Key Insights

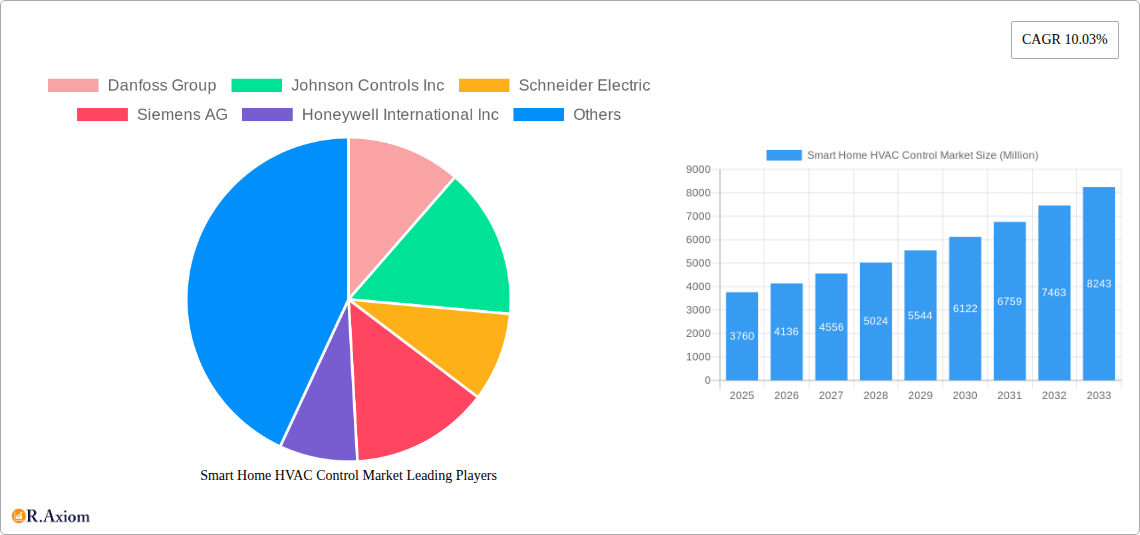

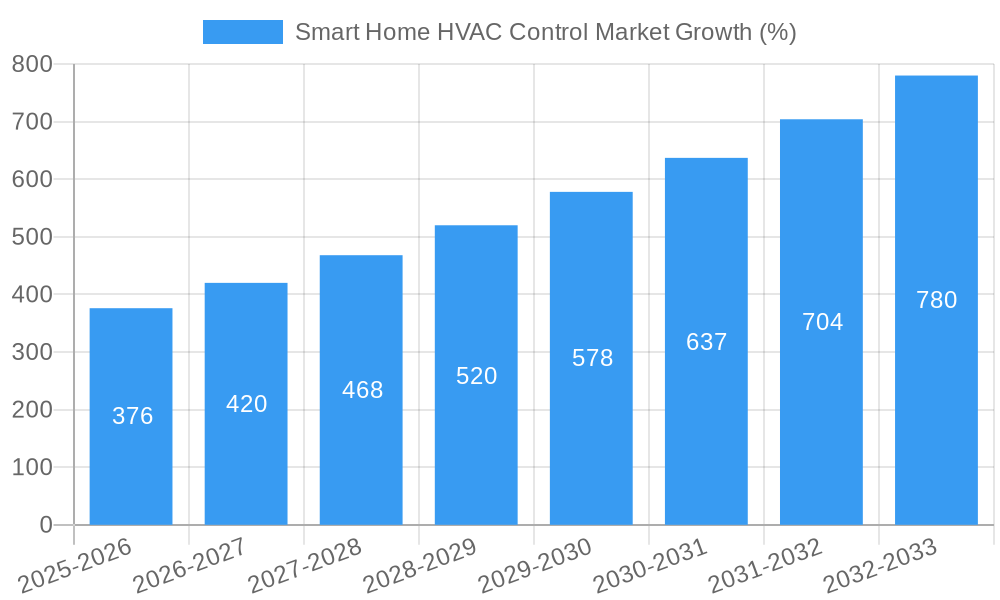

The smart home HVAC control market is experiencing robust growth, projected to reach $3.76 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 10.03% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing consumer adoption of smart home technologies, driven by the desire for enhanced convenience, energy efficiency, and remote control capabilities, is a major factor. Furthermore, rising energy costs are incentivizing homeowners to invest in smart thermostats and control systems that optimize energy consumption, leading to cost savings in the long run. The integration of smart home HVAC systems with other smart home devices, such as voice assistants and home automation platforms, further enhances their appeal and drives market penetration. Technological advancements, including the development of more sophisticated algorithms for energy optimization and the incorporation of advanced features like predictive maintenance and personalized comfort settings, also contribute to market growth. While data privacy and security concerns represent a potential restraint, industry efforts towards developing robust security protocols are mitigating these risks. The market is segmented by technology type (smart thermostats, smart vents, etc.), communication protocol (Wi-Fi, Zigbee, Z-Wave, etc.), application (residential, commercial), and geography. Major players like Danfoss, Johnson Controls, Schneider Electric, and Honeywell are actively shaping the market through product innovation and strategic partnerships.

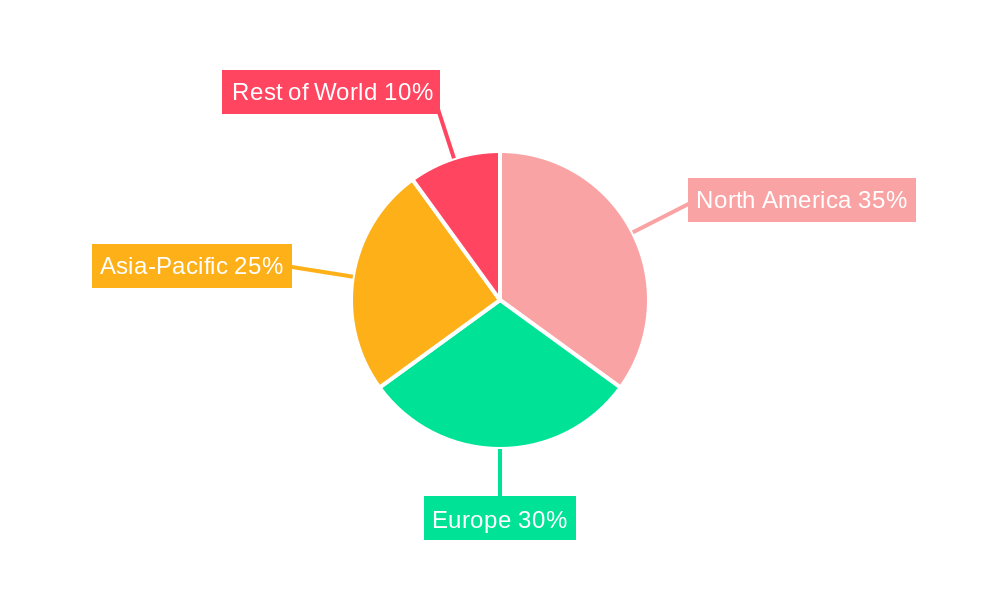

The competitive landscape is characterized by both established players and emerging companies vying for market share. Established players leverage their extensive distribution networks and brand recognition to maintain dominance, while emerging companies focus on introducing innovative solutions and leveraging cost advantages. The market's regional distribution is likely skewed towards developed economies such as North America and Europe, reflecting higher disposable incomes and greater adoption of smart home technologies. However, emerging economies in Asia-Pacific are demonstrating rapid growth potential, fueled by rising urbanization and increasing awareness of energy efficiency. Overall, the smart home HVAC control market presents a lucrative opportunity for companies that can effectively address consumer demands for convenience, cost savings, and enhanced control over their home environments. Future growth will be significantly impacted by the continued development of advanced technologies, the expanding integration of smart home ecosystems, and the increasing availability of affordable smart HVAC solutions.

Smart Home HVAC Control Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Smart Home HVAC Control market, covering market size, growth projections, key players, technological advancements, and emerging trends from 2019 to 2033. The report leverages extensive primary and secondary research, offering actionable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. The base year for this analysis is 2025, with estimations for 2025 and forecasts spanning 2025-2033. The historical period covered is 2019-2024. The global market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Smart Home HVAC Control Market Concentration & Innovation

The Smart Home HVAC Control market exhibits a moderately concentrated landscape, with several major players holding significant market share. Danfoss Group, Johnson Controls Inc., Schneider Electric, Siemens AG, and Honeywell International Inc. are among the key players, collectively accounting for an estimated xx% of the market in 2025. However, the market is witnessing increased competition from smaller, innovative companies focusing on niche segments and smart technologies.

Innovation Drivers:

- Rising consumer demand for energy efficiency and smart home integration.

- Advancements in IoT (Internet of Things) technologies, enabling seamless connectivity and remote control.

- Development of sophisticated algorithms and AI for predictive maintenance and optimized energy management.

Regulatory Frameworks:

Government regulations promoting energy efficiency and smart grid technologies are driving market growth. These regulations vary across regions, influencing adoption rates and technological preferences.

Product Substitutes:

Traditional HVAC systems remain a significant substitute, but their lack of smart features and energy efficiency is leading to gradual market share erosion.

End-User Trends:

Consumers increasingly prioritize convenience, energy savings, and personalized climate control, fueling the demand for smart HVAC solutions.

M&A Activities:

The market has witnessed significant M&A activity in recent years, with larger companies acquiring smaller players to expand their product portfolio and technological capabilities. Total M&A deal value during the historical period is estimated at xx Million. These deals have primarily focused on strengthening technological capabilities and expanding market reach.

Smart Home HVAC Control Market Industry Trends & Insights

The Smart Home HVAC Control market is experiencing robust growth, driven by several key factors. Technological advancements, such as AI-powered learning and predictive maintenance, are enhancing user experience and operational efficiency. The increasing adoption of smart home devices and the growing demand for energy-efficient solutions further contribute to market expansion. Consumer preference for personalized climate control and remote management capabilities has fueled this growth, with penetration exceeding xx% in developed markets. The market is expected to maintain a significant CAGR of xx% during the forecast period (2025-2033), driven by the factors mentioned above and the expanding smart home ecosystem. Competitive dynamics are characterized by continuous innovation, strategic partnerships, and aggressive marketing strategies aimed at capturing market share.

Dominant Markets & Segments in Smart Home HVAC Control Market

North America currently dominates the Smart Home HVAC Control market, driven by high levels of disposable income, early adoption of smart home technologies, and robust infrastructure. Europe follows closely, exhibiting significant growth potential.

Key Drivers for North American Dominance:

- High consumer spending power.

- Early adoption of smart home technologies.

- Well-established HVAC infrastructure.

- Supportive government policies promoting energy efficiency.

Dominance Analysis: The high penetration of smart home devices, coupled with supportive government initiatives promoting energy-efficient technologies, positions North America as the leading market. The mature HVAC infrastructure in the region also facilitates seamless integration of smart control systems.

Smart Home HVAC Control Market Product Developments

Recent product innovations focus on enhanced energy efficiency, improved user interfaces, and seamless integration with other smart home devices. Products like Quilt’s new heat pump, with its intuitive app and customizable design, exemplify this trend. The competitive advantage lies in offering superior energy efficiency, personalized climate control, and user-friendly interfaces. These advancements are directly responding to consumer demand for smart, energy-efficient, and customizable HVAC solutions.

Report Scope & Segmentation Analysis

This report segments the Smart Home HVAC Control market based on several criteria:

By Product Type: This segment includes smart thermostats, smart HVAC controllers, and other related devices. Each segment exhibits distinct growth trajectories and competitive landscapes. Smart thermostats currently hold the largest market share.

By Application: This segment encompasses residential and commercial applications. The residential segment is currently larger, driven by the increasing popularity of smart home technology.

By Region: North America, Europe, Asia-Pacific, and the Rest of the World are analyzed. Growth projections vary significantly by region, driven by economic factors, technology adoption rates, and government policies.

Key Drivers of Smart Home HVAC Control Market Growth

- Technological Advancements: IoT, AI, and cloud computing are enabling advanced functionalities like remote control, predictive maintenance, and energy optimization.

- Rising Energy Costs: Consumers are increasingly motivated to reduce energy consumption, driving demand for energy-efficient HVAC solutions.

- Government Regulations: Government initiatives promoting energy efficiency and smart grid technologies incentivize the adoption of smart HVAC systems.

Challenges in the Smart Home HVAC Control Market Sector

- High Initial Investment Costs: The upfront cost of installing smart HVAC systems can be a barrier for some consumers.

- Cybersecurity Concerns: Smart devices are vulnerable to cyberattacks, necessitating robust security measures to protect user data and system integrity.

- Interoperability Issues: Lack of standardization can lead to compatibility problems between different smart home devices and systems. This issue impacts seamless integration.

Emerging Opportunities in Smart Home HVAC Control Market

- Integration with Smart Assistants: Voice-controlled HVAC systems, integrated with smart assistants like Alexa or Google Assistant, offer improved user convenience.

- Predictive Maintenance: AI-powered predictive maintenance algorithms reduce downtime and extend the lifespan of HVAC equipment.

- Expansion into Emerging Markets: Developing economies present significant growth potential as consumer awareness and purchasing power increase.

Leading Players in the Smart Home HVAC Control Market Market

- Danfoss Group

- Johnson Controls Inc

- Schneider Electric

- Siemens AG

- Honeywell International Inc

- Panasonic Corporation

- Emerson Electric Company

- SAFEX TECHNOLOGIES

- Great Northern Control Inc

- Carel Industries SpA

- Smartemp

- Eato

Key Developments in Smart Home HVAC Control Market Industry

- May 2024: Quilt launches a cutting-edge home heat pump with enhanced intelligence, refined design, and superior efficiency, featuring personalized room climate control via an intuitive app and a Dial-style interface.

- March 2024: Komatsubara and tado° GmbH partner to integrate Panasonic's A2W system with tado°'s smart thermostat, enabling remote temperature control of the A2W system's indoor and outdoor units.

Strategic Outlook for Smart Home HVAC Control Market Market

The Smart Home HVAC Control market is poised for sustained growth, driven by technological innovations, rising energy costs, and increasing consumer demand for smart home solutions. Opportunities exist in developing advanced features like predictive maintenance and seamless integration with other smart home systems. Companies focusing on energy efficiency, user-friendly interfaces, and robust cybersecurity measures are well-positioned to capitalize on this growth. The market will likely see consolidation through M&A activity, as larger players seek to expand their market share and technological capabilities.

Smart Home HVAC Control Market Segmentation

-

1. Product Type

- 1.1. Controllers

- 1.2. Thermostats

- 1.3. Sensors

- 1.4. Valves and Actuators

Smart Home HVAC Control Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Smart Home HVAC Control Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.03% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Number of Residential Construction Projects; Increasing Government Policies Energy Efficiency Driving the Demand

- 3.3. Market Restrains

- 3.3.1. Rising Number of Residential Construction Projects; Increasing Government Policies Energy Efficiency Driving the Demand

- 3.4. Market Trends

- 3.4.1. Rising Popularity of Smart Thermostats

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smart Home HVAC Control Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Controllers

- 5.1.2. Thermostats

- 5.1.3. Sensors

- 5.1.4. Valves and Actuators

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.2.5. Latin America

- 5.2.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Smart Home HVAC Control Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Controllers

- 6.1.2. Thermostats

- 6.1.3. Sensors

- 6.1.4. Valves and Actuators

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Smart Home HVAC Control Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Controllers

- 7.1.2. Thermostats

- 7.1.3. Sensors

- 7.1.4. Valves and Actuators

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Smart Home HVAC Control Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Controllers

- 8.1.2. Thermostats

- 8.1.3. Sensors

- 8.1.4. Valves and Actuators

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia and New Zealand Smart Home HVAC Control Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Controllers

- 9.1.2. Thermostats

- 9.1.3. Sensors

- 9.1.4. Valves and Actuators

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Latin America Smart Home HVAC Control Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Controllers

- 10.1.2. Thermostats

- 10.1.3. Sensors

- 10.1.4. Valves and Actuators

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Middle East and Africa Smart Home HVAC Control Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Controllers

- 11.1.2. Thermostats

- 11.1.3. Sensors

- 11.1.4. Valves and Actuators

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Danfoss Group

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Johnson Controls Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Schneider Electric

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Siemens AG

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Honeywell International Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Panasonic Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Emerson Electric Company

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 SAFEX TECHNOLOGIES

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Great Northern Control Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Carel Industries SpA

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Smartemp

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Eato

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Danfoss Group

List of Figures

- Figure 1: Global Smart Home HVAC Control Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Smart Home HVAC Control Market Volume Breakdown (Billion, %) by Region 2024 & 2032

- Figure 3: North America Smart Home HVAC Control Market Revenue (Million), by Product Type 2024 & 2032

- Figure 4: North America Smart Home HVAC Control Market Volume (Billion), by Product Type 2024 & 2032

- Figure 5: North America Smart Home HVAC Control Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 6: North America Smart Home HVAC Control Market Volume Share (%), by Product Type 2024 & 2032

- Figure 7: North America Smart Home HVAC Control Market Revenue (Million), by Country 2024 & 2032

- Figure 8: North America Smart Home HVAC Control Market Volume (Billion), by Country 2024 & 2032

- Figure 9: North America Smart Home HVAC Control Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Smart Home HVAC Control Market Volume Share (%), by Country 2024 & 2032

- Figure 11: Europe Smart Home HVAC Control Market Revenue (Million), by Product Type 2024 & 2032

- Figure 12: Europe Smart Home HVAC Control Market Volume (Billion), by Product Type 2024 & 2032

- Figure 13: Europe Smart Home HVAC Control Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 14: Europe Smart Home HVAC Control Market Volume Share (%), by Product Type 2024 & 2032

- Figure 15: Europe Smart Home HVAC Control Market Revenue (Million), by Country 2024 & 2032

- Figure 16: Europe Smart Home HVAC Control Market Volume (Billion), by Country 2024 & 2032

- Figure 17: Europe Smart Home HVAC Control Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Smart Home HVAC Control Market Volume Share (%), by Country 2024 & 2032

- Figure 19: Asia Smart Home HVAC Control Market Revenue (Million), by Product Type 2024 & 2032

- Figure 20: Asia Smart Home HVAC Control Market Volume (Billion), by Product Type 2024 & 2032

- Figure 21: Asia Smart Home HVAC Control Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 22: Asia Smart Home HVAC Control Market Volume Share (%), by Product Type 2024 & 2032

- Figure 23: Asia Smart Home HVAC Control Market Revenue (Million), by Country 2024 & 2032

- Figure 24: Asia Smart Home HVAC Control Market Volume (Billion), by Country 2024 & 2032

- Figure 25: Asia Smart Home HVAC Control Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Smart Home HVAC Control Market Volume Share (%), by Country 2024 & 2032

- Figure 27: Australia and New Zealand Smart Home HVAC Control Market Revenue (Million), by Product Type 2024 & 2032

- Figure 28: Australia and New Zealand Smart Home HVAC Control Market Volume (Billion), by Product Type 2024 & 2032

- Figure 29: Australia and New Zealand Smart Home HVAC Control Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 30: Australia and New Zealand Smart Home HVAC Control Market Volume Share (%), by Product Type 2024 & 2032

- Figure 31: Australia and New Zealand Smart Home HVAC Control Market Revenue (Million), by Country 2024 & 2032

- Figure 32: Australia and New Zealand Smart Home HVAC Control Market Volume (Billion), by Country 2024 & 2032

- Figure 33: Australia and New Zealand Smart Home HVAC Control Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Australia and New Zealand Smart Home HVAC Control Market Volume Share (%), by Country 2024 & 2032

- Figure 35: Latin America Smart Home HVAC Control Market Revenue (Million), by Product Type 2024 & 2032

- Figure 36: Latin America Smart Home HVAC Control Market Volume (Billion), by Product Type 2024 & 2032

- Figure 37: Latin America Smart Home HVAC Control Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 38: Latin America Smart Home HVAC Control Market Volume Share (%), by Product Type 2024 & 2032

- Figure 39: Latin America Smart Home HVAC Control Market Revenue (Million), by Country 2024 & 2032

- Figure 40: Latin America Smart Home HVAC Control Market Volume (Billion), by Country 2024 & 2032

- Figure 41: Latin America Smart Home HVAC Control Market Revenue Share (%), by Country 2024 & 2032

- Figure 42: Latin America Smart Home HVAC Control Market Volume Share (%), by Country 2024 & 2032

- Figure 43: Middle East and Africa Smart Home HVAC Control Market Revenue (Million), by Product Type 2024 & 2032

- Figure 44: Middle East and Africa Smart Home HVAC Control Market Volume (Billion), by Product Type 2024 & 2032

- Figure 45: Middle East and Africa Smart Home HVAC Control Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 46: Middle East and Africa Smart Home HVAC Control Market Volume Share (%), by Product Type 2024 & 2032

- Figure 47: Middle East and Africa Smart Home HVAC Control Market Revenue (Million), by Country 2024 & 2032

- Figure 48: Middle East and Africa Smart Home HVAC Control Market Volume (Billion), by Country 2024 & 2032

- Figure 49: Middle East and Africa Smart Home HVAC Control Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East and Africa Smart Home HVAC Control Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Smart Home HVAC Control Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Smart Home HVAC Control Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Global Smart Home HVAC Control Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Global Smart Home HVAC Control Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 5: Global Smart Home HVAC Control Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Smart Home HVAC Control Market Volume Billion Forecast, by Region 2019 & 2032

- Table 7: Global Smart Home HVAC Control Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 8: Global Smart Home HVAC Control Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 9: Global Smart Home HVAC Control Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Smart Home HVAC Control Market Volume Billion Forecast, by Country 2019 & 2032

- Table 11: Global Smart Home HVAC Control Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 12: Global Smart Home HVAC Control Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 13: Global Smart Home HVAC Control Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Smart Home HVAC Control Market Volume Billion Forecast, by Country 2019 & 2032

- Table 15: Global Smart Home HVAC Control Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 16: Global Smart Home HVAC Control Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 17: Global Smart Home HVAC Control Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Smart Home HVAC Control Market Volume Billion Forecast, by Country 2019 & 2032

- Table 19: Global Smart Home HVAC Control Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: Global Smart Home HVAC Control Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 21: Global Smart Home HVAC Control Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Smart Home HVAC Control Market Volume Billion Forecast, by Country 2019 & 2032

- Table 23: Global Smart Home HVAC Control Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 24: Global Smart Home HVAC Control Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 25: Global Smart Home HVAC Control Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Smart Home HVAC Control Market Volume Billion Forecast, by Country 2019 & 2032

- Table 27: Global Smart Home HVAC Control Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 28: Global Smart Home HVAC Control Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 29: Global Smart Home HVAC Control Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Global Smart Home HVAC Control Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart Home HVAC Control Market?

The projected CAGR is approximately 10.03%.

2. Which companies are prominent players in the Smart Home HVAC Control Market?

Key companies in the market include Danfoss Group, Johnson Controls Inc, Schneider Electric, Siemens AG, Honeywell International Inc, Panasonic Corporation, Emerson Electric Company, SAFEX TECHNOLOGIES, Great Northern Control Inc, Carel Industries SpA, Smartemp, Eato.

3. What are the main segments of the Smart Home HVAC Control Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.76 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Number of Residential Construction Projects; Increasing Government Policies Energy Efficiency Driving the Demand.

6. What are the notable trends driving market growth?

Rising Popularity of Smart Thermostats.

7. Are there any restraints impacting market growth?

Rising Number of Residential Construction Projects; Increasing Government Policies Energy Efficiency Driving the Demand.

8. Can you provide examples of recent developments in the market?

May 2024 - Quilt, a leading smart home climate company, unveiled its latest innovation: a cutting-edge home heat pump. This next-gen system outshines its competitors with its enhanced intelligence, refined design, and superior efficiency. Tailored for personalized room climate control, each unit is accompanied by an intuitive app and a Dial reminiscent of a traditional thermostat, empowering users to manage their home temperatures effortlessly. The option for users to customize the appearance of the indoor units sets the product apart.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smart Home HVAC Control Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smart Home HVAC Control Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smart Home HVAC Control Market?

To stay informed about further developments, trends, and reports in the Smart Home HVAC Control Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence