Key Insights

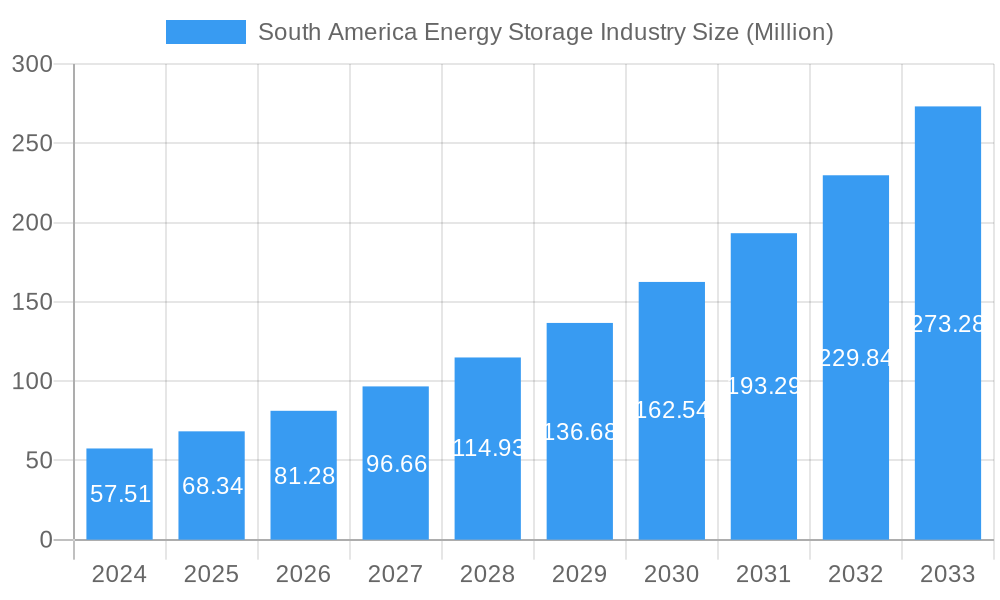

The South America energy storage market is poised for substantial growth, projected to reach USD 57.51 million in 2024, driven by an impressive CAGR of 18.9% from 2025 to 2033. This robust expansion is primarily fueled by the escalating demand for grid stability and the increasing integration of renewable energy sources like solar and wind power across the region. Governments are actively promoting energy independence and reducing reliance on fossil fuels, creating a favorable environment for energy storage investments. Furthermore, the growing adoption of electric vehicles (EVs) is also a significant contributor, as battery technologies developed for EVs can be repurposed for grid-scale storage solutions, thus driving down costs and accelerating market penetration. The need to address intermittent renewable energy generation and enhance the reliability of electricity supply, especially in remote or underserved areas, is a critical driver for the adoption of various energy storage technologies.

South America Energy Storage Industry Market Size (In Million)

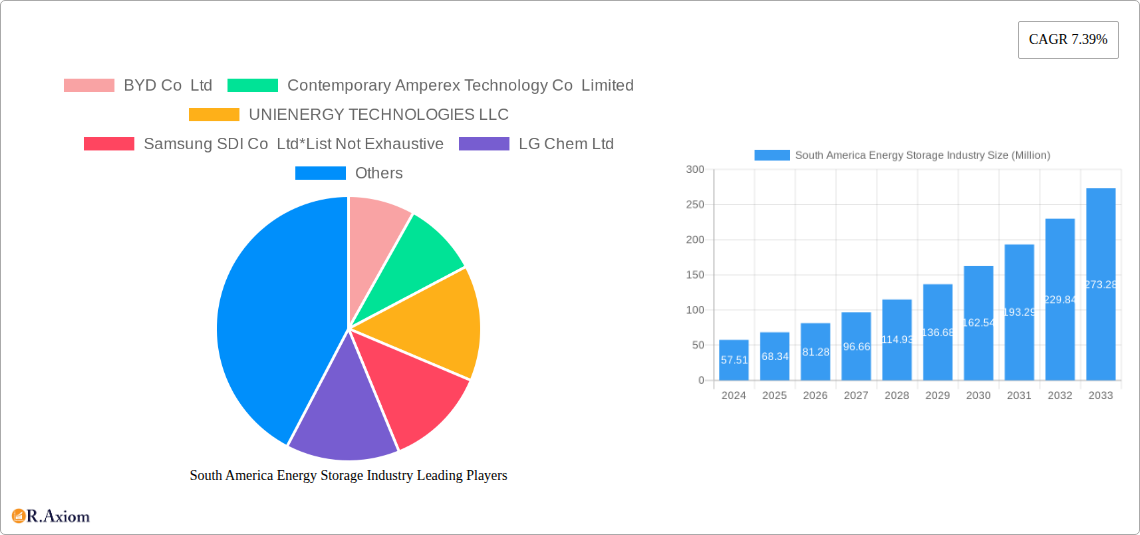

The market is segmented across several key types, including Batteries, Pumped-Storage Hydroelectricity (PSH), Thermal Energy Storage (TES), and Flywheel Energy Storage (FES), with batteries expected to dominate due to their versatility and declining costs. Applications span across Residential, Commercial & Industrial sectors, reflecting a broad spectrum of demand. Geographically, Brazil and Argentina are anticipated to lead the market, supported by significant renewable energy potential and supportive government policies. The competitive landscape features prominent players such as BYD Co. Ltd., Contemporary Amperex Technology Co. Limited, and Samsung SDI Co. Ltd., who are actively investing in research and development to introduce innovative and cost-effective energy storage solutions. While the market is experiencing rapid growth, challenges such as high initial investment costs for certain technologies and the need for robust regulatory frameworks continue to influence adoption rates. However, the overarching trend of decarbonization and the pursuit of a more sustainable energy future strongly underscore the optimistic outlook for the South America energy storage industry.

South America Energy Storage Industry Company Market Share

This comprehensive report provides an in-depth analysis of the South America energy storage industry, covering market dynamics, technological advancements, and future growth prospects from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this study offers critical insights for stakeholders looking to capitalize on the burgeoning energy storage market in the region. The report delves into market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, M&A activities, industry trends, dominant markets and segments, product developments, report scope, segmentation analysis, key growth drivers, challenges, emerging opportunities, leading players, key developments, and strategic outlook.

South America Energy Storage Industry Market Concentration & Innovation

The South America energy storage industry exhibits a moderate level of market concentration, with several key players vying for market share. Innovation is a critical driver, fueled by advancements in battery technology, particularly lithium-ion, and the growing interest in pumped-storage hydroelectricity (PSH) and thermal energy storage (TES) solutions. Regulatory frameworks are evolving, with governments across the region implementing policies to encourage renewable energy integration and grid modernization, thereby boosting the demand for energy storage. Product substitutes, while present, are becoming less competitive as energy storage technologies mature and become more cost-effective. End-user trends are shifting towards greater adoption of decentralized energy systems and demand-side management solutions. Mergers and acquisitions (M&A) activities are expected to increase as companies seek to expand their geographic reach and technological capabilities. For instance, M&A deal values in the broader global energy storage sector have reached several million in recent years, indicating significant investment appetite. Key innovation hubs are emerging in countries like Brazil and Chile, focusing on grid-scale storage and integration with renewable energy sources.

South America Energy Storage Industry Industry Trends & Insights

The South America energy storage industry is poised for substantial growth, driven by an escalating need for grid stabilization, renewable energy integration, and enhanced energy security. The compound annual growth rate (CAGR) for the region's energy storage market is projected to be robust, exceeding xx% during the forecast period. Market penetration of advanced energy storage solutions is rapidly increasing, moving beyond traditional applications to support the intermittency of solar and wind power. Technological disruptions, including advancements in battery chemistries (e.g., solid-state batteries), improved efficiency in PSH systems, and innovative TES solutions, are reshaping the competitive landscape. Consumer preferences are increasingly leaning towards sustainable energy options, with a growing demand for residential energy storage systems that offer backup power and reduce electricity bills. Competitive dynamics are intensifying, with both established energy companies and new market entrants investing heavily in research and development, and strategic partnerships. The market is witnessing a significant shift towards smart grid technologies, where energy storage plays a pivotal role in optimizing energy distribution and consumption. Furthermore, the growing electrification of transportation is indirectly contributing to the demand for energy storage as the grid infrastructure needs to adapt. The economic feasibility of energy storage projects is improving with declining battery costs and supportive government incentives, making it an attractive investment for both public and private entities. The expansion of smart home technologies also complements residential energy storage, offering greater control and efficiency for consumers.

Dominant Markets & Segments in South America Energy Storage Industry

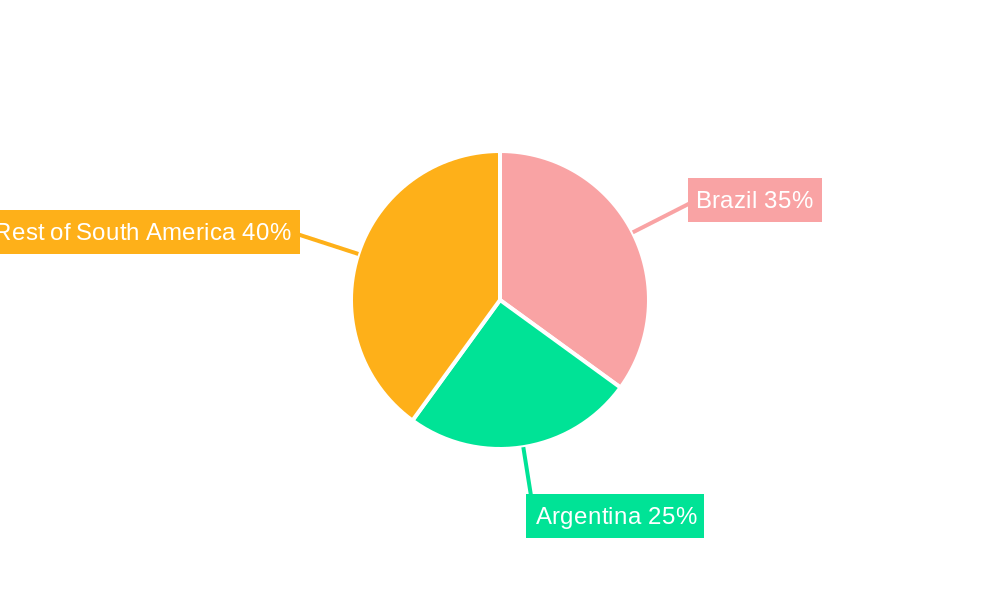

Brazil currently stands as the dominant market within the South America energy storage industry, driven by its vast renewable energy potential, particularly in hydropower and solar. Its large population and significant industrial base also contribute to a high demand for reliable and efficient energy solutions.

- Key Drivers for Brazil's Dominance:

- Robust Hydropower Infrastructure: Brazil's extensive hydropower capacity provides a natural foundation for pumped-storage hydroelectricity (PSH), a cost-effective and mature energy storage technology.

- Growing Solar and Wind Adoption: Increasing investments in solar and wind farms necessitate effective energy storage to mitigate intermittency and ensure grid stability.

- Supportive Government Policies: Incentives for renewable energy and energy storage projects, coupled with grid modernization initiatives, are fostering market growth.

- Large Industrial Sector: The substantial industrial and commercial demand for uninterrupted power supply makes energy storage solutions highly attractive.

Among the types of energy storage, Batteries are expected to dominate the market in the short to medium term, owing to their versatility, declining costs, and widespread applications in residential, commercial, and industrial sectors. However, Pumped-Storage Hydroelectricity (PSH) will remain a significant contributor, especially in countries with favorable geographical conditions and existing infrastructure.

The Commercial & Industrial application segment is projected to exhibit the highest growth rate, driven by the need for backup power, peak shaving, and integration with on-site renewable energy generation by businesses seeking to reduce operating costs and enhance energy resilience.

The "Rest of South America" segment, encompassing countries like Chile, Colombia, and Argentina, is also showing promising growth, spurred by ambitious renewable energy targets and government initiatives to modernize their power grids.

South America Energy Storage Industry Product Developments

Product developments in the South America energy storage industry are primarily focused on enhancing energy density, improving safety, and reducing the cost of battery technologies. Innovations in lithium-ion battery chemistries are leading to longer lifespans and faster charging capabilities, making them more suitable for grid-scale applications and electric vehicle integration. Thermal energy storage systems are evolving to offer more efficient and scalable solutions for industrial heat management and building climate control. Pumped-storage hydroelectricity projects are witnessing advancements in turbine efficiency and the development of smaller-scale, modular systems suitable for diverse topographical locations. The competitive advantage for these evolving products lies in their ability to address the specific energy challenges of the South American region, including grid modernization, renewable energy integration, and ensuring reliable power supply in remote areas.

Report Scope & Segmentation Analysis

This report meticulously segments the South America energy storage industry across key categories. The Batteries segment, encompassing various chemistries like lithium-ion, lead-acid, and emerging technologies, is projected to experience significant market expansion, driven by its adaptability to diverse applications. Pumped-Storage Hydroelectricity (PSH), a mature yet vital technology, will continue to hold a substantial market share, particularly in regions with favorable topography and existing hydrological infrastructure. Thermal Energy Storage (TES) is anticipated to grow steadily, fueled by its application in industrial processes and commercial building climate control. Flywheel Energy Storage (FES), while currently niche, holds potential for specific applications requiring rapid charge and discharge capabilities. In terms of applications, the Commercial & Industrial segment is expected to lead in growth, followed by Residential applications, as energy independence and cost savings become paramount. Geographically, Brazil is forecast to maintain its dominant position, with Argentina and the Rest of South America showing considerable growth potential driven by supportive policies and increasing renewable energy investments.

Key Drivers of South America Energy Storage Industry Growth

The growth of the South America energy storage industry is primarily propelled by the accelerating adoption of renewable energy sources, particularly solar and wind power. The inherent intermittency of these resources necessitates efficient energy storage solutions to ensure grid stability and reliability. Furthermore, government initiatives and supportive regulatory frameworks across the region are incentivizing investments in energy storage infrastructure through tax credits, feed-in tariffs, and renewable portfolio standards. The increasing demand for grid modernization and the need to reduce transmission losses also play a crucial role. Technological advancements, leading to decreased costs of battery technologies and improved system efficiencies, are making energy storage solutions more economically viable for a wider range of applications, from utility-scale projects to residential installations.

Challenges in the South America Energy Storage Industry Sector

Despite its promising outlook, the South America energy storage industry faces several challenges. High upfront capital costs for large-scale energy storage projects remain a significant barrier, although these costs are steadily declining. Regulatory uncertainties and the lack of standardized frameworks in some countries can hinder investment and deployment. Supply chain vulnerabilities, particularly concerning the availability and pricing of raw materials for battery production, can impact project timelines and profitability. Furthermore, the existing grid infrastructure in some parts of the region may require substantial upgrades to effectively integrate and manage distributed energy storage systems. Competition from established fossil fuel-based energy sources, where subsidies still exist, can also present a hurdle.

Emerging Opportunities in South America Energy Storage Industry

Emerging opportunities in the South America energy storage industry are abundant, driven by the region's vast renewable energy potential and the growing demand for sustainable energy solutions. The increasing penetration of electric vehicles (EVs) presents a significant opportunity for vehicle-to-grid (V2G) integration, where EVs can act as mobile energy storage units. The development of microgrids and off-grid energy solutions in remote areas, powered by renewable energy and storage, offers a chance to improve energy access and reliability. Furthermore, the growing focus on digitalization and smart grid technologies creates opportunities for advanced energy management systems that leverage energy storage for optimal grid operation. The increasing awareness of climate change and the desire for energy independence are also fueling consumer demand for residential and commercial energy storage solutions.

Leading Players in the South America Energy Storage Industry Market

- BYD Co Ltd

- Contemporary Amperex Technology Co Limited

- UNIENERGY TECHNOLOGIES LLC

- Samsung SDI Co Ltd

- LG Chem Ltd

- NGK Insulators Ltd

- Clarios (Formerly Johnson Controls International PLC)

- GS Yuasa Corporation

Key Developments in South America Energy Storage Industry Industry

- 2023/08: BYD Co Ltd announces plans to expand its electric vehicle battery production capacity in Brazil, signaling a growing commitment to the South American market.

- 2022/11: Contemporary Amperex Technology Co Limited (CATL) explores strategic partnerships for battery material sourcing and manufacturing within South America.

- 2023/05: UNIENERGY TECHNOLOGIES LLC showcases its advanced energy storage solutions at a regional renewable energy summit in Chile.

- 2023/01: LG Chem Ltd reports significant growth in its energy storage solutions sales in South America, driven by demand for residential and industrial applications.

- 2022/12: Discussions around potential new pumped-storage hydroelectricity (PSH) projects are ongoing in Colombia, aiming to enhance grid stability.

Strategic Outlook for South America Energy Storage Industry Market

The strategic outlook for the South America energy storage industry is overwhelmingly positive, characterized by robust growth catalysts and expanding market potential. The ongoing transition towards cleaner energy sources, coupled with the imperative to enhance grid resilience against climate-related disruptions, will continue to drive demand for energy storage solutions. Investment in battery manufacturing and assembly facilities within the region is expected to rise, further reducing costs and improving accessibility. Opportunities lie in developing integrated energy solutions that combine renewables, energy storage, and smart grid technologies. The continued evolution of policy frameworks to support energy storage deployment and the growing interest from international investors will further fuel market expansion. The industry is set to play a pivotal role in achieving the region's renewable energy targets and ensuring a secure and sustainable energy future for its population.

South America Energy Storage Industry Segmentation

-

1. Type

- 1.1. Batteries

- 1.2. Pumped-Storage Hydroelectricity (PSH)

- 1.3. Thermal Energy Storage (TES)

- 1.4. Fywheel Energy Storage (FES)

-

2. Application

- 2.1. Residential

- 2.2. Commercial & Indsutrial

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Energy Storage Industry Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Energy Storage Industry Regional Market Share

Geographic Coverage of South America Energy Storage Industry

South America Energy Storage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Supporting Government Policies for Solar Energy in South Africa4.; Increasing Investment in Renewable Energy Such as Solar

- 3.2.2 Wind

- 3.2.3 and Others

- 3.3. Market Restrains

- 3.3.1. Increasing Adoption of Alternate Renewable Technologies Such as Wind

- 3.4. Market Trends

- 3.4.1. Batteries Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Batteries

- 5.1.2. Pumped-Storage Hydroelectricity (PSH)

- 5.1.3. Thermal Energy Storage (TES)

- 5.1.4. Fywheel Energy Storage (FES)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial & Indsutrial

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Batteries

- 6.1.2. Pumped-Storage Hydroelectricity (PSH)

- 6.1.3. Thermal Energy Storage (TES)

- 6.1.4. Fywheel Energy Storage (FES)

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Residential

- 6.2.2. Commercial & Indsutrial

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Batteries

- 7.1.2. Pumped-Storage Hydroelectricity (PSH)

- 7.1.3. Thermal Energy Storage (TES)

- 7.1.4. Fywheel Energy Storage (FES)

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Residential

- 7.2.2. Commercial & Indsutrial

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of South America South America Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Batteries

- 8.1.2. Pumped-Storage Hydroelectricity (PSH)

- 8.1.3. Thermal Energy Storage (TES)

- 8.1.4. Fywheel Energy Storage (FES)

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Residential

- 8.2.2. Commercial & Indsutrial

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 BYD Co Ltd

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Contemporary Amperex Technology Co Limited

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 UNIENERGY TECHNOLOGIES LLC

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Samsung SDI Co Ltd*List Not Exhaustive

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 LG Chem Ltd

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 NGK Insulators Ltd

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Clarios (Formerly Johnson Controls International PLC)

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 GS Yuasa Corporation

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 BYD Co Ltd

List of Figures

- Figure 1: South America Energy Storage Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South America Energy Storage Industry Share (%) by Company 2025

List of Tables

- Table 1: South America Energy Storage Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: South America Energy Storage Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: South America Energy Storage Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: South America Energy Storage Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: South America Energy Storage Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: South America Energy Storage Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 7: South America Energy Storage Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: South America Energy Storage Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: South America Energy Storage Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: South America Energy Storage Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: South America Energy Storage Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: South America Energy Storage Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: South America Energy Storage Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 14: South America Energy Storage Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 15: South America Energy Storage Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: South America Energy Storage Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: South America Energy Storage Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: South America Energy Storage Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 19: South America Energy Storage Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 20: South America Energy Storage Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 21: South America Energy Storage Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 22: South America Energy Storage Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: South America Energy Storage Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: South America Energy Storage Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: South America Energy Storage Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 26: South America Energy Storage Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 27: South America Energy Storage Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 28: South America Energy Storage Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 29: South America Energy Storage Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 30: South America Energy Storage Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 31: South America Energy Storage Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: South America Energy Storage Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Energy Storage Industry?

The projected CAGR is approximately 18.9%.

2. Which companies are prominent players in the South America Energy Storage Industry?

Key companies in the market include BYD Co Ltd, Contemporary Amperex Technology Co Limited, UNIENERGY TECHNOLOGIES LLC, Samsung SDI Co Ltd*List Not Exhaustive, LG Chem Ltd, NGK Insulators Ltd, Clarios (Formerly Johnson Controls International PLC), GS Yuasa Corporation.

3. What are the main segments of the South America Energy Storage Industry?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Supporting Government Policies for Solar Energy in South Africa4.; Increasing Investment in Renewable Energy Such as Solar. Wind. and Others.

6. What are the notable trends driving market growth?

Batteries Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Increasing Adoption of Alternate Renewable Technologies Such as Wind.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Energy Storage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Energy Storage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Energy Storage Industry?

To stay informed about further developments, trends, and reports in the South America Energy Storage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence