Key Insights

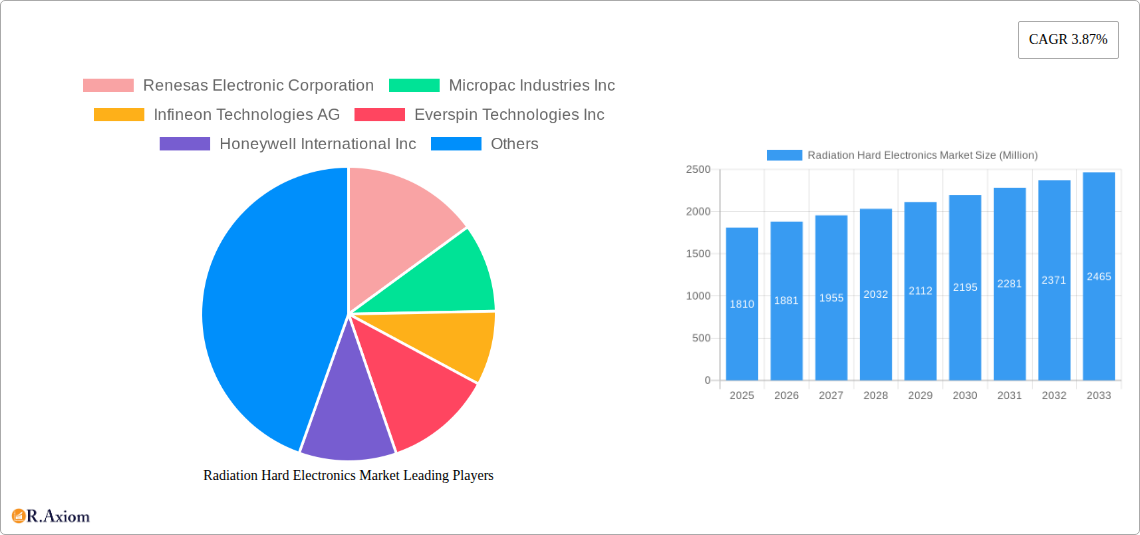

The global Radiation Hard Electronics market is poised for significant growth, projected to reach $1.81 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 3.87% through 2033. This expansion is primarily fueled by the escalating demand for reliable electronic components in environments subjected to intense radiation. Key drivers include the burgeoning space exploration initiatives, the robust growth of the aerospace and defense sectors, and the increasing deployment of nuclear power plants globally. These sectors critically rely on radiation-hardened electronics to ensure the integrity and functionality of their systems, even under extreme conditions. The market's trajectory is further bolstered by ongoing technological advancements in miniaturization and increased power efficiency of radiation-hardened devices.

Radiation Hard Electronics Market Market Size (In Billion)

The market segmentation reveals distinct opportunities across various components and end-user industries. Discrete components, sensors, integrated circuits, microcontrollers, microprocessors, and memory all play crucial roles in the radiation-hardened ecosystem. The dominance of space, aerospace, and defense applications underscores the critical need for resilient electronics in these demanding fields. While the market exhibits strong upward momentum, potential restraints could emerge from the high cost of specialized manufacturing and the extended development cycles associated with qualification and testing of radiation-hardened components. However, the persistent need for mission-critical electronics in harsh environments, coupled with consistent investment in research and development, is expected to outweigh these challenges, paving the way for sustained market expansion.

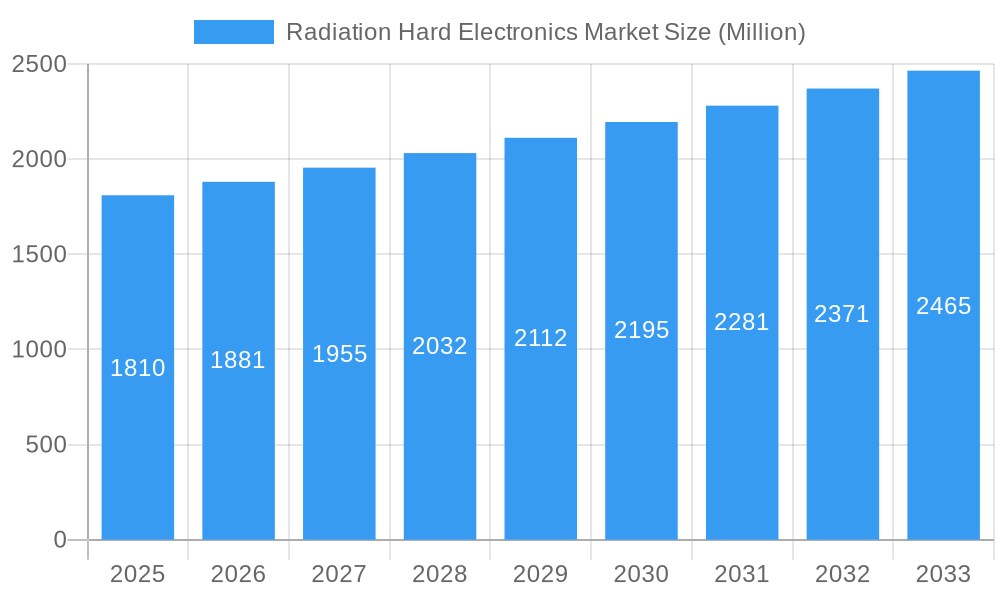

Radiation Hard Electronics Market Company Market Share

This in-depth report provides an exhaustive analysis of the global Radiation Hard Electronics Market, delving into its current landscape, historical performance, and projected future trajectory from 2019 to 2033. With a base year of 2025 and a forecast period spanning 2025–2033, this study leverages granular data to offer actionable insights for stakeholders seeking to capitalize on the burgeoning demand for resilient electronic components in high-radiation environments. The report meticulously examines market dynamics, segmentation, competitive strategies, and emerging trends, positioning it as an essential resource for industry leaders, researchers, and investors. The Radiation Hardened Electronics Market is experiencing robust growth, driven by the increasing sophistication of space missions, defense applications, and the nuclear energy sector. Key companies like Renesas Electronic Corporation, Micropac Industries Inc, Infineon Technologies AG, Everspin Technologies Inc, Honeywell International Inc, Microchip Technology Inc, Texas Instruments, Data Device Corporation, Frontgrade Technologies, BAE Systems PLC, Vorago Technologie, Solid State Devices Inc, Advanced Micro Devices Inc, and STMicroelectronics International NV are at the forefront of innovation.

Radiation Hard Electronics Market Market Concentration & Innovation

The Radiation Hardened Electronics Market exhibits a moderate level of market concentration, with a few key players holding significant market share, yet there remains substantial room for innovation. Major driving forces behind this innovation include the relentless pursuit of higher reliability in extreme environments, the miniaturization of components for space-constrained applications, and the development of novel materials and manufacturing processes to withstand intense radiation. Regulatory frameworks, particularly those governing aerospace and defense procurements, play a crucial role in shaping product development and market access. Product substitutes are limited in truly high-radiation scenarios, where specialized radiation-hardened components are indispensable. However, advancements in radiation-tolerant commercial-off-the-shelf (COTS) components are increasingly being explored for less demanding applications, offering a cost-effective alternative. End-user trends underscore a growing demand for enhanced performance, extended operational lifespans, and reduced system complexity. Mergers and acquisitions (M&A) activities are observed, albeit on a smaller scale, indicating strategic consolidation and technology acquisition to bolster competitive positioning. For instance, recent M&A deals in the semiconductor industry, while not exclusively focused on radiation hardening, signal an interest in acquiring specialized IP and manufacturing capabilities that can be leveraged within this niche market. The estimated M&A deal value within the broader semiconductor space relevant to this market could range from tens of millions to hundreds of millions of US dollars, reflecting the strategic importance of advanced electronic components.

Radiation Hard Electronics Market Industry Trends & Insights

The Radiation Hardened Electronics Market is poised for substantial growth, fueled by a confluence of technological advancements, escalating investments in space exploration and defense, and the evolving needs of the nuclear power industry. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% to 8.5% over the forecast period. This robust expansion is directly attributable to the increasing complexity and ambition of space missions, including satellite constellations, deep-space probes, and manned spaceflight initiatives, all of which necessitate highly reliable electronics capable of enduring prolonged exposure to cosmic and solar radiation. Similarly, the aerospace and defense sector continues to be a dominant consumer, driven by the development of advanced military platforms, communication systems, and electronic warfare capabilities that demand uncompromised performance in hostile environments. The nuclear power sector, despite its challenges, also presents a steady demand for radiation-hardened components for control systems and monitoring equipment in reactors. Technological disruptions are primarily centered on the development of new semiconductor materials, such as Silicon-Germanium (SiGe) and Gallium Nitride (GaN), which offer inherent radiation tolerance. Furthermore, innovative design methodologies, including circuit hardening techniques and error-correction codes, are continuously being refined to enhance the resilience of integrated circuits. Consumer preferences, within this specialized market, are not driven by typical consumer demands but rather by stringent performance specifications, reliability metrics, and adherence to rigorous industry standards set by space agencies and defense organizations. The competitive dynamics are characterized by a blend of established semiconductor giants and specialized niche players. Companies are differentiating themselves through their ability to offer tailored solutions, extensive testing capabilities, and a proven track record of delivering mission-critical components. Market penetration is steadily increasing across all key end-user segments as the adoption of advanced technologies becomes more widespread. The overall market penetration is estimated to be around 30-35% within its addressable segments, with significant potential for expansion.

Dominant Markets & Segments in Radiation Hard Electronics Market

The Radiation Hardened Electronics Market is characterized by the dominance of specific regions and end-user segments, driven by robust governmental and private sector investments in technology-intensive industries.

Dominant End-User Segments:

Space: This segment represents the largest and most influential market for radiation-hardened electronics.

- Key Drivers:

- Exponential Growth in Satellite Deployments: The proliferation of small satellites, constellations for broadband internet, and earth observation platforms are creating unprecedented demand for radiation-hardened components.

- Ambitious Space Exploration Programs: International space agencies are pushing the boundaries with missions to Mars, the Moon, and beyond, requiring electronics that can withstand extreme radiation environments for extended durations.

- Commercial Space Sector Expansion: The rise of private companies in launch services, in-orbit servicing, and space tourism further fuels the need for reliable space-grade electronics.

- Regulatory Mandates: Space agencies often have strict qualification requirements, making radiation hardening a non-negotiable aspect of component selection.

- Key Drivers:

Aerospace and Defense: This sector is the second-largest consumer, driven by the need for high-reliability electronic systems in combat aircraft, missiles, drones, and secure communication networks.

- Key Drivers:

- Modernization of Military Assets: Governments worldwide are investing heavily in upgrading their defense capabilities, leading to increased demand for advanced, radiation-hardened avionics, radar systems, and electronic warfare suites.

- Increased Sophistication of Threats: The evolving nature of geopolitical landscapes necessitates the deployment of resilient systems capable of operating under potential electronic countermeasures and hostile radiation environments.

- Unmanned Aerial Vehicles (UAVs): The growing use of drones for surveillance, reconnaissance, and combat operations requires specialized electronics that can endure harsh conditions.

- Long-Duration Missions: The trend towards longer and more complex military operations, including those in contested airspace, emphasizes the need for fault-tolerant electronics.

- Key Drivers:

Nuclear Power Plants: While a smaller segment compared to space and defense, this sector provides a consistent demand for radiation-hardened components critical for the safe and efficient operation of nuclear reactors.

- Key Drivers:

- Aging Infrastructure and Upgrades: Many existing nuclear power plants require component replacements and system upgrades to maintain operational safety and efficiency, driving demand for specialized electronics.

- New Reactor Designs: The development of advanced reactor designs, including Small Modular Reactors (SMRs), often incorporates enhanced safety features requiring radiation-hardened control and instrumentation systems.

- Safety Regulations: Strict safety regulations in the nuclear industry mandate the use of components that can reliably function in high-radiation environments for extended periods.

- Key Drivers:

Dominant Component Segments:

- Integrated Circuits (ICs): This category, encompassing microprocessors, microcontrollers, FPGAs, ASICs, and memory, constitutes the largest segment due to the complex functionality required in advanced electronic systems. The demand for radiation-hardened ICs is driven by their crucial role in data processing, control, and communication.

- Sensors: Radiation-hardened sensors are vital for data acquisition in extreme environments, including radiation detectors, temperature sensors, and pressure sensors used in space, aerospace, and nuclear applications.

- Memory: Non-volatile memory technologies like SRAM and DRAM that are resistant to radiation-induced errors are critical for data storage in space missions and defense systems.

- Discrete Components: While smaller in value, specialized diodes, transistors, and passive components with radiation-hardened properties remain essential for specific circuit designs.

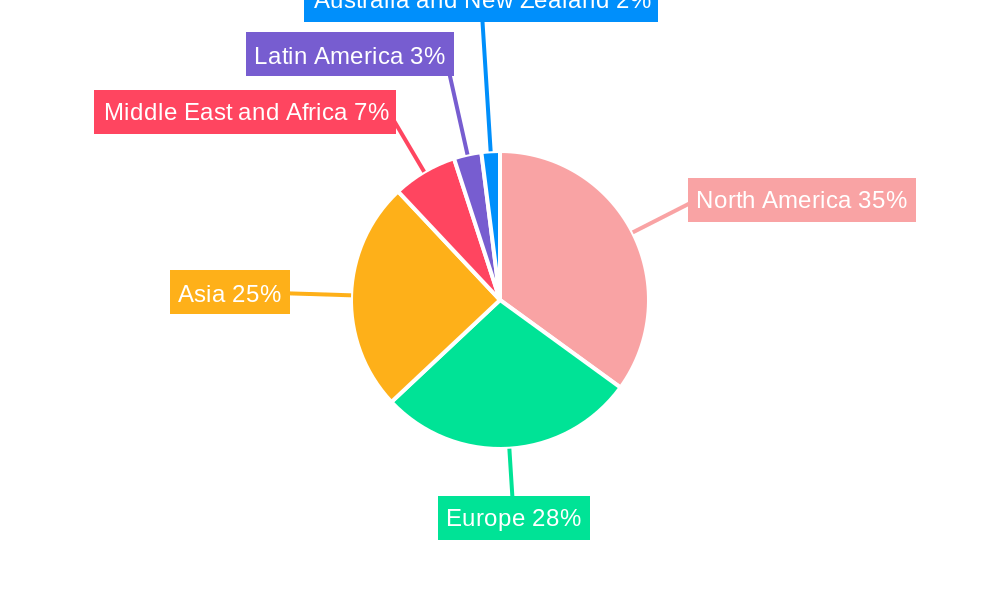

The North America region is a dominant market due to significant government investments in space exploration (NASA) and defense (Department of Defense), coupled with a strong presence of leading aerospace and defense companies. The United States is a key country within this region, leading in R&D and procurement of radiation-hardened electronics.

Radiation Hard Electronics Market Product Developments

Product developments in the Radiation Hardened Electronics Market are characterized by a focus on enhancing device reliability, reducing power consumption, and increasing integration levels. Innovations in materials science are leading to the creation of semiconductor structures with inherent radiation immunity, such as advanced silicon-on-insulator (SOI) technologies. Furthermore, sophisticated circuit design techniques, including error detection and correction (EDAC) mechanisms and redundant architectures, are being implemented to mitigate the impact of radiation-induced single-event effects (SEEs). The development of radiation-hardened FPGAs and ASICs with higher clock speeds and lower power profiles is enabling more complex onboard processing for space missions. The market is witnessing a trend towards radiation-tolerant commercial-off-the-shelf (RT-COTS) components, offering a more cost-effective solution for applications with less stringent radiation requirements, thus expanding the addressable market. These advancements provide crucial competitive advantages by enabling longer mission durations, enhanced system performance, and reduced overall mission costs for users in space, aerospace, and defense.

Report Scope & Segmentation Analysis

The Radiation Hardened Electronics Market report encompasses a comprehensive segmentation of the industry to provide granular insights.

- End-User Segmentation: The market is analyzed across key end-user industries, including Space, Aerospace and Defense, and Nuclear Power Plants. The Space segment is projected to exhibit the highest growth rate due to increasing satellite deployments and ambitious exploration missions. Aerospace and Defense remains a significant market driven by defense modernization. Nuclear Power Plants offer stable, consistent demand driven by safety and operational requirements.

- Component Segmentation: The report further segments the market by component type, including Discrete, Sensors, Integrated Circuits, Microcontrollers and Microprocessors, and Memory. Integrated Circuits, encompassing microprocessors, microcontrollers, and memory, are expected to dominate the market share owing to their critical role in complex systems. Memory components, in particular, are vital for data integrity in radiation-prone environments, with steady growth projected. Discrete components and sensors, while representing smaller market shares individually, are indispensable for specific applications requiring high reliability.

Key Drivers of Radiation Hard Electronics Market Growth

The growth of the Radiation Hardened Electronics Market is propelled by several interconnected factors.

- Increasing Investment in Space Exploration and Commercialization: Ambitious government-led space missions and the burgeoning commercial space sector, including satellite constellations for global connectivity and earth observation, are creating an unprecedented demand for resilient electronics.

- Modernization of Aerospace and Defense Infrastructure: National security imperatives and the need for advanced military capabilities are driving significant investments in sophisticated aircraft, communication systems, and electronic warfare, all requiring radiation-hardened components.

- Technological Advancements in Semiconductor Manufacturing: Innovations in materials science and fabrication techniques are enabling the development of more radiation-tolerant and higher-performance electronic components at competitive costs.

- Stringent Reliability and Safety Standards: The critical nature of applications in space, aerospace, and nuclear power necessitates the use of electronic components that can withstand extreme radiation environments without failure, driving the demand for specialized, hardened solutions.

Challenges in the Radiation Hard Electronics Market Sector

Despite its strong growth trajectory, the Radiation Hardened Electronics Market faces several significant challenges.

- High Development and Qualification Costs: The rigorous testing and qualification processes required to certify electronic components for radiation hardness are exceptionally time-consuming and expensive, creating a substantial barrier to entry for new players.

- Limited Supplier Base and Supply Chain Vulnerabilities: The specialized nature of this market results in a relatively small number of qualified suppliers, making the supply chain susceptible to disruptions and shortages, particularly for highly customized components.

- Longer Lead Times for Production: The intricate manufacturing processes and extensive testing involved lead to significantly longer lead times for radiation-hardened components compared to standard commercial electronics, which can impact project timelines.

- Evolving Radiation Threat Landscape: The increasing sophistication of electronic warfare and the changing nature of radiation environments require continuous research and development to stay ahead of emerging threats, necessitating ongoing investment in innovation.

Emerging Opportunities in Radiation Hard Electronics Market

The Radiation Hardened Electronics Market is brimming with emerging opportunities, driven by technological innovation and expanding application frontiers.

- Growth in the Small Satellite (CubeSat) Market: The rapid proliferation of CubeSats for scientific research, Earth observation, and telecommunications presents a substantial opportunity for cost-effective, radiation-hardened COTS solutions and specialized components.

- Advancements in Next-Generation Nuclear Reactors: The development and deployment of Small Modular Reactors (SMRs) and advanced fission/fusion reactor designs will create a sustained demand for radiation-hardened electronics for control, monitoring, and safety systems.

- Increased Focus on Deep Space Exploration: Missions to outer planets, asteroid mining, and potential human endeavors on Mars will require highly reliable electronics capable of withstanding unprecedented levels of radiation for extended durations.

- Development of Radiation-Hardened AI and Machine Learning Accelerators: The integration of AI and ML into space and defense applications will necessitate the development of specialized, radiation-hardened processors capable of handling complex computational tasks in harsh environments.

Leading Players in the Radiation Hard Electronics Market Market

- Renesas Electronic Corporation

- Micropac Industries Inc

- Infineon Technologies AG

- Everspin Technologies Inc

- Honeywell International Inc

- Microchip Technology Inc

- Texas Instruments

- Data Device Corporation

- Frontgrade Technologies

- BAE Systems PLC

- Vorago Technologie

- Solid State Devices Inc

- Advanced Micro Devices Inc

- STMicroelectronics International NV

Key Developments in Radiation Hard Electronics Market Industry

- October 2023: Indian University (IU) announced that it had secured and would invest about USD 111 million over the next few years to advance its leadership in microelectronics and nanotechnology. The university has also made a provision of USD 10 million to launch the new Center for Reliable and Trusted Electronics, which aims to take forward research activities focused primarily on the modeling and simulation of radiation effects and the design of radiation-hardened technologies. This development signifies a significant commitment to advancing research and development in radiation-hardened electronics, potentially leading to new breakthroughs and enhanced capabilities in the market.

- June 2023: Texas Instruments (TI) announced an expansion of its manufacturing operation in Malaysia by building two new assembly and test factories in Kuala Lumpur and Melaka. Through this expansion, the company aims to extend its cost advantage and have greater control of the supply chain. This strategic expansion by a major player like TI is crucial for the Radiation Hardened Electronics Market, as it could lead to improved supply chain resilience, potentially faster delivery times, and more competitive pricing for critical components.

Strategic Outlook for Radiation Hard Electronics Market Market

The Radiation Hardened Electronics Market is poised for continued robust growth, driven by sustained demand from the space, aerospace, and defense sectors, coupled with emerging opportunities in advanced nuclear technologies and deep-space exploration. Strategic imperatives for market players will revolve around continuous innovation in materials science and design methodologies to enhance radiation tolerance and reduce component size and power consumption. Collaborations between semiconductor manufacturers, research institutions, and end-users will be crucial for developing tailored solutions that meet the increasingly stringent requirements of future missions. Furthermore, the development of radiation-tolerant Commercial-Off-The-Shelf (RT-COTS) components will expand the market's reach into applications with moderate radiation exposure, offering a more accessible and cost-effective alternative. Companies that can demonstrate a proven track record of reliability, offer comprehensive testing and qualification services, and adapt to evolving technological landscapes will be best positioned to capitalize on the immense growth potential of this critical market segment.

Radiation Hard Electronics Market Segmentation

-

1. End-user

- 1.1. Space

- 1.2. Aerospace and Defense

- 1.3. Nuclear Power Plants

-

2. Component

- 2.1. Discrete

- 2.2. Sensors

- 2.3. Integrated Circuit

- 2.4. Microcontrollers and Microprocessors

- 2.5. Memory

Radiation Hard Electronics Market Segmentation By Geography

- 1. Americas

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Radiation Hard Electronics Market Regional Market Share

Geographic Coverage of Radiation Hard Electronics Market

Radiation Hard Electronics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Instances of Satellite Launches and Space Exploration Activities; Growing Adoption of Radiation Hardened Electronics in Power Management and Nuclear Environment

- 3.3. Market Restrains

- 3.3.1. High Designing and Development Cost

- 3.4. Market Trends

- 3.4.1. Nuclear Power Plants to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Radiation Hard Electronics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 5.1.1. Space

- 5.1.2. Aerospace and Defense

- 5.1.3. Nuclear Power Plants

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Discrete

- 5.2.2. Sensors

- 5.2.3. Integrated Circuit

- 5.2.4. Microcontrollers and Microprocessors

- 5.2.5. Memory

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Americas

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 6. Americas Radiation Hard Electronics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user

- 6.1.1. Space

- 6.1.2. Aerospace and Defense

- 6.1.3. Nuclear Power Plants

- 6.2. Market Analysis, Insights and Forecast - by Component

- 6.2.1. Discrete

- 6.2.2. Sensors

- 6.2.3. Integrated Circuit

- 6.2.4. Microcontrollers and Microprocessors

- 6.2.5. Memory

- 6.1. Market Analysis, Insights and Forecast - by End-user

- 7. Europe Radiation Hard Electronics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user

- 7.1.1. Space

- 7.1.2. Aerospace and Defense

- 7.1.3. Nuclear Power Plants

- 7.2. Market Analysis, Insights and Forecast - by Component

- 7.2.1. Discrete

- 7.2.2. Sensors

- 7.2.3. Integrated Circuit

- 7.2.4. Microcontrollers and Microprocessors

- 7.2.5. Memory

- 7.1. Market Analysis, Insights and Forecast - by End-user

- 8. Asia Radiation Hard Electronics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user

- 8.1.1. Space

- 8.1.2. Aerospace and Defense

- 8.1.3. Nuclear Power Plants

- 8.2. Market Analysis, Insights and Forecast - by Component

- 8.2.1. Discrete

- 8.2.2. Sensors

- 8.2.3. Integrated Circuit

- 8.2.4. Microcontrollers and Microprocessors

- 8.2.5. Memory

- 8.1. Market Analysis, Insights and Forecast - by End-user

- 9. Australia and New Zealand Radiation Hard Electronics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user

- 9.1.1. Space

- 9.1.2. Aerospace and Defense

- 9.1.3. Nuclear Power Plants

- 9.2. Market Analysis, Insights and Forecast - by Component

- 9.2.1. Discrete

- 9.2.2. Sensors

- 9.2.3. Integrated Circuit

- 9.2.4. Microcontrollers and Microprocessors

- 9.2.5. Memory

- 9.1. Market Analysis, Insights and Forecast - by End-user

- 10. Latin America Radiation Hard Electronics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user

- 10.1.1. Space

- 10.1.2. Aerospace and Defense

- 10.1.3. Nuclear Power Plants

- 10.2. Market Analysis, Insights and Forecast - by Component

- 10.2.1. Discrete

- 10.2.2. Sensors

- 10.2.3. Integrated Circuit

- 10.2.4. Microcontrollers and Microprocessors

- 10.2.5. Memory

- 10.1. Market Analysis, Insights and Forecast - by End-user

- 11. Middle East and Africa Radiation Hard Electronics Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by End-user

- 11.1.1. Space

- 11.1.2. Aerospace and Defense

- 11.1.3. Nuclear Power Plants

- 11.2. Market Analysis, Insights and Forecast - by Component

- 11.2.1. Discrete

- 11.2.2. Sensors

- 11.2.3. Integrated Circuit

- 11.2.4. Microcontrollers and Microprocessors

- 11.2.5. Memory

- 11.1. Market Analysis, Insights and Forecast - by End-user

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Renesas Electronic Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Micropac Industries Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Infineon Technologies AG

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Everspin Technologies Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Honeywell International Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Microchip Technology Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Texas Instruments

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Data Device Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Frontgrade Technologies

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 BAE Systems PLC

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Vorago Technologie

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Solid State Devices Inc

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Advanced Micro Devices Inc

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 STMicroelectronics International NV

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.1 Renesas Electronic Corporation

List of Figures

- Figure 1: Global Radiation Hard Electronics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Americas Radiation Hard Electronics Market Revenue (Million), by End-user 2025 & 2033

- Figure 3: Americas Radiation Hard Electronics Market Revenue Share (%), by End-user 2025 & 2033

- Figure 4: Americas Radiation Hard Electronics Market Revenue (Million), by Component 2025 & 2033

- Figure 5: Americas Radiation Hard Electronics Market Revenue Share (%), by Component 2025 & 2033

- Figure 6: Americas Radiation Hard Electronics Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Americas Radiation Hard Electronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Radiation Hard Electronics Market Revenue (Million), by End-user 2025 & 2033

- Figure 9: Europe Radiation Hard Electronics Market Revenue Share (%), by End-user 2025 & 2033

- Figure 10: Europe Radiation Hard Electronics Market Revenue (Million), by Component 2025 & 2033

- Figure 11: Europe Radiation Hard Electronics Market Revenue Share (%), by Component 2025 & 2033

- Figure 12: Europe Radiation Hard Electronics Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Radiation Hard Electronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Radiation Hard Electronics Market Revenue (Million), by End-user 2025 & 2033

- Figure 15: Asia Radiation Hard Electronics Market Revenue Share (%), by End-user 2025 & 2033

- Figure 16: Asia Radiation Hard Electronics Market Revenue (Million), by Component 2025 & 2033

- Figure 17: Asia Radiation Hard Electronics Market Revenue Share (%), by Component 2025 & 2033

- Figure 18: Asia Radiation Hard Electronics Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Radiation Hard Electronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Radiation Hard Electronics Market Revenue (Million), by End-user 2025 & 2033

- Figure 21: Australia and New Zealand Radiation Hard Electronics Market Revenue Share (%), by End-user 2025 & 2033

- Figure 22: Australia and New Zealand Radiation Hard Electronics Market Revenue (Million), by Component 2025 & 2033

- Figure 23: Australia and New Zealand Radiation Hard Electronics Market Revenue Share (%), by Component 2025 & 2033

- Figure 24: Australia and New Zealand Radiation Hard Electronics Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Radiation Hard Electronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Radiation Hard Electronics Market Revenue (Million), by End-user 2025 & 2033

- Figure 27: Latin America Radiation Hard Electronics Market Revenue Share (%), by End-user 2025 & 2033

- Figure 28: Latin America Radiation Hard Electronics Market Revenue (Million), by Component 2025 & 2033

- Figure 29: Latin America Radiation Hard Electronics Market Revenue Share (%), by Component 2025 & 2033

- Figure 30: Latin America Radiation Hard Electronics Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Radiation Hard Electronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Radiation Hard Electronics Market Revenue (Million), by End-user 2025 & 2033

- Figure 33: Middle East and Africa Radiation Hard Electronics Market Revenue Share (%), by End-user 2025 & 2033

- Figure 34: Middle East and Africa Radiation Hard Electronics Market Revenue (Million), by Component 2025 & 2033

- Figure 35: Middle East and Africa Radiation Hard Electronics Market Revenue Share (%), by Component 2025 & 2033

- Figure 36: Middle East and Africa Radiation Hard Electronics Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Radiation Hard Electronics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Radiation Hard Electronics Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 2: Global Radiation Hard Electronics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 3: Global Radiation Hard Electronics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Radiation Hard Electronics Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 5: Global Radiation Hard Electronics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 6: Global Radiation Hard Electronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Radiation Hard Electronics Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 8: Global Radiation Hard Electronics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 9: Global Radiation Hard Electronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Radiation Hard Electronics Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 11: Global Radiation Hard Electronics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 12: Global Radiation Hard Electronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Radiation Hard Electronics Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 14: Global Radiation Hard Electronics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 15: Global Radiation Hard Electronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Radiation Hard Electronics Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 17: Global Radiation Hard Electronics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 18: Global Radiation Hard Electronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global Radiation Hard Electronics Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 20: Global Radiation Hard Electronics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 21: Global Radiation Hard Electronics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Radiation Hard Electronics Market?

The projected CAGR is approximately 3.87%.

2. Which companies are prominent players in the Radiation Hard Electronics Market?

Key companies in the market include Renesas Electronic Corporation, Micropac Industries Inc, Infineon Technologies AG, Everspin Technologies Inc, Honeywell International Inc, Microchip Technology Inc, Texas Instruments, Data Device Corporation, Frontgrade Technologies, BAE Systems PLC, Vorago Technologie, Solid State Devices Inc, Advanced Micro Devices Inc, STMicroelectronics International NV.

3. What are the main segments of the Radiation Hard Electronics Market?

The market segments include End-user, Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.81 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Instances of Satellite Launches and Space Exploration Activities; Growing Adoption of Radiation Hardened Electronics in Power Management and Nuclear Environment.

6. What are the notable trends driving market growth?

Nuclear Power Plants to Witness Significant Growth.

7. Are there any restraints impacting market growth?

High Designing and Development Cost.

8. Can you provide examples of recent developments in the market?

October 2023: Indian University (IU) announced that it had secured and would invest about USD 111 million over the next few years to advance its leadership in microelectronics and nanotechnology. The university has also made a provision of USD 10 million to launch the new Center for Reliable and Trusted Electronics, which aims to take forward research activities focused primarily on the modeling and simulation of radiation effects and the design of radiation-hardened technologies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Radiation Hard Electronics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Radiation Hard Electronics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Radiation Hard Electronics Market?

To stay informed about further developments, trends, and reports in the Radiation Hard Electronics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence