Key Insights

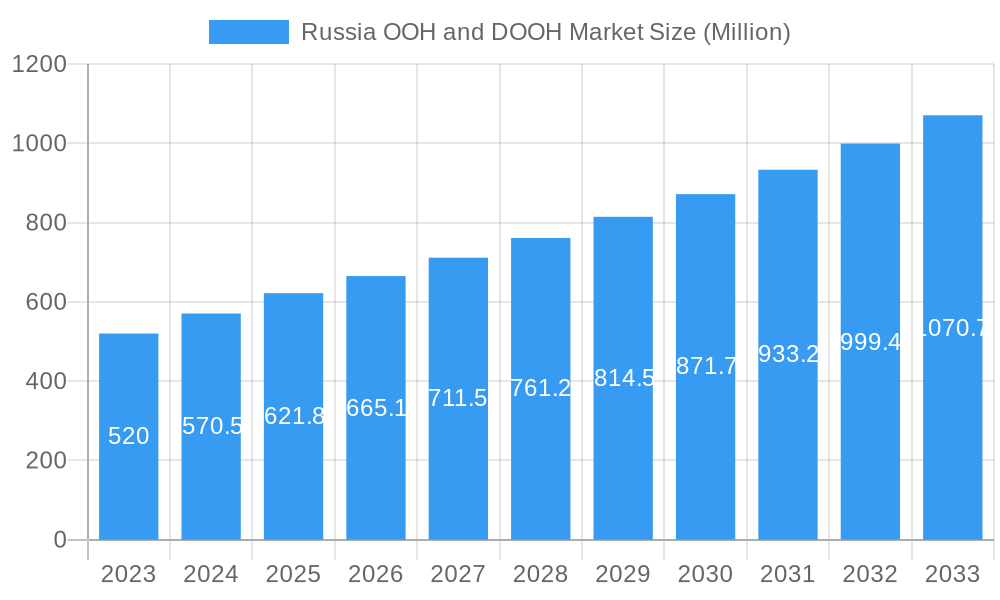

The Russian Out-of-Home (OOH) and Digital Out-of-Home (DOOH) advertising market is poised for robust expansion, projected to reach $621.80 Million by 2025 and continue its upward trajectory with a Compound Annual Growth Rate (CAGR) of 6.90% throughout the forecast period of 2025-2033. This growth is primarily fueled by the increasing adoption of dynamic and programmatic DOOH solutions, which offer greater flexibility, real-time campaign management, and measurable results compared to traditional static OOH formats. The digitalization of billboards, integration with smart city initiatives, and the expansion of digital screens in high-traffic areas like transportation hubs and street furniture are key drivers. Furthermore, the demand for targeted advertising solutions across various end-user industries, including automotive, retail, and BFSI, is propelling the market forward. As advertisers seek more engaging and effective ways to reach consumers, the interactive and data-driven capabilities of DOOH are becoming indispensable.

Russia OOH and DOOH Market Market Size (In Million)

The market's evolution is characterized by a shift towards sophisticated advertising strategies that leverage technology. While static OOH continues to hold a significant share, the rapid growth of Digital OOH, encompassing LED screens and programmatic platforms, is reshaping the landscape. The application segments of billboards and transportation advertising, particularly within airports and transit networks, are expected to witness substantial investment. The increasing consumer spending and the recovery of key sectors such as retail and automotive post-pandemic will further stimulate advertising expenditure in OOH and DOOH. Emerging trends like the integration of AI and data analytics for audience segmentation and ad personalization will enhance the effectiveness and appeal of OOH advertising. Overcoming potential restraints such as evolving regulatory frameworks and the need for significant initial investment in digital infrastructure will be crucial for sustained market growth and the full realization of its potential in reaching diverse consumer segments across Russia.

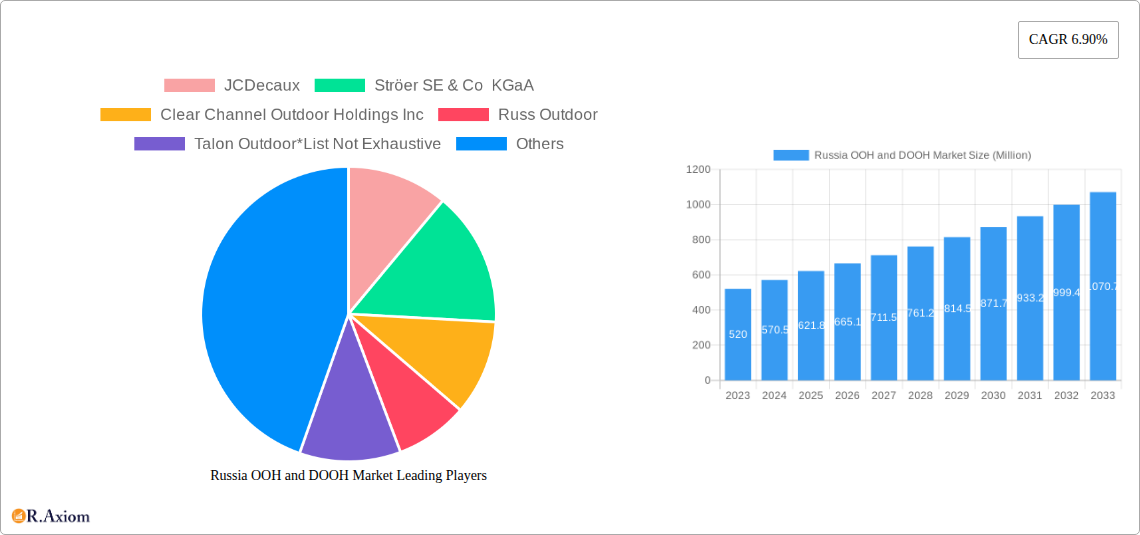

Russia OOH and DOOH Market Company Market Share

This in-depth report provides a definitive analysis of the Russia Out-of-Home (OOH) and Digital Out-of-Home (DOOH) advertising market. Covering the historical period from 2019 to 2024, the base and estimated year of 2025, and a robust forecast period extending to 2033, this study offers unparalleled insights into market dynamics, growth drivers, segmentation, and competitive landscapes. The report is meticulously crafted to equip industry stakeholders, advertisers, media planners, and investors with actionable intelligence for strategic decision-making in this rapidly evolving sector. The Russian OOH and DOOH market is experiencing a significant digital transformation, driven by innovative technologies and increasing demand for impactful advertising solutions.

Russia OOH and DOOH Market Market Concentration & Innovation

The Russia OOH and DOOH market is characterized by a moderate to high degree of concentration, with a few key players dominating the landscape. Innovation is a critical driver, particularly in the Digital Out-of-Home (DOOH) segment, where advancements in programmatic advertising, interactive displays, and data analytics are reshaping campaign effectiveness. Regulatory frameworks, while evolving, play a crucial role in shaping the operational environment for OOH advertising, influencing aspects like location permits and content guidelines. The availability of affordable and high-traffic locations, coupled with the growing adoption of digital technologies, contributes to the market's innovative trajectory.

- Market Concentration: Dominated by major players like Russ Outdoor, JCDecaux, Ströer SE & Co KGaA, and Clear Channel Outdoor Holdings Inc. These companies collectively hold a significant market share, influencing pricing and deployment strategies.

- Innovation Drivers:

- Programmatic DOOH: Enables automated buying and selling of digital ad space, offering greater efficiency and targeting capabilities.

- LED Screen Technology: Advancements in screen resolution, brightness, and flexibility facilitate more dynamic and visually appealing advertisements.

- Data Analytics & Measurement: Increasing focus on audience measurement and campaign attribution for demonstrating ROI.

- Regulatory Frameworks: Evolving regulations impact digital billboard installations and public space advertising.

- Product Substitutes: While traditional media like TV and print are present, DOOH offers unique advantages in capturing attention in physical spaces.

- End-User Trends: Growing demand from sectors like retail, automotive, and BFSI for integrated and impactful advertising campaigns.

- M&A Activities: Strategic acquisitions and partnerships are observed as companies seek to expand their network, technological capabilities, and market reach. Specific M&A deal values are not publicly disclosed for all transactions, but significant investments in digital infrastructure are evident.

Russia OOH and DOOH Market Industry Trends & Insights

The Russia OOH and DOOH market is poised for substantial growth, propelled by a confluence of economic recovery, technological advancements, and shifting consumer behaviors. The increasing urbanization and growth of major cities like Moscow and Saint Petersburg are creating more opportunities for OOH advertising, especially in high-traffic areas. Digital transformation is the cornerstone of this growth, with a significant shift towards DOOH platforms that offer dynamic content, real-time campaign management, and enhanced audience targeting. The adoption of programmatic DOOH is accelerating, allowing for more efficient media buying and personalized ad delivery, mirroring global trends in digital advertising.

Consumer preferences are also evolving, with audiences increasingly receptive to visually engaging and contextually relevant advertising. DOOH screens in high-footfall locations such as shopping malls, transit hubs, and entertainment venues are proving highly effective in capturing attention and influencing purchasing decisions. This trend is further amplified by the integration of DOOH with mobile advertising, creating powerful omnichannel strategies. The COVID-19 pandemic, while initially disruptive, has accelerated the adoption of contactless and digital solutions, further bolstering the case for DOOH. The report forecasts a Compound Annual Growth Rate (CAGR) of approximately 8-10% for the DOOH segment over the forecast period. Market penetration of DOOH is expected to rise from an estimated 40% in 2025 to over 65% by 2033, indicating a significant shift from traditional OOH.

Technological disruptions, including the rollout of 5G networks and the development of AI-powered analytics, are set to revolutionize campaign effectiveness. These advancements will enable more sophisticated audience segmentation, predictive analytics for ad placement, and real-time campaign optimization. Furthermore, the increasing demand for sustainable and eco-friendly advertising solutions may also influence future OOH deployments, with a focus on energy-efficient digital displays. The competitive landscape remains dynamic, with both established players and emerging technology providers vying for market share. Strategic partnerships and collaborations are becoming increasingly common as companies aim to leverage each other's strengths in technology, network coverage, and data capabilities. The Russian government's initiatives to boost digital infrastructure and promote technological innovation indirectly support the growth of the DOOH market by creating a more conducive environment for investment and adoption.

Dominant Markets & Segments in Russia OOH and DOOH Market

The Russia OOH and DOOH market exhibits distinct dominance across various segments, reflecting the country's diverse urban landscape and evolving advertising needs. Moscow and Saint Petersburg consistently emerge as the leading regions due to their high population density, economic activity, and concentration of prime advertising locations. These metropolitan areas represent the highest share of advertising expenditure in both OOH and DOOH.

Type Segmentation:

- Digital DOOH (LED Screens, Programmatic OOH, Others): This segment is experiencing the most rapid growth and is projected to become the dominant force within the OOH market. The increasing deployment of high-resolution LED screens in strategic locations, coupled with the rise of programmatic DOOH platforms, is driving this trend. Programmatic OOH, in particular, offers advertisers unprecedented flexibility and efficiency in campaign execution, allowing for real-time adjustments based on data insights. The "Others" category within DOOH includes various interactive and specialized digital formats.

- Static (Traditional) OOH: While still significant, traditional OOH is gradually ceding market share to its digital counterpart. However, classic formats like billboards and transit advertising continue to hold their ground in certain markets due to their cost-effectiveness and broad reach.

Application Segmentation:

- Billboard: Billboards remain a cornerstone of the OOH industry, particularly for large-scale brand visibility. Their dominance is most pronounced in static OOH, but digital billboards are increasingly replacing traditional ones, offering dynamic content capabilities.

- Transportation (Transit): This segment, encompassing airports, buses, metro stations, and railway hubs, is a high-growth area, especially for DOOH. The captive audience in transit environments provides excellent opportunities for advertisers to engage with consumers. Airport advertising, in particular, garners significant attention from a desirable demographic.

- Street Furniture: This category includes bus shelters, kiosks, and public benches, which are increasingly being modernized with digital displays. They offer localized reach and are effective for hyper-targeted campaigns.

- Other Place-Based Media: This encompasses advertising within specific venues like shopping centers, cinemas, gyms, and business centers. Shopping mall advertising is a particularly strong segment, benefiting from high footfall and dwell times.

End-User Industry Segmentation:

- Retail and Consumer Goods: This sector consistently represents the largest advertiser base, leveraging OOH and DOOH for product launches, promotions, and brand building. The ability of DOOH to drive foot traffic to stores is a key advantage.

- Automotive: The automotive industry utilizes OOH extensively for new model launches and brand awareness campaigns, often placing advertisements in high-visibility locations.

- BFSI (Banking, Financial Services, and Insurance): This sector is increasingly adopting DOOH for targeted campaigns, promoting financial products and services to relevant demographics.

- Healthcare: As the healthcare sector expands, OOH and DOOH are being used for public health campaigns and promotion of medical services.

- Other End Users: This broad category includes telecommunications, entertainment, government, and other sectors that contribute to the overall market demand.

Key drivers for the dominance of these segments include urban density, consumer spending power, infrastructure development, and the strategic placement of advertising assets in high-visibility zones. Economic policies that encourage urban development and consumerism further bolster the growth of these dominant markets and segments.

Russia OOH and DOOH Market Product Developments

Product developments in the Russia OOH and DOOH market are primarily centered around enhancing digital capabilities and audience engagement. The proliferation of high-resolution LED screens, offering superior visual clarity and dynamic content display, is a key trend. Innovations in programmatic DOOH are enabling more sophisticated ad buying, real-time campaign management, and data-driven audience targeting. Interactive DOOH solutions, such as touchscreens and augmented reality integrations, are emerging, offering advertisers novel ways to connect with consumers. The integration of AI for audience analytics and campaign optimization is also a significant development, allowing for more personalized and effective advertising strategies. These advancements provide competitive advantages by increasing ad recall, improving campaign ROI, and delivering unique brand experiences in high-traffic environments.

Report Scope & Segmentation Analysis

This report meticulously segments the Russia OOH and DOOH market across several key dimensions to provide a granular understanding of its structure and growth potential. The Type segmentation includes Static (Traditional) OOH and Digital OOH (LED Screens, Programmatic OOH, Others), with Digital DOOH projected to capture a larger market share due to its advanced capabilities. The Application segmentation covers Billboard, Transportation (Transit) (Airports, Others (Buses, etc.)), Street Furniture, and Other Place-Based Media. The Transportation segment, particularly airports and urban transit, is expected to exhibit robust growth. The End-User Industry segmentation analyzes the market across Automotive, Retail and Consumer Goods, Healthcare, BFSI, and Other End Users. The Retail and Consumer Goods sector is anticipated to remain the largest contributor, while other sectors show increasing adoption. Market sizes and growth projections are provided for each segment, alongside analysis of competitive dynamics within them.

Key Drivers of Russia OOH and DOOH Market Growth

The growth of the Russia OOH and DOOH market is propelled by several interconnected factors. Economically, increasing consumer spending and a rebounding economy are boosting advertising budgets. Technologically, the rapid adoption of DOOH, including programmatic buying and advanced LED screen technology, offers greater flexibility, targeting precision, and measurability. Regulatory support for digital infrastructure development and urban modernization projects also plays a crucial role. Furthermore, evolving consumer preferences towards visually engaging and contextually relevant advertising, particularly in urban centers, drives demand for innovative OOH solutions. The increasing digitalization of daily life and the enhanced audience engagement potential of DOOH platforms are fundamental catalysts for market expansion.

Challenges in the Russia OOH and DOOH Market Sector

Despite its growth potential, the Russia OOH and DOOH market faces several challenges. Regulatory hurdles and complexities in obtaining permits for new installations, particularly for digital billboards, can slow down deployment. Economic volatility and fluctuating advertising budgets can impact investment in OOH campaigns. Competition from digital media channels, including social media and online video, presents an ongoing challenge for market share. Supply chain disruptions and the cost of advanced digital hardware can also pose financial constraints for smaller operators. Furthermore, the accurate measurement and attribution of OOH campaign effectiveness in a rapidly changing digital landscape require continuous innovation and standardization.

Emerging Opportunities in Russia OOH and DOOH Market

Emerging opportunities in the Russia OOH and DOOH market are significant, driven by technological advancements and evolving consumer engagement strategies. The expansion of programmatic DOOH offers unprecedented opportunities for data-driven targeting and automated media buying, creating new avenues for advertisers to reach specific demographics efficiently. The increasing penetration of 5G networks will enable richer, more interactive DOOH experiences, including augmented reality and real-time content personalization. Growing demand for localized and hyper-targeted advertising presents opportunities for street furniture and transit advertising in smaller cities and residential areas. The integration of OOH with mobile advertising and other digital channels opens up possibilities for creating seamless omnichannel marketing campaigns, enhancing overall campaign impact and measurability.

Leading Players in the Russia OOH and DOOH Market Market

- JCDecaux

- Ströer SE & Co KGaA

- Clear Channel Outdoor Holdings Inc

- Russ Outdoor

- Talon Outdoor

Key Developments in Russia OOH and DOOH Market Industry

- May 2024: The digital facade of Moscow's Salute Hotel, a 1,210 square meter vertical LED screen on Leningradsky Prospekt, demonstrated significant campaign effectiveness. An RMAA DOOH campaign tied to this installation achieved over 140,000 views in a single day, highlighting the immense reach of large-format digital displays.

- May 2024: The Riviera shopping center unveiled a 1,164 square meter vertical advertising surface on its facade. This prominent placement is strategically designed to capture the attention of both road and pedestrian traffic in a high-activity retail environment, showcasing the power of facade advertising for commercial success.

Strategic Outlook for Russia OOH and DOOH Market Market

The strategic outlook for the Russia OOH and DOOH market is highly positive, fueled by ongoing digital transformation and a robust demand for engaging advertising solutions. The continued expansion of Digital Out-of-Home (DOOH) infrastructure, particularly in major urban centers, will drive growth through programmatic buying, dynamic content, and enhanced audience targeting capabilities. Investments in advanced LED screen technology and interactive displays will further elevate the advertising experience, leading to increased campaign effectiveness and advertiser satisfaction. The strategic integration of DOOH with mobile and other digital channels presents a significant opportunity for creating cohesive omnichannel campaigns that maximize brand impact and consumer engagement. As the market matures, a focus on data analytics and measurement will become paramount, enabling advertisers to optimize their spend and demonstrate clear ROI, solidifying DOOH's position as a vital component of the modern advertising mix.

Russia OOH and DOOH Market Segmentation

-

1. Type

- 1.1. Static (Traditional) OOH

-

1.2. Digital OOH (LED Screens)

- 1.2.1. Programmatic OOH

- 1.2.2. Others

-

2. Application

- 2.1. Billboard

-

2.2. Transportation (Transit)

- 2.2.1. Airports

- 2.2.2. Others (Buses, etc.)

- 2.3. Street Furniture

- 2.4. Other Place-Based Media

-

3. End-User Industry

- 3.1. Automotive

- 3.2. Retail and Consumer Goods

- 3.3. Healthcare

- 3.4. BFSI

- 3.5. Other End Users

Russia OOH and DOOH Market Segmentation By Geography

- 1. Russia

Russia OOH and DOOH Market Regional Market Share

Geographic Coverage of Russia OOH and DOOH Market

Russia OOH and DOOH Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ongoing Shift Towards Digital Advertising Aided By Increased Spending On Smart City Projects; Increase in Air Traffic owing to Growth in Tourism Industry has aided the spending on Airport Advertisement in Vietnam

- 3.3. Market Restrains

- 3.3.1. Ongoing Shift Towards Digital Advertising Aided By Increased Spending On Smart City Projects; Increase in Air Traffic owing to Growth in Tourism Industry has aided the spending on Airport Advertisement in Vietnam

- 3.4. Market Trends

- 3.4.1. Digital OOH (LED Screens) to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia OOH and DOOH Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Static (Traditional) OOH

- 5.1.2. Digital OOH (LED Screens)

- 5.1.2.1. Programmatic OOH

- 5.1.2.2. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Billboard

- 5.2.2. Transportation (Transit)

- 5.2.2.1. Airports

- 5.2.2.2. Others (Buses, etc.)

- 5.2.3. Street Furniture

- 5.2.4. Other Place-Based Media

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Automotive

- 5.3.2. Retail and Consumer Goods

- 5.3.3. Healthcare

- 5.3.4. BFSI

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 JCDecaux

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ströer SE & Co KGaA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Clear Channel Outdoor Holdings Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Russ Outdoor

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Talon Outdoor*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 JCDecaux

List of Figures

- Figure 1: Russia OOH and DOOH Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Russia OOH and DOOH Market Share (%) by Company 2025

List of Tables

- Table 1: Russia OOH and DOOH Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Russia OOH and DOOH Market Volume Million Forecast, by Type 2020 & 2033

- Table 3: Russia OOH and DOOH Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Russia OOH and DOOH Market Volume Million Forecast, by Application 2020 & 2033

- Table 5: Russia OOH and DOOH Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: Russia OOH and DOOH Market Volume Million Forecast, by End-User Industry 2020 & 2033

- Table 7: Russia OOH and DOOH Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Russia OOH and DOOH Market Volume Million Forecast, by Region 2020 & 2033

- Table 9: Russia OOH and DOOH Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Russia OOH and DOOH Market Volume Million Forecast, by Type 2020 & 2033

- Table 11: Russia OOH and DOOH Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Russia OOH and DOOH Market Volume Million Forecast, by Application 2020 & 2033

- Table 13: Russia OOH and DOOH Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 14: Russia OOH and DOOH Market Volume Million Forecast, by End-User Industry 2020 & 2033

- Table 15: Russia OOH and DOOH Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Russia OOH and DOOH Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia OOH and DOOH Market?

The projected CAGR is approximately 6.90%.

2. Which companies are prominent players in the Russia OOH and DOOH Market?

Key companies in the market include JCDecaux, Ströer SE & Co KGaA, Clear Channel Outdoor Holdings Inc, Russ Outdoor, Talon Outdoor*List Not Exhaustive.

3. What are the main segments of the Russia OOH and DOOH Market?

The market segments include Type , Application , End-User Industry .

4. Can you provide details about the market size?

The market size is estimated to be USD 621.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Ongoing Shift Towards Digital Advertising Aided By Increased Spending On Smart City Projects; Increase in Air Traffic owing to Growth in Tourism Industry has aided the spending on Airport Advertisement in Vietnam.

6. What are the notable trends driving market growth?

Digital OOH (LED Screens) to Drive the Market.

7. Are there any restraints impacting market growth?

Ongoing Shift Towards Digital Advertising Aided By Increased Spending On Smart City Projects; Increase in Air Traffic owing to Growth in Tourism Industry has aided the spending on Airport Advertisement in Vietnam.

8. Can you provide examples of recent developments in the market?

May 2024 - One notable instance was the digital facade of Moscow's Salute Hotel, situated on Leningradsky Prospekt. Covering a vast expanse of 1,210 square meters, the screen stands out for its vertical alignment on the hotel's facade. RMAA's DOOH campaign tied to this installation proved highly effective, garnering over 140,000 views in a single day.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia OOH and DOOH Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia OOH and DOOH Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia OOH and DOOH Market?

To stay informed about further developments, trends, and reports in the Russia OOH and DOOH Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence