Key Insights

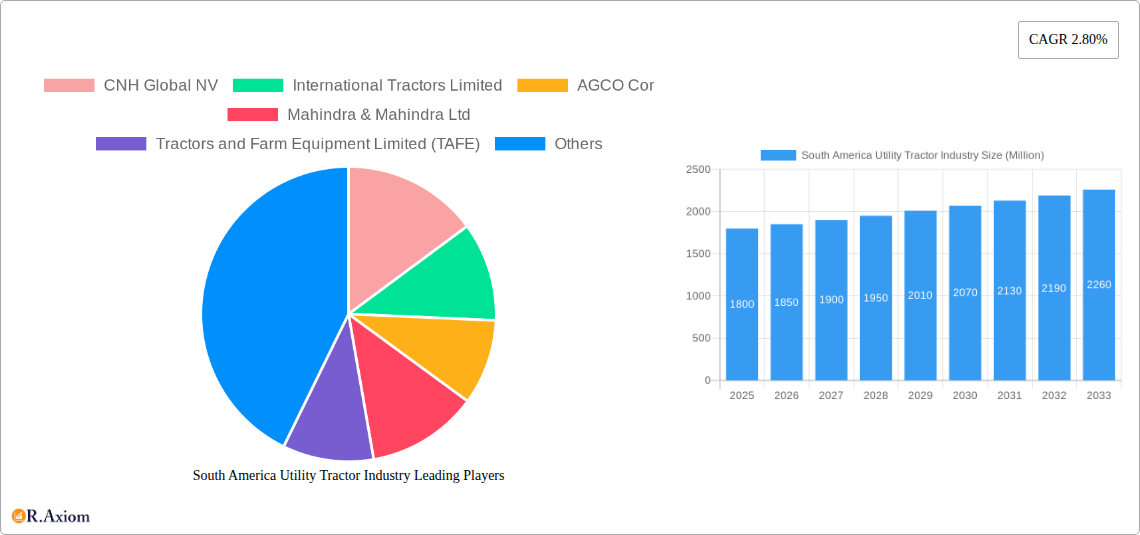

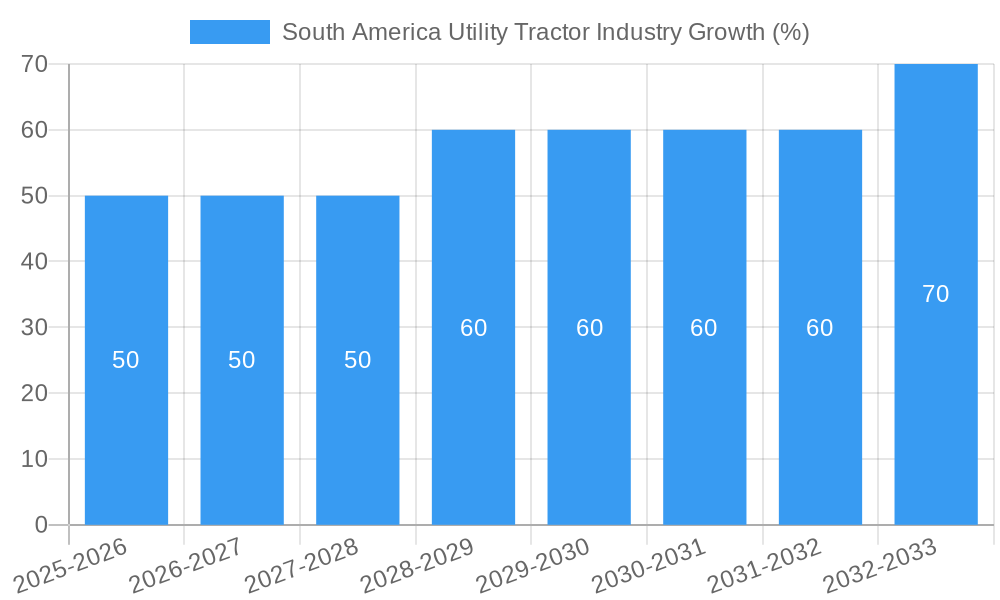

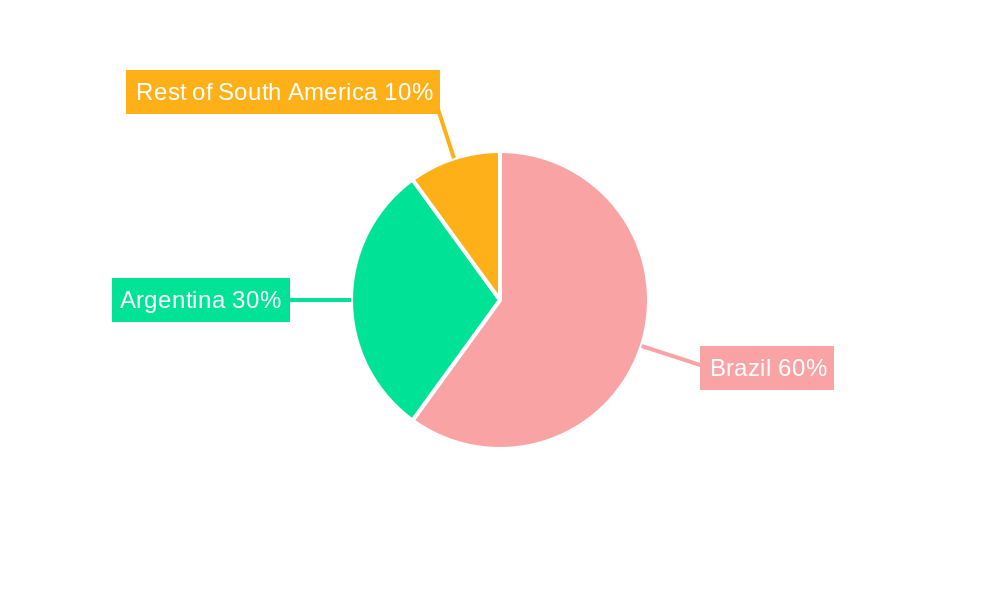

The South American utility tractor market, encompassing compact, mid-size, and large tractors across various horsepower ranges (below 50 HP, 50-100 HP, above 100 HP) and applications (agricultural, construction, municipal), presents a steady growth trajectory. Driven by expanding agricultural activities, particularly in Brazil and Argentina, increasing infrastructure development, and government initiatives promoting modernization in farming practices, the market is projected to maintain a moderate growth rate. The predominance of agricultural applications, fueled by the region's vast arable land and growing demand for food production, contributes significantly to market size. While a precise market size for 2025 isn't provided, considering a global CAGR of 2.80% and the significant agricultural sector in South America, a reasonable estimate for the South American utility tractor market size in 2025 could be between $1.5 billion and $2 billion USD. Key players like CNH Global NV, AGCO Corp, Mahindra & Mahindra Ltd, and TAFE are well-positioned to capitalize on this growth, offering a diverse range of tractors tailored to specific needs. However, economic fluctuations, the availability of financing options for farmers, and potential import restrictions could pose challenges to sustained expansion. The market segmentation by tractor type and horsepower reflects a diverse customer base, requiring manufacturers to offer customized solutions. The concentration of market share in Brazil and Argentina underscores the importance of these countries in driving regional growth. The long-term outlook is positive, but consistent attention to evolving technological demands and regional economic stability will be critical for sustainable growth over the forecast period (2025-2033).

The segment analysis reveals that agricultural applications dominate, followed by construction and municipal sectors. Within horsepower segments, the 50-100 HP range likely holds the largest market share, reflecting the optimal balance between power and affordability for various applications. Mid-size tractors are expected to maintain their leading position in the market due to their versatility and suitability across diverse farming operations. Future growth will be influenced by factors such as technological advancements in tractor efficiency, precision farming techniques, and the adoption of automation and connectivity features. The rise of sustainable agriculture practices could further drive demand for fuel-efficient and environmentally friendly utility tractors. Competitive dynamics within the industry will continue to shape market evolution, with manufacturers emphasizing innovation, customization, and efficient after-sales service to gain a competitive edge.

This comprehensive report provides a detailed analysis of the South America utility tractor industry, covering market size, segmentation, growth drivers, challenges, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period covers 2025-2033, and the historical period encompasses 2019-2024. This report is essential for industry stakeholders, investors, and anyone seeking to understand the dynamics of this evolving market.

South America Utility Tractor Industry Market Concentration & Innovation

The South American utility tractor market exhibits a moderately concentrated landscape, with the top five players—CNH Global NV, AGCO Corp, Mahindra & Mahindra Ltd, Tractors and Farm Equipment Limited (TAFE), and Deere & Company—holding an estimated 65% market share in 2025. However, the presence of several regional and international players fosters competition. Innovation is driven by the need for enhanced fuel efficiency, improved technological integration (GPS, precision farming), and stricter emission regulations. Government initiatives promoting agricultural modernization and infrastructure development further stimulate innovation. The market witnesses frequent mergers and acquisitions (M&A) activity, with deal values exceeding $xx Million in the last five years. Key M&A activities focus on expanding geographic reach and product portfolios. Product substitution is mainly driven by the emergence of more efficient and technologically advanced models. End-user trends show increasing demand for compact and mid-size tractors, driven by the growth of smallholder farms.

- Market Share (2025): Top 5 players: 65%; Others: 35%

- M&A Deal Value (2020-2024): >$xx Million

- Key Innovation Drivers: Fuel efficiency, technological integration, emission regulations, government initiatives.

South America Utility Tractor Industry Industry Trends & Insights

The South American utility tractor market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven primarily by the expanding agricultural sector, rising disposable incomes, and government support for agricultural mechanization. Technological disruptions, such as the increasing adoption of precision farming technologies and automation, are transforming the industry. Consumer preferences are shifting toward fuel-efficient, technologically advanced, and versatile tractors. The competitive landscape is characterized by intense competition among established players and the emergence of new entrants. Market penetration of technologically advanced tractors is gradually increasing, with an estimated xx% penetration rate in 2025, projected to reach xx% by 2033.

Dominant Markets & Segments in South America Utility Tractor Industry

Brazil remains the dominant market for utility tractors in South America, accounting for over xx% of the total market volume in 2025. Its large agricultural sector and favorable government policies contribute significantly to this dominance. Argentina and Colombia represent substantial markets as well. In terms of segments:

- Type: Mid-size tractors dominate, driven by the prevalence of medium-sized farms.

- Horsepower: The 50-100 HP segment holds the largest market share, catering to the needs of a wide range of agricultural applications.

- Application: Agricultural applications constitute the largest segment, reflecting the reliance on tractors for farming activities.

Key Drivers for Brazil's Dominance:

- Large agricultural sector

- Favorable government policies supporting agricultural modernization

- Extensive infrastructure supporting agricultural activities

- Strong economic growth (historical context)

South America Utility Tractor Industry Product Developments

Recent product innovations focus on enhanced fuel efficiency, improved operator comfort, and advanced technological integration (GPS, precision farming). Manufacturers are increasingly incorporating features such as automatic guidance systems, variable rate technology, and telematics for remote monitoring and diagnostics. These advancements aim to improve operational efficiency, reduce fuel consumption, and enhance overall productivity. The market fit for these technologically advanced tractors is strong, particularly among large-scale farms and commercial agricultural operations.

Report Scope & Segmentation Analysis

This report segments the South American utility tractor market based on tractor type (Compact, Mid-size, Large), horsepower (Below 50 HP, 50-100 HP, Above 100 HP), and application (Agricultural, Construction, Municipal). Each segment’s growth projections, market size (in Millions), and competitive dynamics are thoroughly analyzed. The agricultural segment is projected to show the highest growth due to growing demand for mechanization in the agricultural sector.

- Type: Compact tractors are projected for slower growth than mid-size and large tractors.

- Horsepower: The 50-100 HP segment will likely continue to be the most significant for the forecast period.

- Application: The construction and municipal segments are expected to showcase moderate growth, propelled by infrastructure development.

Key Drivers of South America Utility Tractor Industry Growth

The growth of the South American utility tractor industry is fueled by several key factors: the expansion of the agricultural sector, increased government support for agricultural mechanization, rising disposable incomes leading to higher purchasing power among farmers, and the ongoing modernization of farming practices. Technological advancements, such as precision farming technologies, also contribute significantly to market expansion. Furthermore, favorable financing options and robust infrastructure development further enhance growth.

Challenges in the South America Utility Tractor Industry Sector

The South American utility tractor industry faces challenges, including volatile commodity prices impacting farmer purchasing decisions, infrastructure limitations hindering efficient distribution in certain regions, high import duties and tariffs increasing the cost of imported tractors, and intense competition among established players and emerging market entrants. Fluctuations in currency exchange rates also pose a challenge.

Emerging Opportunities in South America Utility Tractor Industry

Emerging opportunities lie in the increasing adoption of precision farming technologies, the growing demand for compact and specialized tractors for smallholder farmers, and the expansion of the construction and municipal segments. Further market penetration in less developed agricultural regions and the development of customized solutions for unique agricultural needs present substantial opportunities. The increasing adoption of rental services is also an emerging trend that presents opportunities for new business models.

Leading Players in the South America Utility Tractor Industry Market

- CNH Global NV

- International Tractors Limited

- AGCO Corp

- Mahindra & Mahindra Ltd

- Tractors and Farm Equipment Limited (TAFE)

- Claas KGaA mbH

- Kubota Agricultural Machinery

- Massey Ferguson

- Deere & Company

Key Developments in South America Utility Tractor Industry Industry

- 2023 Q4: Deere & Company launches a new line of compact utility tractors with advanced technology features.

- 2022 Q2: AGCO Corp announces a strategic partnership to expand distribution networks in key South American markets.

- 2021 Q1: Mahindra & Mahindra Ltd invests in a new manufacturing facility in Brazil to increase production capacity. (Further details and dates would be included in the full report)

Strategic Outlook for South America Utility Tractor Industry Market

The South American utility tractor market presents considerable growth potential over the next decade, driven by technological advancements, expanding agricultural activities, and supportive government policies. Focusing on fuel efficiency, technological integration, and customization to meet the specific needs of diverse farming practices will be crucial for success. Companies that successfully adapt to evolving consumer preferences and technological disruptions will be well-positioned to capitalize on this significant market opportunity.

South America Utility Tractor Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

South America Utility Tractor Industry Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Utility Tractor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Legalization of Cannabis; Growing Focus on Health Benefits of Cannabis

- 3.3. Market Restrains

- 3.3.1. Lack of Data on Dosages and Results; Lack of Access to Financial Assistance

- 3.4. Market Trends

- 3.4.1. Rising Labour Scarcity and Wages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Utility Tractor Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Brazil South America Utility Tractor Industry Analysis, Insights and Forecast, 2019-2031

- 7. Argentina South America Utility Tractor Industry Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America South America Utility Tractor Industry Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 CNH Global NV

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 International Tractors Limited

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 AGCO Cor

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Mahindra & Mahindra Ltd

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Tractors and Farm Equipment Limited (TAFE)

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Claas KGaA mbH

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Kubota Agricultural Machinery

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Massey Ferguson

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Deere & Company

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 CNH Global NV

List of Figures

- Figure 1: South America Utility Tractor Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Utility Tractor Industry Share (%) by Company 2024

List of Tables

- Table 1: South America Utility Tractor Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Utility Tractor Industry Volume Kiloton Forecast, by Region 2019 & 2032

- Table 3: South America Utility Tractor Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: South America Utility Tractor Industry Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 5: South America Utility Tractor Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: South America Utility Tractor Industry Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 7: South America Utility Tractor Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: South America Utility Tractor Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: South America Utility Tractor Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: South America Utility Tractor Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: South America Utility Tractor Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: South America Utility Tractor Industry Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: South America Utility Tractor Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 14: South America Utility Tractor Industry Volume Kiloton Forecast, by Region 2019 & 2032

- Table 15: South America Utility Tractor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: South America Utility Tractor Industry Volume Kiloton Forecast, by Country 2019 & 2032

- Table 17: Brazil South America Utility Tractor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Brazil South America Utility Tractor Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 19: Argentina South America Utility Tractor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Argentina South America Utility Tractor Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 21: Rest of South America South America Utility Tractor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of South America South America Utility Tractor Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 23: South America Utility Tractor Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 24: South America Utility Tractor Industry Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 25: South America Utility Tractor Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 26: South America Utility Tractor Industry Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 27: South America Utility Tractor Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 28: South America Utility Tractor Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 29: South America Utility Tractor Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 30: South America Utility Tractor Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 31: South America Utility Tractor Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 32: South America Utility Tractor Industry Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 33: South America Utility Tractor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: South America Utility Tractor Industry Volume Kiloton Forecast, by Country 2019 & 2032

- Table 35: Brazil South America Utility Tractor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Brazil South America Utility Tractor Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 37: Argentina South America Utility Tractor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Argentina South America Utility Tractor Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 39: Chile South America Utility Tractor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Chile South America Utility Tractor Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 41: Colombia South America Utility Tractor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Colombia South America Utility Tractor Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 43: Peru South America Utility Tractor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Peru South America Utility Tractor Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 45: Venezuela South America Utility Tractor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Venezuela South America Utility Tractor Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 47: Ecuador South America Utility Tractor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Ecuador South America Utility Tractor Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 49: Bolivia South America Utility Tractor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Bolivia South America Utility Tractor Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 51: Paraguay South America Utility Tractor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Paraguay South America Utility Tractor Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 53: Uruguay South America Utility Tractor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Uruguay South America Utility Tractor Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Utility Tractor Industry?

The projected CAGR is approximately 2.80%.

2. Which companies are prominent players in the South America Utility Tractor Industry?

Key companies in the market include CNH Global NV, International Tractors Limited, AGCO Cor, Mahindra & Mahindra Ltd, Tractors and Farm Equipment Limited (TAFE), Claas KGaA mbH, Kubota Agricultural Machinery, Massey Ferguson, Deere & Company.

3. What are the main segments of the South America Utility Tractor Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Legalization of Cannabis; Growing Focus on Health Benefits of Cannabis.

6. What are the notable trends driving market growth?

Rising Labour Scarcity and Wages.

7. Are there any restraints impacting market growth?

Lack of Data on Dosages and Results; Lack of Access to Financial Assistance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Utility Tractor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Utility Tractor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Utility Tractor Industry?

To stay informed about further developments, trends, and reports in the South America Utility Tractor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence