Key Insights

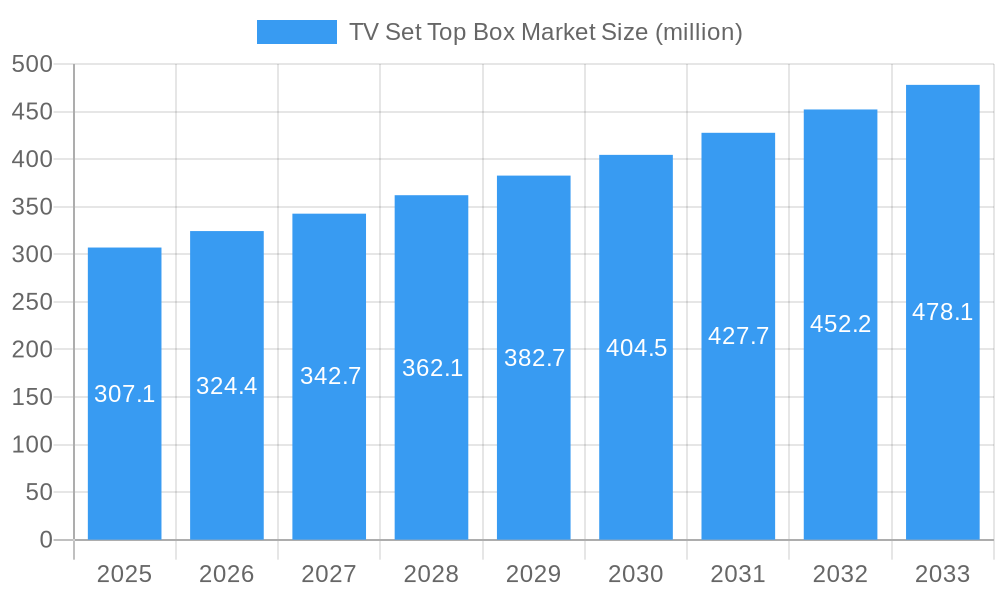

The global TV Set-Top Box (STB) market is poised for significant expansion, projected to reach USD 307.1 million by 2025, and is expected to grow at a robust Compound Annual Growth Rate (CAGR) of 5.54% from 2019 to 2033. This growth is primarily fueled by the increasing demand for enhanced viewing experiences, including High-Definition (HD) and Ultra-High Definition (UHD) content, which necessitates advanced STB technology. The proliferation of subscription-based content and the ongoing digital transformation of television services across emerging and developed economies are key drivers. Furthermore, government initiatives promoting digital broadcasting and the expanding internet infrastructure are creating new opportunities for market players. The market is segmented by technology into Satellite/DTH, IPTV, Cable, and other types like DTT, catering to diverse consumer preferences and existing infrastructure. Similarly, segmentation by resolution, including SD, HD, and Ultra-HD and Higher, highlights the market's adaptation to evolving consumer expectations for superior visual clarity.

TV Set Top Box Market Market Size (In Million)

The competitive landscape is characterized by the presence of established players and innovative newcomers, each striving to capture market share through technological advancements and strategic partnerships. Key companies like ARRIS International PLC (CommScope Inc), Evolution Digital LLC, HUMAX Electronics Co Ltd, and ZTE Corporation are actively involved in developing next-generation STBs that support advanced features such as 4K resolution, HDR, and integrated smart functionalities. While the market is experiencing strong growth, potential restraints include the rising adoption of smart TVs with built-in capabilities, which could reduce the reliance on external set-top boxes in some segments. However, the continued evolution of content delivery platforms and the need for sophisticated signal processing and conditional access systems are expected to sustain the demand for advanced STBs, particularly in regions with a strong cable and satellite infrastructure. North America and Europe are anticipated to lead in terms of market value due to high disposable incomes and advanced technological adoption, while Asia, particularly India, presents significant growth potential driven by a large population and increasing digitalization efforts.

TV Set Top Box Market Company Market Share

Global TV Set Top Box Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a detailed analysis of the global TV Set Top Box market, offering critical insights into market dynamics, growth drivers, challenges, and future opportunities. Covering the historical period from 2019 to 2024 and projecting trends through 2033, this study is an essential resource for industry stakeholders, including manufacturers, service providers, investors, and policymakers seeking to understand the evolving landscape of digital television delivery. The report leverages high-traffic keywords such as "TV Set Top Box," "Digital TV," "IPTV Box," "Satellite Receiver," "Android TV Box," and "4K Set Top Box" to ensure maximum search visibility.

TV Set Top Box Market Market Concentration & Innovation

The global TV Set Top Box market exhibits a moderate level of concentration, with a few key players dominating a significant portion of the market share. ARRIS International PLC (CommScope Inc) and ZTE Corporation are consistently leading the market. Innovation in the set-top box sector is primarily driven by the increasing demand for enhanced viewing experiences, including higher resolutions (Ultra HD), smart features, and seamless integration with Over-The-Top (OTT) content platforms. Regulatory frameworks, such as digital switchover mandates and spectrum allocation policies, also play a crucial role in shaping market dynamics and adoption rates. Product substitutes, including smart TVs with integrated tuners and streaming devices, present a growing challenge. However, the continued need for reliable signal reception and advanced functionalities in specific markets ensures the enduring relevance of set-top boxes. End-user trends are increasingly shifting towards hybrid boxes that offer both traditional broadcast and internet-based content. Mergers and acquisitions (M&A) activities are notable, with companies seeking to consolidate market presence and expand their product portfolios. For instance, CommScope's acquisition of ARRIS has significantly strengthened its position in the connected home and set-top box market. Estimated M&A deal values in this sector often run into hundreds of millions of dollars, underscoring strategic investments in technology and market access.

- Key Innovation Drivers:

- Demand for 4K/Ultra HD and High Dynamic Range (HDR) content.

- Integration of Artificial Intelligence (AI) and voice control features.

- Hybrid functionality supporting both DTT/Satellite and IPTV/OTT services.

- Development of 5G-enabled set-top boxes for faster streaming.

- M&A Activity:

- Strategic acquisitions to gain market share and technological capabilities.

- Focus on companies with strong software and content integration expertise.

TV Set Top Box Market Industry Trends & Insights

The global TV Set Top Box market is experiencing robust growth, fueled by a confluence of technological advancements, evolving consumer preferences, and strategic industry developments. The compound annual growth rate (CAGR) for the market is projected to be approximately 5.8% during the forecast period. A significant market penetration of digital broadcasting across various regions, driven by government initiatives and the phasing out of analog television, is a primary growth catalyst. The increasing adoption of High Definition (HD) and Ultra-High Definition (Ultra-HD) content is compelling consumers to upgrade their existing set-top boxes, thereby driving demand for advanced models. The proliferation of broadband internet services globally is also a key enabler for the growth of Internet Protocol Television (IPTV) set-top boxes, offering a more interactive and personalized viewing experience.

Technological disruptions are characterized by the rapid evolution of smart TV capabilities and the integration of AI and machine learning into set-top boxes. This allows for personalized content recommendations, voice-activated controls, and seamless access to a vast array of streaming services and applications. Consumer preferences are increasingly leaning towards hybrid set-top boxes that consolidate traditional linear TV channels with on-demand OTT content, offering a unified entertainment hub. The convenience of accessing diverse content libraries through a single device is a major selling point.

Competitive dynamics within the industry are intense, with established players continually innovating and emerging companies challenging the status quo with disruptive technologies. Partnerships between set-top box manufacturers, content providers, and internet service providers (ISPs) are becoming crucial for expanding market reach and offering bundled services. The shift towards cloud-based solutions and the development of more energy-efficient devices are also shaping industry trends. The market size for TV Set Top Boxes is estimated to reach over $25,000 million by 2033, with significant contributions from emerging economies due to increasing digitalization and disposable incomes.

Dominant Markets & Segments in TV Set Top Box Market

The global TV Set Top Box market is characterized by distinct regional dominance and segment preferences, driven by varying economic conditions, regulatory landscapes, and consumer adoption patterns.

Dominant Technology Segment:

- Satellite/DTH (Direct-To-Home): Historically a dominant segment, Satellite/DTH continues to hold significant market share in regions with widespread satellite dish penetration and where terrestrial infrastructure is less developed. Countries in Asia, Africa, and parts of Latin America heavily rely on DTH for television reception. The affordability and wide coverage of satellite broadcasting make it a preferred choice for a large consumer base. Economic policies supporting digital migration and the availability of cost-effective satellite receivers contribute to its sustained dominance in these regions.

- IPTV (Internet Protocol Television): This segment is experiencing rapid growth, particularly in developed economies with high-speed broadband penetration. The ability to deliver a rich, interactive, and personalized viewing experience, including Video on Demand (VOD) and live streaming of multiple channels over the internet, makes IPTV increasingly attractive. Key drivers include technological advancements in network infrastructure, the growing popularity of OTT content, and the bundling of IPTV services with broadband packages by telecommunication companies.

- Cable: The traditional Cable TV segment remains strong in many urbanized areas globally, particularly where robust cable networks are already established. Cable operators are increasingly investing in digital upgrades, offering high-definition channels and interactive services to compete with other technologies. Regulatory frameworks supporting cable infrastructure development and the established subscriber base contribute to its continued presence.

- Other Types (DTT - Digital Terrestrial Television): DTT has gained significant traction in countries undergoing digital switchover from analog broadcasting. It offers a cost-effective solution for delivering free-to-air digital channels over the air. Government mandates and the availability of digital terrestrial transmitters are key drivers for this segment.

Dominant Resolution Segment:

- HD (High Definition): HD resolution remains the most prevalent segment, offering a significant upgrade from Standard Definition (SD) and providing a clear and sharp viewing experience. Its widespread adoption is driven by content availability, affordability of HD-enabled TVs and set-top boxes, and consumer demand for improved picture quality.

- Ultra-HD and Higher: This segment is experiencing the fastest growth. The increasing availability of 4K Ultra HD content and the demand for cinematic viewing experiences at home are propelling the adoption of Ultra-HD set-top boxes. As the cost of Ultra-HD TVs and content continues to decline, this segment is expected to capture a larger market share in the coming years. Economic policies promoting technological adoption and consumer desire for premium entertainment experiences are key drivers.

Geographical Dominance:

- Asia Pacific: This region is a significant market for TV Set Top Boxes, driven by its large population, increasing disposable incomes, and rapid digitalization efforts. Countries like India and China are major consumers of DTH and IPTV set-top boxes, fueled by government initiatives for digital broadcasting and the growing demand for affordable entertainment solutions.

- North America and Europe: These regions are characterized by a high penetration of advanced set-top boxes, including IPTV and Ultra-HD models, due to well-established broadband infrastructure and a strong consumer appetite for high-quality, feature-rich entertainment.

TV Set Top Box Market Product Developments

Product development in the TV Set Top Box market is rapidly evolving to meet the escalating consumer demand for immersive and versatile entertainment experiences. Key innovations focus on enhancing user interfaces, integrating AI-powered features, and supporting the latest video and audio standards. Manufacturers are increasingly developing hybrid set-top boxes that seamlessly blend traditional broadcast reception (Satellite, Cable, DTT) with advanced internet-based services like IPTV and OTT streaming. The push towards higher resolutions, such as 4K Ultra HD and even 8K in some high-end models, coupled with High Dynamic Range (HDR) support, is becoming a standard feature. Furthermore, the integration of voice control, smart home connectivity, and the Android TV operating system are key competitive advantages, offering users a unified platform for content discovery and device management. These developments aim to provide superior performance, ease of use, and a richer content ecosystem for consumers.

Report Scope & Segmentation Analysis

This comprehensive report segments the global TV Set Top Box market across two primary dimensions: Technology and Resolution. The Technology segmentation includes: Satellite/DTH, IPTV, Cable, and Other Types (DTT). The Resolution segmentation encompasses: SD (Standard Definition), HD (High Definition), and Ultra-HD and Higher.

- Satellite/DTH: This segment is expected to maintain a significant market presence, particularly in emerging economies, due to its extensive reach and established infrastructure. Growth projections are moderate, with an estimated market size of over $6,000 million by 2033. Competitive dynamics are driven by service providers offering bundled packages.

- IPTV: This segment is projected to witness the highest growth rate, driven by increasing broadband penetration and the demand for on-demand content. The market size is expected to exceed $10,000 million by 2033, with intense competition among telecom operators and technology providers.

- Cable: While mature in some regions, the Cable segment is adapting through digital upgrades, contributing to steady growth. Market size is estimated to be around $5,000 million by 2033. Competitive strategies involve offering advanced features and bundled services.

- Other Types (DTT): This segment's growth is tied to digital switchover initiatives, showing regional variations. Market size is anticipated to be around $2,000 million by 2033, with government policies playing a crucial role.

- SD: This segment is declining as consumers upgrade to higher resolutions, with minimal projected growth.

- HD: HD resolution remains a dominant segment, with steady growth expected as it becomes the standard for most broadcast and streaming content. Market size is estimated at over $15,000 million by 2033.

- Ultra-HD and Higher: This segment is poised for substantial growth, driven by increasing content availability and consumer demand for premium visual experiences. Market size is projected to exceed $8,000 million by 2033.

Key Drivers of TV Set Top Box Market Growth

Several key factors are driving the growth of the global TV Set Top Box market. The ongoing digital migration from analog to digital broadcasting across numerous countries is a primary catalyst, compelling consumers to adopt digital set-top boxes. The escalating demand for high-quality video content, specifically High Definition (HD) and Ultra-High Definition (Ultra-HD), is creating a need for advanced set-top boxes capable of supporting these resolutions. Furthermore, the rapid expansion of broadband internet infrastructure globally is fueling the growth of IPTV and Over-The-Top (OTT) streaming services, thereby increasing the demand for smart and hybrid set-top boxes that can seamlessly integrate these offerings. Government initiatives promoting digital television adoption and the decreasing cost of technology also contribute significantly to market expansion.

Challenges in the TV Set Top Box Market Sector

Despite the positive growth trajectory, the TV Set Top Box market faces several challenges. The increasing integration of smart TV functionalities directly into television sets poses a significant threat, potentially reducing the need for standalone set-top boxes for some consumers. Competition from a wide range of streaming devices and dongles also presents a hurdle, offering alternative and often more flexible content consumption options. Regulatory complexities and varying standards across different regions can complicate market entry and product development. Furthermore, supply chain disruptions, as witnessed in recent years, can impact manufacturing timelines and component availability, leading to increased costs. The ongoing transition to internet-based content delivery also necessitates continuous innovation and investment from set-top box manufacturers to remain competitive.

Emerging Opportunities in TV Set Top Box Market

The TV Set Top Box market is ripe with emerging opportunities driven by technological advancements and evolving consumer behavior. The increasing demand for hybrid set-top boxes, which seamlessly integrate traditional broadcast television with IPTV and OTT streaming services, presents a significant avenue for growth. The expansion of 5G networks offers opportunities for developing next-generation set-top boxes capable of delivering ultra-low latency and high-speed streaming experiences. Furthermore, the integration of Artificial Intelligence (AI) and Machine Learning (ML) into set-top boxes for personalized content recommendations, voice control, and smart home integration opens new frontiers. Growing disposable incomes and increasing digitalization in emerging economies present substantial untapped market potential. Opportunities also lie in developing specialized set-top boxes for niche applications, such as enterprise solutions or hospitality sectors.

Leading Players in the TV Set Top Box Market Market

- ARRIS International PLC (CommScope Inc)

- Evolution Digital LLC

- HUMAX Electronics Co Ltd

- Intek Digital Inc

- Gospell Digital Technology Co Limited

- Shenzhen SDMC Technology Co Ltd

- Shenzhen Coship Electronics Co Ltd

- Sagemcom SAS

- ZTE Corporation

- Skyworth Digital Ltd

- Kaon Media Co Limited

- Technicolor SA

Key Developments in TV Set Top Box Market Industry

- March 2022: GTPL Hathway Limited introduced the GTPL Genie, a Hybrid Android TV Set Top Box, offering integrated Live TV and OTT channels at an attractive bulk price. This product blends traditional cable TV with contemporary features, allowing customers to access popular OTT app content on their existing TV screens.

- February 2022: ZTE Corporation announced the launch of the ZXV10 B960GV1 next-generation 5G media gateway set-top box (STB), powered by Android TV, at Mobile World Congress (MWC) 2022. This device is designed to deliver fast, stable, and low-latency video experiences, combining gigabit gateway, router, and set-top box functionalities to offer gigabit speed access and 4K UHD video services.

Strategic Outlook for TV Set Top Box Market Market

The strategic outlook for the TV Set Top Box market is optimistic, driven by the continuous evolution of digital television and entertainment consumption. The increasing convergence of broadcast and internet-based content delivery necessitates innovative solutions that cater to the demand for a unified and seamless user experience. Companies that focus on developing hybrid set-top boxes with advanced smart features, robust connectivity options, and intuitive user interfaces will be well-positioned for growth. Strategic partnerships with content providers, telecommunication companies, and chip manufacturers will be crucial for expanding market reach and enhancing product offerings. Furthermore, the ongoing development of next-generation technologies like 5G and AI will unlock new opportunities for creating more intelligent and personalized entertainment platforms, ensuring the continued relevance and growth of the TV Set Top Box market in the years to come.

TV Set Top Box Market Segmentation

-

1. Technology

- 1.1. Satellite/DTH

- 1.2. IPTV

- 1.3. Cable

- 1.4. Other Types (DTT)

-

2. Resolution

- 2.1. SD

- 2.2. HD

- 2.3. Ultra-HD and Higher

TV Set Top Box Market Segmentation By Geography

- 1. North America

- 2. Europe

-

3. Asia

- 3.1. India

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

TV Set Top Box Market Regional Market Share

Geographic Coverage of TV Set Top Box Market

TV Set Top Box Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Levels of Technological Innovations; Increasing Adoption of Set-Top Boxes in the Emerging Markets; Deployment of OS-based Devices

- 3.3. Market Restrains

- 3.3.1. Growing Online OTT Services/Platform

- 3.4. Market Trends

- 3.4.1. HD Resolution Held the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global TV Set Top Box Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Satellite/DTH

- 5.1.2. IPTV

- 5.1.3. Cable

- 5.1.4. Other Types (DTT)

- 5.2. Market Analysis, Insights and Forecast - by Resolution

- 5.2.1. SD

- 5.2.2. HD

- 5.2.3. Ultra-HD and Higher

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America TV Set Top Box Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Satellite/DTH

- 6.1.2. IPTV

- 6.1.3. Cable

- 6.1.4. Other Types (DTT)

- 6.2. Market Analysis, Insights and Forecast - by Resolution

- 6.2.1. SD

- 6.2.2. HD

- 6.2.3. Ultra-HD and Higher

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe TV Set Top Box Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Satellite/DTH

- 7.1.2. IPTV

- 7.1.3. Cable

- 7.1.4. Other Types (DTT)

- 7.2. Market Analysis, Insights and Forecast - by Resolution

- 7.2.1. SD

- 7.2.2. HD

- 7.2.3. Ultra-HD and Higher

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia TV Set Top Box Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Satellite/DTH

- 8.1.2. IPTV

- 8.1.3. Cable

- 8.1.4. Other Types (DTT)

- 8.2. Market Analysis, Insights and Forecast - by Resolution

- 8.2.1. SD

- 8.2.2. HD

- 8.2.3. Ultra-HD and Higher

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Australia and New Zealand TV Set Top Box Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Satellite/DTH

- 9.1.2. IPTV

- 9.1.3. Cable

- 9.1.4. Other Types (DTT)

- 9.2. Market Analysis, Insights and Forecast - by Resolution

- 9.2.1. SD

- 9.2.2. HD

- 9.2.3. Ultra-HD and Higher

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Latin America TV Set Top Box Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Satellite/DTH

- 10.1.2. IPTV

- 10.1.3. Cable

- 10.1.4. Other Types (DTT)

- 10.2. Market Analysis, Insights and Forecast - by Resolution

- 10.2.1. SD

- 10.2.2. HD

- 10.2.3. Ultra-HD and Higher

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Middle East and Africa TV Set Top Box Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 11.1.1. Satellite/DTH

- 11.1.2. IPTV

- 11.1.3. Cable

- 11.1.4. Other Types (DTT)

- 11.2. Market Analysis, Insights and Forecast - by Resolution

- 11.2.1. SD

- 11.2.2. HD

- 11.2.3. Ultra-HD and Higher

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 ARRIS International PLC (CommScope Inc )

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Evolution Digital LLC

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 HUMAX Electronics Co Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Intek Digital Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Gospell Digital Technology Co Limited

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Shenzhen SDMC Technology Co Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Shenzhen Coship Electronics Co Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Sagemcom SAS

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 ZTE Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Skyworth Digital Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Kaon Media Co Limited

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Technicolor SA

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 ARRIS International PLC (CommScope Inc )

List of Figures

- Figure 1: Global TV Set Top Box Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Global TV Set Top Box Market Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North America TV Set Top Box Market Revenue (million), by Technology 2025 & 2033

- Figure 4: North America TV Set Top Box Market Volume (K Units), by Technology 2025 & 2033

- Figure 5: North America TV Set Top Box Market Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America TV Set Top Box Market Volume Share (%), by Technology 2025 & 2033

- Figure 7: North America TV Set Top Box Market Revenue (million), by Resolution 2025 & 2033

- Figure 8: North America TV Set Top Box Market Volume (K Units), by Resolution 2025 & 2033

- Figure 9: North America TV Set Top Box Market Revenue Share (%), by Resolution 2025 & 2033

- Figure 10: North America TV Set Top Box Market Volume Share (%), by Resolution 2025 & 2033

- Figure 11: North America TV Set Top Box Market Revenue (million), by Country 2025 & 2033

- Figure 12: North America TV Set Top Box Market Volume (K Units), by Country 2025 & 2033

- Figure 13: North America TV Set Top Box Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America TV Set Top Box Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe TV Set Top Box Market Revenue (million), by Technology 2025 & 2033

- Figure 16: Europe TV Set Top Box Market Volume (K Units), by Technology 2025 & 2033

- Figure 17: Europe TV Set Top Box Market Revenue Share (%), by Technology 2025 & 2033

- Figure 18: Europe TV Set Top Box Market Volume Share (%), by Technology 2025 & 2033

- Figure 19: Europe TV Set Top Box Market Revenue (million), by Resolution 2025 & 2033

- Figure 20: Europe TV Set Top Box Market Volume (K Units), by Resolution 2025 & 2033

- Figure 21: Europe TV Set Top Box Market Revenue Share (%), by Resolution 2025 & 2033

- Figure 22: Europe TV Set Top Box Market Volume Share (%), by Resolution 2025 & 2033

- Figure 23: Europe TV Set Top Box Market Revenue (million), by Country 2025 & 2033

- Figure 24: Europe TV Set Top Box Market Volume (K Units), by Country 2025 & 2033

- Figure 25: Europe TV Set Top Box Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe TV Set Top Box Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia TV Set Top Box Market Revenue (million), by Technology 2025 & 2033

- Figure 28: Asia TV Set Top Box Market Volume (K Units), by Technology 2025 & 2033

- Figure 29: Asia TV Set Top Box Market Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Asia TV Set Top Box Market Volume Share (%), by Technology 2025 & 2033

- Figure 31: Asia TV Set Top Box Market Revenue (million), by Resolution 2025 & 2033

- Figure 32: Asia TV Set Top Box Market Volume (K Units), by Resolution 2025 & 2033

- Figure 33: Asia TV Set Top Box Market Revenue Share (%), by Resolution 2025 & 2033

- Figure 34: Asia TV Set Top Box Market Volume Share (%), by Resolution 2025 & 2033

- Figure 35: Asia TV Set Top Box Market Revenue (million), by Country 2025 & 2033

- Figure 36: Asia TV Set Top Box Market Volume (K Units), by Country 2025 & 2033

- Figure 37: Asia TV Set Top Box Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia TV Set Top Box Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Australia and New Zealand TV Set Top Box Market Revenue (million), by Technology 2025 & 2033

- Figure 40: Australia and New Zealand TV Set Top Box Market Volume (K Units), by Technology 2025 & 2033

- Figure 41: Australia and New Zealand TV Set Top Box Market Revenue Share (%), by Technology 2025 & 2033

- Figure 42: Australia and New Zealand TV Set Top Box Market Volume Share (%), by Technology 2025 & 2033

- Figure 43: Australia and New Zealand TV Set Top Box Market Revenue (million), by Resolution 2025 & 2033

- Figure 44: Australia and New Zealand TV Set Top Box Market Volume (K Units), by Resolution 2025 & 2033

- Figure 45: Australia and New Zealand TV Set Top Box Market Revenue Share (%), by Resolution 2025 & 2033

- Figure 46: Australia and New Zealand TV Set Top Box Market Volume Share (%), by Resolution 2025 & 2033

- Figure 47: Australia and New Zealand TV Set Top Box Market Revenue (million), by Country 2025 & 2033

- Figure 48: Australia and New Zealand TV Set Top Box Market Volume (K Units), by Country 2025 & 2033

- Figure 49: Australia and New Zealand TV Set Top Box Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Australia and New Zealand TV Set Top Box Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America TV Set Top Box Market Revenue (million), by Technology 2025 & 2033

- Figure 52: Latin America TV Set Top Box Market Volume (K Units), by Technology 2025 & 2033

- Figure 53: Latin America TV Set Top Box Market Revenue Share (%), by Technology 2025 & 2033

- Figure 54: Latin America TV Set Top Box Market Volume Share (%), by Technology 2025 & 2033

- Figure 55: Latin America TV Set Top Box Market Revenue (million), by Resolution 2025 & 2033

- Figure 56: Latin America TV Set Top Box Market Volume (K Units), by Resolution 2025 & 2033

- Figure 57: Latin America TV Set Top Box Market Revenue Share (%), by Resolution 2025 & 2033

- Figure 58: Latin America TV Set Top Box Market Volume Share (%), by Resolution 2025 & 2033

- Figure 59: Latin America TV Set Top Box Market Revenue (million), by Country 2025 & 2033

- Figure 60: Latin America TV Set Top Box Market Volume (K Units), by Country 2025 & 2033

- Figure 61: Latin America TV Set Top Box Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Latin America TV Set Top Box Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Middle East and Africa TV Set Top Box Market Revenue (million), by Technology 2025 & 2033

- Figure 64: Middle East and Africa TV Set Top Box Market Volume (K Units), by Technology 2025 & 2033

- Figure 65: Middle East and Africa TV Set Top Box Market Revenue Share (%), by Technology 2025 & 2033

- Figure 66: Middle East and Africa TV Set Top Box Market Volume Share (%), by Technology 2025 & 2033

- Figure 67: Middle East and Africa TV Set Top Box Market Revenue (million), by Resolution 2025 & 2033

- Figure 68: Middle East and Africa TV Set Top Box Market Volume (K Units), by Resolution 2025 & 2033

- Figure 69: Middle East and Africa TV Set Top Box Market Revenue Share (%), by Resolution 2025 & 2033

- Figure 70: Middle East and Africa TV Set Top Box Market Volume Share (%), by Resolution 2025 & 2033

- Figure 71: Middle East and Africa TV Set Top Box Market Revenue (million), by Country 2025 & 2033

- Figure 72: Middle East and Africa TV Set Top Box Market Volume (K Units), by Country 2025 & 2033

- Figure 73: Middle East and Africa TV Set Top Box Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: Middle East and Africa TV Set Top Box Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global TV Set Top Box Market Revenue million Forecast, by Technology 2020 & 2033

- Table 2: Global TV Set Top Box Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 3: Global TV Set Top Box Market Revenue million Forecast, by Resolution 2020 & 2033

- Table 4: Global TV Set Top Box Market Volume K Units Forecast, by Resolution 2020 & 2033

- Table 5: Global TV Set Top Box Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Global TV Set Top Box Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Global TV Set Top Box Market Revenue million Forecast, by Technology 2020 & 2033

- Table 8: Global TV Set Top Box Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 9: Global TV Set Top Box Market Revenue million Forecast, by Resolution 2020 & 2033

- Table 10: Global TV Set Top Box Market Volume K Units Forecast, by Resolution 2020 & 2033

- Table 11: Global TV Set Top Box Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: Global TV Set Top Box Market Volume K Units Forecast, by Country 2020 & 2033

- Table 13: Global TV Set Top Box Market Revenue million Forecast, by Technology 2020 & 2033

- Table 14: Global TV Set Top Box Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 15: Global TV Set Top Box Market Revenue million Forecast, by Resolution 2020 & 2033

- Table 16: Global TV Set Top Box Market Volume K Units Forecast, by Resolution 2020 & 2033

- Table 17: Global TV Set Top Box Market Revenue million Forecast, by Country 2020 & 2033

- Table 18: Global TV Set Top Box Market Volume K Units Forecast, by Country 2020 & 2033

- Table 19: Global TV Set Top Box Market Revenue million Forecast, by Technology 2020 & 2033

- Table 20: Global TV Set Top Box Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 21: Global TV Set Top Box Market Revenue million Forecast, by Resolution 2020 & 2033

- Table 22: Global TV Set Top Box Market Volume K Units Forecast, by Resolution 2020 & 2033

- Table 23: Global TV Set Top Box Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: Global TV Set Top Box Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: India TV Set Top Box Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: India TV Set Top Box Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 27: Global TV Set Top Box Market Revenue million Forecast, by Technology 2020 & 2033

- Table 28: Global TV Set Top Box Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 29: Global TV Set Top Box Market Revenue million Forecast, by Resolution 2020 & 2033

- Table 30: Global TV Set Top Box Market Volume K Units Forecast, by Resolution 2020 & 2033

- Table 31: Global TV Set Top Box Market Revenue million Forecast, by Country 2020 & 2033

- Table 32: Global TV Set Top Box Market Volume K Units Forecast, by Country 2020 & 2033

- Table 33: Global TV Set Top Box Market Revenue million Forecast, by Technology 2020 & 2033

- Table 34: Global TV Set Top Box Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 35: Global TV Set Top Box Market Revenue million Forecast, by Resolution 2020 & 2033

- Table 36: Global TV Set Top Box Market Volume K Units Forecast, by Resolution 2020 & 2033

- Table 37: Global TV Set Top Box Market Revenue million Forecast, by Country 2020 & 2033

- Table 38: Global TV Set Top Box Market Volume K Units Forecast, by Country 2020 & 2033

- Table 39: Global TV Set Top Box Market Revenue million Forecast, by Technology 2020 & 2033

- Table 40: Global TV Set Top Box Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 41: Global TV Set Top Box Market Revenue million Forecast, by Resolution 2020 & 2033

- Table 42: Global TV Set Top Box Market Volume K Units Forecast, by Resolution 2020 & 2033

- Table 43: Global TV Set Top Box Market Revenue million Forecast, by Country 2020 & 2033

- Table 44: Global TV Set Top Box Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the TV Set Top Box Market?

The projected CAGR is approximately 5.54%.

2. Which companies are prominent players in the TV Set Top Box Market?

Key companies in the market include ARRIS International PLC (CommScope Inc ), Evolution Digital LLC, HUMAX Electronics Co Ltd, Intek Digital Inc, Gospell Digital Technology Co Limited, Shenzhen SDMC Technology Co Ltd, Shenzhen Coship Electronics Co Ltd, Sagemcom SAS, ZTE Corporation, Skyworth Digital Ltd, Kaon Media Co Limited, Technicolor SA.

3. What are the main segments of the TV Set Top Box Market?

The market segments include Technology, Resolution.

4. Can you provide details about the market size?

The market size is estimated to be USD 307.1 million as of 2022.

5. What are some drivers contributing to market growth?

High Levels of Technological Innovations; Increasing Adoption of Set-Top Boxes in the Emerging Markets; Deployment of OS-based Devices.

6. What are the notable trends driving market growth?

HD Resolution Held the Largest Market Share.

7. Are there any restraints impacting market growth?

Growing Online OTT Services/Platform.

8. Can you provide examples of recent developments in the market?

March 2022 - The GTPL Genie, a Hybrid Android TV Set Top Box, which provides easy Live TV and OTT channels at an attractive bulk price, was introduced by GTPL Hathway Limited (GTPL), a leading supplier of digital cable TV and broadband service in India. GTPL Genie blends the strength of classic Cable TV with contemporary features and a customizable environment to offer a wide variety of content in OTT entertainment apps. Customers can now watch popular OTT app material on their existing TV screen in addition to line TV channels as part of GTPL Genie's expansion of its "Connection Dil Se" offer.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "TV Set Top Box Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the TV Set Top Box Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the TV Set Top Box Market?

To stay informed about further developments, trends, and reports in the TV Set Top Box Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence