Key Insights

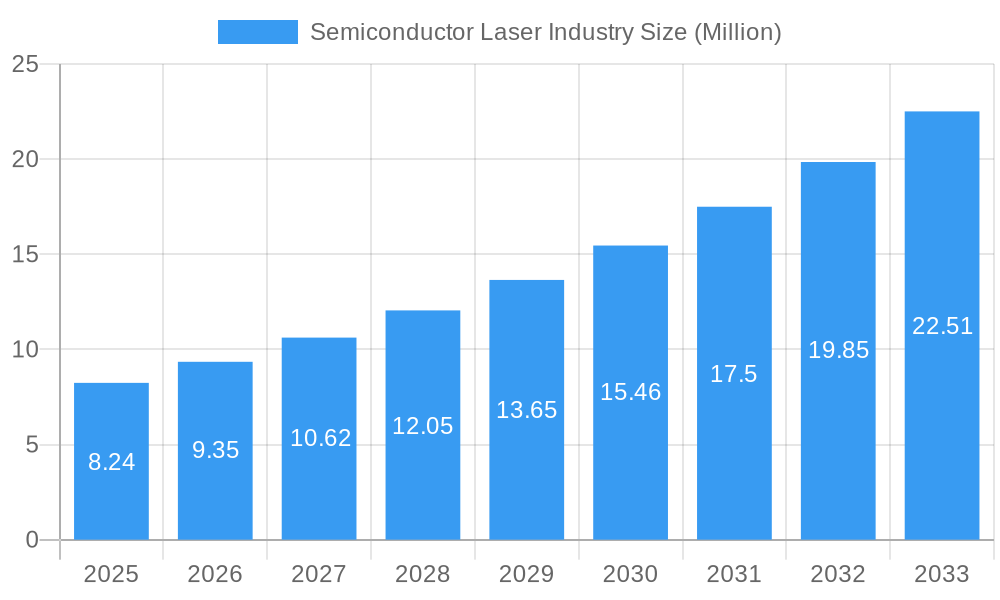

The global Semiconductor Laser Industry is poised for robust expansion, with a current market size of $8.24 Million and a projected Compound Annual Growth Rate (CAGR) of 13.40% over the forecast period of 2025-2033. This significant growth is fueled by escalating demand across diverse applications, including advanced communication networks, cutting-edge medical treatments, and critical military and defense systems. The increasing adoption of optical technologies in consumer electronics, automotive, and industrial automation further bolsters market momentum. Key drivers include the continuous innovation in laser technology, leading to improved efficiency, power, and miniaturization of semiconductor lasers. Furthermore, the growing integration of lasers in sensing and measurement solutions, alongside the relentless pursuit of higher data transmission speeds in telecommunications, are powerful catalysts for this expanding market. The industry is witnessing a surge in the development of specialized laser types, such as VCSELs for short-range communication and advanced sensing, and fiber lasers for high-power industrial applications, underscoring a trend towards tailored solutions for specific market needs.

Semiconductor Laser Industry Market Size (In Million)

Despite the strong growth trajectory, the Semiconductor Laser Industry faces certain restraints, primarily revolving around the high manufacturing costs associated with advanced semiconductor materials and complex fabrication processes. Intense competition among established players and emerging manufacturers also exerts downward pressure on pricing, potentially impacting profit margins. However, the overarching trend towards miniaturization, increased functionality, and broader application scope is expected to outweigh these challenges. The market is segmented by wavelength, type, and application, with Infrared Lasers, EELs, and communication applications currently holding substantial market share. Emerging trends point towards a significant uptake of blue and ultraviolet lasers for applications like advanced lithography and sterilization, alongside a growing demand for VCSELs in augmented reality and autonomous driving. Regional analysis suggests North America and Asia hold significant market positions, driven by strong R&D investments and robust industrial bases, respectively.

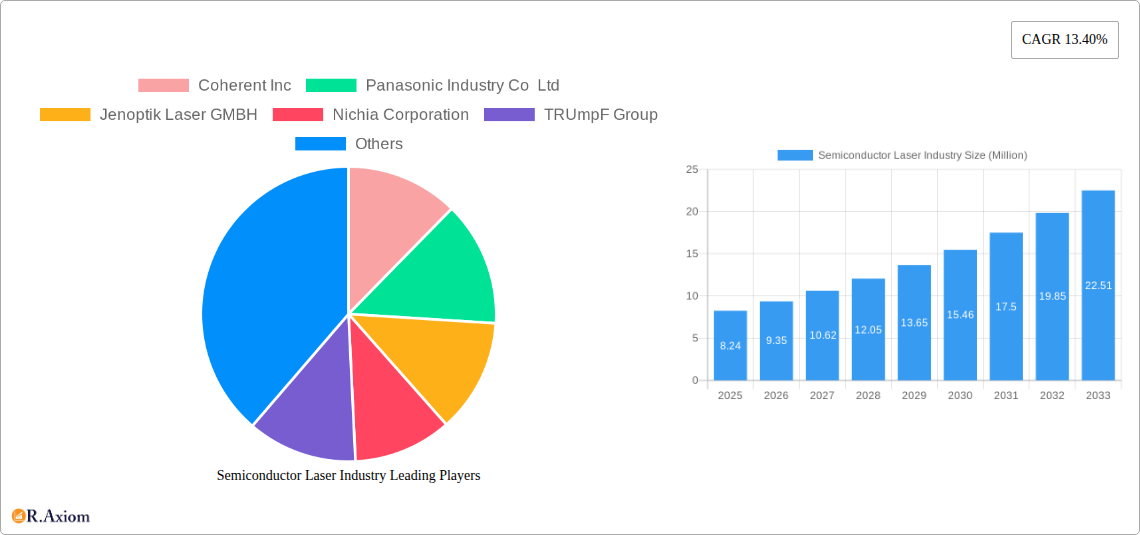

Semiconductor Laser Industry Company Market Share

This comprehensive report provides an in-depth analysis of the global Semiconductor Laser Industry, covering market dynamics, technological advancements, key applications, and future projections from 2019 to 2033. With a base year of 2025, the forecast period (2025-2033) delves into the expected growth trajectory of this vital sector. We meticulously examine market concentration, innovation drivers, dominant market segments, and the strategic initiatives of leading players, offering actionable insights for stakeholders navigating this evolving landscape. This report is essential for industry professionals, investors, researchers, and policymakers seeking to understand the intricate workings and future potential of the semiconductor laser market.

Semiconductor Laser Industry Market Concentration & Innovation

The semiconductor laser industry exhibits a moderate market concentration, with a few dominant players holding significant market share, particularly in high-volume applications like optical communications and consumer electronics. However, innovation remains a key differentiator, driving growth and market penetration across diverse segments. Companies are heavily investing in R&D to develop next-generation semiconductor lasers with enhanced power, efficiency, and novel functionalities. For instance, advancements in quantum dot lasers and GaN-based devices are opening new avenues. Regulatory frameworks, while promoting safety and standards, can also influence market entry and product development. The emergence of advanced materials and fabrication techniques are critical innovation drivers. Product substitutes, such as micro-LEDs in certain display applications, pose a competitive challenge, necessitating continuous innovation in laser performance and cost-effectiveness. End-user trends, driven by the increasing demand for high-speed data transfer, advanced medical diagnostics, and sophisticated industrial automation, are shaping the product roadmap. Mergers and acquisitions (M&A) activities are prevalent, aimed at consolidating market positions, acquiring proprietary technologies, and expanding product portfolios. Recent M&A deal values are estimated to be in the hundreds of millions of dollars, reflecting the strategic importance of this sector. Key companies like Coherent Inc. and Lumentum Holdings Inc. are actively engaged in strategic acquisitions to bolster their market presence.

- Market Share: Dominant players hold an estimated 30-40% market share collectively.

- M&A Deal Values: Average deal values range from tens of millions to over a billion dollars for significant acquisitions.

- Innovation Focus: High-power lasers, miniaturization, wavelength tuning, and integration with other optical components.

Semiconductor Laser Industry Industry Trends & Insights

The Semiconductor Laser Industry is poised for substantial growth, driven by a confluence of technological advancements, expanding applications, and increasing global demand. The Compound Annual Growth Rate (CAGR) for the forecast period is projected to be approximately 8-10%, a testament to the industry's robust expansion. This growth is fueled by the relentless pursuit of faster and more efficient data communication, necessitating the use of advanced semiconductor lasers in fiber optic networks, data centers, and 5G infrastructure. The integration of semiconductor lasers into consumer electronics, such as smartphones for facial recognition (VCSELs) and augmented reality devices, further propents market penetration. In the medical sector, semiconductor lasers are revolutionizing diagnostics and treatment, from surgical procedures to dermatological applications, due to their precision and minimally invasive nature. Industrial applications are also a significant growth area, with lasers being integral to manufacturing processes like cutting, welding, and marking, especially with the rise of Industry 4.0 and automation. The automotive sector is increasingly adopting semiconductor lasers for LiDAR systems in autonomous vehicles, enhancing safety and navigation capabilities. Consumer preferences are leaning towards smaller, more energy-efficient, and feature-rich laser devices, pushing manufacturers to innovate in terms of form factor and functionality. Competitive dynamics are intense, with companies constantly striving for technological leadership, cost optimization, and strategic partnerships to secure market share. Technological disruptions, such as the development of tunable lasers and integrated photonic circuits, are continuously reshaping the competitive landscape. The market penetration of specialized semiconductor lasers for niche applications is also on the rise, indicating a maturing and diversifying market.

Dominant Markets & Segments in Semiconductor Laser Industry

The global Semiconductor Laser Industry is characterized by the dominance of specific segments and geographical regions, driven by unique technological demands and economic factors. In terms of Wavelength, Infrared Lasers currently hold a substantial market share, primarily due to their extensive use in telecommunications, industrial heating, and sensing applications. However, the demand for Blue lasers and Green lasers is rapidly increasing, propelled by advancements in display technologies (e.g., Blu-ray, laser projectors) and solid-state lighting. Ultraviolet Lasers are gaining traction in sterilization, medical applications, and industrial curing processes.

Regarding Type, Edge-Emitting Lasers (EELs) have historically dominated due to their mature technology and cost-effectiveness in high-volume applications like optical communications. Vertical-Cavity Surface-Emitting Lasers (VCSELs) are experiencing explosive growth, driven by their suitability for 2D arrays, low power consumption, and applications in facial recognition, proximity sensing, and short-reach data transmission. Fiber Lasers, while often powered by semiconductor diode lasers, represent a distinct category with immense power and beam quality, finding applications in heavy industrial cutting and welding. Quantum Cascade Lasers are carving out a niche in specialized sensing and spectroscopy due to their mid-infrared emission.

The Application segment analysis reveals that Communication remains the largest and fastest-growing sector, driven by the insatiable demand for bandwidth in data centers, telecommunications networks, and enterprise connectivity. Industrial applications are also a significant contributor, encompassing material processing, automation, and quality control. The Medical sector is witnessing rapid adoption for a wide array of procedures, from laser surgery to therapeutic treatments. Military and Defense sectors utilize semiconductor lasers for targeting, rangefinding, and directed energy applications. Instrumentation and Sensor applications are expanding with the development of sophisticated laser-based measurement and analytical tools. Automotive, particularly with the advent of autonomous driving, is a rapidly emerging application area for LiDAR.

- Dominant Wavelength: Infrared Lasers (e.g., 800nm-1600nm) due to telecommunications and industrial uses.

- Key Growth Wavelength: Blue Lasers (e.g., 445nm-473nm) for displays and Green Lasers (e.g., 532nm) for lighting and projection.

- Dominant Type: Edge-Emitting Lasers (EELs) for broad applications, with Vertical-Cavity Surface-Emitting Lasers (VCSELs) showing the highest growth potential.

- Dominant Application: Communication (fiber optics, data centers, 5G) leading the market, followed closely by Industrial applications.

- Emerging Application: Automotive (LiDAR for autonomous vehicles) exhibiting strong growth prospects.

Semiconductor Laser Industry Product Developments

Recent product developments in the Semiconductor Laser Industry are characterized by a focus on enhanced performance, miniaturization, and integration. Innovations include the development of high-power, efficient semiconductor lasers for industrial cutting and welding, offering improved beam quality and reduced operating costs. In the communication sector, advancements in VCSEL technology are enabling higher data rates and lower power consumption for short-reach optical interconnects. The medical field is benefiting from the introduction of compact, precise semiconductor lasers for minimally invasive surgery and advanced diagnostic imaging. Furthermore, companies are developing specialized lasers for emerging applications like quantum computing and advanced sensing. These product developments are driven by the need to meet the stringent requirements of evolving end-user markets and to maintain a competitive edge through technological superiority.

Report Scope & Segmentation Analysis

This report offers a comprehensive analysis of the Semiconductor Laser Industry segmented by Wavelength, Type, and Application. The Wavelength segmentation includes Infrared Lasers, Red Lasers, Green Lasers, Blue lasers, and Ultraviolet Lasers, each with distinct market sizes and growth projections driven by specific end-use industries. The Type segmentation encompasses EEL (Edge-emitting Laser), VCSEL (Vertical-cavity Surface-emitting Laser), Quantum Cascade Laser, Fiber Laser, and Other Types, detailing their respective market shares and competitive landscapes. The Application segmentation analyzes the market across Communication, Medical, Military and Defense, Industrial, Instrumentation and Sensor, Automotive, and Other Applications, providing insights into growth drivers, market penetration, and competitive dynamics within each vertical. Growth projections for each segment indicate varying trajectories, with communication and automotive applications expected to witness the highest expansion.

- Wavelength Segments: Infrared Lasers expected to maintain a significant market share, while Blue and Green Lasers show high growth potential.

- Type Segments: VCSELs are projected for rapid expansion, complementing the established EEL market.

- Application Segments: Communication and Automotive are identified as key growth drivers, with steady growth anticipated in Medical and Industrial sectors.

Key Drivers of Semiconductor Laser Industry Growth

The semiconductor laser industry's growth is propelled by several interconnected factors. Technologically, the relentless demand for higher bandwidth in data communication is a primary driver, necessitating more efficient and higher-performing semiconductor lasers. Miniaturization and power efficiency are critical for mobile devices and portable sensing equipment. Economically, the expansion of digital infrastructure globally, including 5G deployment and data center growth, directly fuels demand for optical components. Government initiatives supporting research and development in advanced manufacturing and emerging technologies also play a crucial role. Regulatory frameworks promoting cybersecurity and data integrity indirectly drive investment in secure communication technologies utilizing lasers. Furthermore, the increasing adoption of automation across industries necessitates precision laser systems for manufacturing and process control.

Challenges in the Semiconductor Laser Industry Sector

Despite robust growth prospects, the Semiconductor Laser Industry faces several challenges. Supply chain disruptions, particularly concerning the availability of critical raw materials and advanced manufacturing components, can impede production and lead to price volatility. Intense competition among established players and new entrants can put pressure on profit margins and drive down prices. Rapid technological obsolescence requires continuous investment in R&D to stay ahead, posing a significant financial burden. Stringent regulatory requirements in sectors like medical devices and automotive safety can lead to longer development cycles and increased compliance costs. Furthermore, the geopolitical landscape can impact global trade and access to key markets and manufacturing facilities. The cost of entry for advanced laser technologies can be a barrier for smaller companies, limiting market diversification.

Emerging Opportunities in Semiconductor Laser Industry

The Semiconductor Laser Industry is brimming with emerging opportunities, driven by transformative technologies and evolving consumer needs. The expansion of 5G and future wireless networks will continue to drive demand for high-speed optical components. The burgeoning fields of autonomous driving and advanced driver-assistance systems (ADAS) present a massive opportunity for LiDAR technology, predominantly based on semiconductor lasers. The increasing adoption of Augmented Reality (AR) and Virtual Reality (VR) devices creates demand for compact and efficient laser projection and sensing modules. Furthermore, the growing focus on healthcare and personalized medicine is opening avenues for advanced laser-based diagnostic and therapeutic solutions. The development of quantum technologies, including quantum computing and quantum sensing, relies heavily on precise and controllable semiconductor lasers, representing a significant long-term growth opportunity.

Leading Players in the Semiconductor Laser Industry Market

- Coherent Inc.

- Panasonic Industry Co Ltd

- Jenoptik Laser GMBH

- Nichia Corporation

- TRUmpF Group

- Lumentum Holdings Inc.

- Rohm Company Limited

- TT Electronics

- ams OSRAM AG

- Sheaumann Laser Inc.

- Newport Corporation (mks Instruments Inc.)

- IPG Photonics Corporation

- Sharp Corporation

- Hamamatsu Photonics K K

- Sumitomo Electric Industries Ltd.

Key Developments in Semiconductor Laser Industry Industry

- November 2023: The Air Force Research Laboratory opened a new Semiconductor Laser Indoor Propagation Range, known as SLIPR, at Kirtland Air Force Base in New Mexico to support research and development of future laser system propagation studies. SLIPR has 100-meter-long broadcast ranges in an indoor facility to test semiconductor laser technology concepts and includes photoluminescence and X-ray laboratories to characterize molecular beam epitaxy products. This development signals increased government investment in advanced laser R&D for defense applications.

- September 2023: AMS OSRAM AG and the Malaysian Investment Development Authority (MIDA) announced mutual support for the continued investment and expansion in Malaysia. Through a Collaborative Agreement, MIDA demonstrates significant support for AMS OSRAM’s initiatives in Malaysia. This partnership highlights the strategic importance of Asia-Pacific for semiconductor manufacturing and expansion, reinforcing supply chain stability and fostering regional economic growth.

Strategic Outlook for Semiconductor Laser Industry Market

The strategic outlook for the Semiconductor Laser Industry remains exceptionally positive, fueled by continuous technological innovation and the expanding application landscape. Key growth catalysts include the accelerating global digitalization, the relentless demand for higher data transmission speeds, and the transformative potential of technologies like AI and IoT, all of which rely on advanced semiconductor laser solutions. The automotive industry's transition to autonomous driving presents a substantial market opportunity, driving demand for LiDAR and other sensing technologies. Furthermore, the increasing integration of lasers in medical diagnostics and treatment promises significant market expansion. Investment in R&D for novel materials and laser architectures, coupled with strategic partnerships and potential M&A activities, will be crucial for companies to maintain a competitive edge. The industry is well-positioned to capitalize on these trends, projecting sustained growth and innovation in the coming years.

Semiconductor Laser Industry Segmentation

-

1. Wavelength

- 1.1. Infrared Lasers

- 1.2. Red Lasers

- 1.3. Green Lasers

- 1.4. Blue lasers

- 1.5. Ultraviolet Lasers

-

2. Type

- 2.1. EEL (Edge-emitting Laser)

- 2.2. VCSEL (Vertical-cavity Surface-emitting Laser)

- 2.3. Quantum Cascade Laser

- 2.4. Fiber Laser

- 2.5. Other Types

-

3. Application

- 3.1. Communication

- 3.2. Medical

- 3.3. Military and Defense

- 3.4. Industrial

- 3.5. Instrumentation and Sensor

- 3.6. Automotive

- 3.7. Other Applications

Semiconductor Laser Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Semiconductor Laser Industry Regional Market Share

Geographic Coverage of Semiconductor Laser Industry

Semiconductor Laser Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Proliferation of Semiconductor Laser Applications; Growth in the Fiber Laser Market; Preference for Semiconductor Lasers Over Other Light Sources

- 3.3. Market Restrains

- 3.3.1. Increase in Network Complexity

- 3.4. Market Trends

- 3.4.1. Communication Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Semiconductor Laser Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Wavelength

- 5.1.1. Infrared Lasers

- 5.1.2. Red Lasers

- 5.1.3. Green Lasers

- 5.1.4. Blue lasers

- 5.1.5. Ultraviolet Lasers

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. EEL (Edge-emitting Laser)

- 5.2.2. VCSEL (Vertical-cavity Surface-emitting Laser)

- 5.2.3. Quantum Cascade Laser

- 5.2.4. Fiber Laser

- 5.2.5. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Communication

- 5.3.2. Medical

- 5.3.3. Military and Defense

- 5.3.4. Industrial

- 5.3.5. Instrumentation and Sensor

- 5.3.6. Automotive

- 5.3.7. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Latin America

- 5.4.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Wavelength

- 6. North America Semiconductor Laser Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Wavelength

- 6.1.1. Infrared Lasers

- 6.1.2. Red Lasers

- 6.1.3. Green Lasers

- 6.1.4. Blue lasers

- 6.1.5. Ultraviolet Lasers

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. EEL (Edge-emitting Laser)

- 6.2.2. VCSEL (Vertical-cavity Surface-emitting Laser)

- 6.2.3. Quantum Cascade Laser

- 6.2.4. Fiber Laser

- 6.2.5. Other Types

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Communication

- 6.3.2. Medical

- 6.3.3. Military and Defense

- 6.3.4. Industrial

- 6.3.5. Instrumentation and Sensor

- 6.3.6. Automotive

- 6.3.7. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Wavelength

- 7. Europe Semiconductor Laser Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Wavelength

- 7.1.1. Infrared Lasers

- 7.1.2. Red Lasers

- 7.1.3. Green Lasers

- 7.1.4. Blue lasers

- 7.1.5. Ultraviolet Lasers

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. EEL (Edge-emitting Laser)

- 7.2.2. VCSEL (Vertical-cavity Surface-emitting Laser)

- 7.2.3. Quantum Cascade Laser

- 7.2.4. Fiber Laser

- 7.2.5. Other Types

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Communication

- 7.3.2. Medical

- 7.3.3. Military and Defense

- 7.3.4. Industrial

- 7.3.5. Instrumentation and Sensor

- 7.3.6. Automotive

- 7.3.7. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Wavelength

- 8. Asia Semiconductor Laser Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Wavelength

- 8.1.1. Infrared Lasers

- 8.1.2. Red Lasers

- 8.1.3. Green Lasers

- 8.1.4. Blue lasers

- 8.1.5. Ultraviolet Lasers

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. EEL (Edge-emitting Laser)

- 8.2.2. VCSEL (Vertical-cavity Surface-emitting Laser)

- 8.2.3. Quantum Cascade Laser

- 8.2.4. Fiber Laser

- 8.2.5. Other Types

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Communication

- 8.3.2. Medical

- 8.3.3. Military and Defense

- 8.3.4. Industrial

- 8.3.5. Instrumentation and Sensor

- 8.3.6. Automotive

- 8.3.7. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Wavelength

- 9. Australia and New Zealand Semiconductor Laser Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Wavelength

- 9.1.1. Infrared Lasers

- 9.1.2. Red Lasers

- 9.1.3. Green Lasers

- 9.1.4. Blue lasers

- 9.1.5. Ultraviolet Lasers

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. EEL (Edge-emitting Laser)

- 9.2.2. VCSEL (Vertical-cavity Surface-emitting Laser)

- 9.2.3. Quantum Cascade Laser

- 9.2.4. Fiber Laser

- 9.2.5. Other Types

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Communication

- 9.3.2. Medical

- 9.3.3. Military and Defense

- 9.3.4. Industrial

- 9.3.5. Instrumentation and Sensor

- 9.3.6. Automotive

- 9.3.7. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Wavelength

- 10. Latin America Semiconductor Laser Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Wavelength

- 10.1.1. Infrared Lasers

- 10.1.2. Red Lasers

- 10.1.3. Green Lasers

- 10.1.4. Blue lasers

- 10.1.5. Ultraviolet Lasers

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. EEL (Edge-emitting Laser)

- 10.2.2. VCSEL (Vertical-cavity Surface-emitting Laser)

- 10.2.3. Quantum Cascade Laser

- 10.2.4. Fiber Laser

- 10.2.5. Other Types

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Communication

- 10.3.2. Medical

- 10.3.3. Military and Defense

- 10.3.4. Industrial

- 10.3.5. Instrumentation and Sensor

- 10.3.6. Automotive

- 10.3.7. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Wavelength

- 11. Middle East and Africa Semiconductor Laser Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Wavelength

- 11.1.1. Infrared Lasers

- 11.1.2. Red Lasers

- 11.1.3. Green Lasers

- 11.1.4. Blue lasers

- 11.1.5. Ultraviolet Lasers

- 11.2. Market Analysis, Insights and Forecast - by Type

- 11.2.1. EEL (Edge-emitting Laser)

- 11.2.2. VCSEL (Vertical-cavity Surface-emitting Laser)

- 11.2.3. Quantum Cascade Laser

- 11.2.4. Fiber Laser

- 11.2.5. Other Types

- 11.3. Market Analysis, Insights and Forecast - by Application

- 11.3.1. Communication

- 11.3.2. Medical

- 11.3.3. Military and Defense

- 11.3.4. Industrial

- 11.3.5. Instrumentation and Sensor

- 11.3.6. Automotive

- 11.3.7. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Wavelength

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Coherent Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Panasonic Industry Co Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Jenoptik Laser GMBH

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Nichia Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 TRUmpF Group

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Lumentum Holdings Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Rohm Company Limited

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 TT Electronics

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 ams OSRAM AG

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Sheaumann Laser Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Newport Corporation (mks Instruments Inc )

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 IPG Photonics Corporation

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Sharp Corporation

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Hamamatsu Photonics K K

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Sumitomo Electric Industries Ltd

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.1 Coherent Inc

List of Figures

- Figure 1: Global Semiconductor Laser Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Semiconductor Laser Industry Revenue (Million), by Wavelength 2025 & 2033

- Figure 3: North America Semiconductor Laser Industry Revenue Share (%), by Wavelength 2025 & 2033

- Figure 4: North America Semiconductor Laser Industry Revenue (Million), by Type 2025 & 2033

- Figure 5: North America Semiconductor Laser Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Semiconductor Laser Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Semiconductor Laser Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Semiconductor Laser Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Semiconductor Laser Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Semiconductor Laser Industry Revenue (Million), by Wavelength 2025 & 2033

- Figure 11: Europe Semiconductor Laser Industry Revenue Share (%), by Wavelength 2025 & 2033

- Figure 12: Europe Semiconductor Laser Industry Revenue (Million), by Type 2025 & 2033

- Figure 13: Europe Semiconductor Laser Industry Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Semiconductor Laser Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Semiconductor Laser Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Semiconductor Laser Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Semiconductor Laser Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Semiconductor Laser Industry Revenue (Million), by Wavelength 2025 & 2033

- Figure 19: Asia Semiconductor Laser Industry Revenue Share (%), by Wavelength 2025 & 2033

- Figure 20: Asia Semiconductor Laser Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Asia Semiconductor Laser Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Semiconductor Laser Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: Asia Semiconductor Laser Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Semiconductor Laser Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Semiconductor Laser Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Australia and New Zealand Semiconductor Laser Industry Revenue (Million), by Wavelength 2025 & 2033

- Figure 27: Australia and New Zealand Semiconductor Laser Industry Revenue Share (%), by Wavelength 2025 & 2033

- Figure 28: Australia and New Zealand Semiconductor Laser Industry Revenue (Million), by Type 2025 & 2033

- Figure 29: Australia and New Zealand Semiconductor Laser Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Australia and New Zealand Semiconductor Laser Industry Revenue (Million), by Application 2025 & 2033

- Figure 31: Australia and New Zealand Semiconductor Laser Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: Australia and New Zealand Semiconductor Laser Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Australia and New Zealand Semiconductor Laser Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Latin America Semiconductor Laser Industry Revenue (Million), by Wavelength 2025 & 2033

- Figure 35: Latin America Semiconductor Laser Industry Revenue Share (%), by Wavelength 2025 & 2033

- Figure 36: Latin America Semiconductor Laser Industry Revenue (Million), by Type 2025 & 2033

- Figure 37: Latin America Semiconductor Laser Industry Revenue Share (%), by Type 2025 & 2033

- Figure 38: Latin America Semiconductor Laser Industry Revenue (Million), by Application 2025 & 2033

- Figure 39: Latin America Semiconductor Laser Industry Revenue Share (%), by Application 2025 & 2033

- Figure 40: Latin America Semiconductor Laser Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Latin America Semiconductor Laser Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Semiconductor Laser Industry Revenue (Million), by Wavelength 2025 & 2033

- Figure 43: Middle East and Africa Semiconductor Laser Industry Revenue Share (%), by Wavelength 2025 & 2033

- Figure 44: Middle East and Africa Semiconductor Laser Industry Revenue (Million), by Type 2025 & 2033

- Figure 45: Middle East and Africa Semiconductor Laser Industry Revenue Share (%), by Type 2025 & 2033

- Figure 46: Middle East and Africa Semiconductor Laser Industry Revenue (Million), by Application 2025 & 2033

- Figure 47: Middle East and Africa Semiconductor Laser Industry Revenue Share (%), by Application 2025 & 2033

- Figure 48: Middle East and Africa Semiconductor Laser Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East and Africa Semiconductor Laser Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Semiconductor Laser Industry Revenue Million Forecast, by Wavelength 2020 & 2033

- Table 2: Global Semiconductor Laser Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Semiconductor Laser Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Semiconductor Laser Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Semiconductor Laser Industry Revenue Million Forecast, by Wavelength 2020 & 2033

- Table 6: Global Semiconductor Laser Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global Semiconductor Laser Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Semiconductor Laser Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Semiconductor Laser Industry Revenue Million Forecast, by Wavelength 2020 & 2033

- Table 10: Global Semiconductor Laser Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Semiconductor Laser Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Semiconductor Laser Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Semiconductor Laser Industry Revenue Million Forecast, by Wavelength 2020 & 2033

- Table 14: Global Semiconductor Laser Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 15: Global Semiconductor Laser Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 16: Global Semiconductor Laser Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Semiconductor Laser Industry Revenue Million Forecast, by Wavelength 2020 & 2033

- Table 18: Global Semiconductor Laser Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 19: Global Semiconductor Laser Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global Semiconductor Laser Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Semiconductor Laser Industry Revenue Million Forecast, by Wavelength 2020 & 2033

- Table 22: Global Semiconductor Laser Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Semiconductor Laser Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Semiconductor Laser Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Global Semiconductor Laser Industry Revenue Million Forecast, by Wavelength 2020 & 2033

- Table 26: Global Semiconductor Laser Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 27: Global Semiconductor Laser Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global Semiconductor Laser Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Semiconductor Laser Industry?

The projected CAGR is approximately 13.40%.

2. Which companies are prominent players in the Semiconductor Laser Industry?

Key companies in the market include Coherent Inc, Panasonic Industry Co Ltd, Jenoptik Laser GMBH, Nichia Corporation, TRUmpF Group, Lumentum Holdings Inc, Rohm Company Limited, TT Electronics, ams OSRAM AG, Sheaumann Laser Inc, Newport Corporation (mks Instruments Inc ), IPG Photonics Corporation, Sharp Corporation, Hamamatsu Photonics K K, Sumitomo Electric Industries Ltd.

3. What are the main segments of the Semiconductor Laser Industry?

The market segments include Wavelength, Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.24 Million as of 2022.

5. What are some drivers contributing to market growth?

Proliferation of Semiconductor Laser Applications; Growth in the Fiber Laser Market; Preference for Semiconductor Lasers Over Other Light Sources.

6. What are the notable trends driving market growth?

Communication Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Increase in Network Complexity.

8. Can you provide examples of recent developments in the market?

November 2023 - The Air Force Research Laboratory opened a new Semiconductor Laser Indoor Propagation Range, known as SLIPR, at Kirtland Air Force Base in New Mexico to support research and development of future laser system propagation studies. SLIPR has 100-meter-long broadcast ranges in an indoor facility to test semiconductor laser technology concepts and includes photoluminescence and X-ray laboratories to characterize molecular beam epitaxy products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Semiconductor Laser Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Semiconductor Laser Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Semiconductor Laser Industry?

To stay informed about further developments, trends, and reports in the Semiconductor Laser Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence