Key Insights

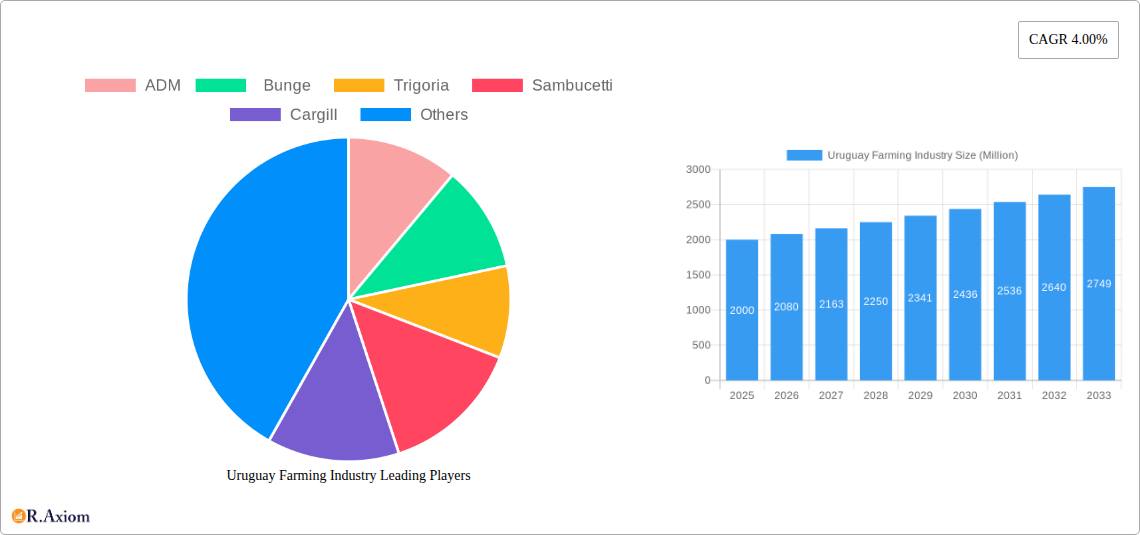

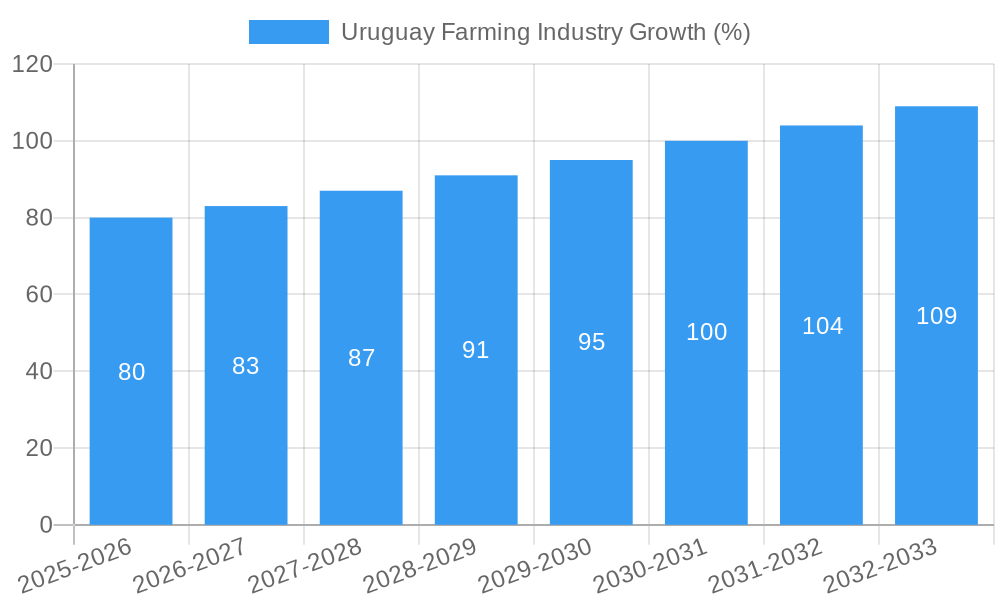

The Uruguayan farming industry, valued at approximately $2 billion in 2025, is projected to experience steady growth, exhibiting a compound annual growth rate (CAGR) of 4% from 2025 to 2033. This growth is fueled by several key drivers. Increased global demand for high-quality agricultural products, particularly cereals and oilseeds, presents significant export opportunities for Uruguay. Furthermore, advancements in agricultural technology, including precision farming techniques and improved irrigation systems, are enhancing productivity and efficiency. Government initiatives supporting sustainable agriculture and investments in infrastructure, such as improved transportation networks, further bolster the sector's expansion. However, challenges remain. Climate change, with its unpredictable weather patterns, poses a significant threat to crop yields. Fluctuations in global commodity prices also create volatility in the market, impacting profitability for farmers. Competition from other agricultural exporters in the region necessitates continuous innovation and efficiency improvements. The industry is segmented by crop type, encompassing cereals, oilseeds, fruits, vegetables, and other crops. Major players, including international giants like ADM, Bunge, and Cargill, alongside significant local businesses like Trigoria and Sambucetti, are actively engaged in the Uruguayan agricultural landscape, contributing to its overall development.

The segmentation by crop type reveals diverse growth trajectories. Cereals, a cornerstone of Uruguayan agriculture, are projected to maintain strong growth driven by consistent demand. Oilseeds, benefiting from global demand for biofuels and vegetable oils, show promising prospects. Fruits and vegetables, while smaller segments, are expected to see growth fueled by increasing domestic consumption and targeted export strategies. The "other crops" category, which may include niche or specialty crops, may exhibit higher volatility but offers potential for growth based on emerging market trends. Analysis of import and export data within each segment provides crucial insights for understanding market dynamics, identifying opportunities for value-added processing, and supporting strategic decision-making. The historical period (2019-2024) likely presented a mixture of challenges and opportunities, shaping the current market conditions and influencing future projections. Continued monitoring of these factors is crucial for informed investment and policy-making within the Uruguayan farming industry.

Uruguay Farming Industry: A Comprehensive Market Analysis (2019-2033)

This report provides a detailed analysis of the Uruguay farming industry, covering market trends, key players, and future growth prospects from 2019 to 2033. The study period encompasses historical data (2019-2024), a base year (2025), and a forecast period (2025-2033). Key segments analyzed include cereals, oilseeds, fruits, vegetables, and other crops. The report leverages data on production, consumption, import/export volumes and values, and price trends, providing crucial insights for industry stakeholders, investors, and policymakers. Companies like ADM, Bunge, Trigoria, Sambucetti, and Cargill are examined for their market share and strategic activities.

Uruguay Farming Industry Market Concentration & Innovation

The Uruguayan farming industry exhibits a moderate level of concentration, with a few large multinational corporations like ADM, Bunge, and Cargill holding significant market share, particularly in the export-oriented segments of oilseeds and cereals. Smaller, family-owned farms dominate the fruit and vegetable sectors. The market share of these key players is estimated to be around xx% collectively in 2025, with ADM and Bunge holding the largest shares. Innovation is driven by government initiatives promoting technological adoption (e.g., the IDB's USD 6.5 million loan for digitalization) and a growing focus on sustainable and climate-resilient agriculture. Regulatory frameworks, while largely supportive, sometimes face challenges in adapting to the rapid pace of technological advancements. Product substitutes are limited, primarily related to imported alternatives for certain crops. End-user trends are shifting towards greater demand for sustainably produced, high-quality products. M&A activity in recent years has been relatively modest, with deal values averaging approximately xx Million USD annually. Key drivers of consolidation include economies of scale, improved access to markets, and enhanced technological capabilities.

Uruguay Farming Industry Industry Trends & Insights

The Uruguayan farming industry is projected to experience steady growth over the forecast period (2025-2033). The Compound Annual Growth Rate (CAGR) is estimated at xx%, primarily driven by increasing global demand for high-quality agricultural products and Uruguay's favorable climate and agricultural practices. Technological advancements, such as precision agriculture and data-driven decision-making, are enhancing productivity and efficiency. Consumer preferences are evolving towards organic and sustainably produced food, creating opportunities for producers adopting agroecological practices. Competitive dynamics are characterized by a mix of established multinational corporations and smaller, specialized producers. Market penetration of new technologies remains relatively low, indicating a significant opportunity for growth in this area. The increasing adoption of climate-smart agriculture practices is contributing to the sector's overall resilience. The government's support for agroecology and climate change adaptation further strengthens market opportunities in the niche high-value markets.

Dominant Markets & Segments in Uruguay Farming Industry

Cereals: Soybeans and wheat are the most significant cereal crops. Strong export demand drives production, with Brazil and China being primary export destinations. Production is primarily concentrated in the central and south regions of the country. High commodity prices and favorable weather conditions contribute to the segment’s dominance.

Oilseeds: Soybean dominates this segment, followed by sunflower. Export-oriented production is concentrated in the larger farms, benefitting from efficient processing infrastructure and established supply chains.

Fruits: Uruguay excels in fruit production, particularly citrus fruits (oranges, lemons), grapes, and apples. The segment is characterized by a significant number of small-scale producers, with a focus on quality and niche markets. Domestic consumption plays a significant role, alongside exports to neighboring countries and beyond.

Vegetables: Potato, onion, and tomato are the leading vegetables. A significant portion is domestically consumed, while the export share is primarily to neighboring markets. This segment faces challenges related to post-harvest losses and storage capacity.

Other Crops: Rice and pulses contribute to this segment. Production is moderate, with a focus on fulfilling domestic demand.

The dominance of specific regions and segments within the Uruguay farming industry is primarily driven by factors such as climatic conditions, land availability, established infrastructure, government support, and export market demand. The country's strategic location and favorable trade agreements enhance the competitiveness of its agricultural exports.

Uruguay Farming Industry Product Developments

Recent product developments have focused on improving crop yields, enhancing quality, and adapting to climate change. Technological innovations in precision agriculture, including the use of drones and sensor technology, are improving farming practices and efficiency. There’s also a growing emphasis on developing organic and sustainably produced crops to meet increasing consumer demand for higher-value products. The introduction of drought-resistant varieties is vital in mitigating the effects of climate change. This translates to enhanced market fit, driving profitability and resilience within the sector.

Report Scope & Segmentation Analysis

This report segments the Uruguayan farming industry by crop type: cereals (soybeans, wheat, etc.), oilseeds (soybeans, sunflower, etc.), fruits (citrus, grapes, apples, etc.), vegetables (potatoes, onions, tomatoes, etc.), and other crops (rice, pulses, etc.). Each segment's analysis includes production, consumption, import, and export analysis by volume and value, along with price trend analysis for the historical period (2019-2024) and forecast period (2025-2033). The report projects considerable growth in most segments, driven by increased demand and technological advancements. The competitive landscape varies across segments, with larger multinational companies playing a dominant role in export-oriented segments, while smaller producers thrive in domestically focused segments.

Key Drivers of Uruguay Farming Industry Growth

The growth of the Uruguayan farming industry is primarily driven by several key factors: favorable climatic conditions, fertile land, government support for agricultural development, rising global demand for agricultural products, and the adoption of advanced technologies, particularly in precision agriculture and data analytics. The country's strategic location facilitates access to major export markets, further boosting industry growth. Furthermore, the government's initiatives to promote sustainable and climate-resilient agriculture are fostering long-term sustainability and resilience within the sector.

Challenges in the Uruguay Farming Industry Sector

The Uruguayan farming industry faces several challenges, including climate change risks (droughts and floods), fluctuations in global commodity prices, infrastructure limitations in certain regions, and competition from other agricultural producers in the global market. These challenges have quantifiable impacts on production costs and overall profitability. Addressing these issues requires investment in infrastructure improvements, research and development for climate-resilient crops, and strategic market diversification.

Emerging Opportunities in Uruguay Farming Industry

The Uruguayan farming industry presents several emerging opportunities, notably in the expanding markets for organic and sustainably produced food. The adoption of new technologies, like precision agriculture and data analytics, is presenting growth opportunities. Furthermore, exploring niche markets and specializing in high-value agricultural products enhances profitability. Diversifying export markets and strengthening value chains through vertical integration will also contribute to future growth.

Leading Players in the Uruguay Farming Industry Market

- ADM

- Bunge

- Trigoria

- Sambucetti

- Cargill

Key Developments in Uruguay Farming Industry Industry

November 2021: The Uruguayan government approved the Agroecological and Climate Resilient Systems Project, focusing on improving information systems and traceability of production to enable producers to market agroecological products effectively. This initiative is anticipated to boost the sector’s competitiveness in high-value markets.

August 2022: The Inter-American Development Bank (IDB) sanctioned a USD 6.5 million loan to increase the efficiency of Uruguay's agricultural sector through digitalization. This program is expected to enhance productivity and competitiveness.

Strategic Outlook for Uruguay Farming Industry Market

The Uruguayan farming industry is poised for continued growth, driven by favorable conditions, strategic government initiatives, technological advancements, and increasing global demand for high-quality, sustainably produced food. Focusing on high-value niche markets, embracing innovative technologies, and strengthening value chains will unlock substantial opportunities in the coming years, enhancing both economic growth and environmental sustainability.

Uruguay Farming Industry Segmentation

-

1. Crop Typ

- 1.1. Cereals

- 1.2. Oilseeds

- 1.3. Fruits

- 1.4. Vegetables

- 1.5. Other Crops

-

2. Crop Typ

- 2.1. Cereals

- 2.2. Oilseeds

- 2.3. Fruits

- 2.4. Vegetables

- 2.5. Other Crops

Uruguay Farming Industry Segmentation By Geography

- 1. Uruguay

Uruguay Farming Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Milled and Broken Rice; Growing Preference for Speciality Rice Variety; Government Initiatives Supports Rice Production

- 3.3. Market Restrains

- 3.3.1. Lack of Supply Chain for Rice; Growing Agricultural Labor Crisis

- 3.4. Market Trends

- 3.4.1. Demand from the Food and Beverage Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Uruguay Farming Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Crop Typ

- 5.1.1. Cereals

- 5.1.2. Oilseeds

- 5.1.3. Fruits

- 5.1.4. Vegetables

- 5.1.5. Other Crops

- 5.2. Market Analysis, Insights and Forecast - by Crop Typ

- 5.2.1. Cereals

- 5.2.2. Oilseeds

- 5.2.3. Fruits

- 5.2.4. Vegetables

- 5.2.5. Other Crops

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Uruguay

- 5.1. Market Analysis, Insights and Forecast - by Crop Typ

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 ADM

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bunge

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Trigoria

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sambucetti

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cargill

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 ADM

List of Figures

- Figure 1: Uruguay Farming Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Uruguay Farming Industry Share (%) by Company 2024

List of Tables

- Table 1: Uruguay Farming Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Uruguay Farming Industry Volume Metric Tons Forecast, by Region 2019 & 2032

- Table 3: Uruguay Farming Industry Revenue Million Forecast, by Crop Typ 2019 & 2032

- Table 4: Uruguay Farming Industry Volume Metric Tons Forecast, by Crop Typ 2019 & 2032

- Table 5: Uruguay Farming Industry Revenue Million Forecast, by Crop Typ 2019 & 2032

- Table 6: Uruguay Farming Industry Volume Metric Tons Forecast, by Crop Typ 2019 & 2032

- Table 7: Uruguay Farming Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Uruguay Farming Industry Volume Metric Tons Forecast, by Region 2019 & 2032

- Table 9: Uruguay Farming Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Uruguay Farming Industry Volume Metric Tons Forecast, by Country 2019 & 2032

- Table 11: Uruguay Farming Industry Revenue Million Forecast, by Crop Typ 2019 & 2032

- Table 12: Uruguay Farming Industry Volume Metric Tons Forecast, by Crop Typ 2019 & 2032

- Table 13: Uruguay Farming Industry Revenue Million Forecast, by Crop Typ 2019 & 2032

- Table 14: Uruguay Farming Industry Volume Metric Tons Forecast, by Crop Typ 2019 & 2032

- Table 15: Uruguay Farming Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Uruguay Farming Industry Volume Metric Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Uruguay Farming Industry?

The projected CAGR is approximately 4.00%.

2. Which companies are prominent players in the Uruguay Farming Industry?

Key companies in the market include ADM, Bunge , Trigoria , Sambucetti, Cargill .

3. What are the main segments of the Uruguay Farming Industry?

The market segments include Crop Typ, Crop Typ.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Milled and Broken Rice; Growing Preference for Speciality Rice Variety; Government Initiatives Supports Rice Production.

6. What are the notable trends driving market growth?

Demand from the Food and Beverage Industry.

7. Are there any restraints impacting market growth?

Lack of Supply Chain for Rice; Growing Agricultural Labor Crisis.

8. Can you provide examples of recent developments in the market?

August 2022: The Inter-American Development Bank (IDB) has sanctioned a USD 6.5 million loan to increase the efficiency of Uruguay's agricultural sector by digitizing more services and operations provided by the country's Ministry of Livestock, Agriculture, and Fisheries. The program will help growers in adopting digital tools as well as in using emerging technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Metric Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Uruguay Farming Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Uruguay Farming Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Uruguay Farming Industry?

To stay informed about further developments, trends, and reports in the Uruguay Farming Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence