Key Insights

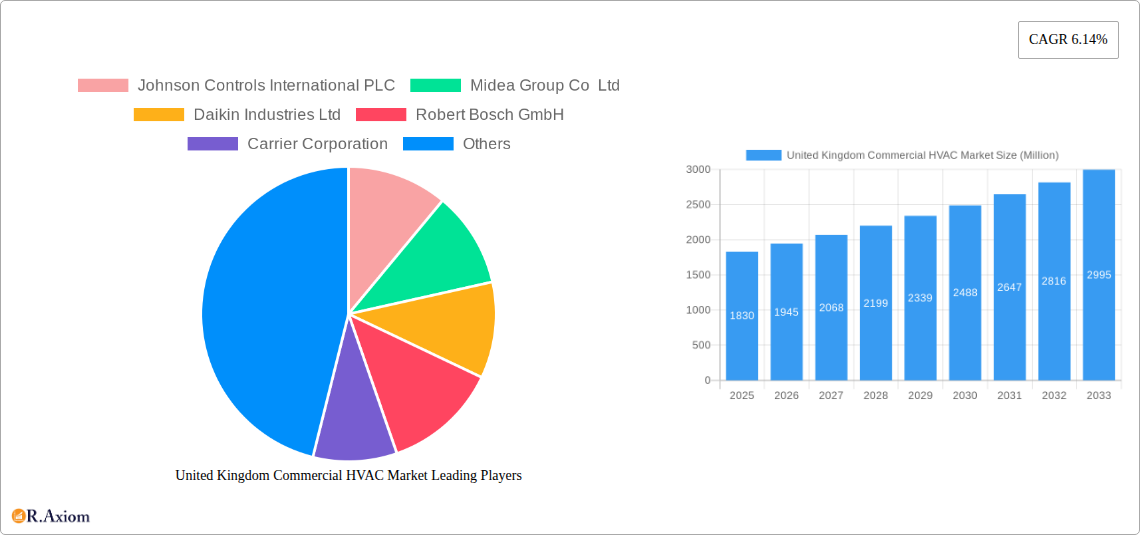

The United Kingdom Commercial HVAC market, valued at approximately £1.83 billion in 2025, is projected to experience robust growth, driven by a number of key factors. Stringent energy efficiency regulations, such as the UK's commitment to net-zero emissions by 2050, are compelling businesses to upgrade their existing systems with more energy-efficient HVAC technologies. Furthermore, the increasing prevalence of smart building technologies and the growing demand for improved indoor air quality (IAQ) are fueling market expansion. The rise of sustainable building practices and the adoption of green building certifications, like BREEAM, further contribute to the market's growth trajectory. Major players such as Johnson Controls, Daikin, and Carrier are actively investing in R&D and expanding their product portfolios to cater to this growing demand. The market is segmented by technology (e.g., chillers, air conditioners, ventilation systems), building type (e.g., office buildings, retail spaces, industrial facilities), and geographic location. The competitive landscape is characterized by both established multinational corporations and specialized local providers, leading to intense competition and a focus on innovation.

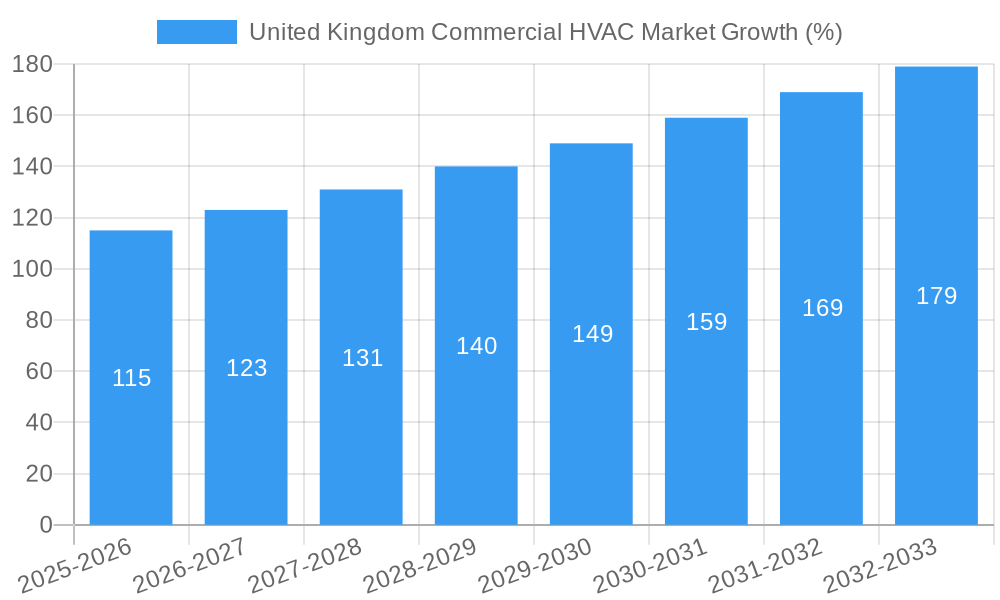

The projected Compound Annual Growth Rate (CAGR) of 6.14% from 2025 to 2033 indicates sustained market expansion. However, factors like economic fluctuations and the potential for supply chain disruptions could pose challenges. Despite these potential restraints, the long-term outlook remains positive, driven by continuous government support for green initiatives, increasing awareness of IAQ's importance, and a growing focus on enhancing operational efficiency across commercial buildings. The market is expected to see significant growth in the adoption of advanced technologies such as variable refrigerant flow (VRF) systems, building management systems (BMS), and heat recovery ventilation systems, enhancing efficiency and reducing environmental impact. This trend will be further accelerated by government incentives and rising energy costs.

This detailed report provides a comprehensive analysis of the United Kingdom Commercial HVAC market, covering market size, growth drivers, challenges, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base year and forecast period from 2025 to 2033. This report is essential for industry stakeholders, investors, and businesses seeking to understand and capitalize on opportunities within this dynamic market.

United Kingdom Commercial HVAC Market Concentration & Innovation

The UK Commercial HVAC market exhibits a moderately concentrated landscape, with a few major players holding significant market share. The market share distribution among the top five players is estimated at xx%. Innovation is driven by increasing energy efficiency regulations, the push for sustainable solutions, and the growing demand for smart building technologies. Stringent environmental regulations, including the UK’s commitment to net-zero emissions, are significant catalysts for innovation, compelling companies to develop energy-efficient HVAC systems. Product substitution is primarily driven by the rising popularity of heat pumps, particularly air-source heat pumps, as a replacement for traditional fossil fuel-based systems. Mergers and acquisitions (M&A) activity in the sector is relatively moderate, with deal values averaging approximately xx Million annually over the historical period (2019-2024). Key M&A activities have focused on expanding geographical reach, acquiring specialized technologies, and strengthening product portfolios. End-user trends demonstrate a clear preference for integrated, smart HVAC systems offering remote control, advanced analytics, and energy monitoring capabilities.

United Kingdom Commercial HVAC Market Industry Trends & Insights

The UK Commercial HVAC market is projected to experience a CAGR of xx% during the forecast period (2025-2033). This growth is propelled by several factors, including increased construction activity across commercial sectors, rising demand for energy-efficient solutions driven by government policies, and the increasing adoption of smart building technologies. Technological disruptions, notably the rise of heat pumps and smart controls, are fundamentally reshaping the market. Consumer preferences are shifting towards systems that offer improved energy efficiency, reduced operating costs, and enhanced comfort levels. Competitive dynamics are characterized by intense rivalry among established players and emerging technology providers, leading to continuous product innovation and price competition. Market penetration of heat pumps is gradually increasing, expected to reach xx% by 2033, driven by government incentives and growing environmental awareness.

Dominant Markets & Segments in United Kingdom Commercial HVAC Market

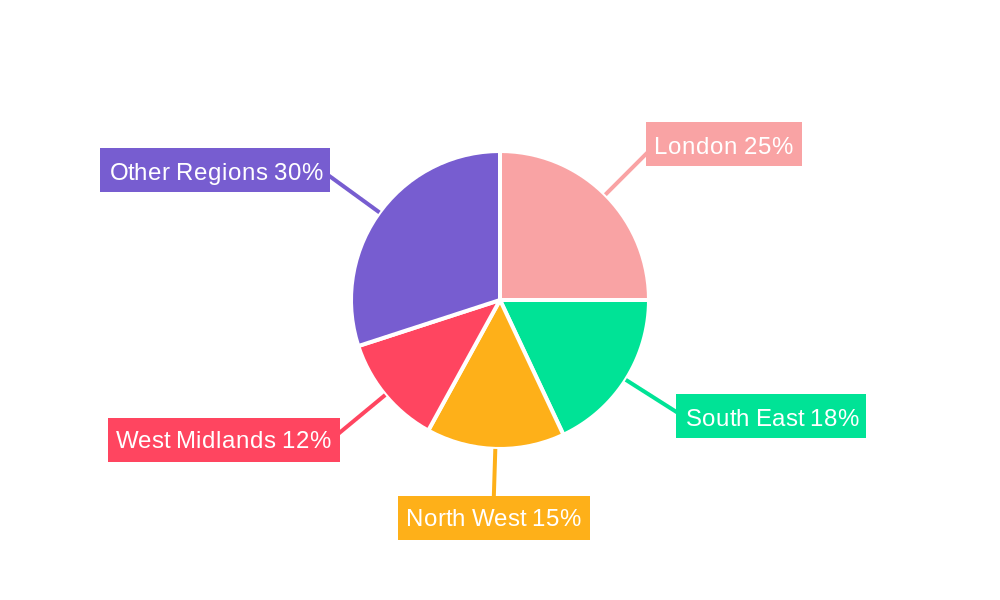

The London region dominates the UK Commercial HVAC market, accounting for approximately xx% of the total market value in 2025. This dominance is primarily attributed to:

- High concentration of commercial buildings: London houses a large number of commercial buildings, including offices, retail spaces, and hospitality establishments, creating significant demand for HVAC systems.

- Robust economic activity: The strong economic activity in London fuels investment in commercial real estate and infrastructure development, driving the demand for sophisticated HVAC solutions.

- Stringent building regulations: London's strict building regulations regarding energy efficiency encourage the adoption of advanced HVAC technologies.

The office segment holds the largest market share within the commercial sector, driven by the high density of office buildings and the significant investment in upgrading existing infrastructure to meet evolving sustainability standards. The retail sector is also a significant segment, with a considerable demand for reliable and efficient HVAC systems to maintain optimal environmental conditions for customers and products.

United Kingdom Commercial HVAC Market Product Developments

Recent product innovations in the UK Commercial HVAC market are primarily focused on enhancing energy efficiency and incorporating smart technology features. Heat pump technology is rapidly gaining traction, offering an environmentally friendly alternative to traditional systems. Smart controls and integrated building management systems are becoming increasingly prevalent, allowing for optimized energy management and remote monitoring. These developments reflect the industry’s ongoing efforts to address environmental concerns while enhancing user experience and reducing operating costs.

Report Scope & Segmentation Analysis

This report segments the UK Commercial HVAC market based on several factors:

By Product Type: This includes air conditioners, heat pumps (air-source, ground-source), ventilation systems, and refrigeration systems. Growth projections vary across segments, with heat pumps exhibiting the highest growth rate.

By Application: This includes offices, retail spaces, healthcare facilities, hospitality establishments, and industrial facilities. Market sizes vary considerably based on application, with offices and retail spaces dominating.

By Technology: This includes traditional HVAC systems, smart HVAC systems, and energy-efficient technologies like variable refrigerant flow (VRF) systems and building automation systems (BAS). The market is rapidly shifting towards smart and energy-efficient technologies.

Key Drivers of United Kingdom Commercial HVAC Market Growth

Several factors are driving the growth of the UK Commercial HVAC market:

- Stringent energy efficiency regulations: The government's commitment to net-zero emissions is pushing the adoption of energy-efficient HVAC systems.

- Increased construction activity: Ongoing investments in commercial real estate contribute to a high demand for HVAC systems.

- Rising awareness of sustainability: Growing environmental consciousness amongst businesses is fueling the demand for eco-friendly HVAC solutions.

Challenges in the United Kingdom Commercial HVAC Market Sector

The UK Commercial HVAC market faces several challenges:

- Supply chain disruptions: Global supply chain issues can impact the availability of components and increase costs.

- High initial investment costs: The upfront costs associated with installing advanced HVAC systems can be a barrier for some businesses.

- Skilled labor shortages: A lack of qualified technicians to install and maintain sophisticated systems is a concern.

Emerging Opportunities in United Kingdom Commercial HVAC Market

Several opportunities are emerging in the UK Commercial HVAC market:

- Growth of smart building technologies: The increasing adoption of IoT and AI in building management systems creates opportunities for integrated HVAC solutions.

- Demand for sustainable solutions: The rising demand for eco-friendly HVAC systems presents opportunities for providers of energy-efficient technologies.

- Expansion into underserved sectors: There is potential for growth in niche segments such as data centers and cold storage facilities.

Leading Players in the United Kingdom Commercial HVAC Market Market

- Johnson Controls International PLC

- Midea Group Co Ltd

- Daikin Industries Ltd

- Robert Bosch GmbH

- Carrier Corporation

- LG Electronics Inc

- Lennox International Inc

- BDR Thermea Group

- Panasonic Corporation

- Danfoss A/S

Key Developments in United Kingdom Commercial HVAC Market Industry

- October 2023: Panasonic developed a new central heat pump system, the Interior 1.5 Ton Central Heat Pump, for residential space heating and cooling. This launch expands Panasonic's product portfolio and strengthens its competitiveness in the heat pump market.

- March 2024: Daikin Industries Ltd announced the launch of the next generation ‘All Seasons’ Perfera home air-to-air heat pump. This product launch demonstrates Daikin's commitment to innovation and enhancing user experience in the HVAC sector.

Strategic Outlook for United Kingdom Commercial HVAC Market Market

The UK Commercial HVAC market is poised for sustained growth, driven by the ongoing focus on sustainability, technological advancements, and increasing construction activity. The market will likely see a continued shift towards energy-efficient and smart HVAC systems, creating significant opportunities for innovative players. The market's future potential is promising, with significant growth expected in the adoption of heat pump technologies and integrated building management systems.

United Kingdom Commercial HVAC Market Segmentation

-

1. Type of Component

-

1.1. HVAC Equipment

- 1.1.1. Heating Equipment

- 1.1.2. Air Conditioning /Ventillation Equipment

- 1.2. HVAC Services

-

1.1. HVAC Equipment

-

2. End User Industry

- 2.1. Hospitality

- 2.2. Commercial Buildings

- 2.3. Public Buildings

- 2.4. Others

United Kingdom Commercial HVAC Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Commercial HVAC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.14% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Commercial Construction in Major Emerging Economies; Increasing Demand For Energy Efficient Devices

- 3.3. Market Restrains

- 3.3.1. Growing Commercial Construction in Major Emerging Economies; Increasing Demand For Energy Efficient Devices

- 3.4. Market Trends

- 3.4.1. Heating Equipment is Expected to Grow with Significant CAGR

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Commercial HVAC Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Component

- 5.1.1. HVAC Equipment

- 5.1.1.1. Heating Equipment

- 5.1.1.2. Air Conditioning /Ventillation Equipment

- 5.1.2. HVAC Services

- 5.1.1. HVAC Equipment

- 5.2. Market Analysis, Insights and Forecast - by End User Industry

- 5.2.1. Hospitality

- 5.2.2. Commercial Buildings

- 5.2.3. Public Buildings

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Type of Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Johnson Controls International PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Midea Group Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Daikin Industries Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Robert Bosch GmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Carrier Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 LG Electronics Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Lennox International Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BDR Thermea Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Panasonic Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Danfoss A/

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Johnson Controls International PLC

List of Figures

- Figure 1: United Kingdom Commercial HVAC Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Commercial HVAC Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Commercial HVAC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Commercial HVAC Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: United Kingdom Commercial HVAC Market Revenue Million Forecast, by Type of Component 2019 & 2032

- Table 4: United Kingdom Commercial HVAC Market Volume Billion Forecast, by Type of Component 2019 & 2032

- Table 5: United Kingdom Commercial HVAC Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 6: United Kingdom Commercial HVAC Market Volume Billion Forecast, by End User Industry 2019 & 2032

- Table 7: United Kingdom Commercial HVAC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: United Kingdom Commercial HVAC Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: United Kingdom Commercial HVAC Market Revenue Million Forecast, by Type of Component 2019 & 2032

- Table 10: United Kingdom Commercial HVAC Market Volume Billion Forecast, by Type of Component 2019 & 2032

- Table 11: United Kingdom Commercial HVAC Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 12: United Kingdom Commercial HVAC Market Volume Billion Forecast, by End User Industry 2019 & 2032

- Table 13: United Kingdom Commercial HVAC Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Kingdom Commercial HVAC Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Commercial HVAC Market?

The projected CAGR is approximately 6.14%.

2. Which companies are prominent players in the United Kingdom Commercial HVAC Market?

Key companies in the market include Johnson Controls International PLC, Midea Group Co Ltd, Daikin Industries Ltd, Robert Bosch GmbH, Carrier Corporation, LG Electronics Inc, Lennox International Inc, BDR Thermea Group, Panasonic Corporation, Danfoss A/.

3. What are the main segments of the United Kingdom Commercial HVAC Market?

The market segments include Type of Component, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.83 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Commercial Construction in Major Emerging Economies; Increasing Demand For Energy Efficient Devices.

6. What are the notable trends driving market growth?

Heating Equipment is Expected to Grow with Significant CAGR.

7. Are there any restraints impacting market growth?

Growing Commercial Construction in Major Emerging Economies; Increasing Demand For Energy Efficient Devices.

8. Can you provide examples of recent developments in the market?

March 2024 - Daikin Industries Ltd announced the launch of the next generation ‘All Seasons’ Perfera home air-to-air heat pump, also referred to as air conditioning. The indoor and outdoor units of the Perfera system have been fully redesigned to enhance the user experience, making them both easy to install and easy to use.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Commercial HVAC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Commercial HVAC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Commercial HVAC Market?

To stay informed about further developments, trends, and reports in the United Kingdom Commercial HVAC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence