Key Insights

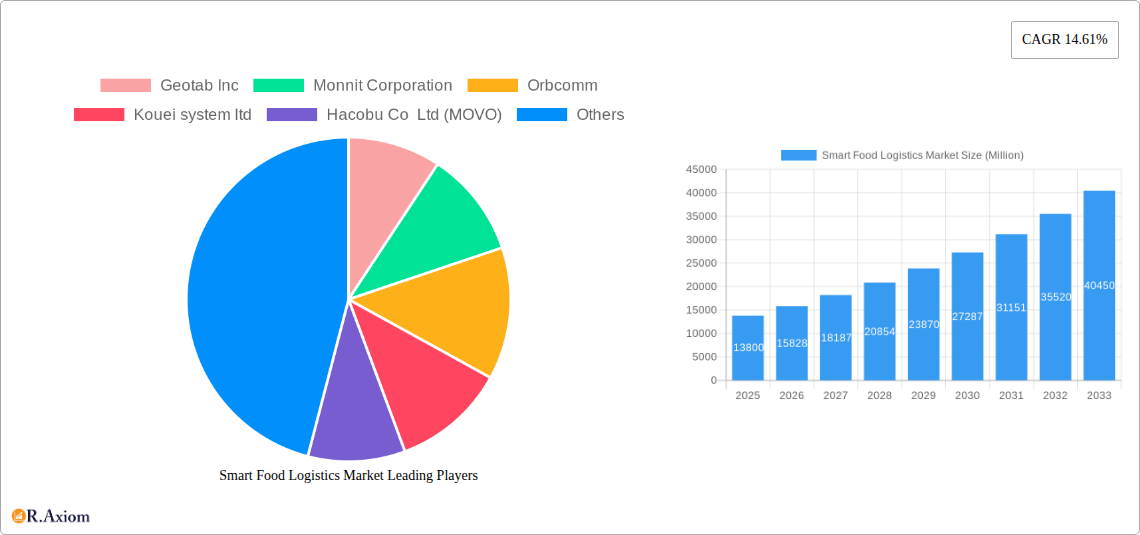

The Smart Food Logistics Market is poised for substantial expansion, projected to reach an estimated market size of $13.80 billion by 2025. This robust growth is driven by an impressive Compound Annual Growth Rate (CAGR) of 14.61%, indicating a dynamic and rapidly evolving sector. The increasing consumer demand for fresh, safe, and traceable food products, coupled with stringent regulatory requirements for food safety and quality, are fundamental drivers. Furthermore, advancements in technologies like IoT, AI, and blockchain are revolutionizing traditional logistics by enabling real-time monitoring, predictive analytics, and enhanced supply chain visibility. These innovations are crucial for minimizing spoilage, optimizing inventory management, and ensuring the integrity of the food supply chain from farm to fork. The market is segmented into key components: Hardware, Software, and Services, all of which are critical for the implementation of smart solutions. Technology segments include Fleet Management, Asset Tracking, and Cold Chain Monitoring, highlighting the multifaceted nature of smart food logistics.

Smart Food Logistics Market Market Size (In Billion)

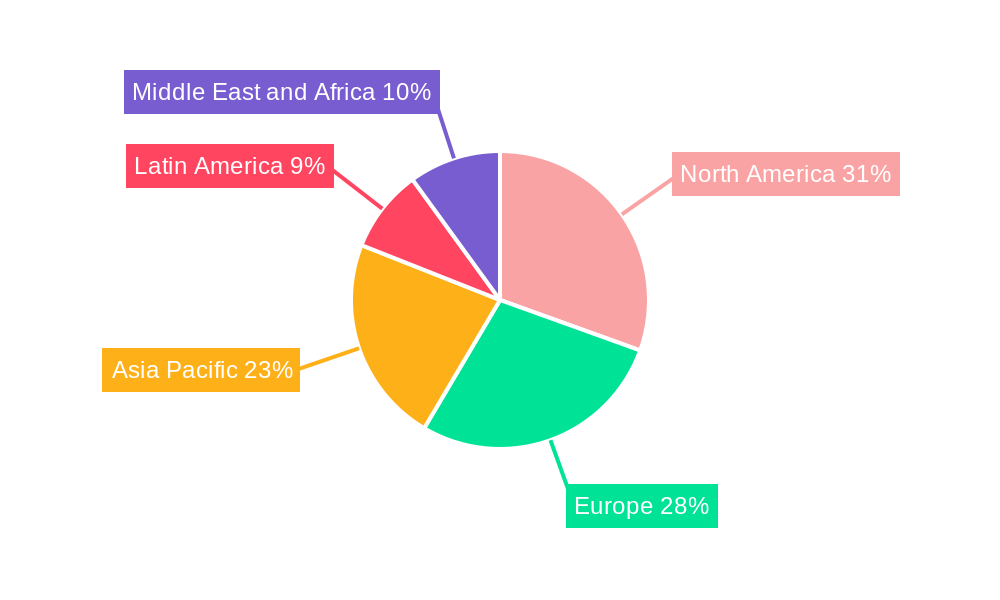

The industry is witnessing significant traction due to the growing adoption of advanced solutions that address the inherent complexities of food distribution. Companies are investing in sophisticated cold chain management systems to maintain optimal temperature conditions, thereby reducing waste and extending shelf life. Fleet management solutions are being enhanced with real-time tracking and route optimization to improve efficiency and reduce delivery times. Asset tracking, particularly for sensitive food items, provides crucial data on handling and transit conditions. Key players such as Geotab Inc., Samsara Inc., and Verizon Connect are at the forefront of developing and deploying these transformative technologies. Geographically, North America and Europe are leading markets due to their established infrastructure and early adoption of smart technologies, while the Asia Pacific region is emerging as a significant growth area driven by increasing disposable incomes and a burgeoning demand for premium food products. The market's trajectory suggests a future where intelligent, data-driven logistics become indispensable for ensuring food security and consumer satisfaction.

Smart Food Logistics Market Company Market Share

This in-depth report offers a detailed analysis of the global Smart Food Logistics Market, examining its current landscape, historical trends, and future trajectory. With a study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period of 2025–2033, this report provides actionable insights for industry stakeholders. We explore key market segments, emerging technologies, competitive strategies, and the impact of recent industry developments.

Smart Food Logistics Market Market Concentration & Innovation

The Smart Food Logistics Market is characterized by moderate concentration, with several key players vying for market share. Innovation is a primary driver, fueled by advancements in IoT, AI, and blockchain technologies that enhance visibility, efficiency, and traceability across the food supply chain. Regulatory frameworks, such as those mandating food safety and temperature control, also shape market dynamics, encouraging the adoption of smart solutions. Product substitutes, like traditional manual tracking systems, are gradually being displaced by more advanced technological alternatives. End-user trends highlight a growing demand for real-time monitoring, reduced spoilage, and improved sustainability in food transportation. Mergers and acquisitions (M&A) activities are expected to continue as companies seek to expand their technological capabilities and market reach. Notable M&A deals in the broader logistics technology sector indicate a potential market size of several billion dollars, with specific smart food logistics acquisitions contributing significantly. Market share is distributed among a mix of established logistics providers and specialized technology firms, with the top 5-7 companies holding an estimated 40-50% of the market.

Smart Food Logistics Market Industry Trends & Insights

The global Smart Food Logistics Market is poised for robust growth, driven by an escalating demand for safe, fresh, and traceable food products worldwide. A projected Compound Annual Growth Rate (CAGR) of approximately 12% to 15% is anticipated over the forecast period of 2025–2033, indicating significant expansion. Technological disruptions, including the proliferation of Internet of Things (IoT) sensors for real-time temperature, humidity, and location monitoring, are revolutionizing cold chain management. Artificial intelligence (AI) and machine learning (ML) are being integrated to optimize routing, predict demand, and enhance inventory management, thereby reducing waste and operational costs. Consumer preferences are increasingly leaning towards transparency and sustainability, pushing food producers and logistics providers to adopt smarter, more eco-friendly solutions. The competitive dynamics of the market are intensifying, with a rise in partnerships and collaborations aimed at developing comprehensive end-to-end smart logistics platforms. Increased market penetration of smart technologies is evident, particularly in developed economies, while emerging markets present significant untapped potential for growth. The market is also witnessing a surge in demand for data analytics capabilities, enabling stakeholders to gain deeper insights into supply chain performance and identify areas for improvement. Furthermore, the focus on reducing food loss and waste, a critical global challenge, is a major impetus for the adoption of smart food logistics solutions, as these technologies offer precise control and monitoring at every stage of the supply chain, from farm to fork. The overall market value is estimated to reach tens of billions of dollars by the end of the forecast period.

Dominant Markets & Segments in Smart Food Logistics Market

The Smart Food Logistics Market is dominated by North America and Europe, owing to their advanced infrastructure, high consumer spending, and stringent food safety regulations. The Asia-Pacific region is rapidly emerging as a significant growth hub, driven by increasing urbanization, a growing middle class, and substantial investments in logistics technology.

Component: Hardware

- Key Drivers: Increasing adoption of IoT sensors, GPS trackers, temperature and humidity monitoring devices, and real-time location systems (RTLS). The need for precise data capture at the source and during transit makes robust hardware essential. The market for smart sensors alone is projected to grow significantly, reaching billions of dollars.

- Dominance: Hardware constitutes a substantial portion of the market, often representing 50-60% of the initial investment. Its dominance is fueled by the foundational role it plays in enabling data collection for smart logistics.

Component: Software and Services

- Key Drivers: Demand for advanced analytics platforms, supply chain visibility software, warehouse management systems (WMS), transportation management systems (TMS), and cloud-based solutions. The value derived from data interpretation and operational efficiency significantly boosts this segment.

- Dominance: While hardware provides the data, software and services unlock its potential. This segment is experiencing rapid growth, with an estimated CAGR exceeding 15%. The increasing complexity of supply chains necessitates sophisticated software to manage operations effectively.

Technology: Fleet Management

- Key Drivers: Need for optimized routing, fuel efficiency monitoring, driver behavior analysis, predictive maintenance, and real-time vehicle tracking. Reducing operational costs and enhancing delivery efficiency are paramount.

- Dominance: Fleet management solutions are integral to any logistics operation, and their smart integration significantly impacts the food sector by ensuring timely and safe deliveries. The market size for smart fleet management in food logistics is estimated to be in the billions.

Technology: Asset Tracking

- Key Drivers: Real-time visibility of food products, containers, and vehicles throughout the supply chain to prevent loss, theft, and ensure integrity. This technology is crucial for high-value or perishable goods.

- Dominance: Asset tracking is fundamental to ensuring the security and accountability of food shipments. Its implementation across various modes of transport, from trucks to shipping containers, solidifies its dominant position.

Technology: Cold Chain Monitoring

- Key Drivers: Strict regulatory requirements for temperature-sensitive food products (e.g., dairy, meat, pharmaceuticals), preventing spoilage, and maintaining product quality. The financial impact of spoilage can be in the billions globally.

- Dominance: This is arguably the most critical technology segment within smart food logistics, given the high stakes involved in maintaining the integrity of perishable goods. Investments in cold chain monitoring solutions are substantial, running into billions of dollars annually, with continued growth anticipated.

Smart Food Logistics Market Product Developments

Product developments in the Smart Food Logistics Market are characterized by the integration of advanced IoT, AI, and blockchain technologies to offer enhanced real-time visibility, traceability, and control. Innovations focus on more sophisticated sensors for granular environmental monitoring (temperature, humidity, ethylene levels), predictive analytics for spoilage prevention, and autonomous systems for optimized routing and warehouse operations. Competitive advantages are being gained through solutions that offer end-to-end cold chain integrity, reduce food waste by millions of dollars annually, improve operational efficiency, and ensure compliance with stringent food safety regulations. For instance, the development of smart containers with self-sustaining power and advanced connectivity is transforming long-haul transportation.

Report Scope & Segmentation Analysis

This report meticulously segments the Smart Food Logistics Market across key dimensions to provide a granular understanding of market dynamics.

Component: The market is analyzed based on its primary components: Hardware (sensors, trackers, connectivity devices), Software (analytics platforms, visibility tools, AI/ML solutions), and Services (implementation, maintenance, consulting). The hardware segment is foundational, with significant market sizes in the billions, while software and services are experiencing higher growth rates, projected to outpace hardware growth in the coming years.

Technology: The technological landscape is broken down into Fleet Management (optimizing vehicle operations), Asset Tracking (monitoring the location and status of goods), and Cold Chain Monitoring (ensuring temperature-controlled environments). Cold chain monitoring is expected to exhibit the highest growth due to its critical importance in food safety and quality preservation, with a market size in the billions. Asset tracking also holds substantial market share, driven by the need for security and visibility. Fleet management, while mature, continues to evolve with smart integrations.

Key Drivers of Smart Food Logistics Market Growth

The growth of the Smart Food Logistics Market is propelled by several interconnected factors. Increasingly stringent global food safety regulations are mandating greater traceability and temperature control, driving the adoption of smart solutions. The escalating consumer demand for fresh, high-quality, and ethically sourced food products also necessitates advanced logistics capabilities. Furthermore, the significant economic losses incurred due to food spoilage and waste, estimated in the hundreds of billions globally each year, are compelling businesses to invest in technologies that minimize these inefficiencies. The ongoing advancements in IoT, AI, and cloud computing are providing cost-effective and powerful tools to achieve these objectives.

Challenges in the Smart Food Logistics Market Sector

Despite its promising growth, the Smart Food Logistics Market faces several challenges. The initial investment cost for implementing smart technologies can be a significant barrier for smaller businesses. Integration complexities with existing legacy systems can also hinder widespread adoption. Cybersecurity concerns related to the vast amounts of data collected by IoT devices need to be addressed robustly to prevent breaches and maintain data integrity. Additionally, the lack of standardized protocols and interoperability between different systems can create inefficiencies. Finally, a shortage of skilled professionals capable of managing and utilizing these advanced technologies poses a constraint on market expansion, impacting the potential market value.

Emerging Opportunities in Smart Food Logistics Market

Emerging opportunities in the Smart Food Logistics Market lie in the growing demand for sustainable logistics solutions that reduce carbon footprints, driven by consumer and regulatory pressures. The expansion of e-commerce and online grocery delivery services creates a significant need for efficient, last-mile cold chain logistics. The application of blockchain technology for enhanced transparency and counterfeit prevention in food supply chains presents another promising avenue. Furthermore, the increasing adoption of AI for predictive analytics in demand forecasting and route optimization offers substantial potential for cost savings and improved service levels. The untapped markets in developing economies, with their rapidly growing food consumption, also represent a vast opportunity for smart logistics solutions, potentially adding billions to the overall market value.

Leading Players in the Smart Food Logistics Market Market

- Geotab Inc

- Monnit Corporation

- Orbcomm

- Kouei system ltd

- Hacobu Co Ltd (MOVO)

- Seaos

- Berlinger & Co AG

- Samsara Inc

- Kii Corporation

- Teletrac Navman

- Nippon Express co Ltd

- Controlant

- LYNA LOGICS Inc

- Sensitech (Carrier Global Corporation)

- YUSEN LOGISTICS CO LTD (Nippon Yusen Kabushiki Kaisha(NYK)

- Verizon Connect

Key Developments in Smart Food Logistics Market Industry

- April 2022: CoolKit, the largest manufacturer of temperature-controlled vans in the UK, has chosen ORBCOMM Inc. to supply temperature monitoring, management, and compliance for the refrigerated vehicles it offers to customers primarily in the pharmaceutical, healthcare, food, beverage, and agricultural industries. With ORBCOMM's strong temperature recorder solution, CoolKit can prove a continuous cold chain, reduce its carbon footprint by encouraging eco-friendly driving, and improve the efficiency of its administrative operations and workflow.

- March 2022: ORBCOMM Inc. announced the launch of their CT 3500 IoT telematics device, which enables end-to-end, remote view and control of containerized assets and shipments on land, rail, and sea. ORBCOMM's data-driven refrigerated container solution improves functionality, analytics, connectivity, and interoperability with third-party telematics devices to help shippers and carriers around the world improve reefer container logistics.

Strategic Outlook for Smart Food Logistics Market Market

The strategic outlook for the Smart Food Logistics Market is exceptionally positive, driven by a confluence of technological advancements, evolving consumer expectations, and increasing regulatory demands. Companies are expected to focus on integrated solutions that offer comprehensive visibility across the entire food supply chain, from farm to fork. Investments in AI and machine learning will be crucial for optimizing operations, predicting demand, and minimizing waste, thereby contributing significantly to cost reduction and sustainability goals. The expansion into emerging markets and the development of specialized solutions for niche food categories (e.g., organic, frozen) will represent key growth catalysts. Furthermore, strategic partnerships and collaborations will play a vital role in developing innovative ecosystems that address the complex challenges of food logistics, ensuring safety, quality, and efficiency in a rapidly changing global landscape. The market is projected to see continued innovation and substantial growth, reaching tens of billions in value by the end of the forecast period.

Smart Food Logistics Market Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software and Services

-

2. Technology

- 2.1. Fleet Management

- 2.2. Asset Tracking

- 2.3. Cold Chain Monitoring

Smart Food Logistics Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Smart Food Logistics Market Regional Market Share

Geographic Coverage of Smart Food Logistics Market

Smart Food Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need for Efficient Monitoring and Tracking for Better Control of Assets

- 3.3. Market Restrains

- 3.3.1. Installation Complexities

- 3.4. Market Trends

- 3.4.1. Cold Chain Monitoring to Hold a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smart Food Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software and Services

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Fleet Management

- 5.2.2. Asset Tracking

- 5.2.3. Cold Chain Monitoring

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Smart Food Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Hardware

- 6.1.2. Software and Services

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Fleet Management

- 6.2.2. Asset Tracking

- 6.2.3. Cold Chain Monitoring

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Smart Food Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Hardware

- 7.1.2. Software and Services

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Fleet Management

- 7.2.2. Asset Tracking

- 7.2.3. Cold Chain Monitoring

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Smart Food Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Hardware

- 8.1.2. Software and Services

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Fleet Management

- 8.2.2. Asset Tracking

- 8.2.3. Cold Chain Monitoring

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America Smart Food Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Hardware

- 9.1.2. Software and Services

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Fleet Management

- 9.2.2. Asset Tracking

- 9.2.3. Cold Chain Monitoring

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East and Africa Smart Food Logistics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Hardware

- 10.1.2. Software and Services

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Fleet Management

- 10.2.2. Asset Tracking

- 10.2.3. Cold Chain Monitoring

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Geotab Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Monnit Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Orbcomm

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kouei system ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hacobu Co Ltd (MOVO)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Seaos

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Berlinger & Co AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Samsara Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kii Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Teletrac Navman

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Nippon Express co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Controlant

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 LYNA LOGICS Inc *List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Sensitech (Carrier Global Corporation)

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 YUSEN LOGISTICS CO LTD (Nippon Yusen Kabushiki Kaisha(NYK)

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Verizon Connect

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Geotab Inc

List of Figures

- Figure 1: Global Smart Food Logistics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Smart Food Logistics Market Revenue (Million), by Component 2025 & 2033

- Figure 3: North America Smart Food Logistics Market Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Smart Food Logistics Market Revenue (Million), by Technology 2025 & 2033

- Figure 5: North America Smart Food Logistics Market Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Smart Food Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Smart Food Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Smart Food Logistics Market Revenue (Million), by Component 2025 & 2033

- Figure 9: Europe Smart Food Logistics Market Revenue Share (%), by Component 2025 & 2033

- Figure 10: Europe Smart Food Logistics Market Revenue (Million), by Technology 2025 & 2033

- Figure 11: Europe Smart Food Logistics Market Revenue Share (%), by Technology 2025 & 2033

- Figure 12: Europe Smart Food Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Smart Food Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Smart Food Logistics Market Revenue (Million), by Component 2025 & 2033

- Figure 15: Asia Pacific Smart Food Logistics Market Revenue Share (%), by Component 2025 & 2033

- Figure 16: Asia Pacific Smart Food Logistics Market Revenue (Million), by Technology 2025 & 2033

- Figure 17: Asia Pacific Smart Food Logistics Market Revenue Share (%), by Technology 2025 & 2033

- Figure 18: Asia Pacific Smart Food Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Smart Food Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Smart Food Logistics Market Revenue (Million), by Component 2025 & 2033

- Figure 21: Latin America Smart Food Logistics Market Revenue Share (%), by Component 2025 & 2033

- Figure 22: Latin America Smart Food Logistics Market Revenue (Million), by Technology 2025 & 2033

- Figure 23: Latin America Smart Food Logistics Market Revenue Share (%), by Technology 2025 & 2033

- Figure 24: Latin America Smart Food Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Smart Food Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Smart Food Logistics Market Revenue (Million), by Component 2025 & 2033

- Figure 27: Middle East and Africa Smart Food Logistics Market Revenue Share (%), by Component 2025 & 2033

- Figure 28: Middle East and Africa Smart Food Logistics Market Revenue (Million), by Technology 2025 & 2033

- Figure 29: Middle East and Africa Smart Food Logistics Market Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Middle East and Africa Smart Food Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Smart Food Logistics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Smart Food Logistics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global Smart Food Logistics Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 3: Global Smart Food Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Smart Food Logistics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 5: Global Smart Food Logistics Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 6: Global Smart Food Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Smart Food Logistics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 8: Global Smart Food Logistics Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 9: Global Smart Food Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Smart Food Logistics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 11: Global Smart Food Logistics Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 12: Global Smart Food Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Smart Food Logistics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 14: Global Smart Food Logistics Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 15: Global Smart Food Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Smart Food Logistics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 17: Global Smart Food Logistics Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 18: Global Smart Food Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart Food Logistics Market?

The projected CAGR is approximately 14.61%.

2. Which companies are prominent players in the Smart Food Logistics Market?

Key companies in the market include Geotab Inc, Monnit Corporation, Orbcomm, Kouei system ltd, Hacobu Co Ltd (MOVO), Seaos, Berlinger & Co AG, Samsara Inc, Kii Corporation, Teletrac Navman, Nippon Express co Ltd, Controlant, LYNA LOGICS Inc *List Not Exhaustive, Sensitech (Carrier Global Corporation), YUSEN LOGISTICS CO LTD (Nippon Yusen Kabushiki Kaisha(NYK), Verizon Connect.

3. What are the main segments of the Smart Food Logistics Market?

The market segments include Component, Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need for Efficient Monitoring and Tracking for Better Control of Assets.

6. What are the notable trends driving market growth?

Cold Chain Monitoring to Hold a Significant Share.

7. Are there any restraints impacting market growth?

Installation Complexities.

8. Can you provide examples of recent developments in the market?

April 2022: CoolKit, the largest manufacturer of temperature-controlled vans in the UK, has chosen ORBCOMM Inc. to supply temperature monitoring, management, and compliance for the refrigerated vehicles it offers to customers primarily in the pharmaceutical, healthcare, food, beverage, and agricultural industries. With ORBCOMM's strong temperature recorder solution, CoolKit can prove a continuous cold chain, reduce its carbon footprint by encouraging eco-friendly driving, and improve the efficiency of its administrative operations and workflow.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smart Food Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smart Food Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smart Food Logistics Market?

To stay informed about further developments, trends, and reports in the Smart Food Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence