Key Insights

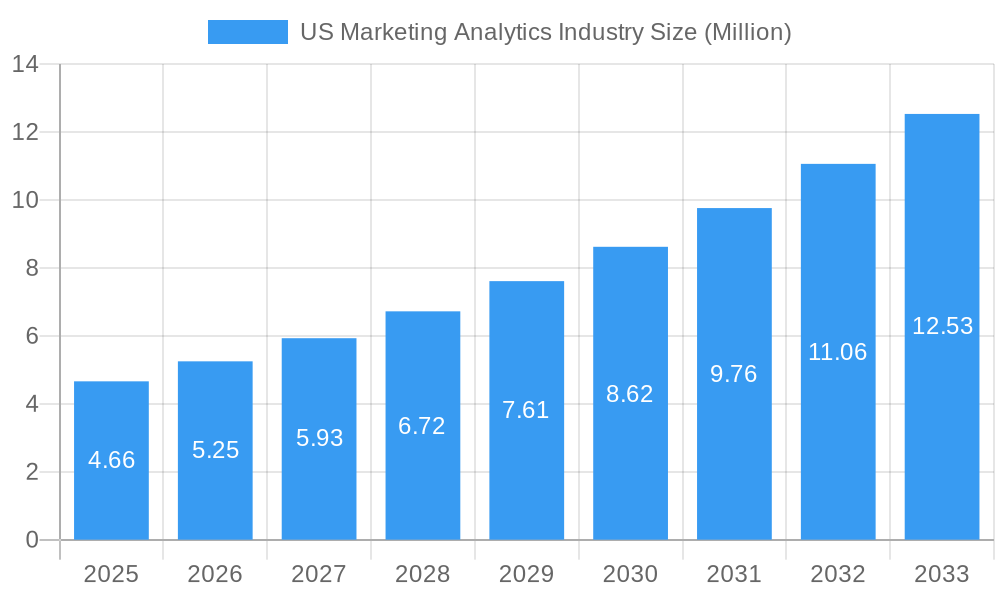

The US Marketing Analytics market is poised for substantial growth, with an estimated market size of $4.66 million in 2025 and a projected Compound Annual Growth Rate (CAGR) exceeding 12.73% through 2033. This robust expansion is driven by the increasing imperative for businesses to leverage data-driven strategies for enhanced customer engagement and improved marketing ROI. Key drivers include the burgeoning volume of digital marketing data, the growing adoption of AI and machine learning for predictive analytics, and the continuous demand for personalized customer experiences. The market is witnessing a significant shift towards cloud-based deployment models, offering greater scalability, flexibility, and cost-efficiency for businesses of all sizes.

US Marketing Analytics Industry Market Size (In Million)

The US marketing analytics landscape is segmenting rapidly, with online marketing, e-mail marketing, content marketing, and social media marketing applications showing particular traction. Industries such as Retail, BFSI, Education, Healthcare, and Manufacturing are increasingly investing in marketing analytics solutions to optimize their campaigns, understand customer behavior, and make informed business decisions. While the market is expanding rapidly, certain restraints might include the scarcity of skilled marketing analytics professionals, data privacy concerns, and the initial investment costs associated with advanced analytics tools. However, the overwhelming benefits of improved campaign performance, deeper customer insights, and a competitive edge are expected to outweigh these challenges, fueling sustained market growth across North America.

US Marketing Analytics Industry Company Market Share

Here is an SEO-optimized, detailed report description for the US Marketing Analytics Industry, designed for immediate use without modification.

US Marketing Analytics Industry Market Concentration & Innovation

The US Marketing Analytics industry exhibits a moderate to high market concentration, with several dominant players and a growing ecosystem of specialized providers. Innovation is a primary driver, fueled by advancements in Artificial Intelligence (AI), Machine Learning (ML), and Big Data processing. The regulatory landscape, particularly around data privacy (e.g., CCPA, future federal regulations), is a significant consideration, shaping how analytics solutions are developed and deployed. Product substitutes are increasingly sophisticated, ranging from in-house developed analytics capabilities to advanced marketing automation platforms with embedded analytics. End-user trends are a key focus, with businesses demanding more personalized customer experiences and demonstrable ROI from their marketing investments. Mergers and Acquisitions (M&A) are a common strategy for consolidating market share and acquiring innovative technologies. Key M&A deal values in the past few years have ranged from tens of millions to several billion US dollars, indicating strategic consolidation. For instance, the acquisition of Tableau Software Inc. by Salesforce Com Inc. for approximately twenty billion US dollars underscored the immense value placed on advanced analytics for CRM and customer engagement. The market share for top players like IBM Corporation, Microsoft Corporation, and Oracle Corporation is substantial, estimated to be in the range of xx% to xx% collectively. Innovation in areas like predictive analytics and AI-powered campaign optimization continues to reshape competitive dynamics.

US Marketing Analytics Industry Industry Trends & Insights

The US Marketing Analytics industry is poised for significant growth, driven by the imperative for data-driven decision-making across all business sectors. The market is experiencing a robust compound annual growth rate (CAGR) estimated at xx% from 2025 to 2033. This growth is underpinned by the escalating volume of digital data generated from online marketing, social media, e-commerce, and customer interactions. Businesses are increasingly recognizing marketing analytics not just as a tool for campaign measurement but as a strategic asset for customer acquisition, retention, and lifetime value optimization. Technological disruptions, particularly the widespread adoption of AI and ML, are revolutionizing the industry. These technologies enable sophisticated predictive modeling, hyper-personalization of customer journeys, automated campaign management, and advanced segmentation. The integration of AI with cloud-based platforms facilitates real-time data processing and actionable insights, making analytics more accessible and impactful. Consumer preferences are evolving towards highly personalized experiences, demanding that brands understand individual needs and behaviors. Marketing analytics provides the foundation for this personalization by uncovering patterns and predicting future actions. Competitive dynamics are intensifying, with established tech giants continuously innovating and smaller, agile firms offering niche solutions. The market penetration of advanced marketing analytics tools is growing, with an estimated xx% of US businesses currently utilizing sophisticated analytics platforms, a figure projected to rise to xx% by 2033. The focus is shifting from descriptive analytics (what happened) to prescriptive analytics (what should happen), empowering marketers with automated recommendations and optimized strategies. The ability to accurately attribute marketing spend to revenue generated is a critical demand, pushing the development of more robust attribution models and cross-channel analytics capabilities. Furthermore, the ethical use of data and transparency in analytics are becoming paramount as regulatory scrutiny increases.

Dominant Markets & Segments in US Marketing Analytics Industry

The Cloud deployment segment is experiencing dominant growth within the US Marketing Analytics industry. This is driven by the scalability, flexibility, and cost-effectiveness offered by cloud solutions, enabling businesses of all sizes to access powerful analytics tools without substantial upfront infrastructure investment. Major cloud providers like Microsoft Azure, Amazon Web Services (AWS), and Google Cloud are integral to this dominance, hosting a vast array of marketing analytics platforms. The Online Marketing application segment also holds a leading position. The sheer volume of data generated from digital channels – including search engine marketing, display advertising, and programmatic advertising – makes analytics indispensable for optimizing campaigns, targeting audiences, and measuring ROI. The Retail end-user segment is a significant driver of the marketing analytics market. Retailers leverage analytics to understand consumer purchasing behavior, personalize promotions, optimize inventory, and enhance the in-store and online customer experience. This includes analyzing website traffic, social media engagement, loyalty program data, and point-of-sale information.

- Cloud Deployment: The shift to cloud infrastructure for data storage and processing offers unparalleled scalability and accessibility, making it the preferred deployment model for most businesses.

- Online Marketing Application: The continuous growth of digital advertising and e-commerce channels generates vast amounts of data, necessitating advanced analytics for campaign optimization and performance tracking.

- Retail End User: The highly competitive retail landscape demands sophisticated customer insights to drive sales, personalize offers, and manage customer relationships effectively.

- BFSI End User: The Banking, Financial Services, and Insurance (BFSI) sector heavily relies on marketing analytics for customer segmentation, fraud detection, risk assessment, and personalized financial product recommendations. Regulatory compliance and data security are key considerations.

- Healthcare End User: The healthcare industry is increasingly adopting marketing analytics for patient engagement, personalized treatment plans, and optimizing outreach for health services.

- Social Media Marketing Application: With the pervasive influence of social media, businesses require analytics to gauge brand sentiment, track campaign performance, and engage with their audience effectively.

US Marketing Analytics Industry Product Developments

Product developments in the US Marketing Analytics industry are increasingly focused on AI-driven automation, enhanced predictive capabilities, and seamless integration across diverse marketing channels. Innovations aim to simplify complex data analysis for marketers, enabling them to derive actionable insights with greater speed and accuracy. Key advancements include the development of sophisticated AI algorithms for sentiment analysis, customer journey mapping, and predictive lead scoring. Furthermore, there's a growing emphasis on real-time analytics dashboards that offer immediate visibility into campaign performance and market trends. The competitive advantage lies in platforms that can unify disparate data sources – from social media and CRM to e-commerce and traditional advertising – to provide a holistic view of marketing effectiveness and customer engagement. This leads to more precise targeting, personalized messaging, and optimized marketing spend.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the US Marketing Analytics Industry, segmented by deployment, application, and end-user. The Deployment segmentation includes Cloud and On-premise solutions, with a projected growth in Cloud adoption due to its inherent flexibility and scalability. The Application segmentation covers Online Marketing, E-mail Marketing, Content Marketing, Social Media Marketing, and Other Applications, with Online Marketing expected to lead in market share due to the extensive digital footprint. The End User segmentation encompasses Retail, BFSI, Education, Healthcare, Manufacturing, Travel and Hospitality, and Other End Users. The Retail and BFSI sectors are anticipated to demonstrate significant market penetration and revenue generation. This segmentation analysis will highlight the specific growth trajectories, market sizes, and competitive landscapes within each category, offering granular insights into the industry's diverse segments.

Key Drivers of US Marketing Analytics Industry Growth

The US Marketing Analytics industry's growth is propelled by several key factors. The increasing volume and complexity of data generated by digital marketing efforts necessitate advanced analytical tools for comprehension and actionable insights. Technological advancements, particularly in AI, ML, and Big Data processing, enable more sophisticated analytics, predictive modeling, and personalization. The growing demand for customer-centric marketing strategies empowers businesses to understand individual consumer behavior, leading to higher engagement and loyalty. The need for demonstrable ROI and optimized marketing spend drives the adoption of analytics for performance measurement and budget allocation. Evolving regulatory landscapes related to data privacy are also a catalyst, pushing for more compliant and transparent data utilization.

Challenges in the US Marketing Analytics Industry Sector

The US Marketing Analytics industry faces several challenges that can impede its growth trajectory. Data privacy regulations and concerns about consumer trust can create compliance hurdles and limit data utilization. The scarcity of skilled data scientists and analytics professionals poses a significant barrier to adoption and effective implementation. Integrating disparate data sources from various platforms and channels remains a complex and time-consuming task. The high cost of advanced analytics solutions can be prohibitive for small and medium-sized enterprises. Ensuring data accuracy and quality is paramount but often challenging due to data silos and inconsistent data collection practices. The rapid pace of technological change requires continuous investment in upgrades and training, presenting a perpetual challenge for businesses.

Emerging Opportunities in US Marketing Analytics Industry

Emerging opportunities in the US Marketing Analytics industry are abundant and driven by innovation and evolving market needs. The hyper-personalization of customer experiences through AI-driven insights presents a significant avenue for growth. The application of marketing analytics in emerging channels, such as the metaverse and augmented reality, offers new frontiers for engagement and data collection. The increasing focus on ethical AI and responsible data usage creates opportunities for analytics providers that prioritize transparency and compliance. The demand for predictive analytics in areas like customer churn prevention and proactive customer service is rapidly expanding. Furthermore, the development of low-code/no-code analytics platforms democratizes access to powerful tools, opening up new market segments. The integration of marketing analytics with broader business intelligence and operational decision-making presents a comprehensive value proposition.

Leading Players in the US Marketing Analytics Industry Market

- SAS Institute Inc

- Accenture PLC

- IBM Corporation

- Teradata Corporation

- Salesforce Com Inc (Tableau Software Inc)

- Microsoft Corporation

- Adobe Systems Incorporated

- Pegasystems Inc

- Neustar Inc

- Oracle Corporation

- Google LLC

Key Developments in US Marketing Analytics Industry Industry

- June 2023: Moody’s Corporation and Microsoft announced a new partnership to deliver next-generation data, analytics, research, collaboration, and risk solutions for financial services and global knowledge workers. This collaboration leverages Microsoft Azure OpenAI Service and Moody's data and analytics to create innovative offerings for corporate intelligence and risk assessment, powered by Microsoft AI.

- July 2022: Neustar, a TransUnion company, partnered with integrated data platform Adverity to enable marketers to effortlessly connect all their data, boosting marketing and brand effectiveness. This partnership aims to help companies and agencies more accurately assess the marketing effectiveness of various online and offline platforms, optimizing marketing spending and ROI.

- December 2022: Vi Labs, an Enterprise-AI for digital health company, acquired Motus Consumer Insights, a firm specializing in member acquisition analytics, site selection, and marketing BI. This acquisition aims to combine Vi's AI-powered customer engagement solutions with Motus's premier platforms for customer acquisition and site selection, accelerating Vi's mission to leverage data and AI for healthy lifestyles.

Strategic Outlook for US Marketing Analytics Industry Market

The strategic outlook for the US Marketing Analytics Industry is exceptionally positive, driven by an unwavering demand for data-driven insights and personalized customer engagement. Future growth will be characterized by the deep integration of AI and ML into every facet of marketing operations, enabling predictive analytics, automated campaign optimization, and hyper-personalized customer journeys. The industry will see a continued shift towards cloud-native solutions, offering scalability and accessibility. Opportunities will emerge in leveraging analytics for emerging channels and technologies, alongside a growing emphasis on ethical data practices and privacy-compliant solutions. The strategic imperative for businesses will be to harness the power of analytics not just for marketing, but for comprehensive business intelligence and decision-making, leading to sustained revenue growth and competitive advantage.

US Marketing Analytics Industry Segmentation

-

1. Deployment

- 1.1. Cloud

- 1.2. On-premise

-

2. Application

- 2.1. Online Marketing

- 2.2. E-mail Marketing

- 2.3. Content Marketing

- 2.4. Social Media Marketing

- 2.5. Other Applications

-

3. End User

- 3.1. Retail

- 3.2. BFSI

- 3.3. Education

- 3.4. Healthcare

- 3.5. Manufacturing

- 3.6. Travel and Hospitality

- 3.7. Other End Users

US Marketing Analytics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Marketing Analytics Industry Regional Market Share

Geographic Coverage of US Marketing Analytics Industry

US Marketing Analytics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 12.73% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Social Media Channels; Increasing Need to Utilize Marketing Budgets for an Effective ROI; Adoption of Cloud Technology and Big Data

- 3.3. Market Restrains

- 3.3.1. High Cost of Implementation and System Integration Issues for Marketing Analytics Software; Availability of Many Free Open Source Software

- 3.4. Market Trends

- 3.4.1. Adoption of Cloud Technology and Big Data is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Marketing Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. Cloud

- 5.1.2. On-premise

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Online Marketing

- 5.2.2. E-mail Marketing

- 5.2.3. Content Marketing

- 5.2.4. Social Media Marketing

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Retail

- 5.3.2. BFSI

- 5.3.3. Education

- 5.3.4. Healthcare

- 5.3.5. Manufacturing

- 5.3.6. Travel and Hospitality

- 5.3.7. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America US Marketing Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. Cloud

- 6.1.2. On-premise

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Online Marketing

- 6.2.2. E-mail Marketing

- 6.2.3. Content Marketing

- 6.2.4. Social Media Marketing

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Retail

- 6.3.2. BFSI

- 6.3.3. Education

- 6.3.4. Healthcare

- 6.3.5. Manufacturing

- 6.3.6. Travel and Hospitality

- 6.3.7. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. South America US Marketing Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. Cloud

- 7.1.2. On-premise

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Online Marketing

- 7.2.2. E-mail Marketing

- 7.2.3. Content Marketing

- 7.2.4. Social Media Marketing

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Retail

- 7.3.2. BFSI

- 7.3.3. Education

- 7.3.4. Healthcare

- 7.3.5. Manufacturing

- 7.3.6. Travel and Hospitality

- 7.3.7. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Europe US Marketing Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. Cloud

- 8.1.2. On-premise

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Online Marketing

- 8.2.2. E-mail Marketing

- 8.2.3. Content Marketing

- 8.2.4. Social Media Marketing

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Retail

- 8.3.2. BFSI

- 8.3.3. Education

- 8.3.4. Healthcare

- 8.3.5. Manufacturing

- 8.3.6. Travel and Hospitality

- 8.3.7. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Middle East & Africa US Marketing Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. Cloud

- 9.1.2. On-premise

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Online Marketing

- 9.2.2. E-mail Marketing

- 9.2.3. Content Marketing

- 9.2.4. Social Media Marketing

- 9.2.5. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Retail

- 9.3.2. BFSI

- 9.3.3. Education

- 9.3.4. Healthcare

- 9.3.5. Manufacturing

- 9.3.6. Travel and Hospitality

- 9.3.7. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Asia Pacific US Marketing Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 10.1.1. Cloud

- 10.1.2. On-premise

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Online Marketing

- 10.2.2. E-mail Marketing

- 10.2.3. Content Marketing

- 10.2.4. Social Media Marketing

- 10.2.5. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Retail

- 10.3.2. BFSI

- 10.3.3. Education

- 10.3.4. Healthcare

- 10.3.5. Manufacturing

- 10.3.6. Travel and Hospitality

- 10.3.7. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SAS Institute Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Accenture PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IBM Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Teradata Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Salesforce Com Inc (Tableau Software Inc )

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Microsoft Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Adobe Systems Incorporated

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pegasystems Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Neustar Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Oracle Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Google LLC*List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 SAS Institute Inc

List of Figures

- Figure 1: Global US Marketing Analytics Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America US Marketing Analytics Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 3: North America US Marketing Analytics Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 4: North America US Marketing Analytics Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America US Marketing Analytics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America US Marketing Analytics Industry Revenue (Million), by End User 2025 & 2033

- Figure 7: North America US Marketing Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America US Marketing Analytics Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America US Marketing Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America US Marketing Analytics Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 11: South America US Marketing Analytics Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 12: South America US Marketing Analytics Industry Revenue (Million), by Application 2025 & 2033

- Figure 13: South America US Marketing Analytics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: South America US Marketing Analytics Industry Revenue (Million), by End User 2025 & 2033

- Figure 15: South America US Marketing Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: South America US Marketing Analytics Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: South America US Marketing Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe US Marketing Analytics Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 19: Europe US Marketing Analytics Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 20: Europe US Marketing Analytics Industry Revenue (Million), by Application 2025 & 2033

- Figure 21: Europe US Marketing Analytics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe US Marketing Analytics Industry Revenue (Million), by End User 2025 & 2033

- Figure 23: Europe US Marketing Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Europe US Marketing Analytics Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe US Marketing Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa US Marketing Analytics Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 27: Middle East & Africa US Marketing Analytics Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 28: Middle East & Africa US Marketing Analytics Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East & Africa US Marketing Analytics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East & Africa US Marketing Analytics Industry Revenue (Million), by End User 2025 & 2033

- Figure 31: Middle East & Africa US Marketing Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 32: Middle East & Africa US Marketing Analytics Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa US Marketing Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific US Marketing Analytics Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 35: Asia Pacific US Marketing Analytics Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 36: Asia Pacific US Marketing Analytics Industry Revenue (Million), by Application 2025 & 2033

- Figure 37: Asia Pacific US Marketing Analytics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: Asia Pacific US Marketing Analytics Industry Revenue (Million), by End User 2025 & 2033

- Figure 39: Asia Pacific US Marketing Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 40: Asia Pacific US Marketing Analytics Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific US Marketing Analytics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Marketing Analytics Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 2: Global US Marketing Analytics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global US Marketing Analytics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global US Marketing Analytics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global US Marketing Analytics Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 6: Global US Marketing Analytics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global US Marketing Analytics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global US Marketing Analytics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global US Marketing Analytics Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 13: Global US Marketing Analytics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global US Marketing Analytics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global US Marketing Analytics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global US Marketing Analytics Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 20: Global US Marketing Analytics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Global US Marketing Analytics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 22: Global US Marketing Analytics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global US Marketing Analytics Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 33: Global US Marketing Analytics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global US Marketing Analytics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 35: Global US Marketing Analytics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global US Marketing Analytics Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 43: Global US Marketing Analytics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 44: Global US Marketing Analytics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 45: Global US Marketing Analytics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Marketing Analytics Industry?

The projected CAGR is approximately > 12.73%.

2. Which companies are prominent players in the US Marketing Analytics Industry?

Key companies in the market include SAS Institute Inc, Accenture PLC, IBM Corporation, Teradata Corporation, Salesforce Com Inc (Tableau Software Inc ), Microsoft Corporation, Adobe Systems Incorporated, Pegasystems Inc, Neustar Inc, Oracle Corporation, Google LLC*List Not Exhaustive.

3. What are the main segments of the US Marketing Analytics Industry?

The market segments include Deployment, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.66 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Social Media Channels; Increasing Need to Utilize Marketing Budgets for an Effective ROI; Adoption of Cloud Technology and Big Data.

6. What are the notable trends driving market growth?

Adoption of Cloud Technology and Big Data is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

High Cost of Implementation and System Integration Issues for Marketing Analytics Software; Availability of Many Free Open Source Software.

8. Can you provide examples of recent developments in the market?

June 2023 - Moody’s Corporation and Microsoft have announced a new partnership to deliver next-generation data, analytics, research, collaboration, and risk solutions for financial services and global knowledge workers. Built on a combination of Moody’s robust data and analytical capabilities and the power and scale of Microsoft Azure OpenAI Service, the partnership creates innovative offerings that enhance insights into corporate intelligence and risk assessment, powered by Microsoft AI and anchored by Moody’s proprietary data, analytics, and research.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Marketing Analytics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Marketing Analytics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Marketing Analytics Industry?

To stay informed about further developments, trends, and reports in the US Marketing Analytics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence