Key Insights

The global Timing Board market is projected to experience substantial growth, reaching an estimated market size of USD 11.22 billion by 2025. The market is anticipated to grow at a robust CAGR of 11.33% from the base year 2025 through 2033. This expansion is primarily driven by the escalating integration of precise timing solutions across critical industries. The defense sector is a key contributor, requiring accurate and reliable timing for navigation, communication, and advanced weaponry. The telecommunications industry's increasing reliance on synchronized networks for 5G deployment and beyond, alongside the power industry's demand for grid stability and fault detection, further fuels market growth. Financial institutions also play a significant role, necessitating precise timing for high-frequency trading, transaction processing, and secure data synchronization. Key market trends include the miniaturization of timing boards and enhanced functionality, facilitating integration into compact and advanced devices. The adoption of dual-system timing boards, offering improved redundancy and accuracy through combined technologies like GPS and BeiDou, is also gaining momentum.

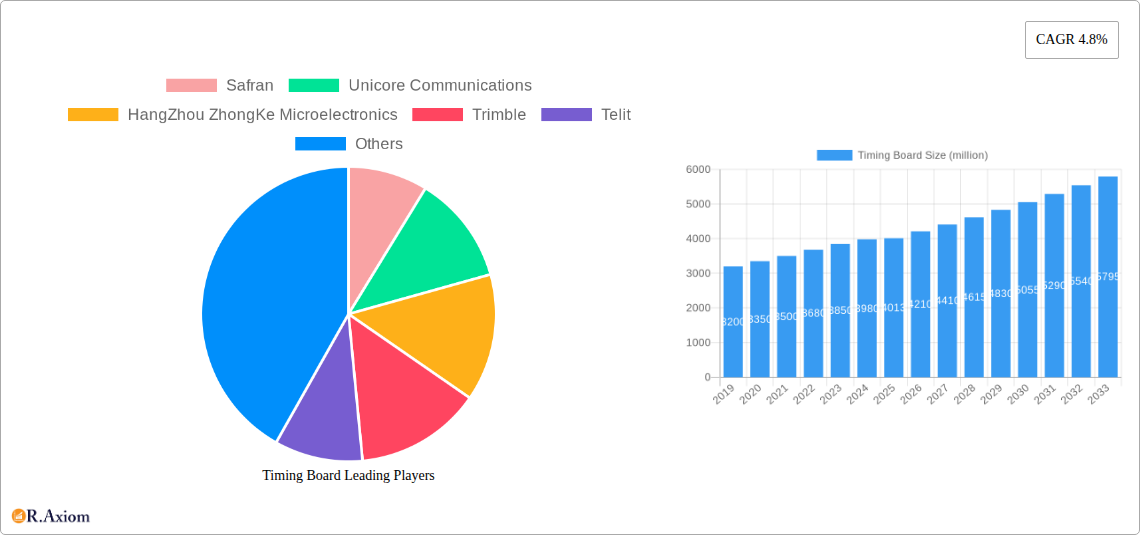

Timing Board Market Size (In Billion)

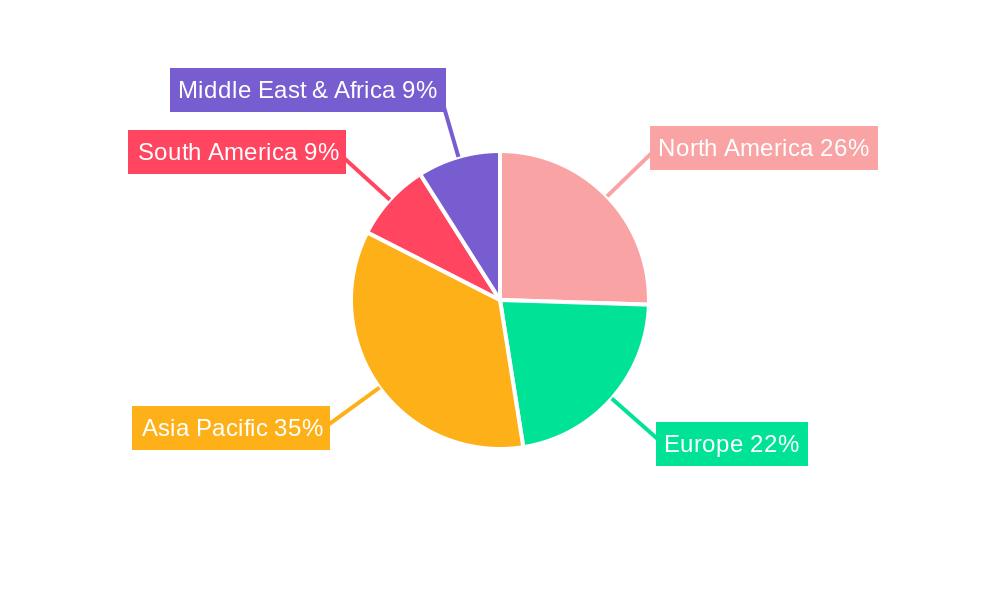

While the growth outlook is positive, potential challenges may include the high cost of advanced timing technologies, integration complexities for some end-users, and evolving regulatory landscapes for satellite navigation and timing accuracy in specific regions. Nevertheless, the intrinsic demand for precise timekeeping in an interconnected, data-driven world, coupled with continuous technological advancements, is expected to surpass these potential hurdles. Market segmentation reveals the dominance of GPS Timing Boards, with BeiDou Timing Boards expected to witness considerable growth, especially in the Asia Pacific region. Dual System Timing Boards represent a promising emerging segment. Geographically, the Asia Pacific, driven by significant investments in satellite navigation and manufacturing capabilities, is anticipated to lead the market, followed by North America and Europe, both strong in defense and advanced technology sectors.

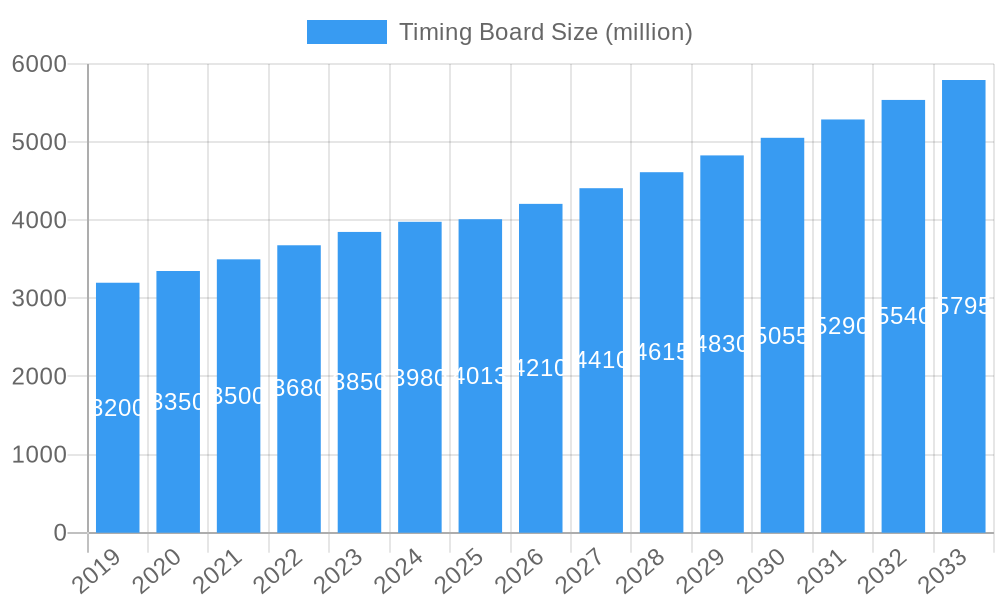

Timing Board Company Market Share

This comprehensive market research report offers an in-depth analysis of the Timing Board market, detailing market size, growth forecasts, CAGR, and key industry drivers. It covers segmentation by technology, application, and geography, highlighting major trends and competitive landscapes.

Timing Board Market Concentration & Innovation

The global Timing Board market exhibits a moderate concentration, driven by continuous innovation in precise time synchronization technologies. Key players are heavily investing in research and development to enhance accuracy, reduce latency, and improve the robustness of their timing solutions. Regulatory frameworks, particularly concerning critical infrastructure and national security, play a significant role in shaping market entry and product certification. The threat of product substitutes, such as software-based synchronization solutions or alternative hardware modules, exists but is often mitigated by the superior performance and reliability offered by dedicated timing boards, especially in high-demand applications. End-user trends are leaning towards miniaturization, increased power efficiency, and advanced connectivity features, prompting manufacturers to adapt their product portfolios. Merger and acquisition (M&A) activities are anticipated, with potential deal values exceeding several hundred million dollars as larger companies seek to consolidate their market position or acquire specialized technological expertise. Market share analysis reveals that leading companies command substantial portions of the revenue, driven by their established reputations and comprehensive product offerings in sectors like military and telecommunications. The innovation pipeline is robust, with an ongoing focus on next-generation GNSS reception and enhanced stability.

Timing Board Industry Trends & Insights

The Timing Board industry is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period of 2025–2033. This sustained expansion is fueled by the increasing demand for precise timekeeping across a multitude of sectors, driven by the relentless advancement of digital technologies. Market penetration is expanding as more industries recognize the critical role of accurate timing in their operations, from ensuring the integrity of financial transactions to enabling seamless communication networks and supporting the reliable operation of power grids. Technological disruptions are a constant feature, with advancements in Global Navigation Satellite System (GNSS) technologies, including GPS, BeiDou, Galileo, and GLONASS, leading to more accurate and resilient timing solutions. The integration of Artificial Intelligence (AI) and Machine Learning (ML) for predictive maintenance and error correction is also emerging as a key trend. Consumer preferences are shifting towards solutions offering higher accuracy, lower power consumption, and enhanced security features, particularly in military and critical infrastructure applications. Competitive dynamics are intense, with established global players and emerging regional manufacturers vying for market share through product differentiation, strategic partnerships, and aggressive pricing strategies. The demand for specialized timing boards, such as those incorporating dual-system capabilities for redundancy and improved accuracy, is on the rise. The overall market value is projected to reach several billion dollars by 2033, underscoring the strategic importance of this technology.

Dominant Markets & Segments in Timing Board

The Military application segment is a dominant force in the Timing Board market, driven by stringent requirements for battlefield synchronization, secure communications, and precision-guided systems. The economic policies supporting defense modernization and national security initiatives globally are key drivers in this segment. The Communication sector, encompassing telecommunications and broadcast, represents another significant market, with the proliferation of 5G networks and the increasing need for precise time alignment for base stations and network synchronization playing a crucial role. Infrastructure development in emerging economies further fuels this demand. The Power Industry, including smart grids and renewable energy integration, relies heavily on accurate timing for grid stability, load balancing, and fault detection, making it a rapidly growing segment. Economic policies aimed at modernizing energy infrastructure are a primary catalyst. The Financial Industry demonstrates a consistent demand for ultra-precise timing to ensure the integrity and compliance of high-frequency trading and transaction processing. Regulatory frameworks in this sector necessitate nanosecond-level accuracy.

In terms of Type, the Dual System Timing Board is gaining substantial traction due to its enhanced reliability and accuracy, offering redundancy by integrating multiple satellite constellations (e.g., GPS and BeiDou). This appeal is particularly strong in mission-critical applications where signal disruption or degradation is unacceptable. The GPS Timing Board continues to hold a significant market share, owing to its widespread adoption and established infrastructure, especially in regions where GPS is the primary or sole available GNSS. The BeiDou Timing Board is experiencing remarkable growth, particularly in Asia-Pacific, driven by national support, technological advancements, and its increasing integration into global navigation systems. Economic policies in China and broader geopolitical factors are significant drivers for BeiDou adoption.

Timing Board Product Developments

Recent product developments in the Timing Board market focus on enhanced accuracy, reduced power consumption, and increased resilience. Innovations include multi-constellation GNSS receivers offering superior signal acquisition and tracking, advanced rubidium oscillators for atomic clock-level precision, and compact form factors for easier integration. These boards are finding new applications in autonomous systems, quantum computing synchronization, and advanced scientific research. The competitive advantage lies in achieving sub-nanosecond accuracy with minimal drift, even in challenging electromagnetic environments, meeting the evolving demands of military, communication, and financial sectors.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Timing Board market across various segments to provide a comprehensive outlook. The Military application segment is expected to witness substantial growth, driven by defense spending and the need for secure, precise timing solutions, with an estimated market size of over a billion dollars and a projected CAGR of 9.0%. The Communication segment, including 5G and future wireless technologies, is also poised for significant expansion, with market sizes expected to exceed several billion dollars and a CAGR of approximately 8.0%. The Power Industry segment is projected to grow rapidly as smart grids become more prevalent, with market sizes potentially reaching several hundred million dollars and a CAGR of 7.5%. The Financial Industry will continue to demand high-precision timing, maintaining a stable growth trajectory with market sizes in the hundreds of millions and a CAGR of 6.5%. The Others segment, encompassing scientific research, transportation, and IoT, is expected to see diversified growth, with market sizes in the hundreds of millions and a CAGR of 7.0%. By Type, GPS Timing Boards will maintain a strong presence, while BeiDou Timing Boards will exhibit rapid growth, especially in Asia. Dual System Timing Boards will become increasingly critical for mission-critical applications, capturing significant market share with robust growth projections.

Key Drivers of Timing Board Growth

The growth of the Timing Board market is propelled by several key factors. Technological advancements in GNSS accuracy and reliability are fundamental, enabling more precise time synchronization. The exponential growth of the Internet of Things (IoT) and the rollout of 5G networks necessitate synchronized timing for seamless operation and data integrity. Increasing investments in critical infrastructure, such as smart grids and secure communication networks, by governments worldwide provide a significant impetus. Furthermore, stringent regulatory requirements in sectors like finance and defense mandating high-precision timing and synchronization directly contribute to market expansion. The demand for enhanced cybersecurity and data integrity also fuels the need for robust timing solutions.

Challenges in the Timing Board Sector

Despite strong growth, the Timing Board sector faces several challenges. Intense competition among established players and new entrants can lead to price wars and pressure on profit margins. Supply chain disruptions, particularly for critical components like high-precision oscillators and GNSS chipsets, can impact production and delivery timelines, potentially affecting market availability and increasing costs by tens of millions of dollars. Navigating complex and evolving regulatory landscapes across different regions requires significant investment in compliance and certification. The threat of alternative technologies, though often less capable for mission-critical tasks, can still pose a challenge in certain less demanding applications. Moreover, the skilled labor shortage for developing and manufacturing advanced timing hardware can also be a restraint.

Emerging Opportunities in Timing Board

Emerging opportunities in the Timing Board market are abundant, driven by ongoing technological evolution and expanding application areas. The increasing adoption of quantum computing technologies presents a significant opportunity for ultra-precise timing solutions. The growth of autonomous vehicles and advanced driver-assistance systems (ADAS) will require highly synchronized positioning and timing data. The expansion of satellite internet constellations and low Earth orbit (LEO) satellite networks also creates demand for robust timing boards. Furthermore, the integration of AI for enhanced timing performance and predictive maintenance offers new avenues for innovation and market differentiation, potentially opening up new revenue streams worth hundreds of millions of dollars.

Leading Players in the Timing Board Market

- Safran

- Unicore Communications

- HangZhou ZhongKe Microelectronics

- Trimble

- Telit

- Protempis

- Synergy Systems, LLC

- SkyTraq

- Chronos Technology

- Quectel Wireless Solutions

- LOCOSYS

- Hypertech

- u-blox

- Kaga FEI America

- Furuno

- Xi'an Synchrotron Electronic Technology Co., Ltd.

- Beijing Time&Frequency Technology

Key Developments in Timing Board Industry

- 2024 Q1: Launch of new multi-constellation GNSS timing boards with enhanced jamming and spoofing resistance by u-blox.

- 2024 Q1: Safran announces advancements in chip scale atomic clocks (CSACs) for improved size, weight, and power (SWaP) in timing solutions.

- 2023 Q4: Quectel Wireless Solutions introduces next-generation timing modules supporting dual-band GNSS for increased accuracy and reliability.

- 2023 Q4: Trimble collaborates with a major telecommunications provider to enhance 5G network synchronization with advanced timing solutions.

- 2023 Q3: HangZhou ZhongKe Microelectronics announces significant production capacity expansion for BeiDou timing modules.

- 2023 Q3: LOCOSYS introduces ruggedized timing boards designed for harsh industrial and automotive environments.

- 2023 Q2: Synergy Systems, LLC announces a strategic partnership to develop enhanced timing solutions for the power industry.

- 2023 Q1: Chronos Technology expands its portfolio of PNT (Positioning, Navigation, and Timing) testing and validation equipment.

Strategic Outlook for Timing Board Market

The strategic outlook for the Timing Board market is overwhelmingly positive, driven by an insatiable global demand for precise time synchronization across critical infrastructure and emerging technologies. Continued innovation in GNSS, coupled with advancements in alternative timing technologies like atomic clocks, will further solidify the market's growth trajectory. Key strategies for players will involve focusing on miniaturization, power efficiency, and enhanced cybersecurity features to capture market share in rapidly evolving sectors like IoT, 5G, and autonomous systems. Strategic partnerships and acquisitions will likely accelerate as companies aim to consolidate their technological capabilities and market reach. The increasing emphasis on resilient and redundant timing solutions presents a significant opportunity for companies offering dual-system and multi-constellation capabilities.

Timing Board Segmentation

-

1. Application

- 1.1. Military

- 1.2. Communication

- 1.3. Power Industry

- 1.4. Financial Industry

- 1.5. Others

-

2. Type

- 2.1. GPS Timing Board

- 2.2. BeiDou Timing Board

- 2.3. Dual System Timing Board

Timing Board Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Timing Board Regional Market Share

Geographic Coverage of Timing Board

Timing Board REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.33% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Timing Board Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Military

- 5.1.2. Communication

- 5.1.3. Power Industry

- 5.1.4. Financial Industry

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. GPS Timing Board

- 5.2.2. BeiDou Timing Board

- 5.2.3. Dual System Timing Board

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Timing Board Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Military

- 6.1.2. Communication

- 6.1.3. Power Industry

- 6.1.4. Financial Industry

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. GPS Timing Board

- 6.2.2. BeiDou Timing Board

- 6.2.3. Dual System Timing Board

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Timing Board Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Military

- 7.1.2. Communication

- 7.1.3. Power Industry

- 7.1.4. Financial Industry

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. GPS Timing Board

- 7.2.2. BeiDou Timing Board

- 7.2.3. Dual System Timing Board

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Timing Board Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Military

- 8.1.2. Communication

- 8.1.3. Power Industry

- 8.1.4. Financial Industry

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. GPS Timing Board

- 8.2.2. BeiDou Timing Board

- 8.2.3. Dual System Timing Board

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Timing Board Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Military

- 9.1.2. Communication

- 9.1.3. Power Industry

- 9.1.4. Financial Industry

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. GPS Timing Board

- 9.2.2. BeiDou Timing Board

- 9.2.3. Dual System Timing Board

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Timing Board Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Military

- 10.1.2. Communication

- 10.1.3. Power Industry

- 10.1.4. Financial Industry

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. GPS Timing Board

- 10.2.2. BeiDou Timing Board

- 10.2.3. Dual System Timing Board

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Safran

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Unicore Communications

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 HangZhou ZhongKe Microelectronics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Trimble

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Telit

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Protempis

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Synergy Systems LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SkyTraq

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Chronos Technology

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Quectel Wireless Solutions

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 LOCOSYS

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Hypertech

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 u-blox

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Kaga FEI America

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Furuno

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Xi'an Synchrotron Electronic Technology Co. Ltd.

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Beijing Time&Frequency Technology

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Safran

List of Figures

- Figure 1: Global Timing Board Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Timing Board Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Timing Board Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Timing Board Revenue (billion), by Type 2025 & 2033

- Figure 5: North America Timing Board Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Timing Board Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Timing Board Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Timing Board Revenue (billion), by Application 2025 & 2033

- Figure 9: South America Timing Board Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Timing Board Revenue (billion), by Type 2025 & 2033

- Figure 11: South America Timing Board Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Timing Board Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Timing Board Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Timing Board Revenue (billion), by Application 2025 & 2033

- Figure 15: Europe Timing Board Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Timing Board Revenue (billion), by Type 2025 & 2033

- Figure 17: Europe Timing Board Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Timing Board Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Timing Board Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Timing Board Revenue (billion), by Application 2025 & 2033

- Figure 21: Middle East & Africa Timing Board Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Timing Board Revenue (billion), by Type 2025 & 2033

- Figure 23: Middle East & Africa Timing Board Revenue Share (%), by Type 2025 & 2033

- Figure 24: Middle East & Africa Timing Board Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Timing Board Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Timing Board Revenue (billion), by Application 2025 & 2033

- Figure 27: Asia Pacific Timing Board Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Timing Board Revenue (billion), by Type 2025 & 2033

- Figure 29: Asia Pacific Timing Board Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Timing Board Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Timing Board Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Timing Board Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Timing Board Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Global Timing Board Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Timing Board Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Global Timing Board Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global Timing Board Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Timing Board Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Timing Board Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Timing Board Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Timing Board Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global Timing Board Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Global Timing Board Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Timing Board Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Timing Board Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Timing Board Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Timing Board Revenue billion Forecast, by Application 2020 & 2033

- Table 17: Global Timing Board Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Global Timing Board Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Timing Board Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Timing Board Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Timing Board Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Timing Board Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Timing Board Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Timing Board Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Timing Board Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Timing Board Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Timing Board Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Timing Board Revenue billion Forecast, by Application 2020 & 2033

- Table 29: Global Timing Board Revenue billion Forecast, by Type 2020 & 2033

- Table 30: Global Timing Board Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Timing Board Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Timing Board Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Timing Board Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Timing Board Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Timing Board Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Timing Board Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Timing Board Revenue billion Forecast, by Application 2020 & 2033

- Table 38: Global Timing Board Revenue billion Forecast, by Type 2020 & 2033

- Table 39: Global Timing Board Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Timing Board Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Timing Board Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Timing Board Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Timing Board Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Timing Board Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Timing Board Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Timing Board Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Timing Board?

The projected CAGR is approximately 11.33%.

2. Which companies are prominent players in the Timing Board?

Key companies in the market include Safran, Unicore Communications, HangZhou ZhongKe Microelectronics, Trimble, Telit, Protempis, Synergy Systems, LLC, SkyTraq, Chronos Technology, Quectel Wireless Solutions, LOCOSYS, Hypertech, u-blox, Kaga FEI America, Furuno, Xi'an Synchrotron Electronic Technology Co., Ltd., Beijing Time&Frequency Technology.

3. What are the main segments of the Timing Board?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.22 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Timing Board," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Timing Board report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Timing Board?

To stay informed about further developments, trends, and reports in the Timing Board, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence