Key Insights

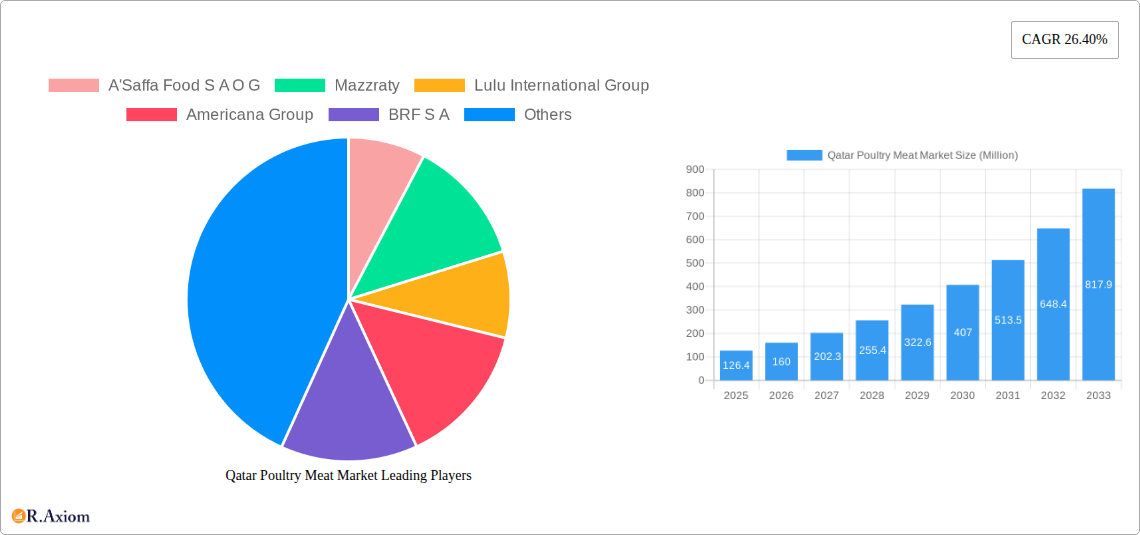

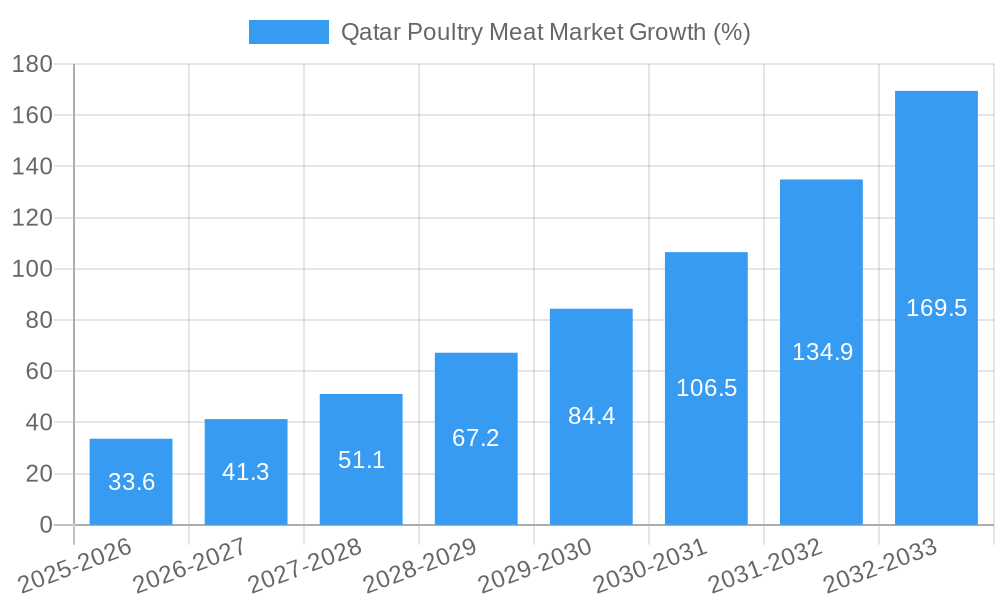

The Qatar poultry meat market exhibits robust growth, driven by a rising population, increasing disposable incomes, and a shift towards convenient, protein-rich food options. The market's 26.40% CAGR from 2019-2024 indicates significant expansion, projected to continue into the forecast period (2025-2033). Key market drivers include the rising demand for processed poultry products, the expansion of the food service sector (particularly restaurants and hotels catering to both locals and tourists), and increasing urbanization. Consumer preference for convenient, ready-to-eat meals is also contributing significantly. While data on specific market segments within Qatar is limited, industry trends suggest that the fresh/chilled segment likely holds the largest market share, followed by frozen and processed poultry. The off-trade distribution channel (supermarkets, hypermarkets, and retail stores) is anticipated to dominate, given the rising popularity of grocery shopping. Major players like A'Saffa Food S.A.O.G., Americana Group, and Lulu International Group are key contributors to the market's growth, leveraging their established distribution networks and brand recognition. Potential restraints could include fluctuations in feed prices, government regulations concerning poultry imports, and potential competition from alternative protein sources. However, the overall market outlook remains positive, indicating substantial future growth opportunities.

The projected market value for 2025 will serve as the base for forecasting future growth. Assuming the market size in 2024 was approximately $100 million (a reasonable estimation given a high CAGR and the presence of significant players), the 2025 market size would be approximately $126.4 million (100 million * 1.264). This estimation allows for a projection of future growth based on the provided CAGR of 26.40%. Further segment-specific analysis, including detailed market share breakdowns by distribution channels (off-trade vs. on-trade), product forms (canned, fresh/chilled, etc.), and end-users (foodservice vs. retail), would require more detailed data, but the existing information points to a dynamic and expanding market. The ongoing expansion of Qatar's infrastructure and economy will likely further fuel market growth in the coming years.

Qatar Poultry Meat Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Qatar poultry meat market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report delves into market dynamics, competitive landscapes, and future growth potential. The report uses Million for all values.

Qatar Poultry Meat Market Market Concentration & Innovation

The Qatar poultry meat market exhibits a moderately concentrated structure, with key players like A'Saffa Food S A O G, Mazzraty, Lulu International Group, Americana Group, BRF S A, Hassad Food Company, JBS SA, and Sunbulah Group holding significant market share. Precise market share figures for each company are unavailable (xx) for this report, but analysis suggests a competitive landscape with room for both organic growth and strategic acquisitions. Innovation is driven by consumer demand for convenient, healthy, and high-quality poultry products. Regulatory frameworks, including food safety standards and import regulations, play a significant role in shaping market dynamics. Product substitutes, such as red meat and plant-based alternatives, present competitive challenges, although poultry remains a staple in Qatari cuisine. End-user trends, such as increasing health consciousness and demand for value-added products, are influencing product development and marketing strategies. The market has witnessed notable M&A activity, including BRF's 2021 investment in Banvit via a joint venture with the Qatar Investment Authority (QIA), highlighting strategic interest in expanding within the region. The value of this deal was xx Million. Further M&A activities and their values are unavailable (xx) at this time.

Qatar Poultry Meat Market Industry Trends & Insights

The Qatar poultry meat market is experiencing robust growth, driven by a rising population, increasing disposable incomes, and a preference for poultry as a primary protein source. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at xx%. Market penetration of processed poultry products is steadily increasing, reflecting changing consumer preferences towards convenience and ready-to-eat options. Technological advancements in poultry farming, processing, and distribution are enhancing efficiency and improving product quality. The adoption of advanced technologies like automation and data analytics is enhancing operational efficiency and improving the quality and traceability of poultry products, while also impacting the overall pricing structure. Competitive dynamics are shaped by pricing strategies, product differentiation, branding, and distribution networks. The market shows strong potential for growth, though challenges including climate change, sustainable farming practices, and fluctuations in feed prices could influence growth.

Dominant Markets & Segments in Qatar Poultry Meat Market

Distribution Channel: The off-trade channel (supermarkets, hypermarkets, and retail stores) dominates the distribution landscape due to its wide reach and accessibility. The on-trade segment (restaurants, hotels, and foodservice establishments) holds a significant share, fueled by the growth of the hospitality and foodservice sectors.

Form: Fresh/chilled poultry remains the dominant form, reflecting consumer preference for freshness and quality. Frozen poultry is also gaining popularity due to its longer shelf life and convenience. Processed and canned poultry segments are relatively smaller but exhibit growth potential.

End-User: The retail segment is the largest end-user of poultry meat, driven by household consumption. The foodservice segment is a significant contributor, especially given the growth of the hospitality and catering industries in Qatar.

The dominance of the off-trade channel stems from the widespread penetration of modern retail formats in Qatar and convenience for consumers. The robust growth in the foodservice sector, fueled by increasing tourism and the expanding local population, directly drives the growth in the on-trade segment. Government initiatives to support local poultry production and enhance food security are also major drivers of the market's growth.

Qatar Poultry Meat Market Product Developments

Recent product innovations focus on convenience, health, and value-added attributes. This includes the introduction of ready-to-cook and ready-to-eat poultry products, marinated meats, and value packs targeting time-pressed consumers. Technological advancements in processing and packaging technologies are enhancing product shelf life and improving food safety. The market is witnessing a gradual shift toward healthier poultry options with lower fat content and increased protein. These innovations meet consumer demand for healthier and more convenient food choices, thereby gaining a strong competitive advantage in a continuously evolving market landscape.

Report Scope & Segmentation Analysis

This report segments the Qatar poultry meat market by distribution channel (off-trade and on-trade), form (canned, fresh/chilled, frozen, and processed), and end-user (foodservice and retail). Each segment's growth projection, market size, and competitive dynamics are thoroughly analyzed. The off-trade segment is expected to experience substantial growth, driven by expanding retail infrastructure and changing consumer behavior. The fresh/chilled segment dominates the form category due to consumer preferences, while frozen poultry presents a significant opportunity given its extended shelf life. The retail end-user segment holds the largest market share due to high household consumption.

Key Drivers of Qatar Poultry Meat Market Growth

Several key factors drive the growth of Qatar’s poultry meat market. These include a steadily rising population, increasing disposable incomes leading to higher per capita expenditure on food, and a strong preference for poultry as a versatile and affordable protein source. Government support for local poultry production through various initiatives also contributes significantly. The development of modern retail infrastructure and cold chain logistics enhances product availability, freshness, and distribution efficiency.

Challenges in the Qatar Poultry Meat Market Sector

The Qatar poultry meat market faces challenges like fluctuations in feed prices, impacting production costs and profitability. Maintaining consistent product quality and adhering to stringent food safety regulations necessitates substantial investments in technology and infrastructure. Competition from imports, particularly from neighboring countries, also poses a significant challenge. The estimated impact of these challenges on market growth is unavailable (xx) at this time.

Emerging Opportunities in Qatar Poultry Meat Market

The market offers opportunities in value-added poultry products, catering to evolving consumer preferences for convenience and health. Expanding into niche segments, such as organic and halal poultry, presents significant growth potential. Investing in sustainable farming practices and improving supply chain efficiency will enhance competitiveness and improve market position. The rising popularity of online grocery platforms creates an opportunity for enhanced distribution channels.

Leading Players in the Qatar Poultry Meat Market Market

- A'Saffa Food S A O G

- Mazzraty

- Lulu International Group

- Americana Group

- BRF S A

- Hassad Food Company

- JBS SA

- Sunbulah Group

Key Developments in Qatar Poultry Meat Market Industry

- November 2021: BRF invested in Banvit through a joint venture with QIA, acquiring a 79.5% stake. This significantly strengthened BRF's presence in the region.

- November 2021: Al-Watania Poultry partnered with Americana Group to boost local poultry production, enhancing food security and potentially stabilizing prices.

- December 2021: LuLu Group launched a new poultry meat range, collaborating with leading manufacturers, broadening product diversity and enhancing consumer choice.

Strategic Outlook for Qatar Poultry Meat Market Market

The Qatar poultry meat market is poised for sustained growth, driven by robust population growth, rising disposable incomes, and the increasing popularity of poultry as a key protein source. Strategic investments in technology, sustainable farming practices, and value-added products will be crucial for success. Expanding distribution channels and exploring new market segments, such as online retail and specialized poultry products, will further enhance market penetration and profitability. The long-term outlook is highly positive, with ample opportunities for existing players and new entrants alike.

Qatar Poultry Meat Market Segmentation

-

1. Form

- 1.1. Canned

- 1.2. Fresh / Chilled

- 1.3. Frozen

-

1.4. Processed

-

1.4.1. By Processed Types

- 1.4.1.1. Deli Meats

- 1.4.1.2. Marinated/ Tenders

- 1.4.1.3. Meatballs

- 1.4.1.4. Nuggets

- 1.4.1.5. Sausages

- 1.4.1.6. Other Processed Poultry

-

1.4.1. By Processed Types

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Channel

- 2.1.3. Supermarkets and Hypermarkets

- 2.1.4. Others

- 2.2. On-Trade

-

2.1. Off-Trade

Qatar Poultry Meat Market Segmentation By Geography

- 1. Qatar

Qatar Poultry Meat Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 26.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Urbanization; Growing Disposable Income

- 3.3. Market Restrains

- 3.3.1. High-price and additional delivery charges

- 3.4. Market Trends

- 3.4.1. The availability of a wide range of products in supermarkets is driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatar Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Canned

- 5.1.2. Fresh / Chilled

- 5.1.3. Frozen

- 5.1.4. Processed

- 5.1.4.1. By Processed Types

- 5.1.4.1.1. Deli Meats

- 5.1.4.1.2. Marinated/ Tenders

- 5.1.4.1.3. Meatballs

- 5.1.4.1.4. Nuggets

- 5.1.4.1.5. Sausages

- 5.1.4.1.6. Other Processed Poultry

- 5.1.4.1. By Processed Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Channel

- 5.2.1.3. Supermarkets and Hypermarkets

- 5.2.1.4. Others

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. UAE Qatar Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 7. South Africa Qatar Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia Qatar Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA Qatar Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 A'Saffa Food S A O G

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Mazzraty

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Lulu International Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Americana Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 BRF S A

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Hassad Food Company

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 JBS SA

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Sunbulah Grou

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 A'Saffa Food S A O G

List of Figures

- Figure 1: Qatar Poultry Meat Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Qatar Poultry Meat Market Share (%) by Company 2024

List of Tables

- Table 1: Qatar Poultry Meat Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Qatar Poultry Meat Market Revenue Million Forecast, by Form 2019 & 2032

- Table 3: Qatar Poultry Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Qatar Poultry Meat Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Qatar Poultry Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: UAE Qatar Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South Africa Qatar Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Saudi Arabia Qatar Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of MEA Qatar Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Qatar Poultry Meat Market Revenue Million Forecast, by Form 2019 & 2032

- Table 11: Qatar Poultry Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: Qatar Poultry Meat Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatar Poultry Meat Market?

The projected CAGR is approximately 26.40%.

2. Which companies are prominent players in the Qatar Poultry Meat Market?

Key companies in the market include A'Saffa Food S A O G, Mazzraty, Lulu International Group, Americana Group, BRF S A, Hassad Food Company, JBS SA, Sunbulah Grou.

3. What are the main segments of the Qatar Poultry Meat Market?

The market segments include Form, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Urbanization; Growing Disposable Income.

6. What are the notable trends driving market growth?

The availability of a wide range of products in supermarkets is driving the market.

7. Are there any restraints impacting market growth?

High-price and additional delivery charges.

8. Can you provide examples of recent developments in the market?

December 2021: LuLu Group launched its latest product categories, including the poultry meat range, in collaboration with world-class brands and leading manufacturers.November 2021: BRF invested in the business in a joint venture with sovereign wealth fund the Qatar Investment Authority.Under this deal, BRF acquired a 79.5% interest in Banvit through the joint venture set up with QIA, the Gulf state’s sovereign investment fund.November 2021: Al-Watania Poultry partnered with Americana Group to develop the local content in the poultry sector in the Middle East region and provide markets with fresh, high-quality, and reliable products. It helps enhance food security and increase production and other direct and indirect costs that contribute to stability in poultry prices for the final consumer.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatar Poultry Meat Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatar Poultry Meat Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatar Poultry Meat Market?

To stay informed about further developments, trends, and reports in the Qatar Poultry Meat Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence