Key Insights

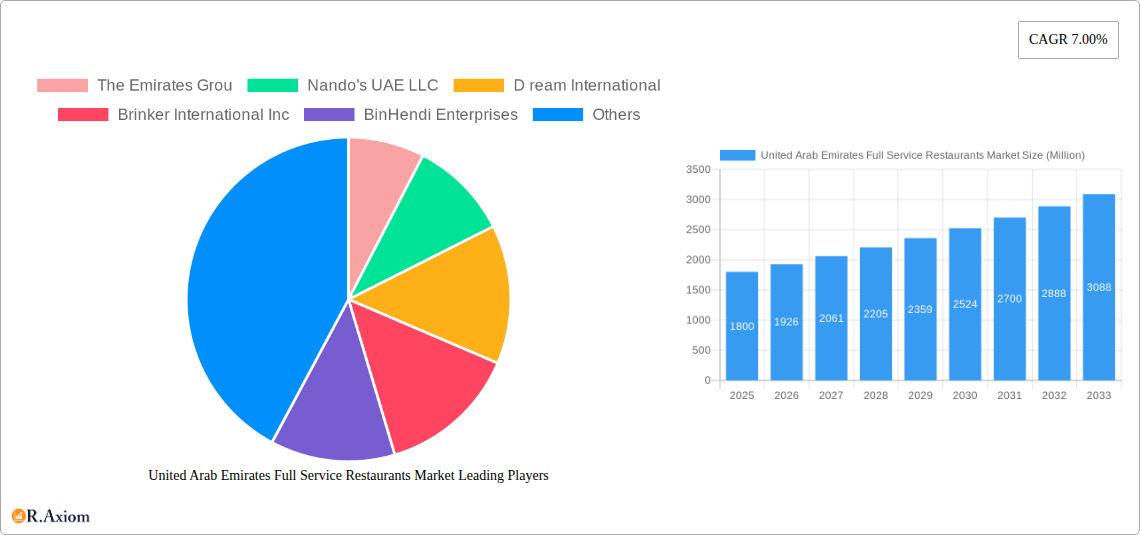

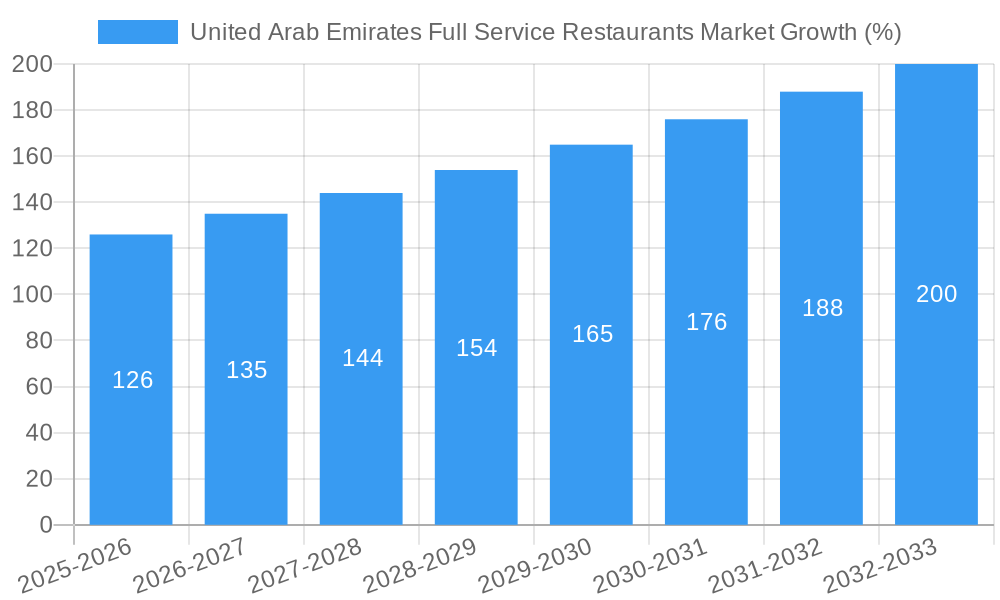

The United Arab Emirates (UAE) full-service restaurant (FSR) market exhibits robust growth, driven by a thriving tourism sector, a burgeoning population with high disposable incomes, and a cosmopolitan culinary landscape. The market's diverse culinary offerings, encompassing Asian, European, Latin American, Middle Eastern, and North American cuisines, cater to a wide range of preferences. The prevalence of both chained and independent outlets, strategically located across leisure, lodging, retail, and standalone settings, further contributes to market expansion. While the exact market size for 2025 is unavailable, considering a CAGR of 7% from a base year (likely 2019 or 2020) and a significant existing market, we can estimate the 2025 market size to be in the range of $1.5 Billion to $2 Billion (USD). This growth is fueled by increased consumer spending on dining experiences, a rise in food tourism, and the continuous influx of international brands seeking to establish a presence in the lucrative UAE market.

However, the market also faces challenges. Rising operational costs, including real estate and labor, pose a significant restraint. Fluctuations in tourism due to global events and intense competition among established and emerging players also impact profitability. The segmentation by outlet type (chained vs. independent) reveals varying competitive dynamics, with established chains leveraging brand recognition while independent restaurants focus on unique culinary experiences and personalized service. Furthermore, the location-based segmentation (leisure, lodging, retail, standalone, travel) indicates different market opportunities and challenges, requiring tailored strategies for success. This necessitates a nuanced approach to market penetration, emphasizing value propositions that resonate with specific consumer segments within each location type. The forecast period of 2025-2033 indicates continued growth, driven by ongoing investments in infrastructure and the UAE's commitment to enhancing its tourism appeal.

United Arab Emirates Full Service Restaurants Market: A Comprehensive Report (2019-2033)

This meticulously researched report provides a detailed analysis of the United Arab Emirates (UAE) Full Service Restaurants (FSR) market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report covers the period 2019-2033, with a focus on the base year 2025 and a forecast period of 2025-2033. It delves into market size, segmentation, competitive landscape, growth drivers, challenges, and future opportunities, providing actionable intelligence to navigate the dynamic FSR landscape in the UAE.

United Arab Emirates Full Service Restaurants Market Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory landscape, and competitive dynamics within the UAE's FSR sector. We examine market share distribution among key players, the influence of mergers and acquisitions (M&A) activities, and the role of innovation in shaping market trends. The analysis includes:

Market Concentration: The UAE FSR market exhibits a [xx]% concentration ratio, with the top 5 players holding a combined market share of approximately [xx]%. This indicates a [highly competitive/moderately concentrated/oligopolistic] market structure.

Innovation Drivers: Technological advancements in online ordering, kitchen automation, and personalized customer experiences are major innovation drivers. Furthermore, the increasing demand for diverse culinary offerings and sustainable practices fuels innovation in menu development and operational efficiency.

Regulatory Framework: The UAE's food safety regulations and licensing procedures significantly impact market operations. Changes in these regulations, such as those related to food labeling and hygiene standards, can influence market dynamics.

Product Substitutes: The rise of quick-service restaurants (QSRs), home delivery services, and meal kit deliveries pose a competitive threat to traditional FSRs. However, the FSR segment retains a strong position by offering premium dining experiences and enhanced customer service.

End-User Trends: Growing consumer preference for healthier options, personalized dining experiences, and value-for-money propositions are shaping demand within the FSR sector. The increasing popularity of international cuisines and experiential dining further contributes to market evolution.

M&A Activities: The UAE FSR market has witnessed [xx] number of M&A deals in the historical period (2019-2024), with a total deal value of approximately [xx] Million. These activities have primarily focused on expanding market reach, acquiring new brands, and enhancing operational capabilities.

United Arab Emirates Full Service Restaurants Market Industry Trends & Insights

This section provides a comprehensive overview of the UAE FSR market's growth trajectory, exploring key trends, challenges, and opportunities. The analysis incorporates various quantitative and qualitative data to provide a holistic view of the market landscape:

The UAE FSR market experienced robust growth during the historical period (2019-2024), registering a CAGR of [xx]%. This growth is primarily attributed to a thriving tourism sector, a rising middle class with increased disposable income, and a preference for diverse culinary experiences. The market is projected to maintain its growth momentum during the forecast period (2025-2033), with an anticipated CAGR of [xx]%, driven by factors such as sustained economic growth, increasing urbanization, and the government's initiatives to boost tourism. Technological disruptions, such as online ordering platforms and delivery services, are significantly impacting consumer behavior and shaping competitive dynamics. The market penetration of online ordering is currently at [xx]% and is expected to reach [xx]% by 2033. Consumer preferences are shifting towards healthier options, personalized experiences, and value-driven propositions. The competitive landscape is characterized by both established international chains and local players, leading to intense competition and strategic initiatives to gain market share.

Dominant Markets & Segments in United Arab Emirates Full Service Restaurants Market

This section identifies the leading segments within the UAE FSR market, based on cuisine, outlet type, and location. The analysis considers various factors driving segment dominance:

Cuisine: Middle Eastern cuisine holds the largest market share, driven by strong local preferences and cultural significance. However, Asian and European cuisines are also experiencing significant growth, fueled by increased tourist arrivals and diverse consumer preferences.

Outlet Type: Chained outlets dominate the market, benefiting from brand recognition, standardized quality, and economies of scale. Independent outlets cater to niche markets and offer unique dining experiences.

Location: Standalone restaurants represent the largest segment, providing a wide range of options across the country. However, leisure and lodging locations are also experiencing growth, driven by the booming tourism sector and increasing demand for convenient dining options within hotels and entertainment venues.

Key drivers of segment dominance include:

- Economic Policies: Government initiatives promoting tourism and diversification of the economy positively impact the FSR market.

- Infrastructure Development: Improved infrastructure, including transportation networks and entertainment facilities, contributes to increased foot traffic and accessibility for FSR outlets.

- Tourism: The flourishing tourism sector in the UAE significantly boosts the FSR market, creating a high demand for diverse culinary experiences.

United Arab Emirates Full Service Restaurants Market Product Developments

The UAE FSR market is witnessing significant product innovations, focusing on enhancing customer experiences and operational efficiency. Technological advancements, such as AI-powered ordering systems, kitchen automation, and personalized menu recommendations, are transforming the industry. Companies are also focusing on incorporating sustainable practices, offering healthy and diverse menu options, and creating unique brand identities to stand out in the competitive market. These innovations contribute to improving customer satisfaction, operational efficiency, and brand differentiation.

Report Scope & Segmentation Analysis

This report segments the UAE FSR market based on cuisine (Asian, European, Latin American, Middle Eastern, North American, Other), outlet type (chained, independent), and location (leisure, lodging, retail, standalone, travel). Each segment's growth projections, market size, and competitive dynamics are analyzed, offering a granular view of the market's composition and future trajectory. For example, the Middle Eastern cuisine segment is projected to maintain its dominance, while the Asian cuisine segment is expected to exhibit significant growth, driven by increasing demand for diverse culinary experiences. Similarly, chained outlets are projected to maintain a substantial market share, while independent outlets are expected to target niche segments and offer specialized dining options.

Key Drivers of United Arab Emirates Full Service Restaurants Market Growth

Several factors drive the growth of the UAE FSR market. These include robust economic growth, a thriving tourism sector, increasing disposable incomes among the population, and a growing preference for diverse culinary experiences. Government initiatives supporting tourism and infrastructure development further stimulate market expansion. The rising adoption of technological advancements, such as online ordering and delivery platforms, also contributes to market growth.

Challenges in the United Arab Emirates Full Service Restaurants Market Sector

The UAE FSR market faces several challenges, including intense competition, fluctuating food costs, rising labor costs, and stringent regulatory requirements. Supply chain disruptions can also impact operational efficiency and profitability. The increasing popularity of alternative dining options, such as QSRs and home delivery services, adds pressure on market players. These factors necessitate strategic adaptations and operational efficiencies to maintain competitiveness and profitability.

Emerging Opportunities in United Arab Emirates Full Service Restaurants Market

The UAE FSR market presents several emerging opportunities. The increasing adoption of technology, such as AI and machine learning, offers opportunities for improved efficiency, personalized services, and enhanced customer experiences. The growing interest in healthy and sustainable food options creates opportunities for specialized restaurants and innovative menu offerings. Furthermore, the expansion of tourism and the increasing affluence of the population present opportunities for new market entry and expansion.

Leading Players in the United Arab Emirates Full Service Restaurants Market Market

- The Emirates Group

- Nando's UAE LLC

- Dream International

- Brinker International Inc

- BinHendi Enterprises

- Americana Restaurants International PLC

- M H Alshaya Co WLL

- Apparel Group

- Al Khaja Group Of Companies

- Kerzner International Limited

Key Developments in United Arab Emirates Full Service Restaurants Market Industry

- January 2022: Tim Hortons expanded its presence by opening six outlets across Dubai, Abu Dhabi, Sharjah, Ajman, Fujairah, Ras Al Khaimah, and Al Ain. This expansion signifies the growing appeal of international FSR brands in the UAE and demonstrates the potential for further market penetration.

Strategic Outlook for United Arab Emirates Full Service Restaurants Market Market

The UAE FSR market is poised for continued growth, driven by strong economic fundamentals, a thriving tourism sector, and evolving consumer preferences. Strategic investments in technology, innovative menu offerings, and enhanced customer experiences will be crucial for success. Adapting to evolving consumer preferences, such as demand for healthy options and personalized experiences, will be key to maintaining competitiveness. The market's long-term outlook remains positive, with opportunities for both established players and new entrants to capitalize on the growing demand for diverse and high-quality dining experiences.

United Arab Emirates Full Service Restaurants Market Segmentation

-

1. Cuisine

- 1.1. Asian

- 1.2. European

- 1.3. Latin American

- 1.4. Middle Eastern

- 1.5. North American

- 1.6. Other FSR Cuisines

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

United Arab Emirates Full Service Restaurants Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Full Service Restaurants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use

- 3.3. Market Restrains

- 3.3.1. Increasing Shift Toward Plant-Based Protein

- 3.4. Market Trends

- 3.4.1. High demand for traditional cuisines has led to the growth of Middle Eastern Cuisines

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Full Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 5.1.1. Asian

- 5.1.2. European

- 5.1.3. Latin American

- 5.1.4. Middle Eastern

- 5.1.5. North American

- 5.1.6. Other FSR Cuisines

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 6. South Africa United Arab Emirates Full Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 7. United Arab Emirates United Arab Emirates Full Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 8. Rest of Middle East and Africa United Arab Emirates Full Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 The Emirates Grou

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Nando's UAE LLC

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 D ream International

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Brinker International Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 BinHendi Enterprises

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Americana Restaurants International PLC

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 M H Alshaya Co WLL

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Apparel Group

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Al Khaja Group Of Companies

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Kerzner International Limited

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 The Emirates Grou

List of Figures

- Figure 1: United Arab Emirates Full Service Restaurants Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Arab Emirates Full Service Restaurants Market Share (%) by Company 2024

List of Tables

- Table 1: United Arab Emirates Full Service Restaurants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Arab Emirates Full Service Restaurants Market Volume Thousand Tons Forecast, by Region 2019 & 2032

- Table 3: United Arab Emirates Full Service Restaurants Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 4: United Arab Emirates Full Service Restaurants Market Volume Thousand Tons Forecast, by Cuisine 2019 & 2032

- Table 5: United Arab Emirates Full Service Restaurants Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 6: United Arab Emirates Full Service Restaurants Market Volume Thousand Tons Forecast, by Outlet 2019 & 2032

- Table 7: United Arab Emirates Full Service Restaurants Market Revenue Million Forecast, by Location 2019 & 2032

- Table 8: United Arab Emirates Full Service Restaurants Market Volume Thousand Tons Forecast, by Location 2019 & 2032

- Table 9: United Arab Emirates Full Service Restaurants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: United Arab Emirates Full Service Restaurants Market Volume Thousand Tons Forecast, by Region 2019 & 2032

- Table 11: United Arab Emirates Full Service Restaurants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United Arab Emirates Full Service Restaurants Market Volume Thousand Tons Forecast, by Country 2019 & 2032

- Table 13: South Africa United Arab Emirates Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South Africa United Arab Emirates Full Service Restaurants Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 15: United Arab Emirates United Arab Emirates Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United Arab Emirates United Arab Emirates Full Service Restaurants Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 17: Rest of Middle East and Africa United Arab Emirates Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Middle East and Africa United Arab Emirates Full Service Restaurants Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 19: United Arab Emirates Full Service Restaurants Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 20: United Arab Emirates Full Service Restaurants Market Volume Thousand Tons Forecast, by Cuisine 2019 & 2032

- Table 21: United Arab Emirates Full Service Restaurants Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 22: United Arab Emirates Full Service Restaurants Market Volume Thousand Tons Forecast, by Outlet 2019 & 2032

- Table 23: United Arab Emirates Full Service Restaurants Market Revenue Million Forecast, by Location 2019 & 2032

- Table 24: United Arab Emirates Full Service Restaurants Market Volume Thousand Tons Forecast, by Location 2019 & 2032

- Table 25: United Arab Emirates Full Service Restaurants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: United Arab Emirates Full Service Restaurants Market Volume Thousand Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Full Service Restaurants Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the United Arab Emirates Full Service Restaurants Market?

Key companies in the market include The Emirates Grou, Nando's UAE LLC, D ream International, Brinker International Inc, BinHendi Enterprises, Americana Restaurants International PLC, M H Alshaya Co WLL, Apparel Group, Al Khaja Group Of Companies, Kerzner International Limited.

3. What are the main segments of the United Arab Emirates Full Service Restaurants Market?

The market segments include Cuisine, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use.

6. What are the notable trends driving market growth?

High demand for traditional cuisines has led to the growth of Middle Eastern Cuisines.

7. Are there any restraints impacting market growth?

Increasing Shift Toward Plant-Based Protein.

8. Can you provide examples of recent developments in the market?

January 2022: Tim Hortons expanded its presence by opening six outlets across Dubai, Abu Dhabi, Sharjah, Ajman, Fujairah, Ras Al Khaimah, and Al Ain.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Thousand Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Full Service Restaurants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Full Service Restaurants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Full Service Restaurants Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Full Service Restaurants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence