Key Insights

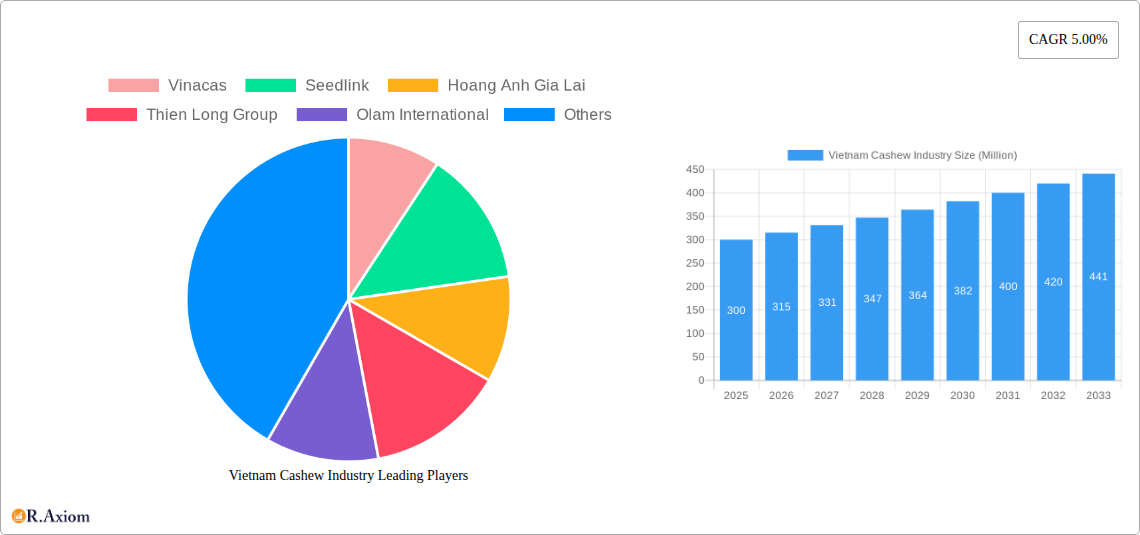

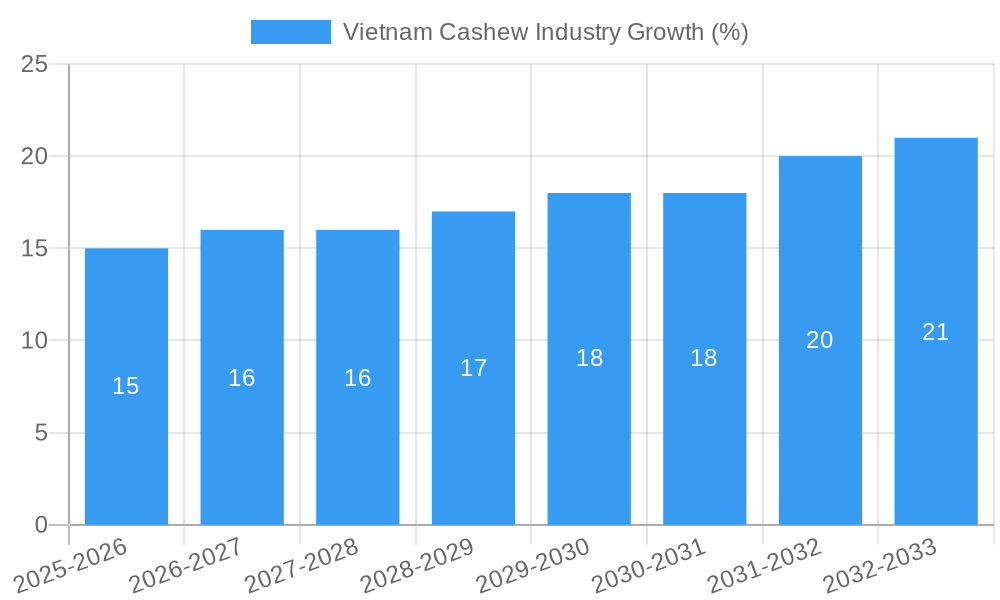

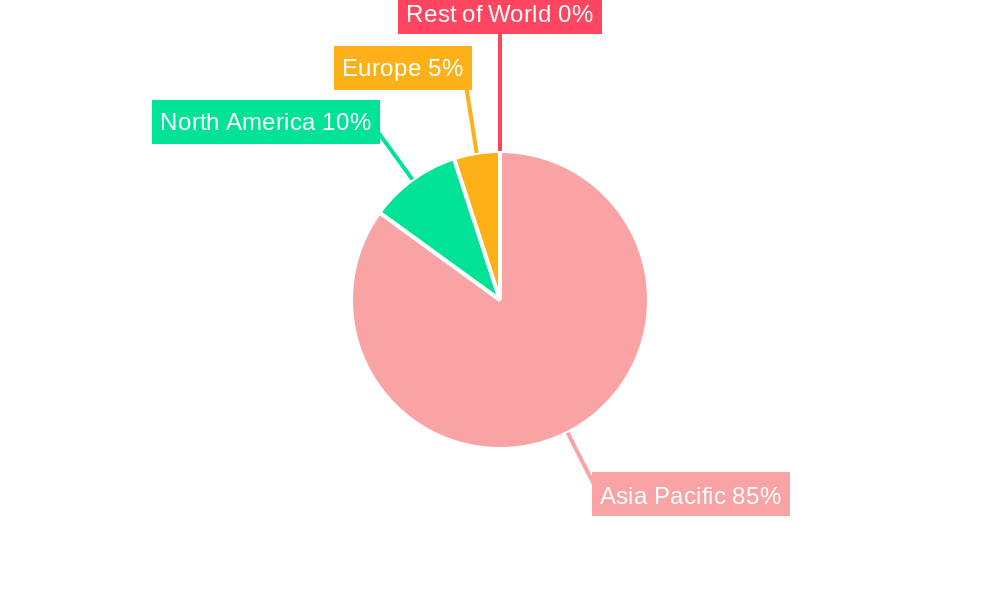

The Vietnam cashew industry, characterized by a Compound Annual Growth Rate (CAGR) of 5.00% from 2019-2024, presents a promising investment landscape. Driven by increasing global demand for healthy snacks and the rising popularity of cashew-based products in confectionery and food processing, the market is experiencing robust growth. Key players like Vinacas, Seedlink, Hoang Anh Gia Lai, Thien Long Group, and Olam International are capitalizing on this trend, investing in improved processing techniques and expanding their product portfolios to cater to diverse consumer preferences. The processed cashew segment, encompassing roasted, salted, and flavored varieties, is expected to dominate the market due to its convenience and enhanced taste appeal. Strong growth is anticipated in the Asia-Pacific region, particularly within major markets such as China, India, and Japan, driven by rising disposable incomes and changing dietary habits. However, challenges such as fluctuating cashew prices, competition from other nut producers, and the need for sustainable farming practices pose potential restraints. The industry's future success hinges on diversification of export markets, strategic partnerships, and adherence to stringent quality and safety standards. The direct consumption segment is expected to demonstrate slower growth than the processed segment; despite the growing interest in healthy snacking, the convenience factor offered by processed cashews remains a key driver of industry expansion.

Further analysis suggests that the Vietnam cashew market size in 2025 is likely to be around $300 million (this is an illustrative example based on a logical estimate considering a CAGR of 5% over several years and assuming available market data from similar regions). This figure is projected to grow steadily, fueled by sustained demand from both domestic and international consumers. While the current focus is heavily concentrated on the Asia-Pacific region, the potential for expansion into other regions like North America and Europe exists, creating opportunities for further industry growth and diversification. The processed cashew segment’s share of the market is anticipated to remain significantly larger than the raw cashew segment throughout the forecast period, driven by consumer preference for ready-to-eat options.

This comprehensive report provides an in-depth analysis of the Vietnam cashew industry, covering the period from 2019 to 2033. It offers valuable insights into market dynamics, competitive landscape, growth drivers, and future opportunities for industry stakeholders, investors, and businesses operating within or looking to enter this dynamic market. The report leverages extensive primary and secondary research, incorporating data from various sources to deliver accurate and actionable intelligence. The base year for this analysis is 2025, with estimations for 2025 and forecasts extending to 2033. The historical period covered is 2019-2024.

Vietnam Cashew Industry Market Concentration & Innovation

This section analyzes the market concentration of the Vietnamese cashew industry, examining the market share of key players like Vinacas, Seedlink, Hoang Anh Gia Lai, Thien Long Group, and Olam International. The report explores the innovation landscape, including new product development, technological advancements in processing and packaging, and the role of research and development in driving growth. It also delves into the regulatory framework governing the industry, analyzing its impact on market players and outlining relevant legislation. Furthermore, the report identifies potential product substitutes, assesses evolving end-user trends, and examines mergers and acquisitions (M&A) activities within the sector, providing data on deal values (e.g., xx Million USD) and their impact on market consolidation. The competitive intensity is evaluated using metrics such as the Herfindahl-Hirschman Index (HHI), although precise figures are unavailable at this time (xx). Market share data is also included for key players but may be estimates (xx%). Finally, the report highlights the influence of government policies and incentives on the industry's competitiveness.

Vietnam Cashew Industry Industry Trends & Insights

This section examines the overarching trends and insights shaping the Vietnamese cashew industry. The report analyzes market growth drivers, including rising domestic and international demand, expanding export markets, and increasing consumer preference for healthy snacks. It further investigates technological disruptions, such as advancements in processing techniques, automation, and supply chain management. The changing consumer preferences regarding cashew products are analyzed, including shifts in demand for different product types (e.g., roasted, salted, flavored) and packaging formats. The competitive landscape is explored, including details on pricing strategies, branding, and marketing efforts of key players. The report also provides estimates of the compound annual growth rate (CAGR) for the period 2025-2033 (xx%), along with projections for market penetration (xx%) in key segments.

Dominant Markets & Segments in Vietnam Cashew Industry

This section identifies the dominant markets and segments within the Vietnamese cashew industry based on product type (Raw Cashews, Processed Cashews – Roasted, Salted, Flavored) and application (Confectionery, Food Processing, Direct Consumption). A detailed analysis of the dominant segment will be provided, examining its market size (xx Million USD), growth drivers, and competitive dynamics.

- Key Drivers for the Dominant Segment:

- Favorable economic policies that support agricultural exports.

- Well-developed infrastructure supporting efficient logistics and distribution.

- Strong government support for the industry's growth through initiatives like R&D funding and export promotion.

- High consumer demand for specific cashew products.

The report provides a thorough analysis of the reasons behind the dominance of this segment, including factors such as consumer preferences, production efficiency, and market access. It also discusses regional variations within Vietnam and the factors contributing to differing levels of market penetration in different areas.

Vietnam Cashew Industry Product Developments

This section details the recent and anticipated product innovations within the Vietnamese cashew industry, such as the introduction of new flavors, improved processing techniques leading to enhanced product quality, and innovative packaging solutions. It highlights the competitive advantages offered by these product developments, analyzing their market fit and potential impact on market share. The section will also discuss technological advancements such as the use of AI in processing and quality control.

Report Scope & Segmentation Analysis

This report segments the Vietnam cashew industry by product type (Raw Cashews, Processed Cashews: Roasted, Salted, Flavored) and application (Confectionery, Food Processing, Direct Consumption). Each segment's growth projections, market size (xx Million USD for each segment), and competitive dynamics are analyzed. The growth projections (xx% CAGR for each segment) will reflect anticipated market trends and consumer preferences. The competitive landscape will be evaluated by analyzing the market share and competitive strategies of key players within each segment.

Key Drivers of Vietnam Cashew Industry Growth

The growth of the Vietnamese cashew industry is driven by several key factors: rising global demand for cashew nuts, favorable government policies supporting agricultural exports, investments in processing and infrastructure, and increasing consumer awareness of the health benefits of cashews. Technological advancements in processing and packaging also contribute to increased efficiency and product quality, further enhancing market growth.

Challenges in the Vietnam Cashew Industry Sector

The Vietnam cashew industry faces challenges, including fluctuations in raw cashew prices, reliance on international markets (making it susceptible to global economic shifts), and the need for continuous improvements in processing technology and sustainability practices to remain competitive. Supply chain vulnerabilities and competition from other cashew-producing countries pose significant hurdles for the industry. The impact of these challenges on overall market growth will be quantified (e.g., potential reduction of growth by xx%).

Emerging Opportunities in Vietnam Cashew Industry

Emerging opportunities include the expansion into new markets, particularly within Asia and beyond. The development of value-added cashew products (e.g., cashew milk, cashew butter) presents significant potential for growth. Sustainable farming practices and traceability initiatives also offer opportunities to enhance the industry's reputation and appeal to environmentally conscious consumers. Innovative marketing and branding strategies can further strengthen market positioning.

Leading Players in the Vietnam Cashew Industry Market

- Vinacas

- Seedlink

- Hoang Anh Gia Lai

- Thien Long Group

- Olam International

Key Developments in Vietnam Cashew Industry Industry

- September 2022: Vinapro introduced Richer Milk, a cashew milk made from Vietnamese cashews. This marks a significant step towards greater value addition within the industry.

- February 2023: Vinacas signed a Memorandum of Understanding (MoU) with the Cambodia Cashew Nut Association to foster mutual development and cooperation within the cashew industry across borders. This collaboration indicates a move towards regional integration and potentially improved supply chain efficiency.

Strategic Outlook for Vietnam Cashew Industry Market

The Vietnamese cashew industry is poised for continued growth, driven by increasing global demand, technological advancements, and a focus on value addition. The strategic focus on expanding export markets, investing in sustainable practices, and developing innovative products will be crucial for sustaining long-term growth and strengthening the industry's global competitiveness. Further investments in processing capacity, improved supply chain management, and enhanced branding will significantly impact future market success. The industry's prospects remain positive, anticipating a steady expansion in both production and market share in the coming years.

Vietnam Cashew Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis (Value and Volume)

- 3. Import Analysis (Value and Volume)

- 4. Export Analysis (Value and Volume)

- 5. Price Trend Analysis

- 6. Production Analysis

- 7. Consumption Analysis (Value and Volume)

- 8. Import Analysis (Value and Volume)

- 9. Export Analysis (Value and Volume)

- 10. Price Trend Analysis

Vietnam Cashew Industry Segmentation By Geography

- 1. Vietnam

Vietnam Cashew Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Food Security Concerns; Inclination Toward a Healthy Lifestyle

- 3.3. Market Restrains

- 3.3.1. ; Unfavorable Climatic Conditions; Higher Market Entry Cost

- 3.4. Market Trends

- 3.4.1. Expanding Processed Cashew Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Cashew Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis (Value and Volume)

- 5.3. Market Analysis, Insights and Forecast - by Import Analysis (Value and Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Analysis (Value and Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Production Analysis

- 5.7. Market Analysis, Insights and Forecast - by Consumption Analysis (Value and Volume)

- 5.8. Market Analysis, Insights and Forecast - by Import Analysis (Value and Volume)

- 5.9. Market Analysis, Insights and Forecast - by Export Analysis (Value and Volume)

- 5.10. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.11. Market Analysis, Insights and Forecast - by Region

- 5.11.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. China Vietnam Cashew Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan Vietnam Cashew Industry Analysis, Insights and Forecast, 2019-2031

- 8. India Vietnam Cashew Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Vietnam Cashew Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Vietnam Cashew Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia Vietnam Cashew Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Vietnam Cashew Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Vinacas

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Seedlink

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Hoang Anh Gia Lai

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Thien Long Group

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Olam International

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.1 Vinacas

List of Figures

- Figure 1: Vietnam Cashew Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Cashew Industry Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Cashew Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Cashew Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Vietnam Cashew Industry Revenue Million Forecast, by Consumption Analysis (Value and Volume) 2019 & 2032

- Table 4: Vietnam Cashew Industry Revenue Million Forecast, by Import Analysis (Value and Volume) 2019 & 2032

- Table 5: Vietnam Cashew Industry Revenue Million Forecast, by Export Analysis (Value and Volume) 2019 & 2032

- Table 6: Vietnam Cashew Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Vietnam Cashew Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 8: Vietnam Cashew Industry Revenue Million Forecast, by Consumption Analysis (Value and Volume) 2019 & 2032

- Table 9: Vietnam Cashew Industry Revenue Million Forecast, by Import Analysis (Value and Volume) 2019 & 2032

- Table 10: Vietnam Cashew Industry Revenue Million Forecast, by Export Analysis (Value and Volume) 2019 & 2032

- Table 11: Vietnam Cashew Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: Vietnam Cashew Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 13: Vietnam Cashew Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China Vietnam Cashew Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Japan Vietnam Cashew Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Vietnam Cashew Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: South Korea Vietnam Cashew Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Taiwan Vietnam Cashew Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Australia Vietnam Cashew Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Asia-Pacific Vietnam Cashew Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Vietnam Cashew Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 22: Vietnam Cashew Industry Revenue Million Forecast, by Consumption Analysis (Value and Volume) 2019 & 2032

- Table 23: Vietnam Cashew Industry Revenue Million Forecast, by Import Analysis (Value and Volume) 2019 & 2032

- Table 24: Vietnam Cashew Industry Revenue Million Forecast, by Export Analysis (Value and Volume) 2019 & 2032

- Table 25: Vietnam Cashew Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 26: Vietnam Cashew Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 27: Vietnam Cashew Industry Revenue Million Forecast, by Consumption Analysis (Value and Volume) 2019 & 2032

- Table 28: Vietnam Cashew Industry Revenue Million Forecast, by Import Analysis (Value and Volume) 2019 & 2032

- Table 29: Vietnam Cashew Industry Revenue Million Forecast, by Export Analysis (Value and Volume) 2019 & 2032

- Table 30: Vietnam Cashew Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 31: Vietnam Cashew Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Cashew Industry?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the Vietnam Cashew Industry?

Key companies in the market include Vinacas , Seedlink , Hoang Anh Gia Lai , Thien Long Group , Olam International.

3. What are the main segments of the Vietnam Cashew Industry?

The market segments include Production Analysis, Consumption Analysis (Value and Volume), Import Analysis (Value and Volume), Export Analysis (Value and Volume), Price Trend Analysis, Production Analysis, Consumption Analysis (Value and Volume), Import Analysis (Value and Volume), Export Analysis (Value and Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Food Security Concerns; Inclination Toward a Healthy Lifestyle.

6. What are the notable trends driving market growth?

Expanding Processed Cashew Market.

7. Are there any restraints impacting market growth?

; Unfavorable Climatic Conditions; Higher Market Entry Cost.

8. Can you provide examples of recent developments in the market?

February 2023: Vietnam Cashew Association (Vinacas) signed an MoU with the Cambodia Cashew Nut Association to mutually develop their cashew industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Cashew Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Cashew Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Cashew Industry?

To stay informed about further developments, trends, and reports in the Vietnam Cashew Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence