Key Insights

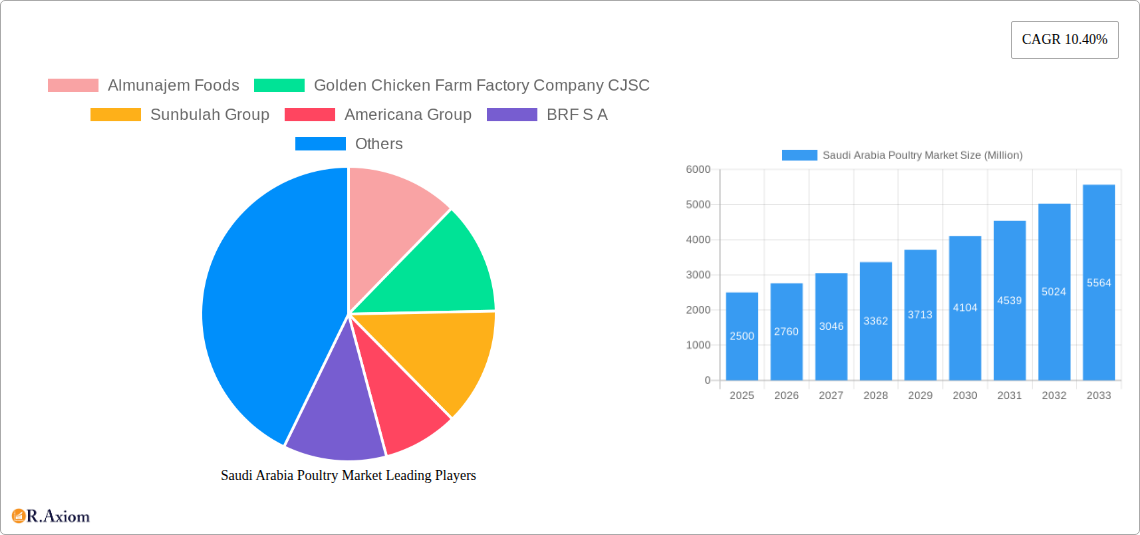

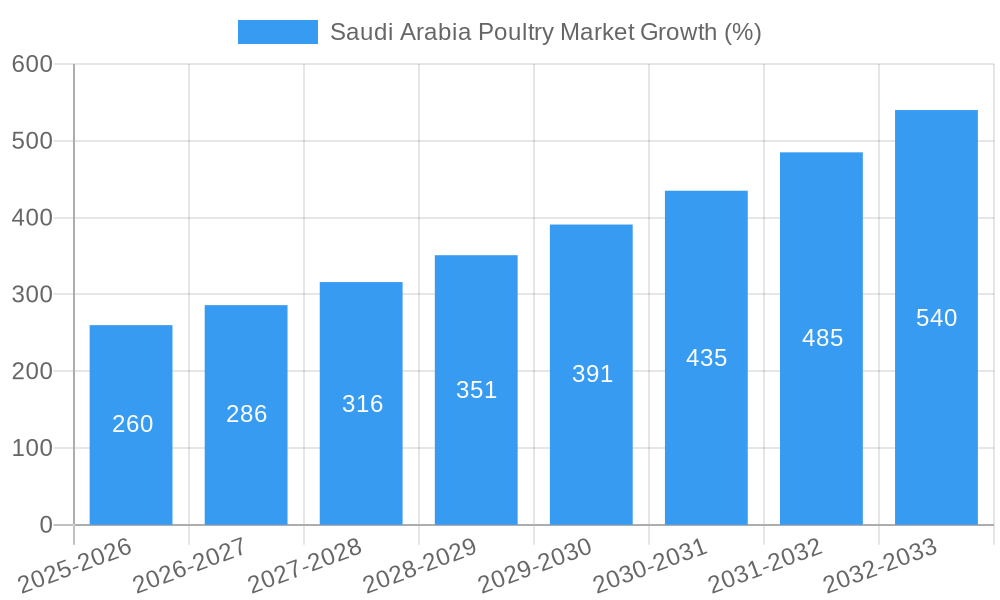

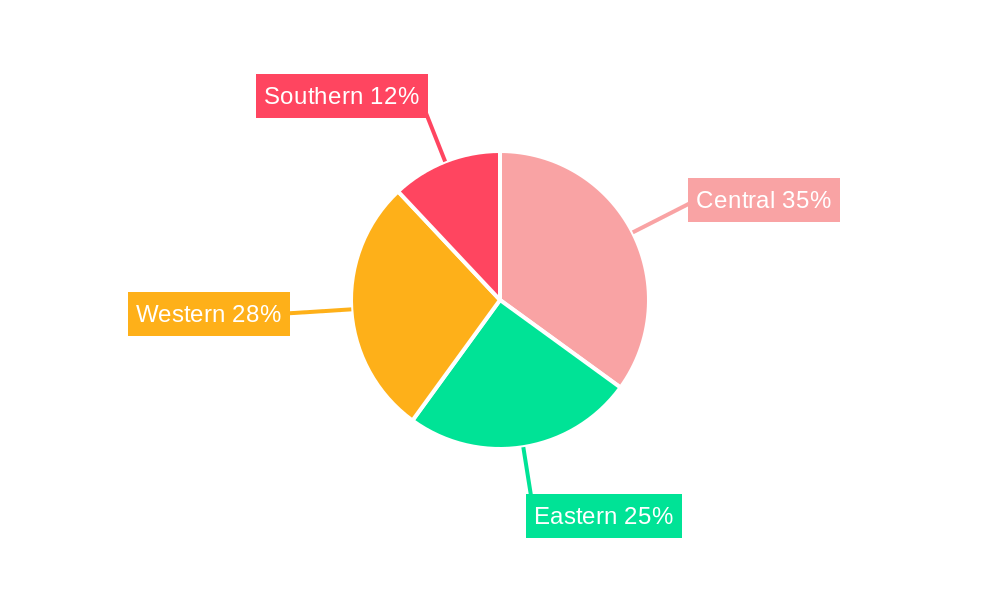

The Saudi Arabian poultry market, valued at approximately $X million in 2025 (assuming a logical extrapolation based on the provided CAGR of 10.40% and the undisclosed 2019 market size), is experiencing robust growth, projected to maintain a compound annual growth rate (CAGR) of 10.40% from 2025 to 2033. This expansion is fueled by several key drivers. A burgeoning population and rising disposable incomes are driving increased demand for protein sources, with poultry being a cost-effective and widely accepted option. Furthermore, the Saudi government's focus on food security and self-sufficiency initiatives is stimulating domestic poultry production, encouraging investment in advanced farming techniques and infrastructure. The growing preference for convenient and processed poultry products, such as canned and frozen options, is further contributing to market expansion. However, challenges remain, including potential fluctuations in feed prices (a major production cost) and the need for continued investment in modernizing the poultry supply chain to enhance efficiency and reduce waste. The market is segmented by distribution channels (off-trade and on-trade) and product form (canned, fresh/chilled, frozen, and processed), with the fresh/chilled segment likely holding the largest market share due to consumer preference for freshness. Key players like Almunajem Foods, Americana Group, and Almarai Food Company are competing in this dynamic market, constantly innovating to meet evolving consumer demands. Regional variations exist within Saudi Arabia, with population density and consumer preferences influencing market performance across Central, Eastern, Western, and Southern regions.

The market's segmentation offers various opportunities for growth. Companies are focusing on product diversification, catering to changing consumer tastes with value-added products like marinated or ready-to-cook poultry items. The growing popularity of online grocery delivery platforms is also creating new avenues for distribution, presenting a significant opportunity for players to expand their reach. To capitalize on these opportunities, companies will need to focus on efficient supply chain management, rigorous quality control measures, and effective marketing strategies to build strong brand loyalty. The long-term outlook for the Saudi Arabian poultry market remains positive, driven by sustained population growth, increasing urbanization, and ongoing government support for the agricultural sector. Strategic investments in technology, sustainability practices, and supply chain resilience will be crucial for sustained market success.

Saudi Arabia Poultry Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Saudi Arabia poultry market, covering the period from 2019 to 2033. With a focus on market size, segmentation, key players, and future trends, this report is an essential resource for industry stakeholders, investors, and anyone seeking to understand this dynamic market. The report utilizes data from the historical period (2019-2024), the base year (2025), and provides detailed forecasts until 2033. Key metrics such as CAGR and market penetration are analyzed to offer actionable insights.

Saudi Arabia Poultry Market Concentration & Innovation

This section analyzes the competitive landscape of the Saudi Arabia poultry market, examining market concentration, innovation drivers, regulatory frameworks, and recent M&A activities. The market is characterized by a mix of large multinational corporations and local players. Key players, including Almunajem Foods, Golden Chicken Farm Factory Company CJSC, Sunbulah Group, Americana Group, BRF S.A., Al-Watania Poultry, The Savola Group, Tanmiah Food Company, and Almarai Food Company, compete based on factors such as product quality, price, and distribution networks.

- Market Concentration: The market exhibits a moderately concentrated structure, with the top five players holding an estimated xx% market share in 2025. Further analysis reveals that market share distribution varies across different segments (fresh, frozen, processed).

- Innovation Drivers: Growing consumer demand for convenient and value-added poultry products drives innovation. Technological advancements in feed formulation, breeding, and processing enhance efficiency and product quality. The adoption of sustainable and ethical farming practices is also emerging as a key driver.

- Regulatory Framework: Government initiatives focused on food security and self-sufficiency influence the market. Regulations related to food safety, animal welfare, and labeling impact operational costs and product offerings.

- Product Substitutes: Red meat and seafood compete with poultry as protein sources. However, the affordability and versatility of poultry maintain its position as a primary protein source.

- End-User Trends: Increasing urbanisation and changing dietary habits are driving demand for processed and convenient poultry products. Health and wellness consciousness also impacts consumer preferences, favoring products with lower fat and sodium content.

- M&A Activities: The market has witnessed strategic mergers and acquisitions, such as the partnership between Al-Watania Poultry and Americana Group, aimed at enhancing production efficiency and market reach. While the exact M&A deal values are not publicly available for all transactions, estimated deal values in the sector range from xx Million to xx Million annually.

Saudi Arabia Poultry Market Industry Trends & Insights

The Saudi Arabian poultry market demonstrates robust growth, driven by rising population, increasing disposable incomes, and shifting consumer preferences. Technological disruptions in farming, processing, and distribution drive efficiency gains. The market is characterized by intense competition, with companies focusing on product differentiation, brand building, and strategic partnerships.

The CAGR for the Saudi Arabia poultry market during the forecast period (2025-2033) is estimated at xx%. Market penetration of processed poultry products is projected to increase to xx% by 2033, driven by growing demand for convenience and ready-to-eat options. The market is experiencing shifts in consumer preferences towards healthier and sustainably sourced poultry products. This includes a growing demand for organic and free-range poultry, representing a significant emerging market segment. The increasing adoption of advanced technologies such as automation in poultry farming and improved cold chain logistics is further shaping the market landscape and contributing to overall growth. Pricing pressures and competition among key players contribute to the dynamic nature of the industry.

Dominant Markets & Segments in Saudi Arabia Poultry Market

The Saudi Arabia poultry market is dominated by the Off-Trade distribution channel, accounting for the largest market share in 2025, followed by the On-Trade segment. Within product forms, Fresh/Chilled poultry holds the largest market share due to consumer preference for freshness and quality.

- Key Drivers for Off-Trade Dominance:

- Extensive retail infrastructure across the country.

- Established distribution networks reaching diverse consumer segments.

- Convenience and accessibility for consumers.

- Key Drivers for Fresh/Chilled Dominance:

- Consumer preference for fresh, high-quality products.

- Shorter shelf life necessitates efficient cold chain logistics.

- Perception of superior taste and nutritional value compared to frozen poultry.

The dominance of these segments is expected to continue throughout the forecast period, although the share of processed poultry is expected to steadily increase due to changing lifestyles and consumer preferences. Regional variations in consumption patterns and market access might influence the regional distribution of the market share.

Saudi Arabia Poultry Market Product Developments

The Saudi Arabia poultry market is witnessing significant product innovation focused on enhanced convenience, value-added features, and health-conscious options. This includes ready-to-cook and ready-to-eat products, marinated and seasoned poultry items, and value-packed family-sized portions. Technological advancements in processing, packaging, and preservation methods, such as modified atmosphere packaging (MAP) and improved freezing technologies, enhance product quality and extend shelf life. Companies are also increasingly focusing on developing organic and free-range options to cater to health-conscious consumers.

Report Scope & Segmentation Analysis

This report comprehensively segments the Saudi Arabia poultry market across various parameters.

Distribution Channel: The market is segmented into Off-Trade (supermarkets, hypermarkets, traditional retail stores) and On-Trade (restaurants, hotels, catering services). The Off-Trade segment is projected to exhibit higher growth than the On-Trade segment due to its wide reach and accessibility.

Form: The market is segmented into Canned, Fresh/Chilled, Frozen, and Processed poultry. Fresh/Chilled is the dominant segment. However, the Processed segment is expected to witness significant growth driven by increasing demand for convenient meal solutions.

Each segment's market size, growth projections, and competitive dynamics are detailed within the full report. The varying growth rates across segments provide valuable insights into market trends.

Key Drivers of Saudi Arabia Poultry Market Growth

Several factors contribute to the growth of the Saudi Arabia poultry market. These include the rising population, increasing per capita consumption of poultry, government support for the food security initiative encouraging domestic production, and a growing middle class with increased disposable income. Furthermore, technological advancements in poultry farming and processing enhance efficiency and productivity. Favorable government policies and investments in infrastructure further stimulate market expansion.

Challenges in the Saudi Arabia Poultry Market Sector

The Saudi Arabia poultry market faces several challenges, including fluctuations in feed prices affecting profitability, potential supply chain disruptions due to global events, and intense competition among existing players. Regulatory hurdles related to food safety and animal welfare, alongside concerns about disease outbreaks, pose operational risks. Maintaining affordable prices while ensuring product quality is a balancing act, necessitating efficient cost management. Maintaining competitiveness against international brands is also a challenge.

Emerging Opportunities in Saudi Arabia Poultry Market

Several opportunities exist in the Saudi Arabia poultry market. These include the growing demand for value-added and processed poultry products, especially ready-to-eat meals; the increasing adoption of sustainable and ethical farming practices, catering to health-conscious consumers; and the penetration of e-commerce channels and food delivery platforms for poultry products. Investment in advanced technologies in poultry farming and cold chain management presents opportunities for cost reduction and enhanced quality.

Leading Players in the Saudi Arabia Poultry Market Market

- Almunajem Foods

- Golden Chicken Farm Factory Company CJSC

- Sunbulah Group

- Americana Group

- BRF S.A.

- Al-Watania Poultry

- The Savola Group

- Tanmiah Food Company

- Almarai Food Company

Key Developments in Saudi Arabia Poultry Market Industry

- November 2021: Al-Watania Poultry partnered with Americana Group to boost local poultry production and improve food security. This strategic alliance aims to enhance the supply of fresh, high-quality poultry and stabilize market prices.

- May 2021: Cobb and Al-Watania Poultry announced plans to double their production capacity through investments in hatcheries and distribution, strengthening food security within Saudi Arabia and the GCC.

- April 2021: BRF Global secured ISO 37001 Anti-bribery Management System certification, highlighting its commitment to ethical business practices and strengthening consumer trust.

Strategic Outlook for Saudi Arabia Poultry Market Market

The Saudi Arabia poultry market is poised for continued growth, driven by favorable demographics, increasing consumer demand, and supportive government policies. Opportunities for expansion exist in value-added products, sustainable farming practices, and efficient cold chain logistics. Companies focusing on innovation, brand building, and strategic partnerships will be well-positioned to succeed in this dynamic market. The market is expected to remain competitive but profitable for companies that can adapt to changing consumer preferences and regulatory environments.

Saudi Arabia Poultry Market Segmentation

-

1. Form

- 1.1. Canned

- 1.2. Fresh / Chilled

- 1.3. Frozen

-

1.4. Processed

-

1.4.1. By Processed Types

- 1.4.1.1. Deli Meats

- 1.4.1.2. Marinated/ Tenders

- 1.4.1.3. Meatballs

- 1.4.1.4. Nuggets

- 1.4.1.5. Sausages

- 1.4.1.6. Other Processed Poultry

-

1.4.1. By Processed Types

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Channel

- 2.1.3. Supermarkets and Hypermarkets

- 2.1.4. Others

- 2.2. On-Trade

-

2.1. Off-Trade

Saudi Arabia Poultry Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Poultry Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use

- 3.3. Market Restrains

- 3.3.1. Increasing Shift Toward Plant-Based Protein

- 3.4. Market Trends

- 3.4.1. The increasing inflation rates and foodservice consumption are fueling sales

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Poultry Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Canned

- 5.1.2. Fresh / Chilled

- 5.1.3. Frozen

- 5.1.4. Processed

- 5.1.4.1. By Processed Types

- 5.1.4.1.1. Deli Meats

- 5.1.4.1.2. Marinated/ Tenders

- 5.1.4.1.3. Meatballs

- 5.1.4.1.4. Nuggets

- 5.1.4.1.5. Sausages

- 5.1.4.1.6. Other Processed Poultry

- 5.1.4.1. By Processed Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Channel

- 5.2.1.3. Supermarkets and Hypermarkets

- 5.2.1.4. Others

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Central Saudi Arabia Poultry Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Poultry Market Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Poultry Market Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Poultry Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Almunajem Foods

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Golden Chicken Farm Factory Company CJSC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Sunbulah Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Americana Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 BRF S A

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Al-Watania Poultry

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 The Savola Grou

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Tanmiah Food Company

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Almarai Food Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Almunajem Foods

List of Figures

- Figure 1: Saudi Arabia Poultry Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Poultry Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Poultry Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Poultry Market Revenue Million Forecast, by Form 2019 & 2032

- Table 3: Saudi Arabia Poultry Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Saudi Arabia Poultry Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Saudi Arabia Poultry Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Central Saudi Arabia Poultry Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Eastern Saudi Arabia Poultry Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Western Saudi Arabia Poultry Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Southern Saudi Arabia Poultry Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Saudi Arabia Poultry Market Revenue Million Forecast, by Form 2019 & 2032

- Table 11: Saudi Arabia Poultry Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: Saudi Arabia Poultry Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Poultry Market?

The projected CAGR is approximately 10.40%.

2. Which companies are prominent players in the Saudi Arabia Poultry Market?

Key companies in the market include Almunajem Foods, Golden Chicken Farm Factory Company CJSC, Sunbulah Group, Americana Group, BRF S A, Al-Watania Poultry, The Savola Grou, Tanmiah Food Company, Almarai Food Company.

3. What are the main segments of the Saudi Arabia Poultry Market?

The market segments include Form, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use.

6. What are the notable trends driving market growth?

The increasing inflation rates and foodservice consumption are fueling sales.

7. Are there any restraints impacting market growth?

Increasing Shift Toward Plant-Based Protein.

8. Can you provide examples of recent developments in the market?

November 2021: Al-Watania Poultry partnered with Americana Group to develop the local content in the poultry sector and provide markets with fresh, high-quality, and reliable products. It helps enhance food security and increase production and other direct and indirect costs that contribute to stability in poultry prices for the final consumer.May 2021: Cobb and Al-Watania Poultry set to double their production following investments in hatcheries and distribution. This move is expected to increase food security in Saudi Arabia and other GCC countries.April 2021: BRF Global achieved the ISO 37001 Anti-bribery Management System certification, issued by an independent and non-governmental entity based in Switzerland. The certification is internationally recognized and emphasizes that the company meets technical requirements and has effect policies, procedures, and controls to prevent and combat bribery, thus promoting an ethical and healthy environment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Poultry Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Poultry Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Poultry Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Poultry Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence