Key Insights

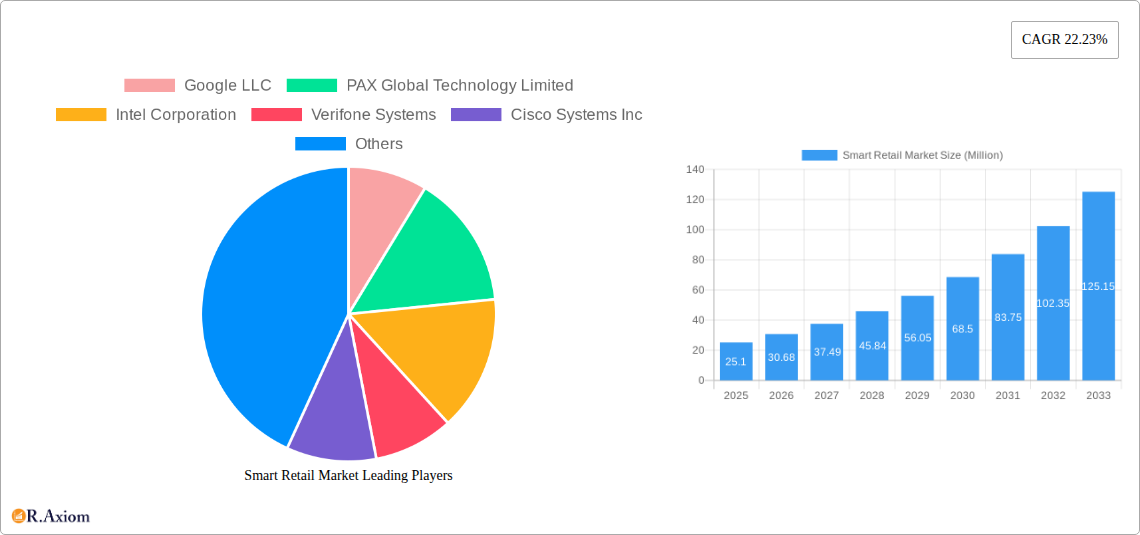

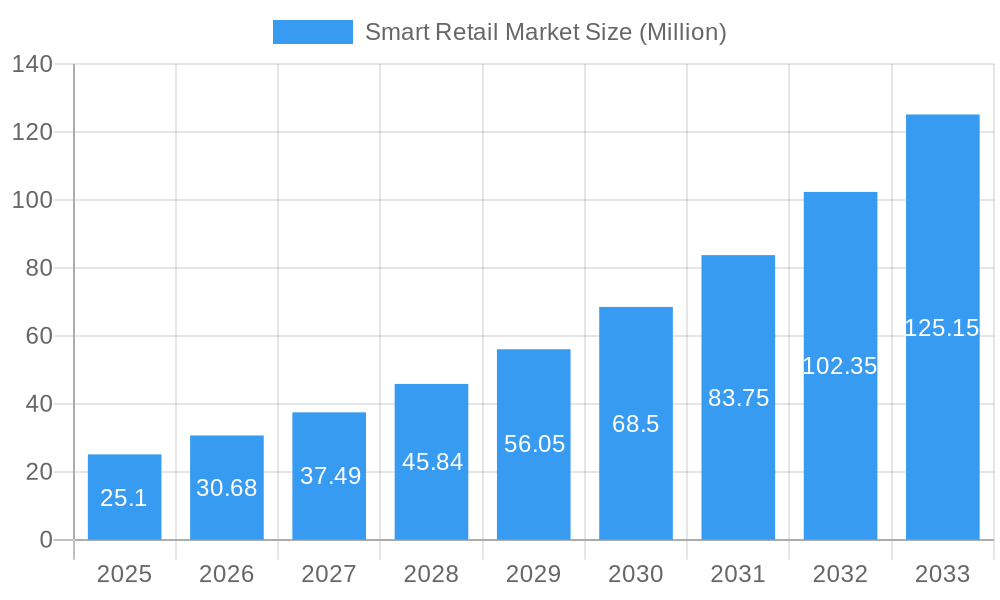

The global Smart Retail Market is experiencing robust expansion, currently valued at approximately $25.10 million and projected to grow at a compelling Compound Annual Growth Rate (CAGR) of 22.23% during the forecast period of 2025-2033. This significant growth is underpinned by a confluence of technological advancements and evolving consumer expectations. Key drivers fueling this surge include the increasing adoption of AI and IoT technologies to enhance in-store experiences, optimize operational efficiency, and personalize customer interactions. The demand for real-time data analytics for inventory management, the imperative for robust brand protection against counterfeiting, and the growing need for accurate foot-traffic monitoring to inform strategic decisions are all contributing to market momentum. Furthermore, advancements in loyalty management and payment systems, coupled with the proactive approach of predictive equipment maintenance to minimize downtime, are shaping the landscape of modern retail operations. The market is segmented across crucial components like hardware, software, and services, catering to diverse applications that are revolutionizing how retailers engage with their customers and manage their businesses.

Smart Retail Market Market Size (In Million)

The dynamic nature of the smart retail ecosystem is further highlighted by emerging trends such as the integration of augmented reality (AR) and virtual reality (VR) for immersive shopping experiences, the rise of autonomous checkout systems, and the utilization of computer vision for sophisticated customer analytics. While significant opportunities exist, the market also faces certain restraints, including the substantial initial investment required for deploying advanced smart retail technologies and concerns surrounding data privacy and cybersecurity. However, the overwhelming benefits in terms of enhanced customer satisfaction, improved operational costs, and increased revenue generation are compelling retailers worldwide to embrace these innovative solutions. The market is characterized by intense competition among major technology providers and retail solution developers, driving continuous innovation and the development of more sophisticated and integrated smart retail offerings across all geographical regions.

Smart Retail Market Company Market Share

Unlock profound insights into the rapidly evolving Smart Retail Market. This in-depth report provides a definitive analysis of the global market for intelligent retail solutions, covering hardware, software, and services that are revolutionizing the customer experience and operational efficiency. With a study period spanning from 2019 to 2033, this report offers crucial data for retail technology providers, software developers, hardware manufacturers, service integrators, investors, and retail industry stakeholders.

This comprehensive report dives deep into the market concentration, innovation drivers, and growth trajectories of the smart retail ecosystem. Explore pivotal industry developments, understand dominant market segments, and identify key players shaping the future of retail. With predictive equipment maintenance, loyalty management and payment systems, inventory management solutions, and foot-traffic monitoring technologies at its core, the smart retail market is poised for unprecedented growth. Our analysis includes granular segmentation by Component (Hardware, Software, Services) and Application, offering actionable intelligence for strategic decision-making.

Key Report Highlights:

This report is essential for businesses aiming to capitalize on the digital transformation of retail, enhance customer engagement, optimize operations, and gain a competitive edge in the dynamic global smart retail market.

- Market Size & Forecast: Global Smart Retail Market valued at over $XX Billion in 2025, projected to reach over $XX Trillion by 2033, exhibiting a robust CAGR of XX% during the forecast period (2025-2033).

- Dominant Segments: Deep dive into the leading segments within Hardware, Software, and Services, and applications such as Inventory Management, Loyalty Management and Payment, and Foot-Traffic Monitoring.

- Key Players: Comprehensive profiling of leading companies including Google LLC, PAX Global Technology Limited, Intel Corporation, Verifone Systems, Cisco Systems Inc, Huawei Technologies Co Ltd, IBM Corporation, Fiserv Inc, Microsoft, Honeywell International Inc, NVIDIA Corporation, Samsung Electronics, Amazon com Inc, NXP Semiconductors, Caper Inc, Ingenico Group, Focal Systems Inc, LG Display Co Ltd, NCR Corporation.

- Industry Developments: Analysis of recent breakthroughs and their market impact.

Smart Retail Market Market Concentration & Innovation

The global Smart Retail Market is characterized by a dynamic interplay of established technology giants and innovative startups, resulting in moderate to high market concentration. Leading players like Google LLC, IBM Corporation, Microsoft, and Amazon com Inc exert significant influence through their comprehensive cloud, AI, and data analytics offerings. Hardware manufacturers such as Intel Corporation, NVIDIA Corporation, and Samsung Electronics provide the foundational technologies, while specialized solution providers like PAX Global Technology Limited, Verifone Systems, and Ingenico Group dominate the payment and point-of-sale segments. Innovation is primarily driven by advancements in Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), and advanced analytics, enabling personalized customer experiences, efficient inventory management, and predictive maintenance. The market is also witnessing a surge in M&A activities as larger corporations acquire promising startups to expand their technology portfolios and market reach. Key M&A deal values are estimated to be in the range of hundreds of Millions to several Billions during the historical period. Regulatory frameworks are evolving to address data privacy and security concerns, influencing the deployment of smart retail solutions. Product substitutes, such as traditional retail models, are progressively being overshadowed by the superior efficiency and customer engagement offered by smart retail technologies. End-user trends increasingly favor hyper-personalization, seamless omnichannel experiences, and frictionless checkout processes, further propelling innovation.

Smart Retail Market Industry Trends & Insights

The Smart Retail Market is experiencing a paradigm shift, driven by a confluence of technological advancements, evolving consumer expectations, and the imperative for operational efficiency. The market is projected to witness substantial growth, with a Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This robust expansion is fueled by the increasing adoption of AI-powered solutions for tasks ranging from predictive equipment maintenance to sophisticated inventory management and real-time foot-traffic monitoring. Consumer preferences are leaning heavily towards personalized shopping experiences, contactless payment options, and the convenience of self-checkout or scan-and-go technologies. Retailers are investing heavily in smart technologies to gain a competitive edge, reduce operational costs, and enhance customer loyalty. The integration of IoT devices, advanced analytics, and cloud computing is enabling retailers to gather actionable insights into consumer behavior, optimize supply chains, and personalize marketing efforts. The competitive landscape is intensifying, with significant investments in research and development by major technology players like Google LLC, Microsoft, and IBM Corporation, who are leveraging their expertise in AI and cloud infrastructure. Emerging technologies such as augmented reality (AR) and virtual reality (VR) are also finding applications in smart retail, offering immersive shopping experiences. The increasing penetration of high-speed internet and the growing availability of affordable smart devices further contribute to the market's upward trajectory. The push for sustainability is also influencing smart retail, with solutions aimed at reducing energy consumption and waste. The transition to a data-driven retail environment is no longer a future prospect but a present reality, with retailers recognizing the immense value of real-time data for informed decision-making and enhanced customer satisfaction. The ability to predict equipment failures before they occur, personalize customer journeys through loyalty management systems, and optimize stock levels through intelligent inventory management are key differentiators in today's competitive retail arena.

Dominant Markets & Segments in Smart Retail Market

The global Smart Retail Market is segmented across various components and applications, with distinct regions and specific segments demonstrating remarkable dominance.

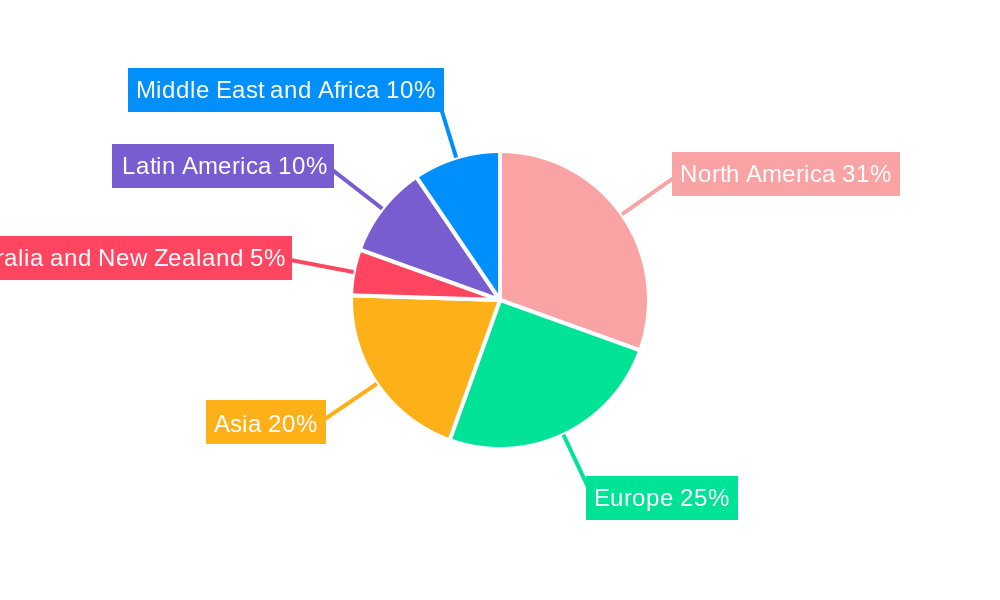

Leading Regions: North America currently leads the smart retail market, driven by early adoption of advanced technologies, high disposable incomes, and a strong presence of major retail chains and technology innovators. The United States, in particular, is a key market for smart retail solutions. Asia Pacific is emerging as a rapidly growing region, fueled by the expanding e-commerce landscape, increasing smartphone penetration, and government initiatives to promote digital transformation in retail. Countries like China and India are significant contributors to this growth.

Dominant Components:

- Hardware: The hardware segment, encompassing smart POS systems, sensors, cameras, digital signage, and RFID tags, is a foundational pillar of the smart retail market. The increasing demand for sophisticated in-store analytics, contactless payment terminals, and automated checkout systems drives the growth of this segment. The market size for hardware is estimated to be over $XX Billion in 2025.

- Key Drivers:

- Technological advancements in sensors and processing power.

- Declining cost of IoT devices.

- Need for enhanced in-store customer experiences.

- Key Drivers:

- Software: The software segment, including AI-powered analytics, inventory management systems, customer relationship management (CRM) tools, and loyalty program platforms, is critical for deriving actionable insights and automating retail operations. The increasing sophistication of AI and machine learning algorithms is a significant growth driver. The market size for software is estimated to be over $XX Billion in 2025.

- Key Drivers:

- Demand for personalized customer engagement.

- Need for operational efficiency and cost reduction.

- Advancements in data analytics and AI.

- Key Drivers:

- Services: The services segment, encompassing implementation, integration, maintenance, and consulting, is essential for the successful deployment and ongoing support of smart retail solutions. As smart retail ecosystems become more complex, the demand for expert services is growing. The market size for services is estimated to be over $XX Billion in 2025.

- Key Drivers:

- Increasing complexity of smart retail deployments.

- Need for specialized expertise in AI, IoT, and cloud integration.

- Focus on maximizing ROI from technology investments.

- Key Drivers:

Dominant Applications:

- Loyalty Management and Payment: This application segment is a major driver of smart retail growth. Integrated payment solutions, personalized loyalty programs, and seamless checkout experiences are crucial for customer retention and increased sales. The market size for loyalty management and payment solutions is estimated to be over $XX Billion in 2025.

- Key Drivers:

- Consumer demand for convenient and rewarding shopping experiences.

- Retailers' focus on customer retention and lifetime value.

- Advancements in mobile payment and digital wallets.

- Key Drivers:

- Inventory Management: Efficient inventory management is paramount for retailers to minimize stockouts and reduce overstocking. Smart inventory solutions leverage AI and IoT to provide real-time visibility, automate reordering, and optimize stock levels. The market size for inventory management solutions is estimated to be over $XX Billion in 2025.

- Key Drivers:

- Need to reduce carrying costs and minimize losses from obsolete inventory.

- Demand for real-time stock visibility across multiple channels.

- Integration with e-commerce platforms for omnichannel fulfillment.

- Key Drivers:

- Foot-Traffic Monitoring: Understanding customer movement within physical stores is crucial for optimizing store layout, product placement, and staffing. Foot-traffic monitoring solutions provide valuable insights into customer behavior and engagement. The market size for foot-traffic monitoring solutions is estimated to be over $XX Billion in 2025.

- Key Drivers:

- Retailers' need to optimize store layout and product placement.

- Desire to understand customer dwell times and engagement patterns.

- Enabling personalized in-store offers based on customer presence.

- Key Drivers:

Smart Retail Market Product Developments

The smart retail market is characterized by continuous product innovation aimed at enhancing customer experience and operational efficiency. Recent developments include AI-powered smart carts that allow shoppers to scan items and bypass checkout lines, such as those introduced by Instacart. These innovations integrate seamlessly with inventory management and payment systems, offering unprecedented convenience. Digital signage is evolving with interactive displays and personalized content delivery, driven by real-time data analytics. Furthermore, advancements in IoT sensors and cameras are enabling more sophisticated foot-traffic monitoring and in-store analytics, providing retailers with deeper insights into consumer behavior. The development of unified commerce platforms that integrate online and offline channels is also a key trend, creating a seamless customer journey.

Report Scope & Segmentation Analysis

This report offers a comprehensive segmentation of the Smart Retail Market.

- Component: The market is segmented into Hardware, encompassing devices like smart POS terminals, sensors, and cameras; Software, including AI analytics, inventory management, and CRM systems; and Services, such as implementation, integration, and support.

- Application: Key applications analyzed include Inventory Management, focusing on optimizing stock levels and reducing waste; Brand Protection, ensuring product authenticity and supply chain integrity; Foot-Traffic Monitoring, for understanding customer behavior and store layout optimization; Loyalty Management and Payment, streamlining customer rewards and transaction processes; Predictive Equipment Maintenance, minimizing downtime and operational disruptions; and Others, covering emerging applications like personalized advertising and in-store robotics.

Each segment is analyzed with its current market size, projected growth, and key market dynamics.

Key Drivers of Smart Retail Market Growth

The Smart Retail Market is propelled by several key drivers:

- Technological Advancements: The rapid evolution of AI, IoT, machine learning, and cloud computing enables more sophisticated and integrated smart retail solutions, driving innovation in areas like personalized customer experiences, automated operations, and predictive analytics.

- Evolving Consumer Expectations: Consumers increasingly demand seamless, personalized, and convenient shopping experiences, both online and offline, pushing retailers to adopt smart technologies to meet these demands.

- Demand for Operational Efficiency: Retailers are focused on reducing operational costs, optimizing supply chains, and improving inventory management, which smart retail solutions effectively address.

- Increased Data Availability and Analytics: The proliferation of connected devices generates vast amounts of data, which, when analyzed effectively, provides invaluable insights for business decision-making and customer engagement.

- Growth of E-commerce and Omnichannel Retail: The blurring lines between online and offline retail necessitate integrated smart solutions that can manage customer journeys across all touchpoints.

Challenges in the Smart Retail Market Sector

Despite its immense growth potential, the Smart Retail Market faces several challenges:

- High Initial Investment Costs: The implementation of comprehensive smart retail solutions can require significant upfront investment in hardware, software, and integration, posing a barrier for smaller retailers.

- Data Privacy and Security Concerns: The collection and analysis of vast amounts of customer data raise concerns about privacy and security, necessitating robust data protection measures and regulatory compliance.

- Integration Complexity: Integrating disparate smart retail systems and ensuring seamless interoperability can be a complex and time-consuming process.

- Talent Gap: A shortage of skilled professionals with expertise in AI, data analytics, and IoT implementation can hinder the adoption and effective utilization of smart retail technologies.

- Resistance to Change: Some traditional retailers may exhibit resistance to adopting new technologies and changing established business processes.

Emerging Opportunities in Smart Retail Market

The Smart Retail Market presents numerous emerging opportunities:

- Hyper-Personalization at Scale: Leveraging AI and machine learning to deliver truly individualized shopping experiences, from product recommendations to in-store promotions.

- Augmented and Virtual Reality Applications: Immersive shopping experiences through AR/VR for virtual try-ons, product visualization, and enhanced store navigation.

- Sustainable Retail Solutions: Developing smart technologies that contribute to energy efficiency, waste reduction, and ethical sourcing within the retail supply chain.

- The Metaverse and Retail: Exploring opportunities for virtual retail spaces, digital goods, and immersive brand experiences within metaverse platforms.

- Edge Computing for Real-Time Insights: Deploying AI and analytics at the edge of the network to enable instantaneous decision-making within physical stores, improving responsiveness and efficiency.

Leading Players in the Smart Retail Market Market

- Google LLC

- PAX Global Technology Limited

- Intel Corporation

- Verifone Systems

- Cisco Systems Inc

- Huawei Technologies Co Ltd

- IBM Corporation

- Fiserv Inc

- Microsoft

- Honeywell International Inc

- NVIDIA Corporation

- Samsung Electronics

- Amazon com Inc

- NXP Semiconductors

- Caper Inc

- Ingenico Group

- Focal Systems Inc

- LG Display Co Ltd

- NCR Corporation

Key Developments in Smart Retail Market Industry

- June 2024: Instacart, in collaboration with Price Chopper and McKeever's Market & Eatery, announced the introduction of Caper Carts, which are powered by artificial intelligence, at select locations in Missouri. These innovative smart carts enhance the shopping experience by enabling customers to scan items while they shop easily, monitor their grocery budget in real time, and bypass the checkout line altogether.

- February 2024: Huawei introduced the Smart Retail Solution, tailored for retail campuses, individual stores, and interconnected multi-branch operations. This series of solutions emphasizes smart retail environments, intelligent warehousing, energy efficiency, and digital marketing strategies. By leveraging cutting-edge Wi-Fi, storage, cloud, and Internet of Things (IoT) technologies, it aims to enhance operational efficiency, lower expenses, and elevate the consumer experience for retail enterprises.

Strategic Outlook for Smart Retail Market Market

The strategic outlook for the Smart Retail Market is exceptionally promising, driven by an irreversible shift towards digital transformation in the retail sector. The increasing adoption of AI, IoT, and data analytics will continue to fuel innovation, leading to more sophisticated customer engagement tools and highly optimized operational processes. The demand for seamless omnichannel experiences will push retailers to further integrate their online and offline presences, creating a unified and personalized customer journey. Key growth catalysts will include the development of more intuitive and cost-effective smart solutions, the expansion of smart retail into emerging markets, and the ongoing exploration of new technologies like AR/VR and metaverse integrations. Investments in predictive analytics for inventory and equipment maintenance will become standard, while enhanced loyalty programs and frictionless payment systems will be critical for customer retention. The market is poised for continued expansion as retailers recognize smart technologies not just as a competitive advantage, but as a fundamental necessity for survival and growth in the evolving retail landscape.

Smart Retail Market Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. Application

- 2.1. Inventory Management

- 2.2. Brand Protection

- 2.3. Foot-Traffic Monitoring

- 2.4. Loyalty Management and Payment

- 2.5. Predictive Equipment Maintenance

- 2.6. Others

Smart Retail Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Smart Retail Market Regional Market Share

Geographic Coverage of Smart Retail Market

Smart Retail Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 22.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Investments in Retail Chains and Retail Supermarkets; Rising Adoption of Advances in Technology Across Retail Chain

- 3.3. Market Restrains

- 3.3.1. Growing Investments in Retail Chains and Retail Supermarkets; Rising Adoption of Advances in Technology Across Retail Chain

- 3.4. Market Trends

- 3.4.1. Inventory Managment Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smart Retail Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Inventory Management

- 5.2.2. Brand Protection

- 5.2.3. Foot-Traffic Monitoring

- 5.2.4. Loyalty Management and Payment

- 5.2.5. Predictive Equipment Maintenance

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Smart Retail Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Hardware

- 6.1.2. Software

- 6.1.3. Services

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Inventory Management

- 6.2.2. Brand Protection

- 6.2.3. Foot-Traffic Monitoring

- 6.2.4. Loyalty Management and Payment

- 6.2.5. Predictive Equipment Maintenance

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Smart Retail Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Hardware

- 7.1.2. Software

- 7.1.3. Services

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Inventory Management

- 7.2.2. Brand Protection

- 7.2.3. Foot-Traffic Monitoring

- 7.2.4. Loyalty Management and Payment

- 7.2.5. Predictive Equipment Maintenance

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Smart Retail Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Hardware

- 8.1.2. Software

- 8.1.3. Services

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Inventory Management

- 8.2.2. Brand Protection

- 8.2.3. Foot-Traffic Monitoring

- 8.2.4. Loyalty Management and Payment

- 8.2.5. Predictive Equipment Maintenance

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Australia and New Zealand Smart Retail Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Hardware

- 9.1.2. Software

- 9.1.3. Services

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Inventory Management

- 9.2.2. Brand Protection

- 9.2.3. Foot-Traffic Monitoring

- 9.2.4. Loyalty Management and Payment

- 9.2.5. Predictive Equipment Maintenance

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Latin America Smart Retail Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Hardware

- 10.1.2. Software

- 10.1.3. Services

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Inventory Management

- 10.2.2. Brand Protection

- 10.2.3. Foot-Traffic Monitoring

- 10.2.4. Loyalty Management and Payment

- 10.2.5. Predictive Equipment Maintenance

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Middle East and Africa Smart Retail Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Component

- 11.1.1. Hardware

- 11.1.2. Software

- 11.1.3. Services

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Inventory Management

- 11.2.2. Brand Protection

- 11.2.3. Foot-Traffic Monitoring

- 11.2.4. Loyalty Management and Payment

- 11.2.5. Predictive Equipment Maintenance

- 11.2.6. Others

- 11.1. Market Analysis, Insights and Forecast - by Component

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Google LLC

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 PAX Global Technology Limited

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Intel Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Verifone Systems

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Cisco Systems Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Huawei Technologies Co Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 IBM Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Fiserv Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Microsoft

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Honeywell International Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 NVIDIA Corporation

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Samsung Electronics

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Amazon com Inc

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 NXP Semiconductors

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Caper Inc

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.16 Ingenico Group

- 12.2.16.1. Overview

- 12.2.16.2. Products

- 12.2.16.3. SWOT Analysis

- 12.2.16.4. Recent Developments

- 12.2.16.5. Financials (Based on Availability)

- 12.2.17 Focal Systems Inc

- 12.2.17.1. Overview

- 12.2.17.2. Products

- 12.2.17.3. SWOT Analysis

- 12.2.17.4. Recent Developments

- 12.2.17.5. Financials (Based on Availability)

- 12.2.18 LG Display Co Ltd

- 12.2.18.1. Overview

- 12.2.18.2. Products

- 12.2.18.3. SWOT Analysis

- 12.2.18.4. Recent Developments

- 12.2.18.5. Financials (Based on Availability)

- 12.2.19 NCR Corporation*List Not Exhaustive

- 12.2.19.1. Overview

- 12.2.19.2. Products

- 12.2.19.3. SWOT Analysis

- 12.2.19.4. Recent Developments

- 12.2.19.5. Financials (Based on Availability)

- 12.2.1 Google LLC

List of Figures

- Figure 1: Global Smart Retail Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Smart Retail Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Smart Retail Market Revenue (Million), by Component 2025 & 2033

- Figure 4: North America Smart Retail Market Volume (Billion), by Component 2025 & 2033

- Figure 5: North America Smart Retail Market Revenue Share (%), by Component 2025 & 2033

- Figure 6: North America Smart Retail Market Volume Share (%), by Component 2025 & 2033

- Figure 7: North America Smart Retail Market Revenue (Million), by Application 2025 & 2033

- Figure 8: North America Smart Retail Market Volume (Billion), by Application 2025 & 2033

- Figure 9: North America Smart Retail Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Smart Retail Market Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Smart Retail Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Smart Retail Market Volume (Billion), by Country 2025 & 2033

- Figure 13: North America Smart Retail Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Smart Retail Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Smart Retail Market Revenue (Million), by Component 2025 & 2033

- Figure 16: Europe Smart Retail Market Volume (Billion), by Component 2025 & 2033

- Figure 17: Europe Smart Retail Market Revenue Share (%), by Component 2025 & 2033

- Figure 18: Europe Smart Retail Market Volume Share (%), by Component 2025 & 2033

- Figure 19: Europe Smart Retail Market Revenue (Million), by Application 2025 & 2033

- Figure 20: Europe Smart Retail Market Volume (Billion), by Application 2025 & 2033

- Figure 21: Europe Smart Retail Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Smart Retail Market Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe Smart Retail Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Smart Retail Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Europe Smart Retail Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Smart Retail Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Smart Retail Market Revenue (Million), by Component 2025 & 2033

- Figure 28: Asia Smart Retail Market Volume (Billion), by Component 2025 & 2033

- Figure 29: Asia Smart Retail Market Revenue Share (%), by Component 2025 & 2033

- Figure 30: Asia Smart Retail Market Volume Share (%), by Component 2025 & 2033

- Figure 31: Asia Smart Retail Market Revenue (Million), by Application 2025 & 2033

- Figure 32: Asia Smart Retail Market Volume (Billion), by Application 2025 & 2033

- Figure 33: Asia Smart Retail Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Asia Smart Retail Market Volume Share (%), by Application 2025 & 2033

- Figure 35: Asia Smart Retail Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Smart Retail Market Volume (Billion), by Country 2025 & 2033

- Figure 37: Asia Smart Retail Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Smart Retail Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Australia and New Zealand Smart Retail Market Revenue (Million), by Component 2025 & 2033

- Figure 40: Australia and New Zealand Smart Retail Market Volume (Billion), by Component 2025 & 2033

- Figure 41: Australia and New Zealand Smart Retail Market Revenue Share (%), by Component 2025 & 2033

- Figure 42: Australia and New Zealand Smart Retail Market Volume Share (%), by Component 2025 & 2033

- Figure 43: Australia and New Zealand Smart Retail Market Revenue (Million), by Application 2025 & 2033

- Figure 44: Australia and New Zealand Smart Retail Market Volume (Billion), by Application 2025 & 2033

- Figure 45: Australia and New Zealand Smart Retail Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: Australia and New Zealand Smart Retail Market Volume Share (%), by Application 2025 & 2033

- Figure 47: Australia and New Zealand Smart Retail Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Australia and New Zealand Smart Retail Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Australia and New Zealand Smart Retail Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Australia and New Zealand Smart Retail Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Smart Retail Market Revenue (Million), by Component 2025 & 2033

- Figure 52: Latin America Smart Retail Market Volume (Billion), by Component 2025 & 2033

- Figure 53: Latin America Smart Retail Market Revenue Share (%), by Component 2025 & 2033

- Figure 54: Latin America Smart Retail Market Volume Share (%), by Component 2025 & 2033

- Figure 55: Latin America Smart Retail Market Revenue (Million), by Application 2025 & 2033

- Figure 56: Latin America Smart Retail Market Volume (Billion), by Application 2025 & 2033

- Figure 57: Latin America Smart Retail Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Latin America Smart Retail Market Volume Share (%), by Application 2025 & 2033

- Figure 59: Latin America Smart Retail Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Latin America Smart Retail Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Latin America Smart Retail Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Latin America Smart Retail Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Middle East and Africa Smart Retail Market Revenue (Million), by Component 2025 & 2033

- Figure 64: Middle East and Africa Smart Retail Market Volume (Billion), by Component 2025 & 2033

- Figure 65: Middle East and Africa Smart Retail Market Revenue Share (%), by Component 2025 & 2033

- Figure 66: Middle East and Africa Smart Retail Market Volume Share (%), by Component 2025 & 2033

- Figure 67: Middle East and Africa Smart Retail Market Revenue (Million), by Application 2025 & 2033

- Figure 68: Middle East and Africa Smart Retail Market Volume (Billion), by Application 2025 & 2033

- Figure 69: Middle East and Africa Smart Retail Market Revenue Share (%), by Application 2025 & 2033

- Figure 70: Middle East and Africa Smart Retail Market Volume Share (%), by Application 2025 & 2033

- Figure 71: Middle East and Africa Smart Retail Market Revenue (Million), by Country 2025 & 2033

- Figure 72: Middle East and Africa Smart Retail Market Volume (Billion), by Country 2025 & 2033

- Figure 73: Middle East and Africa Smart Retail Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: Middle East and Africa Smart Retail Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Smart Retail Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global Smart Retail Market Volume Billion Forecast, by Component 2020 & 2033

- Table 3: Global Smart Retail Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Smart Retail Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: Global Smart Retail Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Smart Retail Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Smart Retail Market Revenue Million Forecast, by Component 2020 & 2033

- Table 8: Global Smart Retail Market Volume Billion Forecast, by Component 2020 & 2033

- Table 9: Global Smart Retail Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Smart Retail Market Volume Billion Forecast, by Application 2020 & 2033

- Table 11: Global Smart Retail Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Smart Retail Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Global Smart Retail Market Revenue Million Forecast, by Component 2020 & 2033

- Table 14: Global Smart Retail Market Volume Billion Forecast, by Component 2020 & 2033

- Table 15: Global Smart Retail Market Revenue Million Forecast, by Application 2020 & 2033

- Table 16: Global Smart Retail Market Volume Billion Forecast, by Application 2020 & 2033

- Table 17: Global Smart Retail Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Smart Retail Market Volume Billion Forecast, by Country 2020 & 2033

- Table 19: Global Smart Retail Market Revenue Million Forecast, by Component 2020 & 2033

- Table 20: Global Smart Retail Market Volume Billion Forecast, by Component 2020 & 2033

- Table 21: Global Smart Retail Market Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global Smart Retail Market Volume Billion Forecast, by Application 2020 & 2033

- Table 23: Global Smart Retail Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Smart Retail Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global Smart Retail Market Revenue Million Forecast, by Component 2020 & 2033

- Table 26: Global Smart Retail Market Volume Billion Forecast, by Component 2020 & 2033

- Table 27: Global Smart Retail Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global Smart Retail Market Volume Billion Forecast, by Application 2020 & 2033

- Table 29: Global Smart Retail Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Smart Retail Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: Global Smart Retail Market Revenue Million Forecast, by Component 2020 & 2033

- Table 32: Global Smart Retail Market Volume Billion Forecast, by Component 2020 & 2033

- Table 33: Global Smart Retail Market Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Smart Retail Market Volume Billion Forecast, by Application 2020 & 2033

- Table 35: Global Smart Retail Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Smart Retail Market Volume Billion Forecast, by Country 2020 & 2033

- Table 37: Global Smart Retail Market Revenue Million Forecast, by Component 2020 & 2033

- Table 38: Global Smart Retail Market Volume Billion Forecast, by Component 2020 & 2033

- Table 39: Global Smart Retail Market Revenue Million Forecast, by Application 2020 & 2033

- Table 40: Global Smart Retail Market Volume Billion Forecast, by Application 2020 & 2033

- Table 41: Global Smart Retail Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Smart Retail Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart Retail Market?

The projected CAGR is approximately 22.23%.

2. Which companies are prominent players in the Smart Retail Market?

Key companies in the market include Google LLC, PAX Global Technology Limited, Intel Corporation, Verifone Systems, Cisco Systems Inc, Huawei Technologies Co Ltd, IBM Corporation, Fiserv Inc, Microsoft, Honeywell International Inc, NVIDIA Corporation, Samsung Electronics, Amazon com Inc, NXP Semiconductors, Caper Inc, Ingenico Group, Focal Systems Inc, LG Display Co Ltd, NCR Corporation*List Not Exhaustive.

3. What are the main segments of the Smart Retail Market?

The market segments include Component, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.10 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Investments in Retail Chains and Retail Supermarkets; Rising Adoption of Advances in Technology Across Retail Chain.

6. What are the notable trends driving market growth?

Inventory Managment Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Growing Investments in Retail Chains and Retail Supermarkets; Rising Adoption of Advances in Technology Across Retail Chain.

8. Can you provide examples of recent developments in the market?

June 2024: Instacart, in collaboration with Price Chopper and McKeever's Market & Eatery, announced the introduction of Caper Carts, which are powered by artificial intelligence, at select locations in Missouri. These innovative smart carts enhance the shopping experience by enabling customers to scan items while they shop easily, monitor their grocery budget in real time, and bypass the checkout line altogether.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smart Retail Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smart Retail Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smart Retail Market?

To stay informed about further developments, trends, and reports in the Smart Retail Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence