Key Insights

The global Soft Facility Management Market is projected for substantial growth, with an estimated market size of 628.91 billion in the base year 2025, and is expected to expand at a Compound Annual Growth Rate (CAGR) of 6.3% through 2033. This expansion is driven by increasing outsourcing of facility management services, a focus on operational efficiency and cost optimization, and the growing need for specialized soft services to maintain productive and hygienic work environments. Demand is particularly high in commercial and industrial sectors, as organizations recognize the value of integrated solutions for employee well-being and business performance. Technological advancements, including smart building technologies, are also enhancing service quality and sustainability.

Soft Facility Management Market Market Size (In Billion)

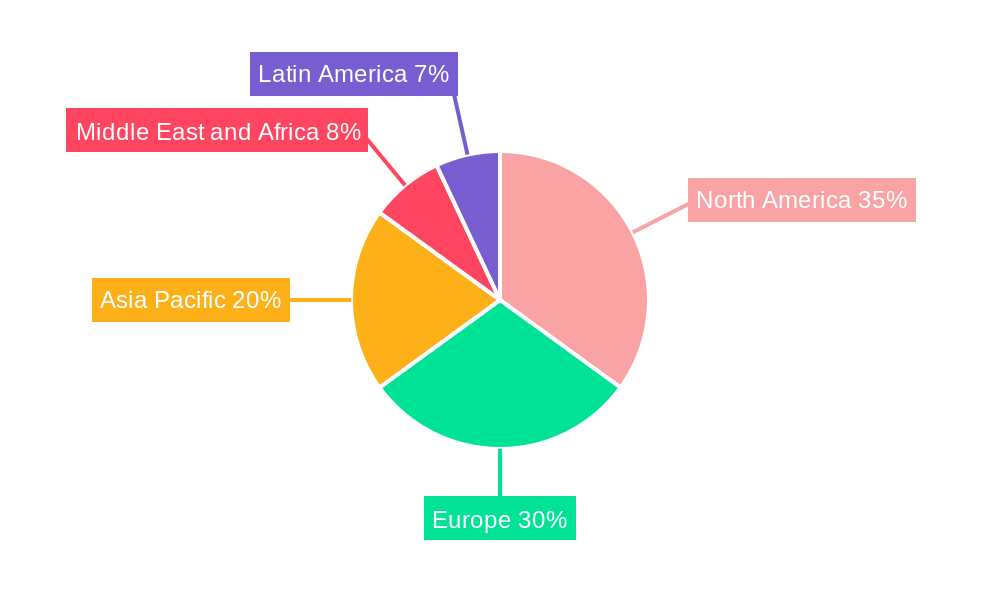

The market exhibits diverse opportunities across segments. Cleaning Services are expected to retain a leading share due to consistent demand, followed by Catering and Security Services, with an increasing emphasis on advanced surveillance. Geographically, North America and Europe are established markets, while the Asia Pacific region is poised for the fastest growth, fueled by urbanization, industrialization, and foreign investment. Key players are actively influencing the market through strategic acquisitions and innovation. While initial implementation costs and skilled labor shortages pose challenges, the overarching trend of strategic outsourcing and the essential nature of these services are expected to drive sustained market growth.

Soft Facility Management Market Company Market Share

This report provides a comprehensive analysis of the Soft Facility Management Market, including its size, growth trajectory, and future outlook.

Soft Facility Management Market Market Concentration & Innovation

The Soft Facility Management Market exhibits a moderate to high concentration, with a few key players dominating a significant portion of the market share. Innovation is primarily driven by the increasing demand for integrated service solutions, driven by technological advancements in areas like IoT and AI for predictive maintenance and enhanced operational efficiency. Regulatory frameworks, particularly concerning health, safety, and environmental standards, play a crucial role in shaping market dynamics and encouraging the adoption of best practices. Product substitutes, while present in niche areas, are largely outpaced by the comprehensive offerings of established soft FM providers. End-user trends are shifting towards a greater reliance on outsourced facilities management to focus on core business activities, leading to increased demand for specialized services. Mergers and acquisitions (M&A) are a significant strategy for market expansion and consolidation, with recent deal values in the range of hundreds of millions to billions of USD. Key M&A activities are focused on acquiring specialized service providers or expanding geographical reach.

- Market Share Dominance: Key players hold significant market share, with top-tier companies accounting for over 50% of the global market.

- Innovation Drivers:

- Adoption of smart building technologies (IoT, AI, ML).

- Demand for sustainable and eco-friendly facility management solutions.

- Integration of digital platforms for service delivery and reporting.

- Regulatory Frameworks: Adherence to ISO standards, local labor laws, and environmental regulations.

- End-User Trends:

- Increasing preference for bundled service offerings.

- Focus on employee well-being and productivity through optimized facility environments.

- M&A Activity: Strategic acquisitions to enhance service portfolios and market presence.

Soft Facility Management Market Industry Trends & Insights

The global Soft Facility Management Market is poised for substantial growth, driven by a confluence of escalating demand for efficient operational management and the outsourcing trend across various industries. The market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.2% during the forecast period of 2025–2033. This robust growth is underpinned by the increasing complexity of business operations and the realization that specialized facility management can significantly enhance productivity, reduce costs, and improve employee satisfaction. Technological disruptions are at the forefront, with the integration of Artificial Intelligence (AI) and the Internet of Things (IoT) revolutionizing service delivery. AI-powered analytics are enabling predictive maintenance, optimizing energy consumption, and enhancing security systems, while IoT sensors provide real-time data on facility performance. Consumer preferences are evolving towards service providers offering integrated solutions, sustainability initiatives, and a strong focus on occupant experience. This includes demands for flexible workspace solutions, advanced cleaning protocols, and personalized catering services. Competitive dynamics are intensifying, with established global players expanding their service portfolios and geographical footprints, while niche players are focusing on specialized offerings and innovative technologies to carve out market share. The market penetration of sophisticated soft FM services is increasing, particularly in commercial and institutional sectors, as organizations recognize the strategic value of these services. The shift towards smart buildings and sustainable operations is further fueling the demand for advanced soft FM solutions. The ongoing digital transformation across industries necessitates robust facility management to support seamless operations and employee well-being.

Dominant Markets & Segments in Soft Facility Management Market

The Commercial end-user segment is a dominant force within the Soft Facility Management Market, representing a significant portion of the market revenue, projected to reach over $200 Billion by 2033. This dominance is driven by the high concentration of businesses, office spaces, and retail establishments that require a wide array of soft FM services to maintain operational efficiency and a conducive working environment. Countries with strong economic bases and a high density of corporate headquarters, such as the United States, the United Kingdom, and Germany, are leading the charge in this segment.

Within the Type segmentation, Cleaning Services is a consistently high-performing segment, projected to exceed $150 Billion in market value by 2033. The increasing emphasis on hygiene, health, and safety protocols, particularly post-pandemic, has solidified the critical role of professional cleaning services across all end-user categories.

- Dominant End User: Commercial

- Key Drivers: Growing office spaces, retail expansion, demand for professional workplace environments, and outsourced facility management strategies by corporations.

- Dominance Analysis: Large corporations and SMEs across sectors like IT, finance, retail, and media heavily rely on soft FM to manage their premises efficiently, ensuring a productive and safe environment for their employees and customers. Economic policies that encourage business growth and foreign investment contribute to this dominance.

- Dominant Type: Cleaning Services

- Key Drivers: Heightened hygiene standards, compliance with health regulations, employee well-being initiatives, and the need for specialized cleaning in diverse environments (e.g., healthcare, hospitality).

- Dominance Analysis: Professional cleaning is a fundamental requirement for all facility types. The demand for deep cleaning, specialized sanitization, and sustainable cleaning practices ensures its consistent growth and market leadership.

- Leading Regions: North America and Europe are currently the largest markets due to their mature economies, high adoption of outsourcing, and stringent regulatory environments. However, the Asia-Pacific region is expected to witness the fastest growth due to rapid urbanization, infrastructure development, and increasing FDI.

- Key Country Analysis:

- United States: Large market size driven by a vast commercial and industrial base, with a strong emphasis on integrated facility management.

- United Kingdom: High adoption of outsourcing by large enterprises and a growing demand for sustainable FM solutions.

- Germany: Robust industrial sector and stringent environmental regulations driving demand for compliant and efficient soft FM.

- India & China: Rapidly growing markets fueled by infrastructure development, urbanization, and increasing foreign investment, presenting significant future growth potential.

Soft Facility Management Market Product Developments

Recent product developments in the Soft Facility Management Market are heavily influenced by technological advancements aimed at enhancing efficiency, sustainability, and occupant experience. Companies are increasingly integrating AI-powered analytics for predictive maintenance and resource optimization, alongside IoT-enabled sensors for real-time monitoring of building performance and environmental conditions. The development of smart cleaning solutions, using automated equipment and data-driven scheduling, is gaining traction. Furthermore, there's a growing focus on the application of eco-friendly cleaning agents and sustainable waste management practices. These innovations aim to provide clients with cost savings, improved operational uptime, and a healthier, more comfortable environment.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global Soft Facility Management Market, segmented by Type and End User. The Type segmentation includes: Office Support and Landscaping Services, Cleaning Services, Catering Services, Security Services, and Other Soft FM Services. Each of these segments is analyzed for market size, growth projections, and competitive dynamics, with Cleaning Services and Security Services anticipated to hold the largest market shares, projected to grow at CAGRs of approximately 7.5% and 7.0% respectively during the forecast period. The End User segmentation comprises: Commercial, Institutional, Public/Infrastructure, Industrial, and Other End Users. The Commercial sector is expected to lead the market, driven by corporate outsourcing trends, with an estimated market size of $200 Billion by 2033. Institutional and Public/Infrastructure segments are also projected to witness steady growth due to government initiatives and the need for essential services.

Key Drivers of Soft Facility Management Market Growth

The growth of the Soft Facility Management Market is propelled by several key factors.

- Increasing Outsourcing Trends: Businesses are increasingly outsourcing non-core functions to focus on their strategic objectives, leading to a higher demand for comprehensive soft FM solutions.

- Technological Advancements: The integration of IoT, AI, and automation in service delivery enhances efficiency, reduces operational costs, and improves the quality of services.

- Focus on Sustainability: Growing environmental awareness and regulatory pressures are driving demand for eco-friendly FM practices, such as waste management and energy efficiency.

- Globalization and Urbanization: The expansion of businesses globally and the rapid growth of urban centers create a persistent need for efficient facility management services.

Challenges in the Soft Facility Management Market Sector

Despite robust growth, the Soft Facility Management Market faces several challenges.

- Skilled Labor Shortage: A significant challenge is the scarcity of skilled labor required for specialized FM services, impacting service quality and operational efficiency.

- Intense Competition: The market is highly competitive, with numerous players vying for market share, leading to price pressures and shrinking profit margins for some.

- Regulatory Compliance: Navigating diverse and evolving regulatory landscapes across different regions can be complex and resource-intensive.

- Cybersecurity Threats: With the increasing digitalization of FM services, the risk of cyberattacks and data breaches poses a significant concern for service providers and their clients.

Emerging Opportunities in Soft Facility Management Market

Emerging opportunities in the Soft Facility Management Market are abundant and poised for significant expansion.

- Smart Building Integration: The widespread adoption of smart building technologies presents a substantial opportunity for FM providers to offer integrated technology-driven services, including predictive maintenance and energy management.

- Focus on Employee Well-being: Increasing emphasis on employee health, safety, and productivity creates demand for specialized services like advanced cleaning, air quality management, and ergonomic workspace solutions.

- Sustainability and ESG Initiatives: The growing corporate focus on Environmental, Social, and Governance (ESG) factors opens avenues for FM providers to offer sustainable solutions, including waste reduction, water conservation, and renewable energy integration.

- Data Analytics and AI: Leveraging big data and AI for operational insights, customized service delivery, and enhanced customer engagement represents a significant growth frontier.

Leading Players in the Soft Facility Management Market Market

- Cushman & Wakefield PLC

- CBRE Group Inc

- Shine Management & Facility Services

- Ahi Facility Services Inc

- Smi Facility Services

- Guardian Service Industries Inc

- Jones Lang LaSalle IP Inc

- ISS A/S

- Sodexo Inc

- Emeric Facility Services

Key Developments in Soft Facility Management Market Industry

- June 2022: ISS A/S, a global facility management service provider, bagged a 5-year contract with a major retailer in the US. The company will provide integrated facilities management services across the retail, office, and industrial spaces.

- April 2022: Tarem Services Limited signed a new cleaning services office contract with CBRE.

- April 2022: SOS International was re-awarded a potential 5-year, USD 17.9 million contract by the US Central Command to continue maintaining and managing secure facilities at MacDill Air Force Base and Al-Udeid Airbase in Tampa, Florida, and Doha, Qatar, respectively.

Strategic Outlook for Soft Facility Management Market Market

The strategic outlook for the Soft Facility Management Market is exceptionally positive, driven by an overarching trend towards specialized, integrated, and technology-enabled service delivery. The market is set to be shaped by a growing demand for sustainable and environmentally conscious solutions, aligning with global ESG mandates. Strategic partnerships and collaborations will become increasingly crucial for providers to expand their service portfolios and geographical reach. Furthermore, the continuous adoption of AI, IoT, and data analytics will enable predictive capabilities, personalized services, and optimized operational efficiencies, offering a distinct competitive advantage. The focus on enhancing occupant well-being and productivity through smart facility management solutions will continue to be a key growth catalyst, making the market a dynamic and evolving landscape for stakeholders.

Soft Facility Management Market Segmentation

-

1. Type

- 1.1. Office Support and Landscaping Services

- 1.2. Cleaning Services

- 1.3. Catering Services

- 1.4. Security Services

- 1.5. Other Soft FM Services

-

2. End User

- 2.1. Commercial

- 2.2. Institutional

- 2.3. Public/Infrastructure

- 2.4. Industrial

- 2.5. Other End Users

Soft Facility Management Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Soft Facility Management Market Regional Market Share

Geographic Coverage of Soft Facility Management Market

Soft Facility Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Megaprojects in Pipeline is Expected to Boost the Construction Sector

- 3.2.2 Driving the Need for Facility Management Services; Increasing Investment in Healthcare Infrastructure and the Construction of Healthcare Facilities

- 3.3. Market Restrains

- 3.3.1. Increased Instance of Data Breaches and Security Threats

- 3.4. Market Trends

- 3.4.1. Infrastructural Development Continue to Open Up New Opportunities for SFM Vendors

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Soft Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Office Support and Landscaping Services

- 5.1.2. Cleaning Services

- 5.1.3. Catering Services

- 5.1.4. Security Services

- 5.1.5. Other Soft FM Services

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Commercial

- 5.2.2. Institutional

- 5.2.3. Public/Infrastructure

- 5.2.4. Industrial

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Soft Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Office Support and Landscaping Services

- 6.1.2. Cleaning Services

- 6.1.3. Catering Services

- 6.1.4. Security Services

- 6.1.5. Other Soft FM Services

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Commercial

- 6.2.2. Institutional

- 6.2.3. Public/Infrastructure

- 6.2.4. Industrial

- 6.2.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Soft Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Office Support and Landscaping Services

- 7.1.2. Cleaning Services

- 7.1.3. Catering Services

- 7.1.4. Security Services

- 7.1.5. Other Soft FM Services

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Commercial

- 7.2.2. Institutional

- 7.2.3. Public/Infrastructure

- 7.2.4. Industrial

- 7.2.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Soft Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Office Support and Landscaping Services

- 8.1.2. Cleaning Services

- 8.1.3. Catering Services

- 8.1.4. Security Services

- 8.1.5. Other Soft FM Services

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Commercial

- 8.2.2. Institutional

- 8.2.3. Public/Infrastructure

- 8.2.4. Industrial

- 8.2.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Soft Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Office Support and Landscaping Services

- 9.1.2. Cleaning Services

- 9.1.3. Catering Services

- 9.1.4. Security Services

- 9.1.5. Other Soft FM Services

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Commercial

- 9.2.2. Institutional

- 9.2.3. Public/Infrastructure

- 9.2.4. Industrial

- 9.2.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Soft Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Office Support and Landscaping Services

- 10.1.2. Cleaning Services

- 10.1.3. Catering Services

- 10.1.4. Security Services

- 10.1.5. Other Soft FM Services

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Commercial

- 10.2.2. Institutional

- 10.2.3. Public/Infrastructure

- 10.2.4. Industrial

- 10.2.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Cushman & Wakefield PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CBRE Group Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Shine Management & Facility Services

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ahi Facility Services Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Smi Facility Services

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Guaridan Service Industries Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Jones Lang LaSalle Ip Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Iss A/s

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sodexo Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Emeric Facility Services

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Cushman & Wakefield PLC

List of Figures

- Figure 1: Global Soft Facility Management Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Soft Facility Management Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Soft Facility Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Soft Facility Management Market Revenue (billion), by End User 2025 & 2033

- Figure 5: North America Soft Facility Management Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Soft Facility Management Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Soft Facility Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Soft Facility Management Market Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Soft Facility Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Soft Facility Management Market Revenue (billion), by End User 2025 & 2033

- Figure 11: Europe Soft Facility Management Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Soft Facility Management Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Soft Facility Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Soft Facility Management Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Soft Facility Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Soft Facility Management Market Revenue (billion), by End User 2025 & 2033

- Figure 17: Asia Pacific Soft Facility Management Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Soft Facility Management Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Soft Facility Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Soft Facility Management Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Latin America Soft Facility Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Soft Facility Management Market Revenue (billion), by End User 2025 & 2033

- Figure 23: Latin America Soft Facility Management Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Latin America Soft Facility Management Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Soft Facility Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Soft Facility Management Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa Soft Facility Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Soft Facility Management Market Revenue (billion), by End User 2025 & 2033

- Figure 29: Middle East and Africa Soft Facility Management Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Middle East and Africa Soft Facility Management Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Soft Facility Management Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Soft Facility Management Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Soft Facility Management Market Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Global Soft Facility Management Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Soft Facility Management Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Soft Facility Management Market Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Global Soft Facility Management Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Soft Facility Management Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Soft Facility Management Market Revenue billion Forecast, by End User 2020 & 2033

- Table 9: Global Soft Facility Management Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Soft Facility Management Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Soft Facility Management Market Revenue billion Forecast, by End User 2020 & 2033

- Table 12: Global Soft Facility Management Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Soft Facility Management Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Soft Facility Management Market Revenue billion Forecast, by End User 2020 & 2033

- Table 15: Global Soft Facility Management Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Soft Facility Management Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Soft Facility Management Market Revenue billion Forecast, by End User 2020 & 2033

- Table 18: Global Soft Facility Management Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Soft Facility Management Market?

The projected CAGR is approximately 6.3%.

2. Which companies are prominent players in the Soft Facility Management Market?

Key companies in the market include Cushman & Wakefield PLC, CBRE Group Inc, Shine Management & Facility Services, Ahi Facility Services Inc, Smi Facility Services, Guaridan Service Industries Inc , Jones Lang LaSalle Ip Inc, Iss A/s, Sodexo Inc, Emeric Facility Services.

3. What are the main segments of the Soft Facility Management Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 628.91 billion as of 2022.

5. What are some drivers contributing to market growth?

Megaprojects in Pipeline is Expected to Boost the Construction Sector. Driving the Need for Facility Management Services; Increasing Investment in Healthcare Infrastructure and the Construction of Healthcare Facilities.

6. What are the notable trends driving market growth?

Infrastructural Development Continue to Open Up New Opportunities for SFM Vendors .

7. Are there any restraints impacting market growth?

Increased Instance of Data Breaches and Security Threats.

8. Can you provide examples of recent developments in the market?

June 2022: ISS A/S, a global facility management service provider, bagged a 5-year contract with a major retailer in the US. The company will provide integrated facilities management services across the retail, office, and industrial spaces.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Soft Facility Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Soft Facility Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Soft Facility Management Market?

To stay informed about further developments, trends, and reports in the Soft Facility Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence