Key Insights

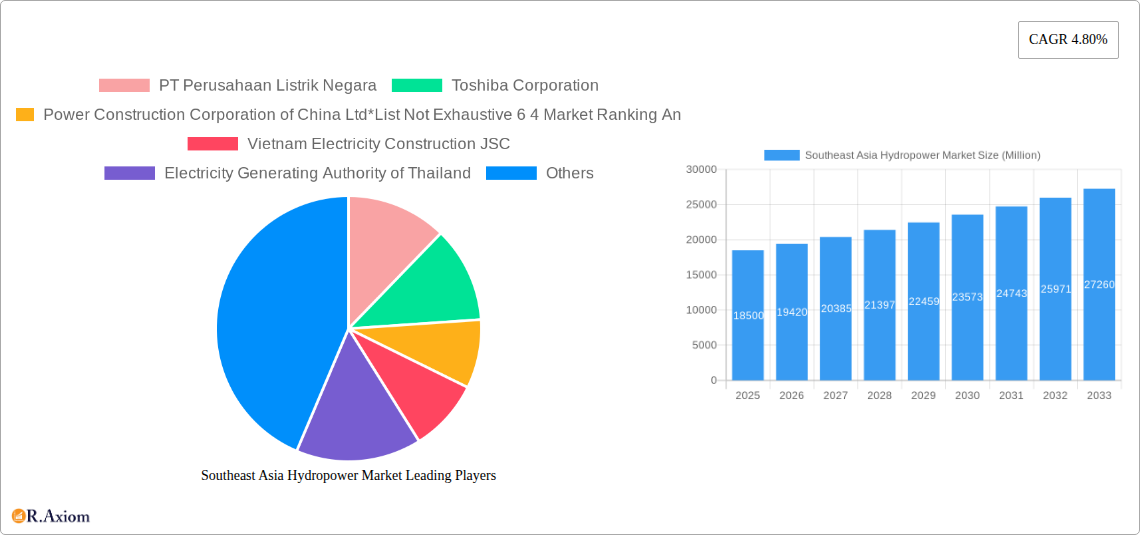

The Southeast Asia Hydropower Market is poised for robust expansion, projected to reach a significant market size of approximately $18,500 million by 2025, with a projected Compound Annual Growth Rate (CAGR) of 4.80% through 2033. This growth is primarily fueled by the region's escalating energy demands, driven by rapid industrialization, urbanization, and a burgeoning population across nations like Vietnam, Indonesia, Malaysia, and the Philippines. Hydropower, being a renewable and relatively cost-effective energy source, is strategically positioned to meet a substantial portion of this demand, contributing to energy security and the decarbonization efforts across Southeast Asia. The market is experiencing a surge in investments, particularly in large hydropower projects which offer economies of scale and significant power generation capacity. Furthermore, the increasing focus on grid stability and peak load management is driving the adoption of pumped storage hydropower, offering a vital solution for integrating intermittent renewable sources.

Southeast Asia Hydropower Market Market Size (In Billion)

Despite the strong growth trajectory, the market faces certain restraints. Environmental concerns, including potential impacts on biodiversity and river ecosystems, alongside the lengthy and complex permitting processes for large-scale projects, can pose challenges. Social acceptance and the need for effective stakeholder engagement are also critical factors influencing project development. However, the prevailing trend towards sustainable energy and supportive government policies aimed at promoting renewable energy infrastructure are expected to mitigate these restraints. Companies like PT Perusahaan Listrik Negara, Toshiba Corporation, and Power Construction Corporation of China Ltd are at the forefront, innovating and expanding their presence to capitalize on the immense opportunities presented by the dynamic Southeast Asia hydropower landscape. The region's diverse geography and existing riverine infrastructure provide a fertile ground for continued development and investment in this crucial sector.

Southeast Asia Hydropower Market Company Market Share

This in-depth report provides a detailed analysis of the Southeast Asia Hydropower Market, offering critical insights into market dynamics, growth drivers, and future potential. Covering the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this report is essential for industry stakeholders seeking to understand and capitalize on the evolving renewable energy landscape in the region. We explore market concentration, innovation, regulatory frameworks, dominant segments, and key players, delivering actionable intelligence for strategic decision-making.

Southeast Asia Hydropower Market Market Concentration & Innovation

The Southeast Asia Hydropower Market exhibits a moderate to high degree of market concentration, with a few dominant players controlling a significant portion of the installed capacity. Major companies like PT Perusahaan Listrik Negara, Toshiba Corporation, Power Construction Corporation of China Ltd, Vietnam Electricity Construction JSC, Electricity Generating Authority of Thailand, Aboitiz Power Corporation, General Electric Company, Andritz AG, and Tenaga Nasional Berhad are instrumental in shaping market trends. Innovation is primarily driven by advancements in turbine efficiency, dam construction technologies, and smart grid integration for better energy management. Regulatory frameworks play a crucial role, with governments increasingly supporting renewable energy through feed-in tariffs and power purchase agreements. Product substitutes, such as solar and wind power, are gaining traction, necessitating continuous improvement and cost-effectiveness in hydropower solutions. End-user trends lean towards reliable, clean energy sources to meet growing industrial and residential demands. Merger and acquisition activities are observed, with strategic acquisitions aimed at expanding portfolios and gaining market share. For instance, deals focusing on small hydropower and pumped storage projects are becoming more frequent, indicating a strategic shift towards diversifying energy generation. The estimated market share for large hydropower is around 75%, small hydropower at 15%, and pumped storage at 10%, with M&A deal values projected to reach over 1,500 Million within the forecast period.

Southeast Asia Hydropower Market Industry Trends & Insights

The Southeast Asia Hydropower Market is experiencing robust growth, driven by the region's escalating energy demand and a strong commitment to decarbonization. Hydropower, a foundational pillar of renewable energy in Southeast Asia, is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.2% from 2025 to 2033. This growth is propelled by government initiatives to increase the share of renewable energy in the national grids, alongside the inherent advantages of hydropower, including its dispatchability and capacity for grid stability. Technological disruptions are focusing on modernizing existing infrastructure, improving operational efficiency, and developing more environmentally friendly construction techniques to mitigate ecological impact. Consumer preferences are increasingly aligned with sustainable energy solutions, boosting the demand for clean power generation. The competitive dynamics are characterized by intense competition among established utility companies, engineering, procurement, and construction (EPC) firms, and international technology providers. The market penetration of hydropower remains high, especially for large-scale projects, but the focus is also shifting towards smaller, decentralized hydropower solutions and pumped storage for enhanced grid flexibility. Investment in R&D for advanced hydropower technologies, such as low-head turbines and integrated environmental monitoring systems, is crucial for sustaining this growth trajectory. The overall market size is estimated to reach over 120,000 Million by 2033.

Dominant Markets & Segments in Southeast Asia Hydropower Market

Within the Southeast Asia Hydropower Market, Large Hydropower continues to dominate, accounting for an estimated 75% of the total market share due to its significant energy generation capacity. Countries like Indonesia, Vietnam, and Laos are key drivers of this segment's growth, leveraging their vast river systems and substantial infrastructure development projects.

- Vietnam: The Vietnamese hydropower sector is experiencing a significant surge, fueled by ambitious national energy plans and increasing investments in both large and pumped-storage facilities. The government's commitment to renewable energy targets, coupled with its strategic geographical location and abundant water resources, positions Vietnam as a leading market. The estimated market size for hydropower in Vietnam is projected to be over 35,000 Million by 2033.

- Indonesia: With its archipelagic nature and numerous major rivers, Indonesia presents immense potential for large-scale hydropower development. The government's focus on energy security and diversification makes it a crucial market.

- Laos: Often referred to as the "battery of Southeast Asia," Laos heavily relies on hydropower for both domestic consumption and export, making it a consistently strong performer in the large hydropower segment.

The Pumped Storage segment is emerging as a critical area for grid stabilization and renewable energy integration, with an anticipated market share of 10%. Vietnam and Thailand are at the forefront of developing these facilities to manage the intermittency of other renewable sources.

- Vietnam: The ongoing development of projects like the Bac Ai pumped-storage hydropower plant highlights Vietnam's strategic investment in this technology.

- Thailand: The Electricity Generating Authority of Thailand is actively exploring and developing pumped storage solutions to enhance grid reliability.

Small Hydropower represents the remaining 15% of the market, offering decentralized energy solutions and catering to remote communities and industrial applications. Malaysia and the Philippines are showing increasing interest in this segment for localized power generation.

- Malaysia: The push for rural electrification and the utilization of smaller river systems are driving the growth of small hydropower projects.

- Philippines: This segment is crucial for providing reliable power to islands and remote areas, contributing to overall energy accessibility.

Southeast Asia Hydropower Market Product Developments

Product developments in the Southeast Asia Hydropower Market are centered on enhancing efficiency, reducing environmental impact, and integrating smart technologies. Innovations include advanced turbine designs for increased energy capture from lower water flows, modular components for faster installation of small hydropower units, and sophisticated control systems for optimized grid integration. The competitive advantage lies in the reliability and dispatchability of hydropower, particularly in large-scale projects and pumped storage, while small hydropower offers decentralized solutions.

Report Scope & Segmentation Analysis

This report segmenting the Southeast Asia Hydropower Market by Type includes Large Hydropower, Small Hydropower, and Pumped Storage. By Geography, it covers Vietnam, Indonesia, Malaysia, Laos, Philippines, Thailand, and the Rest of Southeast Asia.

- Large Hydropower: Projected to maintain its market leadership, with significant investment in new projects and upgrades. Estimated market size: over 80,000 Million by 2033.

- Small Hydropower: Expected to witness steady growth driven by decentralized energy needs and rural electrification. Estimated market size: over 12,000 Million by 2033.

- Pumped Storage: Poised for substantial expansion as a crucial component for grid stability and renewable energy integration. Estimated market size: over 12,000 Million by 2033.

The geographical analysis will highlight the distinct growth trajectories and investment landscapes across Vietnam, Indonesia, Malaysia, Laos, Philippines, Thailand, and the broader Rest of Southeast Asia region, each with unique drivers and market dynamics.

Key Drivers of Southeast Asia Hydropower Market Growth

The growth of the Southeast Asia Hydropower Market is propelled by several key factors:

- Rising Energy Demand: Rapid economic development and population growth across the region are escalating the demand for electricity, making hydropower a vital source of baseload power.

- Government Support & Renewable Energy Targets: National governments are actively promoting renewable energy through supportive policies, incentives, and ambitious targets for clean energy integration.

- Environmental Consciousness & Decarbonization Goals: The increasing focus on reducing carbon emissions and mitigating climate change is driving investments in clean energy sources like hydropower.

- Technological Advancements: Innovations in turbine technology, dam construction, and grid management are improving the efficiency, cost-effectiveness, and environmental performance of hydropower projects.

- Energy Security: Hydropower offers a domestic and reliable source of energy, reducing dependence on imported fossil fuels and enhancing national energy security.

Challenges in the Southeast Asia Hydropower Market Sector

Despite its potential, the Southeast Asia Hydropower Market faces several challenges:

- Environmental and Social Concerns: Large-scale hydropower projects can lead to significant environmental impacts, including habitat disruption and changes in water flow, as well as social displacement, necessitating careful planning and mitigation strategies.

- High Initial Investment Costs: The development of major hydropower projects requires substantial upfront capital investment, which can be a barrier for some developing economies.

- Regulatory and Permitting Complexities: Navigating complex environmental regulations and obtaining necessary permits can lead to project delays and increased costs.

- Geopolitical and Water Resource Management Issues: Transboundary river management and potential conflicts over water resources can pose challenges for regional hydropower development.

- Competition from Other Renewables: The growing affordability and deployment of solar and wind power present competitive alternatives, requiring hydropower to continuously demonstrate its cost-effectiveness and reliability.

Emerging Opportunities in Southeast Asia Hydropower Market

Emerging opportunities in the Southeast Asia Hydropower Market are diverse and promising:

- Pumped Storage Development: The increasing integration of variable renewable energy sources like solar and wind creates a strong demand for pumped storage hydropower for grid stabilization and energy storage solutions.

- Modernization of Existing Facilities: Upgrading and refurbishing older hydropower plants can significantly enhance their efficiency, capacity, and lifespan, offering a cost-effective avenue for growth.

- Small Hydropower and Decentralized Energy: Expanding small hydropower projects can electrify remote areas, support rural economies, and provide resilience against grid disruptions.

- Green Financing and Investment: The growing global focus on sustainable investments provides opportunities for securing financing for hydropower projects that adhere to stringent environmental and social standards.

- Hybrid Renewable Energy Systems: Integrating hydropower with other renewable sources like solar and wind can create optimized and reliable energy systems, leveraging the strengths of each technology.

Leading Players in the Southeast Asia Hydropower Market Market

- PT Perusahaan Listrik Negara

- Toshiba Corporation

- Power Construction Corporation of China Ltd

- Vietnam Electricity Construction JSC

- Electricity Generating Authority of Thailand

- Aboitiz Power Corporation

- General Electric Company

- Andritz AG

- Tenaga Nasional Berhad

Key Developments in Southeast Asia Hydropower Market Industry

- January 2024: Nexif Ratch Energy Investments Pte. Ltd, an owner/operator of clean-energy power, acquired the 30 MW Minh Luong hydropower plant, a run-of-river facility with peak-hour storage in Lao Cai province, Vietnam. The acquisition strengthens the Nexif Ratch Energy portfolio’s growth path in renewables and will create a stable and recurring income through a long-term power purchase agreement.

- February 2024: The French development agency, Agence Française de Développement, announced that it is seeking to engage individual regional or international specialists to form a panel of experts to provide technical assistance services for the development of the 1.2 GW Bac Ai pumped-storage hydropower plant in the Ninh Thuan province of Vietnam.

Strategic Outlook for Southeast Asia Hydropower Market Market

The strategic outlook for the Southeast Asia Hydropower Market is positive, with continued growth anticipated through 2033. The region's insatiable appetite for energy, coupled with a strong policy push towards renewables, will sustain investment in hydropower. The increasing focus on pumped storage for grid modernization and energy security presents a significant growth avenue. Furthermore, ongoing technological advancements and a growing emphasis on sustainable development practices will ensure hydropower's continued relevance as a cornerstone of the region's clean energy future. Strategic partnerships, capacity building, and a commitment to responsible project development will be crucial for unlocking the full potential of this vital energy sector.

Southeast Asia Hydropower Market Segmentation

-

1. Type

- 1.1. Large Hydropower

- 1.2. Small Hydropower

- 1.3. Pumped Storage

-

2. Geography

- 2.1. Vietnam

- 2.2. Indonesia

- 2.3. Malaysia

- 2.4. Laos

- 2.5. Philippines

- 2.6. Thailand

- 2.7. Rest of Southeast Asia

Southeast Asia Hydropower Market Segmentation By Geography

- 1. Vietnam

- 2. Indonesia

- 3. Malaysia

- 4. Laos

- 5. Philippines

- 6. Thailand

- 7. Rest of Southeast Asia

Southeast Asia Hydropower Market Regional Market Share

Geographic Coverage of Southeast Asia Hydropower Market

Southeast Asia Hydropower Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Hydropower Generation4.; Favorable Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Adoption of Other Alternative Clean Energy Sources

- 3.4. Market Trends

- 3.4.1. The Large Hydropower Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Southeast Asia Hydropower Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Large Hydropower

- 5.1.2. Small Hydropower

- 5.1.3. Pumped Storage

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Vietnam

- 5.2.2. Indonesia

- 5.2.3. Malaysia

- 5.2.4. Laos

- 5.2.5. Philippines

- 5.2.6. Thailand

- 5.2.7. Rest of Southeast Asia

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.3.2. Indonesia

- 5.3.3. Malaysia

- 5.3.4. Laos

- 5.3.5. Philippines

- 5.3.6. Thailand

- 5.3.7. Rest of Southeast Asia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Vietnam Southeast Asia Hydropower Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Large Hydropower

- 6.1.2. Small Hydropower

- 6.1.3. Pumped Storage

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Vietnam

- 6.2.2. Indonesia

- 6.2.3. Malaysia

- 6.2.4. Laos

- 6.2.5. Philippines

- 6.2.6. Thailand

- 6.2.7. Rest of Southeast Asia

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Indonesia Southeast Asia Hydropower Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Large Hydropower

- 7.1.2. Small Hydropower

- 7.1.3. Pumped Storage

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Vietnam

- 7.2.2. Indonesia

- 7.2.3. Malaysia

- 7.2.4. Laos

- 7.2.5. Philippines

- 7.2.6. Thailand

- 7.2.7. Rest of Southeast Asia

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Malaysia Southeast Asia Hydropower Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Large Hydropower

- 8.1.2. Small Hydropower

- 8.1.3. Pumped Storage

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Vietnam

- 8.2.2. Indonesia

- 8.2.3. Malaysia

- 8.2.4. Laos

- 8.2.5. Philippines

- 8.2.6. Thailand

- 8.2.7. Rest of Southeast Asia

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Laos Southeast Asia Hydropower Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Large Hydropower

- 9.1.2. Small Hydropower

- 9.1.3. Pumped Storage

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Vietnam

- 9.2.2. Indonesia

- 9.2.3. Malaysia

- 9.2.4. Laos

- 9.2.5. Philippines

- 9.2.6. Thailand

- 9.2.7. Rest of Southeast Asia

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Philippines Southeast Asia Hydropower Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Large Hydropower

- 10.1.2. Small Hydropower

- 10.1.3. Pumped Storage

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Vietnam

- 10.2.2. Indonesia

- 10.2.3. Malaysia

- 10.2.4. Laos

- 10.2.5. Philippines

- 10.2.6. Thailand

- 10.2.7. Rest of Southeast Asia

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Thailand Southeast Asia Hydropower Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Large Hydropower

- 11.1.2. Small Hydropower

- 11.1.3. Pumped Storage

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. Vietnam

- 11.2.2. Indonesia

- 11.2.3. Malaysia

- 11.2.4. Laos

- 11.2.5. Philippines

- 11.2.6. Thailand

- 11.2.7. Rest of Southeast Asia

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Southeast Asia Southeast Asia Hydropower Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Large Hydropower

- 12.1.2. Small Hydropower

- 12.1.3. Pumped Storage

- 12.2. Market Analysis, Insights and Forecast - by Geography

- 12.2.1. Vietnam

- 12.2.2. Indonesia

- 12.2.3. Malaysia

- 12.2.4. Laos

- 12.2.5. Philippines

- 12.2.6. Thailand

- 12.2.7. Rest of Southeast Asia

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 PT Perusahaan Listrik Negara

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Toshiba Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Power Construction Corporation of China Ltd*List Not Exhaustive 6 4 Market Ranking Analysi

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Vietnam Electricity Construction JSC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Electricity Generating Authority of Thailand

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Aboitiz Power Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 General Electric Company

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Andritz AG

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Tenaga Nasional Berhad

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 PT Perusahaan Listrik Negara

List of Figures

- Figure 1: Southeast Asia Hydropower Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Southeast Asia Hydropower Market Share (%) by Company 2025

List of Tables

- Table 1: Southeast Asia Hydropower Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Southeast Asia Hydropower Market Volume gigawatt Forecast, by Type 2020 & 2033

- Table 3: Southeast Asia Hydropower Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Southeast Asia Hydropower Market Volume gigawatt Forecast, by Geography 2020 & 2033

- Table 5: Southeast Asia Hydropower Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Southeast Asia Hydropower Market Volume gigawatt Forecast, by Region 2020 & 2033

- Table 7: Southeast Asia Hydropower Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Southeast Asia Hydropower Market Volume gigawatt Forecast, by Type 2020 & 2033

- Table 9: Southeast Asia Hydropower Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Southeast Asia Hydropower Market Volume gigawatt Forecast, by Geography 2020 & 2033

- Table 11: Southeast Asia Hydropower Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Southeast Asia Hydropower Market Volume gigawatt Forecast, by Country 2020 & 2033

- Table 13: Southeast Asia Hydropower Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Southeast Asia Hydropower Market Volume gigawatt Forecast, by Type 2020 & 2033

- Table 15: Southeast Asia Hydropower Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Southeast Asia Hydropower Market Volume gigawatt Forecast, by Geography 2020 & 2033

- Table 17: Southeast Asia Hydropower Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Southeast Asia Hydropower Market Volume gigawatt Forecast, by Country 2020 & 2033

- Table 19: Southeast Asia Hydropower Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Southeast Asia Hydropower Market Volume gigawatt Forecast, by Type 2020 & 2033

- Table 21: Southeast Asia Hydropower Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Southeast Asia Hydropower Market Volume gigawatt Forecast, by Geography 2020 & 2033

- Table 23: Southeast Asia Hydropower Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Southeast Asia Hydropower Market Volume gigawatt Forecast, by Country 2020 & 2033

- Table 25: Southeast Asia Hydropower Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Southeast Asia Hydropower Market Volume gigawatt Forecast, by Type 2020 & 2033

- Table 27: Southeast Asia Hydropower Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 28: Southeast Asia Hydropower Market Volume gigawatt Forecast, by Geography 2020 & 2033

- Table 29: Southeast Asia Hydropower Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Southeast Asia Hydropower Market Volume gigawatt Forecast, by Country 2020 & 2033

- Table 31: Southeast Asia Hydropower Market Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Southeast Asia Hydropower Market Volume gigawatt Forecast, by Type 2020 & 2033

- Table 33: Southeast Asia Hydropower Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 34: Southeast Asia Hydropower Market Volume gigawatt Forecast, by Geography 2020 & 2033

- Table 35: Southeast Asia Hydropower Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Southeast Asia Hydropower Market Volume gigawatt Forecast, by Country 2020 & 2033

- Table 37: Southeast Asia Hydropower Market Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Southeast Asia Hydropower Market Volume gigawatt Forecast, by Type 2020 & 2033

- Table 39: Southeast Asia Hydropower Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 40: Southeast Asia Hydropower Market Volume gigawatt Forecast, by Geography 2020 & 2033

- Table 41: Southeast Asia Hydropower Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Southeast Asia Hydropower Market Volume gigawatt Forecast, by Country 2020 & 2033

- Table 43: Southeast Asia Hydropower Market Revenue Million Forecast, by Type 2020 & 2033

- Table 44: Southeast Asia Hydropower Market Volume gigawatt Forecast, by Type 2020 & 2033

- Table 45: Southeast Asia Hydropower Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 46: Southeast Asia Hydropower Market Volume gigawatt Forecast, by Geography 2020 & 2033

- Table 47: Southeast Asia Hydropower Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Southeast Asia Hydropower Market Volume gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Southeast Asia Hydropower Market?

The projected CAGR is approximately 4.80%.

2. Which companies are prominent players in the Southeast Asia Hydropower Market?

Key companies in the market include PT Perusahaan Listrik Negara, Toshiba Corporation, Power Construction Corporation of China Ltd*List Not Exhaustive 6 4 Market Ranking Analysi, Vietnam Electricity Construction JSC, Electricity Generating Authority of Thailand, Aboitiz Power Corporation, General Electric Company, Andritz AG, Tenaga Nasional Berhad.

3. What are the main segments of the Southeast Asia Hydropower Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Hydropower Generation4.; Favorable Government Policies.

6. What are the notable trends driving market growth?

The Large Hydropower Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Adoption of Other Alternative Clean Energy Sources.

8. Can you provide examples of recent developments in the market?

January 2024: Nexif Ratch Energy Investments Pte. Ltd, an owner/operator of clean-energy power, acquired the 30 MW Minh Luong hydropower plant, a run-of-river facility with peak-hour storage in Lao Cai province, Vietnam. The acquisition strengthens the Nexif Ratch Energy portfolio’s growth path in renewables and will create a stable and recurring income through a long-term power purchase agreement.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Southeast Asia Hydropower Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Southeast Asia Hydropower Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Southeast Asia Hydropower Market?

To stay informed about further developments, trends, and reports in the Southeast Asia Hydropower Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence