Key Insights

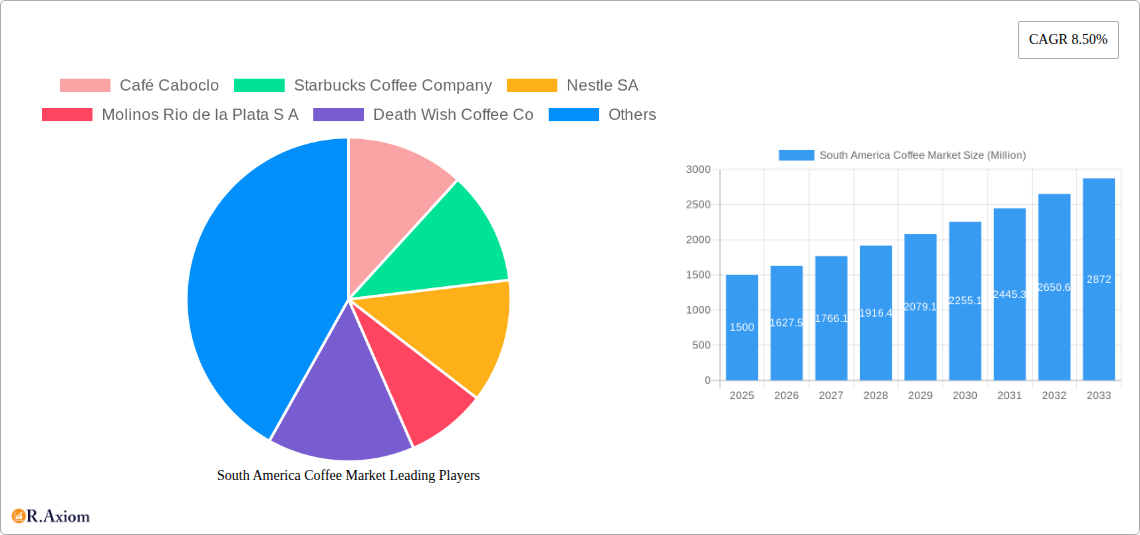

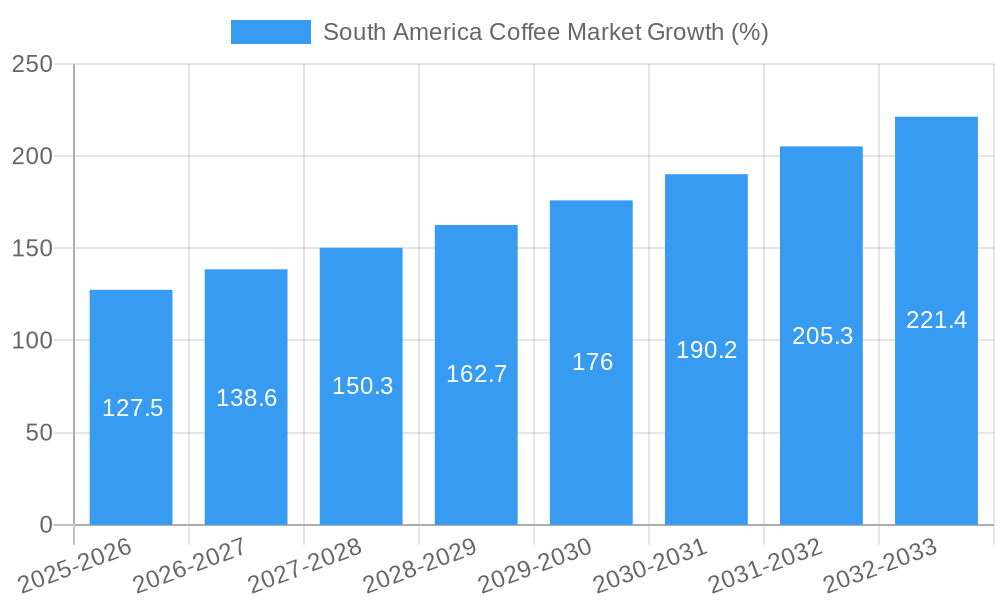

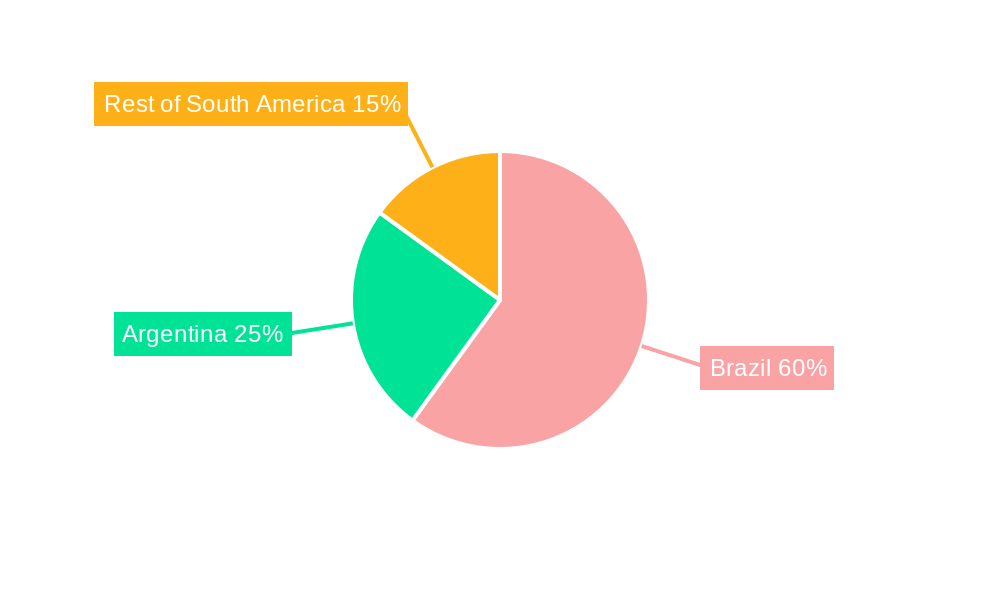

The South American coffee market, valued at approximately $XX million in 2025, is experiencing robust growth, projected to maintain a compound annual growth rate (CAGR) of 8.50% from 2025 to 2033. This expansion is driven by several factors. Firstly, the rising popularity of specialty coffee and increasing consumer disposable incomes in key regions like Brazil and Argentina are fueling demand for premium coffee beans and diverse brewing methods. Secondly, the growing convenience culture is boosting the sales of ready-to-drink coffee and single-serve coffee pods. The expanding online retail sector provides greater accessibility to a wider range of coffee products, further accelerating market growth. However, challenges remain. Fluctuations in coffee bean prices due to climatic conditions and global supply chain disruptions pose significant restraints. Furthermore, the presence of strong local and international players creates a competitive landscape. The market segmentation reveals a diverse product landscape, with whole bean, ground coffee, instant coffee, and coffee pods and capsules all contributing significantly. Distribution channels range from traditional supermarkets and convenience stores to specialized coffee shops and increasingly prominent online retail platforms. Brazil, as a major coffee producer, dominates the South American market, followed by Argentina and other regional players. Companies like Nestlé, Starbucks, and local brands like Café Caboclo and Cafes La Virginia are key players vying for market share.

The forecast for 2025-2033 suggests continued growth, but strategic adaptations will be crucial for success. Companies are likely to focus on product diversification, innovative packaging, and targeted marketing strategies to cater to evolving consumer preferences. Sustainability and ethical sourcing are also gaining traction, potentially influencing consumer choices and shaping the competitive dynamics. The continued expansion of e-commerce will require companies to invest in robust online platforms and logistics networks. Navigating price volatility and ensuring a stable supply chain will be paramount for maintaining consistent growth in the face of potential economic and environmental uncertainties.

This detailed report provides a comprehensive analysis of the South America coffee market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic landscape. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers a robust understanding of historical trends, current market dynamics, and future growth projections. The report meticulously segments the market by product type (whole bean, ground coffee, instant coffee, coffee pods and capsules) and distribution channel (supermarkets/hypermarkets, convenience stores, specialist retailers, online retail stores, other distribution channels), providing granular data and analysis. The report value is xx Million.

South America Coffee Market Concentration & Innovation

This section analyzes the competitive landscape of the South America coffee market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities. The market is characterized by a mix of multinational giants and local players, resulting in a moderately concentrated market structure. Key players like Nestle SA, Starbucks Coffee Company, and JDE Peet's hold significant market share, while regional brands like Café Caboclo, Cafes La Virginia S A, Pilao Coffee, and Cabrales S A cater to specific consumer preferences. Innovation is driven by factors such as the rising demand for specialty coffees, the increasing popularity of single-serve coffee pods, and advancements in coffee brewing technologies. However, stringent regulatory frameworks and the presence of readily available substitutes like tea and other beverages pose challenges. The M&A landscape reveals a pattern of strategic acquisitions and collaborations, aimed at expanding market reach and enhancing product portfolios. While precise M&A deal values are not publicly disclosed in many cases, the overall trend indicates a significant investment in the South American coffee market. For example, the Starbucks and Nestlé alliance exemplifies the consolidation trend. End-user trends point towards increasing demand for premium and ethically sourced coffee, influencing the growth of sustainable and organic coffee segments.

- Market Concentration: Moderately concentrated, with significant players and regional brands coexisting.

- Innovation Drivers: Specialty coffee demand, single-serve pods, brewing technology advancements.

- Regulatory Frameworks: Stringent regulations influence production and distribution.

- Product Substitutes: Tea, other beverages compete for consumer preference.

- End-User Trends: Growing demand for premium and ethically sourced coffee.

- M&A Activity: Strategic acquisitions and collaborations for market expansion. xx Million in estimated M&A deal value in the last 5 years.

South America Coffee Market Industry Trends & Insights

The South America coffee market exhibits robust growth driven by several factors. Rising disposable incomes, particularly in urban areas, fuel greater coffee consumption. The burgeoning middle class's increased spending power is a major driver. Technological disruptions, such as the rise of e-commerce and online retail stores, are transforming distribution channels and creating new opportunities. Consumer preferences are shifting towards premium, specialty coffees, single-serve options, and convenience. The market showcases strong competitive dynamics, with established players constantly innovating and introducing new products to cater to changing consumer demands. The Compound Annual Growth Rate (CAGR) for the market during the forecast period (2025-2033) is estimated to be xx%, driven largely by the increasing adoption of convenient coffee formats, like pods and capsules. Market penetration for these formats continues to increase, indicating significant potential for future growth. The market penetration of online retail channels is also growing rapidly, suggesting a shift in consumer purchasing behaviour.

Dominant Markets & Segments in South America Coffee Market

Brazil holds the dominant position in the South American coffee market, driven by its large production capacity, significant domestic consumption, and established export infrastructure. Colombia and other countries like Peru and Ecuador contribute significantly, though Brazil’s market share is substantial.

By Product Type:

- Ground Coffee: Remains the largest segment due to its widespread appeal and affordability.

- Instant Coffee: Shows consistent growth due to convenience and affordability.

- Whole Bean Coffee: Growing segment driven by demand for premium and specialty coffees.

- Coffee Pods and Capsules: Fastest-growing segment, benefiting from convenience and ease of use.

By Distribution Channel:

- Supermarkets/Hypermarkets: Dominate due to widespread availability and scale.

- Convenience Stores: Significant contribution, capitalizing on impulse purchases.

- Specialist Retailers: Growing segment, catering to specialty coffee lovers.

- Online Retail Stores: Rapid growth due to the increasing adoption of e-commerce.

Key Drivers (Brazil):

- Strong domestic consumption and export infrastructure.

- Favourable climatic conditions for coffee production.

- Government policies supporting agricultural development.

South America Coffee Market Product Developments

The South American coffee market witnesses continuous product innovation, focusing on improving taste, convenience, and sustainability. Single-serve coffee pods and capsules are gaining popularity, due to ease of use and consistency. Functional coffee products with added health benefits are emerging. There's a growing trend towards organic and sustainably sourced coffee, meeting increased ethical consumer demands. Technological advancements in coffee brewing methods, such as automated machines and smart coffee makers, are transforming the at-home coffee experience.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the South American coffee market across various segments. By Product Type: The market is segmented into whole bean, ground coffee, instant coffee, and coffee pods and capsules, each with distinct growth projections and competitive dynamics. By Distribution Channel: The market is segmented into supermarkets/hypermarkets, convenience stores, specialist retailers, online retail stores, and other distribution channels, offering insights into the evolving retail landscape. Market sizes for each segment are provided with an estimated value of xx Million for the base year of 2025, including the forecast for the period 2025-2033. Growth rates and competitive intensity for each segment are carefully examined.

Key Drivers of South America Coffee Market Growth

The South American coffee market's growth is driven by several key factors: Increasing disposable incomes, particularly in urban areas, leading to increased spending on premium coffee products. The rise of e-commerce and online retail channels, offering greater accessibility and convenience. A growing preference for specialty and single-serve coffee formats. Government initiatives and investments in agricultural infrastructure to improve production and quality. Growing international demand for South American coffee beans.

Challenges in the South America Coffee Market Sector

Despite significant growth potential, the South American coffee market faces several challenges. Fluctuations in coffee bean prices due to weather patterns and global demand affect profitability. Intense competition from established international brands and regional players requires constant innovation and adaptation. Logistical hurdles in the supply chain, especially for smaller producers and remote regions, pose obstacles. Addressing sustainability concerns, including water usage, waste management and ethical sourcing is crucial for long-term market success. These challenges collectively impact the market's overall growth trajectory, resulting in an estimated xx% reduction in potential market value for 2026.

Emerging Opportunities in South America Coffee Market

Emerging trends present significant opportunities: The growing demand for sustainable and ethically sourced coffee creates a niche for businesses prioritizing environmental and social responsibility. The increasing popularity of functional coffees (e.g., with added health benefits) opens new product development avenues. Expansion into new markets and consumer segments through online retail and targeted marketing strategies. The development of innovative brewing technologies and coffee-related products to enhance the consumer experience.

Leading Players in the South America Coffee Market Market

- Café Caboclo

- Starbucks Coffee Company

- Nestle SA

- Molinos Rio de la Plata S A

- Death Wish Coffee Co

- Cafes La Virginia S A

- Volcanica Coffee Company

- Pilao Coffee

- Cabrales S A

- JDE Peet's

Key Developments in South America Coffee Market Industry

- December 2021: Starbucks Corporation expands café outlets in Minas Gerais, Brazil, opening eight new stores.

- April 2022: Starbucks and Nestlé launch an e-commerce site for Starbucks packaged coffee products in Brazil.

- May 2022: AriZona Beverages enters the coffee market with Sun Brew, launching a line of 100% Arabica coffee available across South America.

Strategic Outlook for South America Coffee Market Market

The South America coffee market holds significant long-term growth potential. Continued investment in sustainable farming practices, innovations in coffee processing, and expansion into new product categories (e.g., functional coffee) will shape future market dynamics. Further development of e-commerce platforms and logistics will enhance distribution efficiency. Strategic alliances and collaborations among market players will contribute to market consolidation and growth. The market is projected to experience substantial expansion, with the estimated value potentially exceeding xx Million by 2033.

South America Coffee Market Segmentation

-

1. Product Type

- 1.1. Whole Bean

- 1.2. Ground Coffee

- 1.3. Instant Coffee

- 1.4. Coffee Pods and Capsules

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialist Retailers

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

South America Coffee Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Coffee Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Innovation in Vanillin Synthesis; Diverse Functionality of Vanillin In End-use Industries

- 3.3. Market Restrains

- 3.3.1. Supply Chain Variability Impacting Vanilla Bean Availability For Flavor Production

- 3.4. Market Trends

- 3.4.1. Increasing Spending Power Augmenting the Growth for Specialty Coffee

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Coffee Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Whole Bean

- 5.1.2. Ground Coffee

- 5.1.3. Instant Coffee

- 5.1.4. Coffee Pods and Capsules

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialist Retailers

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America Coffee Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina South America Coffee Market Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America South America Coffee Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Café Caboclo

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Starbucks Coffee Company

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Nestle SA

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Molinos Rio de la Plata S A

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Death Wish Coffee Co

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Cafes La Virginia S A *List Not Exhaustive

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Volcanica Coffee Company

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Pilao Coffee

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Cabrales S A

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 JDE Peet's

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Café Caboclo

List of Figures

- Figure 1: South America Coffee Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Coffee Market Share (%) by Company 2024

List of Tables

- Table 1: South America Coffee Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Coffee Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: South America Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: South America Coffee Market Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 5: South America Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: South America Coffee Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 7: South America Coffee Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: South America Coffee Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: South America Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: South America Coffee Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: Brazil South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Brazil South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: Argentina South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Argentina South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Rest of South America South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: South America Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 18: South America Coffee Market Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 19: South America Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 20: South America Coffee Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 21: South America Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: South America Coffee Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 23: Brazil South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Brazil South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 25: Argentina South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Argentina South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 27: Chile South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Chile South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 29: Colombia South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Colombia South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 31: Peru South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Peru South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 33: Venezuela South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Venezuela South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 35: Ecuador South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Ecuador South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 37: Bolivia South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Bolivia South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 39: Paraguay South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Paraguay South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 41: Uruguay South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Uruguay South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Coffee Market?

The projected CAGR is approximately 8.50%.

2. Which companies are prominent players in the South America Coffee Market?

Key companies in the market include Café Caboclo, Starbucks Coffee Company, Nestle SA, Molinos Rio de la Plata S A, Death Wish Coffee Co, Cafes La Virginia S A *List Not Exhaustive, Volcanica Coffee Company, Pilao Coffee, Cabrales S A, JDE Peet's.

3. What are the main segments of the South America Coffee Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Innovation in Vanillin Synthesis; Diverse Functionality of Vanillin In End-use Industries.

6. What are the notable trends driving market growth?

Increasing Spending Power Augmenting the Growth for Specialty Coffee.

7. Are there any restraints impacting market growth?

Supply Chain Variability Impacting Vanilla Bean Availability For Flavor Production.

8. Can you provide examples of recent developments in the market?

In May 2022, AriZona Beverages announced its foray into the coffee space with Sun Brew with its new line of 100% Arabica coffee made with hand-selected beans from Central and South America. Sun Brew is available in three roast styles, namely, Snake Bite Blend, Cactus Blend, and Sedona Blend. The coffees are sold online at DrinkAriZona.com, Amazon.com, and at select grocery stores across South America.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Coffee Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Coffee Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Coffee Market?

To stay informed about further developments, trends, and reports in the South America Coffee Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence