Key Insights

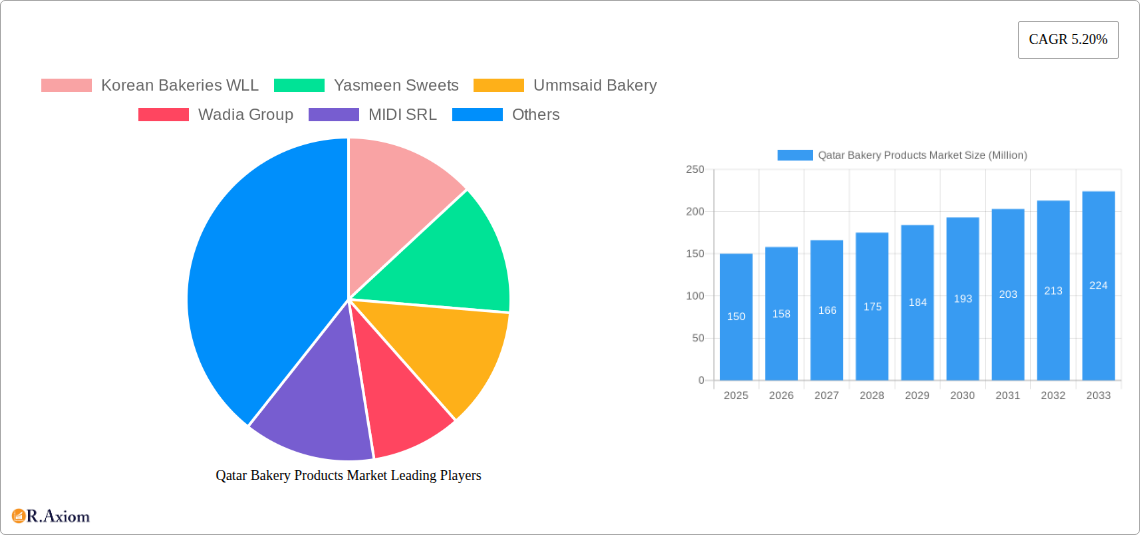

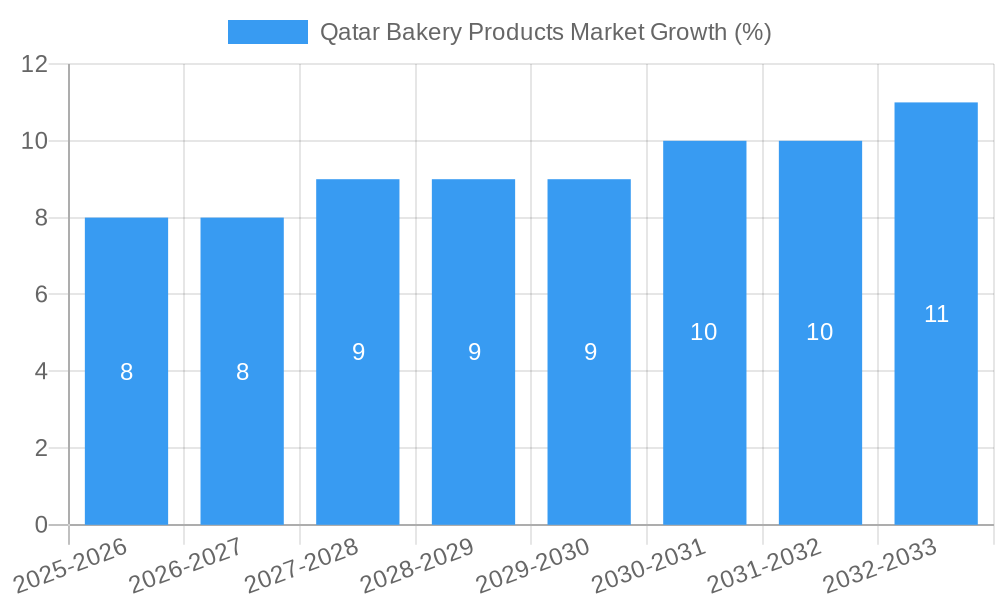

The Qatar bakery products market, valued at approximately $150 million in 2025, is projected to experience robust growth, driven by a rising population, increasing disposable incomes, and a growing preference for convenient and ready-to-eat food options. The market's Compound Annual Growth Rate (CAGR) of 5.20% from 2025 to 2033 indicates a steady expansion, with the market size expected to reach approximately $250 million by 2033. Key drivers include the influx of expatriates, a thriving tourism sector contributing to higher demand, and the increasing popularity of Western-style baked goods alongside traditional Arabic bread and pastries. Furthermore, the growth of organized retail and the expansion of quick-service restaurants (QSRs) are fueling demand for bakery products within these channels. However, factors like fluctuating raw material prices and intense competition among established players and new entrants pose challenges to market growth. Segmentation within the market includes various product types (bread, cakes, pastries, etc.), distribution channels (supermarkets, hypermarkets, specialty stores, online retailers), and price points. Leading players like Korean Bakeries WLL, Yasmeen Sweets, Ummsaid Bakery, and others are actively focusing on product innovation, expansion strategies, and brand building to maintain a competitive edge in this dynamic market.

The competitive landscape is characterized by a mix of established local players and international brands. Local bakeries often enjoy a strong customer base due to familiarity and cultural relevance, while international brands leverage their established brand recognition and global expertise to attract consumers. Future market trends suggest increased demand for healthier and functional bakery products, with a growing focus on ingredients like whole grains, organic flour, and reduced sugar options. Innovation in product offerings, such as customized cakes and personalized baked goods, will also play a critical role in shaping market dynamics. Furthermore, the utilization of advanced technologies in bakery production and distribution to enhance efficiency and reduce costs is expected to become increasingly prevalent. The market's positive growth trajectory is expected to continue, fueled by the nation's economic growth and evolving consumer preferences.

Qatar Bakery Products Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Qatar bakery products market, offering actionable insights for industry stakeholders. The study covers the period 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The report uses Million (M) for all monetary values.

Qatar Bakery Products Market Market Concentration & Innovation

This section analyzes the competitive landscape of the Qatari bakery products market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and merger and acquisition (M&A) activities. The market is moderately concentrated, with a few dominant players alongside numerous smaller bakeries and retailers. Major players such as Wadia Group and Safari Bakery command significant market share (estimated at xx% and xx% respectively in 2025), but the market is fragmented with many smaller local bakeries also present. Innovation is driven by consumer demand for healthier options, premium ingredients, and diverse product offerings. The regulatory framework, while generally supportive of the food industry, includes stringent food safety regulations. Key substitutes include imported confectionery and snacks. End-user trends are shaping innovation towards personalization, convenience, and healthier choices. M&A activity remains moderate, with deal values averaging xx M in recent years, with several smaller acquisitions observed. Key aspects further explored include:

- Market Share Analysis: Detailed breakdown of market share held by key players (including Korean Bakeries WLL, Yasmeen Sweets, Ummsaid Bakery, Wadia Group, MIDI SRL, Valeo Foods Group, IFFCO, Behzad Group, and Safari Bakery). Specific figures are presented within the full report.

- Innovation Drivers: Analysis of factors driving innovation, including consumer preferences, technological advancements, and competition.

- Regulatory Landscape: An overview of relevant regulations impacting the bakery industry in Qatar.

- M&A Activity: A detailed examination of past and potential future merger and acquisition activities.

Qatar Bakery Products Market Industry Trends & Insights

This section delves into the key industry trends and insights shaping the Qatari bakery products market. The market is experiencing robust growth fueled by factors including a growing population, rising disposable incomes, changing lifestyles, and increasing tourism. The CAGR for the forecast period (2025-2033) is estimated at xx%. Market penetration of bakery products is high, with almost universal consumption. Technological disruptions are evident in the automation of baking processes and the use of technology for supply chain management and marketing. Consumer preferences are shifting towards healthier, artisanal, and more innovative products. Competitive dynamics remain intense, with existing players investing in expansion and new product launches, while new entrants aim to carve out market share. Detailed analysis includes:

- Market Growth Drivers: Detailed examination of the factors driving market expansion.

- Technological Disruptions: Discussion of the role of automation and technology in the industry.

- Consumer Preferences: Exploration of shifts in consumer demand for bakery products.

- Competitive Dynamics: Assessment of the competitive intensity and strategies employed by market players.

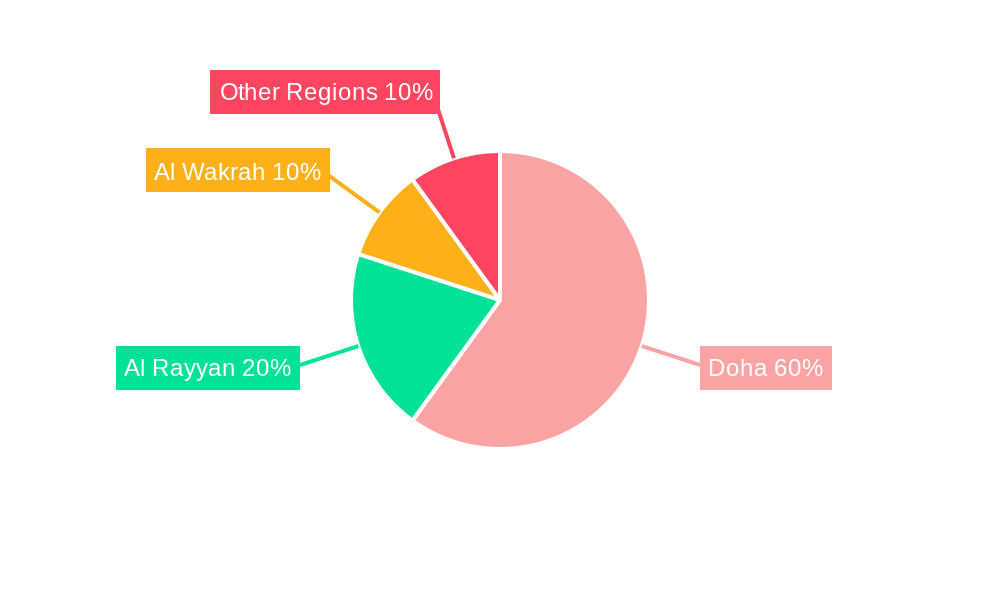

Dominant Markets & Segments in Qatar Bakery Products Market

This section identifies the leading segments within the Qatar bakery products market. The Doha metropolitan area represents the largest segment, driven by high population density and robust consumer spending. The overall market is segmented by product type (bread, cakes, pastries, cookies, etc.), distribution channel (supermarkets, hypermarkets, bakeries, online retailers), and price range (premium, mid-range, budget). Key drivers for the dominance of Doha include:

- High Population Density: Concentrated population within Doha fuels high demand.

- Strong Consumer Spending: Doha's higher-income households drive premium product sales.

- Robust Retail Infrastructure: Well-established supermarket and hypermarket chains enhance distribution.

- Tourism: Tourist influx contributes to increased demand for bakery products.

The detailed analysis of each segment including market size, growth projections and competitive dynamics, are extensively detailed within the report.

Qatar Bakery Products Market Product Developments

Recent product innovations focus on healthier options (e.g., whole-wheat breads, reduced-sugar pastries) and enhanced convenience (e.g., ready-to-eat meals incorporating bakery items). Technological trends include the adoption of automated baking equipment and improved packaging to extend shelf life. These developments cater to rising consumer demands for health, convenience, and premium quality.

Report Scope & Segmentation Analysis

This report segments the Qatar bakery products market based on product type (bread, cakes, pastries, cookies, biscuits etc.), distribution channel (supermarkets/hypermarkets, specialty stores, online channels), and consumer demographics (age, income, etc). Growth projections for each segment are provided, reflecting differences in growth rates and market size. Competitive dynamics within each segment, including the presence of major players, are assessed.

Key Drivers of Qatar Bakery Products Market Growth

Several factors are driving growth in the Qatar bakery products market. The rising population and increasing disposable incomes contribute to higher demand. Government initiatives to promote the food industry and improving infrastructure also play a key role. The increasing popularity of cafes and restaurants also boosts consumption.

Challenges in the Qatar Bakery Products Market Sector

Challenges include increasing input costs for raw materials, supply chain disruptions, and competition from international brands. Stringent food safety regulations can also pose challenges for smaller operators.

Emerging Opportunities in Qatar Bakery Products Market

Opportunities exist in the growing demand for healthier, organic, and artisanal bakery products. The rise of online food delivery platforms presents opportunities for expansion into e-commerce. Catering to the preferences of the large expatriate population also provides a growth opportunity.

Leading Players in the Qatar Bakery Products Market Market

- Korean Bakeries WLL

- Yasmeen Sweets

- Ummsaid Bakery

- Wadia Group

- MIDI SRL

- Valeo Foods Group

- IFFCO

- Behzad Group

- Safari Bakery

Key Developments in Qatar Bakery Products Market Industry

- December 2022: Safari launched its "Bake and Cake" campaign, boosting festive season sales.

- January 2023: Mondelēz International opened an OREO Café at Hamad International Airport, introducing a novel concept to the market.

Strategic Outlook for Qatar Bakery Products Market Market

The Qatar bakery products market is poised for continued growth driven by sustained economic development, population growth, and evolving consumer preferences. Opportunities exist for players to capitalize on the increasing demand for premium, healthy, and convenient bakery products through innovative product development, strategic partnerships, and effective marketing strategies.

Qatar Bakery Products Market Segmentation

-

1. Type

- 1.1. Cakes and Pastries

- 1.2. Biscuits and Cookies

- 1.3. Bread

- 1.4. Morning Goods

- 1.5. Other Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialty Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

Qatar Bakery Products Market Segmentation By Geography

- 1. Qatar

Qatar Bakery Products Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Bread Dominated the Qatari Bakery Goods Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatar Bakery Products Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cakes and Pastries

- 5.1.2. Biscuits and Cookies

- 5.1.3. Bread

- 5.1.4. Morning Goods

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialty Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Korean Bakeries WLL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Yasmeen Sweets

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ummsaid Bakery

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Wadia Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 MIDI SRL

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Valeo Foods Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 IFFCO

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Behzad Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Safari Bakery*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Korean Bakeries WLL

List of Figures

- Figure 1: Qatar Bakery Products Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Qatar Bakery Products Market Share (%) by Company 2024

List of Tables

- Table 1: Qatar Bakery Products Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Qatar Bakery Products Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Qatar Bakery Products Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Qatar Bakery Products Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Qatar Bakery Products Market Revenue Million Forecast, by Type 2019 & 2032

- Table 6: Qatar Bakery Products Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 7: Qatar Bakery Products Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatar Bakery Products Market?

The projected CAGR is approximately 5.20%.

2. Which companies are prominent players in the Qatar Bakery Products Market?

Key companies in the market include Korean Bakeries WLL, Yasmeen Sweets, Ummsaid Bakery, Wadia Group, MIDI SRL, Valeo Foods Group, IFFCO, Behzad Group, Safari Bakery*List Not Exhaustive.

3. What are the main segments of the Qatar Bakery Products Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Bread Dominated the Qatari Bakery Goods Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

Jan 2023: Mondelēz International announced the opening of the first permanent OREO Café outside of the USA and first in an airport located in Doha, Qatar's Hamad International Airport. The 116 sqm café in the new North Node features a selection of sweet inventions, including OREO milkshakes, muffins, and cheesecakes and a comprehensive savory food and beverage menu, while chefs create unique treats live at the café's OREO Creations Bar. The also concept features the OREO brand's electric signature blue, white and black, attracting transiting passengers with giant OREO furniture, digital walls, and a retail area.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatar Bakery Products Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatar Bakery Products Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatar Bakery Products Market?

To stay informed about further developments, trends, and reports in the Qatar Bakery Products Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence