Key Insights

The Saudi Arabian vinyl flooring market is projected for substantial expansion, reaching an estimated USD 20.22 billion by 2025. The market is expected to witness a Compound Annual Growth Rate (CAGR) of 9.79% from the base year 2025 through 2033. This growth is significantly propelled by Saudi Arabia's Vision 2030, driving extensive development in infrastructure, hospitality, and residential sectors. The increasing preference for visually appealing, durable, and cost-effective flooring solutions in both commercial and residential applications is a primary market driver. Furthermore, the rising popularity of Luxury Vinyl Tile (LVT) for its design flexibility and performance characteristics is a key contributor. The evolving construction trends, emphasizing modern aesthetics and sustainable materials, further enhance the adoption of vinyl flooring.

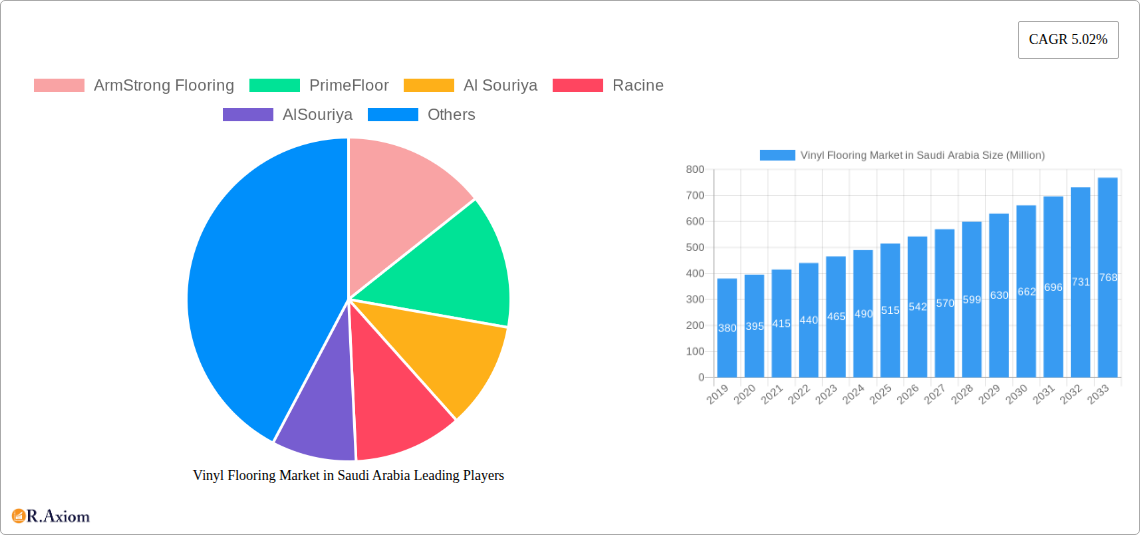

Vinyl Flooring Market in Saudi Arabia Market Size (In Billion)

Key product segments within the market include Vinyl Composite Tile (VCT) and Luxury Vinyl Tile (LVT), serving diverse residential and commercial needs. Distribution networks are varied, with contractors crucial for project installations, while specialty retailers and home improvement stores target a wider consumer base. Online sales are also expanding, offering enhanced accessibility. Leading companies such as ArmStrong Flooring, Polyflor, and Gerflor Group are investing in innovation and distribution to strengthen their market positions. Potential challenges may arise from raw material price volatility and competition from alternative flooring materials. However, vinyl flooring's inherent benefits, including water resistance, low maintenance, and design versatility, are anticipated to ensure sustained market growth.

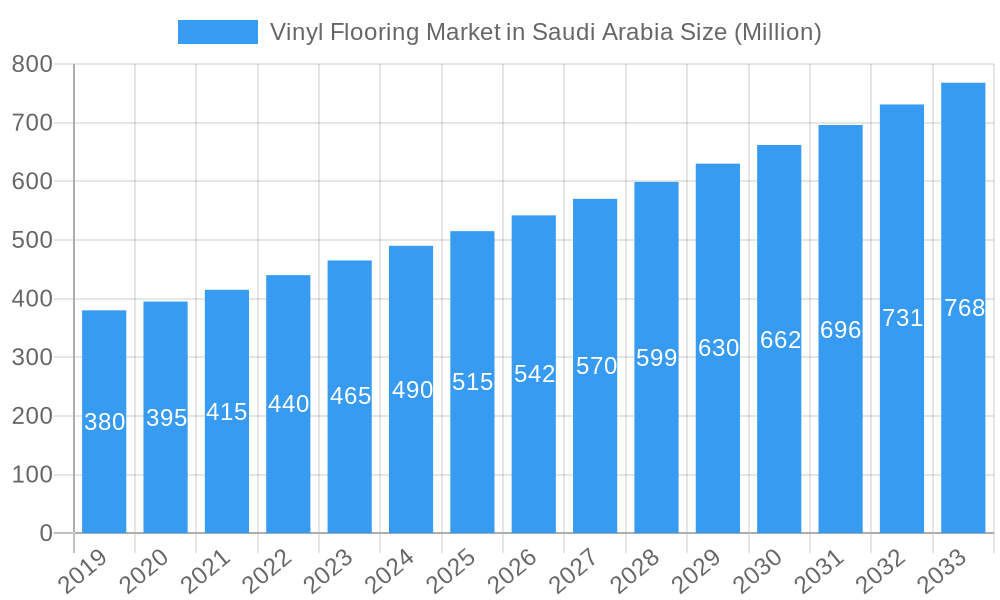

Vinyl Flooring Market in Saudi Arabia Company Market Share

This comprehensive report offers in-depth analysis and actionable intelligence on the Saudi Arabian vinyl flooring market. It covers the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033), examining market dynamics, competitive landscapes, and emerging trends. Market segmentation includes product type, end-user, and distribution channel, with profiles of key players and recent developments. This research is vital for manufacturers, distributors, contractors, and investors seeking to leverage the growth opportunities in the Saudi Arabian vinyl flooring sector.

Vinyl Flooring Market in Saudi Arabia Market Concentration & Innovation

The Saudi Arabian vinyl flooring market is characterized by a moderate to high market concentration, with a few dominant players holding significant market share. Leading companies like Armstrong Flooring, PrimeFloor, Al Souriya, Racine, Toli Floor, Polyflor, and Gerflor Group are instrumental in shaping the competitive landscape. Innovation is a key driver, fueled by increasing demand for aesthetically appealing, durable, and sustainable flooring solutions. Technological advancements in manufacturing processes, such as enhanced printing techniques for realistic wood and stone looks, and the development of eco-friendly materials, are at the forefront of innovation. Regulatory frameworks, though evolving, are increasingly focused on sustainability and safety standards, influencing product development and material choices. Substitutes like laminate, ceramic tiles, and natural wood present ongoing competitive pressure, but vinyl's cost-effectiveness, water resistance, and versatility offer distinct advantages. End-user trends lean towards modern designs, ease of maintenance, and cost-efficiency. Mergers and acquisitions (M&A) activities are expected to play a role in market consolidation, with potential M&A deal values in the range of tens to hundreds of Million as companies seek to expand their footprint and product portfolios.

Vinyl Flooring Market in Saudi Arabia Industry Trends & Insights

The Saudi Arabian vinyl flooring market is poised for significant growth, driven by a confluence of economic, infrastructural, and consumer-driven trends. The Kingdom's Vision 2030 initiative is a paramount catalyst, spurring substantial investments in real estate development, hospitality, healthcare, and retail sectors, all of which are major consumers of vinyl flooring. This translates to a robust demand for durable, aesthetically pleasing, and low-maintenance flooring solutions that align with modern architectural designs and functional requirements. The Compound Annual Growth Rate (CAGR) for the vinyl flooring market in Saudi Arabia is projected to be in the range of 6.5% to 8.0% over the forecast period. Market penetration is steadily increasing, particularly in the commercial segment, as businesses recognize the long-term cost benefits and aesthetic versatility of vinyl flooring.

Technological disruptions are continuously enhancing product offerings. Innovations in wear layers, printing technologies for hyper-realistic designs, and the development of advanced click-locking systems are improving both performance and ease of installation. Furthermore, a growing emphasis on sustainability is driving the adoption of eco-friendly and recyclable vinyl flooring options. Consumer preferences are shifting towards customized solutions, a wider variety of designs, and improved comfort underfoot. The competitive dynamics are intensifying, with both global players and emerging local manufacturers vying for market share. Companies are focusing on expanding their distribution networks, enhancing product portfolios, and investing in marketing to capture consumer attention. The ability to offer a wide range of Luxury Vinyl Tile (LVT) options that mimic natural materials at a fraction of the cost is a key competitive advantage. The increasing disposable income and a growing middle class are also contributing to higher demand for home renovation and interior design, further boosting the residential segment. The proactive government policies aimed at diversifying the economy and attracting foreign investment are creating a favorable business environment for the construction and building materials industry, including vinyl flooring.

Dominant Markets & Segments in Vinyl Flooring Market in Saudi Arabia

The Saudi Arabian vinyl flooring market is experiencing robust growth across its key segments, with the Commercial segment currently holding the largest market share, estimated to be over 55% of the total market value. This dominance is primarily attributed to the massive ongoing and planned infrastructure development projects under Saudi Vision 2030, including hotels, shopping malls, healthcare facilities, educational institutions, and office spaces. The Residential segment is also exhibiting substantial growth, fueled by a burgeoning population, increasing homeownership, and a rising demand for aesthetically pleasing and durable home interiors.

Product Segmentation:

- Luxury Vinyl Tile (LVT): This segment is projected to witness the highest growth rate, with an estimated CAGR of 7.5% to 9.0%. LVT's ability to replicate natural materials like wood and stone with exceptional realism, coupled with its superior durability and water resistance, makes it highly sought after for both residential and high-traffic commercial spaces. Key drivers include a growing preference for premium aesthetics and a desire for low-maintenance flooring solutions. The market value for LVT is projected to reach approximately 300 Million by 2033.

- Vinyl Sheet: This remains a significant segment due to its cost-effectiveness and ease of installation, particularly in large commercial areas and healthcare facilities where hygiene and seamlessness are paramount. It is expected to maintain a steady growth rate.

- Vinyl Composite Tile (VCT): While less prominent than LVT and vinyl sheet, VCT continues to find application in specific commercial settings like schools and retail outlets due to its durability and affordability.

End-User Segmentation:

- Commercial: This segment is the current leader, driven by extensive construction in hospitality, retail, healthcare, and corporate sectors. The demand for durable, aesthetically versatile, and easy-to-maintain flooring in these high-traffic areas is immense.

- Residential: This segment is a strong growth area, supported by population growth, urbanization, and an increasing focus on home renovation and interior design. The demand for stylish and practical flooring solutions for homes is on the rise.

Distribution Channel Segmentation:

- Contractors: This remains the most dominant distribution channel, serving as the primary link for large-scale commercial and residential projects. Their expertise in installation and material selection significantly influences purchasing decisions.

- Specialty Stores & Home Centers: These channels are crucial for reaching individual consumers and smaller contractors, offering a wide selection of products and expert advice. Growth in this segment is tied to the overall retail sector performance and consumer spending.

- Online: While still emerging, the online channel is gaining traction, particularly for consumers seeking specific products or comparing prices. Its market share is expected to grow steadily in the coming years.

The dominance of the commercial sector is underpinned by the Kingdom's ambitious infrastructure development plans, which are creating a sustained demand for flooring solutions. Economic diversification policies are attracting foreign investment, leading to the establishment of new businesses and commercial spaces. The government's commitment to improving the quality of life also fuels residential construction.

Vinyl Flooring Market in Saudi Arabia Product Developments

Product development in the Saudi Arabian vinyl flooring market is heavily focused on enhancing aesthetics, durability, and sustainability. Luxury Vinyl Tile (LVT) continues to lead innovation, with advancements in digital printing technologies enabling hyper-realistic wood, stone, and abstract designs that closely mimic natural materials. Enhanced wear layers provide superior scratch and stain resistance, prolonging product life. Innovations in waterproof and fire-resistant formulations are crucial for applications in kitchens, bathrooms, and commercial environments. The development of click-locking systems has simplified installation, reducing labor costs and time. Furthermore, there's a growing emphasis on eco-friendly and low-VOC (Volatile Organic Compound) products to meet environmental regulations and consumer demand for healthier living spaces.

Report Scope & Segmentation Analysis

The "Vinyl Flooring Market in Saudi Arabia" report meticulously analyzes the market across several key segmentation dimensions. The Product segmentation includes Vinyl Sheet, Vinyl Composite Tile (VCT), and Luxury Vinyl Tile (LVT). Market size for each of these is projected with specific growth rates, with LVT expected to lead future market expansion due to its premium appeal and versatility. The End-User segmentation covers Residential and Commercial sectors. The Commercial sector currently dominates, driven by large-scale construction, while the Residential sector shows significant growth potential due to urbanization and disposable income. The Distribution Channel segmentation encompasses Contractors, Specialty Stores, Home Centers, Online, and Other Distribution Channels. Contractors represent the largest channel, with online channels expected to witness considerable growth. The report details market share projections, growth rates, and competitive dynamics within each of these segments.

Key Drivers of Vinyl Flooring Market in Saudi Arabia Growth

The Saudi Arabian vinyl flooring market is propelled by several key drivers. Foremost is the Kingdom's Vision 2030, which is orchestrating massive investments in infrastructure, including new cities, hotels, healthcare facilities, and retail spaces, all requiring extensive flooring. A burgeoning population and increasing urbanization are fueling demand in the residential sector, with a growing emphasis on modern and durable home interiors. The cost-effectiveness and versatility of vinyl flooring, offering aesthetic appeal at a competitive price point compared to natural materials, make it an attractive choice for a wide range of applications. Furthermore, the durability, water resistance, and ease of maintenance of vinyl products align perfectly with the functional requirements of Saudi Arabia's climate and lifestyle. Growing awareness of sustainable building practices is also promoting the adoption of eco-friendly vinyl flooring options.

Challenges in the Vinyl Flooring Market in Saudi Arabia Sector

Despite its promising growth, the Saudi Arabian vinyl flooring market faces several challenges. Intense competition from both international and local manufacturers can lead to price wars and pressure on profit margins. The availability of a wide range of substitute flooring materials, such as ceramic tiles, porcelain, and laminate, poses a continuous threat. Fluctuations in raw material prices, particularly for PVC and other petrochemical derivatives, can impact production costs and market pricing. Supply chain disruptions, though less prominent currently, can affect the timely availability of raw materials and finished goods. Furthermore, evolving consumer preferences and design trends necessitate continuous product innovation and adaptation. The stringent quality and safety standards required for certain commercial projects can also present a hurdle for smaller manufacturers.

Emerging Opportunities in Vinyl Flooring Market in Saudi Arabia

The Saudi Arabian vinyl flooring market presents numerous emerging opportunities. The increasing focus on sustainable and eco-friendly building materials opens doors for manufacturers offering low-VOC and recyclable vinyl flooring solutions. The booming hospitality and tourism sector, driven by Vision 2030, presents a significant opportunity for high-quality, aesthetically appealing vinyl flooring for hotels and resorts. The healthcare sector's expansion demands specialized, hygienic, and durable flooring, a niche where vinyl excels. The growth of the e-commerce channel presents an opportunity for manufacturers and distributors to reach a wider customer base through online platforms. Furthermore, the development of new residential communities across the Kingdom offers a substantial market for residential vinyl flooring. Innovations in smart flooring technologies and customized design options could also unlock new market segments.

Leading Players in the Vinyl Flooring Market in Saudi Arabia Market

- Armstrong Flooring

- PrimeFloor

- Al Souriya

- Racine

- AlSouriya

- Abdul Rahman Al Shareef Group

- Toli Floor

- Nesma Orbit

- Highmoon Furniture

- Polyflor

- KhalidSaad

- Gerflor Group

- Forbo Flooring Systems

Key Developments in Vinyl Flooring Market in Saudi Arabia Industry

- 2023: Tarkett, a worldwide leader in innovative and sustainable flooring solutions, has announced a new distribution partnership with Midwest Floor Coverings, Inc. The agreement expands Tarkett's distribution network, enhancing the company's ability to effectively respond to the needs of commercial customers in these key geographies.

- 2022: Gerflor introduced its All-in-1 Collection and its new creations 30, 40, and 55. Conception in a few numbers: 500 possibilities, 4 ranges, 5 technologies, and 15 items.

Strategic Outlook for Vinyl Flooring Market in Saudi Arabia Market

The strategic outlook for the Saudi Arabian vinyl flooring market is overwhelmingly positive, driven by sustained government investment in infrastructure and diversification under Vision 2030. The increasing demand for aesthetically pleasing, durable, and cost-effective flooring solutions across both the commercial and residential sectors presents significant growth catalysts. Opportunities lie in capitalizing on the expansion of the hospitality, healthcare, and retail industries, as well as the growing trend towards sustainable building materials. Continuous innovation in product design, technology, and material composition will be crucial for maintaining a competitive edge. Expanding distribution networks, particularly through online channels and strategic partnerships, will also be vital for market penetration and capturing new customer segments. The market is poised for robust growth and offers substantial potential for stakeholders willing to adapt to evolving consumer preferences and embrace technological advancements.

Vinyl Flooring Market in Saudi Arabia Segmentation

-

1. Product

- 1.1. Vinyl Sheet

- 1.2. Vinyl Composite Tile

- 1.3. Luxury Vinyl Tile

-

2. End User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Contractors

- 3.2. Specialty Stores

- 3.3. Home Centers

- 3.4. Online

- 3.5. Other Distribution Channels

Vinyl Flooring Market in Saudi Arabia Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

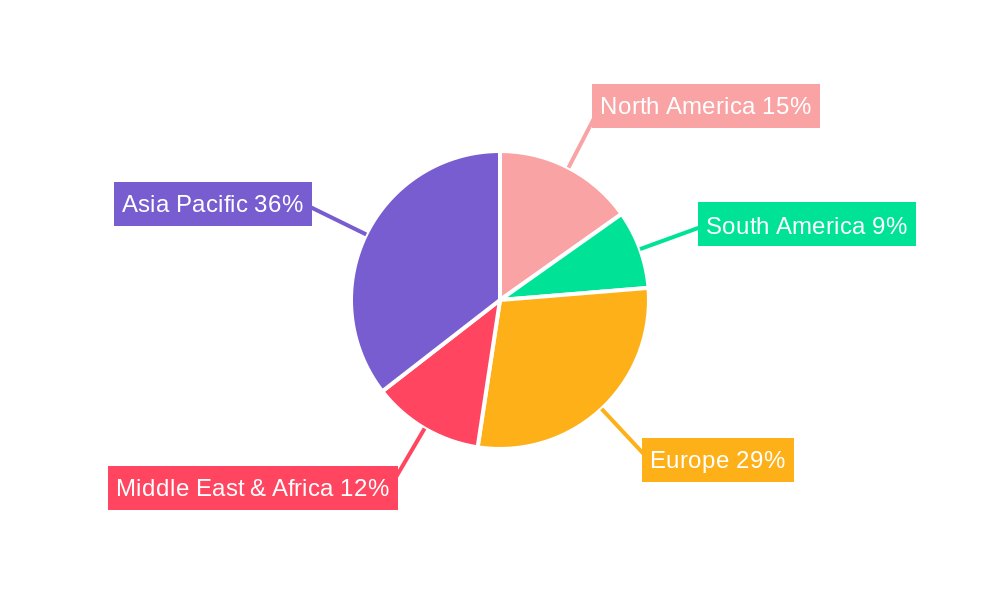

Vinyl Flooring Market in Saudi Arabia Regional Market Share

Geographic Coverage of Vinyl Flooring Market in Saudi Arabia

Vinyl Flooring Market in Saudi Arabia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Evolving Home Décor Concepts; Rapid Growth in Residential Buildings to Drive Market

- 3.3. Market Restrains

- 3.3.1. High Initial Cost; Limited Distribution Channels

- 3.4. Market Trends

- 3.4.1. Commercial Sector is Dominating the Market for Vinyl Flooring Products in Saudi Arabia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Vinyl Flooring Market in Saudi Arabia Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Vinyl Sheet

- 5.1.2. Vinyl Composite Tile

- 5.1.3. Luxury Vinyl Tile

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Contractors

- 5.3.2. Specialty Stores

- 5.3.3. Home Centers

- 5.3.4. Online

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Vinyl Flooring Market in Saudi Arabia Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Vinyl Sheet

- 6.1.2. Vinyl Composite Tile

- 6.1.3. Luxury Vinyl Tile

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Contractors

- 6.3.2. Specialty Stores

- 6.3.3. Home Centers

- 6.3.4. Online

- 6.3.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America Vinyl Flooring Market in Saudi Arabia Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Vinyl Sheet

- 7.1.2. Vinyl Composite Tile

- 7.1.3. Luxury Vinyl Tile

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Contractors

- 7.3.2. Specialty Stores

- 7.3.3. Home Centers

- 7.3.4. Online

- 7.3.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe Vinyl Flooring Market in Saudi Arabia Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Vinyl Sheet

- 8.1.2. Vinyl Composite Tile

- 8.1.3. Luxury Vinyl Tile

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Contractors

- 8.3.2. Specialty Stores

- 8.3.3. Home Centers

- 8.3.4. Online

- 8.3.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa Vinyl Flooring Market in Saudi Arabia Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Vinyl Sheet

- 9.1.2. Vinyl Composite Tile

- 9.1.3. Luxury Vinyl Tile

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Contractors

- 9.3.2. Specialty Stores

- 9.3.3. Home Centers

- 9.3.4. Online

- 9.3.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific Vinyl Flooring Market in Saudi Arabia Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Vinyl Sheet

- 10.1.2. Vinyl Composite Tile

- 10.1.3. Luxury Vinyl Tile

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Contractors

- 10.3.2. Specialty Stores

- 10.3.3. Home Centers

- 10.3.4. Online

- 10.3.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ArmStrong Flooring

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 PrimeFloor

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Al Souriya

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Racine

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AlSouriya

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Abdul Rahman Al Shareef Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Toli Floor

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nesma Orbit

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Highmoon Furniture

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Polyflor

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 KhalidSaad

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Gerflor Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Forbo Flooring Systems

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 ArmStrong Flooring

List of Figures

- Figure 1: Global Vinyl Flooring Market in Saudi Arabia Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Vinyl Flooring Market in Saudi Arabia Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Vinyl Flooring Market in Saudi Arabia Revenue (billion), by Product 2025 & 2033

- Figure 4: North America Vinyl Flooring Market in Saudi Arabia Volume (K Unit), by Product 2025 & 2033

- Figure 5: North America Vinyl Flooring Market in Saudi Arabia Revenue Share (%), by Product 2025 & 2033

- Figure 6: North America Vinyl Flooring Market in Saudi Arabia Volume Share (%), by Product 2025 & 2033

- Figure 7: North America Vinyl Flooring Market in Saudi Arabia Revenue (billion), by End User 2025 & 2033

- Figure 8: North America Vinyl Flooring Market in Saudi Arabia Volume (K Unit), by End User 2025 & 2033

- Figure 9: North America Vinyl Flooring Market in Saudi Arabia Revenue Share (%), by End User 2025 & 2033

- Figure 10: North America Vinyl Flooring Market in Saudi Arabia Volume Share (%), by End User 2025 & 2033

- Figure 11: North America Vinyl Flooring Market in Saudi Arabia Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 12: North America Vinyl Flooring Market in Saudi Arabia Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 13: North America Vinyl Flooring Market in Saudi Arabia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: North America Vinyl Flooring Market in Saudi Arabia Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 15: North America Vinyl Flooring Market in Saudi Arabia Revenue (billion), by Country 2025 & 2033

- Figure 16: North America Vinyl Flooring Market in Saudi Arabia Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Vinyl Flooring Market in Saudi Arabia Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Vinyl Flooring Market in Saudi Arabia Volume Share (%), by Country 2025 & 2033

- Figure 19: South America Vinyl Flooring Market in Saudi Arabia Revenue (billion), by Product 2025 & 2033

- Figure 20: South America Vinyl Flooring Market in Saudi Arabia Volume (K Unit), by Product 2025 & 2033

- Figure 21: South America Vinyl Flooring Market in Saudi Arabia Revenue Share (%), by Product 2025 & 2033

- Figure 22: South America Vinyl Flooring Market in Saudi Arabia Volume Share (%), by Product 2025 & 2033

- Figure 23: South America Vinyl Flooring Market in Saudi Arabia Revenue (billion), by End User 2025 & 2033

- Figure 24: South America Vinyl Flooring Market in Saudi Arabia Volume (K Unit), by End User 2025 & 2033

- Figure 25: South America Vinyl Flooring Market in Saudi Arabia Revenue Share (%), by End User 2025 & 2033

- Figure 26: South America Vinyl Flooring Market in Saudi Arabia Volume Share (%), by End User 2025 & 2033

- Figure 27: South America Vinyl Flooring Market in Saudi Arabia Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 28: South America Vinyl Flooring Market in Saudi Arabia Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 29: South America Vinyl Flooring Market in Saudi Arabia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: South America Vinyl Flooring Market in Saudi Arabia Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 31: South America Vinyl Flooring Market in Saudi Arabia Revenue (billion), by Country 2025 & 2033

- Figure 32: South America Vinyl Flooring Market in Saudi Arabia Volume (K Unit), by Country 2025 & 2033

- Figure 33: South America Vinyl Flooring Market in Saudi Arabia Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Vinyl Flooring Market in Saudi Arabia Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe Vinyl Flooring Market in Saudi Arabia Revenue (billion), by Product 2025 & 2033

- Figure 36: Europe Vinyl Flooring Market in Saudi Arabia Volume (K Unit), by Product 2025 & 2033

- Figure 37: Europe Vinyl Flooring Market in Saudi Arabia Revenue Share (%), by Product 2025 & 2033

- Figure 38: Europe Vinyl Flooring Market in Saudi Arabia Volume Share (%), by Product 2025 & 2033

- Figure 39: Europe Vinyl Flooring Market in Saudi Arabia Revenue (billion), by End User 2025 & 2033

- Figure 40: Europe Vinyl Flooring Market in Saudi Arabia Volume (K Unit), by End User 2025 & 2033

- Figure 41: Europe Vinyl Flooring Market in Saudi Arabia Revenue Share (%), by End User 2025 & 2033

- Figure 42: Europe Vinyl Flooring Market in Saudi Arabia Volume Share (%), by End User 2025 & 2033

- Figure 43: Europe Vinyl Flooring Market in Saudi Arabia Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 44: Europe Vinyl Flooring Market in Saudi Arabia Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 45: Europe Vinyl Flooring Market in Saudi Arabia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Europe Vinyl Flooring Market in Saudi Arabia Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: Europe Vinyl Flooring Market in Saudi Arabia Revenue (billion), by Country 2025 & 2033

- Figure 48: Europe Vinyl Flooring Market in Saudi Arabia Volume (K Unit), by Country 2025 & 2033

- Figure 49: Europe Vinyl Flooring Market in Saudi Arabia Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe Vinyl Flooring Market in Saudi Arabia Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East & Africa Vinyl Flooring Market in Saudi Arabia Revenue (billion), by Product 2025 & 2033

- Figure 52: Middle East & Africa Vinyl Flooring Market in Saudi Arabia Volume (K Unit), by Product 2025 & 2033

- Figure 53: Middle East & Africa Vinyl Flooring Market in Saudi Arabia Revenue Share (%), by Product 2025 & 2033

- Figure 54: Middle East & Africa Vinyl Flooring Market in Saudi Arabia Volume Share (%), by Product 2025 & 2033

- Figure 55: Middle East & Africa Vinyl Flooring Market in Saudi Arabia Revenue (billion), by End User 2025 & 2033

- Figure 56: Middle East & Africa Vinyl Flooring Market in Saudi Arabia Volume (K Unit), by End User 2025 & 2033

- Figure 57: Middle East & Africa Vinyl Flooring Market in Saudi Arabia Revenue Share (%), by End User 2025 & 2033

- Figure 58: Middle East & Africa Vinyl Flooring Market in Saudi Arabia Volume Share (%), by End User 2025 & 2033

- Figure 59: Middle East & Africa Vinyl Flooring Market in Saudi Arabia Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 60: Middle East & Africa Vinyl Flooring Market in Saudi Arabia Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 61: Middle East & Africa Vinyl Flooring Market in Saudi Arabia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 62: Middle East & Africa Vinyl Flooring Market in Saudi Arabia Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 63: Middle East & Africa Vinyl Flooring Market in Saudi Arabia Revenue (billion), by Country 2025 & 2033

- Figure 64: Middle East & Africa Vinyl Flooring Market in Saudi Arabia Volume (K Unit), by Country 2025 & 2033

- Figure 65: Middle East & Africa Vinyl Flooring Market in Saudi Arabia Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East & Africa Vinyl Flooring Market in Saudi Arabia Volume Share (%), by Country 2025 & 2033

- Figure 67: Asia Pacific Vinyl Flooring Market in Saudi Arabia Revenue (billion), by Product 2025 & 2033

- Figure 68: Asia Pacific Vinyl Flooring Market in Saudi Arabia Volume (K Unit), by Product 2025 & 2033

- Figure 69: Asia Pacific Vinyl Flooring Market in Saudi Arabia Revenue Share (%), by Product 2025 & 2033

- Figure 70: Asia Pacific Vinyl Flooring Market in Saudi Arabia Volume Share (%), by Product 2025 & 2033

- Figure 71: Asia Pacific Vinyl Flooring Market in Saudi Arabia Revenue (billion), by End User 2025 & 2033

- Figure 72: Asia Pacific Vinyl Flooring Market in Saudi Arabia Volume (K Unit), by End User 2025 & 2033

- Figure 73: Asia Pacific Vinyl Flooring Market in Saudi Arabia Revenue Share (%), by End User 2025 & 2033

- Figure 74: Asia Pacific Vinyl Flooring Market in Saudi Arabia Volume Share (%), by End User 2025 & 2033

- Figure 75: Asia Pacific Vinyl Flooring Market in Saudi Arabia Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 76: Asia Pacific Vinyl Flooring Market in Saudi Arabia Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 77: Asia Pacific Vinyl Flooring Market in Saudi Arabia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 78: Asia Pacific Vinyl Flooring Market in Saudi Arabia Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 79: Asia Pacific Vinyl Flooring Market in Saudi Arabia Revenue (billion), by Country 2025 & 2033

- Figure 80: Asia Pacific Vinyl Flooring Market in Saudi Arabia Volume (K Unit), by Country 2025 & 2033

- Figure 81: Asia Pacific Vinyl Flooring Market in Saudi Arabia Revenue Share (%), by Country 2025 & 2033

- Figure 82: Asia Pacific Vinyl Flooring Market in Saudi Arabia Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Vinyl Flooring Market in Saudi Arabia Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Global Vinyl Flooring Market in Saudi Arabia Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: Global Vinyl Flooring Market in Saudi Arabia Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Global Vinyl Flooring Market in Saudi Arabia Volume K Unit Forecast, by End User 2020 & 2033

- Table 5: Global Vinyl Flooring Market in Saudi Arabia Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Vinyl Flooring Market in Saudi Arabia Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global Vinyl Flooring Market in Saudi Arabia Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global Vinyl Flooring Market in Saudi Arabia Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Vinyl Flooring Market in Saudi Arabia Revenue billion Forecast, by Product 2020 & 2033

- Table 10: Global Vinyl Flooring Market in Saudi Arabia Volume K Unit Forecast, by Product 2020 & 2033

- Table 11: Global Vinyl Flooring Market in Saudi Arabia Revenue billion Forecast, by End User 2020 & 2033

- Table 12: Global Vinyl Flooring Market in Saudi Arabia Volume K Unit Forecast, by End User 2020 & 2033

- Table 13: Global Vinyl Flooring Market in Saudi Arabia Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global Vinyl Flooring Market in Saudi Arabia Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Vinyl Flooring Market in Saudi Arabia Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Vinyl Flooring Market in Saudi Arabia Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Vinyl Flooring Market in Saudi Arabia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: United States Vinyl Flooring Market in Saudi Arabia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Vinyl Flooring Market in Saudi Arabia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Canada Vinyl Flooring Market in Saudi Arabia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico Vinyl Flooring Market in Saudi Arabia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Mexico Vinyl Flooring Market in Saudi Arabia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Global Vinyl Flooring Market in Saudi Arabia Revenue billion Forecast, by Product 2020 & 2033

- Table 24: Global Vinyl Flooring Market in Saudi Arabia Volume K Unit Forecast, by Product 2020 & 2033

- Table 25: Global Vinyl Flooring Market in Saudi Arabia Revenue billion Forecast, by End User 2020 & 2033

- Table 26: Global Vinyl Flooring Market in Saudi Arabia Volume K Unit Forecast, by End User 2020 & 2033

- Table 27: Global Vinyl Flooring Market in Saudi Arabia Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 28: Global Vinyl Flooring Market in Saudi Arabia Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 29: Global Vinyl Flooring Market in Saudi Arabia Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Global Vinyl Flooring Market in Saudi Arabia Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Brazil Vinyl Flooring Market in Saudi Arabia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Brazil Vinyl Flooring Market in Saudi Arabia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Argentina Vinyl Flooring Market in Saudi Arabia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Argentina Vinyl Flooring Market in Saudi Arabia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of South America Vinyl Flooring Market in Saudi Arabia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Vinyl Flooring Market in Saudi Arabia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Vinyl Flooring Market in Saudi Arabia Revenue billion Forecast, by Product 2020 & 2033

- Table 38: Global Vinyl Flooring Market in Saudi Arabia Volume K Unit Forecast, by Product 2020 & 2033

- Table 39: Global Vinyl Flooring Market in Saudi Arabia Revenue billion Forecast, by End User 2020 & 2033

- Table 40: Global Vinyl Flooring Market in Saudi Arabia Volume K Unit Forecast, by End User 2020 & 2033

- Table 41: Global Vinyl Flooring Market in Saudi Arabia Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 42: Global Vinyl Flooring Market in Saudi Arabia Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 43: Global Vinyl Flooring Market in Saudi Arabia Revenue billion Forecast, by Country 2020 & 2033

- Table 44: Global Vinyl Flooring Market in Saudi Arabia Volume K Unit Forecast, by Country 2020 & 2033

- Table 45: United Kingdom Vinyl Flooring Market in Saudi Arabia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: United Kingdom Vinyl Flooring Market in Saudi Arabia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Germany Vinyl Flooring Market in Saudi Arabia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Germany Vinyl Flooring Market in Saudi Arabia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: France Vinyl Flooring Market in Saudi Arabia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: France Vinyl Flooring Market in Saudi Arabia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: Italy Vinyl Flooring Market in Saudi Arabia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Italy Vinyl Flooring Market in Saudi Arabia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Spain Vinyl Flooring Market in Saudi Arabia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Spain Vinyl Flooring Market in Saudi Arabia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Russia Vinyl Flooring Market in Saudi Arabia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: Russia Vinyl Flooring Market in Saudi Arabia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Benelux Vinyl Flooring Market in Saudi Arabia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Benelux Vinyl Flooring Market in Saudi Arabia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: Nordics Vinyl Flooring Market in Saudi Arabia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 60: Nordics Vinyl Flooring Market in Saudi Arabia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Europe Vinyl Flooring Market in Saudi Arabia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Rest of Europe Vinyl Flooring Market in Saudi Arabia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global Vinyl Flooring Market in Saudi Arabia Revenue billion Forecast, by Product 2020 & 2033

- Table 64: Global Vinyl Flooring Market in Saudi Arabia Volume K Unit Forecast, by Product 2020 & 2033

- Table 65: Global Vinyl Flooring Market in Saudi Arabia Revenue billion Forecast, by End User 2020 & 2033

- Table 66: Global Vinyl Flooring Market in Saudi Arabia Volume K Unit Forecast, by End User 2020 & 2033

- Table 67: Global Vinyl Flooring Market in Saudi Arabia Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 68: Global Vinyl Flooring Market in Saudi Arabia Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 69: Global Vinyl Flooring Market in Saudi Arabia Revenue billion Forecast, by Country 2020 & 2033

- Table 70: Global Vinyl Flooring Market in Saudi Arabia Volume K Unit Forecast, by Country 2020 & 2033

- Table 71: Turkey Vinyl Flooring Market in Saudi Arabia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: Turkey Vinyl Flooring Market in Saudi Arabia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: Israel Vinyl Flooring Market in Saudi Arabia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: Israel Vinyl Flooring Market in Saudi Arabia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: GCC Vinyl Flooring Market in Saudi Arabia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: GCC Vinyl Flooring Market in Saudi Arabia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: North Africa Vinyl Flooring Market in Saudi Arabia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 78: North Africa Vinyl Flooring Market in Saudi Arabia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 79: South Africa Vinyl Flooring Market in Saudi Arabia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 80: South Africa Vinyl Flooring Market in Saudi Arabia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 81: Rest of Middle East & Africa Vinyl Flooring Market in Saudi Arabia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 82: Rest of Middle East & Africa Vinyl Flooring Market in Saudi Arabia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 83: Global Vinyl Flooring Market in Saudi Arabia Revenue billion Forecast, by Product 2020 & 2033

- Table 84: Global Vinyl Flooring Market in Saudi Arabia Volume K Unit Forecast, by Product 2020 & 2033

- Table 85: Global Vinyl Flooring Market in Saudi Arabia Revenue billion Forecast, by End User 2020 & 2033

- Table 86: Global Vinyl Flooring Market in Saudi Arabia Volume K Unit Forecast, by End User 2020 & 2033

- Table 87: Global Vinyl Flooring Market in Saudi Arabia Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 88: Global Vinyl Flooring Market in Saudi Arabia Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 89: Global Vinyl Flooring Market in Saudi Arabia Revenue billion Forecast, by Country 2020 & 2033

- Table 90: Global Vinyl Flooring Market in Saudi Arabia Volume K Unit Forecast, by Country 2020 & 2033

- Table 91: China Vinyl Flooring Market in Saudi Arabia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 92: China Vinyl Flooring Market in Saudi Arabia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 93: India Vinyl Flooring Market in Saudi Arabia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 94: India Vinyl Flooring Market in Saudi Arabia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 95: Japan Vinyl Flooring Market in Saudi Arabia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 96: Japan Vinyl Flooring Market in Saudi Arabia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 97: South Korea Vinyl Flooring Market in Saudi Arabia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 98: South Korea Vinyl Flooring Market in Saudi Arabia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 99: ASEAN Vinyl Flooring Market in Saudi Arabia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 100: ASEAN Vinyl Flooring Market in Saudi Arabia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 101: Oceania Vinyl Flooring Market in Saudi Arabia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 102: Oceania Vinyl Flooring Market in Saudi Arabia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 103: Rest of Asia Pacific Vinyl Flooring Market in Saudi Arabia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 104: Rest of Asia Pacific Vinyl Flooring Market in Saudi Arabia Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vinyl Flooring Market in Saudi Arabia?

The projected CAGR is approximately 9.79%.

2. Which companies are prominent players in the Vinyl Flooring Market in Saudi Arabia?

Key companies in the market include ArmStrong Flooring, PrimeFloor, Al Souriya, Racine, AlSouriya, Abdul Rahman Al Shareef Group, Toli Floor, Nesma Orbit, Highmoon Furniture, Polyflor, KhalidSaad, Gerflor Group, Forbo Flooring Systems.

3. What are the main segments of the Vinyl Flooring Market in Saudi Arabia?

The market segments include Product, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.22 billion as of 2022.

5. What are some drivers contributing to market growth?

Evolving Home Décor Concepts; Rapid Growth in Residential Buildings to Drive Market.

6. What are the notable trends driving market growth?

Commercial Sector is Dominating the Market for Vinyl Flooring Products in Saudi Arabia.

7. Are there any restraints impacting market growth?

High Initial Cost; Limited Distribution Channels.

8. Can you provide examples of recent developments in the market?

In 2023: Tarkett, a worldwide leader in innovative and sustainable flooring solutions, has announced a new distribution partnership with Midwest Floor Coverings, Inc. The agreement expands Tarkett's distribution network, enhancing the company's ability to effectively respond to the needs of commercial customers in these key geographies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vinyl Flooring Market in Saudi Arabia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vinyl Flooring Market in Saudi Arabia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vinyl Flooring Market in Saudi Arabia?

To stay informed about further developments, trends, and reports in the Vinyl Flooring Market in Saudi Arabia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence