Key Insights

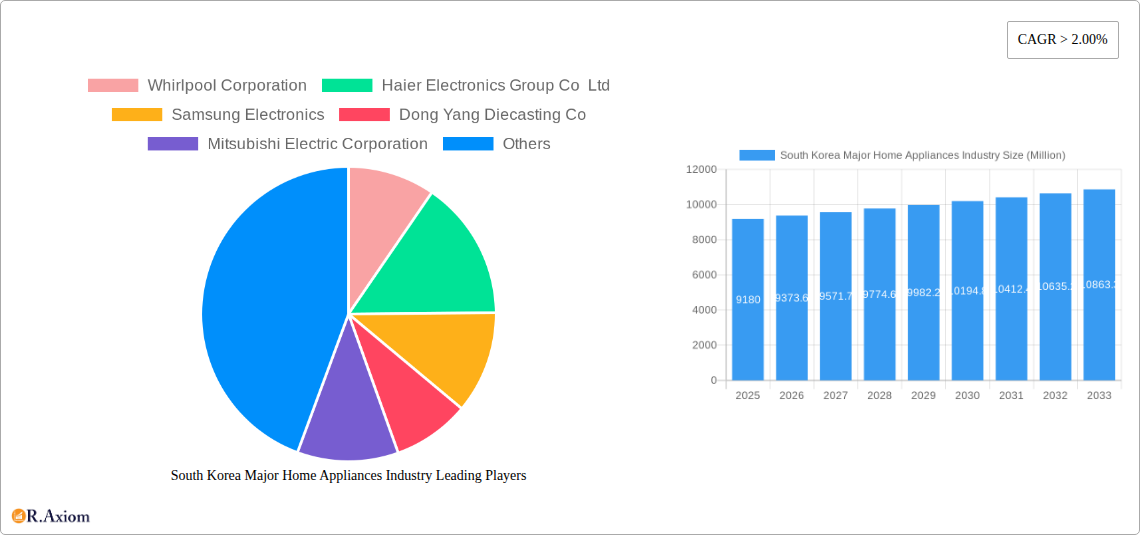

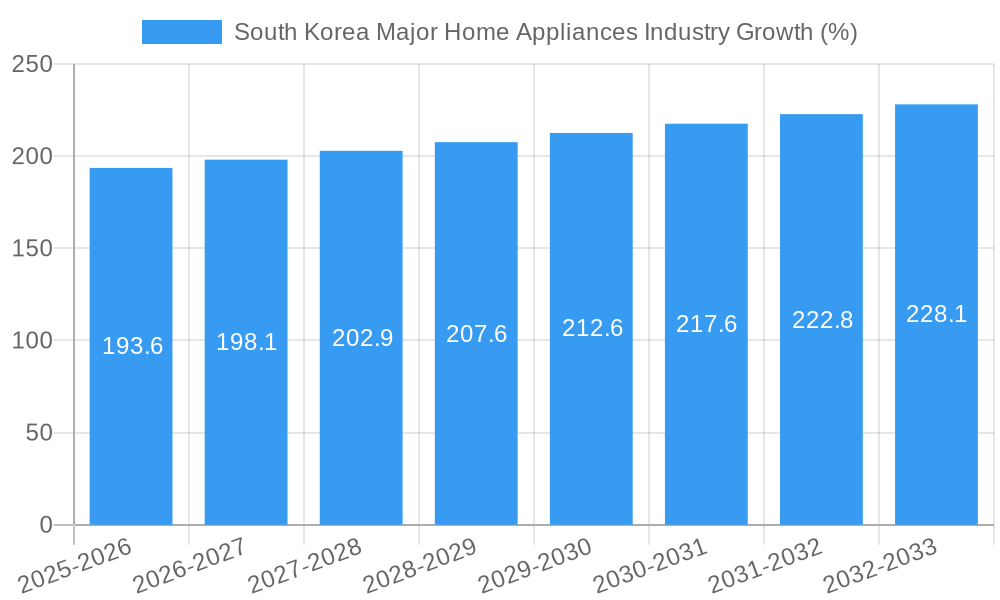

The South Korean major home appliances market, valued at $9.18 billion in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 2.00% from 2025 to 2033. This growth is fueled by several key factors. Rising disposable incomes and a growing preference for technologically advanced, energy-efficient appliances drive strong consumer demand. Furthermore, the increasing urbanization in South Korea leads to higher demand for space-saving and smart home appliances. The market is segmented by product type (refrigerators, freezers, dishwashers, washing machines, cookers and ovens, and other products) and distribution channel (hypermarkets/supermarkets, specialty stores, e-commerce/online, and other channels). E-commerce is experiencing significant growth as a distribution channel, leveraging consumer preference for online shopping and convenient home delivery. Competitive dynamics are intense, with major players like Samsung Electronics, LG Electronics, Whirlpool Corporation, and Haier Electronics Group Co Ltd vying for market share through innovation, brand building, and strategic partnerships. The market's growth trajectory is expected to be influenced by factors such as fluctuating raw material prices, economic conditions, and government policies aimed at promoting energy efficiency in household appliances.

The forecast period (2025-2033) anticipates continued expansion, driven by sustained consumer spending and technological advancements. While potential restraints like economic downturns or supply chain disruptions could temper growth, the overall market outlook remains positive. The dominance of established players will likely continue, but new entrants with innovative products and competitive pricing strategies could disrupt the market. Analyzing segment performance is crucial for effective market entry and growth strategies. For example, understanding the preferences for specific appliance types and preferred purchasing channels will provide valuable insights for companies seeking to penetrate this dynamic market.

This comprehensive report provides a detailed analysis of the South Korea major home appliances industry, covering the period 2019-2033. It offers in-depth insights into market trends, competitive dynamics, and growth opportunities, enabling businesses to make informed strategic decisions. The report leverages extensive data and expert analysis to forecast market size and growth, identify key players, and analyze emerging trends shaping this dynamic sector.

South Korea Major Home Appliances Industry Market Concentration & Innovation

This section analyzes the level of market concentration within South Korea's major home appliances sector, identifying key players and their respective market shares. We examine the innovative drivers influencing the industry, including technological advancements, consumer preferences, and government regulations. Furthermore, the report explores the impact of mergers and acquisitions (M&A) activities on market dynamics, providing an overview of significant deals and their influence on market concentration. The regulatory landscape and its impact on market players are also assessed, along with an analysis of substitute products and their potential to disrupt the market. Finally, we delve into prevailing end-user trends and their implications for the industry's future trajectory.

- Market Share: Samsung Electronics and LG Electronics are expected to hold the largest market share in 2025, with a combined share of approximately 60%. Other key players, including Whirlpool Corporation, Haier Electronics Group Co Ltd, and Panasonic Corporation, will collectively account for around 30% of the market. The remaining 10% will be shared by smaller domestic and international players.

- M&A Activity: The report details M&A activity within the sector during the study period (2019-2024), including deal values (in Millions) where available, highlighting any strategic shifts in market consolidation. The forecast period (2025-2033) also projects potential M&A trends. Expected M&A deal value for 2025 is estimated at xx Million.

- Innovation Drivers: Key innovation drivers include the integration of smart home technology, energy efficiency improvements, and the development of sustainable and eco-friendly appliances. Government incentives towards energy efficiency are also influencing innovation.

South Korea Major Home Appliances Industry Industry Trends & Insights

This section offers a detailed examination of the South Korea major home appliances industry's key trends and insights. We analyze the factors driving market growth, including economic expansion, rising disposable incomes, and urbanization. The report explores the disruptive effects of technological advancements, such as the Internet of Things (IoT) and artificial intelligence (AI), on the industry landscape. Furthermore, evolving consumer preferences, such as a preference for premium appliances with advanced features and aesthetically pleasing designs, are discussed. A thorough analysis of competitive dynamics, encompassing pricing strategies, product differentiation, and marketing campaigns, is provided. We present market growth projections in the form of a Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033), along with an estimate of market penetration for key product categories. The historical period (2019-2024) provides context for these projections. The predicted CAGR for the period 2025-2033 is estimated at xx%.

Dominant Markets & Segments in South Korea Major Home Appliances Industry

This section identifies the dominant regions, countries, and segments within the South Korea major home appliances industry. It analyzes market share across different product categories (Refrigerators, Freezers, Dishwashers, Washing Machines, Cookers and Ovens, Other Products) and distribution channels (Hypermarkets/Supermarkets, Specialty Stores, E-commerce/Online, Other Distribution Channels). The analysis uses data from the historical period (2019-2024) to project dominance into the forecast period (2025-2033).

Key Drivers for Dominant Segments:

- Refrigerators: Growing household incomes and a preference for larger refrigerator models with advanced features.

- E-commerce/Online: Increased internet penetration and the convenience of online shopping.

- Hypermarkets/Supermarkets: Wide reach and established customer base.

Dominance Analysis: The urban areas of South Korea are expected to continue dominating the market due to higher disposable incomes and greater demand for technologically advanced appliances. E-commerce is predicted to experience significant growth, challenging traditional retail channels. Refrigerators and Washing Machines are projected to remain the leading product segments.

South Korea Major Home Appliances Industry Product Developments

This section summarizes recent product innovations, including the integration of smart technology, energy-efficient features, and improved design aesthetics. The focus is on highlighting the technological trends shaping product development and their alignment with market demands. The competitive advantages offered by these innovations and the successful market positioning of new products are also analyzed. The emergence of smart appliances with connectivity features and the increased focus on sustainability are significant trends.

Report Scope & Segmentation Analysis

This report segments the South Korea major home appliances market by product type (Refrigerators, Freezers, Dishwashers, Washing Machines, Cookers and Ovens, Other Products) and distribution channel (Hypermarkets/Supermarkets, Specialty Stores, E-commerce/Online, Other Distribution Channels). Each segment's market size (in Millions), growth projections for the forecast period (2025-2033), and competitive dynamics are analyzed. Market sizes for 2025 are estimated as follows: Refrigerators – xx Million, Freezers – xx Million, Dishwashers – xx Million, Washing Machines – xx Million, Cookers and Ovens – xx Million, Other Products – xx Million. Distribution channels show similar breakdowns, with estimated values for each in 2025.

Key Drivers of South Korea Major Home Appliances Industry Growth

Key drivers of growth include rising disposable incomes, increasing urbanization, technological advancements (smart home integration, energy efficiency), and government initiatives promoting energy-efficient appliances. The expanding middle class and evolving consumer lifestyles are also contributing factors.

Challenges in the South Korea Major Home Appliances Industry Sector

Challenges include intense competition from both domestic and international players, fluctuations in raw material prices, and potential supply chain disruptions. Stringent regulatory requirements related to energy efficiency and safety standards also pose challenges. The impact of these factors on production costs and profitability is evaluated.

Emerging Opportunities in South Korea Major Home Appliances Industry

Emerging opportunities include growth in the smart home appliance market, increased demand for energy-efficient appliances, and the potential for expansion into niche product categories. The rising adoption of subscription models for appliance services is also creating new revenue streams.

Leading Players in the South Korea Major Home Appliances Industry Market

- Whirlpool Corporation

- Haier Electronics Group Co Ltd

- Samsung Electronics

- Dong Yang Diecasting Co

- Mitsubishi Electric Corporation

- Gorenje Group

- Bosch

- Electrolux AB

- Panasonic Corporation

- LG Electronics

Key Developments in South Korea Major Home Appliances Industry Industry

- May 2023: Pohang Iron and Steel Co (South Korea) signed a three-year agreement with Samsung Electronics to supply steel sheets for home appliances until 2026. This strengthens Samsung's supply chain and potentially lowers production costs.

- December 2022: LG Electronics launched the LG ThinQ™ UP upgradeable home appliances. This enhances product lifecycle management and customer loyalty, potentially increasing market share.

Strategic Outlook for South Korea Major Home Appliances Industry Market

The South Korea major home appliances market is poised for continued growth driven by rising disposable incomes, technological innovations, and government support for energy efficiency. The increasing adoption of smart home technologies and the focus on sustainable products will present significant opportunities for industry players. Companies strategically positioning themselves to cater to these trends are expected to gain a competitive advantage.

South Korea Major Home Appliances Industry Segmentation

-

1. Product

- 1.1. Refrigerators

- 1.2. Freezers

- 1.3. Dishwashers

- 1.4. Washing Machines

- 1.5. Cookers and Ovens

- 1.6. Other Products

-

2. Distribution Channel

- 2.1. Hypermarkets/Supermarkets

- 2.2. Specialty Stores

- 2.3. E-commerce/Online

- 2.4. Other Distribution Channels

South Korea Major Home Appliances Industry Segmentation By Geography

- 1. South Korea

South Korea Major Home Appliances Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Online Sales are Witnessing a Major Share of the Market; Increasing Technological Advancements is Driving the Demand for Energy-Efficient Home Appliances

- 3.3. Market Restrains

- 3.3.1. Changing Consumer Preferences

- 3.4. Market Trends

- 3.4.1. Washing Machines are Highly Demanded Major Appliances in South Korea

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Major Home Appliances Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Refrigerators

- 5.1.2. Freezers

- 5.1.3. Dishwashers

- 5.1.4. Washing Machines

- 5.1.5. Cookers and Ovens

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets/Supermarkets

- 5.2.2. Specialty Stores

- 5.2.3. E-commerce/Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Whirlpool Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Haier Electronics Group Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Samsung Electronics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dong Yang Diecasting Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mitsubishi Electric Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gorenje Group**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bosch

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Electrolux AB

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Panasonic Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LG Electronics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Whirlpool Corporation

List of Figures

- Figure 1: South Korea Major Home Appliances Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Korea Major Home Appliances Industry Share (%) by Company 2024

List of Tables

- Table 1: South Korea Major Home Appliances Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Korea Major Home Appliances Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: South Korea Major Home Appliances Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: South Korea Major Home Appliances Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: South Korea Major Home Appliances Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: South Korea Major Home Appliances Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 7: South Korea Major Home Appliances Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: South Korea Major Home Appliances Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Major Home Appliances Industry?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the South Korea Major Home Appliances Industry?

Key companies in the market include Whirlpool Corporation, Haier Electronics Group Co Ltd, Samsung Electronics, Dong Yang Diecasting Co, Mitsubishi Electric Corporation, Gorenje Group**List Not Exhaustive, Bosch, Electrolux AB, Panasonic Corporation, LG Electronics.

3. What are the main segments of the South Korea Major Home Appliances Industry?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.18 Million as of 2022.

5. What are some drivers contributing to market growth?

Online Sales are Witnessing a Major Share of the Market; Increasing Technological Advancements is Driving the Demand for Energy-Efficient Home Appliances.

6. What are the notable trends driving market growth?

Washing Machines are Highly Demanded Major Appliances in South Korea.

7. Are there any restraints impacting market growth?

Changing Consumer Preferences.

8. Can you provide examples of recent developments in the market?

May 2023: Pohang Iron and Steel Co (South Korea) has signed a three-year agreement with South Korea-based Samsung Electronics to supply steel sheets for home appliances until 2026.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Major Home Appliances Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Major Home Appliances Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Major Home Appliances Industry?

To stay informed about further developments, trends, and reports in the South Korea Major Home Appliances Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence