Key Insights

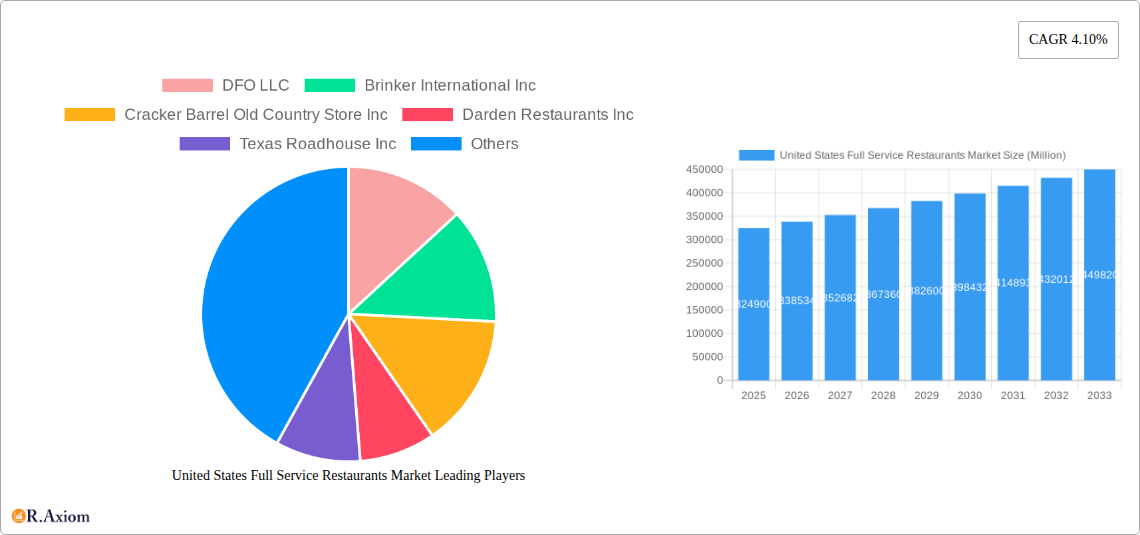

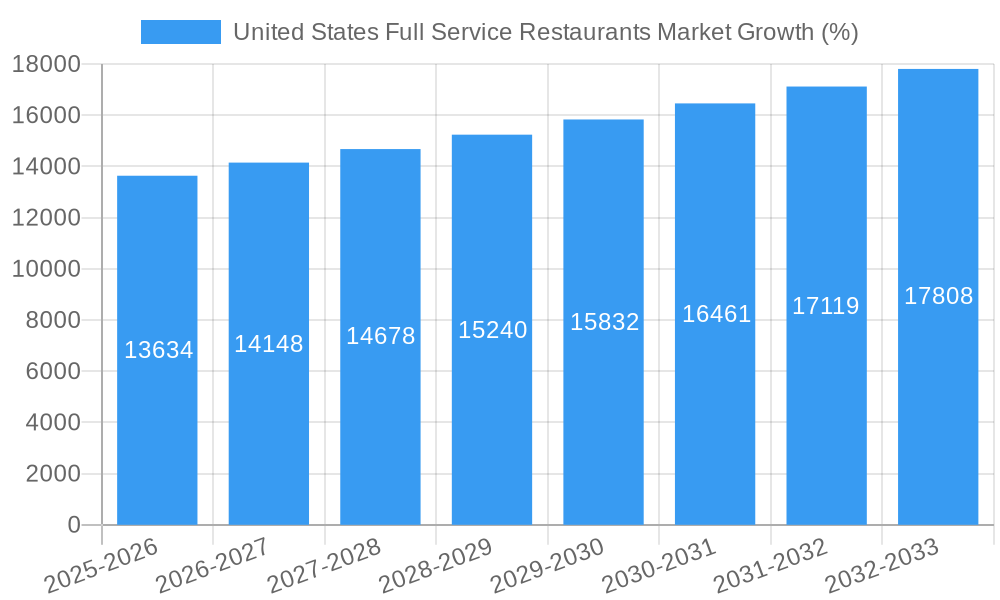

The United States Full Service Restaurant (FSR) market, valued at $324.9 billion in 2025, is projected to experience steady growth, driven by several key factors. The rising disposable incomes, particularly among millennials and Gen Z, fuel increased spending on dining out experiences. A preference for convenient and high-quality food, coupled with the increasing popularity of diverse cuisines beyond traditional American fare (such as Asian, European, and Latin American), significantly contributes to market expansion. The growth is further fueled by the increasing number of chained outlets expanding their footprint, leveraging brand recognition and economies of scale. However, the market faces challenges. Inflationary pressures impacting food and labor costs present a significant restraint, potentially squeezing profit margins. Additionally, competition from quick-service restaurants (QSRs) and the rise of food delivery services offering convenience and lower price points pose a challenge to the FSR sector. Furthermore, consumer preferences for healthier options and sustainable practices are influencing menu development and operational strategies. Segmentation within the market reveals that chained outlets currently hold a larger market share than independent outlets, while the leisure and lodging segments demonstrate strong growth potential due to increased tourism and travel.

Looking ahead to 2033, the market's CAGR of 4.10% suggests a substantial increase in market value. This growth will likely be uneven across segments, with the Asian and other FSR cuisines potentially exhibiting faster growth rates than traditional American cuisines due to evolving tastes. Location-wise, the Standalone and Retail segments could experience accelerated growth owing to strategic expansions and increased foot traffic. The competitive landscape will remain dynamic, with existing players focusing on innovation, brand enhancement, and efficient operations to maintain market share. New entrants are expected to enter the market, focusing on niche cuisines and innovative business models. The success of individual players will depend on their ability to adapt to evolving consumer preferences, manage rising costs, and effectively leverage technological advancements to enhance the customer experience.

United States Full Service Restaurants Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States Full Service Restaurants (FSR) market, covering the period 2019-2033. It offers valuable insights into market dynamics, segmentation, competitive landscape, and future growth opportunities for industry stakeholders, investors, and strategic decision-makers. The report utilizes robust data and analytical methodologies to present a clear and actionable picture of this dynamic sector.

United States Full Service Restaurants Market Concentration & Innovation

The US FSR market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. However, the market also features a substantial number of independent outlets and smaller chains, fostering a competitive landscape. Innovation is driven by evolving consumer preferences, technological advancements (e.g., online ordering, delivery services), and the need to enhance operational efficiency. Regulatory frameworks, such as food safety regulations and labor laws, significantly impact market operations. Product substitutes, like fast-casual dining and meal delivery services, pose a competitive threat. Consumer trends favor experiences beyond simply food, driving innovation in ambiance, service models, and menu offerings. M&A activity, as evidenced by the recent USD 80 Million acquisition of Fuzzy's Taco Shop by Dine Brands Global, plays a pivotal role in shaping market dynamics. Major players such as Darden Restaurants Inc. and Brinker International Inc. are increasingly involved in expansion and acquisition strategies to increase their market share. The average M&A deal value in the FSR sector between 2020 and 2024 was approximately USD xx Million.

- Market Share: Top 5 players hold approximately xx% of the market share (2024).

- M&A Deal Values: Significant variations observed based on target company size and market positioning.

- Innovation Drivers: Consumer demand for unique experiences, technological advancements, and changing dietary preferences.

United States Full Service Restaurants Market Industry Trends & Insights

The US FSR market experienced a CAGR of xx% during the historical period (2019-2024), driven by factors such as rising disposable incomes, increasing urbanization, and changing lifestyle preferences. However, the market faced challenges during the COVID-19 pandemic, leading to temporary closures and shifts in consumer behavior. Technological disruptions, including the rise of online ordering and delivery platforms, have fundamentally altered the industry landscape, demanding adaptability and innovation from FSR operators. Consumer preferences are shifting towards healthier options, personalized experiences, and convenient service models. The competitive dynamics are intensely competitive, with established chains facing pressure from both fast-casual restaurants and independent, specialized establishments. Market penetration of online ordering systems is at xx% in 2025, anticipated to reach xx% by 2033. The market is projected to reach USD xx Million by 2033, reflecting a CAGR of xx% during the forecast period (2025-2033).

Dominant Markets & Segments in United States Full Service Restaurants Market

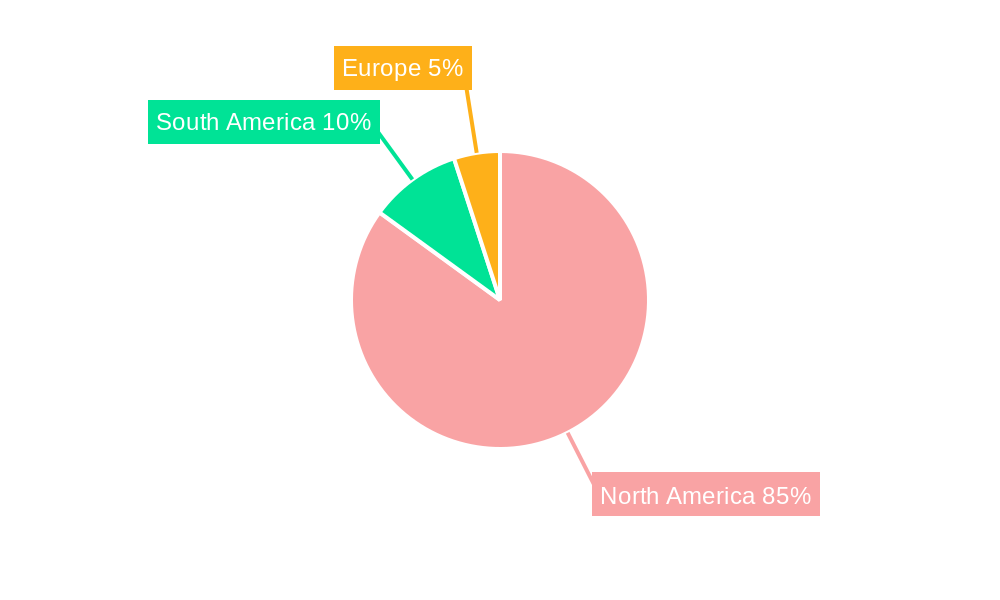

The North American cuisine segment holds the largest market share within the US FSR market due to its widespread appeal and cultural significance. However, other cuisines like Asian and Latin American are experiencing strong growth, reflecting evolving consumer tastes. Chained outlets dominate the market due to their economies of scale and brand recognition. Standalone locations are also significant, catering to specific local markets.

- Leading Segment: North American Cuisine (Market share: xx% in 2025).

- Key Drivers for North American Cuisine: Established consumer base, cultural familiarity, and wide-ranging menu offerings.

- Key Drivers for Chained Outlets: Economies of scale, brand recognition, and consistent quality control.

- Key Drivers for Standalone Locations: Localized menus, unique atmospheres, and direct customer engagement.

Geographic Dominance: The Northeast and West Coast regions demonstrate higher market concentration, driven by dense populations and high disposable income.

United States Full Service Restaurants Market Product Developments

Recent product innovations focus on enhancing convenience, customization, and healthier menu options. Technological advancements like mobile ordering apps and kitchen automation systems are being integrated to improve operational efficiency and customer experience. The emphasis is on providing a seamless omnichannel experience that caters to the varying needs and preferences of diverse customer segments. These innovations are improving market fit by addressing consumer demand for convenience, customization, and health-conscious choices.

Report Scope & Segmentation Analysis

This report segments the US FSR market based on cuisine (Asian, European, Latin American, Middle Eastern, North American, Other FSR Cuisines), outlet type (Chained Outlets, Independent Outlets), and location (Leisure, Lodging, Retail, Standalone, Travel). Each segment's growth projections, market size, and competitive dynamics are analyzed in detail. For instance, the Asian cuisine segment is projected to experience significant growth owing to increased popularity and diverse offerings. Similarly, the chained outlet segment is expected to maintain its dominance due to scale advantages.

Key Drivers of United States Full Service Restaurants Market Growth

The growth of the US FSR market is driven by several factors: rising disposable incomes enabling increased dining out, changing lifestyles and preferences for convenient food experiences, technological advancements streamlining operations and customer service, and the ongoing expansion of the food service sector. Government policies supporting the hospitality industry also contribute positively to market growth.

Challenges in the United States Full Service Restaurants Market Sector

The FSR sector faces several challenges including increasing labor costs impacting profitability, rising food prices affecting menu pricing and margins, intense competition from diverse food service providers, and stringent regulatory compliance increasing operational expenses. Supply chain disruptions can severely impact operations. These factors collectively exert downward pressure on profit margins.

Emerging Opportunities in United States Full Service Restaurants Market

Emerging opportunities exist in personalized dining experiences through advanced data analytics, the growth of health-conscious and sustainable food options, and the expansion into new geographic markets with untapped potential. Leveraging technology for enhanced efficiency and customer engagement presents a significant opportunity for growth.

Leading Players in the United States Full Service Restaurants Market Market

- DFO LLC

- Brinker International Inc

- Cracker Barrel Old Country Store Inc

- Darden Restaurants Inc

- Texas Roadhouse Inc

- The Cheesecake Factory Restaurants Inc

- Red Lobster Hospitality LLC

- Dine Brands Global Inc

- Bloomin' Brands Inc

- BJ's Restaurants Inc

Key Developments in United States Full Service Restaurants Market Industry

- November 2022: Brinker International announced that its brand Chili's Grill & Bar launched its first to-go-only location nationwide. This reflects the increasing demand for convenience and off-premise dining options.

- December 2022: Dine Brands Global Inc. acquired Fuzzy's Taco Shop® for USD 80 million in cash. This strategic acquisition expands Dine Brands' portfolio and market reach.

- January 2023: Applebee’s announced the return of its USD 6 Smoocho Mucho Sips. This promotional campaign aims to drive traffic and boost sales.

Strategic Outlook for United States Full Service Restaurants Market Market

The US FSR market is poised for continued growth, driven by evolving consumer preferences and technological advancements. Opportunities lie in leveraging technology for enhanced efficiency and personalized customer experiences. Companies that adapt to changing consumer preferences and embrace innovation will be best positioned to thrive in this competitive and dynamic market. The continued focus on convenience and health-conscious offerings will be key to future success.

United States Full Service Restaurants Market Segmentation

-

1. Cuisine

- 1.1. Asian

- 1.2. European

- 1.3. Latin American

- 1.4. Middle Eastern

- 1.5. North American

- 1.6. Other FSR Cuisines

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

United States Full Service Restaurants Market Segmentation By Geography

- 1. United States

United States Full Service Restaurants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin

- 3.3. Market Restrains

- 3.3.1. Low Stability of Riboflavin on Exposure to Light and Heat

- 3.4. Market Trends

- 3.4.1 A significant rise in tourist arrivals is driving the market growth

- 3.4.2 capitalizing on the opportunities presented by the influx of visitors

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Full Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 5.1.1. Asian

- 5.1.2. European

- 5.1.3. Latin American

- 5.1.4. Middle Eastern

- 5.1.5. North American

- 5.1.6. Other FSR Cuisines

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 6. North America United States Full Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 United States

- 6.1.2 Canada

- 6.1.3 Mexico

- 7. South America United States Full Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 Brazil

- 7.1.2 Argentina

- 7.1.3 Rest of South America

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2024

- 8.2. Company Profiles

- 8.2.1 DFO LLC

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Brinker International Inc

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Cracker Barrel Old Country Store Inc

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Darden Restaurants Inc

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Texas Roadhouse Inc

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 The Cheesecake Factory Restaurants Inc

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Red Lobster Hospitality LLC

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Dine Brands Global Inc

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Bloomin' Brands Inc

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 BJ's Restaurants Inc

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.1 DFO LLC

List of Figures

- Figure 1: United States Full Service Restaurants Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Full Service Restaurants Market Share (%) by Company 2024

List of Tables

- Table 1: United States Full Service Restaurants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Full Service Restaurants Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 3: United States Full Service Restaurants Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: United States Full Service Restaurants Market Revenue Million Forecast, by Location 2019 & 2032

- Table 5: United States Full Service Restaurants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United States Full Service Restaurants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States United States Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada United States Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico United States Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United States Full Service Restaurants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Brazil United States Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Argentina United States Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of South America United States Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States Full Service Restaurants Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 15: United States Full Service Restaurants Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 16: United States Full Service Restaurants Market Revenue Million Forecast, by Location 2019 & 2032

- Table 17: United States Full Service Restaurants Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Full Service Restaurants Market?

The projected CAGR is approximately 4.10%.

2. Which companies are prominent players in the United States Full Service Restaurants Market?

Key companies in the market include DFO LLC, Brinker International Inc, Cracker Barrel Old Country Store Inc, Darden Restaurants Inc, Texas Roadhouse Inc, The Cheesecake Factory Restaurants Inc, Red Lobster Hospitality LLC, Dine Brands Global Inc, Bloomin' Brands Inc, BJ's Restaurants Inc.

3. What are the main segments of the United States Full Service Restaurants Market?

The market segments include Cuisine, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD 324,900 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin.

6. What are the notable trends driving market growth?

A significant rise in tourist arrivals is driving the market growth. capitalizing on the opportunities presented by the influx of visitors.

7. Are there any restraints impacting market growth?

Low Stability of Riboflavin on Exposure to Light and Heat.

8. Can you provide examples of recent developments in the market?

January 2023: Applebee’s announced the return of its USD 6 Smoocho Mucho Sips.December 2022: Dine Brands Global Inc. acquired Fuzzy's Taco Shop® ("Fuzzy's") from Experiential Brands LLC, a wholly-owned subsidiary of NRD Holding Company, for USD 80 million in cash.November 2022: Brinker International announced that its brand Chili's Grill & Bar launched its first to-go-only location nationwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Full Service Restaurants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Full Service Restaurants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Full Service Restaurants Market?

To stay informed about further developments, trends, and reports in the United States Full Service Restaurants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence