Key Insights

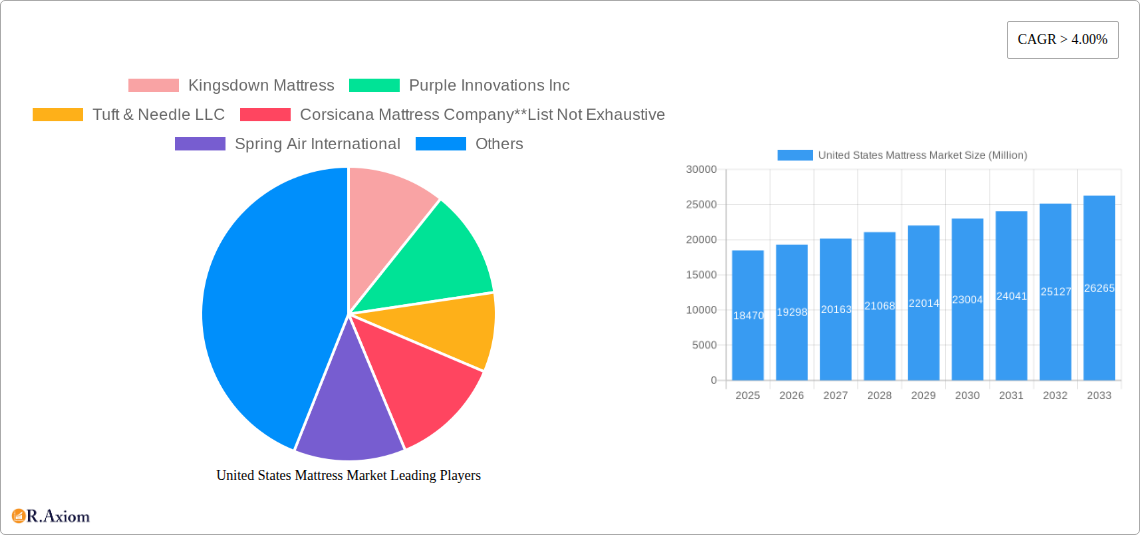

The United States mattress market, valued at $18.47 billion in 2025, is projected for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 4.00% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, rising disposable incomes and a growing emphasis on sleep health are significantly impacting consumer spending on higher-quality mattresses. Secondly, technological advancements in mattress materials, such as the increasing popularity of memory foam and hybrid designs incorporating latex and innerspring technologies, offer consumers a wider range of choices catering to diverse sleep preferences and needs. The rise of e-commerce has also been instrumental in market growth, providing greater accessibility and convenience to consumers, alongside the expansion of specialty mattress stores offering personalized sleep consultations. However, the market also faces challenges. Economic downturns could influence consumer spending on discretionary items like mattresses, representing a potential restraint. Furthermore, intense competition among established brands and emerging direct-to-consumer companies necessitates continuous innovation and effective marketing strategies for sustained market share. Segmentation reveals a diversified market, with significant sales across innerspring, memory foam, and latex mattress types. Residential sales dominate the end-user segment, although the commercial sector, particularly hotels and hospitality, is also a notable contributor. The distribution channels are varied, with multi-brand stores, specialty stores, and online retailers all playing crucial roles. Major players like Serta Simmons Bedding, Tempur Sealy International, and Sleep Number Corporation, alongside emerging brands like Purple Innovations and Casper, are vying for dominance in this dynamic marketplace.

United States Mattress Market Market Size (In Billion)

The forecast period (2025-2033) anticipates continued growth, driven by evolving consumer preferences and innovative product development. The shift towards personalized sleep solutions and the incorporation of smart technology into mattresses are emerging trends, opening opportunities for premium product offerings. The market's success will likely depend on the ability of companies to effectively address consumer demands for comfort, durability, and value, coupled with successful marketing and distribution strategies to reach target demographics effectively across both online and offline channels. The continued development of eco-friendly and sustainable mattress materials will also play a significant role in shaping future market trends. Analyzing the performance of key players across various segments and distribution channels will be crucial for understanding future market dynamics and potential growth areas.

United States Mattress Market Company Market Share

United States Mattress Market: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the United States mattress market, covering the period from 2019 to 2033. It offers invaluable insights for industry stakeholders, investors, and businesses seeking to understand this dynamic sector. With a focus on market trends, segmentation, competitive landscape, and future projections, this report is an essential resource for informed decision-making. The base year for this report is 2025, with estimates for 2025 and forecasts extending to 2033, utilizing historical data from 2019-2024. The report’s value is enhanced by the incorporation of numerous high-traffic keywords related to the mattress industry, including mattress types, distribution channels, key players, and market trends.

United States Mattress Market Market Concentration & Innovation

The United States mattress market exhibits a moderately concentrated landscape, with several major players holding significant market share. Market leaders like Tempur Sealy International Inc and Serta Simmons Bedding LLC benefit from established brand recognition and extensive distribution networks. However, the market also shows a growing presence of digitally native brands like Casper Inc and Tuft & Needle LLC, disrupting traditional retail models. Innovation is a key driver, with companies continuously investing in new materials, technologies (like smart beds), and designs to cater to evolving consumer preferences. Regulatory frameworks, primarily focusing on safety and labeling, influence the market. Product substitutes, such as adjustable air beds, compete for market share, while mergers and acquisitions (M&A) play a significant role in shaping the competitive dynamics. For example, while exact M&A deal values are not publicly available for all transactions, a significant number of smaller acquisitions in the range of xx Million to xx Million have occurred in the last few years, primarily focused on expanding product lines or regional reach.

- Key Players: Tempur Sealy International Inc, Serta Simmons Bedding LLC, Casper Inc, Tuft & Needle LLC, Sleep Number Corporation (and many others)

- Market Concentration: Moderately concentrated, with a few dominant players and increasing competition from smaller, digitally native brands.

- Innovation Drivers: Technological advancements in materials, smart bed technology, personalized sleep solutions.

- M&A Activity: Ongoing consolidation through acquisitions, with deal values ranging from xx Million to xx Million. (Note: Precise figures are often confidential.)

- Regulatory Framework: Safety standards and labeling requirements impact product development and market access.

United States Mattress Market Industry Trends & Insights

The US mattress market is experiencing steady growth, driven by factors like rising disposable incomes, increasing awareness of sleep health, and technological innovations. The Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was approximately xx%, and the projected CAGR for the forecast period (2025-2033) is estimated at xx%. Technological disruptions, particularly the emergence of smart beds and personalized sleep solutions, are reshaping consumer preferences and driving premiumization. The market penetration of smart beds is currently low but exhibiting rapid growth. Online sales channels are expanding rapidly, challenging traditional retail models and creating new competitive dynamics. Key growth drivers include increased demand for premium mattresses, growing online sales, and a focus on sleep health and wellness.

Dominant Markets & Segments in United States Mattress Market

The residential segment significantly dominates the US mattress market, accounting for approximately xx% of total revenue in 2025. The Innerspring mattress type maintains a sizable market share but is facing competition from Memory Foam and other innovative materials. Online distribution channels are growing at a faster rate than traditional channels, driven by the convenience and wider selection offered.

By Type:

- Innerspring: Largest segment due to cost-effectiveness and familiarity.

- Memory Foam: Strong growth, driven by comfort and support features.

- Latex: Niche segment, appeals to consumers seeking natural and durable options.

- Other Types: Hybrid, adjustable air beds; a growing category due to niche needs.

By End User:

- Residential: Dominant segment, driven by individual consumer purchases.

- Commercial: Smaller segment; growth dependent on hospitality and healthcare spending.

By Distribution Channel:

- Online: Fastest growing segment due to convenience and competitive pricing.

- Specialty Stores: Focus on premium brands and personalized service.

- Multi-Brand Stores: Offer variety and accessibility.

Key Drivers: Rising disposable income, increased awareness of sleep health, technological advancements, and the growth of online sales.

United States Mattress Market Product Developments

The mattress industry is witnessing significant product innovation, focusing on enhanced comfort, support, and technology integration. Smart beds with sleep tracking and climate control features are gaining traction. Hybrid mattress designs combining different materials (e.g., innerspring and memory foam) are increasing in popularity, offering customized comfort options. Focus on sustainable materials is also emerging, catering to environmentally conscious consumers. The market is witnessing the introduction of mattresses made with organic materials and reduced chemical content, aligning with growing consumer demand for eco-friendly products.

Report Scope & Segmentation Analysis

This report segments the US mattress market by type (innerspring, memory foam, latex, other), end-user (residential, commercial), and distribution channel (multi-brand stores, specialty stores, online, other). Each segment's growth projections, market size (in Millions), and competitive dynamics are detailed within the full report. The report also analyses market size and growth across different regions within the United States.

Key Drivers of United States Mattress Market Growth

Several factors drive the growth of the US mattress market. These include rising disposable incomes enabling consumers to invest in higher-quality mattresses, increased awareness of the importance of sleep health and its impact on overall well-being, and technological innovations leading to the development of smart beds and other advanced sleep solutions. Government regulations promoting safe and sustainable manufacturing also contribute to market growth.

Challenges in the United States Mattress Market Sector

The US mattress market faces challenges such as increased competition from both established and emerging players, fluctuating raw material costs impacting production expenses, and the complexities associated with e-commerce logistics, specifically delivery and returns. Economic downturns can also affect consumer spending on discretionary items like mattresses.

Emerging Opportunities in United States Mattress Market

Emerging opportunities exist in personalized sleep solutions, leveraging data analytics to tailor mattress designs and features to individual needs. The market also presents opportunities in sustainable and eco-friendly mattress materials, catering to growing consumer demand for environmentally responsible products. Expansion into niche markets, like specialized mattresses for athletes or medical conditions, presents further growth potential.

Leading Players in the United States Mattress Market Market

Key Developments in United States Mattress Market Industry

- August 2023: Sleep Number Corporation launched its next-generation smart beds and lifestyle furnishings, leveraging 19 billion hours of sleep data to enhance sleep quality. This significantly impacts the market by driving innovation in the smart bed segment.

- September 2022: Saatva introduced a dorm-friendly mattress bundle, targeting a new segment of budget-conscious students. This demonstrates market expansion and product diversification.

Strategic Outlook for United States Mattress Market Market

The US mattress market is poised for continued growth, driven by technological advancements, evolving consumer preferences, and a greater focus on sleep wellness. The strategic outlook is positive, with opportunities for growth in both traditional and online channels. Companies that innovate, adapt to changing consumer needs, and effectively leverage data and technology will be best positioned for success.

United States Mattress Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

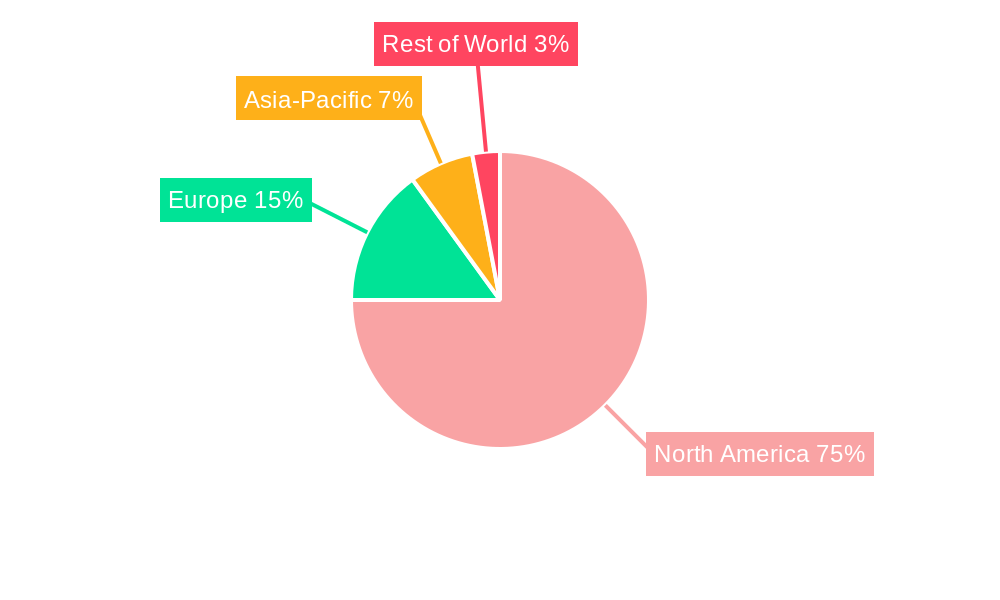

United States Mattress Market Segmentation By Geography

- 1. United States

United States Mattress Market Regional Market Share

Geographic Coverage of United States Mattress Market

United States Mattress Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Changing Consumer Preferences is Driving the Market; Growth in Health awareness is Driving the Market

- 3.3. Market Restrains

- 3.3.1. High Competition among manufacturers barrier to market

- 3.4. Market Trends

- 3.4.1. Memory-Foam Mattresses Dominated the United States Mattress Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Mattress Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kingsdown Mattress

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Purple Innovations Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tuft & Needle LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Corsicana Mattress Company**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Spring Air International

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Casper Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Saatva Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Serta Simmons Bedding LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sleep Number Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tempur Sealy International Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Kingsdown Mattress

List of Figures

- Figure 1: United States Mattress Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Mattress Market Share (%) by Company 2025

List of Tables

- Table 1: United States Mattress Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: United States Mattress Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: United States Mattress Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: United States Mattress Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: United States Mattress Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: United States Mattress Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: United States Mattress Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: United States Mattress Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: United States Mattress Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: United States Mattress Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: United States Mattress Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: United States Mattress Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Mattress Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the United States Mattress Market?

Key companies in the market include Kingsdown Mattress, Purple Innovations Inc, Tuft & Needle LLC, Corsicana Mattress Company**List Not Exhaustive, Spring Air International, Casper Inc, Saatva Inc, Serta Simmons Bedding LLC, Sleep Number Corporation, Tempur Sealy International Inc.

3. What are the main segments of the United States Mattress Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.47 Million as of 2022.

5. What are some drivers contributing to market growth?

Changing Consumer Preferences is Driving the Market; Growth in Health awareness is Driving the Market.

6. What are the notable trends driving market growth?

Memory-Foam Mattresses Dominated the United States Mattress Market.

7. Are there any restraints impacting market growth?

High Competition among manufacturers barrier to market.

8. Can you provide examples of recent developments in the market?

August 2023: Sleep Number Corporation has introduced the next generation of smart beds and lifestyle furnishings. Designed to be used independently yet most effectively when combined, these innovations aim to enhance sleep quality and unlock individuals' full potential across all life stages. The next generation of Smart Beds was developed from the original Sleep Number 360 and awarded for its innovation. The knowledge of more than 19 billion hours of proprietary, longitudinal sleep data from the 360 Smart Bed has led to the most recent advances.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Mattress Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Mattress Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Mattress Market?

To stay informed about further developments, trends, and reports in the United States Mattress Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence