Key Insights

The United States Nuclear Power Plant Equipment Market is poised for steady growth, driven by the nation's ongoing reliance on nuclear energy as a stable, low-carbon power source. With a projected market size of approximately USD 25,000 million (estimated based on typical market values for established industrial sectors and a CAGR above 2.00%), the sector will experience a compound annual growth rate exceeding 2.00% throughout the forecast period of 2025-2033. This expansion is largely fueled by the need for maintaining and upgrading existing nuclear power infrastructure, including the replacement of aging components and the implementation of advanced safety systems. The market is also seeing renewed interest in small modular reactors (SMRs) and advanced reactor designs, which promise enhanced safety, efficiency, and potentially lower construction costs, further stimulating demand for specialized equipment. The "Island Equipment" segment, encompassing critical components like reactors and turbines, is expected to remain the dominant category due to the foundational role these play in plant operation.

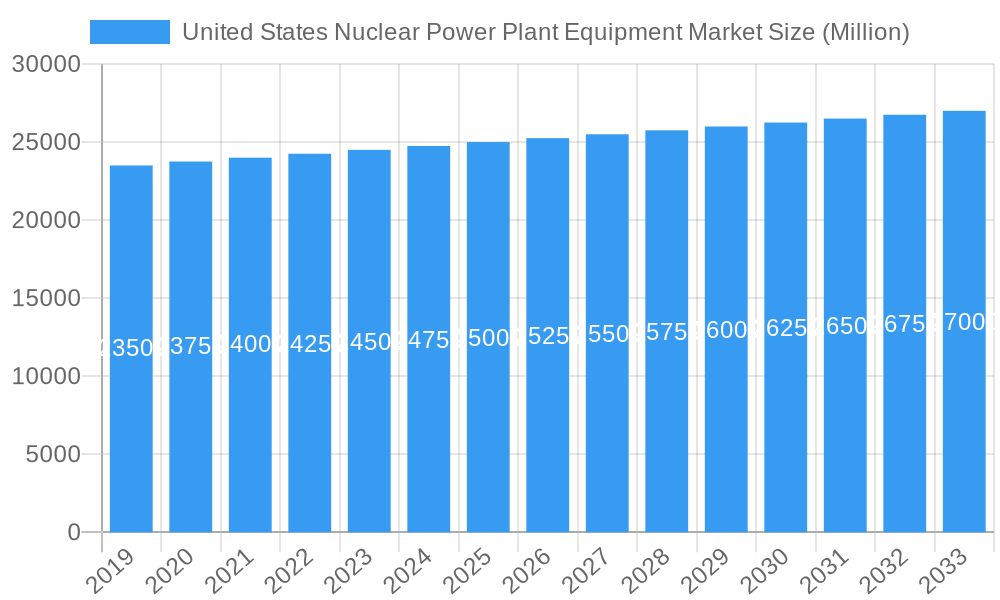

United States Nuclear Power Plant Equipment Market Market Size (In Billion)

The United States Nuclear Power Plant Equipment Market is characterized by a robust ecosystem of established global players and domestic manufacturers, including industry titans like GE-Hitachi Nuclear Energy and Westinghouse Electric Company LLC. These companies are at the forefront of innovation, developing solutions to enhance the operational lifespan and safety of existing plants while also pioneering new reactor technologies. Key drivers for this market include government support for clean energy initiatives, stringent safety regulations that necessitate periodic upgrades, and the desire for energy independence and security. However, challenges such as high upfront capital costs for new construction, public perception issues, and the lengthy regulatory approval processes for new projects can restrain the market's full potential. The "Auxiliary Equipment" segment, covering a wide range of support systems, is also expected to grow as plants invest in modernization and efficiency improvements.

United States Nuclear Power Plant Equipment Market Company Market Share

This detailed report offers an in-depth analysis of the United States Nuclear Power Plant Equipment Market, providing critical insights for industry stakeholders. Covering the historical period from 2019 to 2024 and a forecast period from 2025 to 2033, with 2025 as the base and estimated year, this report delves into market dynamics, key players, technological advancements, and growth opportunities. With an estimated market size of XX Million in 2025, the U.S. nuclear power equipment sector is poised for significant evolution driven by the demand for reliable, low-carbon energy solutions and ongoing technological innovations.

United States Nuclear Power Plant Equipment Market Market Concentration & Innovation

The United States Nuclear Power Plant Equipment Market exhibits a moderate to high concentration, with a few dominant players controlling a significant share of the supply chain. Innovation is primarily driven by the pursuit of enhanced safety features, increased operational efficiency, and the development of Small Modular Reactors (SMRs) to meet evolving energy demands and regulatory requirements. Key innovation areas include advanced reactor designs, improved fuel performance, and sophisticated digital control systems. The regulatory framework, overseen by the Nuclear Regulatory Commission (NRC), plays a crucial role in shaping innovation by setting stringent safety and security standards. Product substitutes, such as renewable energy sources and fossil fuels with carbon capture technologies, present competitive pressures, compelling nuclear equipment manufacturers to focus on cost-effectiveness and environmental performance. End-user trends indicate a growing preference for reliable baseload power and the decarbonization of the energy grid, bolstering the long-term prospects for nuclear energy. Mergers and Acquisitions (M&A) activities are strategic plays to consolidate expertise, expand product portfolios, and secure market positions. For instance, a hypothetical M&A deal value of XX Million could signify a major consolidation. Key market participants are continuously investing in R&D to maintain their competitive edge and respond to the dynamic energy landscape.

United States Nuclear Power Plant Equipment Market Industry Trends & Insights

The United States Nuclear Power Plant Equipment Market is experiencing a resurgence, driven by the nation's commitment to energy security and climate change mitigation. A projected Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033 underscores the robust expansion expected in this sector. The market penetration of nuclear power, while facing historical challenges, is anticipated to see renewed interest, particularly with the development of advanced reactor technologies. Technological disruptions, including the advancement of Small Modular Reactors (SMRs) and the potential for next-generation reactors, are transforming the equipment landscape, offering more flexible and scalable solutions. Consumer preferences are increasingly leaning towards clean and reliable energy sources, with nuclear power being recognized for its low-carbon footprint and consistent baseload generation capabilities. The competitive dynamics are characterized by a focus on long-term contracts for new builds and extensive aftermarket services for existing operational plants. Companies are investing heavily in advanced manufacturing techniques and digital solutions to enhance the performance and longevity of nuclear power plant equipment. Supply chain resilience and the development of a skilled workforce are also critical trends shaping the industry. Government policies supporting nuclear energy, such as tax credits and research funding, are further stimulating growth and innovation. The industry is also witnessing a growing emphasis on life-extension programs for aging nuclear facilities, creating sustained demand for specialized equipment and services.

Dominant Markets & Segments in United States Nuclear Power Plant Equipment Market

Within the United States Nuclear Power Plant Equipment Market, the Pressurized Water Reactor (PWR) segment is historically dominant, accounting for a significant portion of operational capacity and new builds. The robust design and proven track record of PWR technology have solidified its position. Key drivers for PWR dominance include established supply chains, extensive operational experience, and a well-trained workforce familiar with its intricacies. Economic policies favoring stable baseload power generation and infrastructure investments in supporting the existing PWR fleet further bolster this segment.

The Boiling Water Reactor (BWR) segment also holds a substantial market share, characterized by its distinct design and operational characteristics. While PWRs may lead in overall capacity, BWRs are crucial for specific grid needs and are subject to ongoing upgrades and maintenance. Drivers for BWR segment strength include their efficiency in certain operational profiles and continued investment in their modernization.

Emerging Other Reactor Types, particularly Small Modular Reactors (SMRs), represent a significant growth area. These advanced designs are poised to capture future market share due to their potential for enhanced safety, cost-effectiveness, and scalability. Key drivers for this segment's growth include regulatory support for innovation, the demand for flexible energy solutions in remote locations, and the potential for serial manufacturing to reduce costs.

In terms of Carrier Type, Island Equipment, encompassing the main power generation components such as turbines, generators, and reactor vessels, constitutes the largest and most critical segment. The high capital expenditure associated with these core components makes it a focal point for market activity. Drivers for Island Equipment dominance include the necessity of these systems for power generation and the long lifecycle of nuclear power plants.

Auxiliary Equipment, which includes a wide range of systems for cooling, safety, control, and maintenance, forms a vital secondary market. The demand for auxiliary equipment is sustained by both new construction and the ongoing operational needs of existing plants, including upgrades and replacements. Drivers for Auxiliary Equipment include the inherent complexity of nuclear power plants and the continuous need for operational support and safety enhancements.

Research Reactors represent a niche but important segment, crucial for scientific advancement, fuel testing, and medical isotope production. While their power output is minimal, the specialized and high-precision equipment required for research reactors drives innovation and specialized market demand. Drivers for this segment include government funding for scientific research and the growing demand for radioisotopes in healthcare.

United States Nuclear Power Plant Equipment Market Product Developments

Product developments in the U.S. Nuclear Power Plant Equipment Market are largely focused on enhancing safety, efficiency, and economic viability. Innovations in reactor vessel materials, advanced fuel designs, and digital instrumentation and control (I&C) systems are key areas of advancement. The development of passive safety features, inherent to new reactor designs, offers significant competitive advantages by reducing reliance on active systems and minimizing the potential for human error. Furthermore, advancements in manufacturing techniques, such as additive manufacturing, are enabling the production of more complex and resilient components, potentially reducing lead times and costs. The integration of artificial intelligence and machine learning for predictive maintenance and operational optimization is also a growing trend, improving equipment reliability and reducing downtime.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the United States Nuclear Power Plant Equipment Market segmented by Reactor Type and Carrier Type. Under Reactor Type, the market is analyzed across Pressurized Water Reactor (PWR), Boiling Water Reactor (BWR), and Other Reactor Types, which includes emerging technologies like Small Modular Reactors (SMRs). The PWR and BWR segments represent established markets with ongoing maintenance and upgrade opportunities, while the "Other Reactor Types" segment is projected to experience the highest growth rate due to significant investment in advanced reactor designs.

The Carrier Type segmentation includes Island Equipment, encompassing primary power generation components; Auxiliary Equipment, covering all supporting systems; and Research Reactor equipment. The Island Equipment segment, characterized by large-scale, high-value components, is crucial for new builds. The Auxiliary Equipment segment offers consistent demand for repairs, replacements, and upgrades across the existing fleet. The Research Reactor segment, though smaller in scale, is vital for specialized applications and technological advancement. Growth projections and market sizes for each segment are meticulously detailed, alongside an analysis of the competitive dynamics within each.

Key Drivers of United States Nuclear Power Plant Equipment Market Growth

The growth of the United States Nuclear Power Plant Equipment Market is primarily driven by the increasing demand for reliable, low-carbon energy to meet decarbonization targets. Government policies and incentives aimed at promoting clean energy, including tax credits and loan guarantees for nuclear projects, are significant catalysts. The ongoing need for baseload power generation, which nuclear energy uniquely provides, complements the intermittent nature of renewable energy sources. Furthermore, technological advancements, particularly in the development of Small Modular Reactors (SMRs) and advanced reactor designs, are creating new market opportunities and revitalizing interest in nuclear power. The focus on energy security and reducing reliance on volatile fossil fuel markets also bolsters the demand for domestic nuclear energy production and its associated equipment.

Challenges in the United States Nuclear Power Plant Equipment Market Sector

Despite strong growth drivers, the United States Nuclear Power Plant Equipment Market faces several significant challenges. High upfront capital costs associated with building new nuclear power plants remain a major barrier, often leading to project delays and cost overruns. Stringent and evolving regulatory frameworks, while crucial for safety, can also increase complexity and timelines for equipment procurement and deployment. Public perception and political opposition, fueled by historical incidents and concerns about waste disposal, continue to influence policy decisions and project viability. Supply chain disruptions, including the availability of specialized materials and a skilled workforce, can also impact project execution. The long lead times for manufacturing and licensing complex nuclear equipment further add to the challenges.

Emerging Opportunities in United States Nuclear Power Plant Equipment Market

Emerging opportunities in the United States Nuclear Power Plant Equipment Market are predominantly linked to the development and deployment of advanced reactor technologies, particularly Small Modular Reactors (SMRs). SMRs offer the potential for lower capital costs, faster construction times, and greater flexibility in deployment, making them attractive for a wider range of applications. The growing need for reliable power in industrial applications and remote communities presents a significant market for SMRs. Furthermore, the life extension of existing nuclear power plants will continue to drive demand for specialized maintenance, upgrade, and replacement equipment. Opportunities also exist in the development of advanced fuel cycles, waste management solutions, and digital technologies for enhanced operational efficiency and safety. The increasing focus on decarbonization and climate change mitigation creates a favorable environment for nuclear power's expansion.

Leading Players in the United States Nuclear Power Plant Equipment Market Market

- GE-Hitachi Nuclear Energy

- Westinghouse Electric Company LLC

- Dongfang Electric Corp Limited

- Doosan Corporation

- Babcock & Wilcox Company

- JSC Atomstroyexport

- Mitsubishi Heavy Industries Ltd

Key Developments in United States Nuclear Power Plant Equipment Market Industry

- December 2022: Georgia Power announced the completion of cold hydro testing for Vogtle Unit 4 at the nuclear expansion project near Waynesboro, Georgia. The only remaining major test, the hot functional testing, is projected to commence by the end of Q1 2023.

- February 2022: GE and EDF announced that they have signed an exclusive agreement for EDF to acquire part of GE Steam Power's nuclear power activities, which include GE's nuclear steam turbine technology and service businesses.

Strategic Outlook for United States Nuclear Power Plant Equipment Market Market

The strategic outlook for the United States Nuclear Power Plant Equipment Market is positive, driven by a confluence of factors including the imperative for clean energy, enhanced energy security, and technological innovation. The anticipated commercial deployment of Small Modular Reactors (SMRs) within the forecast period presents a significant growth catalyst, promising to democratize nuclear energy access and unlock new market segments. Continued investment in the modernization and life extension of the existing nuclear fleet will sustain demand for reliable components and advanced services. Strategic partnerships and collaborations among key industry players, alongside robust government support through favorable policies and research funding, will be crucial for navigating regulatory complexities and driving down costs. The market's ability to adapt to evolving technological landscapes and address public perception will ultimately shape its long-term trajectory towards a substantial contribution to the U.S. energy mix.

United States Nuclear Power Plant Equipment Market Segmentation

-

1. Reactor Type

- 1.1. Pressurized Water Reactor

- 1.2. Boiling Water Reactor

- 1.3. Other Reactor Types

-

2. Carrier Type

- 2.1. Island Equipment

- 2.2. Auxiliary Equipment

- 2.3. Research Reactor

United States Nuclear Power Plant Equipment Market Segmentation By Geography

- 1. United States

United States Nuclear Power Plant Equipment Market Regional Market Share

Geographic Coverage of United States Nuclear Power Plant Equipment Market

United States Nuclear Power Plant Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Global Inclination toward Renewable-based Power Generation4.; Increased Power Demand in Line with the Increasing Population

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Cost

- 3.4. Market Trends

- 3.4.1. Pressurized Water Reactors to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Nuclear Power Plant Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Reactor Type

- 5.1.1. Pressurized Water Reactor

- 5.1.2. Boiling Water Reactor

- 5.1.3. Other Reactor Types

- 5.2. Market Analysis, Insights and Forecast - by Carrier Type

- 5.2.1. Island Equipment

- 5.2.2. Auxiliary Equipment

- 5.2.3. Research Reactor

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Reactor Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 GE-Hitachi Nuclear Energy

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Westinghouse Electric Company LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dongfang Electric Corp Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Doosan Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Babcock & Wilcox Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 JSC Atomstroyexport

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mitsubishi Heavy Industries Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 GE-Hitachi Nuclear Energy

List of Figures

- Figure 1: United States Nuclear Power Plant Equipment Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: United States Nuclear Power Plant Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: United States Nuclear Power Plant Equipment Market Revenue undefined Forecast, by Reactor Type 2020 & 2033

- Table 2: United States Nuclear Power Plant Equipment Market Volume K Units Forecast, by Reactor Type 2020 & 2033

- Table 3: United States Nuclear Power Plant Equipment Market Revenue undefined Forecast, by Carrier Type 2020 & 2033

- Table 4: United States Nuclear Power Plant Equipment Market Volume K Units Forecast, by Carrier Type 2020 & 2033

- Table 5: United States Nuclear Power Plant Equipment Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: United States Nuclear Power Plant Equipment Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: United States Nuclear Power Plant Equipment Market Revenue undefined Forecast, by Reactor Type 2020 & 2033

- Table 8: United States Nuclear Power Plant Equipment Market Volume K Units Forecast, by Reactor Type 2020 & 2033

- Table 9: United States Nuclear Power Plant Equipment Market Revenue undefined Forecast, by Carrier Type 2020 & 2033

- Table 10: United States Nuclear Power Plant Equipment Market Volume K Units Forecast, by Carrier Type 2020 & 2033

- Table 11: United States Nuclear Power Plant Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: United States Nuclear Power Plant Equipment Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Nuclear Power Plant Equipment Market?

The projected CAGR is approximately 6.84%.

2. Which companies are prominent players in the United States Nuclear Power Plant Equipment Market?

Key companies in the market include GE-Hitachi Nuclear Energy, Westinghouse Electric Company LLC, Dongfang Electric Corp Limited, Doosan Corporation, Babcock & Wilcox Company, JSC Atomstroyexport, Mitsubishi Heavy Industries Ltd .

3. What are the main segments of the United States Nuclear Power Plant Equipment Market?

The market segments include Reactor Type, Carrier Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Global Inclination toward Renewable-based Power Generation4.; Increased Power Demand in Line with the Increasing Population.

6. What are the notable trends driving market growth?

Pressurized Water Reactors to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Cost.

8. Can you provide examples of recent developments in the market?

December 20, 2022: Georgia Power today announced the completion of cold hydro testing for Vogtle Unit 4 at the nuclear expansion project near Waynesboro, Georgia. The only remaining major test, the hot functional testing, is projected to commence by the end of Q1 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Nuclear Power Plant Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Nuclear Power Plant Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Nuclear Power Plant Equipment Market?

To stay informed about further developments, trends, and reports in the United States Nuclear Power Plant Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence