Key Insights

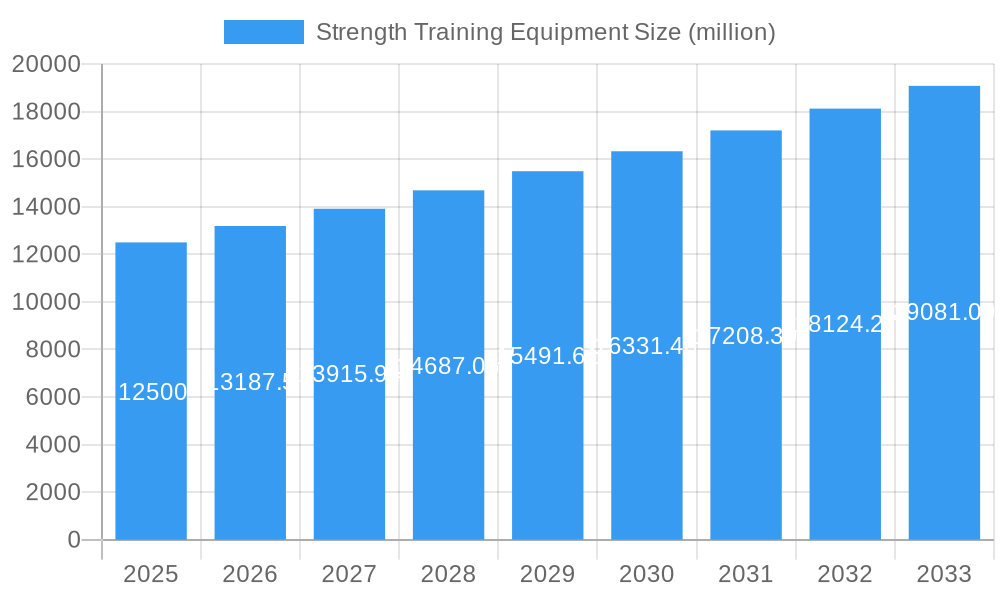

The global strength training equipment market, projected at $12.88 billion in the base year of 2025, is poised for substantial growth. This expansion is driven by increasing global health concerns, including obesity and chronic diseases, which are escalating demand for effective fitness solutions. Strength training's recognized importance for overall health and well-being, coupled with growing awareness of functional fitness benefits like injury prevention and enhanced quality of life, are key market accelerators. Continuous innovation within the fitness industry, featuring technologically advanced equipment with smart capabilities, virtual training, and personalized experiences, further stimulates market development. While home fitness solutions are gaining traction due to convenience and cost-efficiency, commercial gyms remain a vital segment. Competitive pricing strategies from both established and emerging brands are enhancing accessibility and driving market expansion. Key challenges include fluctuating raw material costs, economic impacts on consumer spending, and intensified brand competition.

Strength Training Equipment Market Size (In Billion)

The market is forecasted to achieve a Compound Annual Growth Rate (CAGR) of 6.32% through 2033. This growth will be propelled by the ongoing integration of technology into fitness equipment, the surging popularity of home gyms and personalized fitness regimens, and increased health and wellness investments by individuals and corporations. The expanding global fitness culture, amplified by social media and influencer marketing, will also positively impact consumer adoption. Market segmentation is expected to cover diverse equipment types, price ranges, and end-user segments, including commercial facilities, home users, and fitness studios. Leading market participants are focused on innovation, product diversification, strategic alliances, and mergers and acquisitions to secure market share.

Strength Training Equipment Company Market Share

Strength Training Equipment Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global strength training equipment market, encompassing market size, segmentation, growth drivers, challenges, and key players. The study period covers 2019-2033, with 2025 as the base and estimated year. The report projects a market valued at over $XX Million in 2025, with a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). The report offers actionable insights for industry stakeholders, including manufacturers, distributors, and investors.

Strength Training Equipment Market Concentration & Innovation

This section analyzes the competitive landscape, innovation trends, and regulatory influences shaping the strength training equipment market. The market exhibits a moderately concentrated structure, with key players like Life Fitness, Technogym SpA, and Bowflex Inc. holding significant market share. However, the presence of numerous smaller players and regional manufacturers ensures a dynamic competitive environment. Market share data for 2024 reveals that Life Fitness holds approximately XX% market share, followed by Technogym SpA at XX% and Bowflex Inc at XX%. M&A activity has been relatively low in recent years, with only a few significant deals valued at under $XX Million recorded since 2019.

Innovation Drivers:

- Technological advancements in materials science and AI integration for personalized training experiences.

- Growing demand for home fitness solutions driving innovation in compact and user-friendly equipment.

- Focus on gamification and digital integration to enhance user engagement and adherence.

Regulatory Frameworks:

- Safety standards and certifications influence product design and manufacturing.

- Regulations related to e-commerce and data privacy impact online sales and marketing strategies.

Product Substitutes:

- Bodyweight training and other forms of exercise are viable substitutes.

- Competition from other fitness equipment categories (e.g., cardio equipment) impacts market growth.

End-User Trends:

- Rising health consciousness and increasing awareness of the benefits of strength training fuel demand.

- Growing preference for personalized fitness programs and on-demand training content.

Strength Training Equipment Industry Trends & Insights

The global strength training equipment market is witnessing robust growth fueled by several factors. The increasing prevalence of sedentary lifestyles and the growing awareness of the benefits of regular exercise, particularly strength training, are key drivers. The market is experiencing a significant shift toward digital fitness solutions, with smart equipment offering personalized training programs and data tracking capabilities gaining prominence. The CAGR for the historical period (2019-2024) is estimated at XX%, while the projected CAGR for the forecast period (2025-2033) is XX%. Market penetration has increased steadily, with approximately XX% of households owning some form of strength training equipment in developed markets by 2024. The rising popularity of home fitness is a significant factor, driving demand for compact and versatile equipment suitable for residential use. The competitive landscape remains dynamic, with both established players and emerging brands vying for market share through product innovation, strategic partnerships, and aggressive marketing campaigns. Consumer preferences are shifting towards more sophisticated and technologically advanced equipment offering personalized workout experiences.

Dominant Markets & Segments in Strength Training Equipment

The North American market currently holds the largest market share in the global strength training equipment industry, driven by high disposable incomes, health consciousness, and the prevalence of fitness culture. Within North America, the United States represents the largest national market.

Key Drivers for North American Dominance:

- High disposable incomes and spending on health and wellness.

- Well-established fitness infrastructure, including gyms and fitness studios.

- Strong adoption of technology and digital fitness solutions.

- Favorable government policies supporting physical activity and health initiatives.

The European market is also a significant contributor, with strong growth expected in countries like Germany, the UK, and France. Asia-Pacific is another rapidly expanding market, particularly in countries like China and India, with rising disposable incomes and increased health awareness driving market expansion. The commercial segment (gyms, fitness centers) traditionally held a larger share, but the home fitness segment is rapidly catching up due to the COVID-19 pandemic’s impact and the increasing preference for personalized home workouts.

Strength Training Equipment Product Developments

Recent product innovations emphasize technological integration, personalized training options, and space-saving designs. Manufacturers are increasingly incorporating smart technology to track user progress, provide personalized feedback, and offer connected fitness experiences. The use of durable, high-quality materials is also a key focus, along with designs that prioritize ease of use and adjustability to accommodate different fitness levels and user preferences. This focus on technological advancement and user experience is driving market growth and shaping the competitive landscape.

Report Scope & Segmentation Analysis

The report segments the strength training equipment market based on product type (free weights, weight machines, resistance bands), end-user (home, commercial), and geography (North America, Europe, Asia-Pacific, Rest of the World). Each segment is analyzed in detail, providing market size estimations, growth projections, and competitive landscape analysis. Growth projections vary across segments, with the home fitness segment exhibiting faster growth than the commercial segment, particularly in the wake of the COVID-19 pandemic. Competitive dynamics within each segment also differ, with some segments characterized by intense competition and others showing greater opportunities for new entrants.

Key Drivers of Strength Training Equipment Growth

Several factors contribute to the growth of the strength training equipment market: the rising prevalence of chronic diseases related to physical inactivity, increasing health awareness, and the rising popularity of home fitness workouts. Technological advancements, leading to the introduction of smart fitness equipment and personalized training programs, are also key drivers. Government initiatives promoting healthy lifestyles and increasing disposable incomes in developing countries further fuel market expansion.

Challenges in the Strength Training Equipment Sector

The industry faces challenges such as intense competition, fluctuations in raw material prices, and the need for continuous innovation to stay relevant. Supply chain disruptions and rising transportation costs are also factors impacting profitability. Stringent safety regulations and certifications add to the cost of product development and manufacturing.

Emerging Opportunities in Strength Training Equipment

Emerging opportunities include the growth of the connected fitness segment, expansion into new markets, and the development of specialized equipment for niche fitness segments. The integration of artificial intelligence (AI) and virtual reality (VR) technologies offers potential for creating more engaging and personalized workout experiences. Furthermore, the increasing demand for customized and personalized fitness solutions is creating opportunities for smaller, niche players to cater to specialized needs.

Leading Players in the Strength Training Equipment Market

- Life Fitness

- Technogym SpA

- Bowflex Inc

- Johnson Health Tech Co

- True Fitness Technology Inc

- Origin Fitness Limited

- Dyaco International Inc

- Decathlon

- IFIT Health And Fitness Inc

- Body Solid Inc

Key Developments in Strength Training Equipment Industry

- March 2023: Life Fitness launched its latest generation of cardio, strength, and digital fitness equipment, including the Life Fitness Insignia lines and Hammer Strength HD Plate and Plate Loaded machines. This significantly enhanced its product portfolio and competitive edge.

- August 2023: Bowflex Inc. relaunched its iconic Bowflex brand with a redesigned identity, visual design, and updated logo. This aimed to revitalize brand image and attract a wider consumer base.

- January 2022: Technogym launched a new strength training line incorporating AI and scientific research, positioning itself as a leader in technologically advanced fitness solutions.

Strategic Outlook for Strength Training Equipment Market

The strength training equipment market is poised for continued growth, driven by the global health and fitness trend, technological advancements, and the expanding home fitness sector. Future opportunities lie in the development of personalized and connected fitness solutions, expansion into emerging markets, and strategic partnerships to broaden market reach. The focus on user experience, technological integration, and sustainable manufacturing practices will be crucial for success in the years to come.

Strength Training Equipment Segmentation

-

1. Product Type

- 1.1. Weights

- 1.2. Racks and Benches

- 1.3. Exercise and Medicine Balls

- 1.4. Other Product Types

-

2. End User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Online Retail Stores

- 3.2. Offline retail Stores

Strength Training Equipment Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Spain

- 2.4. France

- 2.5. Italy

- 2.6. Austria

- 2.7. Switzerland

- 2.8. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. South Korea

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East

Strength Training Equipment Regional Market Share

Geographic Coverage of Strength Training Equipment

Strength Training Equipment REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Influence of Healthy Lifestyles; Social Media Revolutionizing the Fitness Industry

- 3.3. Market Restrains

- 3.3.1. Growing Influence of Healthy Lifestyles; Social Media Revolutionizing the Fitness Industry

- 3.4. Market Trends

- 3.4.1. Strong demand for different types of weights from fitness-conscious consumers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Strength Training Equipment Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Weights

- 5.1.2. Racks and Benches

- 5.1.3. Exercise and Medicine Balls

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online Retail Stores

- 5.3.2. Offline retail Stores

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Strength Training Equipment Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Weights

- 6.1.2. Racks and Benches

- 6.1.3. Exercise and Medicine Balls

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Online Retail Stores

- 6.3.2. Offline retail Stores

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Strength Training Equipment Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Weights

- 7.1.2. Racks and Benches

- 7.1.3. Exercise and Medicine Balls

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Online Retail Stores

- 7.3.2. Offline retail Stores

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Strength Training Equipment Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Weights

- 8.1.2. Racks and Benches

- 8.1.3. Exercise and Medicine Balls

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Online Retail Stores

- 8.3.2. Offline retail Stores

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of the World Strength Training Equipment Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Weights

- 9.1.2. Racks and Benches

- 9.1.3. Exercise and Medicine Balls

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Online Retail Stores

- 9.3.2. Offline retail Stores

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Life Fitness

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Technogym SpA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Bowflex Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Johnson Health Tech Co

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 True Fitness Technology Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Origin Fitness Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Dyaco International Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Decathlon

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 IFIT Health And Fitness Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Body Solid Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Life Fitness

List of Figures

- Figure 1: Global Strength Training Equipment Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Strength Training Equipment Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Strength Training Equipment Revenue (billion), by Product Type 2025 & 2033

- Figure 4: North America Strength Training Equipment Volume (Billion), by Product Type 2025 & 2033

- Figure 5: North America Strength Training Equipment Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Strength Training Equipment Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Strength Training Equipment Revenue (billion), by End User 2025 & 2033

- Figure 8: North America Strength Training Equipment Volume (Billion), by End User 2025 & 2033

- Figure 9: North America Strength Training Equipment Revenue Share (%), by End User 2025 & 2033

- Figure 10: North America Strength Training Equipment Volume Share (%), by End User 2025 & 2033

- Figure 11: North America Strength Training Equipment Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 12: North America Strength Training Equipment Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 13: North America Strength Training Equipment Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: North America Strength Training Equipment Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 15: North America Strength Training Equipment Revenue (billion), by Country 2025 & 2033

- Figure 16: North America Strength Training Equipment Volume (Billion), by Country 2025 & 2033

- Figure 17: North America Strength Training Equipment Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Strength Training Equipment Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Strength Training Equipment Revenue (billion), by Product Type 2025 & 2033

- Figure 20: Europe Strength Training Equipment Volume (Billion), by Product Type 2025 & 2033

- Figure 21: Europe Strength Training Equipment Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Europe Strength Training Equipment Volume Share (%), by Product Type 2025 & 2033

- Figure 23: Europe Strength Training Equipment Revenue (billion), by End User 2025 & 2033

- Figure 24: Europe Strength Training Equipment Volume (Billion), by End User 2025 & 2033

- Figure 25: Europe Strength Training Equipment Revenue Share (%), by End User 2025 & 2033

- Figure 26: Europe Strength Training Equipment Volume Share (%), by End User 2025 & 2033

- Figure 27: Europe Strength Training Equipment Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 28: Europe Strength Training Equipment Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 29: Europe Strength Training Equipment Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Europe Strength Training Equipment Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 31: Europe Strength Training Equipment Revenue (billion), by Country 2025 & 2033

- Figure 32: Europe Strength Training Equipment Volume (Billion), by Country 2025 & 2033

- Figure 33: Europe Strength Training Equipment Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Strength Training Equipment Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Strength Training Equipment Revenue (billion), by Product Type 2025 & 2033

- Figure 36: Asia Pacific Strength Training Equipment Volume (Billion), by Product Type 2025 & 2033

- Figure 37: Asia Pacific Strength Training Equipment Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Asia Pacific Strength Training Equipment Volume Share (%), by Product Type 2025 & 2033

- Figure 39: Asia Pacific Strength Training Equipment Revenue (billion), by End User 2025 & 2033

- Figure 40: Asia Pacific Strength Training Equipment Volume (Billion), by End User 2025 & 2033

- Figure 41: Asia Pacific Strength Training Equipment Revenue Share (%), by End User 2025 & 2033

- Figure 42: Asia Pacific Strength Training Equipment Volume Share (%), by End User 2025 & 2033

- Figure 43: Asia Pacific Strength Training Equipment Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 44: Asia Pacific Strength Training Equipment Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 45: Asia Pacific Strength Training Equipment Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Asia Pacific Strength Training Equipment Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: Asia Pacific Strength Training Equipment Revenue (billion), by Country 2025 & 2033

- Figure 48: Asia Pacific Strength Training Equipment Volume (Billion), by Country 2025 & 2033

- Figure 49: Asia Pacific Strength Training Equipment Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Strength Training Equipment Volume Share (%), by Country 2025 & 2033

- Figure 51: Rest of the World Strength Training Equipment Revenue (billion), by Product Type 2025 & 2033

- Figure 52: Rest of the World Strength Training Equipment Volume (Billion), by Product Type 2025 & 2033

- Figure 53: Rest of the World Strength Training Equipment Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Rest of the World Strength Training Equipment Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Rest of the World Strength Training Equipment Revenue (billion), by End User 2025 & 2033

- Figure 56: Rest of the World Strength Training Equipment Volume (Billion), by End User 2025 & 2033

- Figure 57: Rest of the World Strength Training Equipment Revenue Share (%), by End User 2025 & 2033

- Figure 58: Rest of the World Strength Training Equipment Volume Share (%), by End User 2025 & 2033

- Figure 59: Rest of the World Strength Training Equipment Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 60: Rest of the World Strength Training Equipment Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 61: Rest of the World Strength Training Equipment Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 62: Rest of the World Strength Training Equipment Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 63: Rest of the World Strength Training Equipment Revenue (billion), by Country 2025 & 2033

- Figure 64: Rest of the World Strength Training Equipment Volume (Billion), by Country 2025 & 2033

- Figure 65: Rest of the World Strength Training Equipment Revenue Share (%), by Country 2025 & 2033

- Figure 66: Rest of the World Strength Training Equipment Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Strength Training Equipment Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Strength Training Equipment Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: Global Strength Training Equipment Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Global Strength Training Equipment Volume Billion Forecast, by End User 2020 & 2033

- Table 5: Global Strength Training Equipment Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Strength Training Equipment Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global Strength Training Equipment Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global Strength Training Equipment Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global Strength Training Equipment Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: Global Strength Training Equipment Volume Billion Forecast, by Product Type 2020 & 2033

- Table 11: Global Strength Training Equipment Revenue billion Forecast, by End User 2020 & 2033

- Table 12: Global Strength Training Equipment Volume Billion Forecast, by End User 2020 & 2033

- Table 13: Global Strength Training Equipment Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global Strength Training Equipment Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Strength Training Equipment Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Strength Training Equipment Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United States Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: United States Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Canada Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Canada Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of North America Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Rest of North America Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Global Strength Training Equipment Revenue billion Forecast, by Product Type 2020 & 2033

- Table 24: Global Strength Training Equipment Volume Billion Forecast, by Product Type 2020 & 2033

- Table 25: Global Strength Training Equipment Revenue billion Forecast, by End User 2020 & 2033

- Table 26: Global Strength Training Equipment Volume Billion Forecast, by End User 2020 & 2033

- Table 27: Global Strength Training Equipment Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 28: Global Strength Training Equipment Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 29: Global Strength Training Equipment Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Global Strength Training Equipment Volume Billion Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: United Kingdom Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Germany Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Germany Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Spain Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Spain Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: France Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: France Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Italy Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Italy Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Austria Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Austria Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Switzerland Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Switzerland Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Rest of Europe Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Europe Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Global Strength Training Equipment Revenue billion Forecast, by Product Type 2020 & 2033

- Table 48: Global Strength Training Equipment Volume Billion Forecast, by Product Type 2020 & 2033

- Table 49: Global Strength Training Equipment Revenue billion Forecast, by End User 2020 & 2033

- Table 50: Global Strength Training Equipment Volume Billion Forecast, by End User 2020 & 2033

- Table 51: Global Strength Training Equipment Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 52: Global Strength Training Equipment Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 53: Global Strength Training Equipment Revenue billion Forecast, by Country 2020 & 2033

- Table 54: Global Strength Training Equipment Volume Billion Forecast, by Country 2020 & 2033

- Table 55: China Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: China Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Japan Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Japan Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: South Korea Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 60: South Korea Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 61: Australia Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Australia Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Rest of Asia Pacific Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 65: Global Strength Training Equipment Revenue billion Forecast, by Product Type 2020 & 2033

- Table 66: Global Strength Training Equipment Volume Billion Forecast, by Product Type 2020 & 2033

- Table 67: Global Strength Training Equipment Revenue billion Forecast, by End User 2020 & 2033

- Table 68: Global Strength Training Equipment Volume Billion Forecast, by End User 2020 & 2033

- Table 69: Global Strength Training Equipment Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 70: Global Strength Training Equipment Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 71: Global Strength Training Equipment Revenue billion Forecast, by Country 2020 & 2033

- Table 72: Global Strength Training Equipment Volume Billion Forecast, by Country 2020 & 2033

- Table 73: South America Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: South America Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 75: Middle East Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: Middle East Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Strength Training Equipment?

The projected CAGR is approximately 6.32%.

2. Which companies are prominent players in the Strength Training Equipment?

Key companies in the market include Life Fitness, Technogym SpA, Bowflex Inc, Johnson Health Tech Co, True Fitness Technology Inc, Origin Fitness Limited, Dyaco International Inc, Decathlon, IFIT Health And Fitness Inc, Body Solid Inc.

3. What are the main segments of the Strength Training Equipment?

The market segments include Product Type, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.88 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Influence of Healthy Lifestyles; Social Media Revolutionizing the Fitness Industry.

6. What are the notable trends driving market growth?

Strong demand for different types of weights from fitness-conscious consumers.

7. Are there any restraints impacting market growth?

Growing Influence of Healthy Lifestyles; Social Media Revolutionizing the Fitness Industry.

8. Can you provide examples of recent developments in the market?

In March 2023, Life Fitness introduced the latest generation cardio, strength, and digital product innovations, The company’s product innovations include the Life Fitness Insignia lines and the Hammer Strength HD Plate and Plate Loaded machines.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Strength Training Equipment," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Strength Training Equipment report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Strength Training Equipment?

To stay informed about further developments, trends, and reports in the Strength Training Equipment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence