Key Insights

The Southeast Asia Solar Energy Market is projected for significant expansion, with an estimated market size of 3.3 billion by 2024, driven by a robust Compound Annual Growth Rate (CAGR) of 30.1% through 2033. This growth is underpinned by strong governmental support for renewable energy, heightened environmental awareness, and declining solar technology costs. The increasing demand for clean electricity in developing economies and the need to reduce fossil fuel dependency are stimulating substantial investments in utility-scale projects and distributed solar solutions. Favorable policies, including tax incentives, feed-in tariffs, and renewable purchase obligations, are enhancing the attractiveness of solar power for investors. The region's ample solar irradiation further positions solar energy as a cost-effective and dependable power source.

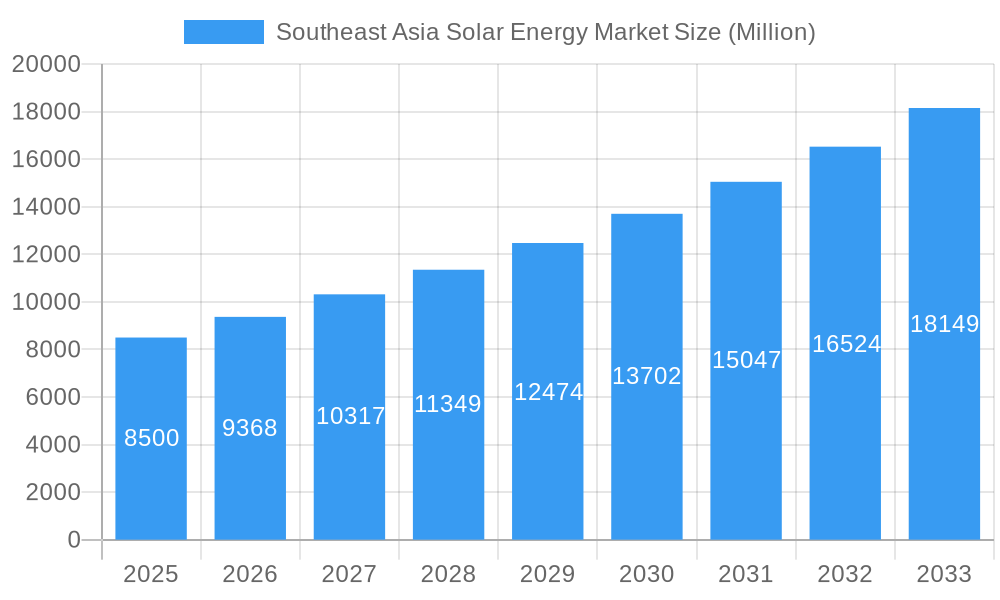

Southeast Asia Solar Energy Market Market Size (In Billion)

Solar Photovoltaic (PV) technology leads market segmentation due to its maturity and cost-effectiveness, while Concentrated Solar Power (CSP) offers potential in high-irradiance areas. Vietnam, Indonesia, and the Philippines are key growth markets with ambitious renewable energy targets. Emerging trends include the integration of energy storage for grid stability, increased adoption of rooftop solar, and the use of smart grid technologies. Challenges such as land acquisition, grid infrastructure limitations, and regulatory uncertainties persist. Despite these, the Southeast Asia solar energy market outlook is highly positive, with major companies actively investing in the region's clean energy transition.

Southeast Asia Solar Energy Market Company Market Share

This comprehensive analysis details the Southeast Asia Solar Energy Market, providing insights into market size, growth, and future forecasts. It incorporates high-traffic keywords relevant to solar energy, renewable energy, and market research for the Southeast Asian region.

Southeast Asia Solar Energy Market Market Concentration & Innovation

The Southeast Asia solar energy market exhibits a moderate to high level of concentration, with key players such as JinkoSolar Holding Co Ltd, LONGi Green Energy Technology Co Ltd, and Trina Solar Limited dominating global manufacturing and increasingly influencing regional supply chains. Innovation is a critical driver, fueled by advancements in solar photovoltaic (PV) panel efficiency, energy storage solutions, and the integration of smart grid technologies. Regulatory frameworks play a pivotal role, with governments across countries like Vietnam, Indonesia, and Thailand implementing supportive policies, feed-in tariffs, and renewable energy targets to accelerate solar adoption. Product substitutes, primarily fossil fuels and other renewable sources like wind and hydro, continue to present competition, though solar PV's decreasing costs and versatility are steadily gaining ground. End-user trends indicate a growing demand from commercial and industrial sectors for self-consumption and energy independence, alongside an expanding residential solar market. Mergers and acquisitions (M&A) activity is on the rise, as larger entities seek to consolidate market share and expand their regional presence. For instance, strategic partnerships and potential acquisitions in the multi-million dollar range are anticipated to reshape the competitive landscape as companies aim to secure project pipelines and technological expertise.

Southeast Asia Solar Energy Market Industry Trends & Insights

The Southeast Asia solar energy market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 15-20% over the forecast period (2025–2033). This dynamic expansion is underpinned by a confluence of factors, including escalating energy demand across the region, the urgent need for energy diversification and security, and a growing commitment to climate change mitigation. Governments are actively promoting solar energy through favorable policies such as tax incentives, streamlined permitting processes, and the establishment of ambitious renewable energy targets. Technological disruptions are rapidly transforming the market, with significant advancements in the efficiency and cost-effectiveness of solar photovoltaic (PV) technologies. The development of more efficient solar cells, the integration of advanced inverters, and the growing adoption of bifacial solar panels are driving down the levelized cost of electricity (LCOE) for solar projects, making them increasingly competitive with traditional energy sources. Furthermore, the burgeoning market for energy storage solutions, including battery energy storage systems (BESS), is addressing the intermittency challenges associated with solar power, enabling greater grid stability and reliability. Consumer preferences are shifting towards cleaner energy solutions, driven by environmental consciousness and the desire for reduced electricity bills. Both commercial and industrial (C&I) sectors are increasingly investing in solar installations for self-consumption and to meet corporate sustainability goals. The residential sector is also witnessing growing adoption, supported by declining system costs and improved financing options. Competitive dynamics within the Southeast Asian solar market are intense, characterized by the presence of global manufacturers and a growing number of local developers and installers. Companies are focusing on developing comprehensive project portfolios, enhancing their supply chain management, and offering integrated solar solutions, including installation, operation, and maintenance services. The market penetration of solar energy is steadily increasing across key economies, with significant investments being made in utility-scale solar farms, distributed solar projects, and off-grid solar solutions for remote areas. The strategic importance of solar energy in enabling energy access and driving economic development in Southeast Asia cannot be overstated.

Dominant Markets & Segments in Southeast Asia Solar Energy Market

The Solar Photovoltaic (PV) segment overwhelmingly dominates the Southeast Asia solar energy market, accounting for over 95% of the total market share. Its dominance is attributed to the rapidly falling costs of solar PV modules, advancements in manufacturing technologies, and widespread applicability across various scales, from large utility-scale projects to small rooftop installations.

- Vietnam is emerging as a powerhouse in the Southeast Asia solar energy market, driven by its aggressive renewable energy policies and substantial installed capacity. The government's supportive regulatory framework, including feed-in tariffs and competitive bidding processes, has attracted significant foreign investment. Economic policies focused on industrial development and energy independence further bolster Vietnam's leadership.

- Indonesia presents a vast and largely untapped market, with immense potential for solar energy deployment due to its widespread archipelagic nature and high population density. The government's commitment to increasing renewable energy's share in its energy mix, coupled with initiatives for energy access in remote islands, positions Indonesia for substantial future growth. The April 2022 agreement with Sunseap Group for large-scale solar and storage projects exemplifies this commitment.

- Thailand has consistently been a frontrunner in solar energy adoption in the region, supported by proactive government policies and a mature market for solar installations. The country's focus on energy security and its strategic location within ASEAN contribute to its strong market position.

- Philippines is experiencing a significant uptick in solar energy development, driven by a growing demand for electricity and a push towards cleaner energy sources. Policy support for renewable energy, including net metering and renewable portfolio standards, is accelerating market growth.

- Malaysia is also making strides in the solar energy sector, with increasing investments in both utility-scale and rooftop solar projects. The government's targets for renewable energy capacity and incentives for solar adoption are key growth drivers.

While Concentrated Solar Power (CSP) represents a niche segment within the Southeast Asian market, its potential is being explored, particularly in regions with consistent direct sunlight. However, the higher initial costs and specific geographical requirements limit its widespread adoption compared to PV.

The dominance of these key countries and the Solar PV segment is further solidified by ongoing industry developments, such as October 2022, where Acwa Power secured a contract for floating solar PV projects in Indonesia, indicating a diversification of solar deployment methods and a growing confidence in the region's solar potential.

Southeast Asia Solar Energy Market Product Developments

Product development in the Southeast Asia solar energy market is primarily focused on enhancing the efficiency, durability, and cost-effectiveness of solar photovoltaic (PV) technologies. Innovations include the advancement of PERC (Passivated Emitter and Rear Cell) and TOPCon (Tunnel Oxide Passivated Contact) solar cells, leading to higher energy yields per module. Bifacial solar panels, which capture sunlight from both sides, are gaining traction, offering increased energy generation, especially in large-scale ground-mounted projects. Furthermore, the integration of advanced inverters with smart grid capabilities, improved energy storage solutions like lithium-ion batteries, and the development of floating solar PV systems designed for deployment on water bodies are key product advancements. These innovations are crucial for expanding solar energy's market fit across diverse geographical conditions and energy needs within Southeast Asia, offering competitive advantages through reduced LCOE and improved grid integration.

Report Scope & Segmentation Analysis

The Southeast Asia Solar Energy Market report provides a comprehensive analysis segmented by Type, encompassing Solar Photovoltaic (PV) and Concentrated Solar Power (CSP). The Solar PV segment is expected to dominate the market throughout the forecast period (2025–2033) due to its decreasing costs and widespread applicability. The CSP segment, while smaller, offers unique advantages in specific regions and is subject to ongoing technological development.

Geographically, the market is segmented into Vietnam, Indonesia, Philippines, Thailand, Malaysia, and the Rest of Southeast Asia. Vietnam and Indonesia are anticipated to exhibit the highest growth rates due to supportive government policies and substantial market potential. Thailand and the Philippines are also expected to see robust expansion, driven by increasing energy demand and renewable energy targets. The competitive dynamics within each country and segment are meticulously analyzed, providing granular insights into market sizes, growth projections, and key influencing factors shaping future market trajectories.

Key Drivers of Southeast Asia Solar Energy Market Growth

Several key drivers are propelling the growth of the Southeast Asia solar energy market. Foremost is the rapidly declining cost of solar photovoltaic (PV) technology, making solar power increasingly competitive with conventional energy sources. Supportive government policies, including feed-in tariffs, tax incentives, and renewable energy mandates in countries like Vietnam and Indonesia, are significant catalysts. Escalating energy demand across the rapidly industrializing and urbanizing region necessitates the adoption of clean and sustainable energy solutions. Furthermore, growing environmental awareness and global commitments to climate change mitigation are pushing both governments and corporations to invest in renewable energy. Technological advancements, such as improved solar cell efficiency and integrated energy storage solutions, are enhancing the reliability and attractiveness of solar power.

Challenges in the Southeast Asia Solar Energy Market Sector

Despite its robust growth, the Southeast Asia solar energy market faces several challenges. Regulatory hurdles and the complexity of permitting processes in certain countries can delay project development and increase costs. Intermittency of solar power remains a concern, necessitating substantial investments in energy storage solutions, which can escalate project expenses. Supply chain disruptions, geopolitical uncertainties, and fluctuating raw material prices can impact the cost and availability of solar components. Grid infrastructure limitations in some areas may hinder the integration of large-scale solar projects. Intense competition among domestic and international players can also lead to price pressures. Additionally, a lack of skilled labor for installation, operation, and maintenance can pose a challenge to the rapid expansion of the solar sector.

Emerging Opportunities in Southeast Asia Solar Energy Market

The Southeast Asia solar energy market presents numerous emerging opportunities. The increasing adoption of distributed solar and rooftop installations by commercial, industrial, and residential consumers offers significant growth potential. The development of floating solar PV projects on reservoirs and bodies of water is an innovative opportunity, particularly in land-scarce regions like Singapore and Indonesia. The growing demand for energy storage solutions, driven by the need for grid stability and reliable power supply, opens avenues for battery manufacturers and integrators. Furthermore, the expansion of off-grid solar solutions in rural and remote areas of countries like Indonesia and the Philippines presents an opportunity to improve energy access and drive socio-economic development. The integration of solar energy with electric vehicle (EV) charging infrastructure is another nascent but promising area.

Leading Players in the Southeast Asia Solar Energy Market Market

- JinkoSolar Holding Co Ltd

- Solarie Energy

- Johnsolar Energy Co Ltd

- Thai Solar Energy Public Company Limited

- Scatec ASA

- Vena Energy Solar Pte Ltd

- Canadian Solar Inc

- Blue Solar Co Ltd

- LONGi Green Energy Technology Co Ltd

- Trina Solar Limited

Key Developments in Southeast Asia Solar Energy Market Industry

- October 2022: Acwa Power secured a contract from Indonesia's state-owned utility, PT Perusahaan Listrik Negara (PLN), to build two floating solar photovoltaic (PV) power plants. The deal encompassed the 60 MW Saguling and 50 MW Singkarak floating solar projects. The two projects were likely to have a combined capacity of 110 MW and cost USD 105 million to build, signifying a major investment in floating solar technology in Indonesia.

- April 2022: The Sunseap Group of Singapore signed an agreement with the provincial administration of Indonesia's Riau Islands to build large-scale solar energy and storage projects to supply power to the islands and Singapore, highlighting the growing trend of cross-border renewable energy collaborations and large-scale storage integration.

Strategic Outlook for Southeast Asia Solar Energy Market Market

The strategic outlook for the Southeast Asia solar energy market is exceptionally positive, driven by strong government commitments to renewable energy targets and the continuous decline in solar technology costs. The increasing focus on energy security and the need to diversify away from fossil fuels will further accelerate solar adoption across the region. Opportunities lie in expanding utility-scale solar farms, promoting distributed generation, and integrating advanced energy storage solutions to address intermittency. The development of smart grids and the potential for green hydrogen production powered by solar energy represent future growth frontiers. Companies that can offer integrated solutions, navigate complex regulatory landscapes, and innovate in areas like floating solar and energy storage are well-positioned for success. The substantial untapped potential in countries like Indonesia and the Philippines, coupled with the mature markets of Vietnam and Thailand, ensures a dynamic and growing market landscape for solar energy in Southeast Asia.

Southeast Asia Solar Energy Market Segmentation

-

1. Type

- 1.1. Solar Photovoltaic

- 1.2. Concentrated Solar Power

-

2. Geography

- 2.1. Vietnam

- 2.2. Indonesia

- 2.3. Philippines

- 2.4. Thailand

- 2.5. Malaysia

- 2.6. Rest of Southeast Asia

Southeast Asia Solar Energy Market Segmentation By Geography

- 1. Vietnam

- 2. Indonesia

- 3. Philippines

- 4. Thailand

- 5. Malaysia

- 6. Rest of Southeast Asia

Southeast Asia Solar Energy Market Regional Market Share

Geographic Coverage of Southeast Asia Solar Energy Market

Southeast Asia Solar Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 30.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Renewable Energy Installation to Reduce the Carbon Emission4.; The Decreasing Price of Solar PV Modules

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Alternative Renewable Technologies like Hydropower

- 3.4. Market Trends

- 3.4.1. Solar Photovoltaic Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Southeast Asia Solar Energy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Solar Photovoltaic

- 5.1.2. Concentrated Solar Power

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Vietnam

- 5.2.2. Indonesia

- 5.2.3. Philippines

- 5.2.4. Thailand

- 5.2.5. Malaysia

- 5.2.6. Rest of Southeast Asia

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.3.2. Indonesia

- 5.3.3. Philippines

- 5.3.4. Thailand

- 5.3.5. Malaysia

- 5.3.6. Rest of Southeast Asia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Vietnam Southeast Asia Solar Energy Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Solar Photovoltaic

- 6.1.2. Concentrated Solar Power

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Vietnam

- 6.2.2. Indonesia

- 6.2.3. Philippines

- 6.2.4. Thailand

- 6.2.5. Malaysia

- 6.2.6. Rest of Southeast Asia

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Indonesia Southeast Asia Solar Energy Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Solar Photovoltaic

- 7.1.2. Concentrated Solar Power

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Vietnam

- 7.2.2. Indonesia

- 7.2.3. Philippines

- 7.2.4. Thailand

- 7.2.5. Malaysia

- 7.2.6. Rest of Southeast Asia

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Philippines Southeast Asia Solar Energy Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Solar Photovoltaic

- 8.1.2. Concentrated Solar Power

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Vietnam

- 8.2.2. Indonesia

- 8.2.3. Philippines

- 8.2.4. Thailand

- 8.2.5. Malaysia

- 8.2.6. Rest of Southeast Asia

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Thailand Southeast Asia Solar Energy Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Solar Photovoltaic

- 9.1.2. Concentrated Solar Power

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Vietnam

- 9.2.2. Indonesia

- 9.2.3. Philippines

- 9.2.4. Thailand

- 9.2.5. Malaysia

- 9.2.6. Rest of Southeast Asia

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Malaysia Southeast Asia Solar Energy Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Solar Photovoltaic

- 10.1.2. Concentrated Solar Power

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Vietnam

- 10.2.2. Indonesia

- 10.2.3. Philippines

- 10.2.4. Thailand

- 10.2.5. Malaysia

- 10.2.6. Rest of Southeast Asia

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Rest of Southeast Asia Southeast Asia Solar Energy Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Solar Photovoltaic

- 11.1.2. Concentrated Solar Power

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. Vietnam

- 11.2.2. Indonesia

- 11.2.3. Philippines

- 11.2.4. Thailand

- 11.2.5. Malaysia

- 11.2.6. Rest of Southeast Asia

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 JinkoSolar Holding Co Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Solarie Energy*List Not Exhaustive

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Johnsolar Energy Co Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Thai Solar Energy Public Company Limited

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Scatec ASA

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Vena Energy Solar Pte Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Canadian Solar Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Blue Solar Co Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 LONGi Green Energy Technology Co Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Trina Solar Limited

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 JinkoSolar Holding Co Ltd

List of Figures

- Figure 1: Southeast Asia Solar Energy Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Southeast Asia Solar Energy Market Share (%) by Company 2025

List of Tables

- Table 1: Southeast Asia Solar Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Southeast Asia Solar Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: Southeast Asia Solar Energy Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Southeast Asia Solar Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Southeast Asia Solar Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Southeast Asia Solar Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Southeast Asia Solar Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Southeast Asia Solar Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: Southeast Asia Solar Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Southeast Asia Solar Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Southeast Asia Solar Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Southeast Asia Solar Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Southeast Asia Solar Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Southeast Asia Solar Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Southeast Asia Solar Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Southeast Asia Solar Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Southeast Asia Solar Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Southeast Asia Solar Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Southeast Asia Solar Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Southeast Asia Solar Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 21: Southeast Asia Solar Energy Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Southeast Asia Solar Energy Market?

The projected CAGR is approximately 30.1%.

2. Which companies are prominent players in the Southeast Asia Solar Energy Market?

Key companies in the market include JinkoSolar Holding Co Ltd, Solarie Energy*List Not Exhaustive, Johnsolar Energy Co Ltd, Thai Solar Energy Public Company Limited, Scatec ASA, Vena Energy Solar Pte Ltd, Canadian Solar Inc, Blue Solar Co Ltd, LONGi Green Energy Technology Co Ltd, Trina Solar Limited.

3. What are the main segments of the Southeast Asia Solar Energy Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.3 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Renewable Energy Installation to Reduce the Carbon Emission4.; The Decreasing Price of Solar PV Modules.

6. What are the notable trends driving market growth?

Solar Photovoltaic Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Alternative Renewable Technologies like Hydropower.

8. Can you provide examples of recent developments in the market?

October 2022: Acwa Power secured a contract from Indonesia's state-owned utility, PT Perusahaan Listrik Negara (PLN), to build two floating solar photovoltaic (PV) power plants. The deal encompassed the 60 MW Saguling and 50 MW Singkarak floating solar projects. The two projects were likely to have a combined capacity of 110 MW and cost USD 105 million to build.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Southeast Asia Solar Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Southeast Asia Solar Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Southeast Asia Solar Energy Market?

To stay informed about further developments, trends, and reports in the Southeast Asia Solar Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence