Key Insights

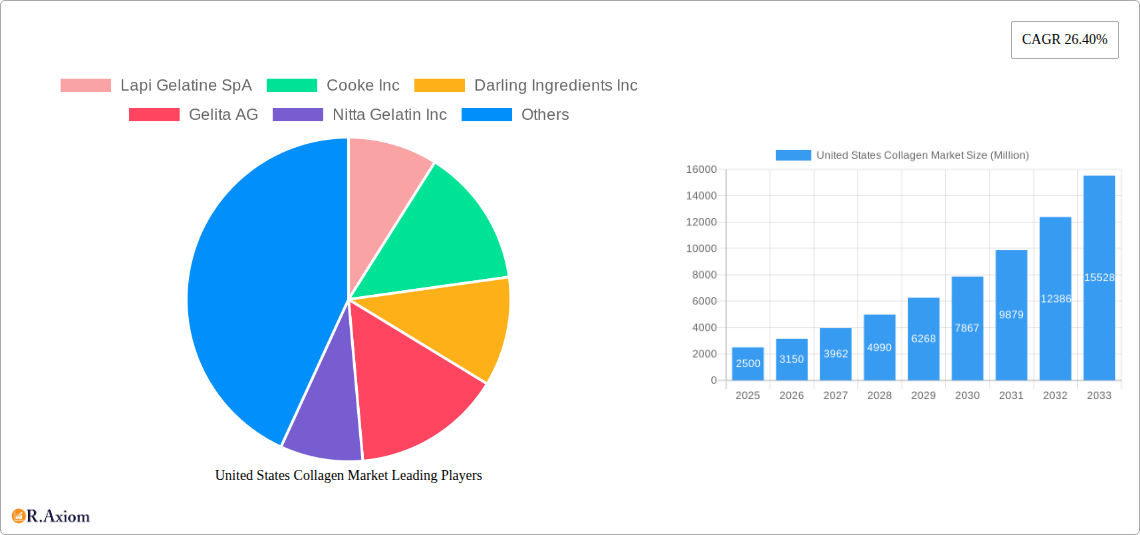

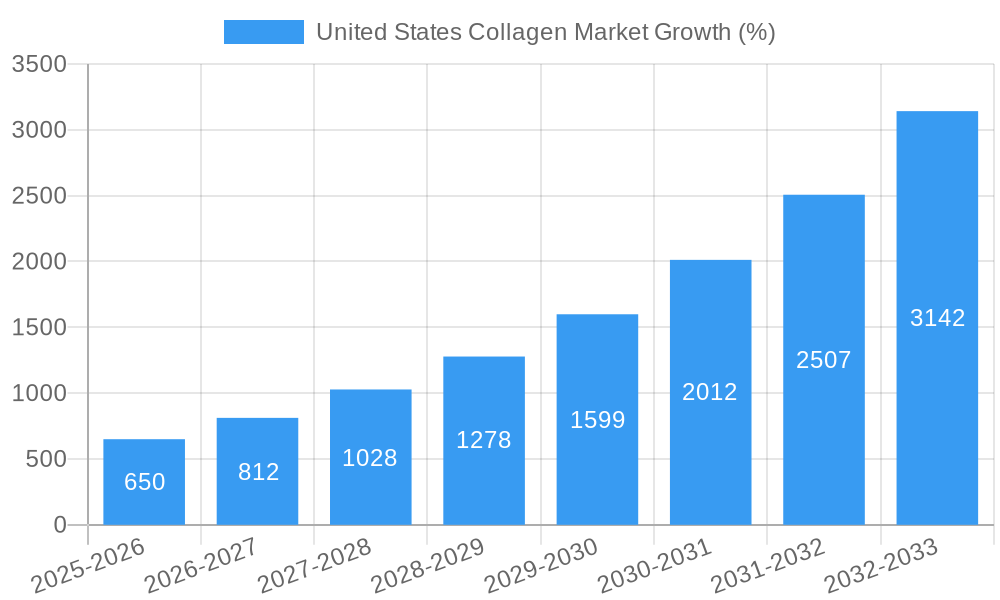

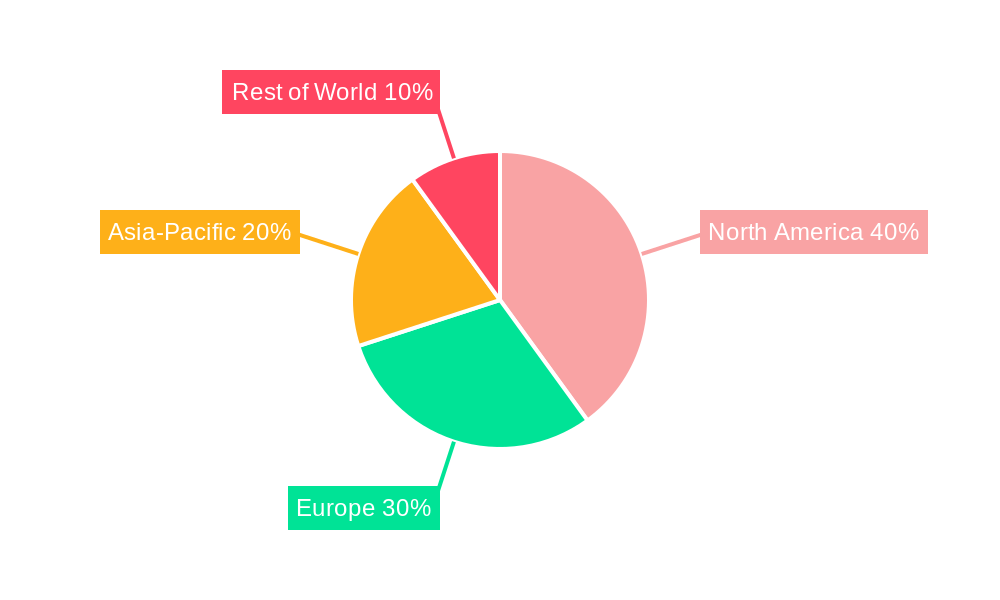

The United States collagen market is experiencing robust growth, driven by increasing consumer awareness of collagen's benefits for skin health, joint mobility, and overall well-being. The market's substantial size, estimated at $X billion in 2025 (assuming a logical extrapolation based on the provided global CAGR of 26.40% and market size, adjusting for the US market share—a reasonable estimate would be to assume a significant share, for instance, 30-40% of the global market), is projected to expand at a significant rate through 2033. This expansion is fueled by several key factors, including the rising popularity of collagen supplements within the food and beverage, sports nutrition, and animal feed industries. The burgeoning health and wellness sector, coupled with increased disposable incomes and a growing preference for natural and functional ingredients, is further propelling market growth. Significant advancements in collagen extraction technologies, leading to higher purity and bioavailability, are also contributing to the market's positive trajectory. The segment breakdown reveals substantial demand across all end-user applications, with animal feed holding significant share due to its use in enhancing animal health and productivity. However, the food and beverage and sports nutrition segments are experiencing the fastest growth rates, as consumers increasingly seek natural solutions to improve their health and fitness.

Competition within the US collagen market is intense, with both established global players and emerging regional companies vying for market share. Major players like Gelita AG, Darling Ingredients Inc., and Lapi Gelatine SpA are leveraging their extensive manufacturing capabilities and strong distribution networks to maintain their market dominance. However, smaller companies specializing in innovative collagen products and formulations are gaining traction, particularly within niche segments like sports nutrition. The market's future hinges on continued innovation in product development, exploration of new collagen sources (including marine-based collagen), and strategic partnerships that ensure supply chain efficiency and sustainability. The continued focus on product efficacy, consumer education, and marketing strategies targeting health-conscious individuals will be crucial for market players' success.

United States Collagen Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States collagen market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a focus on the forecast period from 2025 to 2033, using 2025 as the base year. The report segments the market by form (animal-based, marine-based) and end-user (animal feed, food and beverages, sport/performance nutrition), providing detailed market size estimations in Millions for each segment.

United States Collagen Market Market Concentration & Innovation

The United States collagen market exhibits a moderately consolidated structure, with a few dominant players controlling a significant market share. While precise market share figures for individual companies are proprietary information, industry giants like Gelita AG, Darling Ingredients Inc. (through Rousselot), and Lapi Gelatine SpA hold substantial positions. The market is characterized by ongoing innovation, driven by the increasing demand for high-quality, functional collagen products. Several factors influence the market dynamics including:

- Innovation Drivers: Growing consumer awareness of collagen's health benefits, advancements in extraction and processing technologies (leading to purer, more bioavailable products), and the development of novel applications in diverse sectors (cosmetics, pharmaceuticals, etc.) are propelling innovation.

- Regulatory Frameworks: FDA regulations related to food safety and labeling significantly impact market players. Compliance costs and adherence to evolving guidelines play a crucial role in market competition.

- Product Substitutes: Alternatives like plant-based protein sources present competitive pressure, though collagen's unique properties and established efficacy remain strong advantages.

- End-User Trends: A surge in demand from the food and beverage industry and the sports nutrition sectors, driven by health-conscious consumers, is a key market driver. The animal feed sector continues to represent a significant portion of total demand.

- M&A Activities: While specific deal values are confidential, the market has witnessed several mergers and acquisitions aimed at expanding product portfolios, geographical reach, and technological capabilities. Such activities contribute to market consolidation and influence competitive landscapes. The report analyzes a xx Million worth of M&A activity over the study period.

United States Collagen Market Industry Trends & Insights

The United States collagen market is experiencing robust growth, with a projected CAGR of xx% during the forecast period (2025-2033). Several factors fuel this expansion:

The rising popularity of collagen supplements among health-conscious consumers seeking improved skin, joint, and gut health is a major driving force. Technological advancements in extraction methods yield higher-quality collagen peptides with enhanced bioavailability, further fueling consumer adoption. Changing dietary preferences, the increasing prevalence of age-related ailments, and the growing awareness of preventative healthcare measures are also contributing factors. Increased product diversification, from simple supplements to sophisticated functional foods and beverages, is broadening market appeal. Competition among existing players, and the entry of new companies, is intensifying. This results in innovation, price adjustments, and broader distribution channels, stimulating market growth. Market penetration of collagen products across various end-user sectors continues to rise, indicating substantial future potential. The report provides a comprehensive analysis of these trends and provides insights into the market's future trajectory.

Dominant Markets & Segments in United States Collagen Market

The United States collagen market is characterized by the dominance of the animal-based collagen segment within the ‘Form’ category, accounting for approximately xx% of the total market in 2025. This dominance is attributed to higher production volumes, established supply chains, and relatively lower costs compared to marine-based alternatives. The food and beverage industry is the leading end-user segment, dominating market share with approximately xx% in 2025, driven by the increasing incorporation of collagen peptides in functional foods and beverages.

Key Drivers for Animal-Based Collagen Dominance:

- Established Supply Chains: Well-established supply and distribution networks facilitate cost-effective production and delivery.

- Cost-Effectiveness: Animal-based collagen generally has a lower production cost compared to marine-based alternatives.

- Consumer Preference: Consumer familiarity and acceptance of animal-based collagen contributes to its market share.

Key Drivers for Food and Beverage Segment Dominance:

- Health and Wellness Trend: Growing consumer interest in functional foods and beverages that support health and wellness.

- Product Innovation: The emergence of numerous collagen-infused beverages and foods catering to various preferences.

- Extensive Distribution Channels: Widespread availability in supermarkets, specialty stores, and online retailers.

United States Collagen Market Product Developments

Recent product innovations focus on improved bioavailability, enhanced solubility, and tailored formulations for specific health benefits. Companies are developing hydrolyzed collagen peptides with superior absorption rates and incorporating advanced technologies like microencapsulation to improve stability and shelf life. These developments cater to consumer demand for effective and convenient collagen products. The market sees a clear trend towards specialized collagen formulations targeting specific health needs. For example, collagen peptides formulated for joint health, skin elasticity, or gut health have gained significant traction. This targeted approach enhances product differentiation and increases market appeal.

Report Scope & Segmentation Analysis

This report segments the United States collagen market by:

Form:

Animal-Based: This segment is projected to experience a CAGR of xx% during the forecast period, driven by established production methods and consumer preference. The segment is characterized by intense competition, with major players focusing on innovation and cost optimization.

Marine-Based: This segment is expected to witness a CAGR of xx% during the forecast period, driven by increased consumer demand for sustainably sourced products and growing health-consciousness. While this segment is smaller, it shows strong growth potential.

End-User:

Animal Feed: This segment is expected to maintain a steady growth trajectory, with a projected CAGR of xx%, driven by the increasing use of collagen as a feed additive to enhance animal health and productivity. Competitive landscape is moderate.

Food and Beverages: This segment is projected to have the highest CAGR of xx%, driven by burgeoning consumer interest in collagen-infused foods and beverages. Competitive intensity is high within this rapidly expanding market.

Sport/Performance Nutrition: This segment is expected to grow at a CAGR of xx%, driven by rising consumer demand for performance-enhancing products. The segment presents a competitive landscape where product innovation is key.

Key Drivers of United States Collagen Market Growth

Several factors are fueling the growth of the United States collagen market:

- Growing Health Consciousness: Consumers are increasingly seeking natural solutions for health and wellness, leading to increased collagen consumption.

- Technological Advancements: Improved extraction and processing techniques are resulting in higher-quality and more bioavailable collagen products.

- Rising Disposable Incomes: Increasing disposable incomes allow consumers to spend more on premium health and wellness products.

- Expanding Distribution Channels: Greater availability of collagen products across various retail outlets and online platforms.

Challenges in the United States Collagen Market Sector

Despite the strong growth outlook, certain challenges exist:

- Fluctuations in Raw Material Prices: Prices of raw materials used in collagen production can impact market profitability.

- Stringent Regulatory Requirements: Compliance with food safety and labeling regulations requires significant investment and expertise.

- Competition from Substitutes: Alternative protein sources and other joint health supplements pose competition to collagen products.

Emerging Opportunities in United States Collagen Market

Emerging opportunities include:

- Expansion into Novel Applications: Collagen's applications are continuously expanding, from pharmaceuticals to cosmetics.

- Development of Innovative Delivery Systems: Innovative delivery systems (e.g., liposomal encapsulation) enhance product efficacy and absorption.

- Focus on Sustainability: Consumers are increasingly seeking sustainably sourced collagen products, offering opportunities for environmentally conscious companies.

Leading Players in the United States Collagen Market Market

- Lapi Gelatine SpA

- Cooke Inc

- Darling Ingredients Inc

- Gelita AG

- Nitta Gelatin Inc

- Tessenderlo Group

- Holista Colltech

- NutriScience Innovations LLC

- Nagase & Co Ltd

- Italgelatine SpA

Key Developments in United States Collagen Market Industry

- January 2021: Rousselot (Darling Ingredients) launched MSC-certified marine collagen peptides, expanding its product portfolio in the health and beauty markets.

- March 2021: GELITA USA opened a new collagen peptide production unit, reflecting the significant growth and future prospects of the collagen peptide market.

- May 2021: Holista Colltech received a grant to expand its medical-grade collagen production, strengthening its position in the high-quality collagen segment.

Strategic Outlook for United States Collagen Market Market

The United States collagen market is poised for continued growth, driven by increasing health awareness, technological advancements, and expanding applications. Strategic players should focus on product innovation, sustainable sourcing, and targeted marketing to capture market share in this dynamic sector. The expanding market for collagen peptides in the food and beverage and sports nutrition industries offers attractive opportunities for companies to develop and launch innovative and tailored products. The shift toward plant-based alternatives represents a significant future challenge. Meeting this challenge with innovative solutions and sustainably sourced products will be essential for long-term success.

United States Collagen Market Segmentation

-

1. Form

- 1.1. Animal Based

- 1.2. Marine Based

-

2. End User

- 2.1. Animal Feed

-

2.2. Food and Beverages

-

2.2.1. By Sub End User

- 2.2.1.1. Bakery

- 2.2.1.2. Breakfast Cereals

- 2.2.1.3. Snacks

-

2.2.1. By Sub End User

- 2.3. Personal Care and Cosmetics

-

2.4. Supplements

- 2.4.1. Elderly Nutrition and Medical Nutrition

- 2.4.2. Sport/Performance Nutrition

United States Collagen Market Segmentation By Geography

- 1. United States

United States Collagen Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 26.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Urbanization; Growing Disposable Income

- 3.3. Market Restrains

- 3.3.1. High-price and additional delivery charges

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Collagen Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Animal Based

- 5.1.2. Marine Based

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Animal Feed

- 5.2.2. Food and Beverages

- 5.2.2.1. By Sub End User

- 5.2.2.1.1. Bakery

- 5.2.2.1.2. Breakfast Cereals

- 5.2.2.1.3. Snacks

- 5.2.2.1. By Sub End User

- 5.2.3. Personal Care and Cosmetics

- 5.2.4. Supplements

- 5.2.4.1. Elderly Nutrition and Medical Nutrition

- 5.2.4.2. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. United States United States Collagen Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada United States Collagen Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico United States Collagen Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America United States Collagen Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Lapi Gelatine SpA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Cooke Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Darling Ingredients Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Gelita AG

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Nitta Gelatin Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Tessenderlo Grou

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Holista Colltech

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 NutriScience Innovations LLC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Nagase & Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Italgelatine SpA

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Lapi Gelatine SpA

List of Figures

- Figure 1: United States Collagen Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Collagen Market Share (%) by Company 2024

List of Tables

- Table 1: United States Collagen Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Collagen Market Revenue Million Forecast, by Form 2019 & 2032

- Table 3: United States Collagen Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: United States Collagen Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: United States Collagen Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States United States Collagen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada United States Collagen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico United States Collagen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America United States Collagen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United States Collagen Market Revenue Million Forecast, by Form 2019 & 2032

- Table 11: United States Collagen Market Revenue Million Forecast, by End User 2019 & 2032

- Table 12: United States Collagen Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Collagen Market?

The projected CAGR is approximately 26.40%.

2. Which companies are prominent players in the United States Collagen Market?

Key companies in the market include Lapi Gelatine SpA, Cooke Inc, Darling Ingredients Inc, Gelita AG, Nitta Gelatin Inc, Tessenderlo Grou, Holista Colltech, NutriScience Innovations LLC, Nagase & Co Ltd, Italgelatine SpA.

3. What are the main segments of the United States Collagen Market?

The market segments include Form, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Urbanization; Growing Disposable Income.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High-price and additional delivery charges.

8. Can you provide examples of recent developments in the market?

May 2021: Holista Colltech, a research-driven biotech firm, received an AUD 501,250 grant from the Western Australian government through the Collie Futures Industry Development Fund to expand their collagen production. Holista Colltech would be able to expand higher-quality, medical-grade collagen as a result of this initiative.March 2021: GELITA USA opened its new collagen peptide unit, a 30,000-square-foot production unit at the southeastern end of the complex in the Port Neal industrial area near Sioux City in Iowa. This expansion is majorly driven by the double-digit market growth of GELITA’s collagen peptides, especially in the health and beauty markets, with no sign of slowing down in the future.January 2021: Rousselot, a Darling Ingredients brand producing collagen-based solutions, launched MSC-certified marine collagen peptides, Peptan®, at the virtual Beauty & Skincare Formulation Conference in 2021. This ingredient is sourced from 100% wild-caught marine white fish, certified by the Marine Stewardsh

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Collagen Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Collagen Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Collagen Market?

To stay informed about further developments, trends, and reports in the United States Collagen Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence