Key Insights

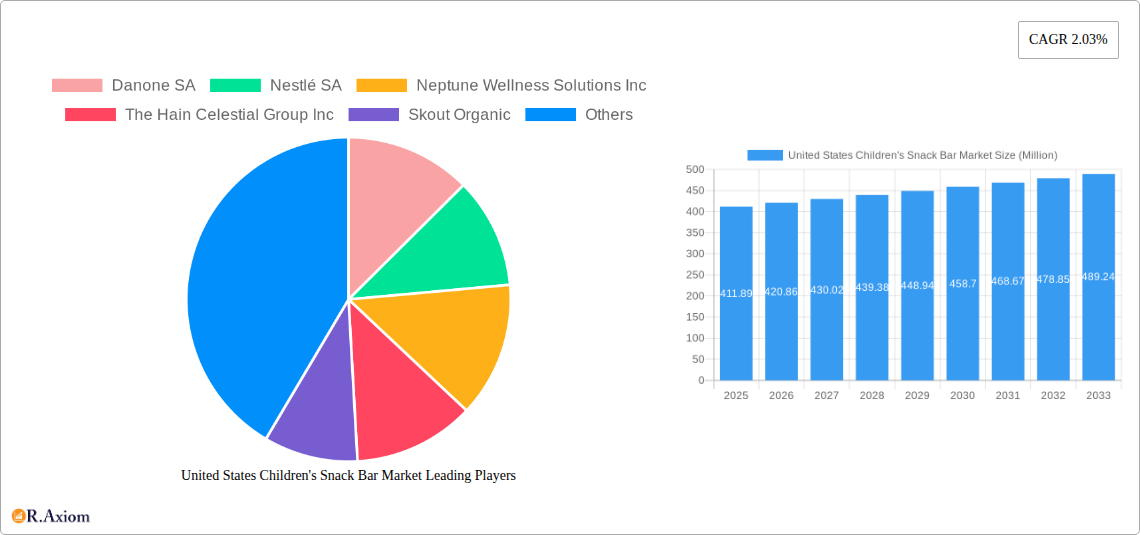

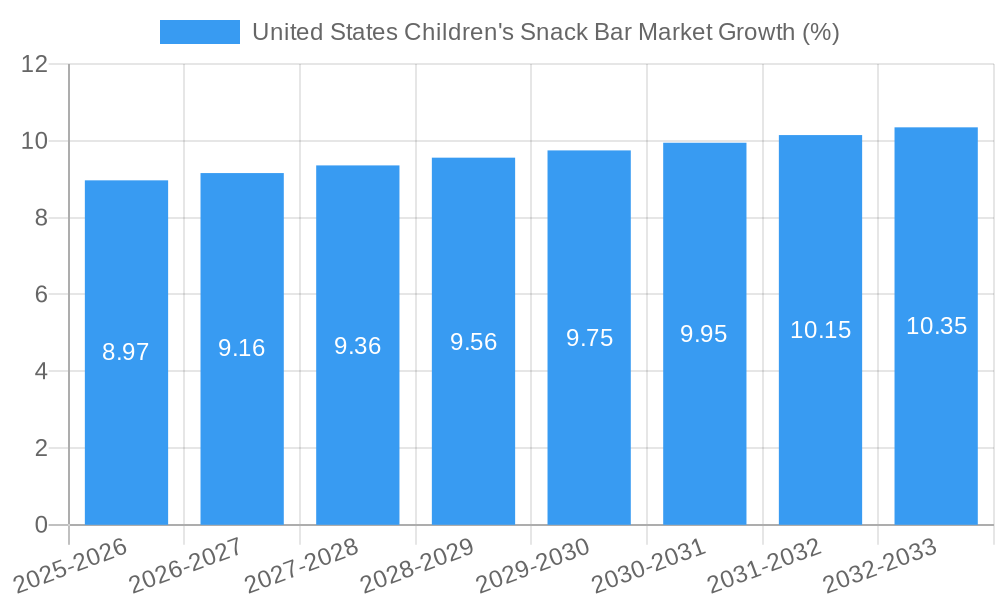

The United States children's snack bar market, valued at $411.89 million in 2025, is projected to experience steady growth, driven by several key factors. The increasing prevalence of busy lifestyles among parents fuels the demand for convenient, nutritious snack options for their children. Health-conscious parents are actively seeking snack bars with reduced sugar, added fiber, and whole grains, leading to a surge in demand for organic and healthier alternatives. Furthermore, the growing awareness of childhood obesity and the need for balanced nutrition is propelling the market forward. Marketing strategies focusing on fun characters, appealing flavors, and educational messaging also significantly influence purchasing decisions. While the market's Compound Annual Growth Rate (CAGR) of 2.03% indicates a moderate growth trajectory, the segmentation within this market presents diverse opportunities. Sub-segments, such as organic snack bars, gluten-free options, and bars fortified with essential vitamins and minerals, are expected to outperform the overall market average due to rising health concerns and specialized dietary needs.

The competitive landscape is dominated by established players like Danone SA, Nestlé SA, and Mondelez International Inc., who leverage their brand recognition and extensive distribution networks. However, smaller companies focusing on niche markets, such as organic or allergen-free snack bars, are gaining traction by catering to specific consumer preferences. The market's future growth hinges on innovation within product formulations, packaging designs that appeal to children, and effective marketing campaigns targeting health-conscious parents. Factors such as fluctuating raw material prices and evolving consumer preferences pose potential challenges, but the overall outlook for the US children's snack bar market remains positive, with promising prospects for continued expansion throughout the forecast period (2025-2033).

United States Children's Snack Bar Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States children's snack bar market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report delves into market dynamics, competitive landscapes, and future growth projections. The market size is projected to reach xx Million by 2033, showcasing significant growth potential.

United States Children's Snack Bar Market Market Concentration & Innovation

The US children's snack bar market exhibits a moderately concentrated landscape, with key players like Danone SA, Nestlé SA, and Mondelez International Inc. holding significant market share. However, the market also features numerous smaller players and emerging brands focusing on niche segments like organic and allergen-free options. Market share data for 2024 indicates that the top 5 players collectively hold approximately xx% of the market, leaving ample room for smaller players. Innovation is driven by increasing consumer demand for healthier, more nutritious options, leading to the development of bars with added vitamins, probiotics, and functional ingredients.

- Market Concentration: Top 5 players hold approximately xx% market share (2024).

- Innovation Drivers: Health and wellness trends, increasing demand for organic and allergen-free options, functional ingredients.

- Regulatory Frameworks: FDA regulations on food labeling and nutritional claims significantly influence product development.

- Product Substitutes: Other convenient snacks, such as fruit, yogurt tubes, and granola.

- End-User Trends: Growing preference for on-the-go snacks, increasing health consciousness amongst parents.

- M&A Activities: The number of M&A deals in the sector has increased in recent years, with deal values averaging xx Million (2019-2024). Consolidation is likely to continue as larger players seek to expand their product portfolios and market reach.

United States Children's Snack Bar Market Industry Trends & Insights

The US children's snack bar market is experiencing robust growth, driven by several key factors. The CAGR for the period 2019-2024 was xx%, and is projected to be xx% from 2025-2033. This growth is fueled by rising disposable incomes, increasing health awareness among parents, and the growing popularity of convenient and portable snack options. Technological advancements, such as improved packaging and shelf-life extension techniques, are also contributing to market expansion. Consumer preferences are shifting towards healthier options, including organic, gluten-free, and low-sugar bars. Competitive dynamics are characterized by intense competition, with both established players and new entrants vying for market share. Market penetration in key segments, such as organic snack bars, is steadily increasing.

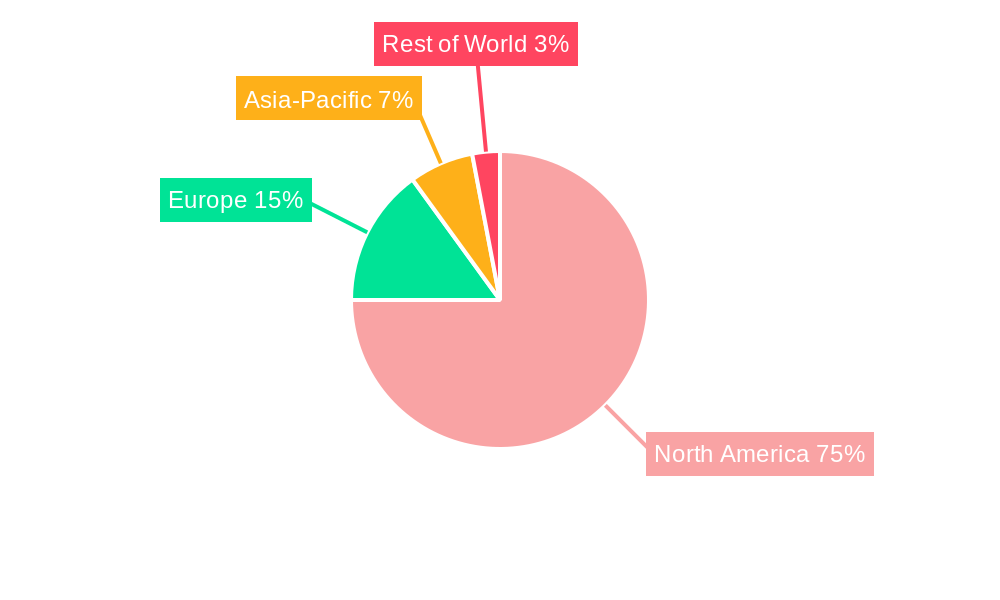

Dominant Markets & Segments in United States Children's Snack Bar Market

The Western region of the United States demonstrates the highest market share within the children's snack bar market. This dominance is attributed to several key drivers:

- Higher Disposable Incomes: Relatively higher disposable incomes compared to other regions fuel greater spending on convenient food products.

- Health Consciousness: A greater emphasis on health and wellness within this region contributes to demand for healthier snack options.

- Strong Retail Infrastructure: A well-established retail network provides broad accessibility for snack bars.

Further market segmentation reveals a strong preference for organic and allergen-free bars, particularly amongst health-conscious parents. The growth within these segments is outpacing the overall market growth, driven by increasing parental awareness regarding dietary restrictions and health concerns in children.

United States Children's Snack Bar Market Product Developments

Recent product innovations focus heavily on catering to specific dietary needs and preferences. There's a surge in organic, gluten-free, and allergen-free options. Furthermore, functional ingredients are being incorporated to boost nutritional value, such as added vitamins, probiotics, and fiber. These developments aim to capture the growing market of health-conscious parents seeking nutritious snack choices for their children.

Report Scope & Segmentation Analysis

This report segments the market by product type (e.g., fruit bars, granola bars, energy bars), distribution channel (e.g., supermarkets, convenience stores, online retailers), age group (e.g., toddlers, school-aged children, teenagers), and ingredient type (e.g., organic, conventional). Each segment's growth trajectory, market size, and competitive dynamics are analyzed, providing a granular understanding of market opportunities. Growth projections vary across segments, with the organic snack bar segment predicted to witness the most rapid expansion.

Key Drivers of United States Children's Snack Bar Market Growth

Several factors contribute to the market's robust growth. The rising prevalence of busy lifestyles, leading to a greater demand for convenient snack options, is a key driver. Increased health awareness amongst parents fuels the demand for nutritious bars. Furthermore, favorable government regulations supporting the food industry and technological advancements in product development and packaging contribute to market expansion.

Challenges in the United States Children's Snack Bar Market Sector

The market faces challenges such as stringent food safety regulations and evolving consumer preferences. Fluctuations in raw material prices pose supply chain disruptions. Intense competition from established players and new entrants also presents a considerable challenge. These factors can influence production costs and pricing strategies, impacting overall market growth.

Emerging Opportunities in United States Children's Snack Bar Market

Emerging opportunities lie in developing innovative products catering to specific dietary requirements and preferences, such as vegan, keto, and low-sugar options. Expanding into emerging markets and online sales channels can unlock significant growth potential. Furthermore, collaborations with established brands and health organizations can enhance product credibility and market penetration.

Leading Players in the United States Children's Snack Bar Market Market

- Danone SA

- Nestlé SA

- Neptune Wellness Solutions Inc

- The Hain Celestial Group Inc

- Skout Organic

- Ready Set Food!

- Cerebelly

- Sun-maid Growers of California

- Mondelez International Inc

- Mars Inc

- List Not Exhaustive

Key Developments in United States Children's Snack Bar Market Industry

- July 2023: Cerebelly launched its bars at Publix stores across the southeastern US, expanding its market reach.

- June 2023: READY. SET. FOOD! collaborated with Daniel Tiger's Neighborhood to launch new toddler snack bars, aiming to ease allergen introduction.

- May 2023: Nestlé SA launched a Milo protein snack bar, expanding its product portfolio and targeting health-conscious consumers.

Strategic Outlook for United States Children's Snack Bar Market Market

The future of the US children's snack bar market is promising. Continued growth is expected, driven by increasing health awareness, product innovation, and expanding distribution channels. Companies focusing on healthy, convenient, and appealing products are poised to capitalize on this growth. The market's dynamic nature requires constant innovation and adaptation to changing consumer preferences.

United States Children's Snack Bar Market Segmentation

-

1. Age

- 1.1. 6 Months - 2 Years

- 1.2. 2-4 Years

- 1.3. 4-6 years

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

United States Children's Snack Bar Market Segmentation By Geography

- 1. United States

United States Children's Snack Bar Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.03% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Convenient and On-the-go Snacking Options Enticing Parents; Health-focused Children's Snack Bars Augmenting Market Demand

- 3.3. Market Restrains

- 3.3.1. Convenient and On-the-go Snacking Options Enticing Parents; Health-focused Children's Snack Bars Augmenting Market Demand

- 3.4. Market Trends

- 3.4.1. Supermarkets/Hypermarkets Remain a Significant Distribution Channel

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Children's Snack Bar Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Age

- 5.1.1. 6 Months - 2 Years

- 5.1.2. 2-4 Years

- 5.1.3. 4-6 years

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Age

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Danone SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nestlé SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Neptune Wellness Solutions Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Hain Celestial Group Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Skout Organic

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ready Set Food!

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cerebelly

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sun-maid Growers of California

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mondelez International Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mars Inc *List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Danone SA

List of Figures

- Figure 1: United States Children's Snack Bar Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Children's Snack Bar Market Share (%) by Company 2024

List of Tables

- Table 1: United States Children's Snack Bar Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Children's Snack Bar Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: United States Children's Snack Bar Market Revenue Million Forecast, by Age 2019 & 2032

- Table 4: United States Children's Snack Bar Market Volume Million Forecast, by Age 2019 & 2032

- Table 5: United States Children's Snack Bar Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: United States Children's Snack Bar Market Volume Million Forecast, by Distribution Channel 2019 & 2032

- Table 7: United States Children's Snack Bar Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: United States Children's Snack Bar Market Volume Million Forecast, by Region 2019 & 2032

- Table 9: United States Children's Snack Bar Market Revenue Million Forecast, by Age 2019 & 2032

- Table 10: United States Children's Snack Bar Market Volume Million Forecast, by Age 2019 & 2032

- Table 11: United States Children's Snack Bar Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: United States Children's Snack Bar Market Volume Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: United States Children's Snack Bar Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States Children's Snack Bar Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Children's Snack Bar Market?

The projected CAGR is approximately 2.03%.

2. Which companies are prominent players in the United States Children's Snack Bar Market?

Key companies in the market include Danone SA, Nestlé SA, Neptune Wellness Solutions Inc, The Hain Celestial Group Inc, Skout Organic, Ready Set Food!, Cerebelly, Sun-maid Growers of California, Mondelez International Inc, Mars Inc *List Not Exhaustive.

3. What are the main segments of the United States Children's Snack Bar Market?

The market segments include Age, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 411.89 Million as of 2022.

5. What are some drivers contributing to market growth?

Convenient and On-the-go Snacking Options Enticing Parents; Health-focused Children's Snack Bars Augmenting Market Demand.

6. What are the notable trends driving market growth?

Supermarkets/Hypermarkets Remain a Significant Distribution Channel.

7. Are there any restraints impacting market growth?

Convenient and On-the-go Snacking Options Enticing Parents; Health-focused Children's Snack Bars Augmenting Market Demand.

8. Can you provide examples of recent developments in the market?

July 2023: Cerebelly launched its bars at Publix stores throughout the southeast United States. Cerebelly claimed to offer an assortment of organic smart bars throughout Alabama, Florida, Georgia, North Carolina, South Carolina, Tennessee, and Virginia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Children's Snack Bar Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Children's Snack Bar Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Children's Snack Bar Market?

To stay informed about further developments, trends, and reports in the United States Children's Snack Bar Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence