Key Insights

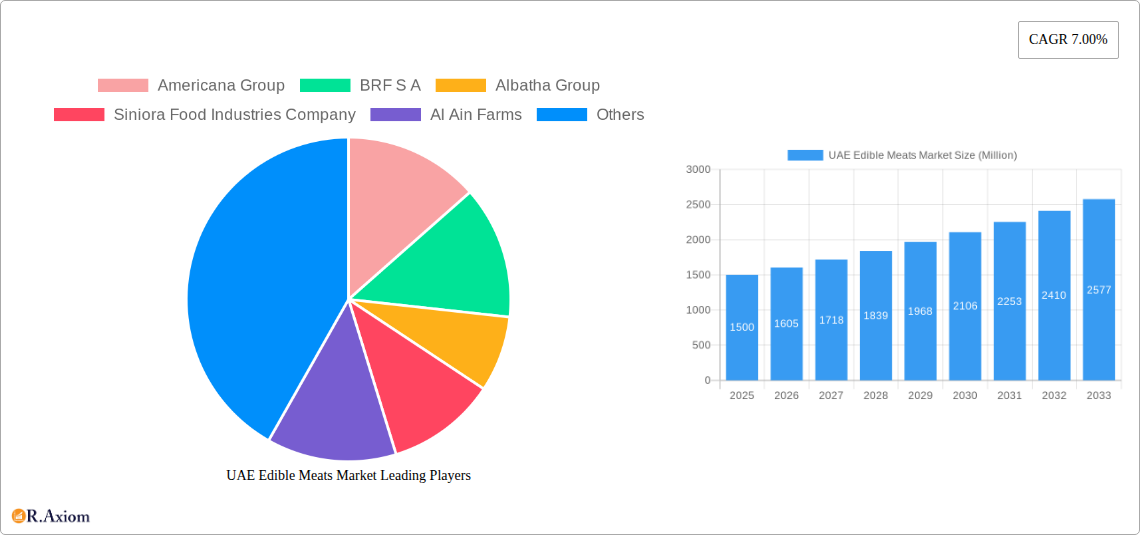

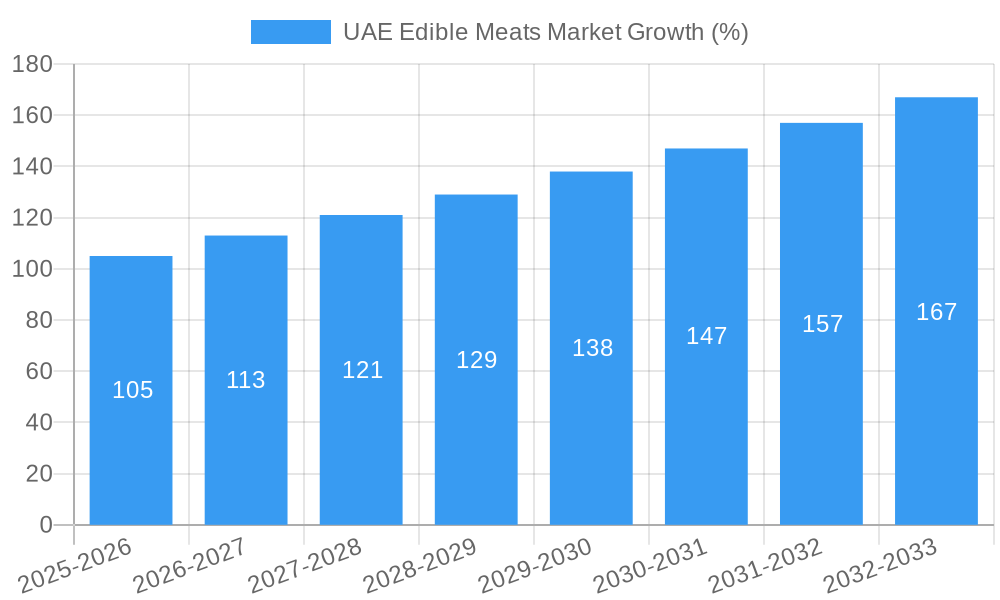

The UAE edible meats market, valued at approximately $X million in 2025 (estimated based on regional trends and the provided CAGR), is poised for robust growth, exhibiting a 7% Compound Annual Growth Rate (CAGR) from 2025 to 2033. This expansion is driven by several key factors. A burgeoning population, coupled with rising disposable incomes and changing dietary habits, fuels increasing meat consumption. The UAE's thriving tourism sector and influx of expatriates further contribute to market demand. Preference for convenience foods and processed meat products, alongside the expansion of organized retail channels, are significantly impacting market dynamics. However, challenges remain. Concerns regarding food safety and sustainability, coupled with fluctuating global meat prices and potential import restrictions, may act as restraints on market growth. The market segmentation reveals a strong demand across various meat types (beef, poultry, mutton exhibiting relatively strong growth) and forms (fresh/chilled, followed by frozen and processed), with a clear preference towards off-trade distribution channels like supermarkets and hypermarkets. Key players like Americana Group, BRF S.A., and Albatha Group are strategically positioning themselves to capitalize on these trends through product diversification, brand building, and expanding their distribution networks.

Further analysis reveals significant opportunities within specific segments. The growing popularity of health-conscious consumers is creating demand for leaner meats and organic options. Innovation in processing techniques, offering extended shelf life and convenient ready-to-eat options, is driving growth within the processed meat segment. The ongoing investment in cold chain infrastructure is also bolstering the market for fresh and chilled meat. Future growth will be shaped by the government's initiatives aimed at enhancing food security, alongside the adoption of sustainable agricultural practices within the country. This comprehensive strategy involving diverse players will shape the trajectory of the UAE edible meat market in the coming years.

UAE Edible Meats Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the UAE edible meats market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, growth drivers, challenges, and opportunities across various segments. Expect detailed analysis of market size, segmentation, competitive landscape, and future projections, enabling informed strategic planning and investment decisions.

UAE Edible Meats Market Concentration & Innovation

The UAE edible meats market exhibits a moderately concentrated structure, with key players like Americana Group, BRF S.A., Albatha Group, and Siniora Food Industries Company holding significant market share. However, the presence of several smaller regional players and emerging brands contributes to competitive dynamism. Market share data for 2024 suggests Americana Group holds approximately 25%, while BRF S.A. holds around 18%. Albatha Group and Siniora Food Industries command roughly 15% and 12%, respectively, with the remaining share distributed among other players. Innovation is driven by consumer demand for convenient, healthy, and diverse meat products. The market witnesses continuous introduction of value-added products, such as marinated meats, ready-to-cook meals, and organic options. Regulatory frameworks, including food safety standards and labeling regulations, significantly impact market operations. Product substitutes, such as plant-based meat alternatives, are emerging but currently hold a minor market share (estimated at 3% in 2024). End-user trends reflect a growing preference for high-quality, ethically sourced meats, along with increasing demand for convenience and ready-to-eat options. M&A activities, like JBS's acquisition of two plants in the MENA region in 2022 (estimated value: xx Million), indicate strategic expansion and consolidation within the market. Further M&A activity is expected, driven by the pursuit of enhanced market access and economies of scale.

UAE Edible Meats Market Industry Trends & Insights

The UAE edible meats market is characterized by robust growth, driven by factors such as a rising population, increasing disposable incomes, changing dietary habits, and the prevalence of food service industries. The market witnessed a CAGR of approximately 6% during the historical period (2019-2024). The projected CAGR for the forecast period (2025-2033) is estimated at 5.5%, indicating sustained growth. Technological disruptions, including advancements in food processing, packaging, and cold chain logistics, are contributing to improved product quality, extended shelf life, and reduced waste. Consumer preferences are shifting towards healthier and more convenient options, fueling demand for lean meats, organic products, and ready-to-eat meals. Competitive dynamics are shaped by intense rivalry among established players and the emergence of new entrants, prompting continuous product innovation and marketing strategies. Market penetration of processed meat products is high, exceeding 70% in 2024, showcasing the significant consumer adoption. The frozen segment is also gaining momentum due to its convenience and extended shelf life.

Dominant Markets & Segments in UAE Edible Meats Market

Leading Segment: Poultry dominates the UAE edible meats market in terms of volume, driven by affordability and cultural acceptance. Frozen poultry also shows significant market penetration, favored for its longer shelf life and convenience.

Dominant Distribution Channel: The Off-Trade channel (supermarkets, hypermarkets, retail stores) constitutes the largest segment in terms of revenue, although the On-Trade channel (restaurants, hotels, catering services) is also experiencing significant growth.

Key Drivers:

- Economic Growth: The UAE's robust economy fuels higher disposable incomes, increasing the purchasing power for meat products.

- Tourism: The influx of tourists boosts demand, particularly within the On-Trade segment.

- Infrastructure Development: Improvements in cold chain infrastructure ensure the efficient distribution of perishable meat products.

The dominance of poultry is primarily attributable to its relatively lower price point compared to beef and mutton, making it accessible to a broader consumer base. The substantial growth in the Off-Trade channel is a reflection of rising urbanization and changing consumer shopping patterns.

UAE Edible Meats Market Product Developments

Recent years have seen a surge in innovative meat products tailored to local tastes and preferences. Examples include Seara's Shawaya chicken (February 2022), highlighting the focus on adapting international products for the UAE market. The introduction of ready-to-cook and value-added products reflects the increasing demand for convenience. Technological advancements in packaging and processing enhance shelf life and product quality, thereby increasing competitiveness. The focus remains on providing healthy, convenient, and culturally relevant options for the diverse consumer base of the UAE.

Report Scope & Segmentation Analysis

This report segments the UAE edible meats market based on type (Beef, Mutton, Poultry, Other Meat), form (Canned, Fresh/Chilled, Frozen, Processed), and distribution channel (Off-Trade, On-Trade). Each segment's growth projection, market size, and competitive dynamics are analyzed in detail, providing a comprehensive overview of the market structure. The Poultry segment is projected to experience significant growth (estimated at a CAGR of 6% from 2025-2033) driven by affordability and demand. The Frozen segment is witnessing the fastest growth due to its convenience and extended shelf life. The Off-Trade distribution channel dominates in terms of market share, but the On-Trade channel exhibits robust growth potential.

Key Drivers of UAE Edible Meats Market Growth

The UAE edible meats market is fueled by a combination of factors. Rising disposable incomes and population growth lead to increased demand. Government initiatives promoting food security and infrastructure development in the cold chain enhance market accessibility. The diversification of the UAE economy supports growth across the various consumer segments. Increasing tourism also adds to the demand, particularly in the On-Trade sector.

Challenges in the UAE Edible Meats Market Sector

The UAE edible meats market faces certain challenges including fluctuating global meat prices, which can impact profitability. Stringent food safety and quality regulations impose operational costs. The growing popularity of plant-based alternatives presents competitive pressure, though currently limited. Maintaining consistent supply chain efficiency is crucial, given the perishability of meat products.

Emerging Opportunities in UAE Edible Meats Market

The UAE's burgeoning food service sector presents significant opportunities for growth, particularly for ready-to-eat and value-added products. The increasing adoption of online grocery platforms offers potential for market expansion. Focus on sustainable and ethical sourcing practices appeals to environmentally conscious consumers.

Leading Players in the UAE Edible Meats Market Market

- Americana Group

- BRF S.A.

- Albatha Group

- Siniora Food Industries Company

- Al Ain Farms

- The Savola Group

- IFFCO Group

- JBS S.A.

- Tanmiah Food Company

Key Developments in UAE Edible Meats Market Industry

- February 2022: Seara launched Shawaya chicken, a frozen product tailored to local tastes.

- February 2022: Al Ain Farms opened a new 2270 sq. m. facility in Abu Dhabi, increasing storage capacity.

- May 2022: JBS acquired two plants in the UAE and Saudi Arabia, expanding its prepared foods production.

Strategic Outlook for UAE Edible Meats Market Market

The UAE edible meats market is poised for sustained growth, driven by economic expansion, population increase, and changing consumer preferences. Opportunities lie in catering to growing demand for convenient, healthy, and culturally relevant meat products. Investing in supply chain optimization, sustainable sourcing, and technological advancements will be crucial for market success. The ongoing focus on innovation and adaptation to local tastes will further drive market expansion in the coming years.

UAE Edible Meats Market Segmentation

-

1. Type

- 1.1. Beef

- 1.2. Mutton

- 1.3. Poultry

- 1.4. Other Meat

-

2. Form

- 2.1. Canned

- 2.2. Fresh / Chilled

- 2.3. Frozen

- 2.4. Processed

-

3. Distribution Channel

-

3.1. Off-Trade

- 3.1.1. Convenience Stores

- 3.1.2. Online Channel

- 3.1.3. Supermarkets and Hypermarkets

- 3.1.4. Others

- 3.2. On-Trade

-

3.1. Off-Trade

UAE Edible Meats Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Edible Meats Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use

- 3.3. Market Restrains

- 3.3.1. Increasing Shift Toward Plant-Based Protein

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Edible Meats Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Beef

- 5.1.2. Mutton

- 5.1.3. Poultry

- 5.1.4. Other Meat

- 5.2. Market Analysis, Insights and Forecast - by Form

- 5.2.1. Canned

- 5.2.2. Fresh / Chilled

- 5.2.3. Frozen

- 5.2.4. Processed

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Off-Trade

- 5.3.1.1. Convenience Stores

- 5.3.1.2. Online Channel

- 5.3.1.3. Supermarkets and Hypermarkets

- 5.3.1.4. Others

- 5.3.2. On-Trade

- 5.3.1. Off-Trade

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America UAE Edible Meats Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Beef

- 6.1.2. Mutton

- 6.1.3. Poultry

- 6.1.4. Other Meat

- 6.2. Market Analysis, Insights and Forecast - by Form

- 6.2.1. Canned

- 6.2.2. Fresh / Chilled

- 6.2.3. Frozen

- 6.2.4. Processed

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Off-Trade

- 6.3.1.1. Convenience Stores

- 6.3.1.2. Online Channel

- 6.3.1.3. Supermarkets and Hypermarkets

- 6.3.1.4. Others

- 6.3.2. On-Trade

- 6.3.1. Off-Trade

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America UAE Edible Meats Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Beef

- 7.1.2. Mutton

- 7.1.3. Poultry

- 7.1.4. Other Meat

- 7.2. Market Analysis, Insights and Forecast - by Form

- 7.2.1. Canned

- 7.2.2. Fresh / Chilled

- 7.2.3. Frozen

- 7.2.4. Processed

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Off-Trade

- 7.3.1.1. Convenience Stores

- 7.3.1.2. Online Channel

- 7.3.1.3. Supermarkets and Hypermarkets

- 7.3.1.4. Others

- 7.3.2. On-Trade

- 7.3.1. Off-Trade

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe UAE Edible Meats Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Beef

- 8.1.2. Mutton

- 8.1.3. Poultry

- 8.1.4. Other Meat

- 8.2. Market Analysis, Insights and Forecast - by Form

- 8.2.1. Canned

- 8.2.2. Fresh / Chilled

- 8.2.3. Frozen

- 8.2.4. Processed

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Off-Trade

- 8.3.1.1. Convenience Stores

- 8.3.1.2. Online Channel

- 8.3.1.3. Supermarkets and Hypermarkets

- 8.3.1.4. Others

- 8.3.2. On-Trade

- 8.3.1. Off-Trade

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa UAE Edible Meats Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Beef

- 9.1.2. Mutton

- 9.1.3. Poultry

- 9.1.4. Other Meat

- 9.2. Market Analysis, Insights and Forecast - by Form

- 9.2.1. Canned

- 9.2.2. Fresh / Chilled

- 9.2.3. Frozen

- 9.2.4. Processed

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Off-Trade

- 9.3.1.1. Convenience Stores

- 9.3.1.2. Online Channel

- 9.3.1.3. Supermarkets and Hypermarkets

- 9.3.1.4. Others

- 9.3.2. On-Trade

- 9.3.1. Off-Trade

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific UAE Edible Meats Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Beef

- 10.1.2. Mutton

- 10.1.3. Poultry

- 10.1.4. Other Meat

- 10.2. Market Analysis, Insights and Forecast - by Form

- 10.2.1. Canned

- 10.2.2. Fresh / Chilled

- 10.2.3. Frozen

- 10.2.4. Processed

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Off-Trade

- 10.3.1.1. Convenience Stores

- 10.3.1.2. Online Channel

- 10.3.1.3. Supermarkets and Hypermarkets

- 10.3.1.4. Others

- 10.3.2. On-Trade

- 10.3.1. Off-Trade

- 10.1. Market Analysis, Insights and Forecast - by Type

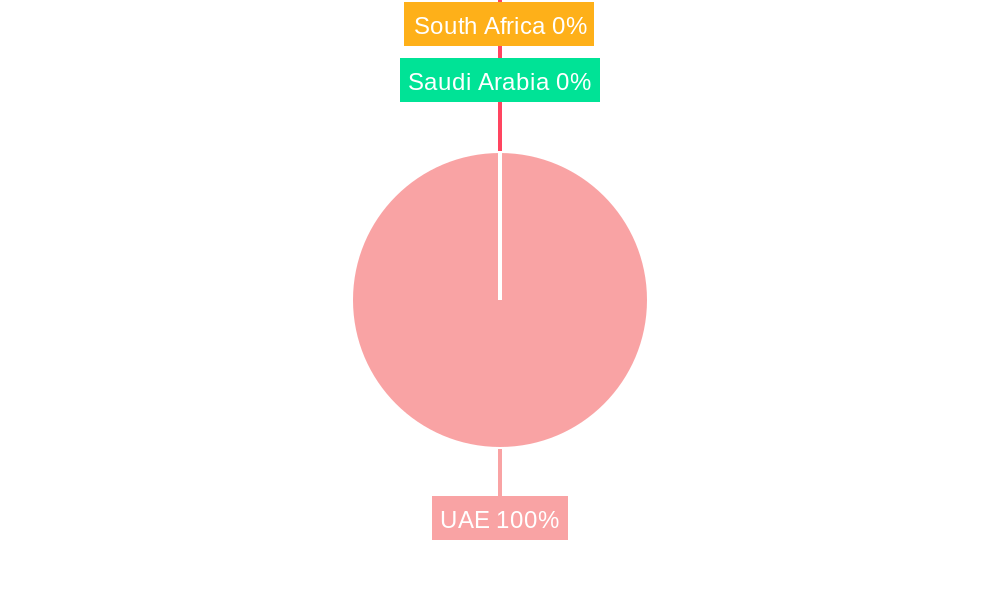

- 11. UAE UAE Edible Meats Market Analysis, Insights and Forecast, 2019-2031

- 12. South Africa UAE Edible Meats Market Analysis, Insights and Forecast, 2019-2031

- 13. Saudi Arabia UAE Edible Meats Market Analysis, Insights and Forecast, 2019-2031

- 14. Rest of MEA UAE Edible Meats Market Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Americana Group

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 BRF S A

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Albatha Group

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Siniora Food Industries Company

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Al Ain Farms

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 The Savola Grou

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 IFFCO Group

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 JBS SA

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Tanmiah Food Company

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.1 Americana Group

List of Figures

- Figure 1: Global UAE Edible Meats Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Middle East & Africa UAE Edible Meats Market Revenue (Million), by Country 2024 & 2032

- Figure 3: Middle East & Africa UAE Edible Meats Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America UAE Edible Meats Market Revenue (Million), by Type 2024 & 2032

- Figure 5: North America UAE Edible Meats Market Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America UAE Edible Meats Market Revenue (Million), by Form 2024 & 2032

- Figure 7: North America UAE Edible Meats Market Revenue Share (%), by Form 2024 & 2032

- Figure 8: North America UAE Edible Meats Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 9: North America UAE Edible Meats Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 10: North America UAE Edible Meats Market Revenue (Million), by Country 2024 & 2032

- Figure 11: North America UAE Edible Meats Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America UAE Edible Meats Market Revenue (Million), by Type 2024 & 2032

- Figure 13: South America UAE Edible Meats Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: South America UAE Edible Meats Market Revenue (Million), by Form 2024 & 2032

- Figure 15: South America UAE Edible Meats Market Revenue Share (%), by Form 2024 & 2032

- Figure 16: South America UAE Edible Meats Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 17: South America UAE Edible Meats Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 18: South America UAE Edible Meats Market Revenue (Million), by Country 2024 & 2032

- Figure 19: South America UAE Edible Meats Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe UAE Edible Meats Market Revenue (Million), by Type 2024 & 2032

- Figure 21: Europe UAE Edible Meats Market Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe UAE Edible Meats Market Revenue (Million), by Form 2024 & 2032

- Figure 23: Europe UAE Edible Meats Market Revenue Share (%), by Form 2024 & 2032

- Figure 24: Europe UAE Edible Meats Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 25: Europe UAE Edible Meats Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 26: Europe UAE Edible Meats Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe UAE Edible Meats Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa UAE Edible Meats Market Revenue (Million), by Type 2024 & 2032

- Figure 29: Middle East & Africa UAE Edible Meats Market Revenue Share (%), by Type 2024 & 2032

- Figure 30: Middle East & Africa UAE Edible Meats Market Revenue (Million), by Form 2024 & 2032

- Figure 31: Middle East & Africa UAE Edible Meats Market Revenue Share (%), by Form 2024 & 2032

- Figure 32: Middle East & Africa UAE Edible Meats Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 33: Middle East & Africa UAE Edible Meats Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 34: Middle East & Africa UAE Edible Meats Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa UAE Edible Meats Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific UAE Edible Meats Market Revenue (Million), by Type 2024 & 2032

- Figure 37: Asia Pacific UAE Edible Meats Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Asia Pacific UAE Edible Meats Market Revenue (Million), by Form 2024 & 2032

- Figure 39: Asia Pacific UAE Edible Meats Market Revenue Share (%), by Form 2024 & 2032

- Figure 40: Asia Pacific UAE Edible Meats Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 41: Asia Pacific UAE Edible Meats Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 42: Asia Pacific UAE Edible Meats Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific UAE Edible Meats Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UAE Edible Meats Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UAE Edible Meats Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global UAE Edible Meats Market Revenue Million Forecast, by Form 2019 & 2032

- Table 4: Global UAE Edible Meats Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: Global UAE Edible Meats Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global UAE Edible Meats Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: UAE UAE Edible Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South Africa UAE Edible Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Saudi Arabia UAE Edible Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of MEA UAE Edible Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global UAE Edible Meats Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Global UAE Edible Meats Market Revenue Million Forecast, by Form 2019 & 2032

- Table 13: Global UAE Edible Meats Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: Global UAE Edible Meats Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States UAE Edible Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada UAE Edible Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico UAE Edible Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global UAE Edible Meats Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global UAE Edible Meats Market Revenue Million Forecast, by Form 2019 & 2032

- Table 20: Global UAE Edible Meats Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 21: Global UAE Edible Meats Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Brazil UAE Edible Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Argentina UAE Edible Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of South America UAE Edible Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global UAE Edible Meats Market Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Global UAE Edible Meats Market Revenue Million Forecast, by Form 2019 & 2032

- Table 27: Global UAE Edible Meats Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 28: Global UAE Edible Meats Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United Kingdom UAE Edible Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Germany UAE Edible Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: France UAE Edible Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Italy UAE Edible Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Spain UAE Edible Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Russia UAE Edible Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Benelux UAE Edible Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Nordics UAE Edible Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Europe UAE Edible Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global UAE Edible Meats Market Revenue Million Forecast, by Type 2019 & 2032

- Table 39: Global UAE Edible Meats Market Revenue Million Forecast, by Form 2019 & 2032

- Table 40: Global UAE Edible Meats Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 41: Global UAE Edible Meats Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Turkey UAE Edible Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Israel UAE Edible Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: GCC UAE Edible Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: North Africa UAE Edible Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: South Africa UAE Edible Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Middle East & Africa UAE Edible Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Global UAE Edible Meats Market Revenue Million Forecast, by Type 2019 & 2032

- Table 49: Global UAE Edible Meats Market Revenue Million Forecast, by Form 2019 & 2032

- Table 50: Global UAE Edible Meats Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 51: Global UAE Edible Meats Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: China UAE Edible Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: India UAE Edible Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Japan UAE Edible Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: South Korea UAE Edible Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: ASEAN UAE Edible Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Oceania UAE Edible Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Asia Pacific UAE Edible Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Edible Meats Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the UAE Edible Meats Market?

Key companies in the market include Americana Group, BRF S A, Albatha Group, Siniora Food Industries Company, Al Ain Farms, The Savola Grou, IFFCO Group, JBS SA, Tanmiah Food Company.

3. What are the main segments of the UAE Edible Meats Market?

The market segments include Type, Form, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Increasing Shift Toward Plant-Based Protein.

8. Can you provide examples of recent developments in the market?

May 2022: JBS has acquired two plants in the MENA (the Middle East and North Africa) region to produce prepared foods. They are located in Saudi Arabia and the United Arab Emirates and produce value-added products. This expansion helps increase market penetration, strengthening distribution channels and client relationships.February 2022: Seara introduced Shawaya chicken, an innovative product under the frozen category. The chicken preparation is tailored according to the local taste and flavor preference.February 2022: Al Ain Farms has announced the launch of its 2270 sq. m. facility in Abu Dhabi. Al Ain Farms has increased its storage capacity for handling products, including chicken, to enhance its operational efficiency.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Edible Meats Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Edible Meats Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Edible Meats Market?

To stay informed about further developments, trends, and reports in the UAE Edible Meats Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence