Key Insights

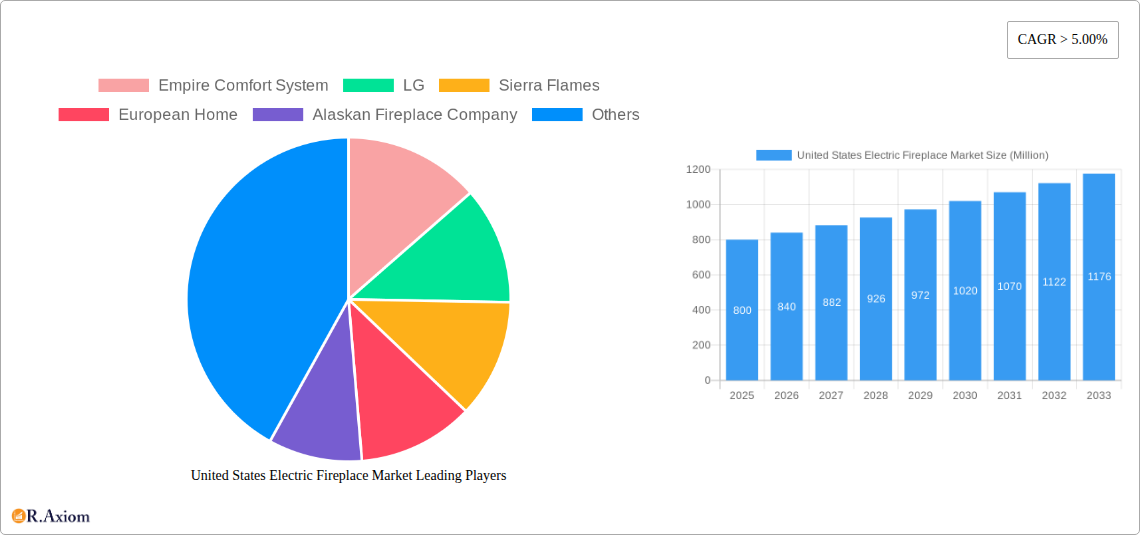

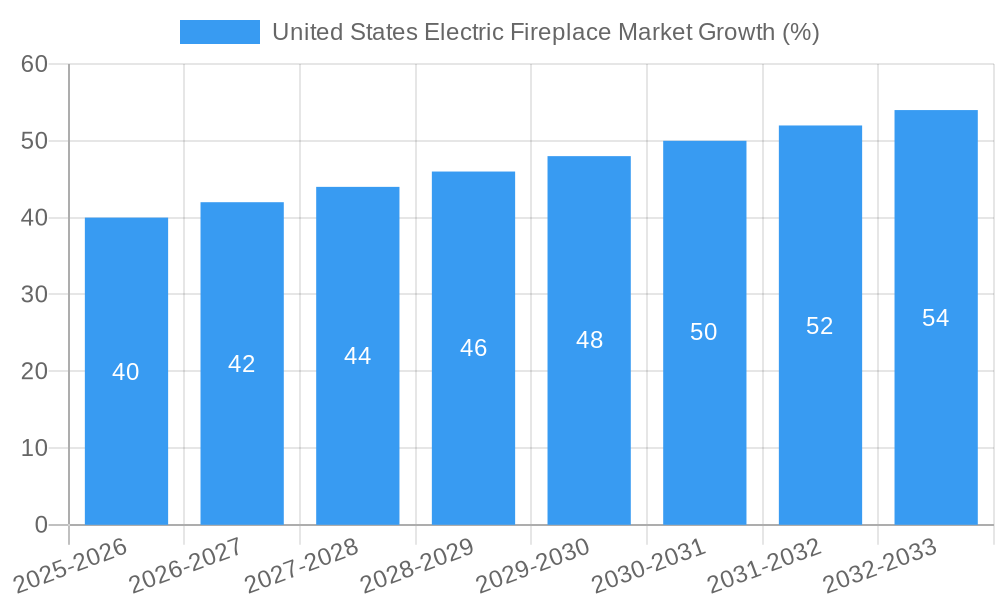

The United States electric fireplace market, valued at approximately $800 million in 2025, is experiencing robust growth, projected to maintain a CAGR exceeding 5% through 2033. This expansion is fueled by several key factors. Increasing consumer preference for energy-efficient and eco-friendly heating solutions is a major driver. Electric fireplaces offer a cleaner alternative to traditional wood-burning fireplaces, aligning with growing environmental consciousness. Furthermore, their ease of installation and maintenance, coupled with versatile design options catering to diverse home aesthetics, contributes significantly to market appeal. The rise in popularity of smart home technology also plays a crucial role, with many modern electric fireplaces offering app-based controls and integration with other smart devices. Segment-wise, the residential sector dominates the market, reflecting the increasing demand for aesthetically pleasing and functional heating options in homes. Online distribution channels are witnessing substantial growth due to increased e-commerce penetration and the convenience of online shopping. Leading brands like Empire Comfort Systems, LG, and Sierra Flames are driving innovation, constantly introducing new models with advanced features and enhanced designs to cater to evolving consumer preferences.

While the market enjoys a positive outlook, challenges remain. Fluctuations in raw material prices and supply chain disruptions can impact production costs and profitability. Competition from alternative heating systems, such as heat pumps and central heating, presents an ongoing challenge. However, the continued focus on energy efficiency, design innovation, and smart home integration positions the US electric fireplace market for sustained growth in the coming years. The diverse range of products, including electric stoves, insert fireplaces, tabletop units, and wall-mounted models, caters to a broad spectrum of consumer needs and preferences across various residential and commercial applications. The projected growth indicates a significant opportunity for manufacturers, retailers, and technology providers within the sector.

United States Electric Fireplace Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States electric fireplace market, offering valuable insights for industry stakeholders, investors, and businesses looking to navigate this dynamic sector. The study covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The report meticulously examines market size, growth drivers, challenges, opportunities, and competitive landscape, projecting the market's future trajectory until 2033. Key segments analyzed include electric stove, insert electric fireplace, table top electric fireplace, wall-mounted electric fireplace, across online and offline distribution channels, and both residential and commercial end-users. Leading companies like Empire Comfort System, LG, Sierra Flames, European Home, Alaskan Fireplace Company, Haier, Touchstone Home Products, Bosch, Toshiba, and King Electric are profiled, providing a granular understanding of market dynamics.

United States Electric Fireplace Market Market Concentration & Innovation

This section analyzes the market concentration, examining the market share held by key players and identifying emerging trends in innovation. The report explores the regulatory landscape impacting the market, along with substitute products and their influence. End-user trends and M&A activity, including deal values, are also comprehensively reviewed. The market concentration is currently considered moderately fragmented, with no single company holding a dominant share exceeding xx%. However, the report identifies a trend towards consolidation, driven by several factors.

- Market Share: The top five players collectively hold approximately xx% of the market share in 2025, with Empire Comfort Systems and LG holding the largest individual shares (xx% and xx%, respectively).

- M&A Activity: The period from 2019-2024 witnessed xx M&A deals with a total value of approximately $xx Million, indicating consolidation within the sector. These deals often involve smaller companies being acquired by larger players to expand product portfolios and distribution networks.

- Innovation Drivers: Increasing consumer demand for energy-efficient and aesthetically pleasing heating solutions is a primary driver of innovation. The integration of smart home technologies, such as Wi-Fi connectivity and voice control, is another significant innovation trend.

- Regulatory Frameworks: Regulations concerning energy efficiency and safety standards are continuously evolving, influencing product development and market competitiveness.

- Product Substitutes: Traditional fireplaces and other heating solutions pose some competitive pressure, but the convenience and energy efficiency of electric fireplaces are key differentiators.

- End-User Trends: Growing awareness of eco-friendly heating solutions and a desire for customizable aesthetics are shaping consumer preferences.

United States Electric Fireplace Market Industry Trends & Insights

This section delves into the key industry trends and insights shaping the US electric fireplace market, exploring market growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The report highlights significant metrics, such as CAGR and market penetration rates, providing a comprehensive overview of the market's evolution and future prospects. The US electric fireplace market is expected to experience robust growth during the forecast period (2025-2033), driven by several factors. The CAGR is projected to be xx% during this period. Market penetration is expected to reach xx% by 2033.

Dominant Markets & Segments in United States Electric Fireplace Market

This section identifies the leading segments within the market by type, distribution channel, and end-user. Detailed analysis explores the key drivers influencing the dominance of specific regions, countries, or segments, using bullet points and paragraphs for clarity.

- Leading Segment: The residential sector remains the dominant end-user segment, accounting for approximately xx% of the total market in 2025. The wall-mounted electric fireplace type dominates the market, capturing xx% of market share due to its space-saving design and ease of installation. Online distribution channels are increasingly popular, with an anticipated xx% market share by 2033.

- Key Drivers:

- Residential: Rising disposable incomes and the increasing popularity of home renovations are driving growth.

- Commercial: The demand for aesthetically pleasing and energy-efficient heating solutions in commercial spaces is on the rise.

- Wall-Mounted: Space-saving design and easy installation make it a favorite among consumers.

- Online: Convenience, wider product selection, and competitive pricing drive online sales.

United States Electric Fireplace Market Product Developments

Recent product developments in the electric fireplace market emphasize enhanced energy efficiency, smart features, and improved aesthetics. Manufacturers are increasingly integrating smart home technologies, offering features like Wi-Fi connectivity, app control, and voice assistants. This allows users to customize heating settings, schedule operation, and integrate fireplaces seamlessly into their smart home ecosystems. The emphasis on realistic flame effects and diverse design options caters to diverse preferences and interior styles.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation analysis of the United States electric fireplace market.

- By Type: Electric Stove, Insert Electric Fireplace, Table Top Electric Fireplace, Wall Mounted Electric Fireplace. Each type segment shows varying growth rates and market sizes, influenced by factors like consumer preferences and technological advancements. Wall-mounted fireplaces are expected to witness the highest growth.

- By Distribution Channel: Online and Offline. Online channels are gaining traction due to convenience and competitive pricing, while offline channels maintain their significance.

- By End-User: Residential and Commercial. The residential segment dominates, driven by increased home renovations and a focus on energy efficiency. The commercial sector exhibits steady growth, primarily driven by the hospitality and retail sectors.

Key Drivers of United States Electric Fireplace Market Growth

Several factors drive the growth of the US electric fireplace market: Increased consumer disposable incomes, rising preference for energy-efficient heating solutions, technological advancements leading to enhanced features and aesthetics, and government initiatives promoting energy conservation. The growing adoption of smart home technologies and the increasing popularity of home renovations also contribute significantly to market growth.

Challenges in the United States Electric Fireplace Market Sector

The electric fireplace market faces challenges including intense competition from traditional fireplaces and other heating systems. Supply chain disruptions and rising raw material costs can impact production and pricing. Fluctuations in consumer confidence and economic downturns can also affect demand. Finally, stringent safety and energy efficiency regulations present compliance hurdles for manufacturers.

Emerging Opportunities in United States Electric Fireplace Market

Emerging opportunities lie in the development of innovative designs and features catering to evolving consumer preferences. The integration of advanced smart home technologies, including AI-powered controls and energy management features, opens new growth avenues. Expansion into niche markets, such as luxury residential and commercial projects, presents significant untapped potential.

Leading Players in the United States Electric Fireplace Market Market

- Empire Comfort System

- LG

- Sierra Flames

- European Home

- Alaskan Fireplace Company

- Haier

- Touchstone Home Products

- Bosch

- Toshiba

- King Electric

Key Developments in United States Electric Fireplace Market Industry

- June 2022: American Residential Service (ARS) acquired Absolute Air, Captain Electric, and OyBoy Heating, expanding its service portfolio in the HVAC and electrical sectors. This acquisition could indirectly influence the electric fireplace market by increasing the availability of installation and maintenance services.

- October 2023: DERO launched the WH710S Wall-Mounted Smart Space Heater, a technologically advanced product with hyperemic heating technology and enhanced safety features. While not directly an electric fireplace, this launch reflects the broader trend towards energy-efficient and smart heating solutions within the home.

Strategic Outlook for United States Electric Fireplace Market Market

The US electric fireplace market is poised for continued growth, driven by technological advancements, changing consumer preferences, and the increasing demand for energy-efficient heating solutions. Strategic investments in innovation, smart home integration, and sustainable manufacturing practices will be crucial for companies to maintain a competitive edge. Expansion into new market segments and strategic partnerships offer significant opportunities for growth and market share gains.

United States Electric Fireplace Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

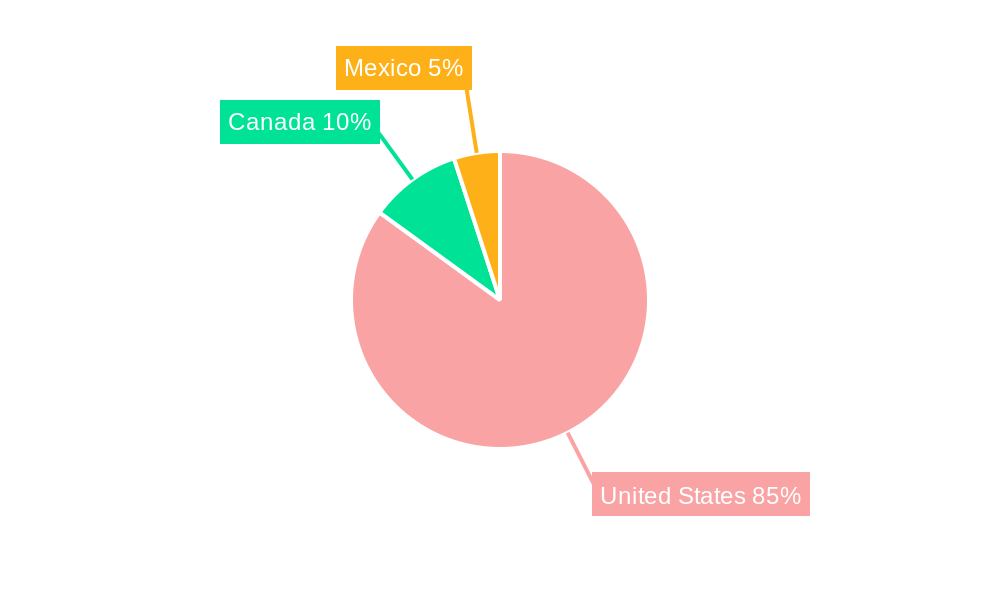

United States Electric Fireplace Market Segmentation By Geography

- 1. United States

United States Electric Fireplace Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand from the Household Segment; Increase in Adoption Rate of Environment Friendly Heating Appliance

- 3.3. Market Restrains

- 3.3.1. Rising Price of Consumer Electronics Affecting the Sales

- 3.4. Market Trends

- 3.4.1. Rising Demand From Residential Users

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Electric Fireplace Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Empire Comfort System

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 LG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sierra Flames

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 European Home

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Alaskan Fireplace Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Haier

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Touchstone Home Products

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bosch

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Toshiba

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 King Electric

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Empire Comfort System

List of Figures

- Figure 1: United States Electric Fireplace Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Electric Fireplace Market Share (%) by Company 2024

List of Tables

- Table 1: United States Electric Fireplace Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Electric Fireplace Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: United States Electric Fireplace Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: United States Electric Fireplace Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: United States Electric Fireplace Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: United States Electric Fireplace Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: United States Electric Fireplace Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: United States Electric Fireplace Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Electric Fireplace Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: United States Electric Fireplace Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: United States Electric Fireplace Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: United States Electric Fireplace Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: United States Electric Fireplace Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: United States Electric Fireplace Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Electric Fireplace Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the United States Electric Fireplace Market?

Key companies in the market include Empire Comfort System, LG, Sierra Flames, European Home, Alaskan Fireplace Company, Haier, Touchstone Home Products, Bosch, Toshiba, King Electric.

3. What are the main segments of the United States Electric Fireplace Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand from the Household Segment; Increase in Adoption Rate of Environment Friendly Heating Appliance.

6. What are the notable trends driving market growth?

Rising Demand From Residential Users.

7. Are there any restraints impacting market growth?

Rising Price of Consumer Electronics Affecting the Sales.

8. Can you provide examples of recent developments in the market?

June 2022: American Residential Service (ARS) made significant acquisitions by adding three companies to their portfolio: Absolute Air, Captain Electric, and OyBoy Heating. Absolute Air specializes in providing residential services in heating, air conditioning, electrical, and plumbing.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Electric Fireplace Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Electric Fireplace Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Electric Fireplace Market?

To stay informed about further developments, trends, and reports in the United States Electric Fireplace Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence