Key Insights

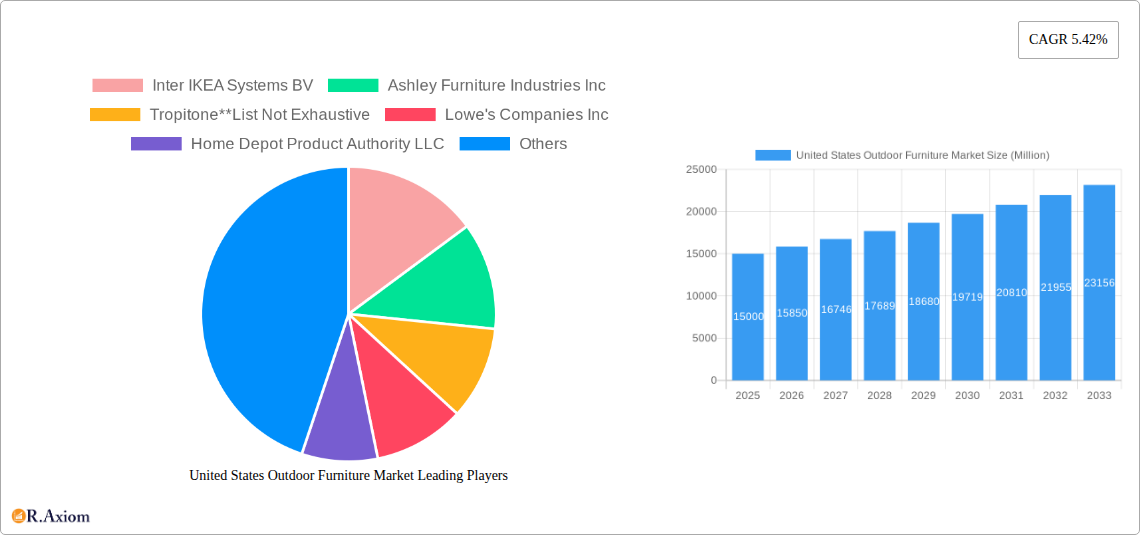

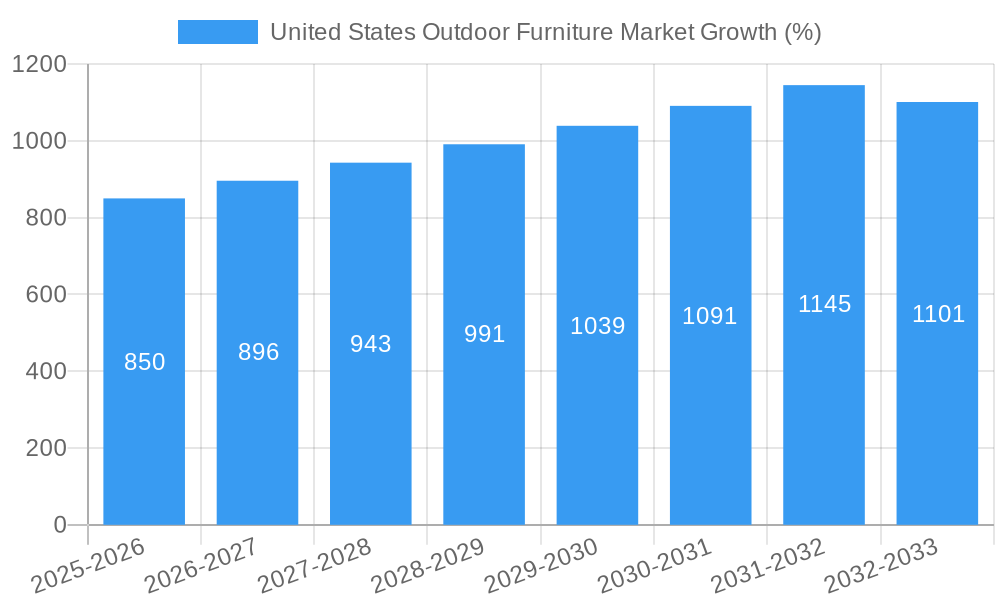

The United States outdoor furniture market, valued at approximately $15 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 5.42% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing popularity of outdoor living and entertaining, driven by a desire for enhanced home comfort and social interaction, is significantly boosting demand. Secondly, rising disposable incomes, particularly amongst millennials and Gen Z, are enabling greater investment in high-quality outdoor furniture. Technological advancements in materials, resulting in more durable, weather-resistant, and aesthetically pleasing products, also contribute to market growth. Finally, the growing adoption of online retail channels is expanding market accessibility and driving sales. The residential segment currently dominates the market, but the commercial sector, encompassing hotels, restaurants, and public spaces, shows significant growth potential due to increased investments in outdoor hospitality and landscaping.

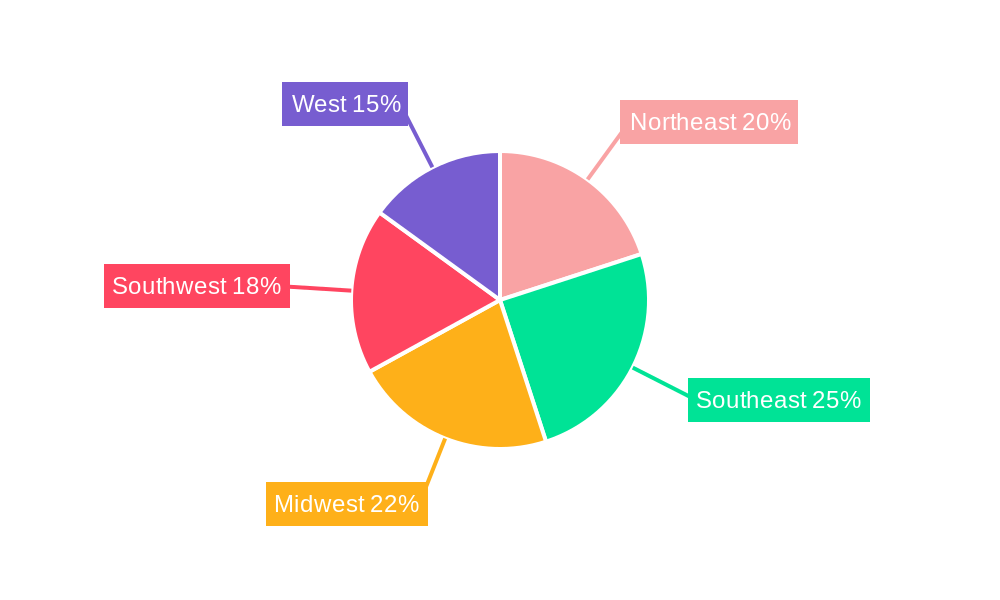

However, several restraints could impact market growth. Fluctuations in raw material prices, particularly lumber and aluminum, pose a challenge to manufacturers. Economic downturns could dampen consumer spending on discretionary items like outdoor furniture. Furthermore, increased competition from imports, particularly from countries with lower manufacturing costs, necessitates innovative product development and efficient supply chain management. Segmentation analysis reveals strong performance across product types, including chairs, tables, seating sets, and loungers/daybeds, with dining sets also showing consistent demand. Popular distribution channels include supermarkets/hypermarkets, specialty stores, and increasingly, online retail. Key players like Inter IKEA Systems BV, Ashley Furniture Industries Inc., and Lowe's Companies Inc. are aggressively competing through product innovation, branding, and robust distribution networks. The regional breakdown within the US shows consistent demand across all regions, with potentially higher growth in the South and West due to favorable climate conditions and higher concentrations of new housing developments.

United States Outdoor Furniture Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States outdoor furniture market, covering market size, segmentation, growth drivers, challenges, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period extends from 2025 to 2033, while the historical period covers 2019-2024. This report is essential for industry stakeholders, investors, and anyone seeking a detailed understanding of this dynamic market.

United States Outdoor Furniture Market Concentration & Innovation

The United States outdoor furniture market exhibits a moderately concentrated landscape, with a few major players holding significant market share. While precise market share figures for individual companies are proprietary, Inter IKEA Systems BV, Ashley Furniture Industries Inc., and Lowe's Companies Inc. are among the prominent players, commanding a significant portion of the overall market. The market is characterized by continuous innovation, driven by consumer demand for durable, stylish, and sustainable products.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated to be between xx and xx, indicating a moderately concentrated market.

- Innovation Drivers: Growing consumer preference for eco-friendly materials, technological advancements in materials science (e.g., weather-resistant fabrics, recycled plastics), and the increasing demand for customizable furniture are key innovation drivers.

- Regulatory Framework: Regulations concerning material safety and environmental standards significantly impact the industry, influencing product development and manufacturing processes.

- Product Substitutes: The market faces competition from alternative outdoor seating options such as hammocks and inflatable furniture.

- End-User Trends: The increasing popularity of outdoor living spaces, coupled with rising disposable incomes, fuels demand for high-quality outdoor furniture.

- M&A Activities: The past five years have witnessed a moderate level of M&A activity, with deal values ranging from xx Million to xx Million. These transactions primarily involve smaller players being acquired by larger established companies.

United States Outdoor Furniture Market Industry Trends & Insights

The United States outdoor furniture market is experiencing robust growth, driven by several factors. The increasing popularity of outdoor living and entertaining, coupled with favorable economic conditions in certain periods, has led to strong demand for durable and aesthetically pleasing outdoor furniture. The market’s Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) is estimated at xx%, while the projected CAGR for the forecast period (2025-2033) is estimated to be xx%. This growth is further propelled by technological advancements in materials and designs, catering to evolving consumer preferences. Market penetration of high-end outdoor furniture is growing, particularly in affluent residential areas. Competitive dynamics are intense, with both established players and new entrants vying for market share through product differentiation, pricing strategies, and brand building.

Dominant Markets & Segments in United States Outdoor Furniture Market

The residential segment dominates the U.S. outdoor furniture market, accounting for approximately xx% of the total market value. Within product types, seating sets and dining sets are the most popular categories, driven by the increasing preference for outdoor dining and entertaining. Online retail is a rapidly growing distribution channel, with a market penetration rate projected to reach xx% by 2033.

Leading Region: The South and West regions are currently the dominant markets, driven by favorable weather conditions and a higher concentration of residential properties with outdoor spaces.

Key Drivers (Residential Segment):

- Rising disposable incomes

- Growing popularity of outdoor living

- Increasing homeownership rates

Key Drivers (Online Retail Channel):

- Convenience and ease of access

- Wider product selection

- Competitive pricing

Dominant Product Type: Seating Sets and Dining Sets hold the largest market share, reflecting the strong preference for complete outdoor living spaces.

United States Outdoor Furniture Market Product Developments

Recent product innovations focus on sustainability, durability, and design. Manufacturers are increasingly utilizing recycled materials and eco-friendly production processes. Technological advancements are evident in the use of weather-resistant fabrics, UV-resistant finishes, and innovative designs that offer both comfort and style. These developments address consumer demands for long-lasting, low-maintenance, and aesthetically pleasing outdoor furniture.

Report Scope & Segmentation Analysis

This report segments the U.S. outdoor furniture market based on product type (Chairs, Tables, Seating Sets, Loungers and Daybeds, Dining Sets, Other Product Types), end-user (Commercial, Residential), and distribution channel (Supermarkets and Hypermarkets, Specialty Stores, Online Retail, Other Distribution Channels). Each segment’s growth projections, market sizes, and competitive dynamics are analyzed in detail within the full report. The market size for each segment is projected to grow steadily throughout the forecast period, with variations depending on consumer preferences and economic factors.

Key Drivers of United States Outdoor Furniture Market Growth

The growth of the U.S. outdoor furniture market is fueled by several key factors: the rising popularity of outdoor living and entertaining, increased disposable incomes, advancements in materials technology leading to more durable and stylish products, and the expansion of online retail channels. Government initiatives promoting sustainable living also contribute to the market's growth, particularly the increasing demand for eco-friendly furniture options.

Challenges in the United States Outdoor Furniture Market Sector

The U.S. outdoor furniture market faces challenges, including fluctuations in raw material costs, supply chain disruptions impacting manufacturing and delivery times, and intense competition among established players and emerging brands. Furthermore, environmental regulations and the need to adapt to evolving consumer preferences for sustainable and ethically sourced products pose significant challenges. The market is also susceptible to economic downturns which can directly impact consumer spending on discretionary items like outdoor furniture.

Emerging Opportunities in United States Outdoor Furniture Market

The market presents significant opportunities, particularly in the growing demand for sustainable and customizable outdoor furniture. The increasing adoption of smart home technology offers potential for integrating smart features into outdoor furniture. Expansion into niche markets, such as commercial outdoor spaces for hospitality and recreation, presents further growth potential. Furthermore, the increasing popularity of outdoor kitchens and related products offers a significant avenue for expansion within the market.

Leading Players in the United States Outdoor Furniture Market Market

- Inter IKEA Systems BV

- Ashley Furniture Industries Inc.

- Tropitone

- Lowe's Companies Inc.

- Home Depot Product Authority LLC

- Barbeques Galore

- Williams-Sonoma Inc.

- Century Furniture LLC

- Herman Miller Inc.

- Berkshire Hathaway Inc.

- Brown Jordan Inc.

- Lloyd Furnitures

Key Developments in United States Outdoor Furniture Market Industry

- November 2022: Martha Stewart partnered with Polywood to launch a sustainable outdoor furniture collection, showcasing a shift towards eco-conscious products. This partnership highlights a growing trend towards sustainable materials and designs within the industry.

- October 2022: Huttig Building Products partnered with Fiberon to expand the distribution of composite wood-alternative decking and railing products, indicating growth in the market for alternative outdoor materials. This partnership will likely boost Fiberon's market share and further enhance the availability of composite wood alternatives in the Southeast region.

Strategic Outlook for United States Outdoor Furniture Market Market

The U.S. outdoor furniture market is poised for continued growth, driven by persistent demand for high-quality, durable, and stylish outdoor furnishings. Innovation in materials, design, and sustainability will be key factors influencing future market dynamics. Companies that can effectively adapt to evolving consumer preferences, leverage technological advancements, and navigate supply chain challenges are best positioned to capitalize on the market's growth potential.

United States Outdoor Furniture Market Segmentation

-

1. Product Type

- 1.1. Chairs

- 1.2. Tables

- 1.3. Seating Sets

- 1.4. Loungers and Daybeds

- 1.5. Dining Sets

- 1.6. Other Product Types

-

2. End User

- 2.1. Commercial

- 2.2. Residential

-

3. Distribution Channel

- 3.1. Supermarkets and Hypermarkets

- 3.2. Specialty Stores

- 3.3. Online Retail

- 3.4. Other Distribution Channels

United States Outdoor Furniture Market Segmentation By Geography

- 1. United States

United States Outdoor Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.42% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of Restaurant and Hotel Chains; Increasing Residential Spending on Luxurious Furnishings is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruptions are Restraining the Market; Economic Downturns are impacting consumer spending on Outdoor Furniture

- 3.4. Market Trends

- 3.4.1. Increasing Disposable Income is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Outdoor Furniture Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Chairs

- 5.1.2. Tables

- 5.1.3. Seating Sets

- 5.1.4. Loungers and Daybeds

- 5.1.5. Dining Sets

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Commercial

- 5.2.2. Residential

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets and Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Online Retail

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Northeast United States Outdoor Furniture Market Analysis, Insights and Forecast, 2019-2031

- 7. Southeast United States Outdoor Furniture Market Analysis, Insights and Forecast, 2019-2031

- 8. Midwest United States Outdoor Furniture Market Analysis, Insights and Forecast, 2019-2031

- 9. Southwest United States Outdoor Furniture Market Analysis, Insights and Forecast, 2019-2031

- 10. West United States Outdoor Furniture Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Inter IKEA Systems BV

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ashley Furniture Industries Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tropitone**List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lowe's Companies Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Home Depot Product Authority LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Barbeques Galore

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Williams-Sonoma Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Century Furniture LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Herman Miller Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Berkshire Hathaway Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Brown Jordan Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Lloyd Furnitures

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Inter IKEA Systems BV

List of Figures

- Figure 1: United States Outdoor Furniture Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Outdoor Furniture Market Share (%) by Company 2024

List of Tables

- Table 1: United States Outdoor Furniture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Outdoor Furniture Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: United States Outdoor Furniture Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: United States Outdoor Furniture Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: United States Outdoor Furniture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United States Outdoor Furniture Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Northeast United States Outdoor Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southeast United States Outdoor Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Midwest United States Outdoor Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Southwest United States Outdoor Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: West United States Outdoor Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States Outdoor Furniture Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 13: United States Outdoor Furniture Market Revenue Million Forecast, by End User 2019 & 2032

- Table 14: United States Outdoor Furniture Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: United States Outdoor Furniture Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Outdoor Furniture Market?

The projected CAGR is approximately 5.42%.

2. Which companies are prominent players in the United States Outdoor Furniture Market?

Key companies in the market include Inter IKEA Systems BV, Ashley Furniture Industries Inc, Tropitone**List Not Exhaustive, Lowe's Companies Inc, Home Depot Product Authority LLC, Barbeques Galore, Williams-Sonoma Inc, Century Furniture LLC, Herman Miller Inc, Berkshire Hathaway Inc, Brown Jordan Inc, Lloyd Furnitures.

3. What are the main segments of the United States Outdoor Furniture Market?

The market segments include Product Type, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growth of Restaurant and Hotel Chains; Increasing Residential Spending on Luxurious Furnishings is Driving the Market.

6. What are the notable trends driving market growth?

Increasing Disposable Income is Driving the Market.

7. Are there any restraints impacting market growth?

Supply Chain Disruptions are Restraining the Market; Economic Downturns are impacting consumer spending on Outdoor Furniture.

8. Can you provide examples of recent developments in the market?

November 2022: Martha Stewart, a home design company, partnered with Polywood, the originator and manufacturer of outdoor furniture made from sustainable materials, including landfill- and ocean-bound plastics, to launch a collection of relaxed heirloom-worthy designs made to last a lifetime.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Outdoor Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Outdoor Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Outdoor Furniture Market?

To stay informed about further developments, trends, and reports in the United States Outdoor Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence