Key Insights

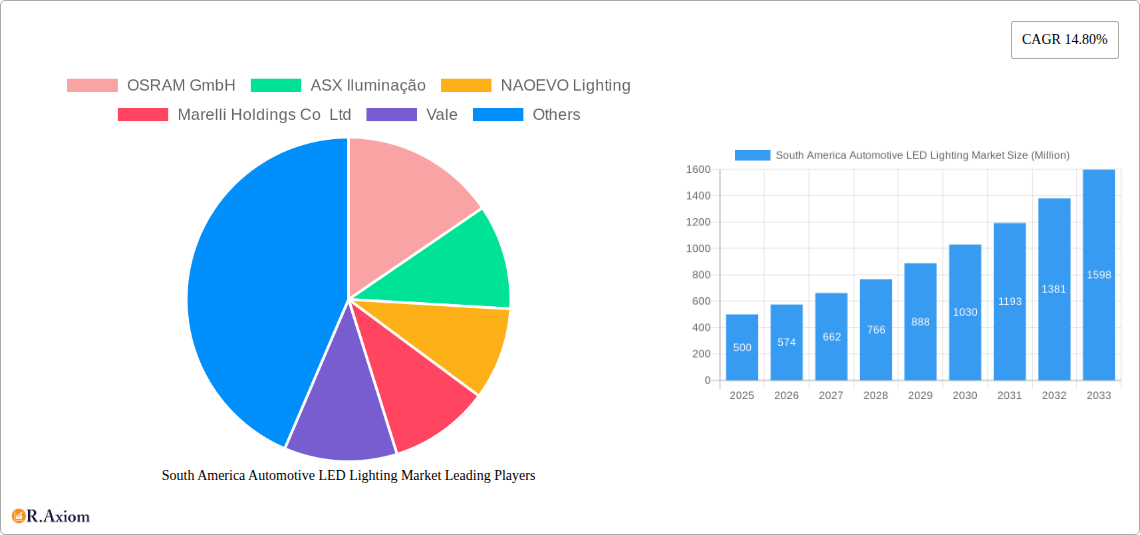

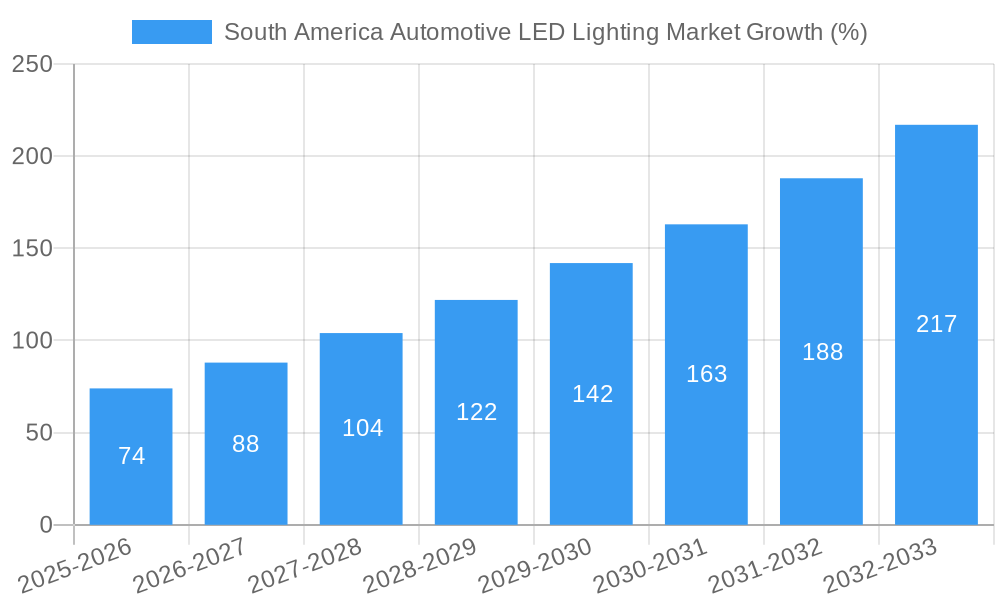

The South American Automotive LED Lighting market is experiencing robust growth, driven by increasing vehicle production, stringent government regulations mandating improved vehicle safety and lighting efficiency, and a rising consumer preference for advanced lighting technologies. The market's Compound Annual Growth Rate (CAGR) of 14.80% from 2019 to 2024 indicates significant expansion. This growth is further fueled by the rising adoption of LED lighting in both passenger cars and commercial vehicles, particularly in Brazil and Argentina, the region's largest automotive markets. The increasing popularity of features like daytime running lights (DRLs), enhanced headlights, and sophisticated tail lights are contributing to market expansion. While challenges such as initial higher costs compared to traditional lighting technologies exist, the long-term cost savings in energy consumption and maintenance are overcoming this barrier. Furthermore, the burgeoning automotive industry in South America, coupled with infrastructure development and increasing disposable incomes, is creating a favorable environment for LED lighting adoption. Segments like two-wheelers are experiencing particularly rapid growth due to increased affordability and the growing popularity of motorcycles and scooters across the region. Major players such as OSRAM, Valeo, and Koito are actively competing in this market, leveraging their technological expertise and established distribution networks to capture significant market share. The forecast period (2025-2033) projects continued strong growth, with the market likely experiencing consistent expansion throughout the decade due to the prevailing market drivers.

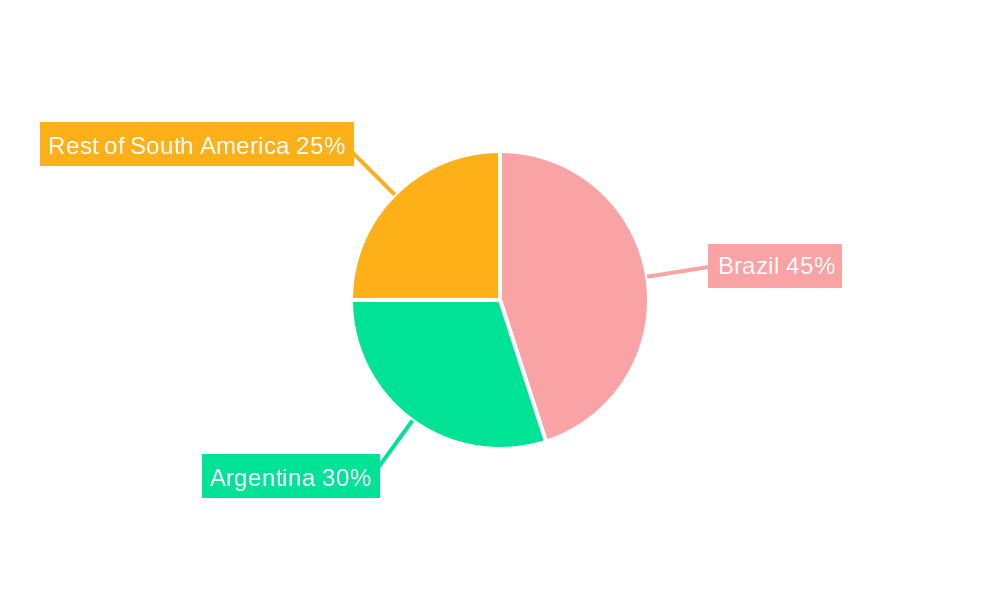

The segmentation within the South American Automotive LED Lighting market reveals significant potential across various vehicle types and lighting applications. Passenger cars currently dominate the market, followed by commercial vehicles, with the two-wheeler segment showing the fastest growth trajectory. Within automotive utility lighting, headlights, tail lights, and DRLs comprise the largest market segments. The "Others" segment, encompassing advanced lighting features like adaptive headlights and interior lighting solutions, is expected to exhibit strong growth as technological advancements make these features more accessible and affordable. While the Rest of South America region exhibits a smaller market size compared to Brazil and Argentina, its growth rate is projected to be higher driven by increasing investments in automotive infrastructure and growing vehicle sales. This diverse landscape provides opportunities for both established players and new entrants to penetrate and capitalize on various market niches. However, effective strategies must consider regional variations in consumer preferences, regulatory frameworks, and infrastructure development.

South America Automotive LED Lighting Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South America Automotive LED Lighting Market, offering actionable insights for industry stakeholders. Covering the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market trends, competitive dynamics, and growth opportunities across various segments. The report leverages extensive market research and data analysis to provide a clear understanding of the current market landscape and future projections.

South America Automotive LED Lighting Market Concentration & Innovation

This section analyzes the market concentration, highlighting the market share of key players such as OSRAM GmbH, ASX Iluminação, and HELLA GmbH & Co KGaA. It explores the driving forces behind innovation, including government regulations promoting energy efficiency and safety, and the increasing consumer preference for advanced lighting features. The report also examines the impact of product substitutes, such as traditional halogen lighting, and analyzes end-user trends. The role of mergers and acquisitions (M&A) activities in shaping the market landscape is examined, including an assessment of deal values (estimated at xx Million for the period 2019-2024). Key aspects of the competitive landscape considered include:

- Market Share Analysis: Details on market share held by top players, categorized by segment.

- Innovation Drivers: Analysis of technological advancements, regulatory pressures, and consumer demand.

- Regulatory Frameworks: An overview of regulations impacting the adoption of LED lighting in South America.

- M&A Activities: A review of significant mergers and acquisitions, with deal values where available.

- Product Substitutes: Evaluation of the competitive threat posed by alternative lighting technologies.

South America Automotive LED Lighting Market Industry Trends & Insights

This section provides a detailed analysis of the South America Automotive LED Lighting Market's growth drivers, technological advancements, and evolving consumer preferences. It projects a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, driven by factors such as increasing vehicle production, rising disposable incomes, and growing demand for enhanced vehicle safety features. Market penetration of LED lighting in different vehicle segments is analyzed. The competitive landscape is assessed, including strategies employed by key players to maintain market share. Specific details included are:

- Market Growth Drivers: Examination of factors driving market expansion, including economic growth and infrastructure development.

- Technological Disruptions: Assessment of the impact of new technologies such as adaptive lighting and laser lighting.

- Consumer Preferences: Analysis of consumer demand for features like improved visibility, energy efficiency, and aesthetics.

- Competitive Dynamics: Detailed examination of competitive strategies and market positioning of key players.

Dominant Markets & Segments in South America Automotive LED Lighting Market

This section identifies the leading regions, countries, and segments within the South America Automotive LED Lighting Market. Brazil is anticipated to be the dominant market due to its large automotive sector and government initiatives promoting LED adoption. The Passenger Cars segment is expected to hold the largest market share, followed by Commercial Vehicles. Within Automotive Utility Lighting, Headlights and Daytime Running Lights (DRL) are expected to be the most significant segments.

- Key Drivers for Leading Segments:

- Passenger Cars: Growing sales of new passenger vehicles and increasing consumer preference for advanced safety features.

- Commercial Vehicles: Stringent safety regulations and the need for enhanced visibility on roads.

- Headlights: Essential for safe driving, particularly in low-light conditions.

- DRL (Daytime Running Lights): Mandatory in many countries, contributing to enhanced road safety.

- Dominance Analysis: Detailed explanation of factors contributing to market dominance in specific segments and regions.

South America Automotive LED Lighting Market Product Developments

Recent innovations in LED lighting technology are driving significant advancements in the automotive industry. HELLA's expansion of its Black Magic auxiliary headlamp series, the introduction of FlatLight technology for daytime running lights, and the expansion in chip-based headlamp technologies demonstrate a continuous push for improved performance, energy efficiency, and design flexibility. These advancements enhance vehicle aesthetics, safety, and operational efficiency.

Report Scope & Segmentation Analysis

This report segments the South America Automotive LED Lighting Market based on vehicle type (2 Wheelers, Commercial Vehicles, Passenger Cars) and lighting type (Daytime Running Lights (DRL), Directional Signal Lights, Headlights, Reverse Light, Stop Light, Tail Light, Others). Each segment's growth projection, market size (in Million), and competitive landscape are thoroughly analyzed. For example, the passenger car segment is expected to exhibit strong growth due to rising vehicle sales and consumer demand for advanced features, while the two-wheeler segment will show slower growth.

Key Drivers of South America Automotive LED Lighting Market Growth

The growth of the South America Automotive LED Lighting Market is fueled by factors including:

- Government Regulations: Stringent safety regulations mandating advanced lighting technologies.

- Technological Advancements: Continuous improvements in LED technology, offering superior performance and energy efficiency.

- Economic Growth: Rising disposable incomes and increasing vehicle ownership rates in several South American countries.

- Infrastructure Development: Investments in road infrastructure boosting demand for safer vehicles.

Challenges in the South America Automotive LED Lighting Market Sector

Several challenges hinder the growth of the South America Automotive LED Lighting Market:

- High Initial Investment Costs: The upfront cost of LED lighting systems can be a barrier for some manufacturers and consumers.

- Supply Chain Disruptions: Global supply chain issues impact the availability and pricing of components.

- Competitive Pressure: Intense competition among various lighting technology providers.

Emerging Opportunities in South America Automotive LED Lighting Market

The South America Automotive LED Lighting Market presents significant opportunities, including:

- Smart Lighting Systems: Growing adoption of adaptive and intelligent lighting systems.

- Expansion into New Markets: Untapped potential in several South American countries with increasing vehicle sales.

- Technological Innovation: Continuous development of advanced LED technologies leading to improved performance and design flexibility.

Leading Players in the South America Automotive LED Lighting Market Market

- OSRAM GmbH

- ASX Iluminação

- NAOEVO Lighting

- Marelli Holdings Co Ltd

- Vale

- Stanley Electric Co Ltd

- KOITO MANUFACTURING CO LTD

- HYUNDAI MOBIS

- SHOCKLIGHT

- HELLA GmbH & Co KGaA

Key Developments in South America Automotive LED Lighting Market Industry

- December 2022: HELLA expands its market position in chip-based headlamp technologies (SSL | HD).

- January 2023: HELLA brings FlatLight technology into series production as a daytime running light. Series production starts in 2025.

- March 2023: HELLA expands Black Magic auxiliary headlamp series with 32 new lightbars (14 for on-road, 18 for off-road use).

Strategic Outlook for South America Automotive LED Lighting Market Market

The South America Automotive LED Lighting Market is poised for significant growth driven by increasing demand for advanced lighting technologies and stringent safety regulations. Continued technological innovation, coupled with supportive government policies, will further propel market expansion. Opportunities exist for companies to focus on developing cost-effective and energy-efficient LED lighting solutions tailored to the specific needs of the South American automotive market. This includes focusing on the growing demand for smart lighting systems and expanding into less penetrated segments and regions.

South America Automotive LED Lighting Market Segmentation

-

1. Automotive Utility Lighting

- 1.1. Daytime Running Lights (DRL)

- 1.2. Directional Signal Lights

- 1.3. Headlights

- 1.4. Reverse Light

- 1.5. Stop Light

- 1.6. Tail Light

- 1.7. Others

-

2. Automotive Vehicle Lighting

- 2.1. 2 Wheelers

- 2.2. Commercial Vehicles

- 2.3. Passenger Cars

South America Automotive LED Lighting Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Automotive LED Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 5.1 Increasing Focus on Miniaturization of Electronics5.2 Increasing Penetration of Connected and Smart Devices and Other Electronics in Asia-Pacific Region

- 3.3. Market Restrains

- 3.3.1. High cost involved in replacing the existing Deep UV with EUV lasers; Monopoly existing within the market

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Automotive LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Automotive Utility Lighting

- 5.1.1. Daytime Running Lights (DRL)

- 5.1.2. Directional Signal Lights

- 5.1.3. Headlights

- 5.1.4. Reverse Light

- 5.1.5. Stop Light

- 5.1.6. Tail Light

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Automotive Vehicle Lighting

- 5.2.1. 2 Wheelers

- 5.2.2. Commercial Vehicles

- 5.2.3. Passenger Cars

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Automotive Utility Lighting

- 6. Brazil South America Automotive LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina South America Automotive LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America South America Automotive LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 OSRAM GmbH

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 ASX Iluminação

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 NAOEVO Lighting

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Marelli Holdings Co Ltd

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Vale

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Stanley Electric Co Ltd

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 KOITO MANUFACTURING CO LTD

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 HYUNDAI MOBIS

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 SHOCKLIGHT

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 HELLA GmbH & Co KGaA

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 OSRAM GmbH

List of Figures

- Figure 1: South America Automotive LED Lighting Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Automotive LED Lighting Market Share (%) by Company 2024

List of Tables

- Table 1: South America Automotive LED Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Automotive LED Lighting Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: South America Automotive LED Lighting Market Revenue Million Forecast, by Automotive Utility Lighting 2019 & 2032

- Table 4: South America Automotive LED Lighting Market Volume K Unit Forecast, by Automotive Utility Lighting 2019 & 2032

- Table 5: South America Automotive LED Lighting Market Revenue Million Forecast, by Automotive Vehicle Lighting 2019 & 2032

- Table 6: South America Automotive LED Lighting Market Volume K Unit Forecast, by Automotive Vehicle Lighting 2019 & 2032

- Table 7: South America Automotive LED Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: South America Automotive LED Lighting Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: South America Automotive LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: South America Automotive LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Brazil South America Automotive LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Brazil South America Automotive LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Argentina South America Automotive LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Argentina South America Automotive LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Rest of South America South America Automotive LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America South America Automotive LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: South America Automotive LED Lighting Market Revenue Million Forecast, by Automotive Utility Lighting 2019 & 2032

- Table 18: South America Automotive LED Lighting Market Volume K Unit Forecast, by Automotive Utility Lighting 2019 & 2032

- Table 19: South America Automotive LED Lighting Market Revenue Million Forecast, by Automotive Vehicle Lighting 2019 & 2032

- Table 20: South America Automotive LED Lighting Market Volume K Unit Forecast, by Automotive Vehicle Lighting 2019 & 2032

- Table 21: South America Automotive LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: South America Automotive LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 23: Brazil South America Automotive LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Brazil South America Automotive LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Argentina South America Automotive LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Argentina South America Automotive LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Chile South America Automotive LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Chile South America Automotive LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Colombia South America Automotive LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Colombia South America Automotive LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Peru South America Automotive LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Peru South America Automotive LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: Venezuela South America Automotive LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Venezuela South America Automotive LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Ecuador South America Automotive LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Ecuador South America Automotive LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: Bolivia South America Automotive LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Bolivia South America Automotive LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: Paraguay South America Automotive LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Paraguay South America Automotive LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: Uruguay South America Automotive LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Uruguay South America Automotive LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Automotive LED Lighting Market?

The projected CAGR is approximately 14.80%.

2. Which companies are prominent players in the South America Automotive LED Lighting Market?

Key companies in the market include OSRAM GmbH, ASX Iluminação, NAOEVO Lighting, Marelli Holdings Co Ltd, Vale, Stanley Electric Co Ltd, KOITO MANUFACTURING CO LTD, HYUNDAI MOBIS, SHOCKLIGHT, HELLA GmbH & Co KGaA.

3. What are the main segments of the South America Automotive LED Lighting Market?

The market segments include Automotive Utility Lighting, Automotive Vehicle Lighting.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

5.1 Increasing Focus on Miniaturization of Electronics5.2 Increasing Penetration of Connected and Smart Devices and Other Electronics in Asia-Pacific Region.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High cost involved in replacing the existing Deep UV with EUV lasers; Monopoly existing within the market.

8. Can you provide examples of recent developments in the market?

March 2023: HELLA expands Black Magic auxiliary headlamp series with 32 new lightbars. Range expansion includes 14 lightbars with ECE approval for on-road use and 18 light-bars for off-road applicationsJanuary 2023: HELLA brings FlatLight technology into series production as a daytime running light for the first time. The lighting concept is successfully transferred from the rear combination lamp to an application in the front area; series production starts in 2025.December 2022: HELLA further expands its market position in chip-based headlamp technologies(SSL | HD).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Automotive LED Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Automotive LED Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Automotive LED Lighting Market?

To stay informed about further developments, trends, and reports in the South America Automotive LED Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence