Key Insights

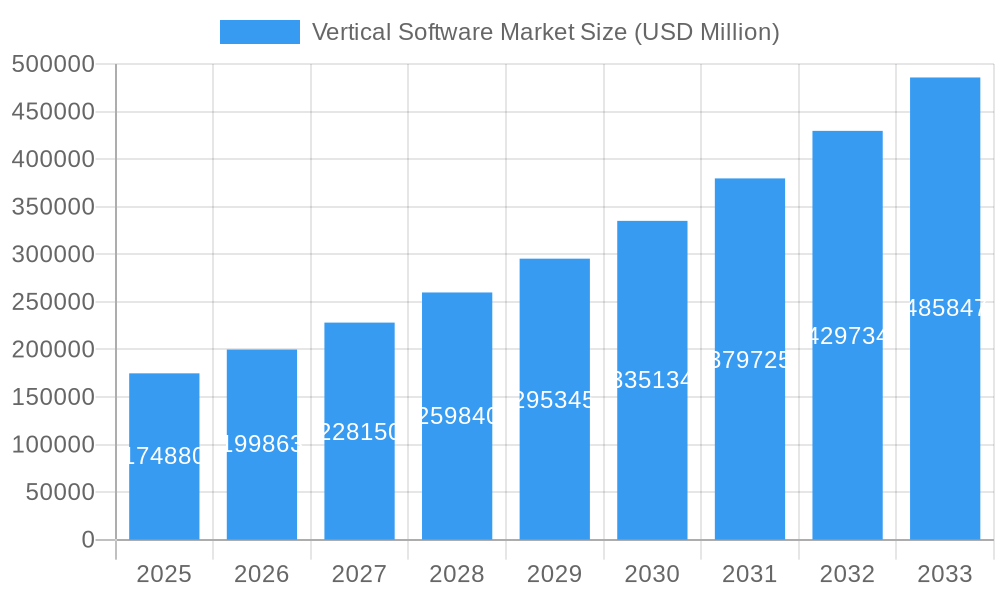

The global Vertical Software Market is poised for significant expansion, projected to reach an estimated $174.88 billion by 2025, with a robust CAGR of 14.6% anticipated throughout the forecast period of 2025-2033. This substantial growth is propelled by a confluence of factors, including the increasing demand for specialized software solutions tailored to unique industry needs, driving efficiency and operational excellence. The market is characterized by its segmentation across various organization sizes, from Small and Medium Enterprises (SMEs) to Large Enterprises, all seeking to leverage industry-specific functionalities. Key end-user industries such as BFSI, Healthcare, and Legal and Government are at the forefront of adopting these specialized solutions, recognizing their potential to streamline complex processes, enhance compliance, and improve customer engagement. The rise of cloud-based vertical software further democratizes access to these powerful tools, fostering wider adoption and innovation across diverse sectors.

Vertical Software Market Market Size (In Billion)

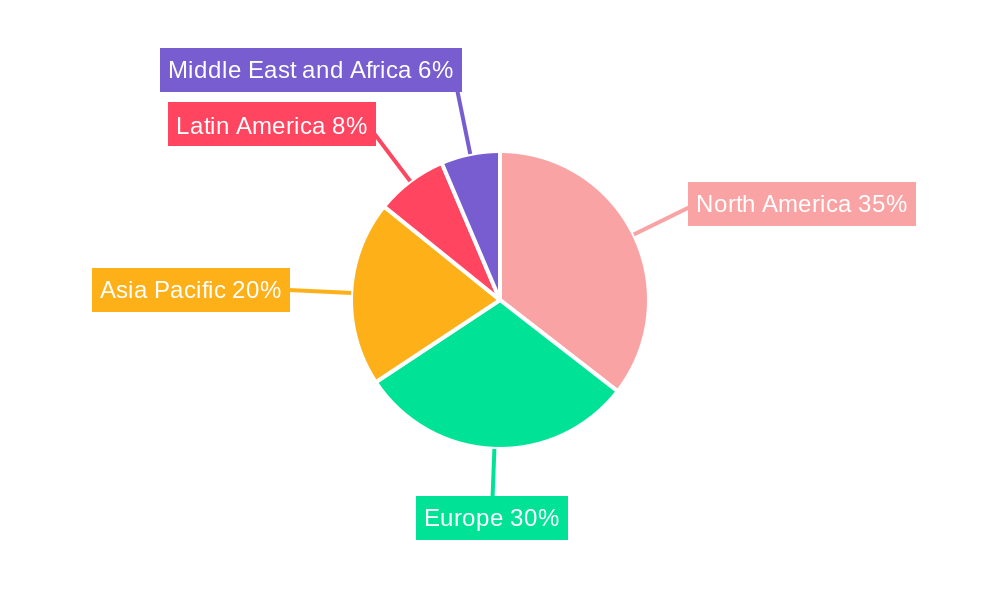

Further analysis reveals that the growth trajectory is further bolstered by the increasing digitization efforts across industries. Emerging trends like the integration of AI and machine learning into vertical software are enhancing predictive capabilities and automation, offering unprecedented advantages to businesses. While the market is generally expansive, certain restraints, such as the high cost of initial implementation for some niche solutions and the need for specialized training, might temper rapid adoption in specific segments. However, the overwhelming benefits of improved productivity, reduced operational costs, and enhanced competitive advantage continue to drive market expansion. Companies like Constellation Software, Verisk Analytics, and Athena are key players actively shaping this dynamic landscape, offering a wide array of solutions that cater to the evolving demands of a global clientele. The North American and European regions are expected to lead in adoption due to their advanced technological infrastructure and early embrace of digital transformation initiatives.

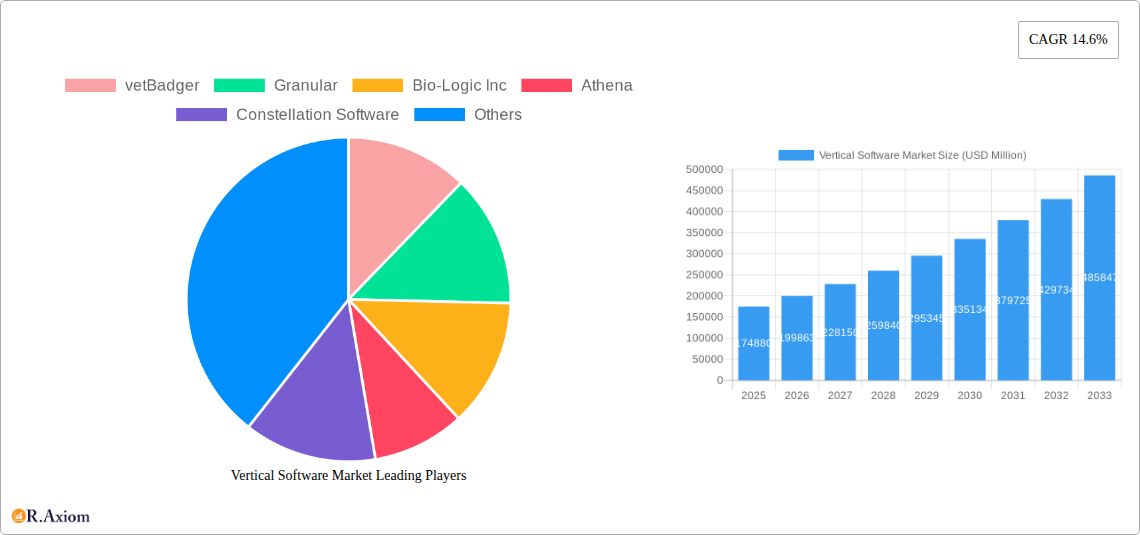

Vertical Software Market Company Market Share

This in-depth report provides a comprehensive analysis of the global vertical software market, a rapidly expanding sector driven by increasing demand for industry-specific solutions. With a study period from 2019 to 2033, a base year of 2025, and a detailed forecast period from 2025 to 2033, this report offers crucial insights for stakeholders seeking to understand current trends, predict future trajectories, and capitalize on emerging opportunities within this dynamic market. We explore key market segments, technological advancements, regulatory landscapes, and competitive dynamics that are shaping the future of vertical SaaS. This report delves into the vertical software market size, vertical software market trends, vertical SaaS growth, and industry-specific software solutions, providing actionable intelligence for businesses across diverse sectors including BFSI software solutions, healthcare vertical software, legal tech software, government software solutions, education technology software, agriculture software solutions, apparel and fashion software, and entertainment and hospitality software. Discover market penetration, CAGR, M&A activities, and leading players like vetBadger, Granular, Bio-Logic Inc, Athena, Constellation Software, RenderForest, FarmBite, Mail Technologies Inc, FastBound, and Verisk Analytics.

Vertical Software Market Market Concentration & Innovation

The vertical software market exhibits a moderate to high level of concentration, characterized by the presence of both established enterprise software giants and nimble, niche players. Innovation is the primary catalyst for growth, fueled by the continuous need for specialized functionalities that address unique industry challenges. Key innovation drivers include the increasing adoption of cloud computing, artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT), enabling vertical SaaS providers to offer more sophisticated and data-driven solutions. Regulatory frameworks, while sometimes posing compliance challenges, also create opportunities for specialized software that ensures adherence to industry-specific mandates in sectors like BFSI and Healthcare. Product substitutes, primarily horizontal software solutions or custom-built applications, are constantly being evaluated against the cost-effectiveness and tailored functionality offered by vertical alternatives. End-user trends clearly favor solutions that offer seamless integration, enhanced user experience, and robust analytics. Mergers and acquisitions (M&A) activities are prevalent as larger players seek to consolidate their market position or acquire innovative technologies. For instance, Constellation Software has a history of strategic acquisitions to expand its portfolio. While specific M&A deal values for the entire market are complex to pinpoint due to proprietary information, the overall trend indicates significant investment in the vertical software industry.

Vertical Software Market Industry Trends & Insights

The vertical software market is poised for substantial growth, projected to achieve a significant market size by 2033. The Compound Annual Growth Rate (CAGR) is expected to remain robust throughout the forecast period, driven by several interconnected trends. The increasing digital transformation initiatives across all end-user industries are a primary growth driver, compelling businesses to seek specialized software that enhances operational efficiency, customer engagement, and regulatory compliance. The proliferation of cloud-based solutions has made sophisticated vertical SaaS more accessible and scalable for businesses of all sizes, significantly boosting market penetration. Technological disruptions, including advancements in AI and ML, are enabling vertical software to offer predictive analytics, automation, and personalized experiences, creating a competitive edge. Consumer preferences are shifting towards solutions that provide seamless integration, intuitive user interfaces, and a high degree of customization to meet unique business needs. Competitive dynamics are intensifying, with established players expanding their offerings and new entrants focusing on underserved niches within the vertical software landscape. The demand for industry-specific solutions in sectors such as healthcare for electronic health records (EHR) and practice management, BFSI for core banking and risk management, and agriculture for precision farming is particularly strong. The ability of vertical software to provide tailored features that directly address industry pain points is a key differentiator, ensuring its continued relevance and growth.

Dominant Markets & Segments in Vertical Software Market

The vertical software market demonstrates significant dominance across several key regions and industry segments, each driven by distinct economic and technological factors. North America currently holds a leading position, largely attributed to its advanced technological infrastructure, high adoption rates of cloud computing, and a mature business environment that actively seeks efficiency-boosting solutions. Within this region, the United States, with its vast economic landscape and diverse industrial base, represents a particularly strong market. The BFSI sector is a dominant end-user industry, driven by the stringent regulatory requirements, the need for robust security, and the demand for advanced financial analytics and customer relationship management (CRM) tools. The growth in BFSI vertical software is further amplified by the increasing adoption of digital banking and fintech solutions, requiring specialized software for fraud detection, compliance, and personalized financial services.

- BFSI: Key drivers include regulatory compliance (e.g., KYC, AML), demand for enhanced customer experience, risk management, and the burgeoning fintech sector. The market size within BFSI is projected to be in the hundreds of billions of dollars by 2033.

- Healthcare: Driven by the transition to electronic health records (EHR), telemedicine, patient data management, and the need for HIPAA compliance. The aging population and increasing healthcare expenditure further fuel demand for healthcare vertical software.

- Legal and Government: Essential for case management, e-discovery, digital record-keeping, and public service delivery. Government initiatives for digital transformation and increased efficiency in legal proceedings are significant growth catalysts.

- Farming and Agriculture: Precision agriculture, farm management software, supply chain optimization, and data analytics for yield improvement are key drivers. The need for sustainable farming practices and efficient resource management is paramount.

- Small and Medium Enterprise (SME) Segment: Increasingly adopting vertical SaaS due to its cost-effectiveness, scalability, and specialized functionalities that were once only accessible to large enterprises. Cloud-based solutions have democratized access to these powerful tools.

- Large Enterprise Segment: Continues to be a significant market, driven by the need for highly integrated and scalable solutions that can manage complex operations, large datasets, and diverse regulatory environments.

Vertical Software Market Product Developments

Product development in the vertical software market is characterized by a relentless focus on specialization and intelligent automation. Companies are developing advanced AI and ML-powered features that offer predictive analytics, personalized customer interactions, and streamlined workflows tailored to the specific needs of each industry. Innovations include enhanced data security protocols to meet stringent compliance requirements in BFSI and healthcare, and IoT integration for real-time data capture in agriculture and manufacturing. The competitive advantage lies in offering seamless integration with existing enterprise systems and providing intuitive user interfaces that minimize training time and maximize user adoption. The trend towards embedded insurance, as highlighted by Vertical Insure's funding, signifies a move towards integrating financial services directly into vertical SaaS platforms, offering greater convenience and value to end-users.

Report Scope & Segmentation Analysis

This report meticulously analyzes the vertical software market across crucial segmentation parameters. The Organization Size segment includes dedicated solutions for Small and Medium Enterprises (SME) and Large Enterprises, each with distinct pricing models and feature sets to cater to their respective operational scales and budgets. The End-User Industry segmentation provides granular insights into the adoption and growth trajectories within the BFSI, Educational Institution, Legal and Government, Entertainment and Hospitality, Clothing and Apparel, Healthcare, and Farming and Agriculture sectors, alongside a comprehensive analysis of the Rest of the End-User Industries. Projections for market size and growth within each segment highlight areas of significant opportunity and ongoing innovation, reflecting the diverse demands and technological advancements specific to each vertical.

Key Drivers of Vertical Software Market Growth

The growth of the vertical software market is propelled by several critical factors. Firstly, the increasing demand for industry-specific functionalities that address unique business challenges and regulatory requirements is paramount. Secondly, the accelerated adoption of digital transformation initiatives across businesses globally necessitates specialized software solutions that enhance operational efficiency, productivity, and customer engagement. Thirdly, the advancements in cloud computing and AI/ML technologies enable vertical SaaS providers to deliver more sophisticated, scalable, and intelligent solutions at competitive price points. The need for data-driven decision-making and enhanced analytics further fuels the adoption of these specialized platforms.

Challenges in the Vertical Software Market Sector

Despite its robust growth, the vertical software market faces several challenges. One significant barrier is the potential for vendor lock-in, where high switching costs can deter businesses from migrating to alternative solutions. The complexity of integrating vertical software with existing legacy systems can also be a deterrent, requiring significant IT resources and expertise. Furthermore, the highly specialized nature of these solutions means that a deep understanding of specific industry nuances is crucial for effective development and implementation, posing a talent acquisition challenge. Intense competition from both established players and emerging startups can also pressure pricing and profitability, while evolving regulatory landscapes necessitate continuous adaptation and compliance efforts.

Emerging Opportunities in Vertical Software Market

Emerging opportunities in the vertical software market are abundant and driven by evolving technological capabilities and changing business needs. The expansion of embedded solutions, such as embedded insurance and embedded finance, offers significant potential for vertical SaaS providers to deliver added value and revenue streams directly within their platforms. The growing demand for AI-powered analytics and automation within specific industries presents a vast opportunity for developing more intelligent and predictive software. Furthermore, the increasing focus on sustainability and ESG (Environmental, Social, and Governance) factors is creating a need for specialized vertical software solutions that help businesses track, manage, and report on their sustainability performance. The continued globalization of businesses also opens up new markets for vertical SaaS solutions tailored to regional specificities and regulatory frameworks.

Leading Players in the Vertical Software Market Market

- vetBadger

- Granular

- Bio-Logic Inc

- Athena

- Constellation Software

- RenderForest

- FarmBite

- Mail Technologies Inc

- FastBound

- Verisk Analytics

Key Developments in Vertical Software Market Industry

- February 2023: The embedded insurance platform for platforms, Vertical Insure, announced that it raised an additional USD 2 million in funding, bringing its total initial money to USD 6 million. Groove Capital, Daren Cotter, and other tactical angel investors joined Greenlight Re Innovations in leading the extra funding. White-label insurance products embedded in vertical SaaS platforms from Vertical Insure can be offered to such platforms' present clientele.

- November 2022: Prismforce, a vertical SaaS company that enables IT organizations to create an agile, digital talent supply chain, announced that it had raised USD 13.6 million in Series A funding from Sequoia Capital India. Prismforce will use the money to expand its talent pool, boost its ability to go to market, and improve its product line. Prismforce has live installations at some of the leading IT providers and fastest-growing digital experts in the USA and India.

Strategic Outlook for Vertical Software Market Market

The strategic outlook for the vertical software market is exceptionally bright, with significant potential for sustained growth and innovation. The increasing recognition of vertical SaaS as a critical enabler of digital transformation and operational excellence will continue to drive adoption across all industries. Key growth catalysts include the ongoing development of AI and ML-driven features that offer predictive capabilities and automation, the expansion of embedded financial services within vertical platforms, and the growing demand for solutions that address sustainability and ESG concerns. Strategic partnerships and M&A activities will likely accelerate as companies seek to broaden their offerings and consolidate market share. The market is expected to witness further specialization, with providers focusing on hyper-niche industries and developing highly tailored solutions to meet evolving business needs.

Vertical Software Market Segmentation

-

1. Organization Size

- 1.1. Small and Medium Enterprise

- 1.2. Large Enterprise

-

2. End-User Industry

- 2.1. BFSI

- 2.2. Educational Institution

- 2.3. Legal and Government

- 2.4. Entertainment and Hospitality

- 2.5. Clothing and Apparel

- 2.6. Healthcare

- 2.7. Farming and Agriculture

- 2.8. Rest of the End-User Industries

Vertical Software Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Vertical Software Market Regional Market Share

Geographic Coverage of Vertical Software Market

Vertical Software Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Demand of Enterprise-specific Solution and Domain-specific Expertise

- 3.3. Market Restrains

- 3.3.1. High cost of initial installation; Lack of skilled technical expertise

- 3.4. Market Trends

- 3.4.1. BFSI is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Vertical Software Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 5.1.1. Small and Medium Enterprise

- 5.1.2. Large Enterprise

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. BFSI

- 5.2.2. Educational Institution

- 5.2.3. Legal and Government

- 5.2.4. Entertainment and Hospitality

- 5.2.5. Clothing and Apparel

- 5.2.6. Healthcare

- 5.2.7. Farming and Agriculture

- 5.2.8. Rest of the End-User Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 6. North America Vertical Software Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Organization Size

- 6.1.1. Small and Medium Enterprise

- 6.1.2. Large Enterprise

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. BFSI

- 6.2.2. Educational Institution

- 6.2.3. Legal and Government

- 6.2.4. Entertainment and Hospitality

- 6.2.5. Clothing and Apparel

- 6.2.6. Healthcare

- 6.2.7. Farming and Agriculture

- 6.2.8. Rest of the End-User Industries

- 6.1. Market Analysis, Insights and Forecast - by Organization Size

- 7. Europe Vertical Software Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Organization Size

- 7.1.1. Small and Medium Enterprise

- 7.1.2. Large Enterprise

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. BFSI

- 7.2.2. Educational Institution

- 7.2.3. Legal and Government

- 7.2.4. Entertainment and Hospitality

- 7.2.5. Clothing and Apparel

- 7.2.6. Healthcare

- 7.2.7. Farming and Agriculture

- 7.2.8. Rest of the End-User Industries

- 7.1. Market Analysis, Insights and Forecast - by Organization Size

- 8. Asia Pacific Vertical Software Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Organization Size

- 8.1.1. Small and Medium Enterprise

- 8.1.2. Large Enterprise

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. BFSI

- 8.2.2. Educational Institution

- 8.2.3. Legal and Government

- 8.2.4. Entertainment and Hospitality

- 8.2.5. Clothing and Apparel

- 8.2.6. Healthcare

- 8.2.7. Farming and Agriculture

- 8.2.8. Rest of the End-User Industries

- 8.1. Market Analysis, Insights and Forecast - by Organization Size

- 9. Latin America Vertical Software Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Organization Size

- 9.1.1. Small and Medium Enterprise

- 9.1.2. Large Enterprise

- 9.2. Market Analysis, Insights and Forecast - by End-User Industry

- 9.2.1. BFSI

- 9.2.2. Educational Institution

- 9.2.3. Legal and Government

- 9.2.4. Entertainment and Hospitality

- 9.2.5. Clothing and Apparel

- 9.2.6. Healthcare

- 9.2.7. Farming and Agriculture

- 9.2.8. Rest of the End-User Industries

- 9.1. Market Analysis, Insights and Forecast - by Organization Size

- 10. Middle East and Africa Vertical Software Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Organization Size

- 10.1.1. Small and Medium Enterprise

- 10.1.2. Large Enterprise

- 10.2. Market Analysis, Insights and Forecast - by End-User Industry

- 10.2.1. BFSI

- 10.2.2. Educational Institution

- 10.2.3. Legal and Government

- 10.2.4. Entertainment and Hospitality

- 10.2.5. Clothing and Apparel

- 10.2.6. Healthcare

- 10.2.7. Farming and Agriculture

- 10.2.8. Rest of the End-User Industries

- 10.1. Market Analysis, Insights and Forecast - by Organization Size

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 vetBadger

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Granular

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bio-Logic Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Athena

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Constellation Software

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 RenderForest

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 FarmBite

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Mail Technologies Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 FastBound

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Verisk Analytics

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 vetBadger

List of Figures

- Figure 1: Global Vertical Software Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Vertical Software Market Revenue (undefined), by Organization Size 2025 & 2033

- Figure 3: North America Vertical Software Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 4: North America Vertical Software Market Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 5: North America Vertical Software Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 6: North America Vertical Software Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Vertical Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Vertical Software Market Revenue (undefined), by Organization Size 2025 & 2033

- Figure 9: Europe Vertical Software Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 10: Europe Vertical Software Market Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 11: Europe Vertical Software Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 12: Europe Vertical Software Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Vertical Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Vertical Software Market Revenue (undefined), by Organization Size 2025 & 2033

- Figure 15: Asia Pacific Vertical Software Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 16: Asia Pacific Vertical Software Market Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 17: Asia Pacific Vertical Software Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 18: Asia Pacific Vertical Software Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Vertical Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Vertical Software Market Revenue (undefined), by Organization Size 2025 & 2033

- Figure 21: Latin America Vertical Software Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 22: Latin America Vertical Software Market Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 23: Latin America Vertical Software Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 24: Latin America Vertical Software Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Latin America Vertical Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Vertical Software Market Revenue (undefined), by Organization Size 2025 & 2033

- Figure 27: Middle East and Africa Vertical Software Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 28: Middle East and Africa Vertical Software Market Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 29: Middle East and Africa Vertical Software Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 30: Middle East and Africa Vertical Software Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Vertical Software Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Vertical Software Market Revenue undefined Forecast, by Organization Size 2020 & 2033

- Table 2: Global Vertical Software Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 3: Global Vertical Software Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Vertical Software Market Revenue undefined Forecast, by Organization Size 2020 & 2033

- Table 5: Global Vertical Software Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 6: Global Vertical Software Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Vertical Software Market Revenue undefined Forecast, by Organization Size 2020 & 2033

- Table 8: Global Vertical Software Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 9: Global Vertical Software Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Vertical Software Market Revenue undefined Forecast, by Organization Size 2020 & 2033

- Table 11: Global Vertical Software Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 12: Global Vertical Software Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Vertical Software Market Revenue undefined Forecast, by Organization Size 2020 & 2033

- Table 14: Global Vertical Software Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 15: Global Vertical Software Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Vertical Software Market Revenue undefined Forecast, by Organization Size 2020 & 2033

- Table 17: Global Vertical Software Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 18: Global Vertical Software Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vertical Software Market?

The projected CAGR is approximately 14.6%.

2. Which companies are prominent players in the Vertical Software Market?

Key companies in the market include vetBadger, Granular, Bio-Logic Inc, Athena, Constellation Software, RenderForest, FarmBite, Mail Technologies Inc, FastBound, Verisk Analytics.

3. What are the main segments of the Vertical Software Market?

The market segments include Organization Size, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increase in Demand of Enterprise-specific Solution and Domain-specific Expertise.

6. What are the notable trends driving market growth?

BFSI is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

High cost of initial installation; Lack of skilled technical expertise.

8. Can you provide examples of recent developments in the market?

February 2023: The embedded insurance platform for platforms, Vertical Insure, announced that it raised an additional USD 2 million in funding, bringing its total initial money to USD 6 million. Groove Capital, Daren Cotter, and other tactical angel investors joined Greenlight Re Innovations in leading the extra funding. White-label insurance products embedded in vertical SaaS platforms from Vertical Insure can be offered to such platforms' present clientele.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vertical Software Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vertical Software Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vertical Software Market?

To stay informed about further developments, trends, and reports in the Vertical Software Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence