Key Insights

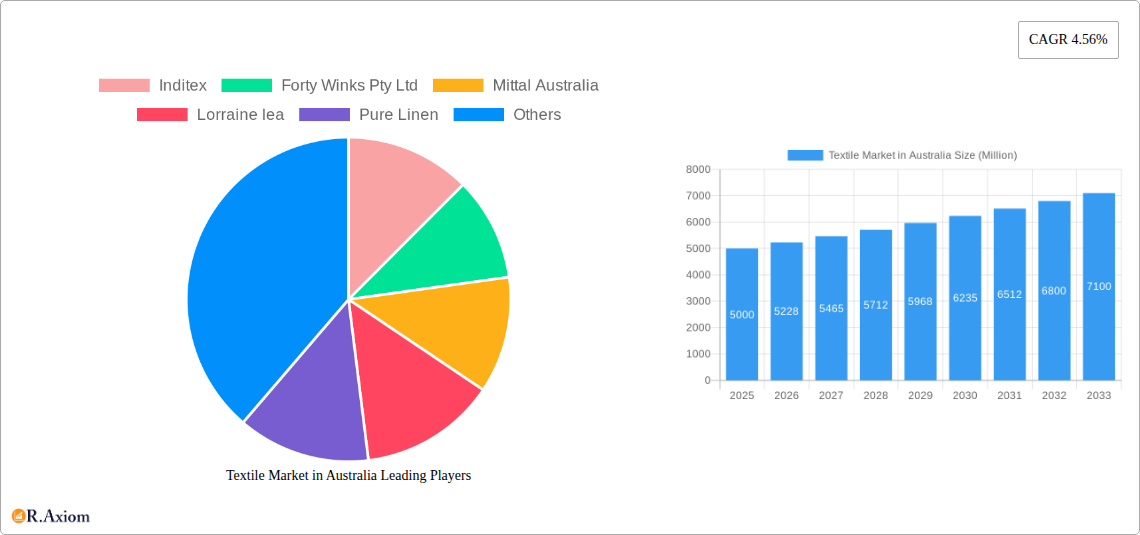

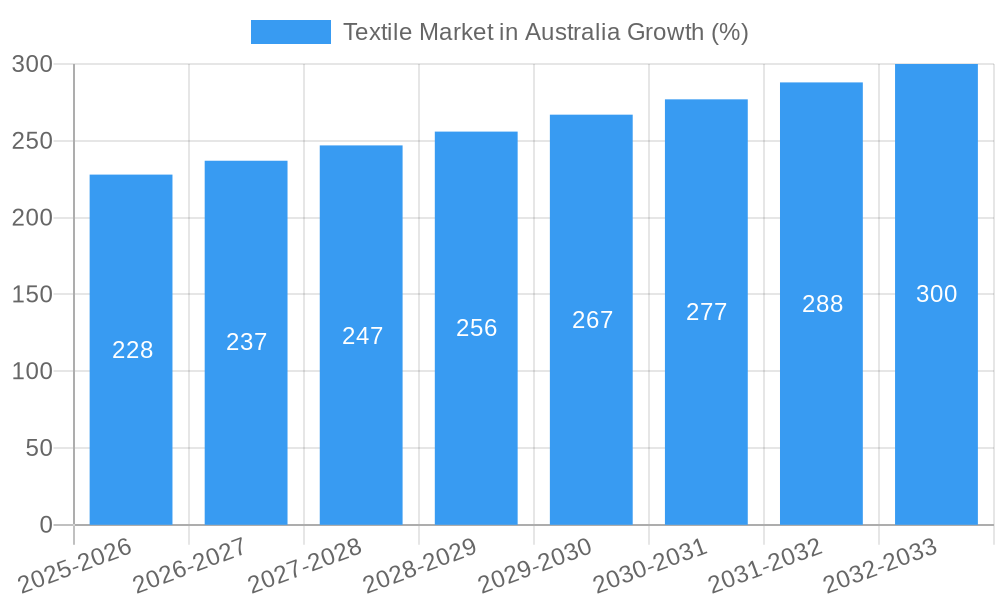

The Australian textile market, valued at approximately $5.00 billion in 2025, is projected to experience steady growth, with a Compound Annual Growth Rate (CAGR) of 4.56% from 2025 to 2033. This growth is driven by several key factors. Increasing disposable incomes and a rising demand for home furnishings, particularly among younger demographics embracing home improvement and lifestyle trends, are fueling market expansion. The growth of e-commerce channels, offering convenience and wider product selections, is also a significant driver. Furthermore, the increasing popularity of sustainable and ethically sourced textiles is creating opportunities for businesses committed to environmentally conscious practices. Competition within the market remains robust, with both established players like Inditex and Harvey Norman, and smaller specialist retailers, vying for market share. While the market demonstrates promising potential, challenges remain. Fluctuations in raw material prices, particularly cotton, pose a risk to profitability. Furthermore, increasing competition from international brands and the rising cost of labor could impact future growth. The segment analysis reveals strong demand across various product categories, including bed linen, bath linen, and kitchen textiles, while online channels are experiencing significant growth in market penetration.

The market's segmentation into product types (bed linen, bath linen, kitchen linen, upholstery, floor coverings) and distribution channels (supermarkets, specialty stores, online, others) offers valuable insights into consumer preferences and purchasing behaviors. The dominance of certain segments, coupled with the rise of online shopping, points to strategic opportunities for businesses to tailor their offerings and marketing strategies. Future growth will likely be influenced by advancements in textile technology, creating innovative products with enhanced features such as improved durability, stain resistance, and eco-friendly properties. Understanding consumer preferences towards sustainability, quality, and convenience will be critical for businesses aiming to capitalize on the market's potential. The Australian textile market is dynamic and competitive, offering both opportunities and challenges for businesses operating within this sector.

Textile Market in Australia: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Australian textile market, covering the period from 2019 to 2033. It offers valuable insights into market size, segmentation, growth drivers, challenges, and future opportunities, empowering stakeholders to make informed strategic decisions. The report leverages extensive data analysis and incorporates key industry developments to provide a holistic view of the dynamic Australian textile landscape. The base year for this report is 2025, with estimations for 2025 and forecasts extending to 2033.

Textile Market in Australia: Market Concentration & Innovation

The Australian textile market exhibits a moderately concentrated structure, with a few major players holding significant market share. While precise market share figures for individual companies remain proprietary, industry giants like Inditex, Hennes & Mauritz AB (H&M), and IKEA command substantial portions. Smaller, specialized players like Forty Winks Pty Ltd and Lorraine Lea cater to niche segments, focusing on bed linen and other home textiles. Mittal Australia’s presence represents a crucial aspect of raw material supply. The market is characterized by both established brands and emerging players.

Innovation Drivers: Innovation within the Australian textile market is driven by several factors:

- Sustainable and ethical sourcing: Increasing consumer demand for eco-friendly and ethically produced textiles is pushing manufacturers to adopt sustainable practices.

- Technological advancements: Developments in fabric technology, manufacturing processes, and digital design are enhancing product quality, efficiency, and customization.

- Product diversification: The market witnesses continuous product diversification, with companies introducing innovative designs, functional fabrics, and smart textiles.

- E-commerce growth: Online retail is significantly transforming distribution channels, fostering competition and requiring innovative digital marketing strategies.

Regulatory Framework: Australian regulations concerning textile labeling, safety, and environmental standards significantly influence market operations. These regulations promote transparency and consumer protection, while also posing compliance challenges for businesses.

Product Substitutes: The Australian textile market faces competition from substitute products, including synthetic materials and alternatives from other sectors. However, the demand for natural fibers and quality textiles continues to fuel the growth of the overall market.

M&A Activities: The textile sector in Australia has seen a moderate level of mergers and acquisitions (M&A) activity in recent years. While precise deal values remain confidential, these activities generally focus on consolidating market share, expanding product portfolios, and enhancing distribution networks. The estimated value of these deals is approximately xx Million over the past five years.

End-User Trends: Consumers in Australia display growing preference for sustainable, high-quality textiles with enhanced features, driving innovation in material selection and manufacturing techniques.

Textile Market in Australia: Industry Trends & Insights

The Australian textile market is experiencing robust growth, driven by rising disposable incomes, changing consumer lifestyles, and increased demand for home improvement and furnishing. The compound annual growth rate (CAGR) for the period 2019-2024 is estimated at xx%, and the projected CAGR for 2025-2033 is expected to reach xx%. Market penetration is particularly high in urban areas, owing to higher disposable incomes and greater awareness of lifestyle and home furnishing trends.

Technological disruptions, particularly in e-commerce and digital marketing, are reshaping the market landscape. Online retailers are gaining significant market share, challenging traditional brick-and-mortar stores. Consumer preferences are shifting towards sustainable and ethically sourced products, driving innovation in sustainable textile production and supply chains.

Competitive dynamics are intensifying with the entry of new players and increased competition from global brands. Price competition remains a significant factor, along with the emphasis on value-added features such as durability, comfort, and aesthetics. The increasing focus on sustainability and ethical sourcing is creating a unique competitive advantage for companies that adopt such practices proactively.

Dominant Markets & Segments in Textile Market in Australia

Dominant Regions/Segments:

The Australian textile market displays a geographically diverse distribution, with no single region or state dominating completely. However, major metropolitan areas like Sydney and Melbourne account for a significant share of the market due to higher population density and purchasing power.

Dominant Product Types:

- Bed Linen: This segment holds the largest market share due to the high demand for comfortable and high-quality bedding. Continuous innovations in fabric technology, design, and comfort features further fuel this segment’s growth.

- Bath Linen: This segment is experiencing steady growth driven by increasing disposable incomes and improved standards of living.

- Kitchen Linen: This segment showcases moderate growth and is being driven by rising interest in home cooking and improvements in kitchen aesthetics.

- Upholstery: The upholstery market has a stable market share, influenced by the renovation and redecoration activities.

- Floor Covering: This segment displays moderate growth, affected by trends in home interior design and refurbishment projects.

Dominant Distribution Channels:

- Speciality Stores: These stores maintain a significant market share due to specialized product offerings and expert advice provided to customers.

- Online Channels: E-commerce platforms are experiencing rapid growth, creating a wider reach and enhanced customer convenience.

- Supermarkets & Hypermarkets: These channels provide a large volume of textile products, although usually at lower price points.

Key Drivers:

- Economic Factors: Rising disposable incomes and increased consumer spending on home goods drive market growth.

- Technological Advancements: Innovations in fabric technology and manufacturing processes result in better quality and increased production efficiency.

- Infrastructure: Well-established logistics and distribution networks aid efficient delivery of products across the country.

Textile Market in Australia: Product Developments

Recent product innovations in the Australian textile market focus on sustainability, comfort, and functionality. Manufacturers are increasingly incorporating recycled materials, organic cotton, and innovative blends to appeal to environmentally conscious consumers. Smart textiles with features such as temperature regulation and antimicrobial properties are emerging as a niche segment with significant future potential. Technological advancements in weaving, printing, and finishing processes enhance product quality, aesthetics, and durability. The market is witnessing a growing preference for bespoke and customized textile products, catering to individual customer preferences.

Report Scope & Segmentation Analysis

This report segments the Australian textile market based on product type (bed linen, bath linen, kitchen linen, upholstery, floor coverings) and distribution channels (supermarkets & hypermarkets, specialty stores, online, others). Each segment's market size is analyzed across the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033), highlighting growth projections and competitive dynamics. Specific market sizes for each segment are detailed in the full report.

Key Drivers of Textile Market in Australia Growth

The Australian textile market growth is propelled by several factors:

- Rising disposable incomes: Increased purchasing power allows consumers to spend more on home textiles.

- Growing focus on home improvement: A surge in home renovation and furnishing projects boosts demand for textiles.

- Technological innovation: Advances in fabric technology and production methods result in superior product quality and increased efficiency.

- E-commerce expansion: The rise of online shopping enhances accessibility and provides consumer convenience.

- Government support for the textile industry: Initiatives to promote sustainable practices and boost local manufacturing.

Challenges in the Textile Market in Australia Sector

The Australian textile market faces several challenges:

- Intense competition from global brands: This puts pressure on pricing and profitability.

- Fluctuating raw material prices: The cost of raw materials significantly influences manufacturing costs.

- Supply chain disruptions: Global events can significantly disrupt the supply of raw materials and finished products.

- Labor costs: Rising labor costs can reduce profit margins.

- Sustainability concerns: Meeting stringent environmental regulations and consumer demand for ethical products present a challenge.

Emerging Opportunities in Textile Market in Australia

The Australian textile market offers exciting emerging opportunities:

- Growth of the sustainable and ethical textile segment: Increasing consumer awareness promotes demand for environmentally friendly products.

- Expansion of e-commerce: Online channels present opportunities to reach a broader customer base and diversify sales channels.

- Innovation in product design and functionality: Creating unique and high-value-added textile products will attract customers.

- Development of niche product segments: Targeting specific consumer groups with specialized textiles can create new revenue streams.

- Focus on personalized and customizable products: Consumers are increasingly seeking customized items and unique designs.

Leading Players in the Textile Market in Australia Market

- Inditex

- Forty Winks Pty Ltd

- Mittal Australia

- Lorraine Lea

- Pure Linen

- Greenlit Brands

- ST Albans Textiles

- Harvey Norman Holdings Ltd

- Hennes & Mauritz AB

- Charles Pearson

- Ikea

Key Developments in Textile Market in Australia Industry

- September 2022: IKEA opens its first planning studio in West Melbourne, focusing on kitchens and wardrobes. This signifies increased investment in the Australian home textile market.

- August 2022: Forty Winks opens a new store in Noarlunga, Adelaide, expanding its retail presence and enhancing its market share in the bedding segment.

Strategic Outlook for Textile Market in Australia Market

The Australian textile market holds significant growth potential, driven by rising disposable incomes, a focus on home improvement, and growing consumer demand for sustainable and innovative products. Companies that adopt sustainable practices, leverage e-commerce effectively, and innovate in product design and functionality are poised to thrive in this dynamic market. The increasing focus on personalized and customizable options will also generate significant opportunities for businesses that cater to evolving customer preferences. The projected growth rates suggest substantial investment potential across all segments of the market.

Textile Market in Australia Segmentation

-

1. Product type

- 1.1. Bed linen

- 1.2. Bath linen

- 1.3. Kitchen linen

- 1.4. Upholstery

- 1.5. Floor Covering

-

2. Distribution Channel

- 2.1. Supermarkets & Hypermarkets

- 2.2. Speciality Stores

- 2.3. Online

- 2.4. Others

Textile Market in Australia Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Textile Market in Australia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.56% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Convenience and Time-Saving; Changing Food Culture and Western Influence

- 3.3. Market Restrains

- 3.3.1. Power Supply Issues; Preference for Traditional Cooking Methods

- 3.4. Market Trends

- 3.4.1. Home Textile Trade from Australia is Increasing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Textile Market in Australia Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product type

- 5.1.1. Bed linen

- 5.1.2. Bath linen

- 5.1.3. Kitchen linen

- 5.1.4. Upholstery

- 5.1.5. Floor Covering

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets & Hypermarkets

- 5.2.2. Speciality Stores

- 5.2.3. Online

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product type

- 6. North America Textile Market in Australia Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product type

- 6.1.1. Bed linen

- 6.1.2. Bath linen

- 6.1.3. Kitchen linen

- 6.1.4. Upholstery

- 6.1.5. Floor Covering

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets & Hypermarkets

- 6.2.2. Speciality Stores

- 6.2.3. Online

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Product type

- 7. South America Textile Market in Australia Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product type

- 7.1.1. Bed linen

- 7.1.2. Bath linen

- 7.1.3. Kitchen linen

- 7.1.4. Upholstery

- 7.1.5. Floor Covering

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets & Hypermarkets

- 7.2.2. Speciality Stores

- 7.2.3. Online

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Product type

- 8. Europe Textile Market in Australia Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product type

- 8.1.1. Bed linen

- 8.1.2. Bath linen

- 8.1.3. Kitchen linen

- 8.1.4. Upholstery

- 8.1.5. Floor Covering

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets & Hypermarkets

- 8.2.2. Speciality Stores

- 8.2.3. Online

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Product type

- 9. Middle East & Africa Textile Market in Australia Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product type

- 9.1.1. Bed linen

- 9.1.2. Bath linen

- 9.1.3. Kitchen linen

- 9.1.4. Upholstery

- 9.1.5. Floor Covering

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets & Hypermarkets

- 9.2.2. Speciality Stores

- 9.2.3. Online

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Product type

- 10. Asia Pacific Textile Market in Australia Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product type

- 10.1.1. Bed linen

- 10.1.2. Bath linen

- 10.1.3. Kitchen linen

- 10.1.4. Upholstery

- 10.1.5. Floor Covering

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets & Hypermarkets

- 10.2.2. Speciality Stores

- 10.2.3. Online

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Product type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Inditex

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Forty Winks Pty Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mittal Australia

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lorraine lea

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Pure Linen

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Greenlit Brands

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ST Albans Textiles

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Harvey Norman Holdings Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hennes & Mauritz AB

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Charles Pearson

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Ikea

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Inditex

List of Figures

- Figure 1: Global Textile Market in Australia Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Textile Market in Australia Volume Breakdown (K Unit, %) by Region 2024 & 2032

- Figure 3: Australia Textile Market in Australia Revenue (Million), by Country 2024 & 2032

- Figure 4: Australia Textile Market in Australia Volume (K Unit), by Country 2024 & 2032

- Figure 5: Australia Textile Market in Australia Revenue Share (%), by Country 2024 & 2032

- Figure 6: Australia Textile Market in Australia Volume Share (%), by Country 2024 & 2032

- Figure 7: North America Textile Market in Australia Revenue (Million), by Product type 2024 & 2032

- Figure 8: North America Textile Market in Australia Volume (K Unit), by Product type 2024 & 2032

- Figure 9: North America Textile Market in Australia Revenue Share (%), by Product type 2024 & 2032

- Figure 10: North America Textile Market in Australia Volume Share (%), by Product type 2024 & 2032

- Figure 11: North America Textile Market in Australia Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 12: North America Textile Market in Australia Volume (K Unit), by Distribution Channel 2024 & 2032

- Figure 13: North America Textile Market in Australia Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 14: North America Textile Market in Australia Volume Share (%), by Distribution Channel 2024 & 2032

- Figure 15: North America Textile Market in Australia Revenue (Million), by Country 2024 & 2032

- Figure 16: North America Textile Market in Australia Volume (K Unit), by Country 2024 & 2032

- Figure 17: North America Textile Market in Australia Revenue Share (%), by Country 2024 & 2032

- Figure 18: North America Textile Market in Australia Volume Share (%), by Country 2024 & 2032

- Figure 19: South America Textile Market in Australia Revenue (Million), by Product type 2024 & 2032

- Figure 20: South America Textile Market in Australia Volume (K Unit), by Product type 2024 & 2032

- Figure 21: South America Textile Market in Australia Revenue Share (%), by Product type 2024 & 2032

- Figure 22: South America Textile Market in Australia Volume Share (%), by Product type 2024 & 2032

- Figure 23: South America Textile Market in Australia Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 24: South America Textile Market in Australia Volume (K Unit), by Distribution Channel 2024 & 2032

- Figure 25: South America Textile Market in Australia Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 26: South America Textile Market in Australia Volume Share (%), by Distribution Channel 2024 & 2032

- Figure 27: South America Textile Market in Australia Revenue (Million), by Country 2024 & 2032

- Figure 28: South America Textile Market in Australia Volume (K Unit), by Country 2024 & 2032

- Figure 29: South America Textile Market in Australia Revenue Share (%), by Country 2024 & 2032

- Figure 30: South America Textile Market in Australia Volume Share (%), by Country 2024 & 2032

- Figure 31: Europe Textile Market in Australia Revenue (Million), by Product type 2024 & 2032

- Figure 32: Europe Textile Market in Australia Volume (K Unit), by Product type 2024 & 2032

- Figure 33: Europe Textile Market in Australia Revenue Share (%), by Product type 2024 & 2032

- Figure 34: Europe Textile Market in Australia Volume Share (%), by Product type 2024 & 2032

- Figure 35: Europe Textile Market in Australia Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 36: Europe Textile Market in Australia Volume (K Unit), by Distribution Channel 2024 & 2032

- Figure 37: Europe Textile Market in Australia Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 38: Europe Textile Market in Australia Volume Share (%), by Distribution Channel 2024 & 2032

- Figure 39: Europe Textile Market in Australia Revenue (Million), by Country 2024 & 2032

- Figure 40: Europe Textile Market in Australia Volume (K Unit), by Country 2024 & 2032

- Figure 41: Europe Textile Market in Australia Revenue Share (%), by Country 2024 & 2032

- Figure 42: Europe Textile Market in Australia Volume Share (%), by Country 2024 & 2032

- Figure 43: Middle East & Africa Textile Market in Australia Revenue (Million), by Product type 2024 & 2032

- Figure 44: Middle East & Africa Textile Market in Australia Volume (K Unit), by Product type 2024 & 2032

- Figure 45: Middle East & Africa Textile Market in Australia Revenue Share (%), by Product type 2024 & 2032

- Figure 46: Middle East & Africa Textile Market in Australia Volume Share (%), by Product type 2024 & 2032

- Figure 47: Middle East & Africa Textile Market in Australia Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 48: Middle East & Africa Textile Market in Australia Volume (K Unit), by Distribution Channel 2024 & 2032

- Figure 49: Middle East & Africa Textile Market in Australia Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 50: Middle East & Africa Textile Market in Australia Volume Share (%), by Distribution Channel 2024 & 2032

- Figure 51: Middle East & Africa Textile Market in Australia Revenue (Million), by Country 2024 & 2032

- Figure 52: Middle East & Africa Textile Market in Australia Volume (K Unit), by Country 2024 & 2032

- Figure 53: Middle East & Africa Textile Market in Australia Revenue Share (%), by Country 2024 & 2032

- Figure 54: Middle East & Africa Textile Market in Australia Volume Share (%), by Country 2024 & 2032

- Figure 55: Asia Pacific Textile Market in Australia Revenue (Million), by Product type 2024 & 2032

- Figure 56: Asia Pacific Textile Market in Australia Volume (K Unit), by Product type 2024 & 2032

- Figure 57: Asia Pacific Textile Market in Australia Revenue Share (%), by Product type 2024 & 2032

- Figure 58: Asia Pacific Textile Market in Australia Volume Share (%), by Product type 2024 & 2032

- Figure 59: Asia Pacific Textile Market in Australia Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 60: Asia Pacific Textile Market in Australia Volume (K Unit), by Distribution Channel 2024 & 2032

- Figure 61: Asia Pacific Textile Market in Australia Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 62: Asia Pacific Textile Market in Australia Volume Share (%), by Distribution Channel 2024 & 2032

- Figure 63: Asia Pacific Textile Market in Australia Revenue (Million), by Country 2024 & 2032

- Figure 64: Asia Pacific Textile Market in Australia Volume (K Unit), by Country 2024 & 2032

- Figure 65: Asia Pacific Textile Market in Australia Revenue Share (%), by Country 2024 & 2032

- Figure 66: Asia Pacific Textile Market in Australia Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Textile Market in Australia Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Textile Market in Australia Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Global Textile Market in Australia Revenue Million Forecast, by Product type 2019 & 2032

- Table 4: Global Textile Market in Australia Volume K Unit Forecast, by Product type 2019 & 2032

- Table 5: Global Textile Market in Australia Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Global Textile Market in Australia Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 7: Global Textile Market in Australia Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Textile Market in Australia Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Global Textile Market in Australia Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Textile Market in Australia Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Global Textile Market in Australia Revenue Million Forecast, by Product type 2019 & 2032

- Table 12: Global Textile Market in Australia Volume K Unit Forecast, by Product type 2019 & 2032

- Table 13: Global Textile Market in Australia Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: Global Textile Market in Australia Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 15: Global Textile Market in Australia Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Textile Market in Australia Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: United States Textile Market in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United States Textile Market in Australia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Canada Textile Market in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Canada Textile Market in Australia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Mexico Textile Market in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Mexico Textile Market in Australia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Global Textile Market in Australia Revenue Million Forecast, by Product type 2019 & 2032

- Table 24: Global Textile Market in Australia Volume K Unit Forecast, by Product type 2019 & 2032

- Table 25: Global Textile Market in Australia Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 26: Global Textile Market in Australia Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 27: Global Textile Market in Australia Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Global Textile Market in Australia Volume K Unit Forecast, by Country 2019 & 2032

- Table 29: Brazil Textile Market in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Brazil Textile Market in Australia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Argentina Textile Market in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Argentina Textile Market in Australia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: Rest of South America Textile Market in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of South America Textile Market in Australia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Global Textile Market in Australia Revenue Million Forecast, by Product type 2019 & 2032

- Table 36: Global Textile Market in Australia Volume K Unit Forecast, by Product type 2019 & 2032

- Table 37: Global Textile Market in Australia Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 38: Global Textile Market in Australia Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 39: Global Textile Market in Australia Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Global Textile Market in Australia Volume K Unit Forecast, by Country 2019 & 2032

- Table 41: United Kingdom Textile Market in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: United Kingdom Textile Market in Australia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Germany Textile Market in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Germany Textile Market in Australia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: France Textile Market in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: France Textile Market in Australia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: Italy Textile Market in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Italy Textile Market in Australia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: Spain Textile Market in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Spain Textile Market in Australia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Russia Textile Market in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Russia Textile Market in Australia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 53: Benelux Textile Market in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Benelux Textile Market in Australia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 55: Nordics Textile Market in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Nordics Textile Market in Australia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 57: Rest of Europe Textile Market in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Europe Textile Market in Australia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 59: Global Textile Market in Australia Revenue Million Forecast, by Product type 2019 & 2032

- Table 60: Global Textile Market in Australia Volume K Unit Forecast, by Product type 2019 & 2032

- Table 61: Global Textile Market in Australia Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 62: Global Textile Market in Australia Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 63: Global Textile Market in Australia Revenue Million Forecast, by Country 2019 & 2032

- Table 64: Global Textile Market in Australia Volume K Unit Forecast, by Country 2019 & 2032

- Table 65: Turkey Textile Market in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Turkey Textile Market in Australia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 67: Israel Textile Market in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Israel Textile Market in Australia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 69: GCC Textile Market in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: GCC Textile Market in Australia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 71: North Africa Textile Market in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: North Africa Textile Market in Australia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 73: South Africa Textile Market in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: South Africa Textile Market in Australia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 75: Rest of Middle East & Africa Textile Market in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Rest of Middle East & Africa Textile Market in Australia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 77: Global Textile Market in Australia Revenue Million Forecast, by Product type 2019 & 2032

- Table 78: Global Textile Market in Australia Volume K Unit Forecast, by Product type 2019 & 2032

- Table 79: Global Textile Market in Australia Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 80: Global Textile Market in Australia Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 81: Global Textile Market in Australia Revenue Million Forecast, by Country 2019 & 2032

- Table 82: Global Textile Market in Australia Volume K Unit Forecast, by Country 2019 & 2032

- Table 83: China Textile Market in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 84: China Textile Market in Australia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 85: India Textile Market in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 86: India Textile Market in Australia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 87: Japan Textile Market in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 88: Japan Textile Market in Australia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 89: South Korea Textile Market in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 90: South Korea Textile Market in Australia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 91: ASEAN Textile Market in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 92: ASEAN Textile Market in Australia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 93: Oceania Textile Market in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 94: Oceania Textile Market in Australia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 95: Rest of Asia Pacific Textile Market in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 96: Rest of Asia Pacific Textile Market in Australia Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Textile Market in Australia?

The projected CAGR is approximately 4.56%.

2. Which companies are prominent players in the Textile Market in Australia?

Key companies in the market include Inditex, Forty Winks Pty Ltd, Mittal Australia, Lorraine lea, Pure Linen, Greenlit Brands, ST Albans Textiles, Harvey Norman Holdings Ltd, Hennes & Mauritz AB, Charles Pearson, Ikea.

3. What are the main segments of the Textile Market in Australia?

The market segments include Product type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.00 Million as of 2022.

5. What are some drivers contributing to market growth?

Convenience and Time-Saving; Changing Food Culture and Western Influence.

6. What are the notable trends driving market growth?

Home Textile Trade from Australia is Increasing.

7. Are there any restraints impacting market growth?

Power Supply Issues; Preference for Traditional Cooking Methods.

8. Can you provide examples of recent developments in the market?

In September 2022, Ingka group operating in Australian home textile opens its first planning studio in Australia in west Melbourne. This studio will be focusing on kitchens and wardrobes, offering customers one-to-one planning with experts, with the full IKEA range available to order.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Textile Market in Australia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Textile Market in Australia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Textile Market in Australia?

To stay informed about further developments, trends, and reports in the Textile Market in Australia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence