Key Insights

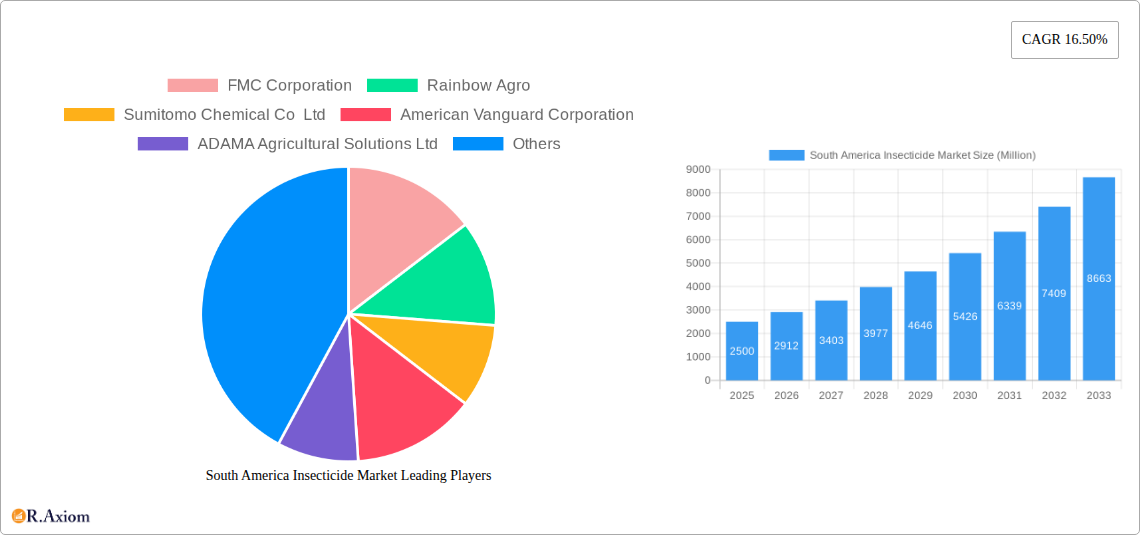

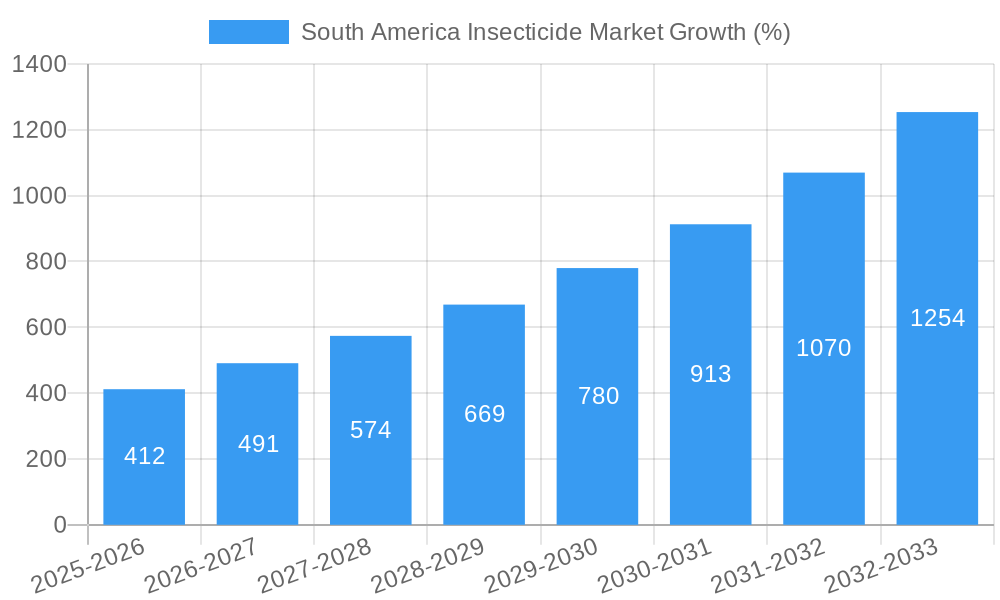

The South American insecticide market is experiencing robust growth, driven by a burgeoning agricultural sector, increasing pest infestations due to climate change, and rising demand for high-yielding crops. The market, valued at approximately $XX million in 2025 (assuming a logical estimation based on the provided CAGR and market size), is projected to exhibit a Compound Annual Growth Rate (CAGR) of 16.50% from 2025 to 2033. Brazil, Argentina, and other South American nations are key contributors to this growth, fueled by substantial investments in agricultural modernization and intensification. The diverse agricultural landscape, encompassing commercial crops, fruits and vegetables, grains and cereals, pulses and oilseeds, and turf & ornamental plants, necessitates a wide array of insecticide solutions, contributing to market segmentation. Key application modes include chemigation, foliar application, fumigation, seed treatment, and soil treatment, each catering to specific crop needs and pest control strategies. Leading players like FMC Corporation, Bayer AG, Syngenta, and BASF SE are actively engaged in this market, driving innovation and competition through the development of novel and effective insecticide formulations. However, factors such as stringent regulatory frameworks, environmental concerns regarding pesticide use, and the emergence of insecticide resistance pose significant challenges to sustained market growth.

The forecast period (2025-2033) anticipates continued expansion, driven by advancements in insecticide technology, including the development of biopesticides and targeted formulations that minimize environmental impact. This shift towards sustainable agriculture is expected to reshape the market landscape, with a greater focus on integrated pest management (IPM) strategies. Growth in specific segments, such as the demand for insecticides targeting pests affecting high-value crops like fruits and vegetables, is likely to outpace the overall market growth. Further, the expanding adoption of precision agriculture techniques, including drone-based pesticide application, will influence the market dynamics, providing opportunities for specialized insecticide solutions. The continued economic growth in South America, coupled with government support for agricultural development, will also contribute to market expansion in the coming years. However, careful consideration of environmental sustainability and potential regulatory hurdles remains crucial for long-term market success.

South America Insecticide Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the South America Insecticide Market, covering the period 2019-2033. It offers in-depth insights into market dynamics, segmentation, leading players, and future growth potential, equipping stakeholders with actionable intelligence for strategic decision-making. The report utilizes robust data and analysis to forecast market trends and identify key opportunities within this dynamic sector. The total market size in 2025 is estimated at xx Million.

South America Insecticide Market Concentration & Innovation

The South American insecticide market exhibits a moderately concentrated landscape, dominated by multinational corporations like Bayer AG, Syngenta Group, BASF SE, and Corteva Agriscience, which collectively hold approximately xx% of the market share in 2025. However, regional players and smaller specialized firms contribute significantly to innovation and niche market segments. The market is characterized by continuous innovation driven by the need for effective pest control solutions, increasing resistance to existing insecticides, and growing consumer demand for environmentally friendly alternatives.

Regulatory frameworks, particularly concerning pesticide registration and usage, play a crucial role in shaping market dynamics. Stringent regulations are driving the development of biopesticides and other sustainable solutions. The market also witnesses continuous development of new active ingredients and formulations designed to enhance efficacy and reduce environmental impact. Mergers and acquisitions (M&A) activities have played a significant role in market consolidation, with recent deals valuing several hundred Million dollars, resulting in broader product portfolios and expanded market reach for leading players. For example, UPL's partnership with Bayer (May 2022) signifies the strategic importance of collaborative innovation in this sector.

- Market Concentration: Top 5 players hold approximately xx% market share (2025).

- Innovation Drivers: Pest resistance, environmental regulations, consumer demand for sustainable solutions.

- Regulatory Landscape: Stringent pesticide registration and usage regulations impacting market access and product development.

- M&A Activity: Significant M&A activity observed in recent years, with deal values reaching xx Million.

South America Insecticide Market Industry Trends & Insights

The South America insecticide market is experiencing robust growth, driven by factors such as expanding agricultural land, rising demand for high-yield crops, and increasing pest infestations. The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected at xx%. This growth is further fueled by technological advancements leading to the development of novel insecticides with enhanced efficacy and reduced environmental impact.

Consumer preference for safe and effective pest control solutions is driving the adoption of biopesticides and integrated pest management (IPM) techniques. However, the market faces challenges such as the emergence of insecticide resistance, stringent regulatory requirements, and fluctuations in agricultural commodity prices. Competitive dynamics are intense, with major players focusing on product diversification, strategic partnerships, and geographical expansion to maintain their market positions. Market penetration of new technologies varies by region and crop type. Seed treatment is witnessing high penetration in Brazil, driven by advancements in seed technology.

Dominant Markets & Segments in South America Insecticide Market

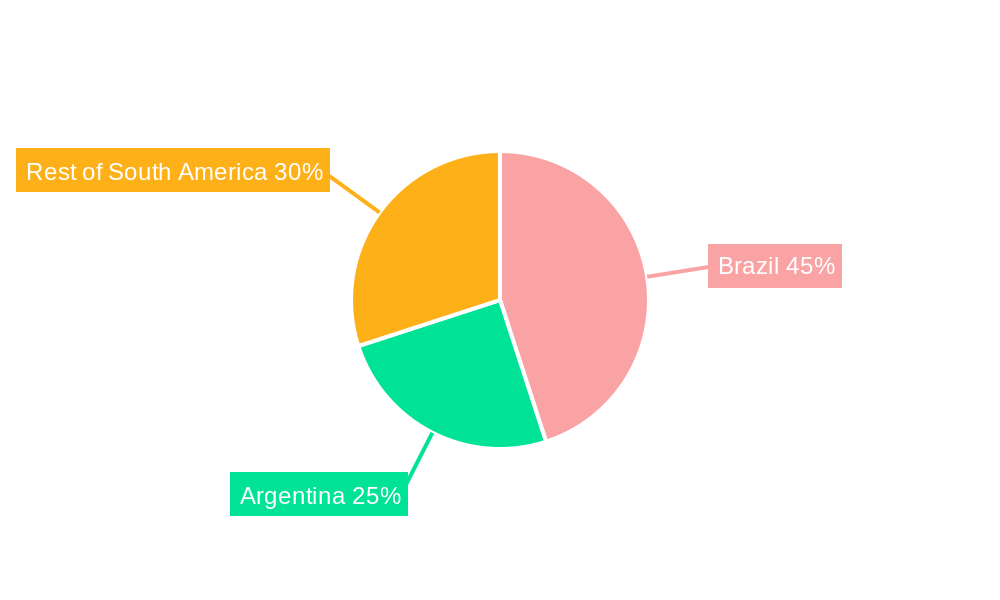

Brazil accounts for the largest share of the South American insecticide market, driven by its vast agricultural sector and high crop production. Argentina and Chile also represent significant markets, while the "Rest of South America" segment demonstrates steady growth potential.

By Application Mode: Foliar application dominates the market due to its ease of use and widespread adoption across various crops. However, seed treatment and chemigation are witnessing increasing adoption due to improved efficiency and reduced environmental impact.

By Crop Type: Fruits & Vegetables and Grains & Cereals are the leading crop segments in terms of insecticide consumption. The growing demand for these crops, along with increasing pest pressure, fuels substantial insecticide usage in these segments.

- Brazil: Largest market share due to extensive agricultural land and high crop production. Key drivers include government support for agricultural development and a robust agricultural infrastructure.

- Argentina & Chile: Significant markets fueled by growing demand for high-yield crops and efficient pest management practices.

- Foliar Application: Dominates the application mode segment due to widespread adoption and ease of use.

- Seed Treatment: Shows high growth potential driven by improved efficacy and reduced environmental concerns.

- Fruits & Vegetables/Grains & Cereals: Leading crop segments based on high insecticide usage due to pest pressure and crop value.

South America Insecticide Market Product Developments

The South American insecticide market is witnessing the introduction of novel formulations featuring advanced active ingredients with improved efficacy, lower toxicity, and enhanced environmental compatibility. These innovations address increasing resistance to traditional insecticides and align with stricter environmental regulations. The growing adoption of biopesticides is further contributing to the diversification of product offerings and market competitiveness. Companies are also focusing on developing integrated pest management (IPM) solutions, combining different pest control approaches for enhanced efficacy and reduced reliance on chemical insecticides.

Report Scope & Segmentation Analysis

This report segments the South America insecticide market by application mode (Chemigation, Foliar, Fumigation, Seed Treatment, Soil Treatment), crop type (Commercial Crops, Fruits & Vegetables, Grains & Cereals, Pulses & Oilseeds, Turf & Ornamental), and country (Argentina, Brazil, Chile, Rest of South America). Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail, providing a comprehensive understanding of the market landscape. For example, the foliar application segment is projected to witness a CAGR of xx% during the forecast period, driven by its wide adaptability and affordability.

Key Drivers of South America Insecticide Market Growth

The South America insecticide market growth is propelled by several key factors: rising agricultural production, increasing pest infestation rates due to changing climate patterns, growing demand for high-yield crops, and government initiatives promoting agricultural development. Technological advancements in insecticide formulation and delivery systems, coupled with the development of novel, environmentally friendlier products, also contribute significantly to market growth.

Challenges in the South America Insecticide Market Sector

The South America insecticide market faces challenges including stringent regulatory requirements for pesticide registration and usage, concerns over environmental safety and potential health risks associated with pesticide use, and the emergence of insecticide resistance in target pest populations. Supply chain disruptions, fluctuating agricultural commodity prices, and price volatility of raw materials pose further obstacles to market growth. The cost of compliance with environmental regulations may impact profitability, especially for smaller companies.

Emerging Opportunities in South America Insecticide Market

The market presents opportunities for the development and adoption of sustainable and eco-friendly pest control solutions, including biopesticides and IPM techniques. The growing consumer awareness regarding environmental and health concerns creates a strong demand for these alternatives. Expansion into niche markets, such as organic farming and specialty crops, and tapping into the growing demand for high-value crops also presents significant business opportunities.

Leading Players in the South America Insecticide Market

- FMC Corporation

- Rainbow Agro

- Sumitomo Chemical Co Ltd

- American Vanguard Corporation

- ADAMA Agricultural Solutions Ltd

- Bayer AG

- UPL Limite

- Syngenta Group

- Corteva Agriscience

- BASF SE

Key Developments in South America Insecticide Market Industry

- May 2022: UPL partnered with Bayer for Spirotetramat insecticide, aiming to develop new pest management solutions.

- May 2022: Corteva Agriscience expanded its seed treatment portfolio and infrastructure in Brazil.

- January 2023: Bayer partnered with Oerth Bio to develop eco-friendly crop protection solutions.

Strategic Outlook for South America Insecticide Market

The South America insecticide market is poised for sustained growth, driven by technological advancements, increasing agricultural production, and growing demand for effective and sustainable pest control solutions. Companies focusing on innovation, product diversification, strategic partnerships, and adherence to stringent regulatory requirements will be well-positioned to capitalize on the market's growth potential. The increasing adoption of biopesticides and IPM strategies presents a significant growth catalyst for the future.

South America Insecticide Market Segmentation

-

1. Application Mode

- 1.1. Chemigation

- 1.2. Foliar

- 1.3. Fumigation

- 1.4. Seed Treatment

- 1.5. Soil Treatment

-

2. Crop Type

- 2.1. Commercial Crops

- 2.2. Fruits & Vegetables

- 2.3. Grains & Cereals

- 2.4. Pulses & Oilseeds

- 2.5. Turf & Ornamental

-

3. Application Mode

- 3.1. Chemigation

- 3.2. Foliar

- 3.3. Fumigation

- 3.4. Seed Treatment

- 3.5. Soil Treatment

-

4. Crop Type

- 4.1. Commercial Crops

- 4.2. Fruits & Vegetables

- 4.3. Grains & Cereals

- 4.4. Pulses & Oilseeds

- 4.5. Turf & Ornamental

South America Insecticide Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Insecticide Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 16.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs

- 3.3. Market Restrains

- 3.3.1. Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers

- 3.4. Market Trends

- 3.4.1. Brazil's dominance in the market is fueled by the increasing demand for insecticides driven by the necessity for effective insect control

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Insecticide Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application Mode

- 5.1.1. Chemigation

- 5.1.2. Foliar

- 5.1.3. Fumigation

- 5.1.4. Seed Treatment

- 5.1.5. Soil Treatment

- 5.2. Market Analysis, Insights and Forecast - by Crop Type

- 5.2.1. Commercial Crops

- 5.2.2. Fruits & Vegetables

- 5.2.3. Grains & Cereals

- 5.2.4. Pulses & Oilseeds

- 5.2.5. Turf & Ornamental

- 5.3. Market Analysis, Insights and Forecast - by Application Mode

- 5.3.1. Chemigation

- 5.3.2. Foliar

- 5.3.3. Fumigation

- 5.3.4. Seed Treatment

- 5.3.5. Soil Treatment

- 5.4. Market Analysis, Insights and Forecast - by Crop Type

- 5.4.1. Commercial Crops

- 5.4.2. Fruits & Vegetables

- 5.4.3. Grains & Cereals

- 5.4.4. Pulses & Oilseeds

- 5.4.5. Turf & Ornamental

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Application Mode

- 6. Brazil South America Insecticide Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina South America Insecticide Market Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America South America Insecticide Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 FMC Corporation

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Rainbow Agro

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Sumitomo Chemical Co Ltd

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 American Vanguard Corporation

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 ADAMA Agricultural Solutions Ltd

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Bayer AG

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 UPL Limite

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Syngenta Group

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Corteva Agriscience

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 BASF SE

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 FMC Corporation

List of Figures

- Figure 1: South America Insecticide Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Insecticide Market Share (%) by Company 2024

List of Tables

- Table 1: South America Insecticide Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Insecticide Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 3: South America Insecticide Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 4: South America Insecticide Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 5: South America Insecticide Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 6: South America Insecticide Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: South America Insecticide Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Brazil South America Insecticide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Argentina South America Insecticide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of South America South America Insecticide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South America Insecticide Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 12: South America Insecticide Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 13: South America Insecticide Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 14: South America Insecticide Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 15: South America Insecticide Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Brazil South America Insecticide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Argentina South America Insecticide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Chile South America Insecticide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Colombia South America Insecticide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Peru South America Insecticide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Venezuela South America Insecticide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Ecuador South America Insecticide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Bolivia South America Insecticide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Paraguay South America Insecticide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Uruguay South America Insecticide Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Insecticide Market?

The projected CAGR is approximately 16.50%.

2. Which companies are prominent players in the South America Insecticide Market?

Key companies in the market include FMC Corporation, Rainbow Agro, Sumitomo Chemical Co Ltd, American Vanguard Corporation, ADAMA Agricultural Solutions Ltd, Bayer AG, UPL Limite, Syngenta Group, Corteva Agriscience, BASF SE.

3. What are the main segments of the South America Insecticide Market?

The market segments include Application Mode, Crop Type, Application Mode, Crop Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs.

6. What are the notable trends driving market growth?

Brazil's dominance in the market is fueled by the increasing demand for insecticides driven by the necessity for effective insect control.

7. Are there any restraints impacting market growth?

Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers.

8. Can you provide examples of recent developments in the market?

January 2023: Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.May 2022: UPL partnered with Bayer for Spirotetramat insecticide to develop new pest management solutions. Through this long-term global data access and supply agreement with Bayer, specifically for addressing farmer demands regarding resistance management and difficult-to-control sucking pests, UPL will develop, register, and distribute new unique solutions, including Spirotetramat, using its experience in insecticides and worldwide research and development network.May 2022: Corteva Agriscience in Brazil expanded its portfolio, services, and industrial infrastructure to commercial partners to strengthen its activities in the seed treatment industry. For instance, the company strengthened its operations in the area of seed treatment with the new global brands LumiGEN and Ampl.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Insecticide Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Insecticide Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Insecticide Market?

To stay informed about further developments, trends, and reports in the South America Insecticide Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence