Key Insights

The United States data center networking market is projected to reach approximately $7.85 billion in value by 2025, demonstrating robust growth driven by an estimated CAGR of 4.20% over the forecast period extending to 2033. This expansion is fueled by critical drivers such as the escalating demand for high-speed data processing, the proliferation of cloud computing services, and the ongoing digital transformation initiatives across various industries. The increasing adoption of advanced technologies like artificial intelligence, machine learning, and the Internet of Things (IoT) necessitates more sophisticated and efficient networking infrastructures within data centers to handle the exponential growth in data traffic. Furthermore, the need for enhanced security, scalability, and performance in enterprise networks continues to propel investments in cutting-edge data center networking solutions.

United States Data Center Networking Market Market Size (In Billion)

Key market segments contributing to this growth include components like Ethernet switches and routers, which are fundamental to network infrastructure, and services such as installation, integration, training, and support. The IT & Telecommunication and BFSI sectors are anticipated to be major end-users, leveraging data center networking for their critical operations. Emerging trends like software-defined networking (SDN) and network function virtualization (NFV) are reshaping the market by offering greater flexibility and automation. While the market exhibits strong growth, potential restraints such as the high initial investment costs and the complexity of integrating new technologies may pose challenges. Nevertheless, the sustained digital evolution and the continuous upgrading of data center capabilities position the United States data center networking market for significant and sustained expansion.

United States Data Center Networking Market Company Market Share

This comprehensive report delves into the United States Data Center Networking Market, offering in-depth analysis, actionable insights, and critical market intelligence for industry stakeholders. Covering a Study Period of 2019–2033, with a Base Year and Estimated Year of 2025, and a Forecast Period of 2025–2033, this report meticulously examines historical trends from 2019–2024 to project future market trajectories. We explore the intricate landscape of data center networking solutions, focusing on crucial segments like Ethernet Switches, Routers, Storage Area Network (SAN), Application Delivery Controllers (ADC), and Other Networking Equipment, alongside Installation & Integration, Training & Consulting, and Support & Maintenance services. The report further dissects end-user adoption across IT & Telecommunication, BFSI, Government, Media & Entertainment, and Other End-Users, providing a granular view of market dynamics. With an estimated market size of over $XX Billion in 2025, and a projected Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033, this research is essential for understanding the evolution of critical infrastructure in the US.

United States Data Center Networking Market Market Concentration & Innovation

The United States Data Center Networking Market exhibits a moderate to high degree of market concentration, with a few dominant players controlling a significant share of the market. Innovation serves as a primary driver, fueled by the relentless demand for higher bandwidth, lower latency, and enhanced security. Key innovation drivers include advancements in AI and machine learning, the proliferation of edge computing, the need for hyperscale data center scalability, and the increasing adoption of cloud-native architectures. Regulatory frameworks, while generally supportive of technological advancement, can influence deployment strategies, particularly concerning data privacy and security mandates. Product substitutes, such as advancements in software-defined networking (SDN) and network function virtualization (NFV), are increasingly challenging traditional hardware-centric approaches, forcing vendors to adapt their product portfolios. End-user trends are shifting towards more agile, flexible, and automated network solutions to support dynamic workloads and real-time data processing. Mergers and acquisition (M&A) activities are a crucial aspect of market dynamics, with deal values often in the hundreds of millions to billions of dollars, as companies seek to consolidate market share, acquire cutting-edge technologies, and expand their service offerings. For instance, a major acquisition by a leading networking hardware provider to integrate a cutting-edge AI networking software company could reshape competitive landscapes.

United States Data Center Networking Market Industry Trends & Insights

The United States data center networking market is experiencing robust growth, propelled by an insatiable demand for data processing, storage, and connectivity. The escalating adoption of cloud computing, both public and private, stands as a pivotal growth driver, necessitating scalable and high-performance networking infrastructure. The continuous surge in data generation from diverse sources, including the Internet of Things (IoT), social media, and scientific research, further amplifies the need for advanced data center networking solutions. Technological disruptions are reshaping the market at an unprecedented pace. Software-Defined Networking (SDN) and Network Function Virtualization (NFV) are revolutionizing network management by offering greater flexibility, automation, and cost-efficiency. The advent of 5G technology is also a significant influencer, demanding ultra-low latency and massive bandwidth capabilities within data centers to support a new wave of applications and services. Consumer preferences are increasingly leaning towards seamless, high-speed connectivity and enhanced user experiences, which directly translate into requirements for sophisticated data center networks capable of handling massive data flows. Competitive dynamics are intensifying, with established players continually innovating to maintain market leadership while new entrants leverage emerging technologies to disrupt the status quo. Companies are investing heavily in research and development to offer solutions that address the growing complexities of modern data center environments. The market penetration of advanced networking technologies like AI-driven network optimization and intent-based networking is on an upward trajectory. The projected CAGR of XX% for the forecast period underscores the market's strong expansion potential, driven by ongoing digital transformation initiatives across all sectors.

Dominant Markets & Segments in United States Data Center Networking Market

The IT & Telecommunication end-user segment is unequivocally the dominant force within the United States Data Center Networking Market. This leadership is driven by the sector's inherent reliance on vast, high-speed, and secure network infrastructure to support its core operations, including cloud services, mobile communication networks, and internet service provision. The sheer volume of data traffic generated and consumed by telecommunications companies and IT service providers necessitates continuous investment in the latest networking technologies.

- Key Drivers for IT & Telecommunication Dominance:

- Exponential Data Growth: The explosion of data from mobile devices, streaming services, and cloud applications directly fuels demand for advanced networking in this sector.

- Cloud Adoption: The widespread migration of workloads to public, private, and hybrid cloud environments requires robust and scalable data center networking.

- 5G Rollout: The ongoing deployment of 5G networks demands significant upgrades in data center infrastructure to handle increased capacity and reduced latency.

- Digital Transformation Initiatives: Ongoing investments in digital services and platforms by IT and telecom companies necessitate sophisticated networking capabilities.

Beyond the IT & Telecommunication sector, the BFSI (Banking, Financial Services, and Insurance) segment also represents a significant and growing market. Financial institutions demand extremely low-latency, high-throughput, and highly secure networking solutions for critical operations such as high-frequency trading, real-time transaction processing, and fraud detection. Regulatory compliance and data security are paramount, driving investments in resilient and advanced networking architectures.

Within the component segmentation, Ethernet Switches are the most prominent product category. Their ubiquity, versatility, and ability to handle high-volume data traffic make them the backbone of most data center networks. The increasing demand for higher port densities and faster speeds (e.g., 25GbE, 100GbE, 400GbE) directly contributes to the dominance of this segment.

On the services front, Support & Maintenance services are crucial, reflecting the complex nature of data center networking infrastructure and the need for continuous operational efficiency and uptime. As networks become more sophisticated, the demand for expert support to ensure seamless performance and rapid issue resolution grows in tandem.

United States Data Center Networking Market Product Developments

Product developments in the United States Data Center Networking Market are characterized by a relentless pursuit of enhanced performance, efficiency, and intelligence. Companies are focused on releasing solutions that address the burgeoning demands of AI/ML workloads, cloud-native applications, and edge computing. Innovations often revolve around higher port speeds, reduced latency, improved power efficiency, and advanced features for network automation and orchestration. Competitive advantages are increasingly derived from proprietary silicon, advanced software features that enable programmability and visibility, and integrated solutions that combine networking with compute and storage capabilities. For example, the introduction of switches with integrated DPUs is a significant trend, offloading critical network and security functions from the CPU to the network adapter itself.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the United States Data Center Networking Market.

By Product: The market is analyzed across Ethernet Switches, Routers, Storage Area Network (SAN), Application Delivery Controller (ADC), and Other Networking Equipment. Ethernet switches are projected to hold the largest market share due to their foundational role in data center connectivity, with substantial growth anticipated in high-speed variants. SAN solutions are expected to see steady growth driven by the increasing storage demands of data-intensive applications.

By Services: The segmentation includes Installation & Integration, Training & Consulting, and Support & Maintenance. Support & Maintenance is anticipated to capture a significant market share throughout the forecast period, reflecting the ongoing need for operational reliability and expert assistance. Installation & Integration services will also experience robust growth as organizations deploy new or upgrade existing data center infrastructure.

By End-User: The analysis covers IT & Telecommunication, BFSI, Government, Media & Entertainment, and Other End-Users. The IT & Telecommunication segment is projected to remain the leading adopter, driven by the massive scale of their operations and continuous need for network upgrades. The BFSI sector is expected to exhibit strong growth due to stringent security and low-latency requirements.

Key Drivers of United States Data Center Networking Market Growth

The growth of the United States Data Center Networking Market is propelled by several powerful drivers. The accelerating adoption of cloud computing, both public and private, is a primary catalyst, requiring robust and scalable network infrastructure. The exponential increase in data generation from IoT devices, social media, and digital services fuels the demand for higher bandwidth and processing capabilities. Furthermore, the ongoing digital transformation across industries necessitates advanced networking solutions to support new applications and services. The development and deployment of 5G technology are also significant drivers, demanding ultra-low latency and massive network capacity within data centers. Government initiatives promoting digital infrastructure and cybersecurity further contribute to market expansion.

Challenges in the United States Data Center Networking Market Sector

Despite its robust growth, the United States Data Center Networking Market faces several challenges. Supply chain disruptions, particularly for critical components like semiconductors, can impact manufacturing and lead to extended lead times and increased costs. The increasing complexity of network architectures and the rapid pace of technological advancements create a demand for specialized skills, leading to a talent shortage in network engineering and management. Intense competition among established vendors and new entrants can pressure profit margins. Evolving cybersecurity threats necessitate continuous investment in advanced security solutions, adding to operational expenses. Finally, the significant capital expenditure required for deploying and upgrading data center networking infrastructure can be a barrier for smaller organizations.

Emerging Opportunities in United States Data Center Networking Market

Emerging opportunities in the United States Data Center Networking Market are abundant, driven by transformative technological trends. The burgeoning field of Artificial Intelligence (AI) and Machine Learning (ML) is creating significant demand for high-performance networking solutions capable of handling massive datasets and complex computations. The expansion of edge computing, driven by the need for real-time data processing closer to the source, presents opportunities for distributed networking solutions. The ongoing evolution of cloud-native architectures and containerization technologies requires agile and programmable networking. Furthermore, the increasing focus on network automation and orchestration offers avenues for vendors providing intelligent management platforms. The growing adoption of hyperconverged infrastructure (HCI) also presents opportunities for integrated networking solutions.

Leading Players in the United States Data Center Networking Market Market

- NVIDIA (Cumulus Networks Inc)

- IBM Corporation

- Arista Networks Inc

- Cisco Systems Inc

- HP Development Company L P

- Emerson Electric Co

- Dell Inc

- Schneider Electric

- Huawei Technologies Co Ltd

- VMware Inc

- Intel Corporation

- Eaton Corporation

Key Developments in United States Data Center Networking Market Industry

- October 2023: Arista Networks has introduced a portfolio of 25G Ethernet switches designed to cater to the demanding requirements of financial applications, emphasizing high performance and low latency. The new 7130 25G Series offers substantial upgrades in power and features over its predecessor, aiming to reduce link latency by 2.5-fold through optimized queuing and serialization, and eliminating the need for latency-inducing Forward Error Correction (FEC) typically required for 25G Ethernet.

- May 2023: NVIDIA announced SpectrumXtreme, an accelerated networking platform engineered to boost the performance and efficiency of cloud-based Ethernet AI. This platform, built upon the NVIDIA Spectrum-4 Ethernet switch and NVIDIA BlueField-3 DPU, delivers 1.7x better overall AI performance and power efficiency, along with consistent, predictable performance in multi-tenant environments.

Strategic Outlook for United States Data Center Networking Market Market

The strategic outlook for the United States Data Center Networking Market is exceptionally positive, driven by persistent digital transformation and the ever-increasing demand for data-intensive applications. Investments in advanced networking technologies, such as AI-optimized networks, edge computing infrastructure, and 5G-enabled services, will continue to fuel market expansion. Strategic partnerships and collaborations between hardware vendors, software providers, and cloud service providers will be crucial for delivering integrated and comprehensive solutions. The focus on network automation, programmability, and security will remain paramount, offering significant growth potential for companies that can provide intelligent and resilient networking platforms. Organizations that can effectively navigate supply chain complexities and talent acquisition challenges are poised for substantial growth in this dynamic market.

United States Data Center Networking Market Segmentation

-

1. Component

-

1.1. By Product

- 1.1.1. Ethernet Switches

- 1.1.2. Routers

- 1.1.3. Storage Area Network (SAN)

- 1.1.4. Application Delivery Controller (ADC)

- 1.1.5. Other Networking Equipment

-

1.2. By Services

- 1.2.1. Installation & Integration

- 1.2.2. Training & Consulting

- 1.2.3. Support & Maintenance

-

1.1. By Product

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-Users

United States Data Center Networking Market Segmentation By Geography

- 1. United States

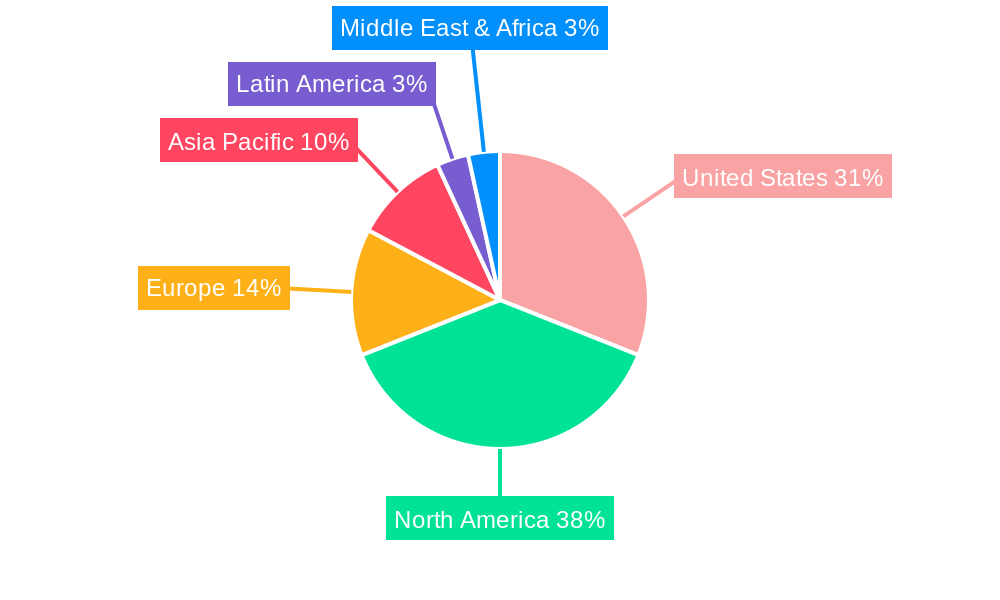

United States Data Center Networking Market Regional Market Share

Geographic Coverage of United States Data Center Networking Market

United States Data Center Networking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend of High-Performance Computing across Europe; Growing Investments in IT& Telecom Sector

- 3.3. Market Restrains

- 3.3.1. Regulatory constraints

- 3.4. Market Trends

- 3.4.1. Ethernet Switches is Anticipated to be the Largest Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Data Center Networking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. By Product

- 5.1.1.1. Ethernet Switches

- 5.1.1.2. Routers

- 5.1.1.3. Storage Area Network (SAN)

- 5.1.1.4. Application Delivery Controller (ADC)

- 5.1.1.5. Other Networking Equipment

- 5.1.2. By Services

- 5.1.2.1. Installation & Integration

- 5.1.2.2. Training & Consulting

- 5.1.2.3. Support & Maintenance

- 5.1.1. By Product

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NVIDIA (Cumulus Networks Inc )

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 IBM Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Arista Networks Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cisco Systems Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HP Development Company L P

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Emerson Electric Co

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Dell Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Schneider Electric

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Huawei Technologies Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 VMware Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Intel Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Eaton Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 NVIDIA (Cumulus Networks Inc )

List of Figures

- Figure 1: United States Data Center Networking Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Data Center Networking Market Share (%) by Company 2025

List of Tables

- Table 1: United States Data Center Networking Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: United States Data Center Networking Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: United States Data Center Networking Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: United States Data Center Networking Market Revenue Million Forecast, by Component 2020 & 2033

- Table 5: United States Data Center Networking Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: United States Data Center Networking Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Data Center Networking Market?

The projected CAGR is approximately 4.20%.

2. Which companies are prominent players in the United States Data Center Networking Market?

Key companies in the market include NVIDIA (Cumulus Networks Inc ), IBM Corporation, Arista Networks Inc, Cisco Systems Inc, HP Development Company L P, Emerson Electric Co, Dell Inc, Schneider Electric, Huawei Technologies Co Ltd, VMware Inc, Intel Corporation, Eaton Corporation.

3. What are the main segments of the United States Data Center Networking Market?

The market segments include Component, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.85 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend of High-Performance Computing across Europe; Growing Investments in IT& Telecom Sector.

6. What are the notable trends driving market growth?

Ethernet Switches is Anticipated to be the Largest Segment.

7. Are there any restraints impacting market growth?

Regulatory constraints.

8. Can you provide examples of recent developments in the market?

October 2023: Arista Networks has introduced a portfolio of 25G Ethernet switches to support primarily financial applications that demand high performance and low latency. The new 7130 25G Series boxes are a significant power and features upgrade over the vendor’s current 7130 10G Ethernet line of devices and promise to reduce link latency 2.5-fold for data transmission by reducing queuing, serialization delays and eliminating the need for latency-inducing Forward Error Correction (FEC) typically required by 25G Ethernet.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Data Center Networking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Data Center Networking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Data Center Networking Market?

To stay informed about further developments, trends, and reports in the United States Data Center Networking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence