Key Insights

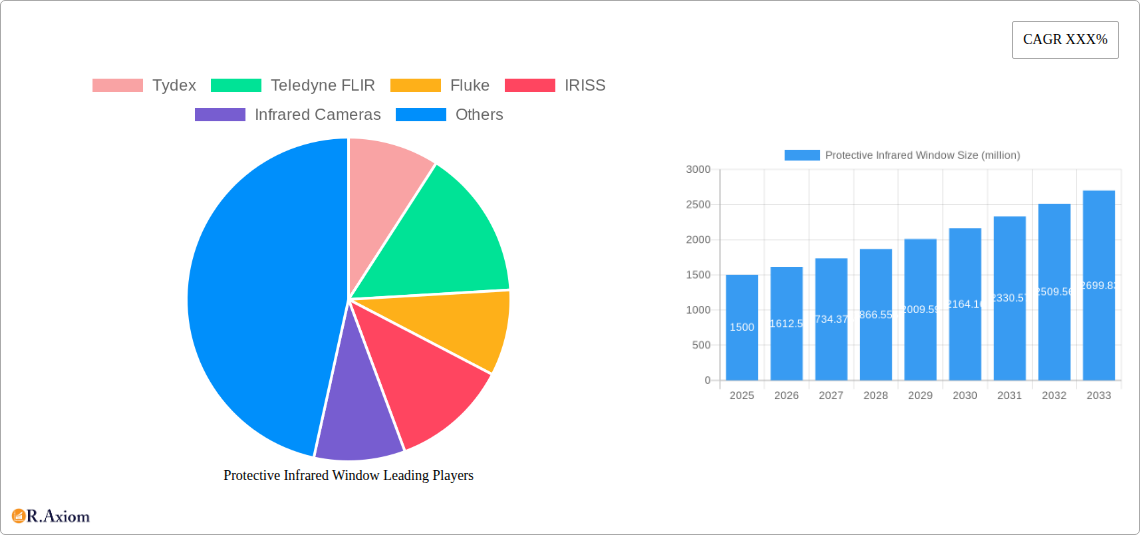

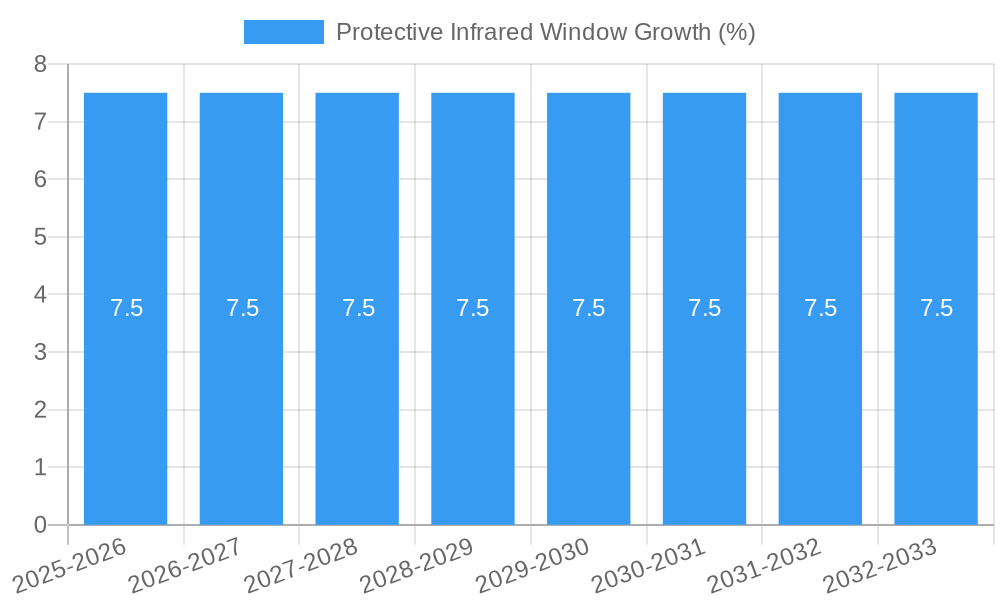

The global Protective Infrared Window market is poised for significant expansion, estimated to reach approximately $1,500 million by 2025 and projected to grow at a Compound Annual Growth Rate (CAGR) of around 7.5% over the forecast period of 2025-2033. This robust growth is primarily fueled by the escalating demand for enhanced safety and predictive maintenance solutions across various industrial sectors, including power generation and distribution, manufacturing, and oil and gas. The increasing adoption of thermal imaging technology for early detection of electrical faults and equipment failures is a key driver. Protective infrared windows play a crucial role in enabling safe and efficient infrared inspections of energized equipment, thereby preventing costly downtime and potential hazards. Furthermore, stringent safety regulations and a growing awareness of the benefits of proactive asset management are contributing to market acceleration. The market is characterized by continuous innovation in material science and window design, leading to improved durability, clarity, and specialized functionalities.

The market segmentation reveals that the "Application" segment is dominated by electrical inspections, followed by mechanical inspections and process monitoring. In terms of "Type," coated infrared windows are gaining traction due to their superior performance characteristics, such as anti-reflective properties and resistance to harsh environmental conditions. Leading players like Teledyne FLIR, Fluke, and Schneider Electric are investing heavily in research and development and expanding their product portfolios to cater to the evolving needs of end-users. However, the market faces certain restraints, including the initial high cost of advanced infrared window technologies and the availability of alternative inspection methods, albeit less safe or efficient. Despite these challenges, the long-term outlook for the Protective Infrared Window market remains highly positive, driven by the indispensable need for reliable and safe industrial monitoring and maintenance practices.

Protective Infrared Window Market Concentration & Innovation

The global Protective Infrared Window market is characterized by moderate concentration, with key players like Teledyne FLIR, Fluke, IRISS, and Schneider Electric holding significant market share. However, a growing number of innovative smaller firms, including Tydex and Exiscan, are contributing to a dynamic competitive landscape. Innovation is primarily driven by the increasing demand for enhanced electrical safety, predictive maintenance, and the need for non-intrusive thermal imaging solutions across various industries. Regulatory frameworks, particularly those focusing on occupational safety and hazard reduction, are indirectly fostering innovation by mandating stricter safety protocols, thereby increasing the adoption of advanced protective solutions. While product substitutes, such as traditional inspection methods, exist, the superior safety and efficiency offered by infrared windows are diminishing their relevance. End-user trends lean towards integrated solutions and smart technologies that enable real-time monitoring and data analysis. Mergers and acquisitions (M&A) activity, while not currently at a peak, is expected to rise as larger companies seek to consolidate their market position and acquire specialized technologies. Estimated M&A deal values are projected to reach several hundred million dollars in the coming years as strategic partnerships and acquisitions become more prevalent. The market is witnessing continuous product development and a drive towards miniaturization and enhanced durability.

Protective Infrared Window Industry Trends & Insights

The Protective Infrared Window market is poised for robust growth, exhibiting a projected Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025–2033. This significant expansion is propelled by an escalating emphasis on industrial safety and the proactive adoption of predictive maintenance strategies across a multitude of sectors. The imperative to minimize unplanned downtime, prevent catastrophic equipment failures, and safeguard personnel from electrical hazards directly translates into a heightened demand for reliable and non-invasive thermal imaging inspection tools, with infrared windows at the forefront. Technological advancements are playing a pivotal role, with ongoing innovations focusing on improving material science for enhanced durability and thermal transmission, alongside the development of windows compatible with a broader spectrum of infrared cameras and diagnostic equipment. The integration of smart technologies, such as embedded sensors and wireless connectivity, is further enhancing the value proposition by enabling real-time data acquisition and remote monitoring capabilities. Consumer preferences are shifting towards solutions that offer superior image quality, ease of installation, and long-term reliability, thereby minimizing the need for frequent replacements. This evolution in user expectations is compelling manufacturers to invest heavily in research and development to deliver cutting-edge products. The competitive dynamics within the market are characterized by both established industry giants and agile, innovation-driven startups. Companies are increasingly focusing on offering comprehensive solutions rather than just individual products, encompassing installation services, training, and after-sales support. Market penetration is steadily increasing across developed economies, driven by stringent safety regulations and a mature industrial base, while emerging economies present significant untapped potential due to rapid industrialization and a growing awareness of safety best practices. The adoption of infrared windows is no longer a niche requirement but is becoming an integral part of standard electrical maintenance procedures globally. The trend towards digitalization and the Industrial Internet of Things (IIoT) further fuels the demand for connected devices, including advanced infrared windows that can seamlessly integrate into larger monitoring systems, providing invaluable data for operational efficiency and risk management.

Dominant Markets & Segments in Protective Infrared Window

The Application segment of Electrical Panel Inspections is currently the dominant force within the Protective Infrared Window market, projected to account for over 50% of the total market value by 2025. This dominance is underpinned by the critical need for routine and proactive thermal inspections of electrical switchgear, motor control centers, and distribution panels across virtually all industrial and commercial facilities. The inherent risk of arcing faults and equipment malfunctions within these critical infrastructure components makes non-invasive inspection methods, facilitated by protective infrared windows, an indispensable safety measure.

Key Drivers for Dominance in Electrical Panel Inspections:

- Enhanced Safety Standards: Stringent occupational safety regulations worldwide mandate regular inspections to prevent electrical hazards, directly boosting the demand for infrared windows as a safe inspection solution.

- Predictive Maintenance Adoption: Industries are increasingly embracing predictive maintenance to minimize downtime and operational costs. Infrared windows enable early detection of developing faults, preventing costly failures.

- Cost-Effectiveness: While an initial investment, the ability to conduct inspections without de-energizing equipment significantly reduces downtime costs and associated risks, proving highly cost-effective in the long run.

- Technological Advancements: Innovations in infrared camera technology and the development of more durable and versatile infrared windows have made inspections more efficient and reliable.

The Type segment of Fixed Infrared Windows holds the largest market share, estimated to be around 65% by 2025. These windows are permanently installed on electrical enclosures, providing continuous access for thermal imaging without the need for opening the panel doors.

Key Drivers for Dominance in Fixed Infrared Windows:

- Uninterrupted Access: Fixed windows offer continuous and immediate access for thermographers, eliminating the need for scheduling or temporary safety measures.

- Ease of Installation: Their design allows for straightforward integration into existing or new electrical panel installations.

- Durability and Reliability: Manufactured with robust materials like various crystalline optics and specialized frames, they are designed to withstand harsh industrial environments.

- Regulatory Compliance: Fixed windows are often specified in safety standards for electrical enclosures, making them a preferred choice for compliance.

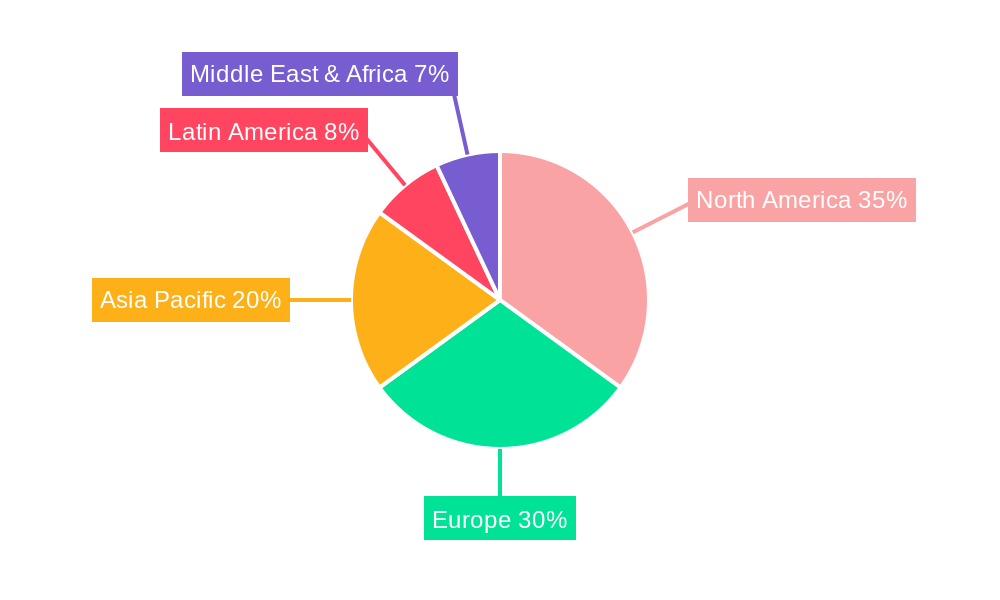

Geographically, North America is expected to maintain its leading position, driven by a mature industrial base, a strong emphasis on safety regulations, and high adoption rates of advanced technologies. The United States, in particular, represents a significant market due to its extensive infrastructure and proactive approach to industrial safety. Europe follows closely, with countries like Germany and the UK exhibiting strong demand owing to their established manufacturing sectors and commitment to worker safety. Asia Pacific, however, is projected to be the fastest-growing region, fueled by rapid industrialization, increasing investments in infrastructure, and a rising awareness of electrical safety practices in developing economies. Countries like China, India, and Southeast Asian nations are key contributors to this growth trajectory.

Protective Infrared Window Product Developments

Recent product developments in the Protective Infrared Window market are focused on enhancing durability, optical clarity, and ease of installation. Manufacturers are introducing windows with improved scratch resistance and wider temperature tolerance, suitable for more extreme industrial environments. Innovations include the use of advanced crystalline materials for superior infrared transmission across a broader spectrum, leading to clearer and more accurate thermal images. The integration of features like quick-release mechanisms and built-in safety latches is streamlining the inspection process and further bolstering safety. Competitive advantages are being derived from these advancements, offering end-users more reliable, user-friendly, and cost-effective solutions for proactive maintenance and safety compliance.

Report Scope & Segmentation Analysis

This report encompasses a comprehensive analysis of the global Protective Infrared Window market, segmented by Application and Type.

The Application segments include Electrical Panel Inspections, Motor Control Center Inspections, Transformer Inspections, and Other Applications. The Electrical Panel Inspections segment is projected to experience the highest growth rate, driven by safety mandates and predictive maintenance initiatives. Market sizes for each application are detailed with growth projections based on regional industrial development and safety standards.

The Type segments include Fixed Infrared Windows, Detachable Infrared Windows, and Hinged Infrared Windows. Fixed Infrared Windows are expected to maintain their market leadership due to their ease of use and continuous access capabilities. Growth projections for each type are analyzed based on evolving technological preferences and specific application requirements.

Key Drivers of Protective Infrared Window Growth

The Protective Infrared Window market is propelled by several key drivers. Technological advancements in infrared camera technology and material science are enabling the development of more efficient, durable, and cost-effective windows. Increasing emphasis on industrial safety and regulatory compliance globally mandates non-intrusive inspection methods to prevent electrical hazards and ensure worker safety, directly boosting adoption. The widespread adoption of predictive maintenance strategies across industries to minimize downtime and operational costs further fuels demand, as infrared windows are crucial for early fault detection. Additionally, the growing awareness of the economic benefits of preventing equipment failures and avoiding costly unplanned outages makes infrared windows a financially prudent investment.

Challenges in the Protective Infrared Window Sector

Despite robust growth, the Protective Infrared Window sector faces several challenges. High initial investment costs for advanced windows can be a barrier for smaller enterprises. Limited awareness and understanding of the benefits of infrared windows among some segments of the industry can hinder adoption. Stringent material sourcing and manufacturing standards can lead to supply chain complexities and potential delays. Furthermore, competition from traditional inspection methods, although diminishing, still presents a challenge in certain cost-sensitive markets. The need for specialized training to effectively utilize infrared imaging can also be a deterrent for some end-users.

Emerging Opportunities in Protective Infrared Window

Emerging opportunities within the Protective Infrared Window market are abundant. The rapid industrialization in emerging economies, particularly in Asia Pacific and Latin America, presents a significant untapped market. The integration of IoT capabilities into infrared windows, enabling real-time data analytics and remote monitoring, is a key technological opportunity. The development of specialized windows for niche applications, such as renewable energy infrastructure (wind turbines, solar farms) and data centers, offers new avenues for growth. Furthermore, strategic partnerships and collaborations between infrared window manufacturers and thermal camera providers can lead to bundled solutions and expanded market reach.

Leading Players in the Protective Infrared Window Market

- Tydex

- Teledyne FLIR

- Fluke

- IRISS

- Infrared Cameras

- Grace Technologies

- Cordex Instruments

- Schneider Electric

- Exiscan

Key Developments in Protective Infrared Window Industry

- 2023: Teledyne FLIR launched a new series of advanced infrared windows with enhanced durability and broader spectral transmission capabilities, catering to extreme environmental conditions.

- 2022: IRISS introduced a new quick-release mechanism for its infrared windows, significantly reducing inspection time and enhancing safety protocols for electrical inspections.

- 2021: Grace Technologies expanded its product line with the introduction of more compact and versatile infrared window models designed for smaller electrical enclosures.

- 2020: Schneider Electric showcased integrated smart infrared window solutions designed to seamlessly connect with their electrical distribution systems for real-time monitoring.

- 2019: Exiscan focused on developing specialized infrared windows for high-voltage applications, aiming to address specific safety concerns in power transmission and distribution.

Strategic Outlook for Protective Infrared Window Market

The strategic outlook for the Protective Infrared Window market is highly optimistic, characterized by sustained growth and innovation. The continued emphasis on industrial safety, coupled with the escalating adoption of predictive maintenance, will remain the primary growth catalysts. Strategic focus will be on developing more intelligent, connected, and robust infrared window solutions that offer enhanced data analytics and seamless integration into broader industrial IoT ecosystems. Expansion into emerging markets and the development of customized solutions for niche applications will be crucial for capturing new market share. Furthermore, strategic alliances and acquisitions are expected to play a significant role in consolidating market leadership and accelerating technological advancements, ensuring the market remains dynamic and responsive to evolving industry needs.

Protective Infrared Window Segmentation

-

1. Application

- 1.1. undefined

-

2. Type

- 2.1. undefined

Protective Infrared Window Segmentation By Geography

- 1. undefined

- 2. undefined

- 3. undefined

- 4. undefined

- 5. undefined

Protective Infrared Window REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Protective Infrared Window Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1.

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1.

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1.

- 5.3.2.

- 5.3.3.

- 5.3.4.

- 5.3.5.

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. undefined Protective Infrared Window Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1.

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1.

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. undefined Protective Infrared Window Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1.

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1.

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. undefined Protective Infrared Window Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1.

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1.

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. undefined Protective Infrared Window Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1.

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1.

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. undefined Protective Infrared Window Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1.

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1.

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Tydex

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Teledyne FLIR

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fluke

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IRISS

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Infrared Cameras

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Grace Technologies

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cordex Instruments

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Schneider Electric

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Exiscan

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Tydex

List of Figures

- Figure 1: Global Protective Infrared Window Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: undefined Protective Infrared Window Revenue (million), by Application 2024 & 2032

- Figure 3: undefined Protective Infrared Window Revenue Share (%), by Application 2024 & 2032

- Figure 4: undefined Protective Infrared Window Revenue (million), by Type 2024 & 2032

- Figure 5: undefined Protective Infrared Window Revenue Share (%), by Type 2024 & 2032

- Figure 6: undefined Protective Infrared Window Revenue (million), by Country 2024 & 2032

- Figure 7: undefined Protective Infrared Window Revenue Share (%), by Country 2024 & 2032

- Figure 8: undefined Protective Infrared Window Revenue (million), by Application 2024 & 2032

- Figure 9: undefined Protective Infrared Window Revenue Share (%), by Application 2024 & 2032

- Figure 10: undefined Protective Infrared Window Revenue (million), by Type 2024 & 2032

- Figure 11: undefined Protective Infrared Window Revenue Share (%), by Type 2024 & 2032

- Figure 12: undefined Protective Infrared Window Revenue (million), by Country 2024 & 2032

- Figure 13: undefined Protective Infrared Window Revenue Share (%), by Country 2024 & 2032

- Figure 14: undefined Protective Infrared Window Revenue (million), by Application 2024 & 2032

- Figure 15: undefined Protective Infrared Window Revenue Share (%), by Application 2024 & 2032

- Figure 16: undefined Protective Infrared Window Revenue (million), by Type 2024 & 2032

- Figure 17: undefined Protective Infrared Window Revenue Share (%), by Type 2024 & 2032

- Figure 18: undefined Protective Infrared Window Revenue (million), by Country 2024 & 2032

- Figure 19: undefined Protective Infrared Window Revenue Share (%), by Country 2024 & 2032

- Figure 20: undefined Protective Infrared Window Revenue (million), by Application 2024 & 2032

- Figure 21: undefined Protective Infrared Window Revenue Share (%), by Application 2024 & 2032

- Figure 22: undefined Protective Infrared Window Revenue (million), by Type 2024 & 2032

- Figure 23: undefined Protective Infrared Window Revenue Share (%), by Type 2024 & 2032

- Figure 24: undefined Protective Infrared Window Revenue (million), by Country 2024 & 2032

- Figure 25: undefined Protective Infrared Window Revenue Share (%), by Country 2024 & 2032

- Figure 26: undefined Protective Infrared Window Revenue (million), by Application 2024 & 2032

- Figure 27: undefined Protective Infrared Window Revenue Share (%), by Application 2024 & 2032

- Figure 28: undefined Protective Infrared Window Revenue (million), by Type 2024 & 2032

- Figure 29: undefined Protective Infrared Window Revenue Share (%), by Type 2024 & 2032

- Figure 30: undefined Protective Infrared Window Revenue (million), by Country 2024 & 2032

- Figure 31: undefined Protective Infrared Window Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Protective Infrared Window Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Protective Infrared Window Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Protective Infrared Window Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Protective Infrared Window Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Protective Infrared Window Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Protective Infrared Window Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Protective Infrared Window Revenue million Forecast, by Country 2019 & 2032

- Table 8: Global Protective Infrared Window Revenue million Forecast, by Application 2019 & 2032

- Table 9: Global Protective Infrared Window Revenue million Forecast, by Type 2019 & 2032

- Table 10: Global Protective Infrared Window Revenue million Forecast, by Country 2019 & 2032

- Table 11: Global Protective Infrared Window Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Protective Infrared Window Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Protective Infrared Window Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Protective Infrared Window Revenue million Forecast, by Application 2019 & 2032

- Table 15: Global Protective Infrared Window Revenue million Forecast, by Type 2019 & 2032

- Table 16: Global Protective Infrared Window Revenue million Forecast, by Country 2019 & 2032

- Table 17: Global Protective Infrared Window Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Protective Infrared Window Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Protective Infrared Window Revenue million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Protective Infrared Window?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Protective Infrared Window?

Key companies in the market include Tydex, Teledyne FLIR, Fluke, IRISS, Infrared Cameras, Grace Technologies, Cordex Instruments, Schneider Electric, Exiscan.

3. What are the main segments of the Protective Infrared Window?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Protective Infrared Window," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Protective Infrared Window report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Protective Infrared Window?

To stay informed about further developments, trends, and reports in the Protective Infrared Window, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence