Key Insights

The global Power Management industry is poised for significant expansion, projected to reach a substantial market size within the forecast period, driven by a compound annual growth rate (CAGR) of 7.02%. This robust growth trajectory is fueled by a confluence of critical factors, including the escalating demand for reliable and efficient power in burgeoning sectors like Data Centers and the Oil & Gas industry. The increasing complexity of power grids, coupled with a global push towards electrification and renewable energy integration, necessitates advanced power management solutions to ensure stability, optimize consumption, and minimize downtime. Furthermore, stringent regulatory frameworks and the growing awareness of energy conservation and cost reduction among end-users are compelling businesses to invest in sophisticated power management systems. The industry's ability to adapt to evolving energy landscapes, including the integration of smart grid technologies and distributed energy resources, will be paramount in sustaining this upward momentum.

Power Management Industry Market Size (In Billion)

Key trends shaping the Power Management industry include the rapid adoption of digital technologies such as AI, IoT, and cloud computing, enabling predictive maintenance, real-time monitoring, and optimized energy distribution. The growing emphasis on sustainability is also a major catalyst, with a focus on solutions that improve energy efficiency and reduce carbon footprints. While the market is experiencing strong tailwinds, certain restraints could influence its pace. These include the high initial investment costs associated with advanced power management systems and the ongoing cybersecurity concerns related to connected infrastructure. However, the increasing availability of scalable and modular solutions, alongside favorable government initiatives and incentives for energy efficiency, are expected to mitigate these challenges. The industry's diverse segmentation across Utilities, Data Centers, Oil & Gas, Marine, and Other End Users underscores its broad applicability and the vast opportunities for innovation and market penetration.

Power Management Industry Company Market Share

Power Management Industry Market Concentration & Innovation

The global Power Management Industry is characterized by moderate to high market concentration, with a dynamic interplay between established conglomerates and agile innovators. Leading players like ABB Ltd, Wartsila Oyj Abp, and Kongsberg Gruppen ASA command significant market share, driven by extensive product portfolios, robust R&D capabilities, and global distribution networks. Innovation remains a paramount driver, fueled by the increasing demand for energy efficiency, grid modernization, and the integration of renewable energy sources. Key innovation areas include advanced control systems, smart grid technologies, digital twins for predictive maintenance, and sophisticated energy storage solutions. Regulatory frameworks, particularly concerning emissions standards and grid interconnection policies, are shaping innovation trajectories and market access. Product substitutes, while present in niche applications, are largely outpaced by the integrated solutions offered by major players. End-user trends, such as the burgeoning demand from data centers for reliable and efficient power, and the marine sector's push for decarbonization, are creating specific innovation needs. Merger and acquisition (M&A) activities, while not currently at a fever pitch, are strategic opportunities for consolidation and market expansion. Notable M&A deal values are estimated to be in the range of several hundred million to over a billion dollars, often focusing on acquiring specialized technologies or market access. The market share of the top five players is estimated to be around 60%, with significant room for growth in emerging technologies.

Power Management Industry Industry Trends & Insights

The Power Management Industry is poised for substantial growth, projecting a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033. This robust expansion is underpinned by a confluence of potent growth drivers, primarily the accelerating global demand for electricity across various sectors. The electrification of transportation, the proliferation of smart devices, and the exponential growth of data centers are creating an unprecedented need for sophisticated and efficient power management solutions. Technological disruptions are a significant catalyst, with the integration of Artificial Intelligence (AI) and Machine Learning (ML) revolutionizing grid operations, enabling predictive analytics for fault detection, optimizing energy distribution, and enhancing overall system resilience. The Industrial Internet of Things (IIoT) is further empowering real-time monitoring and control of power systems, leading to greater efficiency and reduced operational costs. Consumer preferences are increasingly tilting towards sustainable and reliable power sources. This is driving investments in renewable energy integration and distributed energy resources (DERs), necessitating advanced power management systems to seamlessly integrate these intermittent sources into the existing grid infrastructure. The competitive dynamics within the industry are intensifying, with a clear trend towards offering integrated solutions that encompass generation, transmission, distribution, and consumption management. Companies are differentiating themselves through their ability to provide end-to-end services and digital platforms. Market penetration for advanced power management solutions is currently estimated at 45% but is expected to climb significantly as smart grid initiatives gain momentum and regulatory mandates for efficiency become more stringent. The global market size is projected to reach over $200 billion by 2033, a testament to the industry's critical role in the modern economy.

Dominant Markets & Segments in Power Management Industry

The Utilities end-user segment stands out as the dominant force within the Power Management Industry, representing a significant portion of the market share, estimated at over 35% of the total market size. This dominance is propelled by several key drivers. Firstly, the fundamental role of utilities in providing electricity to residential, commercial, and industrial sectors creates an inherent and continuous demand for robust power management solutions. Secondly, the ongoing global push for grid modernization, often referred to as smart grid initiatives, is a major impetus. Governments worldwide are investing heavily in upgrading their electrical infrastructure to enhance reliability, efficiency, and resilience. This includes the deployment of advanced metering infrastructure (AMI), smart substations, and sophisticated grid control systems, all of which fall under the purview of power management. Economic policies that encourage the integration of renewable energy sources like solar and wind power further bolster the utilities' need for advanced power management to balance grid stability and manage intermittency. The Oil and Gas segment also represents a substantial market, driven by the critical need for reliable and safe power operations in remote and hazardous environments. Power management solutions ensure operational continuity, prevent costly downtime, and enhance safety protocols in exploration, production, and refining processes. The Marine sector is another significant and rapidly growing segment, propelled by stringent environmental regulations and the industry's commitment to reducing emissions. This translates to a heightened demand for efficient power generation, distribution, and energy-saving technologies on vessels. The Data Centers segment is experiencing explosive growth, fueled by the digital transformation and the increasing demand for cloud computing, AI, and big data analytics. Data centers are power-intensive, and efficient power management is crucial for operational cost optimization, reliability, and sustainability. The "Other End Users" category, encompassing sectors like manufacturing, transportation, and healthcare, collectively forms a considerable market, each with specific power management requirements related to process optimization, energy efficiency, and backup power solutions.

Power Management Industry Product Developments

Product developments in the Power Management Industry are increasingly focused on intelligent automation, enhanced energy efficiency, and seamless integration of renewable energy sources. Smart controllers offering advanced diagnostics and remote monitoring capabilities are gaining traction. Innovations in digital substations and smart grid technologies are enabling real-time data analysis for predictive maintenance and optimized energy distribution. The competitive advantage lies in solutions that can significantly reduce operational costs, improve grid stability, and facilitate the widespread adoption of sustainable energy. Many new products are designed with a modular architecture, allowing for scalability and customization to meet diverse end-user needs across utilities, data centers, and marine applications.

Power Management Industry Report Scope & Segmentation Analysis

This report delves into the global Power Management Industry, meticulously segmenting the market by end-user. The Utilities segment is projected to experience a CAGR of approximately 7.0% during the forecast period, driven by grid modernization and renewable energy integration. The Data Centers segment is expected to witness the highest growth, with a CAGR of around 9.5%, due to the insatiable demand for computing power. The Oil and Gas segment, while mature, will see steady growth of approximately 5.5%, supported by the need for reliable operations. The Marine segment is anticipated to grow at a CAGR of 7.8%, fueled by decarbonization efforts and efficiency mandates. The Other End Users segment will exhibit a diverse growth trajectory, with an estimated CAGR of 6.2%, reflecting varied industrial applications and adoption rates.

Key Drivers of Power Management Industry Growth

The Power Management Industry is propelled by several compelling growth drivers. Technological advancements such as AI, ML, and IoT are revolutionizing grid intelligence and automation, leading to enhanced efficiency and reliability. The global push for sustainability and decarbonization is a significant catalyst, driving the integration of renewable energy sources and demanding sophisticated management solutions. Increasing energy consumption driven by industrialization, urbanization, and the digital economy further necessitates advanced power management. Government initiatives and favorable policies promoting grid modernization, renewable energy adoption, and energy efficiency are crucial economic drivers.

Challenges in the Power Management Industry Sector

Despite robust growth, the Power Management Industry faces several challenges. High initial investment costs for advanced infrastructure upgrades and smart grid technologies can be a barrier, particularly for smaller utilities. Complex regulatory frameworks and evolving standards can create compliance hurdles and slow down innovation adoption. Cybersecurity threats pose a significant risk to interconnected power systems, requiring constant vigilance and investment in robust security measures. Supply chain disruptions, as seen in recent global events, can impact the availability of critical components and lead to project delays.

Emerging Opportunities in Power Management Industry

The Power Management Industry is ripe with emerging opportunities. The widespread adoption of distributed energy resources (DERs), including solar panels, wind turbines, and battery storage, presents a significant opportunity for intelligent management and integration solutions. The electrification of transportation, particularly electric vehicles (EVs), is creating new demands for charging infrastructure and grid management. The increasing focus on energy efficiency and demand-side management offers avenues for innovative solutions that empower consumers and businesses to optimize their energy usage. The development of microgrids and smart cities represents a substantial future market for integrated and resilient power systems.

Leading Players in the Power Management Industry Market

- ComAp AS

- Brush Group

- Nipro Corporation

- ABB Ltd

- etap (Operation Technology Inc)

- Wartsila Oyj Abp

- INTECH Process Automation Inc

- RH Marine Netherlands BV

- Marine Control Services

- Kongsberg Gruppen ASA

- SELMA

Key Developments in Power Management Industry Industry

- 2023 March: ABB Ltd launches its new generation of intelligent medium-voltage switchgear, enhancing grid reliability and safety.

- 2023 February: Wartsila Oyj Abp secures a significant contract for a hybrid power plant solution in Southeast Asia, emphasizing sustainable energy integration.

- 2022 December: Kongsberg Gruppen ASA announces advancements in its autonomous shipping power management systems, pushing for greener maritime operations.

- 2022 October: etap (Operation Technology Inc) releases its latest software updates for power system analysis and simulation, improving design and operational efficiency.

- 2022 August: ComAp AS introduces new control units for renewable energy integration, simplifying the connection of solar and wind farms to the grid.

Strategic Outlook for Power Management Industry Market

The strategic outlook for the Power Management Industry is overwhelmingly positive, driven by the fundamental need for reliable, efficient, and sustainable energy infrastructure. The increasing integration of renewable energy, coupled with the growing demand from sectors like data centers and electric mobility, creates a fertile ground for innovation and market expansion. Companies that can offer intelligent, integrated, and digitally enabled power management solutions, while effectively navigating regulatory landscapes and addressing cybersecurity concerns, are well-positioned for sustained growth and market leadership. The future will be defined by smart grids, distributed energy resources, and a relentless pursuit of energy efficiency and decarbonization.

Power Management Industry Segmentation

-

1. End User

- 1.1. Utilities

- 1.2. Data Centers

- 1.3. Oil and Gas

- 1.4. Marine

- 1.5. Other End Users

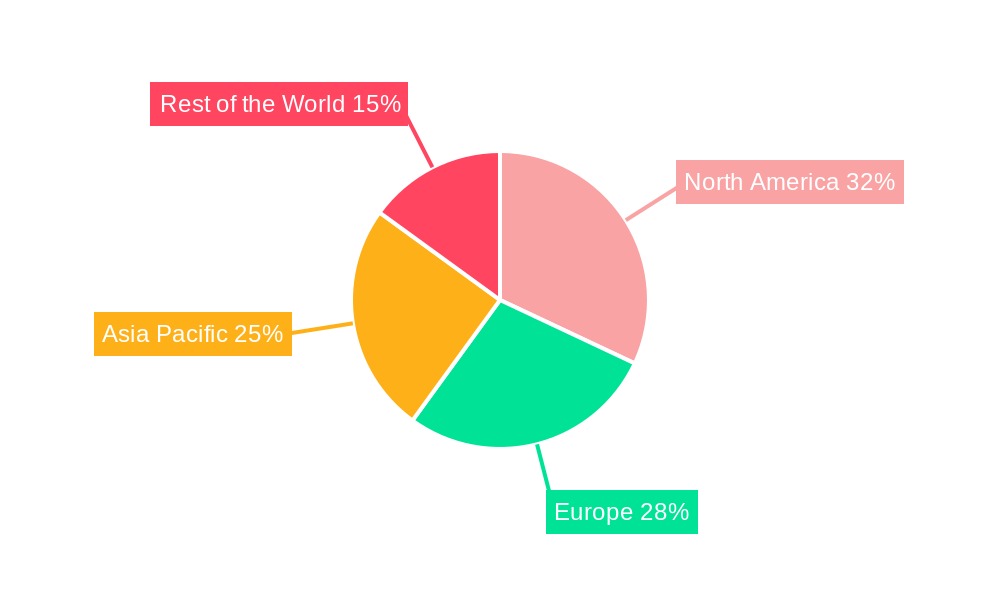

Power Management Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Power Management Industry Regional Market Share

Geographic Coverage of Power Management Industry

Power Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; Increasing Focus on Safety

- 3.2.2 Especially in the Manufacturing Environment; Increase in Awareness Regarding Energy Efficiency due to Government Regulations

- 3.3. Market Restrains

- 3.3.1 ; Increasing Focus on Safety

- 3.3.2 Especially in the Manufacturing Environment; Increase in Awareness Regarding Energy Efficiency due to Government Regulations

- 3.4. Market Trends

- 3.4.1 Increasing Focus on Safety

- 3.4.2 Especially in Manufacturing Environment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Power Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Utilities

- 5.1.2. Data Centers

- 5.1.3. Oil and Gas

- 5.1.4. Marine

- 5.1.5. Other End Users

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. North America Power Management Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Utilities

- 6.1.2. Data Centers

- 6.1.3. Oil and Gas

- 6.1.4. Marine

- 6.1.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. Europe Power Management Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Utilities

- 7.1.2. Data Centers

- 7.1.3. Oil and Gas

- 7.1.4. Marine

- 7.1.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Asia Pacific Power Management Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Utilities

- 8.1.2. Data Centers

- 8.1.3. Oil and Gas

- 8.1.4. Marine

- 8.1.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. Rest of the World Power Management Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Utilities

- 9.1.2. Data Centers

- 9.1.3. Oil and Gas

- 9.1.4. Marine

- 9.1.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ComAp AS

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Brush Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Nipro Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 ABB Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 etap (Operation Technology Inc )

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Wartsila Oyj Abp

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 INTECH Process Automation Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 RH Marine Netherlands BV

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Marine Control Services

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Kongsberg Gruppen ASA

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 SELMA*List Not Exhaustive

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 ComAp AS

List of Figures

- Figure 1: Global Power Management Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Power Management Industry Revenue (Million), by End User 2025 & 2033

- Figure 3: North America Power Management Industry Revenue Share (%), by End User 2025 & 2033

- Figure 4: North America Power Management Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Power Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Power Management Industry Revenue (Million), by End User 2025 & 2033

- Figure 7: Europe Power Management Industry Revenue Share (%), by End User 2025 & 2033

- Figure 8: Europe Power Management Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Power Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Power Management Industry Revenue (Million), by End User 2025 & 2033

- Figure 11: Asia Pacific Power Management Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Asia Pacific Power Management Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Power Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Power Management Industry Revenue (Million), by End User 2025 & 2033

- Figure 15: Rest of the World Power Management Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: Rest of the World Power Management Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Rest of the World Power Management Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Power Management Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 2: Global Power Management Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Power Management Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Power Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Power Management Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Power Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Power Management Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global Power Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Power Management Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Global Power Management Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Power Management Industry?

The projected CAGR is approximately 7.02%.

2. Which companies are prominent players in the Power Management Industry?

Key companies in the market include ComAp AS, Brush Group, Nipro Corporation, ABB Ltd, etap (Operation Technology Inc ), Wartsila Oyj Abp, INTECH Process Automation Inc, RH Marine Netherlands BV, Marine Control Services, Kongsberg Gruppen ASA, SELMA*List Not Exhaustive.

3. What are the main segments of the Power Management Industry?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Focus on Safety. Especially in the Manufacturing Environment; Increase in Awareness Regarding Energy Efficiency due to Government Regulations.

6. What are the notable trends driving market growth?

Increasing Focus on Safety. Especially in Manufacturing Environment.

7. Are there any restraints impacting market growth?

; Increasing Focus on Safety. Especially in the Manufacturing Environment; Increase in Awareness Regarding Energy Efficiency due to Government Regulations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Power Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Power Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Power Management Industry?

To stay informed about further developments, trends, and reports in the Power Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence