Key Insights

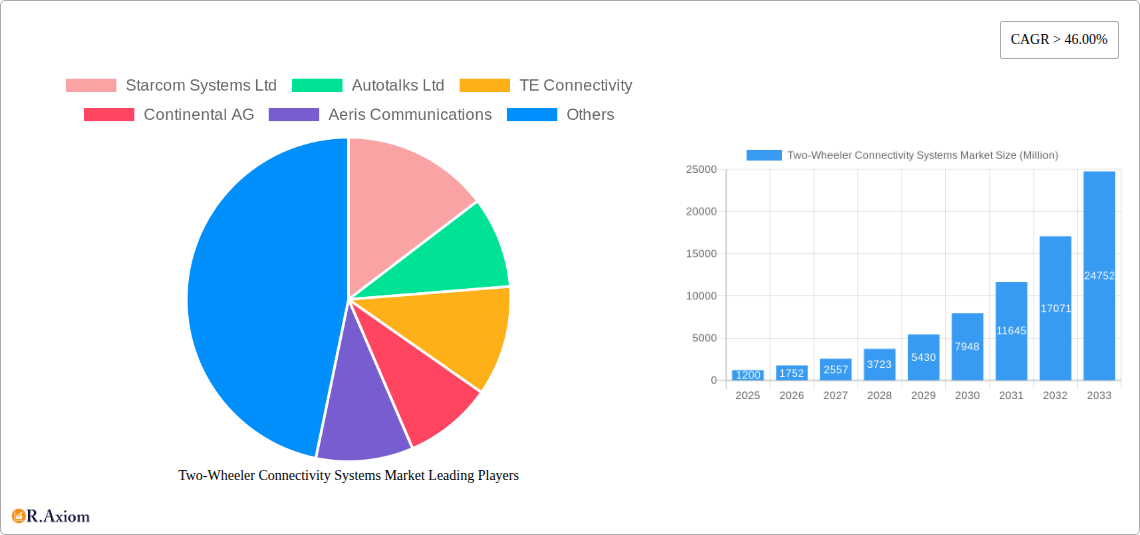

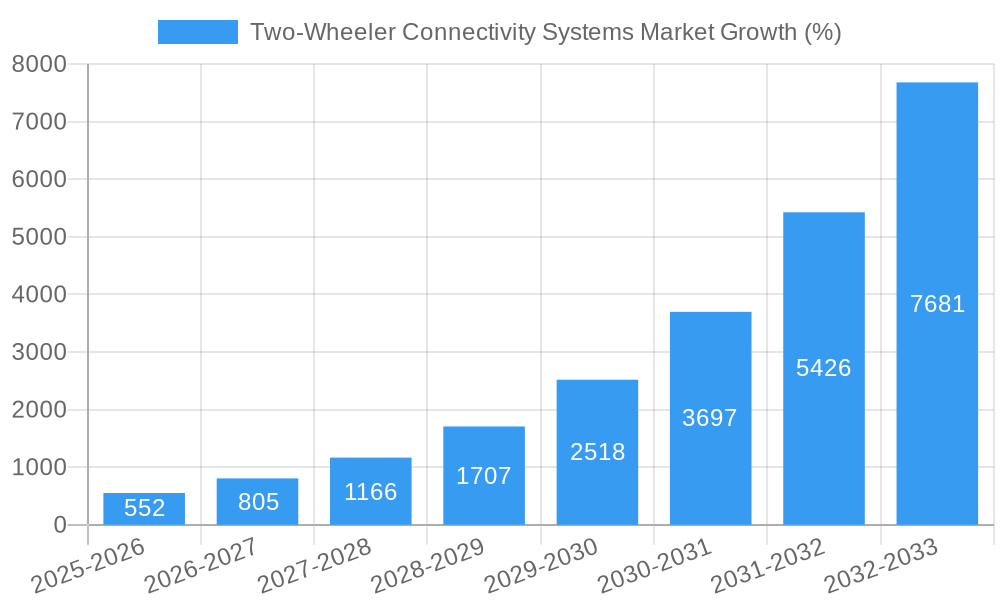

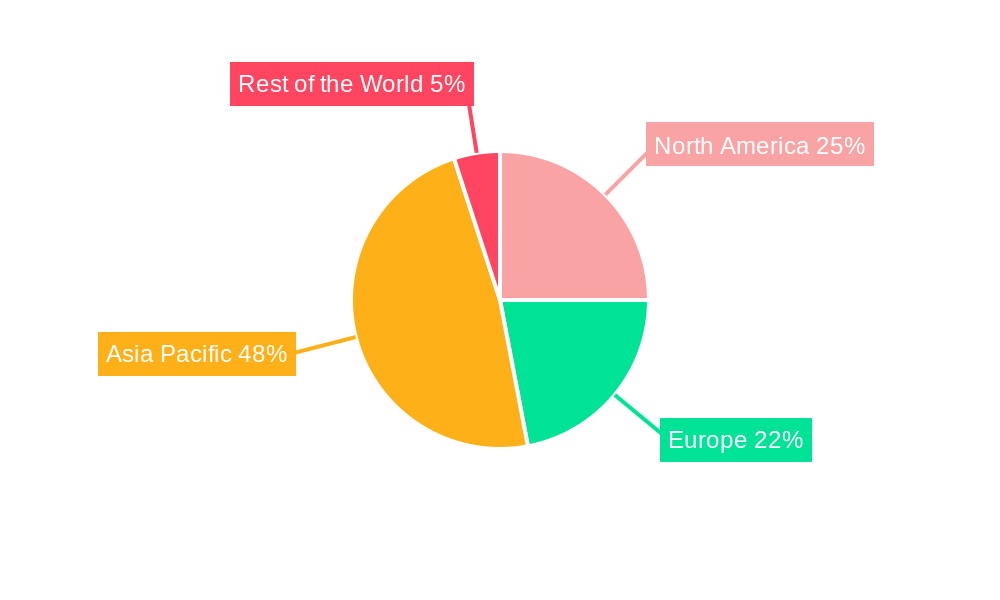

The Two-Wheeler Connectivity Systems market is experiencing robust growth, projected to exceed a market size of $15 billion by 2033, fueled by a remarkable Compound Annual Growth Rate (CAGR) of over 46% from 2025 to 2033. This expansion is driven by several key factors. Increasing consumer demand for enhanced safety features, such as anti-theft systems and emergency SOS functionalities, is a primary driver. The integration of infotainment systems, offering navigation, music streaming, and connectivity with smartphones, significantly boosts user experience and market appeal. Furthermore, the burgeoning adoption of electric two-wheelers further fuels market growth, as these vehicles inherently require sophisticated connectivity solutions for battery management, remote diagnostics, and over-the-air updates. The market segmentation reveals strong growth across all feature types (driver assistance, safety, vehicle management, and infotainment), with Vehicle-to-Everything (V2X) communication technologies showing particularly promising potential. Geographic analysis indicates strong growth in Asia-Pacific, driven by the large and rapidly expanding two-wheeler market in countries like India and China. North America and Europe also contribute significantly, driven by advanced safety regulations and consumer preference for technologically advanced vehicles. However, challenges remain, including the high initial cost of implementation and potential concerns about data privacy and security.

The competitive landscape is highly dynamic, with established automotive component manufacturers like Continental AG and Robert Bosch GmbH competing alongside specialized connectivity solution providers such as Starcom Systems Ltd and Autotalks Ltd. The success of companies in this market hinges on their ability to deliver innovative, cost-effective, and secure connectivity solutions that cater to the evolving needs of two-wheeler manufacturers and consumers. Strategic partnerships and collaborations are crucial for leveraging technological advancements and expanding market reach. Future growth is expected to be shaped by advancements in 5G technology, improved cybersecurity measures, and the increasing integration of artificial intelligence (AI) and machine learning (ML) to enhance the functionalities of two-wheeler connectivity systems. The market is poised for substantial growth, presenting significant opportunities for companies capable of navigating the technological and regulatory complexities of this rapidly evolving sector.

This comprehensive report provides an in-depth analysis of the Two-Wheeler Connectivity Systems market, covering the period from 2019 to 2033. It offers valuable insights into market dynamics, growth drivers, challenges, opportunities, and key players, enabling stakeholders to make informed strategic decisions. The report utilizes data from the historical period (2019-2024), base year (2025), and estimated year (2025) to forecast market trends until 2033. Key market segments are analyzed by Feature Type, Powertrain Type, and Network Type, providing a granular understanding of this rapidly evolving market.

Two-Wheeler Connectivity Systems Market Concentration & Innovation

The Two-Wheeler Connectivity Systems market exhibits a moderately concentrated landscape, with key players such as Starcom Systems Ltd, Autotalks Ltd, TE Connectivity, Continental AG, Aeris Communications, Robert Bosch GmbH, BMW Group, KPIT Technologies Limited, Fabricacion Componentes Motocicletas S, and Panasonic Corporation holding significant market share. While precise market share figures for each company are proprietary data, the market is characterized by both established automotive component suppliers and emerging technology companies. Innovation is driven by advancements in telematics, 5G connectivity, and the development of sophisticated driver-assistance systems. Regulatory frameworks, particularly those focused on safety and data privacy, play a crucial role in shaping market growth. Product substitutes, such as standalone aftermarket add-ons, present competitive pressures. End-user trends increasingly favor connected features, boosting demand for advanced systems. M&A activity in the sector remains moderate; however, larger players are strategically acquiring smaller companies to enhance their technology portfolios. The total value of M&A deals in the last 5 years is estimated to be around xx Million.

Two-Wheeler Connectivity Systems Market Industry Trends & Insights

The Two-Wheeler Connectivity Systems market is experiencing robust growth, driven by increasing consumer demand for enhanced safety features, improved vehicle management capabilities, and advanced infotainment systems. Technological disruptions, such as the proliferation of 5G and V2X communication technologies, are transforming the market landscape. Consumer preferences are shifting towards connected vehicles equipped with sophisticated features, leading to increased market penetration. The competitive dynamics are characterized by intense rivalry among established players and the emergence of new entrants. The market is expected to register a CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033. Market penetration of connected two-wheelers is currently estimated at xx%, with significant growth potential in developing economies. This growth is further fueled by government initiatives promoting road safety and smart city infrastructure development. The increasing adoption of electric two-wheelers is also significantly impacting the market, driving demand for specific connectivity solutions optimized for electric powertrains.

Dominant Markets & Segments in Two-Wheeler Connectivity Systems Market

- Leading Region: Asia Pacific dominates the Two-Wheeler Connectivity Systems market, driven by high two-wheeler sales, increasing disposable incomes, and favorable government policies. India and China are particularly significant contributors.

- Leading Country: India leads the market due to its vast two-wheeler population and growing adoption of connected technologies.

- Leading Segment (By Feature Type): The Safety segment commands the largest market share due to increasing consumer awareness of safety concerns and stringent regulations.

- Leading Segment (By Powertrain Type): The Internal Combustion Engine (ICE) segment currently holds a larger market share due to the existing dominance of ICE two-wheelers. However, the electric segment is experiencing rapid growth, fuelled by increasing electric vehicle adoption.

- Leading Segment (By Network Type): The Dedicated Short-Range Communication (DSRC) segment is currently the largest, but V2X is expected to show significant growth in the coming years due to its potential for enhanced safety and traffic management.

Key drivers for the dominance of these segments include favorable economic policies supporting the automotive sector, expanding infrastructure for connected technologies, and increasing consumer demand for safety and convenience features. The continued growth in these segments is expected to drive further market expansion.

Two-Wheeler Connectivity Systems Market Product Developments

Recent product innovations focus on integrating advanced driver-assistance systems (ADAS), enhanced telematics, and improved connectivity solutions. These innovations offer several competitive advantages, including improved safety, enhanced user experience, and greater vehicle efficiency. The integration of artificial intelligence and machine learning is transforming the capabilities of these systems, leading to more sophisticated and personalized functionalities. The market fit of these new products is strong, given the rising consumer demand for connected and intelligent vehicles. The emphasis is on creating smaller, more efficient, and cost-effective modules that can be easily integrated into various two-wheeler models.

Report Scope & Segmentation Analysis

The report comprehensively segments the Two-Wheeler Connectivity Systems market by Feature Type (Driver Assistance, Safety, Vehicle Management, Infotainment, Other Features), Powertrain Type (Internal Combustion Engine, Electric), and Network Type (Vehicle-to-everything (V2X), Dedicated short-range communication (DSRC)). Each segment is analyzed in terms of market size, growth projections, and competitive dynamics. The Driver Assistance segment is expected to witness significant growth due to increasing demand for advanced safety features. The Electric powertrain segment is projected to experience faster growth rates than ICE, driven by the expanding electric two-wheeler market. The V2X segment is expected to achieve higher growth rates in the future due to its ability to enable advanced safety applications and enhance traffic management efficiency.

Key Drivers of Two-Wheeler Connectivity Systems Market Growth

Several key factors are driving the growth of the Two-Wheeler Connectivity Systems market. Firstly, stringent government regulations mandating safety features are boosting adoption. Secondly, technological advancements, such as the development of 5G and V2X technologies, are opening up new possibilities for connected features. Thirdly, increasing consumer demand for enhanced safety, convenience, and infotainment is driving market expansion. Finally, the burgeoning electric two-wheeler market is creating additional demand for specialized connectivity solutions.

Challenges in the Two-Wheeler Connectivity Systems Market Sector

The Two-Wheeler Connectivity Systems market faces several challenges. High initial costs of implementing connected systems can hinder adoption, especially in price-sensitive markets. Data security and privacy concerns pose a significant risk. The complexity of integrating connectivity solutions into existing two-wheeler platforms adds to the challenge. The reliability of connectivity, particularly in areas with limited infrastructure, can be a significant obstacle. Supply chain disruptions can impact the availability of critical components and affect production timelines. Finally, intense competition from established and emerging players can limit profitability. These challenges collectively impact market growth by reducing adoption rates and increasing costs.

Emerging Opportunities in Two-Wheeler Connectivity Systems Market

The Two-Wheeler Connectivity Systems market presents substantial opportunities. The expansion of 5G networks opens doors to more sophisticated applications. Growth in the electric two-wheeler market offers significant potential. The development of integrated platforms that combine safety, infotainment, and vehicle management capabilities presents a major opportunity for companies. The potential for data monetization through improved traffic management and predictive maintenance services is another emerging opportunity. Finally, expansion into developing markets with a large two-wheeler population represents a substantial avenue for growth.

Leading Players in the Two-Wheeler Connectivity Systems Market Market

- Starcom Systems Ltd

- Autotalks Ltd

- TE Connectivity

- Continental AG

- Aeris Communications

- Robert Bosch GmbH

- BMW Group

- KPIT Technologies Limited

- Fabricacion Componentes Motocicletas S

- Panasonic Corporation

Key Developments in Two-Wheeler Connectivity Systems Market Industry

- January 2023: Autotalks Ltd. announces a new generation of V2X communication chips.

- June 2022: Bosch launches an advanced driver-assistance system for two-wheelers.

- October 2021: Panasonic Corporation partners with a major two-wheeler manufacturer to develop a new connectivity platform.

- March 2020: TE Connectivity introduces a new range of connectivity solutions optimized for electric two-wheelers.

Strategic Outlook for Two-Wheeler Connectivity Systems Market Market

The Two-Wheeler Connectivity Systems market holds significant future potential, driven by increasing demand for enhanced safety, improved vehicle management, and advanced infotainment features. The continued adoption of electric two-wheelers and the expansion of 5G networks will fuel market growth. Strategic partnerships and collaborations between technology providers and two-wheeler manufacturers will play a vital role in shaping the market's future. Innovation in areas such as artificial intelligence, machine learning, and data analytics will drive the development of more intelligent and personalized connectivity solutions. This evolution will strengthen market growth and expand opportunities for key players to capitalize on the increasing demand for connected vehicles.

Two-Wheeler Connectivity Systems Market Segmentation

-

1. Feature Type

- 1.1. Driver Assistance

- 1.2. Safety

- 1.3. Vehicle Management

- 1.4. Infotainment

- 1.5. Other Features

-

2. Powertrain Type

- 2.1. Internal Combustion Engine

- 2.2. Electric

-

3. Network Type

- 3.1. Vehicle-to-everything (V2X)

- 3.2. Dedicated short-range communication (DSRC)

Two-Wheeler Connectivity Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. South Africa

- 4.3. United Arab Emirates

- 4.4. Other Countries

Two-Wheeler Connectivity Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 46.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Sale of Electric Two-wheelers Poised to Boost Market Growth

- 3.3. Market Restrains

- 3.3.1. Lack of Connectivity Infrastructure

- 3.4. Market Trends

- 3.4.1. Sale of Electric Two-wheelers Poised to Boost Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Two-Wheeler Connectivity Systems Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Feature Type

- 5.1.1. Driver Assistance

- 5.1.2. Safety

- 5.1.3. Vehicle Management

- 5.1.4. Infotainment

- 5.1.5. Other Features

- 5.2. Market Analysis, Insights and Forecast - by Powertrain Type

- 5.2.1. Internal Combustion Engine

- 5.2.2. Electric

- 5.3. Market Analysis, Insights and Forecast - by Network Type

- 5.3.1. Vehicle-to-everything (V2X)

- 5.3.2. Dedicated short-range communication (DSRC)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Feature Type

- 6. North America Two-Wheeler Connectivity Systems Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Feature Type

- 6.1.1. Driver Assistance

- 6.1.2. Safety

- 6.1.3. Vehicle Management

- 6.1.4. Infotainment

- 6.1.5. Other Features

- 6.2. Market Analysis, Insights and Forecast - by Powertrain Type

- 6.2.1. Internal Combustion Engine

- 6.2.2. Electric

- 6.3. Market Analysis, Insights and Forecast - by Network Type

- 6.3.1. Vehicle-to-everything (V2X)

- 6.3.2. Dedicated short-range communication (DSRC)

- 6.1. Market Analysis, Insights and Forecast - by Feature Type

- 7. Europe Two-Wheeler Connectivity Systems Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Feature Type

- 7.1.1. Driver Assistance

- 7.1.2. Safety

- 7.1.3. Vehicle Management

- 7.1.4. Infotainment

- 7.1.5. Other Features

- 7.2. Market Analysis, Insights and Forecast - by Powertrain Type

- 7.2.1. Internal Combustion Engine

- 7.2.2. Electric

- 7.3. Market Analysis, Insights and Forecast - by Network Type

- 7.3.1. Vehicle-to-everything (V2X)

- 7.3.2. Dedicated short-range communication (DSRC)

- 7.1. Market Analysis, Insights and Forecast - by Feature Type

- 8. Asia Pacific Two-Wheeler Connectivity Systems Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Feature Type

- 8.1.1. Driver Assistance

- 8.1.2. Safety

- 8.1.3. Vehicle Management

- 8.1.4. Infotainment

- 8.1.5. Other Features

- 8.2. Market Analysis, Insights and Forecast - by Powertrain Type

- 8.2.1. Internal Combustion Engine

- 8.2.2. Electric

- 8.3. Market Analysis, Insights and Forecast - by Network Type

- 8.3.1. Vehicle-to-everything (V2X)

- 8.3.2. Dedicated short-range communication (DSRC)

- 8.1. Market Analysis, Insights and Forecast - by Feature Type

- 9. Rest of the World Two-Wheeler Connectivity Systems Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Feature Type

- 9.1.1. Driver Assistance

- 9.1.2. Safety

- 9.1.3. Vehicle Management

- 9.1.4. Infotainment

- 9.1.5. Other Features

- 9.2. Market Analysis, Insights and Forecast - by Powertrain Type

- 9.2.1. Internal Combustion Engine

- 9.2.2. Electric

- 9.3. Market Analysis, Insights and Forecast - by Network Type

- 9.3.1. Vehicle-to-everything (V2X)

- 9.3.2. Dedicated short-range communication (DSRC)

- 9.1. Market Analysis, Insights and Forecast - by Feature Type

- 10. North America Two-Wheeler Connectivity Systems Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Rest of North America

- 11. Europe Two-Wheeler Connectivity Systems Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Rest of Europe

- 12. Asia Pacific Two-Wheeler Connectivity Systems Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 India

- 12.1.2 China

- 12.1.3 Japan

- 12.1.4 South Korea

- 12.1.5 Rest of Asia Pacific

- 13. Rest of the World Two-Wheeler Connectivity Systems Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Brazil

- 13.1.2 South Africa

- 13.1.3 United Arab Emirates

- 13.1.4 Other Countries

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Starcom Systems Ltd

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Autotalks Ltd

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 TE Connectivity

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Continental AG

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Aeris Communications

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Robert Bosch GmbH

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 BMW Group

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 KPIT Technologies Limited

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Fabricacion Componentes Motocicletas S

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Panasonic Corporation

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Starcom Systems Ltd

List of Figures

- Figure 1: Global Two-Wheeler Connectivity Systems Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Two-Wheeler Connectivity Systems Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Two-Wheeler Connectivity Systems Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Two-Wheeler Connectivity Systems Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Two-Wheeler Connectivity Systems Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Two-Wheeler Connectivity Systems Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Two-Wheeler Connectivity Systems Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Two-Wheeler Connectivity Systems Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Two-Wheeler Connectivity Systems Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Two-Wheeler Connectivity Systems Market Revenue (Million), by Feature Type 2024 & 2032

- Figure 11: North America Two-Wheeler Connectivity Systems Market Revenue Share (%), by Feature Type 2024 & 2032

- Figure 12: North America Two-Wheeler Connectivity Systems Market Revenue (Million), by Powertrain Type 2024 & 2032

- Figure 13: North America Two-Wheeler Connectivity Systems Market Revenue Share (%), by Powertrain Type 2024 & 2032

- Figure 14: North America Two-Wheeler Connectivity Systems Market Revenue (Million), by Network Type 2024 & 2032

- Figure 15: North America Two-Wheeler Connectivity Systems Market Revenue Share (%), by Network Type 2024 & 2032

- Figure 16: North America Two-Wheeler Connectivity Systems Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Two-Wheeler Connectivity Systems Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Two-Wheeler Connectivity Systems Market Revenue (Million), by Feature Type 2024 & 2032

- Figure 19: Europe Two-Wheeler Connectivity Systems Market Revenue Share (%), by Feature Type 2024 & 2032

- Figure 20: Europe Two-Wheeler Connectivity Systems Market Revenue (Million), by Powertrain Type 2024 & 2032

- Figure 21: Europe Two-Wheeler Connectivity Systems Market Revenue Share (%), by Powertrain Type 2024 & 2032

- Figure 22: Europe Two-Wheeler Connectivity Systems Market Revenue (Million), by Network Type 2024 & 2032

- Figure 23: Europe Two-Wheeler Connectivity Systems Market Revenue Share (%), by Network Type 2024 & 2032

- Figure 24: Europe Two-Wheeler Connectivity Systems Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Two-Wheeler Connectivity Systems Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Two-Wheeler Connectivity Systems Market Revenue (Million), by Feature Type 2024 & 2032

- Figure 27: Asia Pacific Two-Wheeler Connectivity Systems Market Revenue Share (%), by Feature Type 2024 & 2032

- Figure 28: Asia Pacific Two-Wheeler Connectivity Systems Market Revenue (Million), by Powertrain Type 2024 & 2032

- Figure 29: Asia Pacific Two-Wheeler Connectivity Systems Market Revenue Share (%), by Powertrain Type 2024 & 2032

- Figure 30: Asia Pacific Two-Wheeler Connectivity Systems Market Revenue (Million), by Network Type 2024 & 2032

- Figure 31: Asia Pacific Two-Wheeler Connectivity Systems Market Revenue Share (%), by Network Type 2024 & 2032

- Figure 32: Asia Pacific Two-Wheeler Connectivity Systems Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Two-Wheeler Connectivity Systems Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the World Two-Wheeler Connectivity Systems Market Revenue (Million), by Feature Type 2024 & 2032

- Figure 35: Rest of the World Two-Wheeler Connectivity Systems Market Revenue Share (%), by Feature Type 2024 & 2032

- Figure 36: Rest of the World Two-Wheeler Connectivity Systems Market Revenue (Million), by Powertrain Type 2024 & 2032

- Figure 37: Rest of the World Two-Wheeler Connectivity Systems Market Revenue Share (%), by Powertrain Type 2024 & 2032

- Figure 38: Rest of the World Two-Wheeler Connectivity Systems Market Revenue (Million), by Network Type 2024 & 2032

- Figure 39: Rest of the World Two-Wheeler Connectivity Systems Market Revenue Share (%), by Network Type 2024 & 2032

- Figure 40: Rest of the World Two-Wheeler Connectivity Systems Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World Two-Wheeler Connectivity Systems Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Two-Wheeler Connectivity Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Two-Wheeler Connectivity Systems Market Revenue Million Forecast, by Feature Type 2019 & 2032

- Table 3: Global Two-Wheeler Connectivity Systems Market Revenue Million Forecast, by Powertrain Type 2019 & 2032

- Table 4: Global Two-Wheeler Connectivity Systems Market Revenue Million Forecast, by Network Type 2019 & 2032

- Table 5: Global Two-Wheeler Connectivity Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Two-Wheeler Connectivity Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Two-Wheeler Connectivity Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Two-Wheeler Connectivity Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America Two-Wheeler Connectivity Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Two-Wheeler Connectivity Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Two-Wheeler Connectivity Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Two-Wheeler Connectivity Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Two-Wheeler Connectivity Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe Two-Wheeler Connectivity Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Two-Wheeler Connectivity Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: India Two-Wheeler Connectivity Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: China Two-Wheeler Connectivity Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Two-Wheeler Connectivity Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: South Korea Two-Wheeler Connectivity Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Asia Pacific Two-Wheeler Connectivity Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Two-Wheeler Connectivity Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Brazil Two-Wheeler Connectivity Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: South Africa Two-Wheeler Connectivity Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: United Arab Emirates Two-Wheeler Connectivity Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Other Countries Two-Wheeler Connectivity Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Two-Wheeler Connectivity Systems Market Revenue Million Forecast, by Feature Type 2019 & 2032

- Table 27: Global Two-Wheeler Connectivity Systems Market Revenue Million Forecast, by Powertrain Type 2019 & 2032

- Table 28: Global Two-Wheeler Connectivity Systems Market Revenue Million Forecast, by Network Type 2019 & 2032

- Table 29: Global Two-Wheeler Connectivity Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United States Two-Wheeler Connectivity Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Canada Two-Wheeler Connectivity Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of North America Two-Wheeler Connectivity Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Two-Wheeler Connectivity Systems Market Revenue Million Forecast, by Feature Type 2019 & 2032

- Table 34: Global Two-Wheeler Connectivity Systems Market Revenue Million Forecast, by Powertrain Type 2019 & 2032

- Table 35: Global Two-Wheeler Connectivity Systems Market Revenue Million Forecast, by Network Type 2019 & 2032

- Table 36: Global Two-Wheeler Connectivity Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Germany Two-Wheeler Connectivity Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: United Kingdom Two-Wheeler Connectivity Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: France Two-Wheeler Connectivity Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Europe Two-Wheeler Connectivity Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Two-Wheeler Connectivity Systems Market Revenue Million Forecast, by Feature Type 2019 & 2032

- Table 42: Global Two-Wheeler Connectivity Systems Market Revenue Million Forecast, by Powertrain Type 2019 & 2032

- Table 43: Global Two-Wheeler Connectivity Systems Market Revenue Million Forecast, by Network Type 2019 & 2032

- Table 44: Global Two-Wheeler Connectivity Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 45: India Two-Wheeler Connectivity Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: China Two-Wheeler Connectivity Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Japan Two-Wheeler Connectivity Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Korea Two-Wheeler Connectivity Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Asia Pacific Two-Wheeler Connectivity Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Two-Wheeler Connectivity Systems Market Revenue Million Forecast, by Feature Type 2019 & 2032

- Table 51: Global Two-Wheeler Connectivity Systems Market Revenue Million Forecast, by Powertrain Type 2019 & 2032

- Table 52: Global Two-Wheeler Connectivity Systems Market Revenue Million Forecast, by Network Type 2019 & 2032

- Table 53: Global Two-Wheeler Connectivity Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Brazil Two-Wheeler Connectivity Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: South Africa Two-Wheeler Connectivity Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: United Arab Emirates Two-Wheeler Connectivity Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Other Countries Two-Wheeler Connectivity Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Two-Wheeler Connectivity Systems Market?

The projected CAGR is approximately > 46.00%.

2. Which companies are prominent players in the Two-Wheeler Connectivity Systems Market?

Key companies in the market include Starcom Systems Ltd, Autotalks Ltd, TE Connectivity, Continental AG, Aeris Communications, Robert Bosch GmbH, BMW Group, KPIT Technologies Limited, Fabricacion Componentes Motocicletas S, Panasonic Corporation.

3. What are the main segments of the Two-Wheeler Connectivity Systems Market?

The market segments include Feature Type, Powertrain Type, Network Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Sale of Electric Two-wheelers Poised to Boost Market Growth.

6. What are the notable trends driving market growth?

Sale of Electric Two-wheelers Poised to Boost Market Growth.

7. Are there any restraints impacting market growth?

Lack of Connectivity Infrastructure.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Two-Wheeler Connectivity Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Two-Wheeler Connectivity Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Two-Wheeler Connectivity Systems Market?

To stay informed about further developments, trends, and reports in the Two-Wheeler Connectivity Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence