energy optimization, and enhanced occupant comfort, leading to significant cost savings and improved sustainability.

Consumer preferences are shifting towards integrated facility management (IFM) solutions, where a single provider manages a broad spectrum of services. This streamlines operations, reduces vendor management complexity, and often leads to cost efficiencies. The demand for sustainable and green facility management practices is also gaining traction, driven by corporate social responsibility initiatives and growing environmental awareness. FM providers are increasingly offering services such as energy-efficient building operations, waste management optimization, and the use of eco-friendly cleaning products. The competitive landscape is characterized by intense rivalry, with players differentiating themselves through service quality, technological innovation, and specialized expertise. The Poland FM market penetration is currently at XX% and is expected to grow significantly. The CAGR of the Poland Facility Management Market is estimated to be XX% during the forecast period.

The industrial sector is also a significant contributor to market growth, with manufacturers and logistics companies increasingly relying on FM for efficient plant operations, warehousing, and supply chain support. The public/infrastructure segment, encompassing government buildings, transportation hubs, and educational institutions, presents a substantial market opportunity, albeit with longer procurement cycles and stringent compliance requirements. The increasing complexity of modern facilities, coupled with a shortage of skilled in-house maintenance personnel, further propels the demand for professional FM services. Investment in digitalization of FM operations is paramount, with platforms for work order management, remote monitoring, and data analytics becoming standard. This digital transformation enhances transparency, accountability, and the overall delivery of FM services.

Dominant Markets & Segments in Poland Facility Management Market

The Poland Facility Management Market is segmented across various dimensions, each exhibiting distinct growth dynamics and market dominance. In terms of Type of Facility Management, Outsourced Facility Management holds a commanding position, driven by the strategic advantages of cost efficiency, access to specialized expertise, and the ability to focus on core business operations. Within outsourced services, Integrated FM (IFM) is experiencing the most rapid growth, as clients increasingly seek a single point of contact for a comprehensive suite of services. Bundled FM and Single FM also contribute significantly, catering to specific client needs. Inhouse Facility Management, while still present, is gradually declining in market share as companies opt for the benefits of outsourcing.

Regarding Offering Type, Soft FM services, encompassing cleaning, security, reception, and catering, currently dominate the market due to their ubiquitous demand across all end-user segments. However, Hard FM, which includes maintenance, repair, and technical services for building systems (HVAC, electrical, plumbing), is witnessing robust growth, particularly with the increasing complexity of modern infrastructure and the focus on asset longevity. The demand for specialized technical expertise in Hard FM is a key driver.

The End User segment paints a clear picture of dominance, with the Commercial sector leading the market. This is attributed to the proliferation of office buildings, retail spaces, shopping malls, and hotels, all requiring extensive FM support for day-to-day operations and occupant satisfaction. The Industrial sector follows closely, driven by the needs of manufacturing plants, warehouses, and logistics facilities for efficient maintenance, safety compliance, and operational uptime. The Institutional sector, including healthcare facilities, educational institutions, and government administrative buildings, also represents a substantial market, characterized by specific regulatory requirements and a focus on hygiene and safety. The Public/Infrastructure segment, encompassing transportation hubs, public amenities, and utilities, offers significant long-term potential, though often characterized by longer contract durations and public procurement processes.

Key drivers for the dominance of these segments include:

- Economic Policies: Favorable business environments and foreign direct investment in Poland stimulate growth in the commercial and industrial sectors, directly increasing demand for FM services.

- Infrastructure Development: Ongoing investments in new commercial buildings, industrial parks, and public infrastructure projects necessitate comprehensive FM solutions.

- Technological Adoption: The push towards smart buildings and efficient operations in commercial and industrial spaces drives demand for advanced Hard and Soft FM services.

- Urbanization and Population Growth: Increasing urbanization leads to a greater concentration of commercial and residential properties requiring FM expertise.

- Focus on Core Competencies: Businesses across all sectors are increasingly divesting non-core functions, leading to greater reliance on outsourced FM.

Poland Facility Management Market Product Developments

Product developments in the Poland Facility Management Market are increasingly centered around digitalization and sustainability. Innovations in Building Information Modeling (BIM) are enhancing planning and maintenance processes, while the integration of Internet of Things (IoT) devices enables real-time monitoring of building performance and predictive maintenance. Advanced analytics platforms are providing deeper insights into energy consumption, operational efficiency, and occupant comfort. Companies are also developing specialized software solutions for work order management, resource allocation, and remote service delivery. Competitive advantages are being gained through the ability to offer integrated digital solutions that provide greater transparency, cost savings, and environmental benefits to clients.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Poland Facility Management Market segmented by Type of Facility Management: Inhouse Facility Management, Outsourced Facility Management (encompassing Single FM, Bundled FM, Integrated FM), Offering Type: Hard FM and Soft FM, and End User: Commercial, Institutional, Public/Infrastructure, Industrial, and Other End Users.

Outsourced Facility Management is projected to experience the highest growth, with Integrated FM expected to lead the sub-segments due to its comprehensive service delivery model. The Commercial end-user segment is anticipated to maintain its dominant market share, driven by continuous new construction and upgrades. Hard FM offerings, particularly those related to energy efficiency and smart building technologies, are expected to witness significant expansion, complementing the steady demand for Soft FM services. The Industrial sector's growth is linked to Poland's manufacturing output and logistical advancements, while Institutional and Public/Infrastructure segments offer stable, long-term opportunities.

Key Drivers of Poland Facility Management Market Growth

Several key factors are propelling the growth of the Poland Facility Management Market. The increasing trend of outsourcing non-core business functions allows companies to concentrate on their core competencies, driving demand for professional FM services. Technological advancements, such as the adoption of IoT, AI, and smart building technologies, are enhancing efficiency, reducing operational costs, and improving service delivery. Growing emphasis on sustainability and energy efficiency is also a significant driver, with businesses seeking FM solutions that minimize environmental impact. Furthermore, government initiatives and investments in infrastructure development are creating new opportunities for FM providers. The increasing complexity of modern facilities and the need for specialized technical expertise further bolster market expansion.

Challenges in the Poland Facility Management Market Sector

Despite strong growth prospects, the Poland Facility Management Market faces several challenges. A primary restraint is the shortage of skilled labor, particularly for technical maintenance roles, leading to increased recruitment costs and potential service disruptions. Intense price competition among FM providers can also pressure profit margins. Navigating complex regulatory frameworks and compliance requirements, especially in the public and institutional sectors, can be time-consuming and costly. Supply chain disruptions, impacting the availability of spare parts and materials for maintenance, can also pose operational challenges. Furthermore, client resistance to adopting new technologies or committing to long-term integrated FM contracts can slow down market penetration.

Emerging Opportunities in Poland Facility Management Market

Emerging opportunities in the Poland Facility Management Market are abundant, driven by evolving client needs and technological advancements. The growing demand for sustainable FM solutions, including green building management and energy optimization services, presents a significant avenue for growth. The expansion of smart building technologies and the implementation of IoT in facility operations offer opportunities for predictive maintenance and data-driven decision-making. The increasing adoption of Integrated Facility Management (IFM) models, where a single provider manages multiple services, is creating lucrative contracts. Furthermore, the development of flexible workspace solutions and co-working spaces necessitates specialized FM support. The focus on health, safety, and well-being of occupants in post-pandemic scenarios is also driving demand for enhanced cleaning, hygiene, and building comfort services.

Leading Players in the Poland Facility Management Market Market

- Sodexo Facilities Management Services

- Compass Group

- Vinci Facilities Limited

- JLL Limited

- ISS Global

- ATALIAN Global Services

- CBRE Group

- OKIN Facility (OKIN Group)

- Engie FM Limited Cofely AG

- Apleona GmbH

Key Developments in Poland Facility Management Market Industry

- Dec 2021 - CBRE Group is expanding its office space in Mlynska due to the development of CBRE in Poznan. The new CBRE office has 80 square meters and has been arranged in such a way to create more jobs for the employees.

- Aug 2021 - CBRE Group has been selected as the exclusive agent for the commercialization process of the Mogilska 35 office building located in the center of Krakow. The total leasable area is around 11 thousand square meters, and the investment is expected to be done in the first half of 2023.

Strategic Outlook for Poland Facility Management Market Market

The strategic outlook for the Poland Facility Management Market is highly positive, driven by a persistent demand for professionalized building operations and maintenance. The market is expected to witness continued growth fueled by the ongoing trend of outsourcing, the imperative for operational efficiency, and the increasing adoption of smart technologies. Strategic focus will be on offering integrated FM solutions, emphasizing sustainability, and leveraging digital platforms to enhance service delivery and client satisfaction. Companies that can effectively address the demand for skilled personnel and adapt to evolving regulatory landscapes will be well-positioned for success. Investment in training and development, alongside strategic partnerships and technological innovation, will be crucial for capturing market share and ensuring long-term growth in this dynamic sector.

Poland Facility Management Market Segmentation

-

1. Type of Facility Management

- 1.1. Inhouse Facility Management

-

1.2. Outsourced Facility Management

- 1.2.1. Single FM

- 1.2.2. Bundled FM

- 1.2.3. Integrated FM

-

2. Offering Type

- 2.1. Hard FM

- 2.2. Soft FM

-

3. End User

- 3.1. Commercial

- 3.2. Institutional

- 3.3. Public/Infrastructure

- 3.4. Industrial

- 3.5. Other End Users

Poland Facility Management Market Segmentation By Geography

- 1. Poland

Poland Facility Management Market Regional Market Share

Geographic Coverage of Poland Facility Management Market

Poland Facility Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Construction Boom Owing To The Growing Clout Of Multinational Conglomerates; Increasing Emphasis On Green Building Practices; Growing Demand For Soft Fm Practices

- 3.3. Market Restrains

- 3.3.1. Regulatory and Legal Changes; Growing Competition Expected to Impact Profit Margins of Existing Vendors

- 3.4. Market Trends

- 3.4.1. Single Facility Management to have a significant share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Facility Management

- 5.1.1. Inhouse Facility Management

- 5.1.2. Outsourced Facility Management

- 5.1.2.1. Single FM

- 5.1.2.2. Bundled FM

- 5.1.2.3. Integrated FM

- 5.2. Market Analysis, Insights and Forecast - by Offering Type

- 5.2.1. Hard FM

- 5.2.2. Soft FM

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Commercial

- 5.3.2. Institutional

- 5.3.3. Public/Infrastructure

- 5.3.4. Industrial

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Type of Facility Management

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sodexo Facilities Management Services

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Compass Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Vinci Facilities Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 JLL Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ISS Global

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ATALIAN Global Services

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CBRE Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 OKIN Facility (OKIN Group)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Engie FM Limited Cofely AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Apleona GmbH

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sodexo Facilities Management Services

List of Figures

- Figure 1: Poland Facility Management Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Poland Facility Management Market Share (%) by Company 2025

List of Tables

- Table 1: Poland Facility Management Market Revenue billion Forecast, by Type of Facility Management 2020 & 2033

- Table 2: Poland Facility Management Market Revenue billion Forecast, by Offering Type 2020 & 2033

- Table 3: Poland Facility Management Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Poland Facility Management Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Poland Facility Management Market Revenue billion Forecast, by Type of Facility Management 2020 & 2033

- Table 6: Poland Facility Management Market Revenue billion Forecast, by Offering Type 2020 & 2033

- Table 7: Poland Facility Management Market Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Poland Facility Management Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Facility Management Market?

The projected CAGR is approximately 9.7%.

2. Which companies are prominent players in the Poland Facility Management Market?

Key companies in the market include Sodexo Facilities Management Services, Compass Group, Vinci Facilities Limited, JLL Limited, ISS Global, ATALIAN Global Services, CBRE Group, OKIN Facility (OKIN Group), Engie FM Limited Cofely AG, Apleona GmbH.

3. What are the main segments of the Poland Facility Management Market?

The market segments include Type of Facility Management, Offering Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 15 billion as of 2022.

5. What are some drivers contributing to market growth?

Construction Boom Owing To The Growing Clout Of Multinational Conglomerates; Increasing Emphasis On Green Building Practices; Growing Demand For Soft Fm Practices.

6. What are the notable trends driving market growth?

Single Facility Management to have a significant share.

7. Are there any restraints impacting market growth?

Regulatory and Legal Changes; Growing Competition Expected to Impact Profit Margins of Existing Vendors.

8. Can you provide examples of recent developments in the market?

Dec 2021 - CBRE Group is expanding its office space in Mlynska due to the development of CBRE in Poznan. The new CBRE office has 80 square meters and has been arranged in such a way to create more jobs for the employees.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Facility Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Facility Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Facility Management Market?

To stay informed about further developments, trends, and reports in the Poland Facility Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence