Key Insights

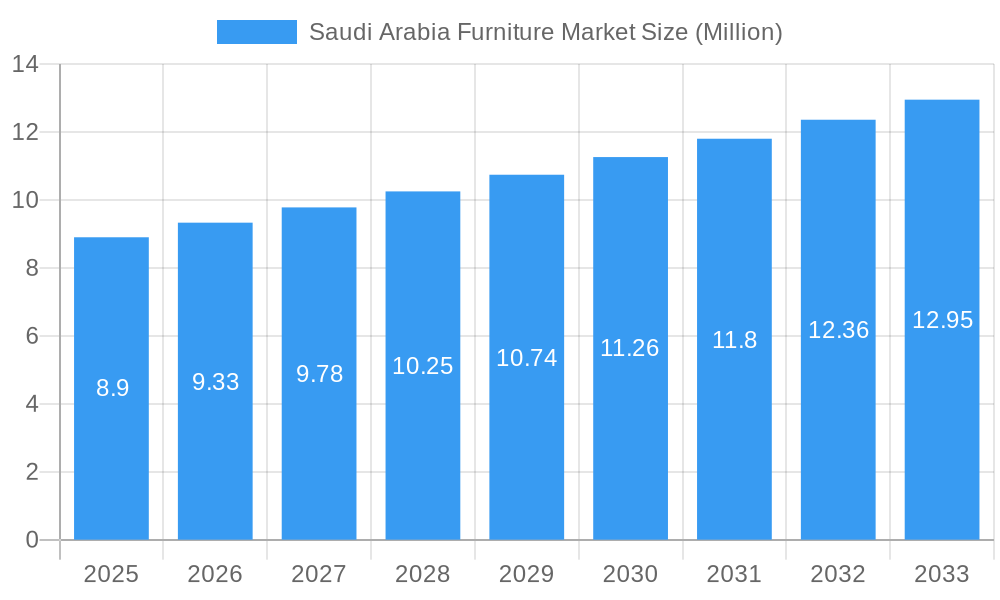

The Saudi Arabia furniture market is poised for robust growth, projected to reach $8.90 million in 2025 and expand at a Compound Annual Growth Rate (CAGR) of 4.79% through 2033. This expansion is driven by a dynamic blend of factors, including significant government initiatives aimed at boosting the construction and real estate sectors, a burgeoning young population with evolving lifestyle preferences, and increased disposable incomes fueling demand for aesthetically pleasing and functional home and office furnishings. The "Vision 2030" blueprint is a pivotal catalyst, encouraging diversification of the economy and attracting foreign investment, which in turn creates new commercial spaces and residential projects, directly impacting the furniture industry. Furthermore, a growing emphasis on interior design and home renovation, amplified by social media trends and increased exposure to global styles, is driving consumers towards higher-quality and more contemporary furniture options. This presents a fertile ground for both established local players and international brands to capitalize on the evolving consumer tastes and the nation's development ambitions.

Saudi Arabia Furniture Market Market Size (In Million)

The market segmentation reveals a diverse landscape. In terms of materials, wood and metal furniture currently hold significant shares, reflecting both traditional preferences and modern industrial aesthetics. However, there is a discernible upward trend in the demand for plastic and other innovative materials, driven by their durability, affordability, and design flexibility. Application-wise, home furniture remains the dominant segment, followed closely by office furniture, as businesses expand and adopt modern workspaces. The hospitality sector also presents a substantial growth opportunity, fueled by the kingdom's push to become a global tourism hub. Distribution channels are also undergoing a transformation; while supermarkets and hypermarkets continue to cater to basic needs, specialty stores are gaining traction for premium offerings, and the online channel is witnessing exponential growth, offering convenience and a wider selection to consumers. Key players like IKEA, HomeCenter, and Riyadh Furniture Industries Co. are actively shaping this market through innovation and strategic expansion, catering to the diverse needs of the Saudi consumer base.

Saudi Arabia Furniture Market Company Market Share

Saudi Arabia Furniture Market: Market Concentration & Innovation

The Saudi Arabia furniture market is characterized by a moderately concentrated landscape, with a few dominant players and a significant number of regional and specialized manufacturers. Innovation is a key differentiator, driven by increasing consumer demand for modern, sustainable, and technologically integrated furniture solutions. Regulatory frameworks are evolving to support local manufacturing and promote quality standards, impacting market entry and product development. Product substitutes, such as rental services and DIY solutions, present a growing challenge, particularly in the urban segments. End-user trends are heavily influenced by Vision 2030 initiatives, spurring demand for both residential and commercial furniture to support infrastructure development and a growing expatriate population. Mergers and acquisitions (M&A) are relatively infrequent but are strategic moves to gain market share or acquire innovative technologies. Market share estimates for top players range from 15% to 25%, while M&A deal values are projected to be in the tens of millions of Saudi Riyals.

- Innovation Drivers:

- Smart furniture solutions with integrated technology.

- Sustainable and eco-friendly material sourcing.

- Customization and personalized design offerings.

- Enhanced in-store and online customer experiences.

- Regulatory Frameworks:

- Increasing emphasis on local content and manufacturing.

- Stricter quality control and safety standards.

- Incentives for furniture manufacturers establishing operations in the Kingdom.

- Product Substitutes:

- Furniture rental services for temporary needs.

- Affordable, ready-to-assemble (RTA) furniture options.

- DIY furniture kits and modification services.

- End-User Trends:

- Demand for stylish and functional home furniture for new residential projects.

- Growth in office furniture to support evolving work environments.

- Increased need for hospitality furniture for the booming tourism sector.

- M&A Activities:

- Targeted acquisitions to expand product portfolios.

- Strategic partnerships to enter new market segments.

Saudi Arabia Furniture Market Industry Trends & Insights

The Saudi Arabia furniture market is experiencing robust growth, propelled by a confluence of economic reforms, burgeoning population, and a significant surge in construction and real estate development, particularly within the context of Vision 2030. The compound annual growth rate (CAGR) for the furniture market is anticipated to be approximately 7.5% to 9% during the forecast period of 2025–2033. This expansion is underpinned by increasing disposable incomes, a growing middle-class segment with a penchant for modern aesthetics, and a substantial influx of expatriate residents contributing to a heightened demand for diverse furniture styles. Technological advancements are playing a pivotal role, with manufacturers increasingly adopting automation in production, sophisticated design software, and e-commerce platforms to enhance efficiency and reach. The market penetration of online furniture sales is projected to climb from approximately 15% to over 30% by 2033, reflecting a significant shift in consumer purchasing behavior. Consumer preferences are leaning towards a blend of contemporary design, comfort, and durability, with a rising interest in customizable options and sustainable materials. The competitive landscape is dynamic, featuring both established international brands and agile local manufacturers striving to cater to evolving tastes. Key growth drivers include the giga-projects like NEOM, Red Sea Project, and Qiddiya, which are creating substantial demand for furniture across residential, hospitality, and commercial sectors. Furthermore, government initiatives aimed at boosting local manufacturing and diversifying the economy are fostering a more competitive and innovative environment. The increasing adoption of smart home technology is also influencing furniture design, leading to the integration of features like wireless charging, adjustable lighting, and ergonomic adjustments. The market’s trajectory is also influenced by global design trends, with Scandinavian, minimalist, and industrial styles gaining traction, alongside a growing appreciation for artisanal and handcrafted pieces. The retail sector is also undergoing a transformation, with a move towards experiential retail spaces that offer a more engaging and personalized shopping journey. This includes the integration of augmented reality (AR) and virtual reality (VR) tools to help customers visualize furniture in their own spaces. The overall industry is poised for sustained expansion, driven by a strong foundation of economic development and a dynamic consumer base.

Dominant Markets & Segments in Saudi Arabia Furniture Market

The Saudi Arabia furniture market is experiencing significant dynamism across its various segments, with Home Furniture emerging as the dominant application, driven by the Kingdom's ambitious housing initiatives and a growing population. The Wood segment, within materials, continues to hold a substantial market share due to its aesthetic appeal, durability, and traditional preference in the region. However, Metal and Plastic & Other Materials are witnessing robust growth, fueled by demand for contemporary designs, affordability, and lighter, more modular furniture solutions.

Dominant Application: Home Furniture

- Key Drivers: Vision 2030's focus on increasing homeownership, construction of new residential units, and a rising expatriate population seeking furnished living spaces. This segment is expected to constitute over 55% of the total market value.

- Detailed Dominance Analysis: The demand for living room sets, bedroom furniture, dining sets, and modular kitchen systems is exceptionally high. Consumers are increasingly seeking furniture that combines functionality with modern aesthetics. The growth of the middle-income segment is also a significant factor, driving demand for mid-range and premium home furnishings. The ongoing development of integrated communities and smart cities further amplifies the need for sophisticated and aesthetically pleasing home furniture.

Dominant Material: Wood

- Key Drivers: Enduring preference for natural materials, perceived quality and longevity, and the availability of local and imported timber. This segment is projected to hold around 45% of the material market.

- Detailed Dominance Analysis: Traditional and contemporary wooden furniture, including solid wood and engineered wood products like MDF and plywood, are highly sought after. The craftsmanship and design versatility of wood make it a preferred choice for various furniture types, from intricate carvings to sleek, modern designs. The growing emphasis on sustainable sourcing and eco-friendly finishes is also influencing the wood segment.

Emerging Distribution Channel: Online

- Key Drivers: Increasing internet penetration, smartphone adoption, and the convenience of e-commerce. The online segment is experiencing rapid growth, with projections indicating it will capture over 30% of the market share by 2033.

- Detailed Dominance Analysis: The shift towards online purchasing is evident across all furniture categories. Leading retailers are investing heavily in their e-commerce platforms, offering a seamless user experience, detailed product information, and efficient delivery services. This channel provides greater accessibility to a wider range of products and competitive pricing, appealing to a broad spectrum of consumers, especially the younger demographic.

Significant Segment: Office Furniture

- Key Drivers: Expansion of the corporate sector, the establishment of new businesses, and the evolving nature of workplaces aiming for more ergonomic and collaborative designs.

- Detailed Dominance Analysis: Demand for ergonomic chairs, modular workstations, executive desks, and meeting room furniture is strong. The focus on employee well-being and productivity is driving investment in high-quality office furniture.

Growth Segment: Hospitality Furniture

- Key Drivers: Massive investments in tourism infrastructure, including hotels, resorts, and entertainment venues, driven by Vision 2030.

- Detailed Dominance Analysis: This segment encompasses furniture for hotel rooms, lobbies, restaurants, and recreational areas. Durability, aesthetic appeal, and compliance with specific brand standards are crucial.

Saudi Arabia Furniture Market Product Developments

Product development in the Saudi Arabia furniture market is characterized by an increasing emphasis on smart functionality, sustainability, and customization. Manufacturers are integrating technology into furniture, offering solutions with built-in charging ports, adjustable lighting, and ergonomic controls. A significant trend is the adoption of eco-friendly materials and production processes, responding to growing consumer environmental consciousness. Customized furniture, tailored to specific dimensions and design preferences, is gaining traction as consumers seek unique pieces that reflect their personal style and optimize their living or working spaces. These innovations aim to enhance user experience, promote well-being, and align with modern lifestyle demands, providing a competitive edge in a discerning market.

Saudi Arabia Furniture Market Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Saudi Arabia furniture market, segmented by material, application, and distribution channel. The material segment includes Wood, Metal, and Plastic & Other Materials, with Wood expected to dominate due to traditional preferences, while Metal and Plastic & Other Materials are poised for significant growth driven by modern designs and affordability. The application segment is led by Home Furniture, fueled by residential development, followed by Office Furniture and Hospitality Furniture, which are experiencing robust expansion due to economic diversification and tourism initiatives. The distribution channel segment sees a rapid shift towards Online channels, reflecting changing consumer purchasing habits, alongside continued strength in Specialty Stores and a developing presence of Supermarkets & Hypermarkets for certain furniture categories. Growth projections for these segments vary, with Online channels and Hospitality Furniture expected to exhibit the highest CAGRs.

- Material: Wood, Metal, Plastic & Other Materials.

- Application: Home Furniture, Office Furniture, Hospitality Furniture, Other Applications.

- Distribution Channel: Supermarkets & Hypermarkets, Specialty Stores, Online, Other Distribution Channels.

Key Drivers of Saudi Arabia Furniture Market Growth

Several key drivers are propelling the Saudi Arabia furniture market forward. Vision 2030 initiatives are a primary catalyst, driving massive investments in real estate development, tourism infrastructure, and the creation of new urban centers, consequently boosting demand for furniture across residential, hospitality, and commercial sectors. Increasing disposable incomes and a growing young population with a preference for modern and aesthetically pleasing furniture further stimulate consumption. The government's focus on local manufacturing and economic diversification also encourages investment in the furniture industry, leading to enhanced product offerings and competitive pricing. Technological advancements in production, design, and e-commerce are improving efficiency and expanding market reach.

- Vision 2030 Mega-Projects: Fueling demand in residential, hospitality, and commercial spaces.

- Economic Growth & Rising Disposable Incomes: Increasing consumer spending on home and lifestyle products.

- Young & Growing Population: Driving demand for contemporary and stylish furniture.

- E-commerce Penetration: Expanding market reach and accessibility for consumers.

Challenges in the Saudi Arabia Furniture Market Sector

Despite the positive growth trajectory, the Saudi Arabia furniture market faces several challenges. Intense competition from both local and international players can lead to price wars and pressure on profit margins. Fluctuations in raw material prices, particularly for wood and metal, can impact manufacturing costs and product pricing. Supply chain disruptions, coupled with logistical complexities in a vast country, can affect delivery times and operational efficiency. Stringent import regulations and tariffs for certain materials or finished goods can also pose hurdles for international players and impact product availability. Evolving consumer tastes and preferences require continuous product innovation and adaptation, which can be resource-intensive.

- Intense Competition: Driving down profit margins and necessitating continuous differentiation.

- Raw Material Price Volatility: Affecting production costs and pricing strategies.

- Supply Chain & Logistics: Challenges in timely and cost-effective delivery across the Kingdom.

- Evolving Consumer Preferences: Requiring constant adaptation in product design and offerings.

Emerging Opportunities in Saudi Arabia Furniture Market

The Saudi Arabia furniture market presents numerous emerging opportunities. The burgeoning tourism sector, with the development of numerous hotels and resorts, creates significant demand for high-quality hospitality furniture. The ongoing giga-projects like NEOM and Red Sea Project will continue to drive demand for a wide array of furniture for residential, commercial, and public spaces. There is a growing opportunity for manufacturers focusing on sustainable and eco-friendly furniture solutions, catering to an increasingly environmentally conscious consumer base. The expansion of e-commerce platforms and the adoption of digital technologies offer a significant opportunity to reach a wider customer base and enhance customer engagement. Furthermore, the government's support for local manufacturing presents an opportunity for domestic players to expand their production capabilities and market share.

- Hospitality Sector Boom: Driven by Vision 2030's tourism targets.

- Giga-Projects: Creating long-term demand across multiple sectors.

- Sustainable Furniture Demand: Growing consumer preference for eco-friendly products.

- Digitalization & E-commerce Growth: Expanding market reach and customer engagement.

Leading Players in the Saudi Arabia Furniture Market Market

- Riyadh Furniture Industries Co

- Midas Furniture

- Gautier Jeddah

- AL Aamer Furniture

- Al-Abdulkader Furniture Co Ltd

- Al Jedaie

- IKEA

- Wardeh Salehiya

- BoConcept

- HABITAT FURNITURE CO LTD

- Almutlaq Furniture

- HomeCenter

- Saudi Modern Factory Company

- AL Rugaib Furniture

Key Developments in Saudi Arabia Furniture Market Industry

- March 2024: Al-Futtaim IKEA, the region's foremost Swedish home furnishing retailer, is thrilled to introduce its groundbreaking "Store of Tomorrow," which is set to transform the retail industry by prioritizing play, discovery, and family-oriented experiences. With an unwavering dedication to accessibility and affordability, Al-Futtaim IKEA welcomes customers to embark on a journey where playfulness and practicality harmoniously merge, providing a hassle-free shopping experience.

- June 2023: Al Mutlaq Group collaborated with Thriwe, a consumer benefits company, to enhance the customer experience and loyalty and rewards program in Saudi Arabia.

Strategic Outlook for Saudi Arabia Furniture Market Market

The strategic outlook for the Saudi Arabia furniture market remains exceptionally positive, driven by sustained government support, robust economic diversification efforts, and significant infrastructure development. The ongoing implementation of Vision 2030 continues to be a primary growth catalyst, creating unparalleled opportunities in residential, hospitality, and commercial sectors. The increasing adoption of e-commerce and digital technologies presents a crucial avenue for market expansion and enhanced customer reach. Furthermore, the growing consumer demand for sustainable, technologically integrated, and customizable furniture solutions will shape product development and market strategies. Strategic partnerships, investments in local manufacturing, and a focus on innovation will be key to navigating the competitive landscape and capitalizing on the substantial future potential of this dynamic market.

Saudi Arabia Furniture Market Segmentation

-

1. Material

- 1.1. Wood

- 1.2. Metal

- 1.3. Plastic & Other Materials

-

2. Application

- 2.1. Home Furniture

- 2.2. Office Furniture

- 2.3. Hospitality Furniture

- 2.4. Other Applications

-

3. Distribution Channel

- 3.1. Supermarkets & Hypermarkets

- 3.2. Specialty Stores

- 3.3. Online

- 3.4. Other Distribution Channels

Saudi Arabia Furniture Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Furniture Market Regional Market Share

Geographic Coverage of Saudi Arabia Furniture Market

Saudi Arabia Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Growth in Urbanization; Growing Awareness of Sustainable Furniture

- 3.3. Market Restrains

- 3.3.1. Fluctuating Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Growth in the Construction Sector Boosting the Demand for Furniture Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Furniture Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Wood

- 5.1.2. Metal

- 5.1.3. Plastic & Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Home Furniture

- 5.2.2. Office Furniture

- 5.2.3. Hospitality Furniture

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets & Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Online

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Riyadh Furniture Industries Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Midas Furniture

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gautier Jeddah

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AL Aamer Furniture

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Al-Abdulkader Furniture Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Al Jedaie

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 IKEA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wardeh Salehiya

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BoConcept

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 HABITAT FURNITURE CO LTD

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Almutlaq Furniture

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 HomeCenter**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Saudi Modern Factory Company

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 AL Rugaib Furniture

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Riyadh Furniture Industries Co

List of Figures

- Figure 1: Saudi Arabia Furniture Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Furniture Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Furniture Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Saudi Arabia Furniture Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Saudi Arabia Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Saudi Arabia Furniture Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Furniture Market Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Saudi Arabia Furniture Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Saudi Arabia Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Saudi Arabia Furniture Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Furniture Market?

The projected CAGR is approximately 4.79%.

2. Which companies are prominent players in the Saudi Arabia Furniture Market?

Key companies in the market include Riyadh Furniture Industries Co, Midas Furniture, Gautier Jeddah, AL Aamer Furniture, Al-Abdulkader Furniture Co Ltd, Al Jedaie, IKEA, Wardeh Salehiya, BoConcept, HABITAT FURNITURE CO LTD, Almutlaq Furniture, HomeCenter**List Not Exhaustive, Saudi Modern Factory Company, AL Rugaib Furniture.

3. What are the main segments of the Saudi Arabia Furniture Market?

The market segments include Material, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Growth in Urbanization; Growing Awareness of Sustainable Furniture.

6. What are the notable trends driving market growth?

Growth in the Construction Sector Boosting the Demand for Furniture Products.

7. Are there any restraints impacting market growth?

Fluctuating Raw Material Prices.

8. Can you provide examples of recent developments in the market?

March 2024: Al-Futtaim IKEA, the region's foremost Swedish home furnishing retailer, is thrilled to introduce its groundbreaking "Store of Tomorrow," which is set to transform the retail industry by prioritizing play, discovery, and family-oriented experiences. With an unwavering dedication to accessibility and affordability, Al-Futtaim IKEA welcomes customers to embark on a journey where playfulness and practicality harmoniously merge, providing a hassle-free shopping experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Furniture Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence