Key Insights

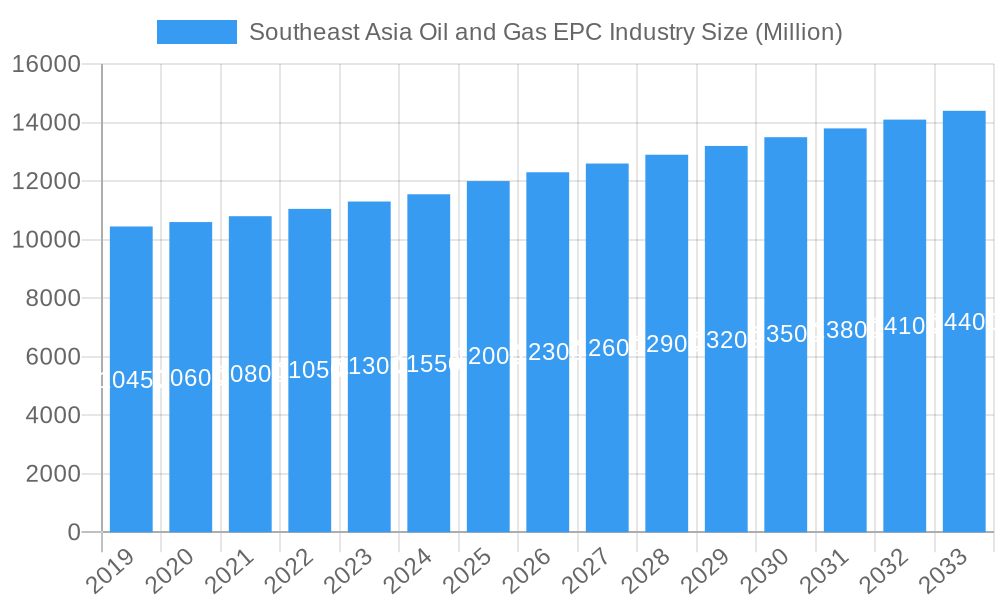

The Southeast Asia Oil and Gas EPC (Engineering, Procurement, and Construction) market is projected for robust expansion, anticipating a market size of $478.66 billion by 2025. The industry is expected to grow at a Compound Annual Growth Rate (CAGR) of 4.76% from the base year 2025. This growth is propelled by sustained energy demand in the region's rapidly developing economies and significant investments in upstream exploration and production. Midstream infrastructure development, including pipelines and storage, is crucial for meeting increasing domestic consumption and export demands. Downstream opportunities are also expanding with investments in refinery upgrades and petrochemical plant construction, aiming to enhance the value of oil and gas resources.

Southeast Asia Oil and Gas EPC Industry Market Size (In Billion)

Key market trends include the adoption of digital transformation and advanced technologies to improve EPC operational efficiency and safety. A growing emphasis on sustainable energy solutions and the integration of green technologies reflects the global move towards decarbonization. However, challenges such as volatile crude oil prices and stringent environmental regulations with higher compliance costs may impact investment decisions and project timelines. Indonesia, Malaysia, and Thailand are expected to lead the market due to their established oil and gas infrastructure and ongoing development projects. Leading companies such as Bechtel Corporation, Samsung Engineering, Sinopec Engineering, and TechnipFMC are actively shaping this dynamic market.

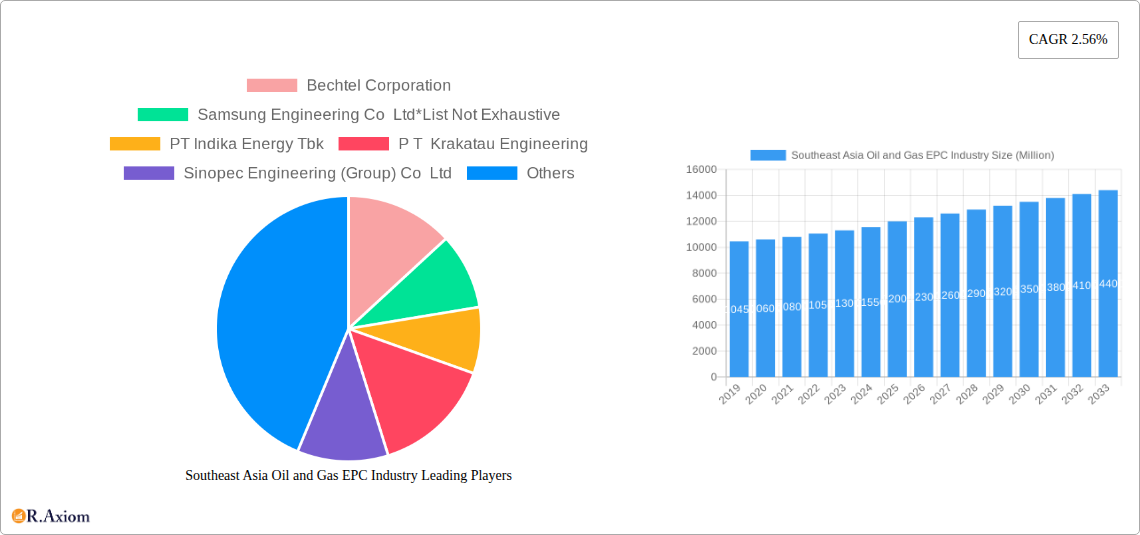

Southeast Asia Oil and Gas EPC Industry Company Market Share

This report provides a comprehensive analysis of the Southeast Asia Oil and Gas EPC market, covering the forecast period. It offers critical insights into market dynamics, growth drivers, challenges, and opportunities, utilizing high-traffic keywords for maximum industry stakeholder engagement, including oil and gas companies, EPC contractors, investors, and policymakers.

Southeast Asia Oil and Gas EPC Industry Market Concentration & Innovation

The Southeast Asia Oil and Gas EPC industry exhibits a moderate to high level of market concentration, with a few dominant players controlling a significant market share. Innovation is a key differentiator, driven by the need for cost optimization, enhanced safety, and environmental compliance. Regulatory frameworks, particularly concerning environmental protection and local content requirements, play a crucial role in shaping the competitive landscape. Product substitutes are limited in the core upstream and downstream sectors, but advancements in renewable energy integration present a long-term consideration. End-user trends are leaning towards greater efficiency, digital integration, and sustainable practices. Mergers and acquisitions (M&A) activities are observed as companies seek to consolidate expertise, expand geographic reach, and secure market leadership. Notable M&A deals in recent years have reshaped the industry's structure, with deal values often in the hundreds of millions of dollars.

Southeast Asia Oil and Gas EPC Industry Industry Trends & Insights

The Southeast Asia Oil and Gas EPC industry is poised for robust growth, fueled by increasing energy demand across the region and the ongoing development of both conventional and unconventional hydrocarbon resources. Market growth drivers include governmental support for energy security, significant investments in new infrastructure projects, and the need to modernize existing facilities to meet stringent environmental standards. Technological disruptions are transforming project execution, with a growing adoption of digital twins, artificial intelligence (AI) for predictive maintenance, and advanced automation enhancing efficiency and safety. Consumer preferences are shifting towards cleaner energy solutions, pushing EPC contractors to develop capabilities in carbon capture, utilization, and storage (CCUS) and the integration of renewable energy sources within traditional oil and gas infrastructure. Competitive dynamics are characterized by fierce competition among global and regional players, with a strong emphasis on cost-effectiveness, project execution track record, and the ability to deliver complex projects on time and within budget. The compound annual growth rate (CAGR) for the forecast period is projected to be approximately 5-7%, with market penetration of advanced digital solutions steadily increasing.

Dominant Markets & Segments in Southeast Asia Oil and Gas EPC Industry

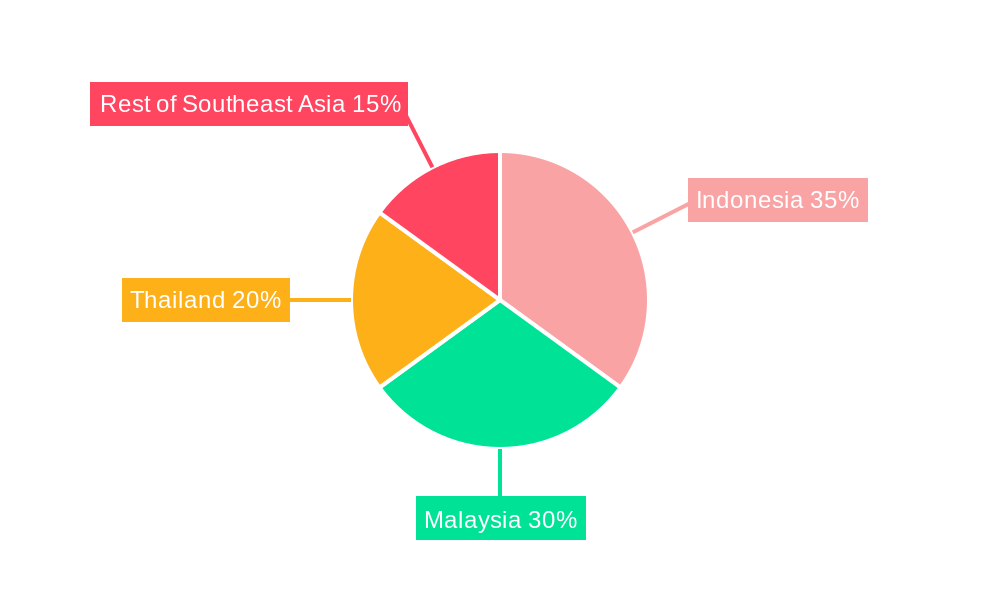

Indonesia stands out as the dominant market within the Southeast Asia Oil and Gas EPC industry, driven by its vast untapped hydrocarbon reserves, significant domestic energy consumption, and government initiatives to bolster the energy sector. The Upstream segment, particularly deepwater exploration and development, is a major contributor, supported by substantial investments in offshore projects. Economic policies promoting local content and foreign direct investment have further accelerated project pipelines. Malaysia also holds a strong position, with a mature offshore exploration and production sector that continues to demand EPC services for both new developments and aging asset maintenance.

- Indonesia: Key drivers include the development of large-scale gas projects, offshore exploration in deepwater and ultra-deepwater blocks, and the expansion of LNG facilities. Economic policies favoring local participation and infrastructure development are critical.

- Malaysia: Dominated by offshore production platforms, subsea infrastructure, and FPSO (Floating Production, Storage, and Offloading) unit developments. Investments in mature fields and enhanced oil recovery (EOR) projects are significant.

- Thailand: While having a mature refining sector, Thailand is increasingly focusing on refinery upgrades and petrochemical plant expansions to meet rising demand for refined products and specialized chemicals. The drive towards cleaner fuels is a significant catalyst.

- Rest of Southeast Asia (Vietnam, Philippines, Myanmar): These markets present growing opportunities driven by new discoveries, exploration activities, and the development of cross-border pipeline projects. Government policies and geopolitical stability play a crucial role in attracting investment.

The Midstream sector, encompassing pipelines, storage facilities, and LNG terminals, is experiencing steady growth, especially with the increasing focus on gas monetization and regional energy interconnectivity. The Downstream segment, including refineries and petrochemical complexes, is witnessing significant activity driven by the need to upgrade existing facilities to produce higher-value products and meet stricter environmental regulations, particularly for cleaner fuels.

Southeast Asia Oil and Gas EPC Industry Product Developments

Innovations in the Southeast Asia Oil and Gas EPC industry are focused on enhancing project efficiency, safety, and environmental performance. Advancements in modular construction techniques, pre-fabrication, and the use of high-strength, corrosion-resistant materials are leading to faster project delivery and reduced on-site risks. The integration of digital technologies, such as AI-powered project management tools and IoT sensors for real-time monitoring, is improving operational insights and predictive maintenance capabilities. Furthermore, EPC companies are developing expertise in sustainable technologies, including CCUS solutions and the retrofitting of facilities to accommodate bio-fuels and hydrogen. These product developments offer significant competitive advantages by enabling cost savings and meeting evolving market demands for greener operations.

Report Scope & Segmentation Analysis

This report segments the Southeast Asia Oil and Gas EPC industry by Sector into Upstream, Midstream, and Downstream. The Upstream segment encompasses exploration, drilling, and production facilities, with significant growth expected from deepwater and complex field developments, projected to contribute over 40% of the market value. The Midstream segment covers pipelines, storage, and transportation infrastructure, with robust growth driven by gas pipeline networks and LNG terminal expansion, estimated to reach USD 10 Billion by 2033. The Downstream segment includes refineries and petrochemical plants, with growth fueled by modernization projects and the demand for specialty chemicals and cleaner fuels, expected to account for approximately 30% of the market. Geographically, the report analyzes Indonesia, Malaysia, Thailand, and the Rest of Southeast Asia. Indonesia is projected to lead the market with a CAGR of over 6%, followed by Malaysia and Thailand. The Rest of Southeast Asia presents emerging opportunities with a high growth potential due to new project announcements.

Key Drivers of Southeast Asia Oil and Gas EPC Industry Growth

The growth of the Southeast Asia Oil and Gas EPC industry is primarily driven by several key factors:

- Rising Energy Demand: The burgeoning economies and growing populations across Southeast Asia necessitate increased energy consumption, spurring investment in new exploration, production, and refining capacities.

- Government Support and Policy Initiatives: Governments in the region are actively promoting energy security and economic development, offering incentives for domestic and foreign investment in the oil and gas sector.

- Technological Advancements: The adoption of innovative technologies, such as advanced drilling techniques, digital project management, and AI-driven solutions, enhances efficiency and reduces project costs.

- Infrastructure Modernization and Expansion: There is a continuous need to upgrade aging oil and gas infrastructure and build new facilities to meet evolving market demands and environmental standards.

- Exploration and Production in Frontier Areas: The pursuit of untapped hydrocarbon reserves in deepwater and challenging offshore environments requires specialized EPC expertise and significant investment.

Challenges in the Southeast Asia Oil and Gas EPC Industry Sector

Despite the growth prospects, the Southeast Asia Oil and Gas EPC industry faces several significant challenges:

- Regulatory Complexity and Political Instability: Navigating diverse regulatory frameworks across different countries and dealing with potential political instability can pose significant risks to project execution and investment.

- Skilled Labor Shortages: A persistent shortage of skilled engineers, technicians, and project managers can lead to project delays and increased labor costs.

- Price Volatility of Hydrocarbons: Fluctuations in global oil and gas prices can impact investment decisions and project financing, leading to project deferrals or cancellations.

- Environmental Regulations and Sustainability Pressures: Increasingly stringent environmental regulations and growing pressure for decarbonization require substantial investments in greener technologies and processes, posing a challenge for traditional EPC models.

- Supply Chain Disruptions: Geopolitical events, natural disasters, and logistical challenges can disrupt global supply chains, leading to delays in material procurement and equipment delivery.

Emerging Opportunities in Southeast Asia Oil and Gas EPC Industry

The Southeast Asia Oil and Gas EPC industry is witnessing emerging opportunities driven by evolving energy landscapes and technological advancements:

- Renewable Energy Integration: EPC companies are increasingly involved in the integration of renewable energy sources into existing oil and gas infrastructure and in the development of hybrid energy projects.

- Carbon Capture, Utilization, and Storage (CCUS): Growing global efforts to decarbonize the energy sector present significant opportunities for EPC contractors to design and build CCUS facilities.

- Digitalization and Automation: The adoption of Industry 4.0 technologies, including AI, IoT, and big data analytics, offers opportunities for enhanced project management, predictive maintenance, and operational efficiency.

- LNG Infrastructure Development: The rising demand for Liquefied Natural Gas (LNG) across the region is driving the development of new LNG terminals, regasification facilities, and associated infrastructure.

- Circular Economy and Waste-to-Energy Solutions: Opportunities exist in developing projects related to the circular economy within the petrochemical sector and in waste-to-energy initiatives.

Leading Players in the Southeast Asia Oil and Gas EPC Industry Market

- Bechtel Corporation

- Samsung Engineering Co Ltd

- PT Indika Energy Tbk

- P T Krakatau Engineering

- Sinopec Engineering (Group) Co Ltd

- PT Barata Indonesia (Persero)

- PT Meindo Elang Indah

- Petrofac Limited

- PT Rekayasa Industri

- Saipem SpA

- Fluor Corporation

- John Wood Group PLC

- PT JGC Indonesia

- TechnipFMC PLC

Key Developments in Southeast Asia Oil and Gas EPC Industry Industry

- August 2021: Hyundai Engineering Co. secured a USD 256 Million order from IRPC Pcl, Thailand's third-largest refiner, for a refinery revamp project in Rayong. This project aims to upgrade the refinery, with a capacity of 215,000 barrels per day, to produce cleaner Euro V standard diesel. Construction commenced in August 2021, with expected operational start-up by 2024, incorporating new facilities like a Diesel Hydrotreating Unit (DHT).

- 2020: The Indonesia Deepwater Development, a significant project involving Chevron and partners Pertamina, Eni Indonesia, and Sinopec, focused on the Gendalo, Gehem, Bangka, and Gandang fields in the Kutal Basin, at depths of 610 to 1,829 meters. The project's phased development includes the Bangka field in stage one and Gendalo, Gehem, and Gandang fields in stage two. It entails the procurement and installation of 630 kilometers of pipelines, 80 kilometers of umbilicals, and 120 subsea flowline connections.

Strategic Outlook for Southeast Asia Oil and Gas EPC Industry Market

The strategic outlook for the Southeast Asia Oil and Gas EPC industry is characterized by a dynamic interplay of traditional energy development and the transition towards a more sustainable energy future. Continued investment in upstream exploration and production, particularly in deepwater regions, will remain a cornerstone. Simultaneously, significant opportunities lie in the downstream sector, with a strong emphasis on refinery modernization, petrochemical expansion, and the adoption of cleaner fuel technologies. The growing focus on energy security and regional connectivity will drive demand for midstream infrastructure, including pipelines and LNG facilities. Furthermore, the industry's strategic imperative will involve embracing digital transformation to enhance project execution efficiency and safety, while also building capabilities in emerging areas such as CCUS and renewable energy integration to align with global decarbonization goals. Strategic partnerships, technological innovation, and adaptability to evolving regulatory and market landscapes will be critical for sustained growth and competitive advantage.

Southeast Asia Oil and Gas EPC Industry Segmentation

-

1. Sector

- 1.1. Upstream

- 1.2. Midstream

- 1.3. Downstream

-

2. Geography

- 2.1. Indonesia

- 2.2. Malaysia

- 2.3. Thailand

- 2.4. Rest of Southeast Asia

Southeast Asia Oil and Gas EPC Industry Segmentation By Geography

- 1. Indonesia

- 2. Malaysia

- 3. Thailand

- 4. Rest of Southeast Asia

Southeast Asia Oil and Gas EPC Industry Regional Market Share

Geographic Coverage of Southeast Asia Oil and Gas EPC Industry

Southeast Asia Oil and Gas EPC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The High Amount of Waste Generation in the Country4.; The growing Focus on Non-Fossil Fuel Sources

- 3.3. Market Restrains

- 3.3.1. 4.; The Recycling Rate of Waste in Germany

- 3.4. Market Trends

- 3.4.1. The Downstream Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Southeast Asia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Upstream

- 5.1.2. Midstream

- 5.1.3. Downstream

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Indonesia

- 5.2.2. Malaysia

- 5.2.3. Thailand

- 5.2.4. Rest of Southeast Asia

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.3.2. Malaysia

- 5.3.3. Thailand

- 5.3.4. Rest of Southeast Asia

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Indonesia Southeast Asia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Upstream

- 6.1.2. Midstream

- 6.1.3. Downstream

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Indonesia

- 6.2.2. Malaysia

- 6.2.3. Thailand

- 6.2.4. Rest of Southeast Asia

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. Malaysia Southeast Asia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Upstream

- 7.1.2. Midstream

- 7.1.3. Downstream

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Indonesia

- 7.2.2. Malaysia

- 7.2.3. Thailand

- 7.2.4. Rest of Southeast Asia

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Thailand Southeast Asia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Upstream

- 8.1.2. Midstream

- 8.1.3. Downstream

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Indonesia

- 8.2.2. Malaysia

- 8.2.3. Thailand

- 8.2.4. Rest of Southeast Asia

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Rest of Southeast Asia Southeast Asia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Upstream

- 9.1.2. Midstream

- 9.1.3. Downstream

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Indonesia

- 9.2.2. Malaysia

- 9.2.3. Thailand

- 9.2.4. Rest of Southeast Asia

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Bechtel Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Samsung Engineering Co Ltd*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 PT Indika Energy Tbk

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 P T Krakatau Engineering

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Sinopec Engineering (Group) Co Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 PT Barata Indonesia (Persero)

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 PT Meindo Elang Indah

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Petrofac Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 PT Rekayasa Industri

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Saipem SpA

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Fluor Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 John Wood Group PLC

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 PT JGC Indonesia

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 TechnipFMC PLC

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 Bechtel Corporation

List of Figures

- Figure 1: Southeast Asia Oil and Gas EPC Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Southeast Asia Oil and Gas EPC Industry Share (%) by Company 2025

List of Tables

- Table 1: Southeast Asia Oil and Gas EPC Industry Revenue billion Forecast, by Sector 2020 & 2033

- Table 2: Southeast Asia Oil and Gas EPC Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: Southeast Asia Oil and Gas EPC Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Southeast Asia Oil and Gas EPC Industry Revenue billion Forecast, by Sector 2020 & 2033

- Table 5: Southeast Asia Oil and Gas EPC Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Southeast Asia Oil and Gas EPC Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Southeast Asia Oil and Gas EPC Industry Revenue billion Forecast, by Sector 2020 & 2033

- Table 8: Southeast Asia Oil and Gas EPC Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: Southeast Asia Oil and Gas EPC Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Southeast Asia Oil and Gas EPC Industry Revenue billion Forecast, by Sector 2020 & 2033

- Table 11: Southeast Asia Oil and Gas EPC Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Southeast Asia Oil and Gas EPC Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Southeast Asia Oil and Gas EPC Industry Revenue billion Forecast, by Sector 2020 & 2033

- Table 14: Southeast Asia Oil and Gas EPC Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Southeast Asia Oil and Gas EPC Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Southeast Asia Oil and Gas EPC Industry?

The projected CAGR is approximately 4.76%.

2. Which companies are prominent players in the Southeast Asia Oil and Gas EPC Industry?

Key companies in the market include Bechtel Corporation, Samsung Engineering Co Ltd*List Not Exhaustive, PT Indika Energy Tbk, P T Krakatau Engineering, Sinopec Engineering (Group) Co Ltd, PT Barata Indonesia (Persero), PT Meindo Elang Indah, Petrofac Limited, PT Rekayasa Industri, Saipem SpA, Fluor Corporation, John Wood Group PLC, PT JGC Indonesia, TechnipFMC PLC.

3. What are the main segments of the Southeast Asia Oil and Gas EPC Industry?

The market segments include Sector, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 478.66 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; The High Amount of Waste Generation in the Country4.; The growing Focus on Non-Fossil Fuel Sources.

6. What are the notable trends driving market growth?

The Downstream Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Recycling Rate of Waste in Germany.

8. Can you provide examples of recent developments in the market?

In August 2021, Hyundai Engineering Co. won a USD 256 million order from Thailand's third-largest refiner, IRPC Pcl, to revamp its refinery with a total capacity of 215,000 barrels per day in Rayong. Hyundai Engineering Co. has to upgrade its refinery, allowing the Thai integrated petrochemical company to produce cleaner diesel of Euro V standard. The construction started in August 2021, and the refinery is expected to come into operation by 2024 with new facilities such as a Diesel Hydrotreating Unit (DHT) and upgraded existing plants.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Southeast Asia Oil and Gas EPC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Southeast Asia Oil and Gas EPC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Southeast Asia Oil and Gas EPC Industry?

To stay informed about further developments, trends, and reports in the Southeast Asia Oil and Gas EPC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence