Key Insights

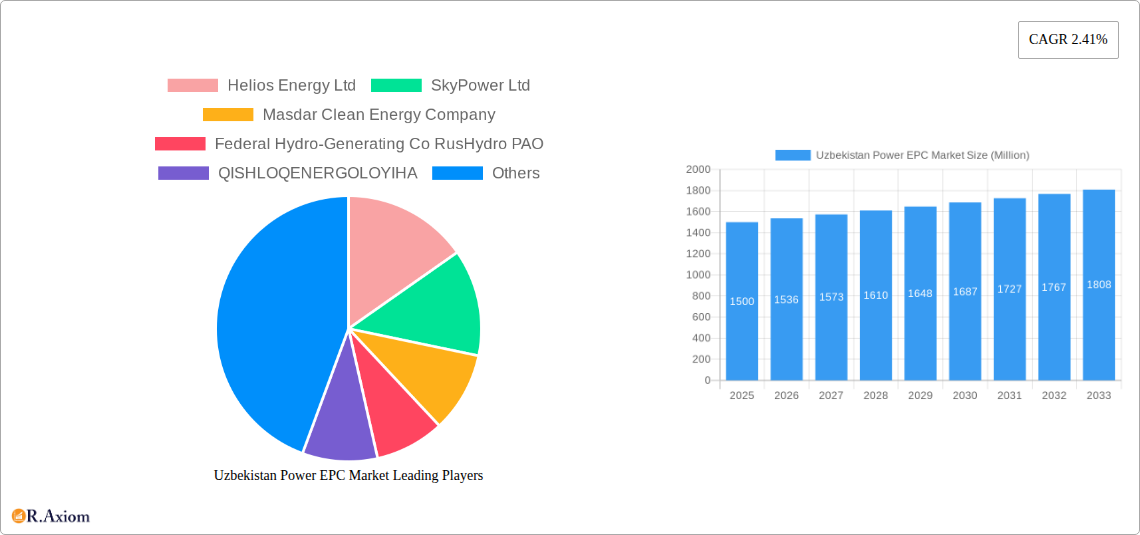

The Uzbekistan Power EPC Market is projected for substantial growth, anticipated to reach $145.81 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 2.41% through 2033. This expansion is driven by Uzbekistan's commitment to modernizing its power infrastructure and meeting rising energy demands. The nation's focus on diversifying its energy sources, including renewables and thermal power generation, is stimulating demand for Engineering, Procurement, and Construction (EPC) services. Investments in new power plants, grid enhancements, and transmission infrastructure present significant opportunities for EPC firms. Government initiatives to attract foreign investment and promote public-private partnerships further support the market's positive trajectory.

Uzbekistan Power EPC Market Market Size (In Billion)

Key growth drivers encompass the development of large-scale thermal power projects, the increasing adoption of renewable energy sources such as solar and wind, and the modernization of power transmission and distribution networks. Potential challenges may include significant capital investment requirements, complex regulatory environments, and the availability of skilled labor. Nevertheless, robust government backing and a clear strategy for energy security and sustainability are expected to mitigate these concerns. While thermal power currently dominates market segmentation, the expanding renewables sector and critical power transmission and distribution projects will significantly influence the future Uzbekistan Power EPC Market.

Uzbekistan Power EPC Market Company Market Share

This report provides a comprehensive, SEO-optimized analysis of the Uzbekistan Power EPC Market.

Uzbekistan Power EPC Market Market Concentration & Innovation

The Uzbekistan Power Engineering, Procurement, and Construction (EPC) market is characterized by a dynamic yet consolidating landscape. While major international players are increasingly active, local entities are also carving out significant market share, particularly in smaller-scale projects. Innovation is a key differentiator, with a growing emphasis on smart grid technologies, advanced energy storage solutions, and the integration of digital twins for project management and operational efficiency. Regulatory frameworks are evolving to attract foreign investment and promote renewable energy adoption, driving competition and requiring EPC firms to adapt their service offerings. The threat of product substitutes, though minimal in core infrastructure, exists in the form of localized, off-grid solutions. End-user trends highlight a demand for reliable, cost-effective, and sustainable power generation. Mergers and acquisitions (M&A) are anticipated to play a crucial role in shaping market concentration, with potential deal values in the tens to hundreds of millions of USD as larger entities seek to expand their footprint and technological capabilities. Market Share for leading EPC firms in the thermal segment is estimated to be around 15-20%, while the rapidly growing renewables sector sees a more fragmented distribution. M&A Deal Values in the past year have been in the range of 50 Million to 150 Million USD for strategic acquisitions of technology providers and regional EPC contractors.

Uzbekistan Power EPC Market Industry Trends & Insights

The Uzbekistan Power EPC market is poised for significant expansion, driven by a robust government agenda focused on modernizing its energy infrastructure and increasing energy independence. The Compound Annual Growth Rate (CAGR) is projected to be between 8.5% and 10.5% over the forecast period of 2025-2033. This growth is fueled by a confluence of factors including increasing electricity demand from a growing industrial base and residential sector, coupled with a strategic push towards diversification of the energy mix. Technological disruptions are at the forefront, with a pronounced shift towards renewable energy sources like solar and wind, necessitating the development of advanced grid integration and energy storage capabilities. Consumer preferences are evolving, with a growing awareness and demand for cleaner energy solutions, directly influencing project selection and EPC firm capabilities. Competitive dynamics are intensifying, with established global EPC giants vying for lucrative projects alongside emerging regional players. Market Penetration of renewable energy technologies is expected to surge from its current base of approximately 5% to over 25% by 2033. Key market drivers include substantial foreign direct investment, the liberalization of the energy sector, and the implementation of supportive government policies such as tax incentives and feed-in tariffs. The ongoing transition from a predominantly thermal-based energy system to a more diversified portfolio, including significant investments in hydropower and planned nuclear energy projects, presents unparalleled opportunities for EPC contractors with specialized expertise. Furthermore, the modernization of the power transmission and distribution network is a critical component of the market's evolution, demanding innovative solutions for grid stability, efficiency, and resilience.

Dominant Markets & Segments in Uzbekistan Power EPC Market

The Power Generation Scenario remains a dominant segment within the Uzbekistan Power EPC Market, with Thermal power generation, though undergoing a transition, still representing a substantial portion of existing capacity. The Market Overview of the thermal segment reveals a mature market with ongoing upgrades and efficiency improvements to existing plants. Key Project Information for existing thermal projects includes a total installed capacity of approximately 12,500 MW, with major facilities like Talimarjan Thermal Power Plant and Novo Angren Thermal Power Plant being key operational assets. Planned and Upcoming Projects in the thermal sector are focused on modernization and co-firing capabilities, with an estimated investment of around 3,000 Million USD over the forecast period.

Hydropower presents a significant growth area, driven by the country's vast river network and government initiatives to enhance domestic energy production. The Market Overview indicates a steady increase in hydropower capacity, contributing to energy security. Projects include the ongoing development of smaller-scale hydropower plants and upgrades to existing facilities.

The Renewables segment is experiencing the most explosive growth, propelled by ambitious government targets for solar and wind energy deployment. The Market Overview highlights substantial investments in utility-scale solar farms and wind parks. Key Project Information includes ongoing tenders and construction of solar photovoltaic (PV) projects with capacities ranging from 100 MW to 500 MW, and initial wind power projects exceeding 250 MW. Planned and Upcoming Projects in renewables are estimated to attract over 7,000 Million USD in investment, with a focus on attracting leading global developers and EPC firms.

The Nuclear segment, while in its nascent stages, holds immense future potential. Planned Projects include the development of Uzbekistan's first nuclear power plant, a significant undertaking involving substantial technological expertise and investment, estimated at over 11,000 Million USD for the initial phase.

The Power Transmission and Distribution Scenario is equally critical for ensuring grid stability and efficient energy delivery. The Market Overview indicates a widespread need for upgrading and expanding the existing grid infrastructure to accommodate new generation sources and meet rising demand. Projects involve the modernization of substations, enhancement of transmission lines, and the implementation of smart grid technologies, with an estimated investment of 4,500 Million USD. Planned and Upcoming Projects in this sector will focus on creating a more resilient and efficient national grid, with a particular emphasis on interconnections and digital monitoring systems.

Key Drivers for dominance in these segments include:

- Economic Policies: Government support for renewable energy, incentives for foreign investment, and favorable financing mechanisms.

- Infrastructure Development: Strategic investments in grid modernization, port facilities for equipment import, and skilled labor availability.

- Technological Advancements: Adoption of cutting-edge technologies in power generation, transmission, and distribution.

- International Partnerships: Collaboration with international financial institutions and leading global EPC companies.

- Energy Security Imperatives: The drive to diversify energy sources and reduce reliance on single fuel types.

Uzbekistan Power EPC Market Product Developments

Product developments in the Uzbekistan Power EPC market are increasingly focused on enhancing efficiency, sustainability, and grid integration. Innovations in solar PV technology, such as higher-efficiency bifacial modules and advanced inverters, are improving energy yields. In the thermal sector, developments center on cleaner combustion technologies and carbon capture solutions to meet evolving environmental standards. For hydropower, advancements in turbine design and smart control systems are optimizing energy generation and operational flexibility. The burgeoning nuclear power sector will see the deployment of advanced reactor designs emphasizing safety and efficiency. Across all segments, the integration of digital technologies, including AI-powered predictive maintenance and IoT-enabled monitoring systems for transmission and distribution networks, represents a significant competitive advantage for EPC firms.

Report Scope & Segmentation Analysis

This report analyzes the Uzbekistan Power EPC Market across key segments, including Power Generation Scenario (Thermal, Hydropower, Renewables, Nuclear) and Power Transmission and Distribution Scenario. The Thermal segment includes Market Overview and Key Project Information (Existing, Planned, and Upcoming Projects). Hydropower covers its current status and future development prospects. Renewables focus on solar and wind energy projects, detailing market sizes and growth projections. Nuclear presents an overview of planned projects and their potential market impact. The Power Transmission and Distribution segment delves into the current Market Overview, ongoing Projects, and Planned and Upcoming Projects, highlighting the infrastructure development roadmap. Growth projections for each segment are detailed, with the renewables sector expected to show the highest CAGR.

Key Drivers of Uzbekistan Power EPC Market Growth

The Uzbekistan Power EPC Market is propelled by several key drivers. Foremost is the government's strong commitment to energy sector modernization and diversification, evident in ambitious renewable energy targets and plans for nuclear power development. Significant foreign direct investment is flowing into the sector, attracted by supportive policies and the vast untapped potential. Economic growth and rising industrial demand necessitate substantial expansion of power generation and transmission capacity. Technological advancements, particularly in solar PV and smart grid solutions, are making new projects more viable and efficient. Furthermore, the ongoing emphasis on energy security and reducing reliance on traditional fossil fuels is a critical catalyst for growth.

Challenges in the Uzbekistan Power EPC Market Sector

Despite its growth potential, the Uzbekistan Power EPC market faces several challenges. Regulatory complexities and bureaucratic processes can lead to project delays and increased costs. Securing consistent and competitive financing for large-scale projects remains a hurdle, particularly for newer technologies. The availability of skilled labor and specialized technical expertise can be limited, requiring significant training and development efforts. Supply chain disruptions, both domestic and international, can impact project timelines and material costs. Finally, intense competition among both local and international EPC firms can put pressure on profit margins.

Emerging Opportunities in Uzbekistan Power EPC Market

Emerging opportunities in the Uzbekistan Power EPC market lie in the rapid expansion of the renewable energy sector, particularly utility-scale solar and wind farms, and the development of associated energy storage solutions. The planned construction of nuclear power plants presents a significant long-term opportunity for firms with specialized nuclear EPC capabilities. Modernization of the aging power transmission and distribution network, including the implementation of smart grid technologies and digital substations, offers substantial project potential. Furthermore, opportunities exist in energy efficiency retrofits for existing industrial facilities and the development of distributed energy resources.

Leading Players in the Uzbekistan Power EPC Market Market

- Helios Energy Ltd

- SkyPower Ltd

- Masdar Clean Energy Company

- Federal Hydro-Generating Co RusHydro PAO

- QISHLOQENERGOLOYIHA

- Rosatom Corp

- Mitsubishi Heavy Industries Ltd

Key Developments in Uzbekistan Power EPC Market Industry

- 2023/09: Uzbekistan announces tender for its largest solar PV project to date, a 500 MW plant, attracting major international developers.

- 2023/07: Masdar Clean Energy Company secures contracts for multiple renewable energy projects, signaling increased foreign investment in solar and wind.

- 2023/05: Rosatom Corp progresses with plans for Uzbekistan's first nuclear power plant, initiating site selection and preliminary engineering studies.

- 2023/03: Government unveils revised energy strategy, prioritizing renewables and grid modernization, with enhanced incentives for private sector participation.

- 2022/11: Federal Hydro-Generating Co RusHydro PAO announces plans to explore small-scale hydropower development opportunities in mountainous regions.

- 2022/08: Mitsubishi Heavy Industries Ltd awarded contract for efficiency upgrades at a major thermal power plant, focusing on reducing emissions.

Strategic Outlook for Uzbekistan Power EPC Market Market

The strategic outlook for the Uzbekistan Power EPC Market is highly positive, driven by a clear government vision for a modern, diversified, and sustainable energy future. The ongoing liberalization of the energy sector and strong government support are expected to attract significant domestic and international investment. Focus will remain on the rapid expansion of renewable energy capacity, coupled with critical investments in grid infrastructure to ensure stability and efficiency. The ambitious nuclear power program and the continuous need for thermal power plant modernization and efficiency improvements present substantial long-term opportunities for EPC providers with diverse technical expertise and a commitment to innovation.

Uzbekistan Power EPC Market Segmentation

-

1. Power Generation Scenario Fuel Type

-

1.1. Thermal

- 1.1.1. Market Overview

-

1.1.2. Key Project Information

- 1.1.2.1. Existing Projects

- 1.1.2.2. Planned and Upcoming Projects

- 1.2. Hydropower

- 1.3. Renewables

-

1.4. Nuclear

- 1.4.1. Planned Projects

-

1.1. Thermal

-

2. Power Transmission and Distribution Scenario

- 2.1. Market Overview

- 2.2. Projects

- 2.3. Planned and Upcoming Projects

Uzbekistan Power EPC Market Segmentation By Geography

- 1. Uzbekistan

Uzbekistan Power EPC Market Regional Market Share

Geographic Coverage of Uzbekistan Power EPC Market

Uzbekistan Power EPC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Drivers; Restraints

- 3.3. Market Restrains

- 3.3.1. 4.; Political Instability and Militant Attacks on Pipeline Infrastructure

- 3.4. Market Trends

- 3.4.1. Thermal Power Generation Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Uzbekistan Power EPC Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Power Generation Scenario Fuel Type

- 5.1.1. Thermal

- 5.1.1.1. Market Overview

- 5.1.1.2. Key Project Information

- 5.1.1.2.1. Existing Projects

- 5.1.1.2.2. Planned and Upcoming Projects

- 5.1.2. Hydropower

- 5.1.3. Renewables

- 5.1.4. Nuclear

- 5.1.4.1. Planned Projects

- 5.1.1. Thermal

- 5.2. Market Analysis, Insights and Forecast - by Power Transmission and Distribution Scenario

- 5.2.1. Market Overview

- 5.2.2. Projects

- 5.2.3. Planned and Upcoming Projects

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Uzbekistan

- 5.1. Market Analysis, Insights and Forecast - by Power Generation Scenario Fuel Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Helios Energy Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SkyPower Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Masdar Clean Energy Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Federal Hydro-Generating Co RusHydro PAO

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 QISHLOQENERGOLOYIHA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rosatom Corp

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mitsubishi Heavy Industries Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Helios Energy Ltd

List of Figures

- Figure 1: Uzbekistan Power EPC Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Uzbekistan Power EPC Market Share (%) by Company 2025

List of Tables

- Table 1: Uzbekistan Power EPC Market Revenue billion Forecast, by Power Generation Scenario Fuel Type 2020 & 2033

- Table 2: Uzbekistan Power EPC Market Revenue billion Forecast, by Power Transmission and Distribution Scenario 2020 & 2033

- Table 3: Uzbekistan Power EPC Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Uzbekistan Power EPC Market Revenue billion Forecast, by Power Generation Scenario Fuel Type 2020 & 2033

- Table 5: Uzbekistan Power EPC Market Revenue billion Forecast, by Power Transmission and Distribution Scenario 2020 & 2033

- Table 6: Uzbekistan Power EPC Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Uzbekistan Power EPC Market?

The projected CAGR is approximately 2.41%.

2. Which companies are prominent players in the Uzbekistan Power EPC Market?

Key companies in the market include Helios Energy Ltd, SkyPower Ltd, Masdar Clean Energy Company, Federal Hydro-Generating Co RusHydro PAO, QISHLOQENERGOLOYIHA, Rosatom Corp, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Uzbekistan Power EPC Market?

The market segments include Power Generation Scenario Fuel Type, Power Transmission and Distribution Scenario.

4. Can you provide details about the market size?

The market size is estimated to be USD 145.81 billion as of 2022.

5. What are some drivers contributing to market growth?

; Drivers; Restraints.

6. What are the notable trends driving market growth?

Thermal Power Generation Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Political Instability and Militant Attacks on Pipeline Infrastructure.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Uzbekistan Power EPC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Uzbekistan Power EPC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Uzbekistan Power EPC Market?

To stay informed about further developments, trends, and reports in the Uzbekistan Power EPC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence