Key Insights

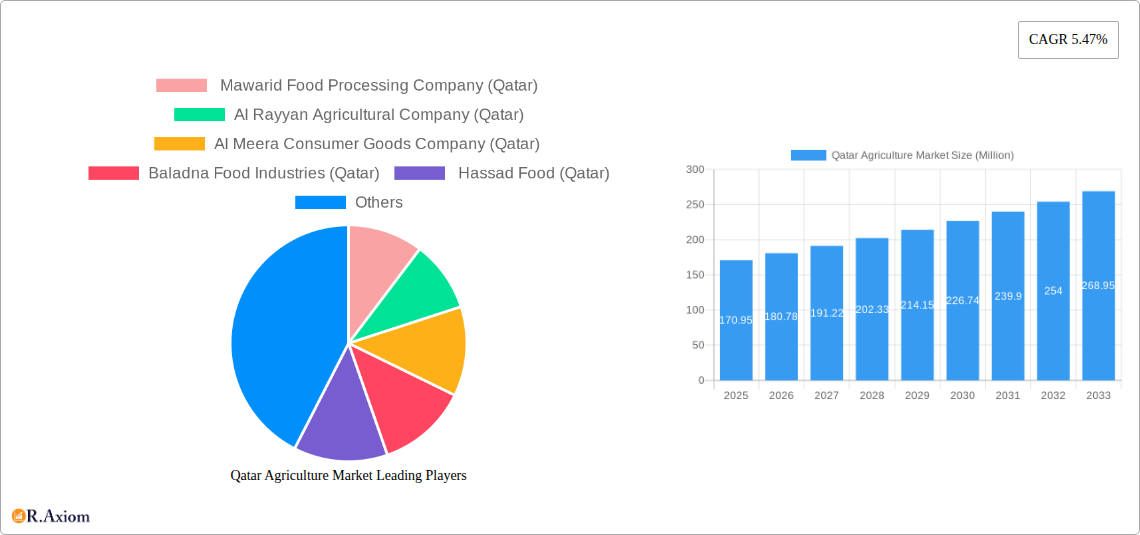

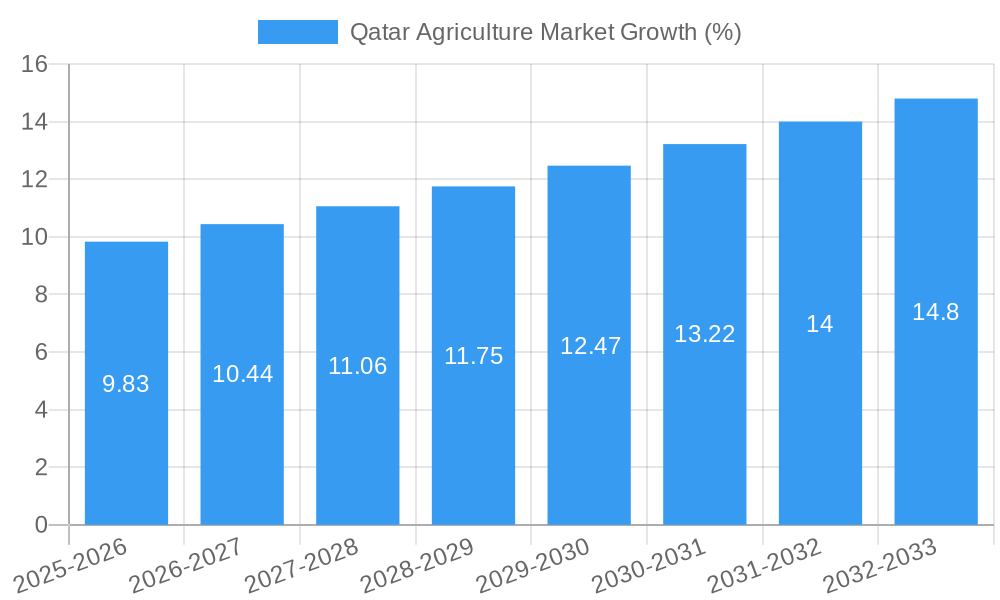

The Qatar agriculture market, valued at $170.95 million in 2025, is projected to experience robust growth, driven by increasing government initiatives promoting food security and diversification, coupled with rising consumer demand for fresh, locally-sourced produce. The Compound Annual Growth Rate (CAGR) of 5.47% from 2025 to 2033 indicates a significant expansion of the market. Key drivers include government investments in advanced agricultural technologies, such as hydroponics and vertical farming, aimed at enhancing productivity and mitigating the challenges posed by the country's arid climate. Furthermore, the growing tourism sector fuels demand for high-quality produce, contributing to market expansion. Segments like fresh produce (fruits, vegetables, herbs) and dairy & poultry are expected to dominate market share, reflecting consumer preference for these staple food items. The human consumption application segment will continue to be the largest, followed by animal feed, as the livestock and pet sectors also expand. Challenges may include reliance on imports for certain agricultural inputs and the high cost of production. Nevertheless, the strategic focus on agricultural development positions the Qatar market for continued growth and self-sufficiency.

Competition in the Qatari agricultural market is characterized by a mix of established local players and international companies. Companies like Mawarid Food Processing Company, Al Rayyan Agricultural Company, Al Meera Consumer Goods Company, Baladna Food Industries, and Hassad Food play a crucial role in shaping the market landscape. These companies are actively involved in various segments, including production, processing, and distribution of agricultural products. Expansion strategies often involve enhancing production capacity, improving supply chain efficiency, and diversifying product offerings to cater to evolving consumer preferences. The market will likely see increasing investments in technology and sustainable agricultural practices, leading to further improvements in quality, quantity, and efficiency. The expansion into the Middle East and Africa region offers additional growth opportunities for Qatari agricultural businesses, particularly in exporting high-value products.

This comprehensive report provides an in-depth analysis of the Qatar agriculture market, encompassing market size, growth drivers, challenges, opportunities, and competitive landscape from 2019 to 2033. The report is designed to provide actionable insights for industry stakeholders, investors, and policymakers. It leverages robust data analysis and incorporates key industry developments to paint a clear picture of this dynamic market. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period covers 2019-2024.

Qatar Agriculture Market: Market Concentration & Innovation

This section analyzes the concentration of the Qatari agricultural market, highlighting key drivers of innovation, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities. The market is characterized by a mix of large established players and smaller, specialized businesses.

Market Concentration: The market share held by the top five players (Mawarid Food Processing Company, Al Rayyan Agricultural Company, Al Meera Consumer Goods Company, Baladna Food Industries, and Hassad Food) accounts for approximately xx% of the total market value (2025 estimated). Precise figures are detailed within the full report.

Innovation Drivers: Government initiatives promoting sustainable agriculture, technological advancements in vertical farming and precision agriculture, and increasing consumer demand for locally sourced, high-quality products are major drivers of innovation.

Regulatory Framework: Qatar's regulatory framework influences market dynamics by focusing on food security, sustainable practices, and import regulations. These regulations are detailed within the report.

Product Substitutes: Importation of agricultural products acts as a significant substitute, influencing local production strategies and pricing. The report assesses the impact of these substitutions in detail.

End-User Trends: Growing consumer awareness of health and wellness is driving demand for organic and sustainably produced food, impacting production methods and product offerings.

M&A Activities: The report includes an analysis of past and potential M&A activity in the Qatari agriculture sector, including deal values (in Millions) and their impact on market structure. For example, the xx Million deal between [Company A] and [Company B] in [Year] significantly altered market share.

Qatar Agriculture Market: Industry Trends & Insights

This section explores the key trends shaping the Qatar agriculture market, including market growth drivers (CAGR), technological disruptions, evolving consumer preferences, and the competitive dynamics at play. The Qatari agricultural market is projected to experience significant growth, driven by factors such as increasing population, rising disposable incomes, and government support for food security initiatives. The CAGR for the forecast period (2025-2033) is estimated at xx%. Market penetration for locally produced goods is projected to reach xx% by 2033. Technological advancements in areas such as hydroponics, vertical farming, and precision agriculture are transforming production methods, improving efficiency, and enhancing product quality. The ongoing shift toward sustainable and organic farming practices is further influencing market dynamics.

Dominant Markets & Segments in Qatar Agriculture Market

This section identifies the leading segments within the Qatari agriculture market based on product type (Fresh Produce, Dairy & Poultry, Fish & Seafood) and application (Human Consumption, Animal Feed).

Product Segments: The Dairy & Poultry segment is currently the largest segment, driven by high demand for milk, eggs, and meat, while the Fresh Produce segment is anticipated to experience rapid growth with an increasing focus on local production and demand for organic products. The Fish & Seafood segment shows promising growth potential due to increased aquaculture investments.

Application Segments: The Human Consumption segment dominates the market due to the fundamental need for food. However, the Animal Feed segment is also experiencing growth, driven by the increasing demand for locally produced livestock and poultry.

Key Drivers: Several factors drive the dominance of specific segments:

- Economic Policies: Government subsidies and initiatives aimed at promoting food security directly impact segment growth.

- Infrastructure Development: Investments in irrigation systems, cold storage facilities, and transportation networks significantly influence market dynamics.

- Consumer Preferences: Changes in consumer preferences towards healthy, organic, and locally sourced products greatly influence segment performance.

Detailed analysis of the dominance of each segment, including market size (in Millions) and growth projections, is included in the full report.

Qatar Agriculture Market: Product Developments

The Qatari agricultural market is witnessing significant product innovation driven by technological advancements. Vertical farming technologies are gaining traction, enabling year-round production of leafy greens, strawberries, and edible flowers. Precision agriculture techniques, employing data analytics and automation, are improving efficiency and yields. Companies are also focusing on developing innovative products that meet the changing needs and preferences of consumers, emphasizing organic and sustainably produced options. These advancements have allowed companies to improve their product offerings, leading to enhanced market fit and competitive advantages.

Report Scope & Segmentation Analysis

This report comprehensively segments the Qatar agriculture market based on product type and application, offering a granular view of market size and dynamics for each segment. Projected growth rates for each segment and competitive landscapes are provided.

Product: Fresh Produce (Fruits, Vegetables, Herbs); Dairy & Poultry (Milk, Eggs, Meat); Fish & Seafood (Farmed fish, Wild-caught fish)

Application: Human Consumption (Fresh produce, Dairy products, Poultry products, Fish and seafood); Animal Feed (Feed for livestock, Feed for pets)

Each segment's detailed analysis, including market size (in Millions), growth projections, and competitive dynamics, is available in the complete report.

Key Drivers of Qatar Agriculture Market Growth

Several factors are driving growth in the Qatari agriculture market. Government initiatives focused on food security and self-sufficiency are promoting investments and technological advancements in agriculture. Rising disposable incomes among the population fuel increased demand for higher-quality and diverse food products. Furthermore, growing consumer awareness of the importance of healthy eating and sustainable farming practices is shaping market trends. The introduction of advanced technologies like vertical farming and precision agriculture further enhances efficiency and production yields.

Challenges in the Qatar Agriculture Market Sector

The Qatar agriculture market faces several challenges. The arid climate necessitates significant investments in irrigation and water management technologies. The high cost of labor and production inputs impacts profitability. Competition from imported agricultural products also poses a challenge to local producers. Furthermore, the market faces potential disruptions from climate change and its effects on yields and production. These challenges translate to a xx% reduction in overall market growth potential.

Emerging Opportunities in Qatar Agriculture Market

Significant opportunities exist within the Qatari agriculture market. Growing consumer demand for organic and sustainably produced food creates a niche for locally produced products. The adoption of advanced technologies in areas like hydroponics and vertical farming opens doors to increased efficiency and output. Furthermore, the government's commitment to food security provides a positive environment for investment and expansion in the agricultural sector.

Leading Players in the Qatar Agriculture Market Market

- Mawarid Food Processing Company (Qatar)

- Al Rayyan Agricultural Company (Qatar)

- Al Meera Consumer Goods Company (Qatar)

- Baladna Food Industries (Qatar)

- Hassad Food (Qatar)

Key Developments in Qatar Agriculture Market Industry

June 2021: iFarm's partnership with Sadarah Partners to establish a commercial-scale indoor farm signifies the growing adoption of advanced technologies in the Qatari agriculture sector, enhancing the supply of fresh produce.

August 2022: Carnegie Mellon University's research project on optimizing greenhouse operations using AI and machine learning showcases the increasing use of technology to improve efficiency and yields in the Qatari agricultural sector. This project, funded by the QNRF, highlights the government's commitment to technological advancements in agriculture.

Strategic Outlook for Qatar Agriculture Market Market

The Qatar agriculture market is poised for continued growth, driven by government initiatives, technological innovation, and evolving consumer preferences. The focus on food security, coupled with investments in advanced technologies and sustainable practices, will shape the future trajectory of the market. The increasing adoption of vertical farming and precision agriculture will significantly contribute to improving efficiency and productivity. This will, in turn, attract more private investment, potentially leading to higher market concentration and a more mature and competitive landscape.

Qatar Agriculture Market Segmentation

- 1. Food Crops/Cereals

- 2. Fruits

- 3. Vegetables

- 4. Food Crops/Cereals

- 5. Fruits

- 6. Vegetables

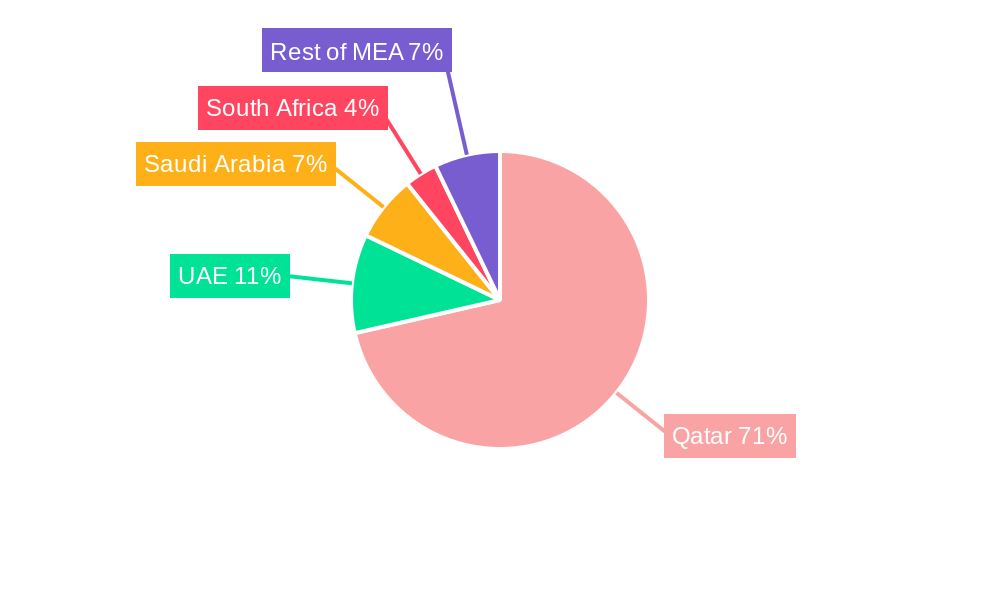

Qatar Agriculture Market Segmentation By Geography

- 1. Qatar

Qatar Agriculture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.47% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Indian Rice; Enhancing Production Capacities; Increasing Government Initiatives

- 3.3. Market Restrains

- 3.3.1. Abiotic and Biotic Stresses in Rice Cultivation; High Market Entry Costs

- 3.4. Market Trends

- 3.4.1. Increase in Adoption of High Technology Farming Practices

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatar Agriculture Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Food Crops/Cereals

- 5.2. Market Analysis, Insights and Forecast - by Fruits

- 5.3. Market Analysis, Insights and Forecast - by Vegetables

- 5.4. Market Analysis, Insights and Forecast - by Food Crops/Cereals

- 5.5. Market Analysis, Insights and Forecast - by Fruits

- 5.6. Market Analysis, Insights and Forecast - by Vegetables

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by Food Crops/Cereals

- 6. UAE Qatar Agriculture Market Analysis, Insights and Forecast, 2019-2031

- 7. South Africa Qatar Agriculture Market Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia Qatar Agriculture Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA Qatar Agriculture Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Mawarid Food Processing Company (Qatar)

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Al Rayyan Agricultural Company (Qatar)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Al Meera Consumer Goods Company (Qatar)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Baladna Food Industries (Qatar)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hassad Food (Qatar)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.1 Mawarid Food Processing Company (Qatar)

List of Figures

- Figure 1: Qatar Agriculture Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Qatar Agriculture Market Share (%) by Company 2024

List of Tables

- Table 1: Qatar Agriculture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Qatar Agriculture Market Revenue Million Forecast, by Food Crops/Cereals 2019 & 2032

- Table 3: Qatar Agriculture Market Revenue Million Forecast, by Fruits 2019 & 2032

- Table 4: Qatar Agriculture Market Revenue Million Forecast, by Vegetables 2019 & 2032

- Table 5: Qatar Agriculture Market Revenue Million Forecast, by Food Crops/Cereals 2019 & 2032

- Table 6: Qatar Agriculture Market Revenue Million Forecast, by Fruits 2019 & 2032

- Table 7: Qatar Agriculture Market Revenue Million Forecast, by Vegetables 2019 & 2032

- Table 8: Qatar Agriculture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 9: Qatar Agriculture Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: UAE Qatar Agriculture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South Africa Qatar Agriculture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Saudi Arabia Qatar Agriculture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of MEA Qatar Agriculture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Qatar Agriculture Market Revenue Million Forecast, by Food Crops/Cereals 2019 & 2032

- Table 15: Qatar Agriculture Market Revenue Million Forecast, by Fruits 2019 & 2032

- Table 16: Qatar Agriculture Market Revenue Million Forecast, by Vegetables 2019 & 2032

- Table 17: Qatar Agriculture Market Revenue Million Forecast, by Food Crops/Cereals 2019 & 2032

- Table 18: Qatar Agriculture Market Revenue Million Forecast, by Fruits 2019 & 2032

- Table 19: Qatar Agriculture Market Revenue Million Forecast, by Vegetables 2019 & 2032

- Table 20: Qatar Agriculture Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatar Agriculture Market?

The projected CAGR is approximately 5.47%.

2. Which companies are prominent players in the Qatar Agriculture Market?

Key companies in the market include Mawarid Food Processing Company (Qatar) , Al Rayyan Agricultural Company (Qatar), Al Meera Consumer Goods Company (Qatar) , Baladna Food Industries (Qatar), Hassad Food (Qatar).

3. What are the main segments of the Qatar Agriculture Market?

The market segments include Food Crops/Cereals, Fruits, Vegetables, Food Crops/Cereals, Fruits, Vegetables.

4. Can you provide details about the market size?

The market size is estimated to be USD 170.95 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Indian Rice; Enhancing Production Capacities; Increasing Government Initiatives.

6. What are the notable trends driving market growth?

Increase in Adoption of High Technology Farming Practices.

7. Are there any restraints impacting market growth?

Abiotic and Biotic Stresses in Rice Cultivation; High Market Entry Costs.

8. Can you provide examples of recent developments in the market?

August 2022: Carnegie Mellon University has launched a new research project in Qatar (CMU-Q), a Qatar Foundation (QF) partner university, to optimize the operations of greenhouses in Qatar. This project is funded by the Qatar National Research Fund through the National Priorities Research Program (QNRF) and will use machine learning (ML) to coordinate a fleet of mobile robots to collect visual data from Qatar greenhouse plants autonomously and use AI and machine learning to create predictive models of the crop's development status, quality, health, and expected yield.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatar Agriculture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatar Agriculture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatar Agriculture Market?

To stay informed about further developments, trends, and reports in the Qatar Agriculture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence