Key Insights

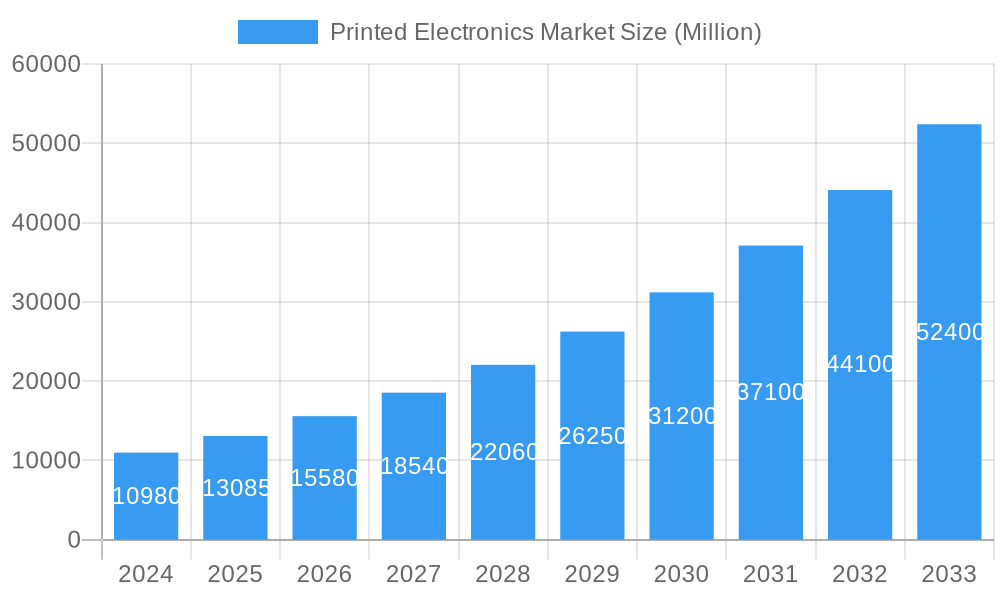

The global Printed Electronics Market is poised for remarkable expansion, projected to reach an estimated $10.98 billion in 2024. This robust growth is fueled by an impressive CAGR of 19.19% anticipated over the forecast period of 2025-2033. A primary driver for this surge is the increasing demand for flexible and lightweight electronic components across a multitude of applications, from wearable devices and smart packaging to advanced medical sensors and Internet of Things (IoT) solutions. The development of novel printing techniques, coupled with advancements in material science, is continuously enhancing the performance and reducing the cost of printed electronic devices, making them a viable and often superior alternative to traditional silicon-based electronics. The versatility offered by printed sensors, including gas, temperature, and biosensors, alongside the growing adoption of stretchable electronics and printed RFID tags, underscores the market's diverse and dynamic nature.

Printed Electronics Market Market Size (In Billion)

The market is experiencing a significant trend towards miniaturization and integration of electronic functionalities into everyday objects. Innovations in printed electronics are enabling the creation of truly embedded systems, where electronic components are seamlessly integrated into surfaces, textiles, and even biological tissues. While the rapid pace of technological development and expanding application areas are strong growth enablers, the market also faces certain restraints. These include the initial high costs associated with R&D and manufacturing scale-up for certain advanced applications, the need for standardization in printing processes and materials, and the ongoing challenges related to achieving long-term reliability and durability in harsh environmental conditions. Despite these hurdles, the inherent advantages of printed electronics, such as low-cost manufacturing, high-volume production capabilities, and suitability for large-area applications, continue to drive significant investment and innovation, promising a future where electronics are more ubiquitous and adaptable than ever before.

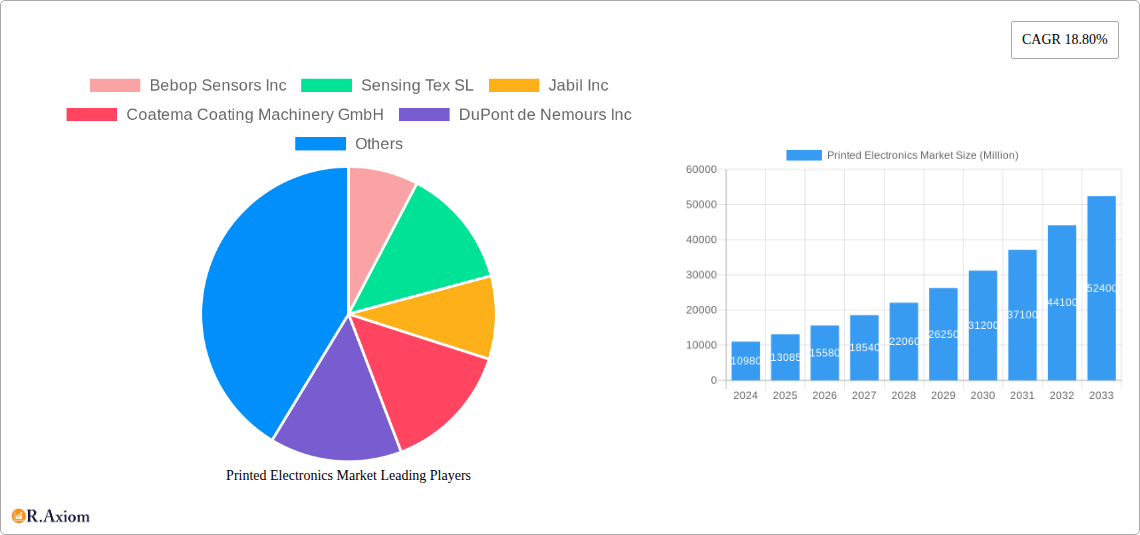

Printed Electronics Market Company Market Share

Here is the SEO-optimized, detailed report description for the Printed Electronics Market:

Printed Electronics Market Market Concentration & Innovation

The printed electronics market exhibits a moderate to high degree of market concentration, driven by significant capital investments required for research, development, and advanced manufacturing capabilities. Key players are actively engaged in innovation, focusing on enhancing performance, durability, and cost-effectiveness of printed electronic components. Regulatory frameworks are evolving to support the adoption of these novel technologies, particularly in sectors like healthcare and automotive, though standardization remains a gradual process. Product substitutes, such as conventional electronics, still hold a strong market position, but printed electronics offer unique advantages in flexibility, conformability, and cost for specific applications, narrowing the substitution threat. End-user trends lean towards miniaturization, integration into everyday objects, and the demand for smart, connected devices, directly fueling printed electronics adoption. Mergers and acquisitions (M&A) activities are strategic, aimed at consolidating technological expertise, expanding product portfolios, and gaining market access. M&A deal values are expected to reach billions of dollars as companies seek to strengthen their competitive edge in this rapidly expanding domain. Market share for printed sensors, stretchable electronics, and printed RFID is continually being reshaped by these strategic moves and ongoing technological advancements.

- Innovation Drivers: Miniaturization, integration, cost reduction, enhanced functionality (e.g., sensing capabilities, conductivity).

- Regulatory Frameworks: Focus on safety, performance standards, and material compliance, with increasing government support for R&D.

- Product Substitutes: Conventional rigid electronics, offering established reliability but lacking flexibility.

- End-User Trends: Wearables, IoT devices, smart packaging, disposable medical sensors, flexible displays.

- M&A Activities: Consolidation of intellectual property, expansion into new application areas, vertical integration.

Printed Electronics Market Industry Trends & Insights

The global Printed Electronics Market is poised for substantial growth, projected to expand from an estimated value of XX billion in 2025 to reach an impressive XX billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025–2033. This robust expansion is underpinned by a confluence of technological advancements, increasing demand for flexible and conformable electronic solutions, and a widening array of applications across diverse industries. The market is witnessing a significant shift towards integrating printed electronics into everyday objects and smart devices, driven by the ever-growing Internet of Things (IoT) ecosystem. Consumer preferences are increasingly gravitating towards personalized, wearable, and discreet electronic functionalities, where the inherent flexibility and low-profile nature of printed electronics offer a distinct advantage over traditional rigid components. The development of advanced printable materials, including conductive inks, semiconducting polymers, and dielectric formulations, is a critical enabler, allowing for enhanced performance, improved durability, and reduced manufacturing costs. Furthermore, breakthroughs in printing techniques, such as inkjet printing, screen printing, and gravure printing, are facilitating high-volume production and enabling the creation of intricate circuit designs on various substrates, including plastics, textiles, and paper. The competitive landscape is characterized by intense research and development efforts, with established electronics manufacturers, material suppliers, and specialized startups vying for market leadership. Strategic collaborations and partnerships are becoming increasingly prevalent as companies aim to leverage complementary expertise and accelerate product development cycles. The rising adoption of printed electronics in the healthcare sector, particularly for disposable diagnostic devices and wearable health monitors, represents a significant growth avenue. Similarly, the automotive industry is exploring printed electronics for integrated sensors, flexible displays, and smart lighting solutions, further propelling market penetration. The packaging sector is also a key beneficiary, with printed RFID tags and sensors enhancing supply chain traceability and product authentication. The underlying trend of miniaturization across all electronic applications continues to favor printed electronics, offering solutions that are both space-efficient and highly adaptable to complex form factors. As the technology matures and economies of scale are achieved, the cost-competitiveness of printed electronics is expected to improve, making them an even more attractive alternative to conventional electronics in a broader range of applications. The market penetration is deepening as awareness of its capabilities grows and more real-world use cases emerge, solidifying its position as a transformative technology in the electronics landscape.

Dominant Markets & Segments in Printed Electronics Market

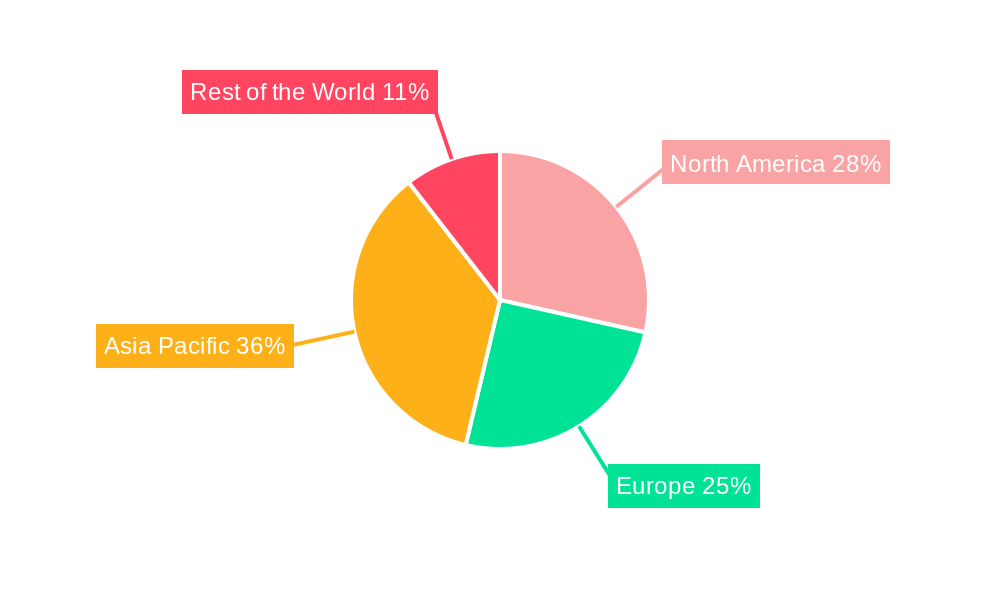

The Printed Electronics Market is characterized by dynamic regional dominance and segment leadership, driven by technological innovation, economic policies, and evolving end-user demands. North America currently holds a significant market share, propelled by robust research and development initiatives, strong government support for advanced manufacturing, and a high concentration of technology-driven industries such as healthcare, automotive, and consumer electronics. The United States, in particular, is a hub for printed electronics innovation, with numerous universities and private companies investing heavily in next-generation printed electronic solutions. Asia Pacific is rapidly emerging as a dominant force, driven by its extensive manufacturing capabilities, growing demand for smart devices, and increasing adoption of IoT technologies. Countries like South Korea, Japan, and China are at the forefront, investing in local production and R&D to capture a larger share of the global market.

Within the Type segmentation, Printed Sensors are a major revenue generator, expected to command a substantial market share throughout the forecast period. This dominance is fueled by the increasing need for intelligent and interconnected devices across various sectors.

- Printed Sensors: This segment itself is further divided, with significant growth observed across its sub-segments:

- Gas Sensors: Demand is rising due to environmental monitoring, industrial safety applications, and the proliferation of smart home devices that require air quality detection.

- Temperature Sensors: Crucial for wearables, medical diagnostics, and temperature-sensitive logistics, these are experiencing strong adoption due to their flexibility and low-profile integration capabilities.

- Biosensors: Revolutionizing healthcare, biosensors are finding widespread use in non-invasive diagnostics, continuous health monitoring, and point-of-care testing, driving substantial growth.

- Other Printed Sensors: This includes pressure sensors, strain sensors, and proximity sensors, catering to niche but growing applications in robotics, automotive, and industrial automation.

Stretchable Electronics represent another high-growth segment, driven by the burgeoning wearable technology market and the demand for electronics that can conform to the human body or dynamic surfaces. The ability to integrate electronics seamlessly into textiles and flexible substrates is a key differentiator.

Printed RFID technology is also a significant contributor, enabling enhanced supply chain management, anti-counterfeiting solutions, and the development of smart packaging. The increasing adoption of RFID for inventory tracking and asset management in retail, logistics, and manufacturing sectors is a key driver for this segment's expansion.

Economic policies in leading regions, such as tax incentives for R&D and manufacturing, coupled with investments in digital infrastructure, are crucial in fostering the growth of these dominant markets and segments. Infrastructure development, particularly in advanced manufacturing facilities and the supply chain for printable materials, further bolsters regional dominance. The interplay between technological breakthroughs, market demand, and supportive policies will continue to shape the landscape of the printed electronics market.

Printed Electronics Market Product Developments

Product developments in the printed electronics market are centered on creating more integrated, functional, and cost-effective solutions. Innovations include the development of highly sensitive printed biosensors for rapid disease detection and continuous health monitoring, and advanced printed temperature sensors capable of precise measurement in extreme conditions or embedded within flexible substrates for wearables. The emergence of fully printable logic circuits and memory elements signifies a move towards complete system integration using printing techniques. These advancements provide a competitive advantage by enabling lower-cost manufacturing, unique form factors, and novel applications previously unachievable with traditional electronics, catering to the growing demand for smart, conformable, and disposable electronic devices.

Report Scope & Segmentation Analysis

The scope of this report encompasses the global printed electronics market, analyzing its current state and future trajectory from 2019 to 2033. The market is segmented based on Type, including Printed Sensors, Stretchable Electronics, and Printed RFID.

Printed Sensors: This segment is projected to witness robust growth, driven by the increasing demand for sensing capabilities in IoT devices, wearables, and healthcare applications. Within this, Gas Sensors are expected to see a CAGR of xx%, Temperature Sensors xx%, Biosensors xx%, and Other Printed Sensors xx%.

Stretchable Electronics: This segment is poised for significant expansion, fueled by the burgeoning wearable technology market and the need for electronics that can conform to various surfaces. Growth is estimated at a CAGR of xx% over the forecast period.

Printed RFID: This segment is driven by the demand for smart packaging, supply chain management, and asset tracking. Projections indicate a CAGR of xx% during the study period.

Key Drivers of Printed Electronics Market Growth

The growth of the printed electronics market is propelled by several key factors. Technological advancements in printable materials and deposition techniques are continuously improving performance and reducing costs. The increasing demand for flexible, lightweight, and conformable electronic devices in wearables, IoT, and medical applications is a primary driver. Miniaturization trends across industries necessitate compact and integrated electronic solutions, which printed electronics readily provide. Furthermore, growing applications in healthcare, such as disposable diagnostics and wearable health monitors, are significantly contributing to market expansion. The cost-effectiveness of printing processes compared to traditional semiconductor fabrication also makes it an attractive option for high-volume applications.

- Technological Advancements: Improved conductive inks, flexible substrates, and printing methods.

- Demand for Flexibility & Conformability: Essential for wearables, IoT, and medical devices.

- Miniaturization: Enabling smaller and more integrated electronic components.

- Healthcare Applications: Driving innovation in diagnostics and monitoring.

- Cost-Effectiveness: Particularly for mass-produced, specialized electronic functions.

Challenges in the Printed Electronics Market Sector

Despite its promising growth, the printed electronics market faces several challenges. Achieving mass-scale production with consistent quality and reliability remains a hurdle, especially for highly complex circuits. The relatively lower conductivity and performance of printed materials compared to their silicon-based counterparts can limit their application in high-performance electronics. The availability and cost of specialized printable inks and substrates can also impact market adoption. Regulatory approvals, particularly for medical and safety-critical applications, can be a lengthy and complex process. Finally, established market players and existing infrastructure for conventional electronics present a significant competitive barrier, requiring substantial market education and demonstration of value proposition for wider adoption.

- Scalability & Reliability: Consistent high-volume manufacturing challenges.

- Performance Limitations: Lower conductivity and efficiency compared to traditional electronics.

- Material Costs & Availability: Specialized inks and substrates can be expensive.

- Regulatory Hurdles: Long approval processes for sensitive applications.

- Competitive Landscape: Strong presence of conventional electronics.

Emerging Opportunities in Printed Electronics Market

Emerging opportunities in the printed electronics market are abundant, driven by continuous innovation and expanding application horizons. The burgeoning Internet of Things (IoT) ecosystem presents a vast landscape for printed sensors and smart tags for connected devices and infrastructure. The healthcare sector continues to be a significant opportunity, with the development of low-cost, disposable biosensors for point-of-care diagnostics and continuous health monitoring wearables. Smart packaging offers another lucrative avenue, with printed RFID and NFC tags enabling enhanced traceability, authentication, and interactive consumer experiences. The automotive industry is increasingly exploring printed electronics for integrated sensors, flexible displays, and illuminated surfaces. Furthermore, advancements in recyclable and biodegradable printable materials open doors for sustainable electronic solutions, aligning with growing environmental concerns.

- IoT Integration: Enabling ubiquitous sensing and connectivity.

- Advancements in Healthcare Diagnostics: Disposable sensors for rapid testing.

- Smart Packaging Solutions: Enhancing supply chain and consumer engagement.

- Automotive Applications: Integrated sensors and flexible displays.

- Sustainable Electronics: Development of eco-friendly materials.

Leading Players in the Printed Electronics Market Market

- Bebop Sensors Inc

- Sensing Tex SL

- Jabil Inc

- Coatema Coating Machinery GmbH

- DuPont de Nemours Inc

- Agfa-Gevaert NV

- E Ink Holdings Inc

- Carre Technologies Inc

- Flex Ltd

- GSI Technologies

Key Developments in Printed Electronics Market Industry

- July 2022: Heraeus Nexensos, a temperature sensor expert, and Accensors, a film sensor expert, announced a partnership to jointly develop solutions supporting the miniaturization trend and integrate precise temperature sensor elements into integrable film sensor elements and application-specific film sensors for various applications, including medical, diagnostics, and wearables, among others.

- January 2022: Scientists at Queen's University, Belfast, announced that they had invented a tiny indicator that changes color if a patient's wound shows early signs of infection. This non-invasive indicator does not make any contact with the wound but detects the beginnings of infection by sniffing the air above it.

Strategic Outlook for Printed Electronics Market Market

The strategic outlook for the printed electronics market is exceptionally positive, driven by ongoing technological advancements and a burgeoning demand for flexible, cost-effective, and integrated electronic solutions. The expanding applications in IoT, healthcare, and smart packaging are key growth catalysts. Future market potential lies in the continued development of high-performance printable materials and the refinement of printing techniques to enable mass production of complex devices. Strategic collaborations between material suppliers, printing equipment manufacturers, and end-product developers will be crucial for unlocking new market opportunities and accelerating product commercialization. The focus on sustainability and the development of biodegradable printed electronics also presents a significant long-term growth avenue. As the market matures, expect to see further consolidation and innovation driving this transformative technology forward.

Printed Electronics Market Segmentation

-

1. Type

-

1.1. Printed Sensors

- 1.1.1. Gas Sensors

- 1.1.2. Temperature Sensors

- 1.1.3. Biosensors

- 1.1.4. Other Printed Sensors

- 1.2. Stretchable Electronics

- 1.3. Printed RFID

-

1.1. Printed Sensors

Printed Electronics Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Printed Electronics Market Regional Market Share

Geographic Coverage of Printed Electronics Market

Printed Electronics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Low Cost of Manufacturing; Increasing Geriatric Population; Evolvement of Digital Print Technology

- 3.3. Market Restrains

- 3.3.1. Heavy Regulations in Medical Industry; Lack of Standardization across Different Geographies

- 3.4. Market Trends

- 3.4.1. Increasing Geriatric Population to Drive the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Printed Electronics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Printed Sensors

- 5.1.1.1. Gas Sensors

- 5.1.1.2. Temperature Sensors

- 5.1.1.3. Biosensors

- 5.1.1.4. Other Printed Sensors

- 5.1.2. Stretchable Electronics

- 5.1.3. Printed RFID

- 5.1.1. Printed Sensors

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Printed Electronics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Printed Sensors

- 6.1.1.1. Gas Sensors

- 6.1.1.2. Temperature Sensors

- 6.1.1.3. Biosensors

- 6.1.1.4. Other Printed Sensors

- 6.1.2. Stretchable Electronics

- 6.1.3. Printed RFID

- 6.1.1. Printed Sensors

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Printed Electronics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Printed Sensors

- 7.1.1.1. Gas Sensors

- 7.1.1.2. Temperature Sensors

- 7.1.1.3. Biosensors

- 7.1.1.4. Other Printed Sensors

- 7.1.2. Stretchable Electronics

- 7.1.3. Printed RFID

- 7.1.1. Printed Sensors

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Printed Electronics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Printed Sensors

- 8.1.1.1. Gas Sensors

- 8.1.1.2. Temperature Sensors

- 8.1.1.3. Biosensors

- 8.1.1.4. Other Printed Sensors

- 8.1.2. Stretchable Electronics

- 8.1.3. Printed RFID

- 8.1.1. Printed Sensors

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Printed Electronics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Printed Sensors

- 9.1.1.1. Gas Sensors

- 9.1.1.2. Temperature Sensors

- 9.1.1.3. Biosensors

- 9.1.1.4. Other Printed Sensors

- 9.1.2. Stretchable Electronics

- 9.1.3. Printed RFID

- 9.1.1. Printed Sensors

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Bebop Sensors Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Sensing Tex SL

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Jabil Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Coatema Coating Machinery GmbH

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 DuPont de Nemours Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Agfa-Gevaert NV

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 E Ink Holdings Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Carre Technologies Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Flex Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 GSI Technologies

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Bebop Sensors Inc

List of Figures

- Figure 1: Global Printed Electronics Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Printed Electronics Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Printed Electronics Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Printed Electronics Market Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Printed Electronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Printed Electronics Market Revenue (undefined), by Type 2025 & 2033

- Figure 7: Europe Printed Electronics Market Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe Printed Electronics Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: Europe Printed Electronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Printed Electronics Market Revenue (undefined), by Type 2025 & 2033

- Figure 11: Asia Pacific Printed Electronics Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific Printed Electronics Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific Printed Electronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Printed Electronics Market Revenue (undefined), by Type 2025 & 2033

- Figure 15: Rest of the World Printed Electronics Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Rest of the World Printed Electronics Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Rest of the World Printed Electronics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Printed Electronics Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Printed Electronics Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Printed Electronics Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 4: Global Printed Electronics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: Global Printed Electronics Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Printed Electronics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Printed Electronics Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 8: Global Printed Electronics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Printed Electronics Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Global Printed Electronics Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Printed Electronics Market?

The projected CAGR is approximately 19.19%.

2. Which companies are prominent players in the Printed Electronics Market?

Key companies in the market include Bebop Sensors Inc, Sensing Tex SL, Jabil Inc, Coatema Coating Machinery GmbH, DuPont de Nemours Inc, Agfa-Gevaert NV, E Ink Holdings Inc, Carre Technologies Inc, Flex Ltd, GSI Technologies.

3. What are the main segments of the Printed Electronics Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Low Cost of Manufacturing; Increasing Geriatric Population; Evolvement of Digital Print Technology.

6. What are the notable trends driving market growth?

Increasing Geriatric Population to Drive the Growth.

7. Are there any restraints impacting market growth?

Heavy Regulations in Medical Industry; Lack of Standardization across Different Geographies.

8. Can you provide examples of recent developments in the market?

July 2022: Heraeus Nexensos, a temperature sensor expert and film sensor expert accensors, announced a partnership to jointly develop solutions supporting the miniaturization trend and integrate precise temperature sensor elements into integrable film sensor elements and application-specific film sensors for various applications, including medical, diagnostics, and wearables, among others.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Printed Electronics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Printed Electronics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Printed Electronics Market?

To stay informed about further developments, trends, and reports in the Printed Electronics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence