Key Insights

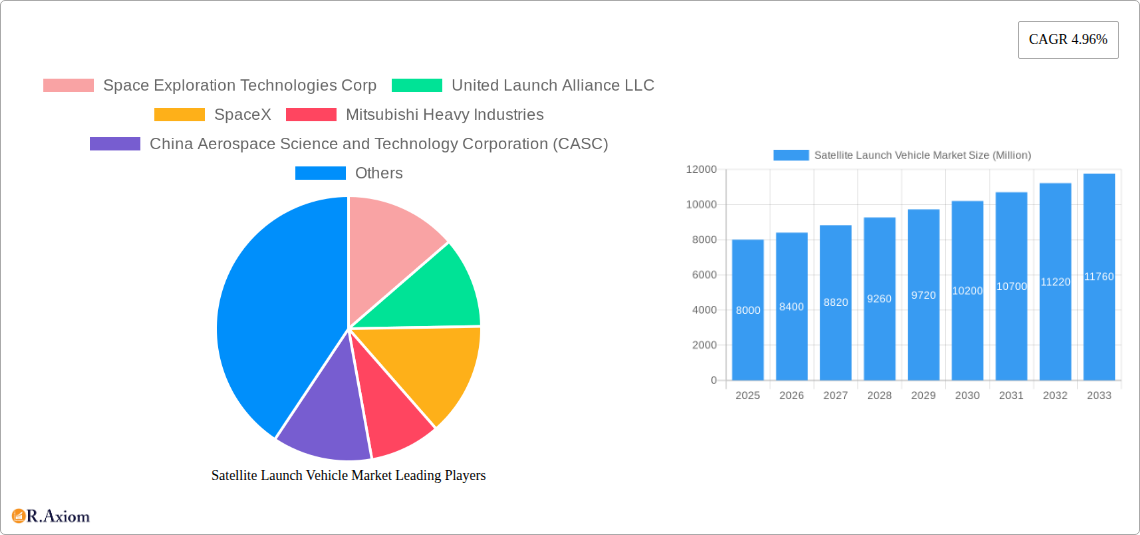

The global satellite launch vehicle market is projected for substantial expansion, propelled by escalating demand for satellite-enabled services across telecommunications, navigation, Earth observation, and defense sectors. With a Compound Annual Growth Rate (CAGR) of 3.7%, the market is forecasted to reach 442.33 billion by 2025. Key growth drivers include technological advancements in launch vehicles enhancing payload capacity and reducing costs, the rise of satellite constellations, and government-backed space initiatives. The market is segmented by orbit class (GEO, LEO, MEO) and Maximum Take-Off Weight (MTOW) (Heavy, Interplanetary, Light, Medium), catering to diverse industry needs. Intense competition exists among established players like SpaceX, United Launch Alliance, and Arianespace, alongside emerging entities from China and India. The heavy-lift segment is poised for significant growth driven by demand for large communication satellites and space exploration. Light and medium-lift segments are rapidly expanding due to the increasing deployment of small satellites. Despite regulatory challenges and launch risks, the market outlook is optimistic, fueled by continuous innovation and broadening satellite applications.

Satellite Launch Vehicle Market Market Size (In Billion)

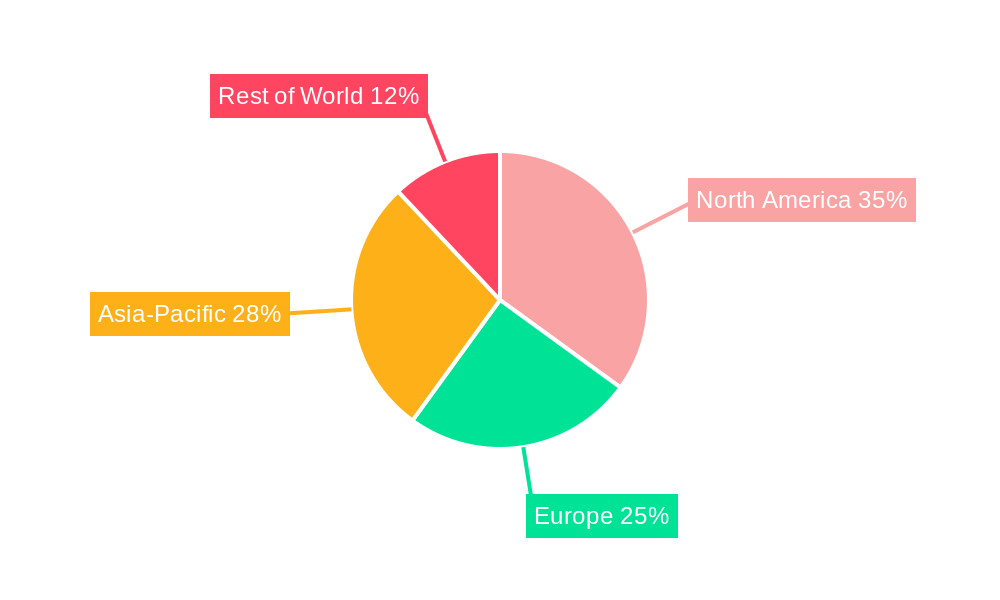

Geographically, market dominance is expected in regions with advanced technological capabilities and significant government investment in space programs, notably North America and Europe. Emerging economies, particularly China and India, are increasing their participation, contributing to global expansion. The forecast period of 2025-2033 offers considerable market growth potential, contingent on sustained technological innovation and supportive regulatory environments. The successful integration of reusable launch vehicle technology will be pivotal in cost reduction and further market stimulation.

Satellite Launch Vehicle Market Company Market Share

Satellite Launch Vehicle Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Satellite Launch Vehicle market, covering the historical period (2019-2024), base year (2025), and forecast period (2025-2033). It offers actionable insights for industry stakeholders, investors, and strategic decision-makers, incorporating key market trends, competitive dynamics, and future growth prospects. The report utilizes rigorous data analysis and expert insights to present a clear and concise picture of this dynamic market. Expected market value (in Million) are provided where data is available, otherwise estimations are used.

Satellite Launch Vehicle Market Market Concentration & Innovation

This section analyzes the market concentration, identifying key players and their market share. It explores innovation drivers, regulatory landscapes, and the impact of mergers and acquisitions (M&A) activities on market dynamics. The study period covers 2019-2033, providing a comprehensive historical and future outlook. Several metrics are used to quantify market concentration, including the Herfindahl-Hirschman Index (HHI) and the top 5 market share. M&A activity is analyzed based on deal values and strategic implications for the competitive landscape. The impact of government regulations, technological advancements, and substitute technologies are also evaluated.

- Market Concentration: The market is moderately concentrated, with a few major players holding significant market share. SpaceX, United Launch Alliance, and ArianeGroup are currently dominant players. Precise market share data for each company is available in the full report, calculated for 2025. The HHI is estimated to be xx in 2025.

- Innovation Drivers: The drive for miniaturization, reusability, and increased payload capacity are major innovation drivers. The development of more efficient and cost-effective launch vehicles is crucial.

- Regulatory Frameworks: International space laws and national regulations significantly influence the market. Licensing, environmental impact assessments, and safety regulations impact operations.

- Product Substitutes: While no direct substitutes exist, alternative satellite deployment methods like air launch systems are emerging.

- End-User Trends: Demand is driven by growing commercial satellite applications, including broadband internet, Earth observation, and navigation. Government space programs remain significant contributors.

- M&A Activities: The report details recent M&A activity in the satellite launch vehicle industry, including deal values (xx Million in the last five years) and strategic rationale behind the acquisitions.

Satellite Launch Vehicle Market Industry Trends & Insights

This section provides a comprehensive overview of the Satellite Launch Vehicle market's growth trajectory. It analyzes key market drivers, technological disruptions, shifting consumer preferences, and the intensifying competitive dynamics. The report leverages a robust methodology combining market sizing, forecasting, and competitive analysis to provide a comprehensive understanding of the market's evolution and future prospects. Key performance indicators like Compound Annual Growth Rate (CAGR) and market penetration are utilized to illustrate market trends. The forecast period is 2025-2033. The estimated CAGR is xx% during the forecast period. The market penetration of reusable launch vehicles is expected to increase to xx% by 2033.

Dominant Markets & Segments in Satellite Launch Vehicle Market

This section identifies the dominant regional markets and segments within the Satellite Launch Vehicle market. The analysis considers Orbit Class (GEO, LEO, MEO) and Launch Vehicle MTOW (Heavy, Interplanetary, Light, Medium). Key drivers of dominance, such as economic policies, infrastructure development, and government support, are analyzed for each segment.

Orbit Class: LEO remains the largest segment due to the proliferation of small satellites for Earth observation and communication. GEO remains crucial for global communication networks. MEO is a growing segment, facilitating navigation and communication systems.

Launch Vehicle MTOW: The Heavy-lift segment commands a significant share, driven by large satellite deployments and interplanetary missions. The Medium-lift segment shows consistent growth due to its cost-effectiveness. Light-lift is primarily used for smaller payloads and research missions. The Interplanetary segment is a smaller, but high-value niche market.

Regional Dominance: The North American market currently holds a significant share. However, the Asia-Pacific region, particularly China, is experiencing rapid growth due to substantial investments in space exploration.

Key Drivers (by Segment):

- LEO: Increased demand for small satellites, lower launch costs.

- GEO: Demand for high-bandwidth communication, stable orbital position.

- MEO: Navigation and communication needs, cost-effective than GEO.

- Heavy-lift: Government space programs, large commercial satellite constellations.

- Medium-lift: Cost-effectiveness, versatility.

Satellite Launch Vehicle Market Product Developments

The Satellite Launch Vehicle market is experiencing rapid technological advancements. The trend is towards reusable launch vehicles, which significantly reduce launch costs. Increased payload capacity and improved reliability are crucial competitive advantages. These innovations are driven by the demand for more cost-effective and efficient access to space. Advanced propulsion systems and improved guidance systems are enhancing performance. The market is also witnessing the development of innovative materials and manufacturing techniques that contribute to lighter, more durable vehicles.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Satellite Launch Vehicle market, segmented by orbit class (GEO, LEO, MEO) and launch vehicle MTOW (Heavy, Interplanetary, Light, Medium). Each segment's growth projections, market size, and competitive dynamics are analyzed. The historical period is 2019-2024, the base year is 2025, and the forecast period is 2025-2033. Specific market sizes for each segment in Million for 2025 and projected 2033 are provided in the full report. Competitive dynamics within each segment are analyzed in detail.

Key Drivers of Satellite Launch Vehicle Market Growth

Several key factors drive the growth of the Satellite Launch Vehicle market. The increasing demand for satellite-based services like broadband internet and Earth observation fuels market expansion. Technological advancements, particularly in reusable launch vehicles, are lowering launch costs, making space access more affordable. Government investments in space exploration initiatives also significantly contribute to market growth. Lastly, supportive regulatory frameworks encourage private sector participation and innovation.

Challenges in the Satellite Launch Vehicle Market Sector

Despite significant growth, the Satellite Launch Vehicle market faces several challenges. High initial investment costs, technological complexities, and stringent safety regulations pose significant barriers to entry. Supply chain disruptions and geopolitical uncertainties can impact launch schedules and costs. Intense competition among established players and new entrants creates pressure on pricing and margins. The dependence on government contracts for a significant portion of the revenue can lead to market volatility.

Emerging Opportunities in Satellite Launch Vehicle Market

Emerging opportunities exist in several areas. The increasing demand for small satellites and constellations opens avenues for smaller, more agile launch providers. Advancements in propulsion technologies, such as electric propulsion, offer greater fuel efficiency and payload capacity. New markets, such as space tourism and in-space manufacturing, create additional demand for launch services. Finally, collaboration between government and private sector actors fuels innovation.

Leading Players in the Satellite Launch Vehicle Market Market

- Space Exploration Technologies Corp (SpaceX)

- United Launch Alliance LLC

- Mitsubishi Heavy Industries

- China Aerospace Science and Technology Corporation (CASC)

- Ariane Group

- ROSCOSMOS

- Northrop Grumman Corporation

- Indian Space Research Organisation (ISRO)

- The Boeing Company

Key Developments in Satellite Launch Vehicle Market Industry

- March 2023: ISRO launched 36 OneWeb communication satellites into LEO using its LVM3 rocket, showcasing the growing demand for LEO constellations.

- August 2022: United Launch Alliance launched the SBIRS GEO-6 satellite for the US Air Force, highlighting the continued reliance on GEO for defense applications.

- April 2022: China launched the Chinasat 6D communication satellite using the Long March 3B rocket, demonstrating China's advancements in space technology. These developments showcase the increasing competitiveness in the satellite launch vehicle market and the diversification of launch capabilities across different orbit classes.

Strategic Outlook for Satellite Launch Vehicle Market Market

The Satellite Launch Vehicle market is poised for significant growth driven by the increasing demand for satellite-based services and technological advancements, such as reusable launch systems. The market will continue to evolve with new players entering and existing players expanding their capabilities. Strategic partnerships and collaborations between companies will be key to success. Focus on reducing launch costs, improving reliability, and offering flexible launch solutions will be critical for competitive advantage. The market shows strong potential for sustained growth in the coming decade.

Satellite Launch Vehicle Market Segmentation

-

1. Orbit Class

- 1.1. GEO

- 1.2. LEO

- 1.3. MEO

-

2. Launch Vehicle Mtow

- 2.1. Heavy

- 2.2. Inter Planetary

- 2.3. Light

- 2.4. Medium

Satellite Launch Vehicle Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Satellite Launch Vehicle Market Regional Market Share

Geographic Coverage of Satellite Launch Vehicle Market

Satellite Launch Vehicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Satellite Launch Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Orbit Class

- 5.1.1. GEO

- 5.1.2. LEO

- 5.1.3. MEO

- 5.2. Market Analysis, Insights and Forecast - by Launch Vehicle Mtow

- 5.2.1. Heavy

- 5.2.2. Inter Planetary

- 5.2.3. Light

- 5.2.4. Medium

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Orbit Class

- 6. North America Satellite Launch Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Orbit Class

- 6.1.1. GEO

- 6.1.2. LEO

- 6.1.3. MEO

- 6.2. Market Analysis, Insights and Forecast - by Launch Vehicle Mtow

- 6.2.1. Heavy

- 6.2.2. Inter Planetary

- 6.2.3. Light

- 6.2.4. Medium

- 6.1. Market Analysis, Insights and Forecast - by Orbit Class

- 7. South America Satellite Launch Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Orbit Class

- 7.1.1. GEO

- 7.1.2. LEO

- 7.1.3. MEO

- 7.2. Market Analysis, Insights and Forecast - by Launch Vehicle Mtow

- 7.2.1. Heavy

- 7.2.2. Inter Planetary

- 7.2.3. Light

- 7.2.4. Medium

- 7.1. Market Analysis, Insights and Forecast - by Orbit Class

- 8. Europe Satellite Launch Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Orbit Class

- 8.1.1. GEO

- 8.1.2. LEO

- 8.1.3. MEO

- 8.2. Market Analysis, Insights and Forecast - by Launch Vehicle Mtow

- 8.2.1. Heavy

- 8.2.2. Inter Planetary

- 8.2.3. Light

- 8.2.4. Medium

- 8.1. Market Analysis, Insights and Forecast - by Orbit Class

- 9. Middle East & Africa Satellite Launch Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Orbit Class

- 9.1.1. GEO

- 9.1.2. LEO

- 9.1.3. MEO

- 9.2. Market Analysis, Insights and Forecast - by Launch Vehicle Mtow

- 9.2.1. Heavy

- 9.2.2. Inter Planetary

- 9.2.3. Light

- 9.2.4. Medium

- 9.1. Market Analysis, Insights and Forecast - by Orbit Class

- 10. Asia Pacific Satellite Launch Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Orbit Class

- 10.1.1. GEO

- 10.1.2. LEO

- 10.1.3. MEO

- 10.2. Market Analysis, Insights and Forecast - by Launch Vehicle Mtow

- 10.2.1. Heavy

- 10.2.2. Inter Planetary

- 10.2.3. Light

- 10.2.4. Medium

- 10.1. Market Analysis, Insights and Forecast - by Orbit Class

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Space Exploration Technologies Corp

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 United Launch Alliance LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SpaceX

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mitsubishi Heavy Industries

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 China Aerospace Science and Technology Corporation (CASC)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ariane Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ROSCOSMOS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Northrop Grumman Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Indian Space Research Organisation (ISRO)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 The Boeing Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Space Exploration Technologies Corp

List of Figures

- Figure 1: Global Satellite Launch Vehicle Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Satellite Launch Vehicle Market Revenue (billion), by Orbit Class 2025 & 2033

- Figure 3: North America Satellite Launch Vehicle Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 4: North America Satellite Launch Vehicle Market Revenue (billion), by Launch Vehicle Mtow 2025 & 2033

- Figure 5: North America Satellite Launch Vehicle Market Revenue Share (%), by Launch Vehicle Mtow 2025 & 2033

- Figure 6: North America Satellite Launch Vehicle Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Satellite Launch Vehicle Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Satellite Launch Vehicle Market Revenue (billion), by Orbit Class 2025 & 2033

- Figure 9: South America Satellite Launch Vehicle Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 10: South America Satellite Launch Vehicle Market Revenue (billion), by Launch Vehicle Mtow 2025 & 2033

- Figure 11: South America Satellite Launch Vehicle Market Revenue Share (%), by Launch Vehicle Mtow 2025 & 2033

- Figure 12: South America Satellite Launch Vehicle Market Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Satellite Launch Vehicle Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Satellite Launch Vehicle Market Revenue (billion), by Orbit Class 2025 & 2033

- Figure 15: Europe Satellite Launch Vehicle Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 16: Europe Satellite Launch Vehicle Market Revenue (billion), by Launch Vehicle Mtow 2025 & 2033

- Figure 17: Europe Satellite Launch Vehicle Market Revenue Share (%), by Launch Vehicle Mtow 2025 & 2033

- Figure 18: Europe Satellite Launch Vehicle Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Satellite Launch Vehicle Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Satellite Launch Vehicle Market Revenue (billion), by Orbit Class 2025 & 2033

- Figure 21: Middle East & Africa Satellite Launch Vehicle Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 22: Middle East & Africa Satellite Launch Vehicle Market Revenue (billion), by Launch Vehicle Mtow 2025 & 2033

- Figure 23: Middle East & Africa Satellite Launch Vehicle Market Revenue Share (%), by Launch Vehicle Mtow 2025 & 2033

- Figure 24: Middle East & Africa Satellite Launch Vehicle Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Satellite Launch Vehicle Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Satellite Launch Vehicle Market Revenue (billion), by Orbit Class 2025 & 2033

- Figure 27: Asia Pacific Satellite Launch Vehicle Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 28: Asia Pacific Satellite Launch Vehicle Market Revenue (billion), by Launch Vehicle Mtow 2025 & 2033

- Figure 29: Asia Pacific Satellite Launch Vehicle Market Revenue Share (%), by Launch Vehicle Mtow 2025 & 2033

- Figure 30: Asia Pacific Satellite Launch Vehicle Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Satellite Launch Vehicle Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Satellite Launch Vehicle Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 2: Global Satellite Launch Vehicle Market Revenue billion Forecast, by Launch Vehicle Mtow 2020 & 2033

- Table 3: Global Satellite Launch Vehicle Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Satellite Launch Vehicle Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 5: Global Satellite Launch Vehicle Market Revenue billion Forecast, by Launch Vehicle Mtow 2020 & 2033

- Table 6: Global Satellite Launch Vehicle Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Satellite Launch Vehicle Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 11: Global Satellite Launch Vehicle Market Revenue billion Forecast, by Launch Vehicle Mtow 2020 & 2033

- Table 12: Global Satellite Launch Vehicle Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Satellite Launch Vehicle Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 17: Global Satellite Launch Vehicle Market Revenue billion Forecast, by Launch Vehicle Mtow 2020 & 2033

- Table 18: Global Satellite Launch Vehicle Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Satellite Launch Vehicle Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 29: Global Satellite Launch Vehicle Market Revenue billion Forecast, by Launch Vehicle Mtow 2020 & 2033

- Table 30: Global Satellite Launch Vehicle Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Satellite Launch Vehicle Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 38: Global Satellite Launch Vehicle Market Revenue billion Forecast, by Launch Vehicle Mtow 2020 & 2033

- Table 39: Global Satellite Launch Vehicle Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Satellite Launch Vehicle Market?

The projected CAGR is approximately 3.7%.

2. Which companies are prominent players in the Satellite Launch Vehicle Market?

Key companies in the market include Space Exploration Technologies Corp, United Launch Alliance LLC, SpaceX, Mitsubishi Heavy Industries, China Aerospace Science and Technology Corporation (CASC), Ariane Group, ROSCOSMOS, Northrop Grumman Corporation, Indian Space Research Organisation (ISRO), The Boeing Company.

3. What are the main segments of the Satellite Launch Vehicle Market?

The market segments include Orbit Class, Launch Vehicle Mtow.

4. Can you provide details about the market size?

The market size is estimated to be USD 442.33 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2023: ISRO launched 36 communication satellites of Oneweb aboarding its LVM3 rocket into LEO.August 2022: United Launch Alliance's Atlas V rocket carried SBIRS GEO-6, built by Lockheed Martin for the US Air Force, was launched from the Cape Canaveral Space Force Station.April 2022: The Long March 3B rocket lifted off from the Xichang launch base with the Chinasat 6D, or Zhongxing 6D, communications satellite.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Satellite Launch Vehicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Satellite Launch Vehicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Satellite Launch Vehicle Market?

To stay informed about further developments, trends, and reports in the Satellite Launch Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence